Introduction

One of the most enticing readings in finance starts with To the Shareholders of Berkshire Hathaway Inc. However, the investment reasoning of Warren Buffett is not only relevant in its current edition but also in the previous ones in which he has formed a long-lasting investment principle on an asset class that ends up being only strong enough of a conviction to be on or off his books for a certain time interval proving to be a great trade opportunity for thousands of investors reading through his SEC reports quarterly in times when he has a change of heart. That was most certainly the case with gold and his trades in 2020.

In his 2011 letter to shareholders, Buffett writes:

“The second major category of investments involves assets that will never produce anything, but that are purchased in the buyer’s hope that someone else – who also knows that the assets will be forever unproductive – will pay more for them in the future. This type of investment requires an expanding pool of buyers, who, in turn, are enticed because they believe the buying pool will expand still further.

The major asset in this category is gold, currently a huge favorite of investors who fear almost all other assets… Gold, however, has two significant shortcomings, being neither of much use nor procreative. What motivates most gold purchasers is their belief that the ranks of the fearful will grow. Beyond that, the rising price has on its own generated additional buying enthusiasm, attracting purchasers who see the rise as validating an investment thesis.

Over the past 15 years, both Internet stocks and houses have demonstrated the extraordinary excesses that can be created by combining an initially sensible thesis with well-publicized rising prices. In these bubbles, an army of originally skeptical investors succumbed to the “proof” delivered by the market, and the pool of buyers – for a time – expanded sufficiently to keep the bandwagon rolling. But bubbles blown large enough inevitably pop.

Today the world’s gold stock is about 170,000 metric tons. If all of this gold were melded together, it would form a cube of about 68 feet per side. At $1,750 per ounce – gold’s price as I write this – its value would be $9.6 trillion. Call this cube pile A.

Let’s now create a pile B costing an equal amount. For that, we could buy all U.S. cropland (400 million acres with output of about $200 billion annually), plus 16 ExxonMobil’s (the world’s most profitable company, one earning more than $40 billion annually). After these purchases, we would have about $1 trillion left over for walking-around money (no sense feeling strapped after this buying binge). Can you imagine an investor with $9.6 trillion selecting pile A over pile B?

Beyond the staggering valuation given the existing stock of gold, current prices make today’s annual production of gold command about $160 billion. Buyers – whether jewelry and industrial users, frightened individuals, or speculators – must continually absorb this additional supply to merely maintain an equilibrium at present prices.

A century from now the 400 million acres of farmland will have produced staggering amounts of corn, wheat, cotton, and other crops – and will continue to produce that valuable bounty, whatever the currency may be. ExxonMobil will probably have delivered trillions of dollars in dividends to its owners and will also hold assets worth many more trillions (and, remember, you get 16 Exxons). The 170,000 tons of gold will be unchanged in size and still incapable of producing anything. You can fondle the cube, but it will not respond.

Admittedly, when people a century from now are fearful, it’s likely many will still rush to gold. I’m confident, however, that the $9.6 trillion current valuation of pile A will compound over the century at a rate far inferior to that achieved by pile B.”

The change of heart

During the June 2020 quarter however, Berkshire Hathaway bought 20.92 million shares in Barrick Gold, Canadian gold giant, while a March quarter SEC filing showed they had no investment in the said name. Given that gold still generates no income unless it is leased out and can only increase or decrease in value against currency, what has so dramatically influenced the change of his investment rationale?

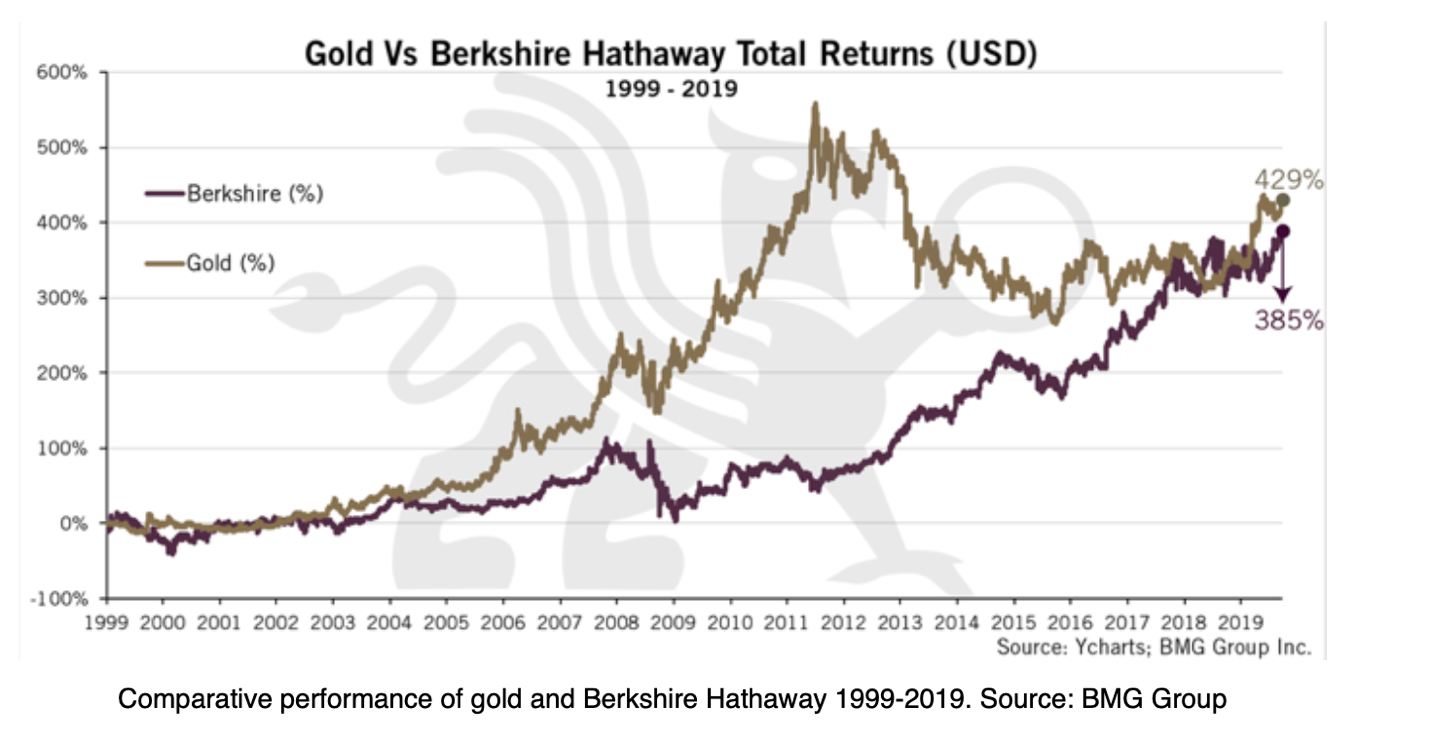

It is possible that the flirting with the 2000USD/oz level for most of the crisis proves mining companies to be profitable opportunities for a given level of all-in cost structures (which are in turn influenced by production i.e., energy prices). On the other hand, gold had outperformed Berkshire Hathaway over a 20-year period where from 1999 to 2019, gold returned 429 per cent, while Berkshire Hathaway returned 385 per cent making a case that Berkshire Hathaway in retrospect would have performed even better had they included gold.

Source: YCharts, BMG Group

Whatever has made Warren Buffett divert from his previous strategy, the investment case in our article argues that there are much more fundamental reasons to have approximately and at least one-year long view on gold which can be expressed through a variety of assets, making Barrick Gold a buy at a t+h point in time which is to be assessed as a relatively cheap point of entry, where h is the time increment that we need to wait in order to buy the underlying at a perfectly depressed price point.

Firstly we need to get a sense of the gold price levels such that our further analysis becomes more intuitive. As of 12 February, we identify the weekly resistance caps as follows. The beginning of the week gains faded until Friday. Upside has been capped at 1860, this time the 50-200DMA holding firm. Also, the 1840-60 area has been a tough area for gold to break in recently. On the downside, support is stationed at 1809 (as the Jan 18th low) with 1784 below (as the Feb low), which protects the November low 1764. With even a slighter weaker dollar going below the 90USD index magic line, it would present a further decrease case for gold. The last week’s distinctly bearish speech at the Economic Club of New York by Jerome Powell ties into this view of weaker dollar with his repeated statement that the Fed would not consider raising interest rates even if inflation exceeds 2% on a temporary basis.

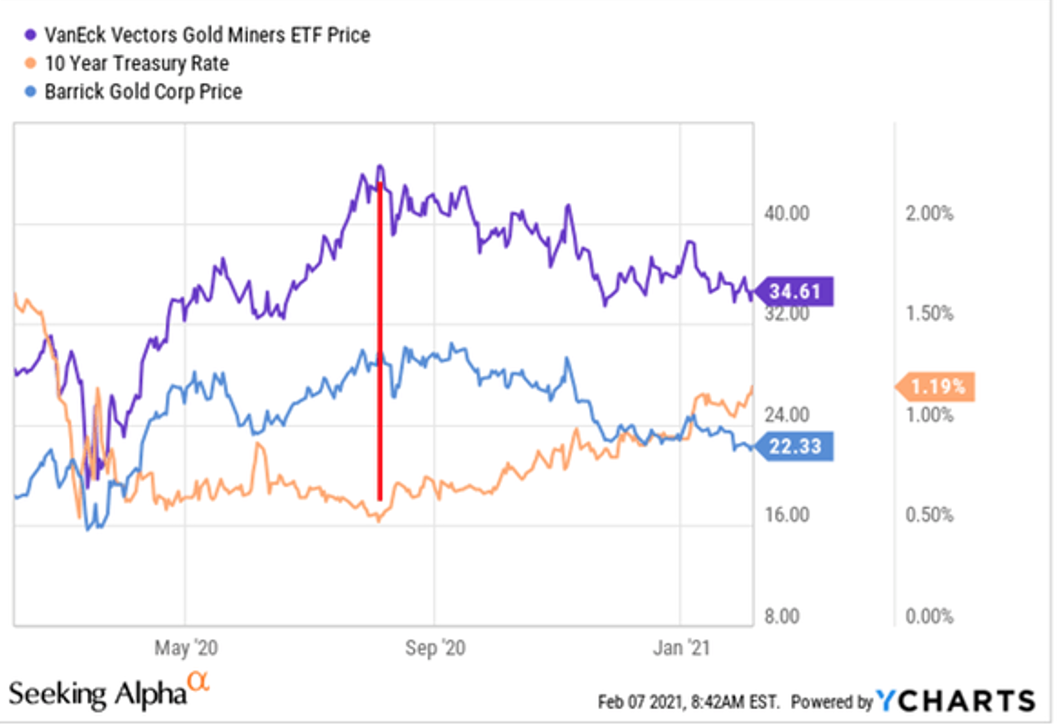

When to buy Barrick

With respect to the depressed gold price, we observe a depressed price also in Barrick Gold at 22.15USD Friday close (which is a significantly lower point to the August 2020 when the Oracle from Omaha announced that he had purchased shares in our asset of interest – the stock price rose from 35.79USD to above 40USD). Connecting our trade to our above gold considerations, we deem possible for the stock to be even cheaper if we are to be more patient until the underlying reached a relatively cheap price point taking into consideration as the lower limit the fact that the 2020 year-low downside was floored at approximately 15USD. We do not want to buy in too early and leave potential money on the table, but we also should not wait to buy above 22USD.

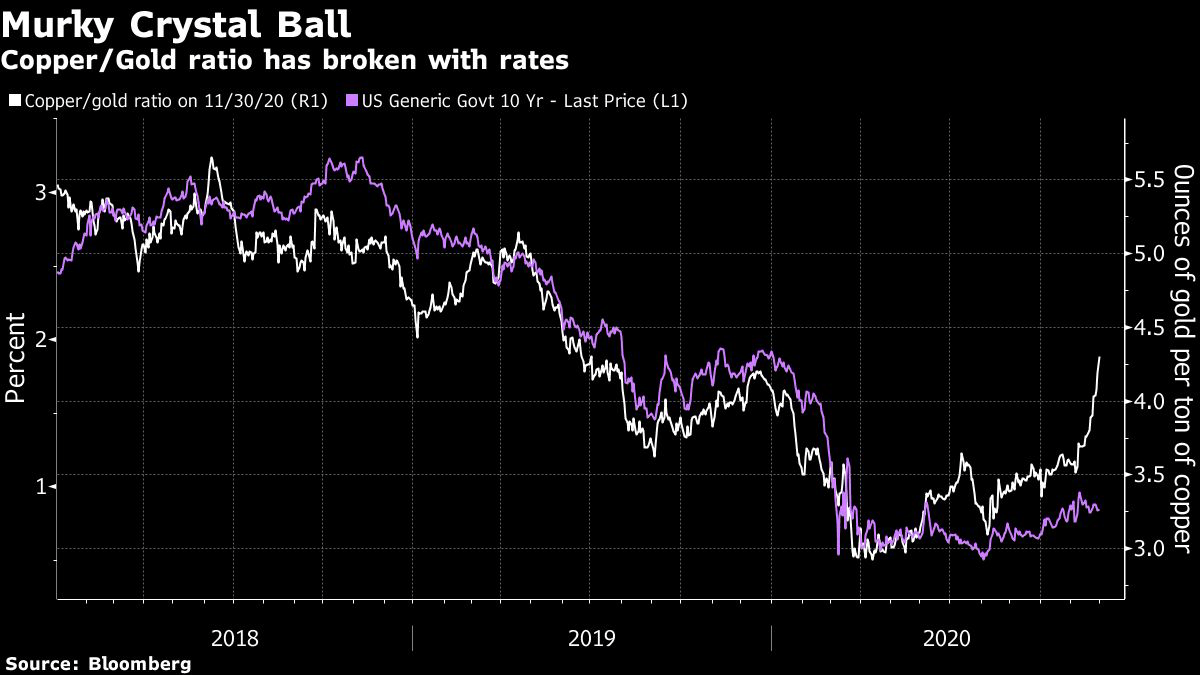

To further prove that Barrick may be cheap but not as cheap as it could be, we examine the graph below. The 10y Treasury yield alongside the ratio of copper prices to gold prices are the two lines that always seem to catch up to each other. In order for the two lines to meet, the three scenario conditions will be that either, 10y Treasury yields could rise to 175bps, copper prices could fall to 2.50USD/pound from the current levels near 3.50USD/pound, or that Gold Prices could rise to 2,400USD/ounce, or at any combination of the three.

Source: Bloomberg

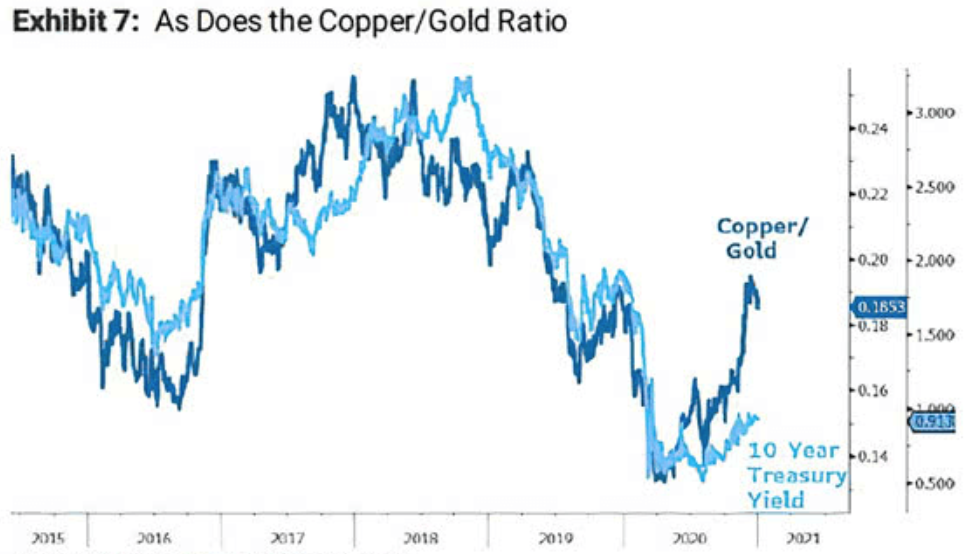

In 2021, copper has moved higher and gold has moved lower, pushing the ratio even higher even though we see the 10y at 121bps as of February 2021.

Source: Bloomberg

Should the yield move up by another approximately 50bps to catch up with the ratio, it will depress the gold sector even further given how they show to have profited from the lower interest rates environment making a case that our trade has reason to be further delayed.

Source: Seeking Alpha, YCharts

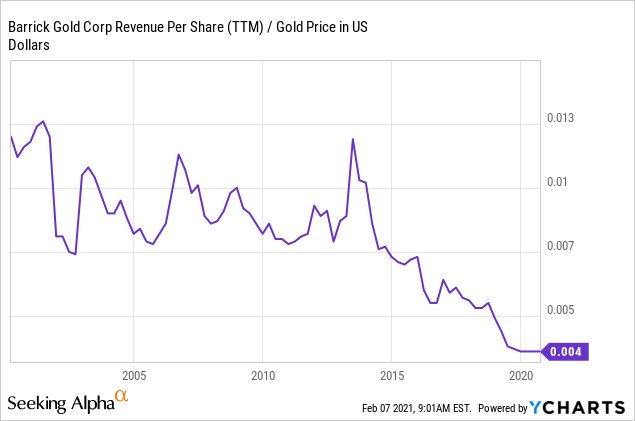

There are further metrics to suggest that Barrick maybe not as cheap as it should, and they have to do with gold prices. One interesting ratio is the revenue per share, divided by the price of gold. The logic behind it is that if Barrick’s production of gold was flat, and its share count was flat, this ratio would be unchanged. Moreover, if the price of gold rose, then revenues per share would rise to an equivalent extent and vice versa.

Source: Seeking Alpha, YCharts

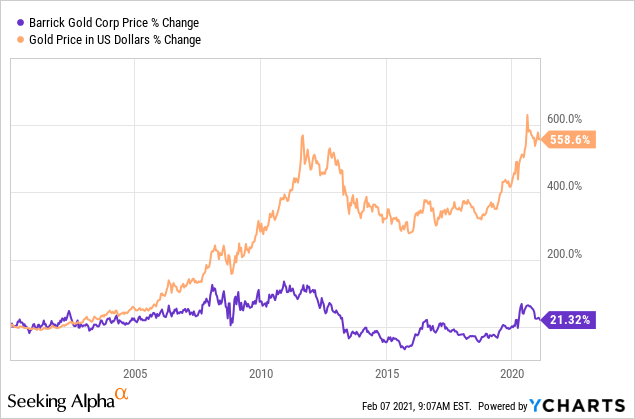

This is to say that the company might not be entirely capable of taking advantage of the profit potential that their commodity was intrinsically offering which is most evident from the graph below.

Source: Seeking Alpha, YCharts

This fact introduces another necessary assumption into our trade consideration and that is that not only do gold prices have to be sufficiently low for the entry and sufficiently high for the exit, but throughout the hold period Barrick has to deliver on a flat (or increasing) production level. This in turn suggests that the length of the hold period (t+h, t+k; k>h) should be determined based off of firstly the gold accretion prediction and secondly on an educated belief that in that accretion period Barrick will have constant output.

All these considerations are to show that it still may be early for the purchase as the underlying might have a proven downward potential in the near future dependent on the variables explained above. The company could deliver positive annual returns, but it is to be reasonably suspected it will come mainly as a result of higher gold prices and not from anything particular to Barrick, contingent upon a flat production level fulfillment.

Until when to hold

It would be ridiculous to make the case for perfectly timing the cheapest point without making a convincing case for the time and the size of the assumed price increase especially since Barrick appreciation will depend on gold prices mostly as concluded above and in current environment one could argue that the recent vaccine development news has diminished uncertainty and depressed gold demand for this entire year. However, in order to assess the length of the holding period (k-h) we might not have to look to the short-term pandemic recovery predictions but the inflation that has been creeping in. This in turn might prolong our holding period and push back its start simultaneously since once we embrace inflation, gold prices will explode but it might take some time to get there making the recent trends possibly basing of a long-term bottom. If that is the case, all the more reason to understand better where the that bottom may be and picking the right asset to make all that gold money on.

I need to make some calls

Given all the above reasoning we prefer to keep the holing period (t+h,t+k; k>h) as undefined variables however that does not mean that we cannot assess the structure of the trade on the resent past and assess its PnL for the purposes of materialization of our discussion. Instead of purchasing the stock outright and risking the entire investment, we have an obvious alternative in a long call position. Last expiry of 15 Jan call with strike at 30USD could have been bought for approximately 1.75USD. Had we bought 10 of these call options (or any multiple proportional to the intended size of the investment), we would have the right to purchase 1,000 shares of ABX at 30USD until January 15, 2021. The PnL diagram shows the breakeven price for the position is 31.75USD (given the initial premia). This is still more than 8USD lower than the price at which investors were buying ABX in the days following Warren’s announcement. The investment downside is limited to the outlay at 1,750USD. Had Barrick Gold before the Jan 15 returned to the price paid before Buffett’s announcement (35.79USD), then we would have made a profit of 4,040USD. If ABX was able to rally back to the old highs, the we would have doubled the profit at 8,250USD.

Conclusion

Investors are not often given a chance to purchase shares at a price lower than what Warren Buffett paid, but with Barrick Gold approaching levels not seen since the spring, this might present a unique opportunity. One could be tempted to take advantage by buying at 17-24USD lower than investors who chased the greatest value investor of all time since it definitely seems like a decent entry point. However, there are further considerations to be taken into account since even if something is cheap it might not be cheap enough. Given that inflation is waiting to take the stage, this might be a viable trade should we allow ourselves to be patient enough. Because patience is golden?

0 Comments