USA

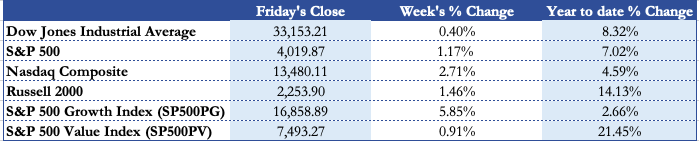

It doesn’t take long for the stock market’s mood to change, and the past week proved the point as the market quickly turned up and the majority of indexes closed Thursday with considerable gains. The Nasdaq composite and S&P 500 were respectively up 2.71% and 1.17% over the past week, and the latter index is making record highs, breaking the 4000 level for the first time. Growth stocks are rebounding after several weeks of underperformance. S&P 500 Pure Growth Index rose more than 5% for the week, while S&P 500 Pure Value Index was almost flat, up just 0.91%. Still, growth has some catching up to do: The growth index is up 2.66% YTD while the value index is outperforming with an impressive 21.45% gain this year.

The Dow Jones Industrial Average still tops the Nasdaq and S&P 500 in year-to-date performance. But the Dow was essentially flat the past week as the real economy lost momentum, closing the week up 0.40%. The energy, technology and communications services S&P sectors did best. In the tech sector, semiconductors stood out: The Philadelphia Semiconductor Index gapped up 3.7% and is near record highs. Many investors are hopeful that stocks will continue to climb in the second quarter. Their optimism is pegged to the prospect of a surge in economic growth amid widespread vaccinations, fresh spending programs from the Biden administration and earnings expectations. Still, they point to risks stemming from rising bond yields, new lockdowns in Europe and signs of excess in corners of the market.

Some are questioning whether this year’s rotation out of technology stocks and into economically sensitive sectors like banks and energy has gone too far. Having powered the broad market higher in 2020, the rally in tech stocks slowed in the first quarter as investors bought into companies that stood to benefit from the economic rebound. “We are entering a period of time when there is a bit more risk, and for that I want to have a more balanced approach,” said Lars Skovgaard Andersen, Investment Strategist at Danske Bank Wealth Management. Mr. Andersen said he thinks information-technology stocks such as Microsoft and Salesforce.com would provide a cushion if cyclical stocks lose momentum.

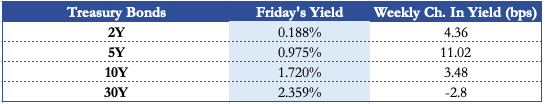

The global reflation trade that fueled the biggest Treasury losses in decades got a boost from stronger-than-expected U.S. jobs data, causing the market to price in an earlier start to Federal Reserve rate increases. In a holiday-shortened session Friday, the 10-year Treasury note’s yield climbed as much as 6 basis points to 1.73% before retreating to end around 1.72%. Shorter-maturity securities more closely linked to monetary policy expectations fared even worse, with the five-year note’s yield rising more than 11 basis points to 0.975%, the highest level since February 2020. The two-year yield is approaching 0.19%, last seen in June. “Rates will continue to move higher and should because job creation is coming to fruition as the economic reopening gains speed,” said Robert Daly, Director of Fixed Income for Glenmede Investment Management in Philadelphia. “The 5-year and 7-year sectors are the most vulnerable,” and shorter-maturity yields “should start to move higher as well.”. Treasury futures

volumes surged immediately following the jobs report, although the market took some time to find a firm direction, with the 10-year yield fluctuating between small advances and declines before pushing upward. The 10Y yield closed higher at 1.720% on Friday, the 2 year was up at 0.188% during the week, while the 5-year yield surged to 0.975%. Only declining is the 30Y interest rate, down to 2.359%.

The U.S. economy added 916,000 jobs in March as hiring heated up thanks to vaccine progress, warmer weather, and an end to Covid restrictions in Texas and some other states. The unemployment rate eased to 6.0%. Private-sector payrolls rose 780,000, while government jobs rose 136,000. Wall Street expected the March jobs report to show a gain of 625,000 jobs overall, including 538,000 private-sector jobs. Economists expected the unemployment rate to fall to 6.0%.

The Institute for Supply Management’s March survey of purchasing managers at U.S. factories was better than expected, showing another solid month for new orders, output and employment. The March PMI came in at 64.7, higher than the projected 61.7. On Wednesday, President Biden unveiled a $2.3 trillion infrastructure plan centered on fixing roads and bridges, expanding broadband internet access and boosting funding for research and development. Semiconductor producers and others stand to benefit from President Biden’s infrastructure package, Mr. Andersen said.

Europe and UK

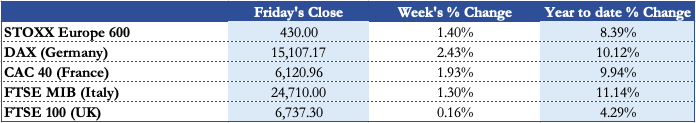

European stocks kicked off the new quarter with gains on Thursday, as optimism around a new U.S. government spending plan and strong factory activity data out of the euro zone eclipsed concerns about another lockdown in France. The pan-European STOXX 600 index rose 1.40%, just 2 points below its all-time high. The benchmark ended the first quarter with an 8.39% rise – its fourth straight quarter of gains. Pacing gains on the Stoxx 600 was a 2.02% jump in a sub-index of Technology issues, led by European chip companies including ASML, ASMI and Infineon Technologies. Boosting the sector was an upbeat revenue forecast from US chipmaking rival Micron Technology.

The German DAX climbed 2.43% to hit a record high, while the UK’s FTSE 100 closed the week up 0.16%. British food delivery firm Deliveroo’s shares inched down 0.8% after plunging by as much as 30% in their trading debut on Wednesday. France’s blue-chip CAC 40 closed up 1.93% despite the latest lockdown announcement.

Despite slow vaccination programmes and a fresh pandemic wave hitting several countries, European markets have recovered almost all of their pandemic-driven losses on strong manufacturing activity and a bounce back in economy-linked stocks such as banks and energy. Data showed euro zone factory activity growth galloped at its fastest pace in the near 24-year history of a leading business survey in March.

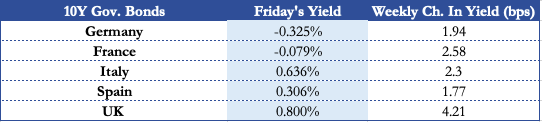

Core eurozone government bond yields ended higher overall. They rose early in the week with U.S Treasuries, which sold off on expectations of more U.S. fiscal stimulus and U.S. vaccination progress. However, surging coronavirus cases in Europe amid vaccine rollout challenges and widened lockdown measures in some countries, including France, drove demand for core bonds, causing yields to fall midweek onward. They were pushed lower after European Central Bank President Christine Lagarde said the end of the Pandemic Emergency Purchase Programme is “not set in stone.” Peripheral government bond yields largely tracked core markets. UK gilt yields rose primarily due to the sell-off in U.S. Treasuries, the efficient vaccine rollout in the UK, and the easing of restrictions in England. On Friday the German 10Y Government closed the week at -0.325%, a weekly increase of 1.94bps. The UK 10Y Gilt closed at 0.800%, increasing from 4.21 from last week’s close and +60.01 bps YTD.

Eurozone manufacturing activity grew at its fastest pace on record in March, with IHS Markit’s final manufacturing PMI coming in at 62.5 compared to February’s 57.9. The bounce was led by Germany, which notched a reading of 66.6 thanks to resurgent demand from the U.S. and China. However, German retail sales in February fell short of economist expectations to rise by 1.2%, a full 9% below the same time last year. Neil Wilson at Markets.com said global manufacturing activity “is starting to look good”. “France’s March PMI showed the sharpest rise in manufacturing output since September 2000, albeit before the nation’s third lockdown was announced,” he added. “Italy’s factory activity has grown at the fastest pace in over 20 years.” But much of Europe is suffering a third wave of coronavirus infections, and with a slow vaccine rollout in the region, governments have re-imposed tough controls on citizens, likely hitting the bloc’s dominant services industry hard. The health agency also described Europe’s vaccination campaign as “unacceptably slow” and said it was crucial to speed up the rollout because new infections are currently increasing in every age group apart from those aged 80 years or older. It’s a messy picture, further complicated by the unique nature of European politics.

In Britain, outside the currency union, factories rode a wave of orders and prepared for a gradual re-opening of the economy from its Covid-19 shutdowns by hiring staff at the fastest rate since 2014.

Meanwhile, supply-chain issues, exacerbated when the recent blockage of the Suez Canal caused disruption in global shipping and ports that could take months to resolve, has driven a surge in input prices and the biggest increase in suppliers’ delivery times since the survey began.

Rest of The World

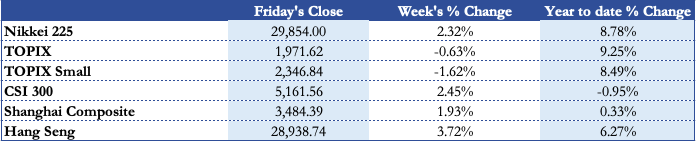

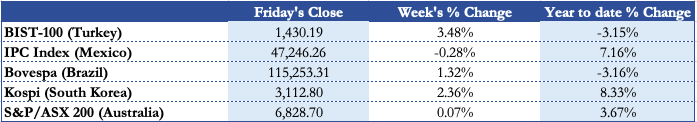

Japanese shares closed higher on Friday, with the Nikkei hitting a two-week high, due to hopes of earnings recovery and gains in semiconductor-related shares as they look to raise their outputs to deal with a global shortage of chips. The Nikkei share average ended 2.32% higher at 29,854.00. The broader TOPIX closed the week down 0.63% to 1,971.62. “We are entering a phase where the stock market rallies even as interest rates rise because of strong earnings growth. This stage will eventually lead to an overheated market, but we are not there yet,” said Masayuki Kubota, chief strategist at Rakuten Securities. Semiconductor related shares continued to lead the market as the industry looks set to boost manufacturing amid a global shortage of chips. The bullish sentiment was also fueled by U.S. President Joe Biden’s $2 trillion spending plan that included a call to spend $50 billion in chip manufacturing and other technology research, said Fumio Matsumoto, chief strategist at Okasan Securities. Investors rotated out of value shares to growth shares, with TOPIX value underperforming TOPIX Growth.

China stocks ended higher on Friday, posting their second straight weekly gain, as investors were encouraged by recent data pointing to a solid recovery in the world’s second-largest economy. The blue-chip CSI300 index rose 2.45% to 5,161.56, while the Shanghai Composite Index added 01.93% to 3,484.39. Leading the gains, the CSI300 consumer staples index firmed 3.9%, while the CSI semiconductors & semiconductor equipment index advanced 5.3% on chip shortage worries. “It’s not a bear market. The mid-term correction since February has basically ended now and there are no conditions for major indexes to fall further as overall valuations of the A-share market remain low,” said Ma Manran, chairman of Beijing Ma Manran Asset Management Company. The CSI300 index has declined 13% from an all-time high hit on Feb. 18, amid worries Beijing could move to rein in bubbles in the financial markets. Data over the weekend showed annual profits at China’s industrial firms surged in the first two months of 2021, highlighting a rebound in the country’s manufacturing sector and a broad revival in economic activity. Data on Wednesday showed China’s manufacturing activity expanded at the quickest pace in three months in March as factories cranked up production after a brief lull during the Lunar New Year holidays.

Adding to Brazil’s pandemic woes, a new COVID-19 variant similar to the one first seen in South Africa was detected as the country notched another record daily death toll. Data showed industrial production in Brazil fell in February for the first time in 10 months, an unexpected decline that adds weight to a growing view that Latin America’s largest economy shrank in the first quarter. The Mexican peso rose 0.5%. “The proximity to the U.S. has become a blessing for Mexico as the country should benefit from the U.S. fiscal stimulus via several transmission channels, including exports, remittances and tourism flows,” said Gabriela Soni, emerging markets strategist Mexico at UBS. IPC closed almost flat for the week, down 0.28%. Adding to Brazil’s pandemic woes, a new COVID-19 variant similar to the one first seen in South Africa was detected as the country notched another record daily death toll. Data showed industrial production in Brazil fell in February for the first time in 10 months, an unexpected decline that adds weight to a growing view that Latin America’s largest economy shrank in the first quarter, but the Bovespa closed the week up 1.32%, still with a negative performance YTD. The ASX 200 finished higher to 6,828.7, its second day of gains. The rise helped erase Monday and Tuesday declines, with the index finishing the week 0.07% higher. Tech and materials helped lift the index, increasing 2.45% and 1.48% respectively. Utilities, and consumer discretionary also surged. Health care fell 0.2%, while consumer staples declined 0.1%. Energy, industrials and property also fell.

Fx and Commodities

Members of the 23-nation OPEC+, meeting via a two-day video hook-up, agreed to raise output by 350,000 barrels per day in May and June, and 400,000 bpd in July. Oil prices rose despite OPEC+’s decision to increase production. In fact, rather than a bearish move, investors interpreted the decision as a vote of confidence in demand. “The supply deficit that we’re already in is likely to accelerate,” Jeff Currie, Head of Commodities Research at Goldman Sachs Group Inc., said. London-traded Brent settled up 0.42%, at $64.64 per barrel. It reached as high as $64.95 earlier. New York-traded West Texas Intermediate, settled up 0.73%, at $61.25. Saudi Arabia was initially reported to be considering another 250,000 barrels per day of cuts in May, and 250,000 bpd in June, to provide continued support to the market. It terminated that idea after reaching a consensus with the other producers that an output hike may not be a bad thing after all, especially if demand for crude spiked in the coming months, allowing the kingdom greater market share.

Spot gold rose 0.23% to $1,734.82. U.S. gold futures settled at $1,728.40.” This is an upward correction in a structured bear market,” said Phillip Streible, Chief Market Strategist at Blue Line Futures in Chicago, adding gold could climb to $1,740 before yields resume its uptrend to push gold back down again. Gold markets have been trying to hang on to the $1700 level for a while, which is a crucial support level, if financial markets believe inflation will be transitory, gold prices could start to appreciate. The inflation dynamics are complicated for gold, because right now inflationary fears could lead to higher yields and lower gold prices.

On the currency side, the dollar rose on Friday in thin trading, posting its third straight weekly gain, after data showed the world’s largest economy created more jobs than expected in March, suggesting it is on a steady path to recovery from the pandemic. “The overall strength of the labor market is likely to prove dollar-positive,” said Joe Manimbo, senior market analyst, at Western Union Business Solutions in Washington. The dollar’s ascent to multi-month highs is likely to continue as more investors bet on economic recovery. The dollar was up 0.89% versus the yen at 110.64 yen, not far from its strongest level in a year at just under 111 yen. The euro, meanwhile, was down 0.29% against the dollar at $1.1760. AUD/USD is down -0.35% for the week at 0.7609USD.

The dollar index was up 0.2% at 93.011, posting gains in five of the last six weeks. Broad strength in the US Dollar has been making it harder for the GBP/USD exchange rate to keep recovering from near its monthly lows. The US Dollar outlook has risen on US President Joe Biden’s latest infrastructure plans. Since opening this week at the level of 1.3791, GBP/USD has been trending with a largely downside bias. GBP/USD has been able to hold above last week’s monthly lows and it’s up 0.26% at 1.381. In the cryptocurrency market, Ethereum, the second-largest cryptocurrency in terms of market capitalization, hit a record high of $2,081.83 and was last up 5% at $2,065.45.

3 Biggest Movers

Axcelis Technologies Inc (ACLS), manufactures ion implantation, dry strip and other processing equipment used in the fabrication of ics, surged 21.46% this week. Wednesday, the company announced that it has shipped multiple Purion VXE(TM) high energy systems to leading CMOS image sensor manufacturers. These shipments include a follow-on order to the recently closed Purion VXE evaluation. The Purion VXE is an extended energy range solution for the industry leading Purion XE(TM) high energy implanter.

Diamondback Energy Inc (FANG), engaged in oil and gas exploration and production of unconventional, onshore oil and gas in Permian, closed the week +7.16 %, after surging 10.52% on Friday as oil prices rose after another surprise move from OPEC+. U.S. oil prices retook the $60-per-barrel level Thursday after OPEC+ unexpectedly agreed to increase production in May. But the pace of increases through July was still seen as cautious and supportive of oil prices and shale producers like Diamondback Energy are expected to avoid big surges in production that could send oil prices back into a steel slump again.

Taiwan Semiconductor Adr (TSM), Taiwanese maker of logic, mixed signal ics for fabless chip companies and integrated device manufacturers, gained 7.07% this week. Semiconductor equipment stocks (including ENTG KLAC and LCRX) surged higher on Thursday after the world’s leading chip foundry said it plans to spend $100 billion over the next three years to increase capacity at its plants. The company is currently facing a large backlog of chip orders from fabless semiconductor companies. Its customers include Apple (AAPL), Advanced Micro Devices (AMD), Nvidia (NVDA) and more.

Next week main events

The main events of next week are the following. On Monday, in addition to release of Spain Consumer Confidence, the March Non-Manufacturing ISM Report will be released with a forecast of 58.5. On Tuesday, it will be released both the Japan Household Spending YoY forecasted at -5.3% and Euro area, in addition to the Italian one, Unemployment Rate forecasted 8.1%. On the 7th of April the Euro Area Markit Eurozone PMI Composite Output Index tracks business trends across both the manufacturing and service sectors, based on data collected from a representative panel of over 5,000 companies, will be released, followed by Federal Open Market Committee (FOMC) Minutes. The week will close with ECB Monetary Policy Meeting Accounts on Thursday and the release of China Inflation Rate YoY and the USA wholesale inventories MoM (0.5% forecast) on Friday.

Brain Teaser #2

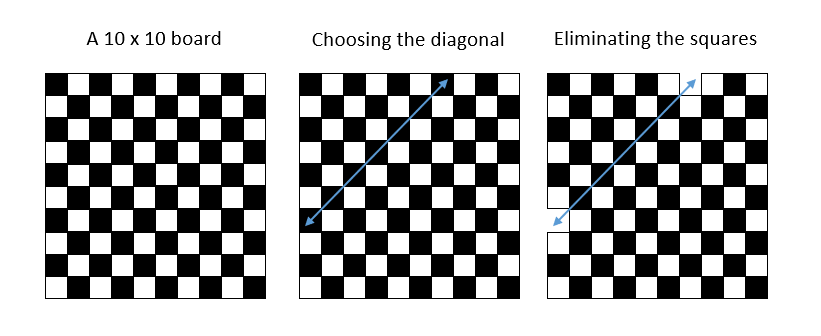

There is a board with 2N x 2N squares, where N is a natural number. We choose one random diagonal from it, and then we eliminate one square from each end. Thus, we now have a board with two missing squares, i.e., -2 squares. Is there a way to cover this board with 1 x 2 tiles (a rectangular that covers two squares), given that we can place them both in a horizontal and vertical position?

Hint: Below you can find an example for N = 5 of the steps previously described.

Solution:

The first step towards solving this problem is to color the board in black and white, similar to the chessboard. Next, we observe that each diagonal has squares of only one color, and hence the newly obtained board will have two missing squares, both of the same color. Thus, we remain either with black squares and white or vice versa. Also, we should notice that each 1×2 tile, placed in any possible way, will cover one white and one black square.

Now suppose that we manage to pack with tiles the entire board. It implies that tiles will be used, together covering black and white squares. However, this contradicts the fact that there are more squares of one color than the other. Consequently, it must be the case that our assumption is false, and we cannot cover this board with 1×2 tiles.

Brain Teaser #3

There is a light bulb inside a room and four switches outside. All switches are currently at off state and only one switch controls the light bulb. You may turn any number of switches on or off any number of times you want. How many times do you need to go into the room to figure out which switch controls the light bulb?

(Hint: it’s possible to solve it by entering just once, using not only your eyes)

Source: “A Practical Guide to Quantitative Finance Interviews” by Xinfeng Zhou

In the next Market Recap, we will provide the solution to the Brain Teaser #3.

0 Comments