USA

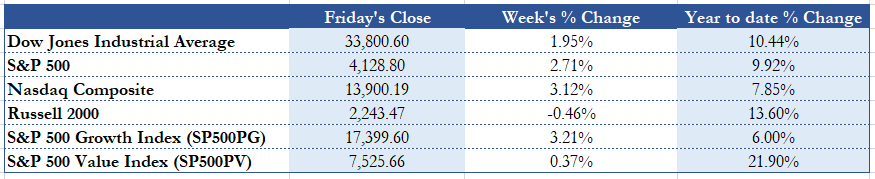

US indexes ended the week higher, one of the reasons seems to be the minute of the Federal Open Market Committee, which spread positivity on the market. The S&P 500 and Nasdaq Composite kept their upward trend with the latter approaching the 14,000.00 level, a barrier surpassed during the second week of February, and the first one breaking the 4,100.00 level. Dragged by the surge in price in blue chip stocks such as Apple, Amazon and Alphabet, all up more than 6%, they gained respectively 2.71% and 3.12%. Growth stocks outperformed value stocks after the bond market calmed, easing worries about the discounting mechanism: when rates are high, the present value of future cash flows decrease, in particular the ones of tech companies, which are characterized by high-growth . Indeed, the S&P Pure Value Index closed almost flat and S&P Pure Growth Index advanced almost 3%. The energy sector performed the worst, while the financial, tech and health sector registered an above-average performance. The Dow Jones lost the race against the S&P in YTD performance, despite rising nearly 2% this week. The Russell 2000, gathering mostly small-cap stocks, was the only index which closed in negative territory. The CBOE Volatility Index (VIX), which measures volatility based on S&P index options, touched the 52 weeks record low of 16.2, proving the quietness of this week’s session.

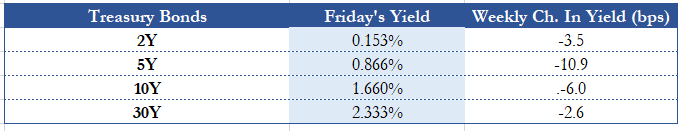

During the week, the 10Y Treasury yield fell by 6 basis points, the downward trend reversed momentarily after Wednesday’s FOMC minutes release indicated that loose monetary policy is going to remain until further unemployment rate improvement and an updated outlook for GDP increase in 2021 of 6.5% against 4.2% December projections. On Thursday, Jobless Claims came in higher than expected, leading to two consecutive weeks of rising figures, 744k against 680k forecasted. After the unexpected data, the 10Y yield fell to 1.62%, as investors shifted from paying equity risk premium to buying Treasury bonds. The week concluded with a larger-than-expected producer price index (PPI), which measures wholesale price inflation, leading the 10Y yield to rise again to 1.66% in the afternoon and closing the week stable at that level. The March PPI was up 1% against an estimated 0.5%.

“The recovery from the pandemic remains uneven and incomplete”, Fed Chairman Jerome Powell said on Thursday, during his comment on the economy. “This unevenness that we’re talking about is a very serious issue”, he added. These words express that a more robust recovery is needed and the Federal Reserve will do its best to provide the needed support in terms of monetary policy. JP Morgan Chase CEO, Jamie Dimon expressed his bullish view on the U.S. economy for the next few years in his annual shareholder letter. He said that the economic boom could easily run into 2023 due to excess savings, new stimulus, more QE, the potential infrastructure bill and a successful vaccine campaign. He rated the current valuations “quite high” but probably justified by the pricing of expected economic growth.

Europe and UK

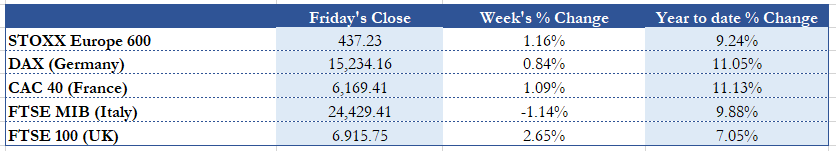

Europe’s major indexes increased slightly during the week. The continent wide Stoxx Europe 600 gained 1.16%, surpassing by more than 2% pre-pandemic level and making a record high of 437.00. The German DAX closed almost flat, with a 0.84% gain, staying over the 15,000.00 threshold and up more than 10% from February 2020. The French CAC 40 rose 1.09%, surpassing by almost 1% the highs of January 2020. While negotiating the acquisition of Lyxor to become the European leader in the ETF sector, Amundi’s stocks climbed more than 5% this week. The FTSE 100 surged 2.65% mainly due to the optimism spread by a strong and rapid vaccination program. While the rollout of Moderna vaccines started in London, the British index surpassed 6,900.00 heading to 7,000.00 level. Deliveroo’s shares plummeted around 10% only on Friday to 254.00. Italy’s FTSE MIB was left behind by the other major indexes, declining 1.14%.

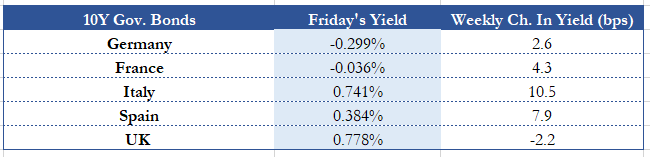

Differently from US Treasuries, European bonds and UK Gilt yields rose during the week. While the German and French are still moving in negative areas, the Italian yield climbed 10 basis points after both unemployment rate and services PMI came in lower than expected, ending the week at 0.741%. UK gilt yields fell 2.2 basis points, closing at 0.778%. At Thursday’s policy meeting, the ECB announced that it expects purchases of bonds under the PEPP in the second quarter to be conducted at a “significantly higher pace than during the first months of this year.” This was the reason under the momentarily drop in yield for German bunds, which however rose again during Friday session, after industrial output in February fell 1.6%, down from a consensus forecast of 1.5% rise.

Services PMI across Europe were higher than estimated, the Italian one was 0.4 below the forecast. UK Composite PMI came in 56.4 against 56.6 projected and the Service PMI 56.3 against 56.8 projected. Boris Johnson confirmed that step two to ease England from lockdown will take place on 12 April thanks to a successful vaccine programme, which together with the American one are the most effective in the world. On Friday, Christine Lagarde, ECB president, said that 2021 will probably see inflation in the EU at 1.5 percent, well below its target of 2%. She added that the ECB will continue its complete flexibility approach in terms of monetary policy and if it is necessary to provide more support they will do so. Differently, in the US the Fed sees inflation rate rise to 2.4% this year, well above the 2% target and then settle down to 2.1% by 2023. “We are in a completely different situation”, Lagarde defined the position of the two continents. While 14% of the EU population have received at least one vaccine dose, in the US the figure is approaching 35%, the ECB president expressed that there is a strong determination to bring that number up to 70% by the summer.

Rest of The World

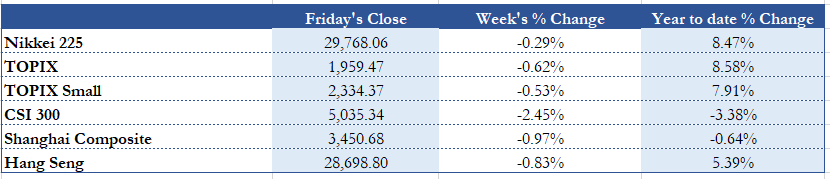

Asian indexes were mostly lower from last week levels. Japanese ones closed flat, the Nikkei 225 after breaking 30,000.00 level on Monday, ended the week at 29,768.00, losing 0.29%. The TOPIX and the TOPIX Small-cap index declined respectively 0.62% and 0.59%. Hong Kong based Hang Seng declined 0.83%, with the shares of Tencent-backed Linklogis, a supply chain financing provider based in Shenzhen, surging almost 10% after their debut. Chinese indexes closed lower, the large-medium cap CSI 300, fell 2.45%, and the Shanghai Composite slipped 0.97%. The Chinese PPI rose 4.4% in annual terms, above the 3.5% expected by analysts. The data represents with no surprise the expansion in manufacturing activity that in March was at the most active pace since the beginning of the year. The consumer price index increased 0.4% from March 2020. After Asian markets closed the week, a statement from China’s antitrust regulator imposing a fine equivalent to $2.8 billion against Alibaba for abusing its market dominance was released, the 18.2 billion yuan penalty is equivalent to 4% of the company’s domestic annual sales. The regulators started the investigation for the company’s monopolistic practices in December. Alibaba said it fully cooperated with the investigation and it accepted the penalty. The company will host a conference on Monday to discuss the fine.

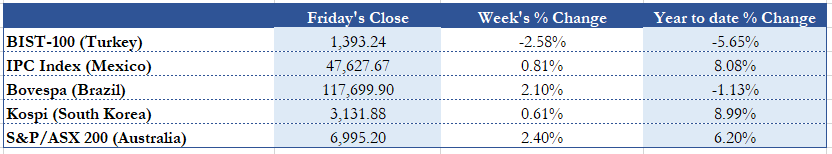

Turkish BIST-100 Index slid 2.58% returning below 1,400.00 level. Following a collapse of 7.5% of the Turkish lira during the second week of March after the president Erdogan ousted the governor of the central bank, the currency market calmed with the lira trading at 8.15 average for a dollar. Brasilian Bovespa gained 2.10%, railing towards its January high of 125,000.00. In South Korea, Kospi ended 0.61% up during the week. Australian S&P/ASX 200 grew 2.4%, after touching its record high of 7,000.00 during Thursday’s session.

FX and Commodities

Oil prices declined this week, Brent crude fell 2.79% closing at $63.05 a barrel, still 21.91% up year-to-date. West Texas Intermediate(WTI) crude shrunk 3.10%, ending at $59.34 a barrell. Downward pressure came from the decision of the OPEC+ to increase supplies by 2 million barrels per day between May and July.

Gold futures increased 0.80% at $1,744.10, down by 8.28% YTD. Spot price settled at $1743.10. Analysts expect gold to reach 1,760 level, supported by next week’s CPI report. “This type of potentially inflationary environment is generally viewed as supportive for gold,” said David Meger, director of metals trading at High Ridge Futures. Silver increased 1.12% to $25.33, down by 4.52% year to date.

The U.S Dollar Currency Index, which measures the greenback against a basket of six currencies, lost 0.89% closing at 92.18. The greenback has generally been positively correlated to stocks for the past few months, this week the relationship didn’t hold. “The trickiest thing for markets right now is to figure out what the dollar’s sensitivity is to good U.S. economic news,” said Erik Nelson, a macro strategist at Wells Fargo in New York. Investors are focused on President Biden’s proposed $2 trillion infrastructure plan, which would involve an increase in corporate taxes to finance the new spending. EUR/USD ended 1.21% higher at 1.1902 rate. GBP/USD fell 0.92% at 1.3705 and USD/JPY closed 0.93% lower at 109.67. Chinese Yuan closed almost flat against the dollar at 6.5530. Bitcoin/USD broke 61,100.00 on Friday recording an all-time high, with an impressive 111.27% YTD performance.

3 Biggest Movers

Affimed NV (AFMD), a clinical-stage biopharmaceutical company based in Germany, focuses on discovering and developing cancer immunotherapies in the United States and across all Europe. Its lead product candidate is AFM13, a natural killer cell, which is destined to treat patients with relapsed Hodgkin lymphoma. Shares surged 25.19% this week after the company disclosed positive data from an early-stage clinical trial of its AFM13 in patients affected by Hodgkin lymphoma.

Sohu.com Limited (SOHU), a Chinese tech company based in Beijing engaged in online media, search engine, gaming and other services. On Friday, market shares gained an impressive 16% and closed the week with an increase of 18.5%. The stocks rose after a report disclosed that Tencent was set to complete its acquisition of Sogou, China’s No.2 search engine. Sohu.com, which owns a third of Sogou, will receive $1.16 billion, a significant payout, considering that the gainer’s market cap is currently just $745 million. Sogou’ stocks were also more than 10% up.

fuboTV Inc. (FUBO), an American streaming platform focused on the distribution of live sports, including NFL, NBA, MLS, MLB saw its share growing 12% on Friday after the sports-focused streaming service announced a deal for the exclusive rights to a major set of soccer matches. fuboTV will now be able to livestream the Qatar World Cup 2022 qualifying matches of the South American Football Confederation. The rise inverted the downward trend, closing the week with 3.88% gains. The stocks are still down 16.75% year-to date after earnings came in much lower than consensus.

Next week main events

The following week starts smoothly with Euro Area Retail Sales and Chinese New Loans on Monday. On Tuesday, the UK GDP and USD Inflation rate will be released. The second part of the week is packed with relevant events. On Wednesday, alongside ECB President Lagarde speech and Fed Chair Powell speech, Euro Area Industrial Production will be out. Thursday is the most important day for the US market, with Retail Sales, Jobless claims and Industrial production being released. The week will end with some data from the Chinese side and the Euro Area Inflation rate.

Brain Teaser #3

There is a light bulb inside a room and four switches outside. All switches are currently at off state and only one switch controls the light bulb. You may turn any number of switches on or off any number of times you want. How many times do you need to go into the room to figure out which switch controls the light bulb?

Solution:

We will prove that you need to enter the room just one time to figure out which switch controls the light bulb. As the bulb emits heat when turned on for a long time, we will determine the right switch using the light and warmth factors. Initially, turn on the first and the second switch. Then, read a BSIC article or completely relax for a couple of minutes. When you are back, turn off the first switch and turn on the third one. Immediately open the door, enter the room, and touch the bulb.

If the light bulb is off and hot the first switch controls the light.

If the light bulb is on and hot the second switch controls the light.

If the light bulb is on and cold the third switch controls the light.

If the light bulb is off and cold the fourth switch controls the light.

Source: “A Practical Guide to Quantitative Finance Interviews” by Xinfeng Zhou

Brain Teaser #4

Can we arrange the numbers 1, 2, 3,…, 21 on a circle such that the sum of any two is a prime number?

In the next Market Recap, we will provide the solution to the Brain Teaser #4

0 Comments