I. OPEC and price trends

Oil prices have been declining since last summer on concerns about production outpacing demand: the Brent slid by almost 30% from $115 in mid-June to the recent low of $76. Will prices carry on falling? Or have we hit the bottom?

Next Thursday’s OPEC meeting will address concerns over market instability and prices close to 4-year lows, though according to rumors oil cartel’s members only a few days ago were far from an agreement. Members who rely most heavily on oil export to finance public deficit- such as Venezuela, Ecuador and Iran- are in favor of strong action to fix prices, whereas Saudi Arabia’s fear of losing market shares led the kingdom’s officials to adopt a prudent stance. According to analysts the Saudis benefit from price volatility, to which they can potentially react in any moment by changing the output, while the same volatility cripples fixed income investment into the US Shale energy sector. Such intention seems to be confirmed by the Saudis’ recent decision to cut prices for US markets, but not for Asia.

Given such significant tensions across OPEC, firms are divided between those who believe the cartel will not agree immediately on output cuts, leaving the current trend unharmed and causing a further downfall in prices, and those like Bank of America who see an agreement on a 500.000 barrels a day cut, and a moderate price recovery.

On the one hand, we have the same reasons for which the last months’ price slide took place: reduced cartel power of the OPEC, which accounts only for a third of global production, and may not be able to increase prices even in the unlikely scenario of strong supply cuts; lagging global demand and of course the growth of US shale oil production. Also, any agreement resulting from Iran Nuclear Talks in Vienna would probably involve a gradual lift on sanctions, thus expanding global oil supply even further.

On the other hand, the latest news seems to encourage market bulls, as China’s 0.4% interest rate cut on November 21th boosted the Brent by 1.4% up to $80.44, and led both Brent and WTI to the first weekly gains since September. According to analysts, lower interest rates could bring about 100.000 barrels demand growth in 2015 in the best case scenario. However, many do not believe such factors will be sufficient to contrast the stronger tendency which has dominated markets since last summer; for example, Goldman Sachs’ economists speak of a “New Oil Order” and predict a further 5-15% cost deflation in 2015 due to capacity expansion in recent years.

In our opinion, oil prices are not likely to recover significantly in the next months, if we exclude fluctuations which might follow the OPEC decision or other events, although, if demand picks up significantly due to lower prices, in the longer run the trend will revert.

II. Effects

The declining trend for oil prices also has implications for different equity sectors. In the following we will shed some light on the winners and losers from the negative movement in crude prices.

First of all, we briefly look at the economic consequences of the current environment and point out the effects on GDP growth and headline inflation. According to simulations of the IMF a 20% decrease in the price of crude oil has a 0.5% positive impact on global GDP, by transferring wealth from producers to consumers, who are more prone to spend their additional gains compared to rich corporates and governments. Furthermore, inflation is predicted to drop by 0.9% as cheaper oil results in lower manufacturing costs(1).

Having these effects in mind, a key industry is the airline sector, for which fuel costs represent the largest part of expenses according to the International Air Transport Organization (IATA). Historically the sector performance shows a weak negative correlation (correlation coefficient of -0.16) to oil price developments as firms traditionally hedge their exposure through forward contracts.

However, the NYSE Arca Global Airlines Index is up 12% since the end of June, when crude started its decline. This trend could continue as more firms cut back on their hedging exposure to directly profit from low fuel costs (American Airlines, Air France-KLM, International Consolidated Airline Group and Easyjet were among those operators that reduced their hedges for the coming months).

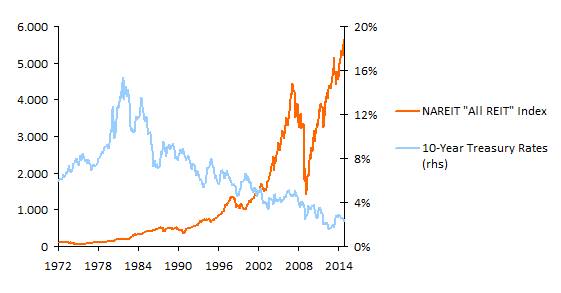

Moreover, the real-estate sector also stands out as property is attractive for investors looking for returns in a low-yield environment supported subdued inflation and implicitly lower interest. Over the long-term decreasing interest rates were coupled with higher returns for REITs.

Higher GDP prospects and a shift of wealth to consumers might also bode well for the consumer discretionary space, especially in the lower income segment, as the energy bill represents a higher proportion of their customers’ income.

With regard to the losers from the current trend in crude oil, the oil producers stand out to suffer the most as their upstream business is directly impacted by lower prices. This is reflected in the weak performance of the iShares MSCI Global Energy Producers ETF that fell by approximately 17% since end June.

However, with reference to our article about Exxon Mobile two weeks ago (Oil and Oil Producers: Exxon Mobile), we want to highlight that these integrated companies with profitable refining operations might be able to partly offset the trend by increasing downstream profits.

III. Conclusion

In our belief of a continued weakness in oil prices we expect the aforementioned equity sectors should benefit from favorable fundamental trends (lower fuel costs, sustained low interest rates and a lift for GDP). Factors that may work against our assumptions for these sectors are deteriorating economic activity (especially in Europe), that might outweigh the benefits from cheaper energy prices, or an unexpected interest rate tightening from the FED despite moderate price growth. Concerning the losers of the current development, we expect oil producers to continue to suffer further in the short-term as lower oil prices will weigh on their profitability and financial strength. With respect to the medium term, however, we think that companies in this sector might represent an interesting investment opportunity. As soon as they establish cost controls and cut back on capacity they might be able to react to the slump in crude prices by decreasing supply. Moreover, as capex spending also declines, more funds could be channeled to shareholders in the form of dividends and buybacks – a situation generally appreciated by yield-starved investors.

(1) The IMF’s simulation is originally based on a price increase by 20%. For our purpose we inverted the resulting data, knowing that this is not perfectly precise, but serves as an approximation of the situation.

[edmc id=2223]Download as PDF[/edmc]

0 Comments