USA

It was a turbulent week for equities due to a flare-up in global coronavirus cases and to the fact that President Joe Biden will seek an increase in the tax on capital gains to 39.6% for those Americans earning more than $1 million to fund education and other priorities (formal proposal should be released next week) however market gained on Friday as new data confirmed that economic recovery is underway partially limiting the negative week and confirming investors’ enthusiasm. The overall performance of the main indexes therefore was nearly flat with some indexes falling negative.

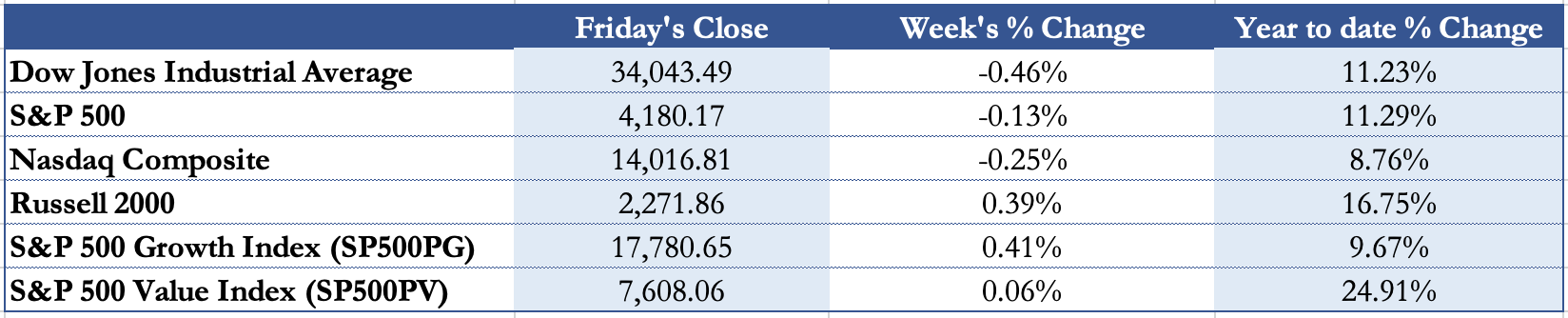

The S&P 500 after a tiny decreased 0.46% and closed at 4180.17 while the Nasdaq Composite lost 0.25% but consolidated its position above the 14,000.00 barrier. The mixed performance during the week of these indexes is also confirmed by the quarterly results released this week by IBM, Coca Cola and Netflix. The first is not new in confirming its post-pandemic recovery with strong data: over the last four quarters, the company has surpassed consensus EPS estimates four times two both beat estimates. Also Coca Cola beats on earnings, showing that demand in March hit pre-pandemic levels. Bad news for Netflix instead, the company plunged more than 8% because subscriber growth decelerated after enjoying a boom throughout the past year. Growth stock outperformed value stock with the latest slowing their rise and the growth gaining back from the March fall. The Dow Jones Industrial average was the worst in this week and the S&P 500 has overtaken it in YTD performance. Russel 2000 was among the biggest gainer with a 0.39% increase to 2,271.86 and holding its position among the top performing indexes YTD. After volatility touched its lowest level since pre-pandemic last week, it surged this week by 6.55%. The financials, materials and technology (to notice Snapchat that surged after strong rise in first-quarter revenue from a year earlier) sectors were among the best this week while utilities and consumer staples were the biggest losers.

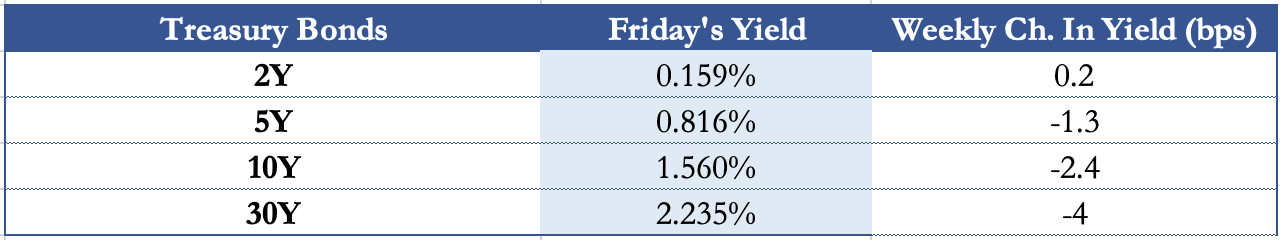

The yield on the 10-year Treasury set itself on Friday on 1.560%, closing 2.4 points lower. Still, the 10-year yield has retreated recently from its peak of well over 1.7% earlier this year. On Friday U.S. services index jumped to 63.1 in April, from 60.4 in March, signaling the fastest expansion in service-sector activity since data collection for the series began in 2009 (data from IHS Markit). Meanwhile, manufacturers signaled a huge rise in output in April, even if many firms said production capacity was impeded due to issues sourcing raw materials. The number of Americans filing new claims for unemployment benefits fell to a 13-month low last week, suggesting layoffs were subsiding and strengthening expectations for another month of blockbuster job growth in April as a reopening economy unleashes pent-up demand. It was the second straight week that claims were below the 700,000 level since March 2020 when mandatory shutdowns of non-essential businesses like restaurants and bars were enforced to slow the first wave of COVID-19 infections.

Federal Reserve officials next week are likely to draw a robust picture on the economy while simultaneously not even hinting at policy changes ahead. The Fed has kept short-term borrowing rates near zero since early in the Covid-19 pandemic and has continued to buy at least $120bn of bond-related assets each month. The asset purchases have pushed the central bank’s balance sheet to nearly $8 tn, or about double its level since the crisis began.

Europe and UK

European stocks were all negative this week after a surge in global coronavirus cases offset strong earnings reports. Global market sentiment also took a knocking following reports U.S. President Joe Biden planned to raise income taxes on the wealthy, a proposal some said would be hard to pass in Congress. Among the big news surely it figures out the Super League. A league project proposed by the twelve biggest teams of football in Europe, and which had Florentino Perez (Real Madrid chairman) as president. The goal of this new league was to recover the losses of the pandemic and offer a more exciting football, however the protests of the governments and the fans soon stopped the project.

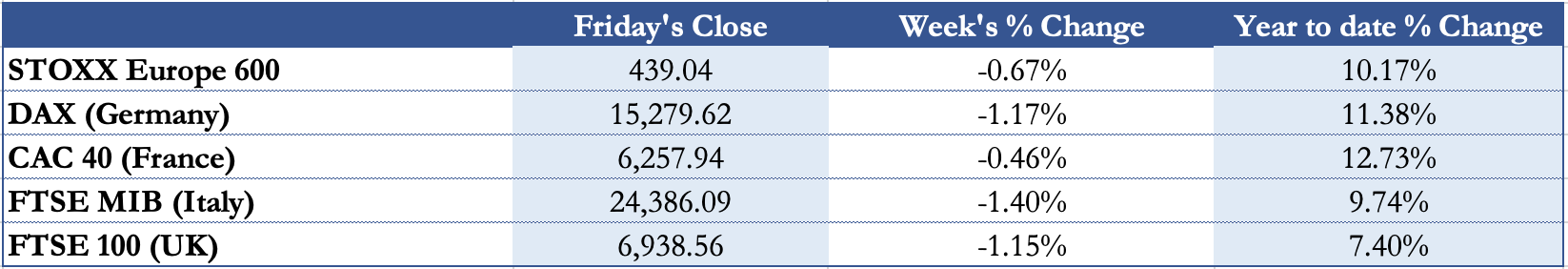

The STOXX Europe 600 fell 0.67% to 439.04. In these last five sessions, mainly banks and automotive companies have fallen: the sector index of the former marks a decline of 3%, that of the latter by 3%. Biggest losers are DAX and FTSE MIB. The German index lost 1.17% to 15,279.62 while the Italian one fell 1.40% to 24,386.09. In the week there were some positive news like the Italian luxury goods group Tod’s jumped 11.4% after France’s LVMH agreed to increase its stake in the company to 10% and French media giant Vivendi rose 2.8% as strong performance at its music unit Universal and a sales jump at its publishing division helped its quarterly revenue grow; these were offset however by the bad news from U.S. and a rise in coronavirus cases. FTSE 100 followed the overall path losing 1.15% to 6,938.56. The top performing index YTD remains CAC 40 closing at 6,357.94 strengthened by companies in the luxury sector which reported positive results.

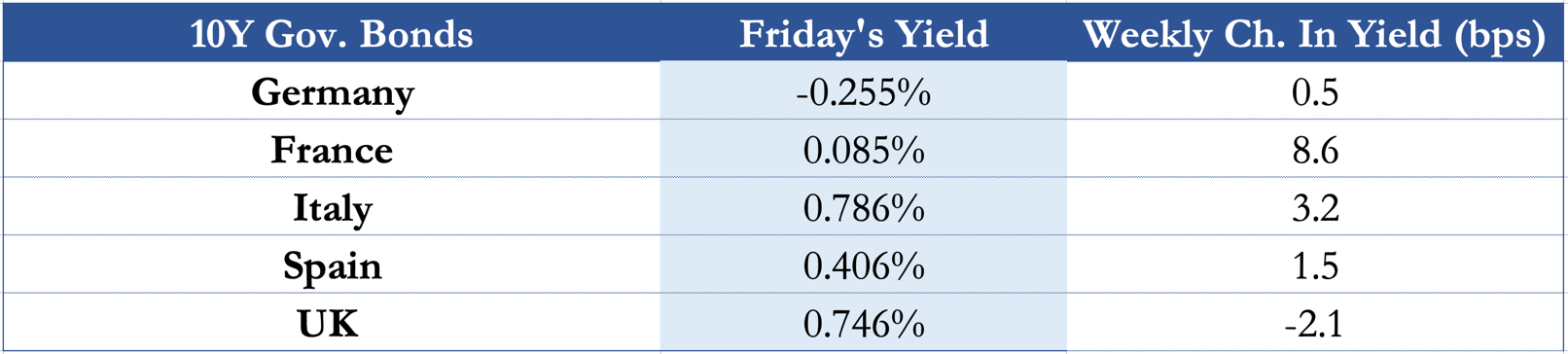

The gap between U.S. and European 10-year government bond yields has tightened to its narrowest in more than a month as Treasuries rallied and German bunds sold off in recent days. In general, yields increased by a few basis points across Europe. The most important data is surely the French yield moving above the zero. The only one keeping negative yield is the German bund which rose by 0.5 bts. The European Central Bank decided on Thursday to keep its policy unchanged while market players look for clues on when its massive monetary stimulus might start to be wound down. “Preserving favorable financing conditions over the pandemic period remains essential to reduce uncertainty and bolster confidence, thereby underpinning economic activity and safeguarding medium-term price stability,” ECB President Lagarde said at a press conference on Thursday. The UK inflation rate rose to 0.7% in the 12 months to March (as reported on Wednesday), up from 0.4% in February, pushed up by the increased cost of fuel, transport and clothes. The Bank of England has forecast that inflation could reach 1.9% by the end of 2021, hoping it won’t exceed 2%. These news were appreciated by investors with the U.K. 10 Year Gilt Price rising.

Market players are keenly anticipating the June meeting, the next in the ECB’s calendar, as the next key moment for monetary stimulus in the Euro zone. Aggressive ECB members are hoping that, as vaccination roll-out rises and economies reopen, they can start talks on when to ease stimulus. Nevertheless, this will depend on how the pandemic and respective vaccination programs play out. At the moment Lagarde said there hadn’t been discussions so far on a possible phasing out of stimulus, as it was “simply premature.”

Rest of The World

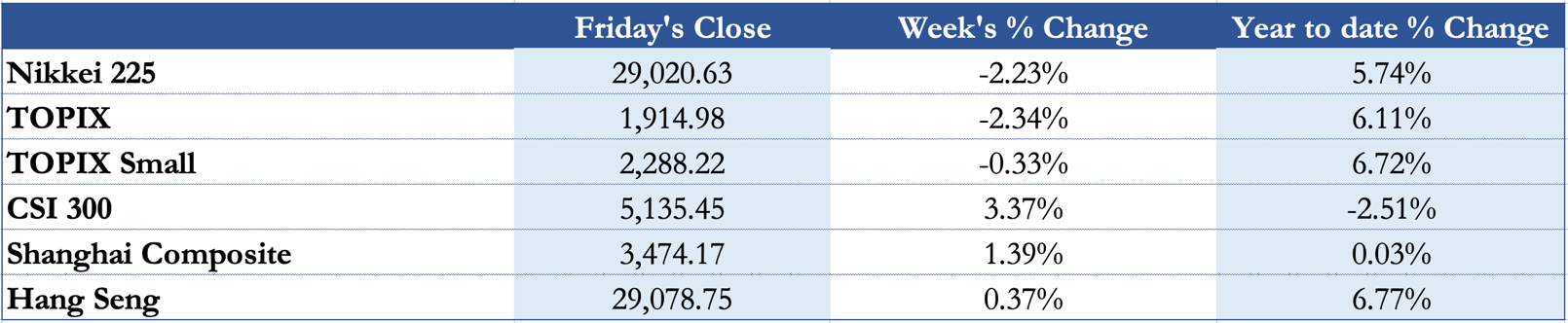

Japanese shares closed lower this week, as stricter government curbs to contain COVID-19 infections raised economic recovery concerns, while a disappointing forecast from Nidec added to the cautious mood at the start of the corporate earnings season. The Nikkei share average fell 2.23% to 29,020.63, while the broader Topix lost 2.34% to 1,914.98. “The market sentiment has gotten weaker since reports on the virus emergency measures started floating this week,” said Koichi Kurose, chief strategist, Resona Asset Management. Tech firms lead the fall, with Tokyo Electron losing 1.45%, Fanuc falling 3.05% and Advantest shedding 1.25%. on the other hand pandemic-hit shares rose the most on index, with ANA Holdings up 3.38%, followed by Odakyu Electric Railway, gaining 2.66%, and Central Japan Railway Co, up by 2.53%. There were 79 advancers on the Nikkei index against 139 decliners. Opposite direction for Chinese stocks which rose during the week as President Xi Jinping’s renewed green pledge bolstered clean energy stocks while coronavirus cases soared in some Asian countries helped support healthcare shares. The blue-chip CSI300 index rose 3.37% (the biggest weekly gain in two months), to 5,135.45, while the Shanghai Composite Index gained 1.39% to 3,474.17 points. An index tracking China’s environment protection stocks rose over 1% after Chinese President Xi reiterated his intention to make China carbon neutral by 2060. China will start phasing down coal use from 2026, Xi said at a summit of global leaders on Thursday. Meanwhile, China’s healthcare stocks registered robust gains amid reports of rising COVID-19 cases in India and Japan, in particular India set the world record for new coronavirus cases on Friday: 332,730 in 24 hours against the country’s average of around 280,000. Hong Kong shares rose too, led by tech and healthcare plays amid signs of an increase in coronavirus cases in countries cited above. The Hang Seng index rose 0.37% to 29,078.75 with healthcare stocks jumping over 3% on Friday.

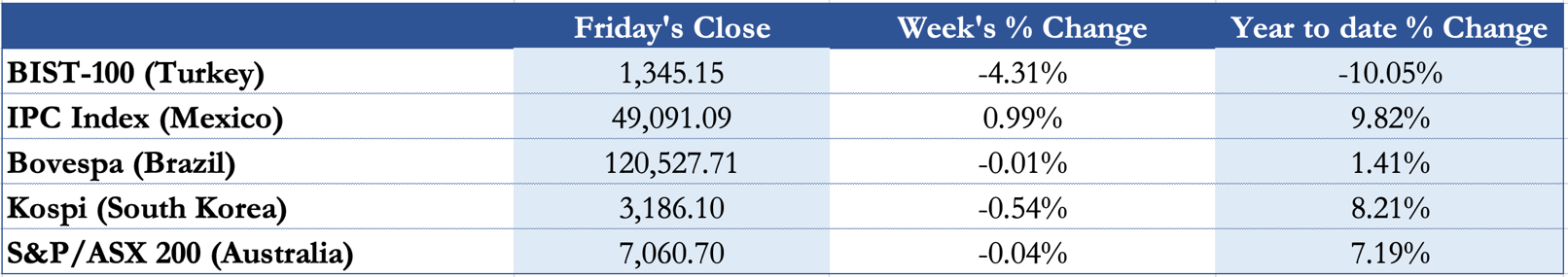

In keeping the green trend line Brazil’s President Jair Bolsonaro approved a 24% cut to the environment budget for 2021 from last year’s level, according to official numbers published on Friday, just one day after he vowed to increase spending to fight deforestation. Speaking on Thursday to the summit organized by U.S. President Joe Biden, Bolsonaro pledged to double the budget for environmental enforcement and end illegal deforestation by 2030. Bovespa was among the least worst in this week closing at 120,527.71. The Turkish Central Bank will continue monetary tightening until mid-term inflation target of 5% is achieved, its governor said. He added Turkey will make reserves permanent and better implement a system that finances production and exports. These news were not received with great enthusiasm by the market with the BIST-100 falling 4.31% to 1,345.15 and the YTD performance losing over 10%. Latin America’s second-biggest economy shrank by 8.5% last year and has suffered one of the world’s worst Covid-19 death tolls, however this year is set to turn around with a YTD increase of 9.82%. The Mexican economy stands to gain from two important key factors: the first is that Joe Biden’s stimulus-fuelled boom is excellent news for the country’s manufacturing and tourism sectors (more than three-quarters of Mexican exports go to its northern neighbour). The second regards a renewed focus on simplifying and “reshoring” global supply chains away from China that means that corporate investment that once went to Asia is now directed towards Mexico.

FX and Commodities

Oil prices rose on Friday on hopes of a fuel demand recovery in the United States and Europe as economic growth picks up and lockdowns ease, but it was not enough to recover from starting week losses due to India’s raging second wave of COVID-19 cases. The Brent closed the week almost flat at $ 66.11 while the WTI lost 1.3 % and closed at $62.14.

Gold closed flat this week at $1,777.11. It attempted but failed to tackle the $1,800 an ounce this week. Even though the attack on $1,800 was unsuccessful for now, investors remain optimistic on gold’s near-term price direction. The positive outlook is largely due to two drivers — the recent bitcoin selloff and U.S. President Joe Biden’s plan to nearly double the capital gains tax rate for wealthy Americans. “We can get a move in gold after seeing the double-bottom. And next week might be the catalyst to push the precious metal higher due to bitcoin’s drop and Biden tax announcement,” RJO Futures senior commodities broker Daniel Pavilonis told Kitco News.

Looking at currencies, the dollar fell against major currencies on Friday as U.S. yields languished and the euro got an extra late-day lift following an earlier boost from an upbeat survey of purchasing managers. The Dollar Index fell 0.77% to $90.8080, a level not seen since early March, after the EUR/USD climbed to $1.2098, pushing through its earlier high for the week. The exaggerated move came after the markets saw a European purchasing managers’ index for April come in better than expected, supporting the view that the region’s economic recovery is accelerating and won’t keep lagging so far behind the U.S. recovery. Different outcome for the GBP/USD which fell 0.79% to $1.39 after economic releases. Bitcoin fell over 15% on last Sunday following a broad sell-off. In this week decreased 10.9$ and the Bitcoin/USD reached $49,559.30.

3 Biggest Movers

Juventus Football Club SpA (JUVE), an Italian football team rose over 18% on Monday after the official statement of the Super League was released late on Sunday. After numerous protests from fans and threats from UEFA (Union of European Football Associations) the Super League project was stopped and many clubs decided to withdraw from it. Juventus’ stock declined immediately after these news by 18.5% closing the week with an overall loss of 4.01%.

Skillz Inc. (AA), an American online mobile multiplayer competition platform that is integrated into a number of iOS and Android games soared back this week after some difficult months. The past month drop has multiple explanations: first, short-sellers have published reports alleging management is only trying to enrich insiders, among other things, secondly, retail investors are supposedly relinquishing growth stocks and buying value stocks instead. This week the stock rose by 22.37% also thanks to Cathie Wood that bet on it.

Sypris Solutions, Inc. (SYPR), an American company specialized in the development of electronic design and manufacturing services for the aerospace sector announced that it has recently received a follow-on award from a US DoD prime contractor to manufacture and test electronic assemblies for a Government spacecraft program. Shares of the company soared over 56.84% this week.

Next week main events

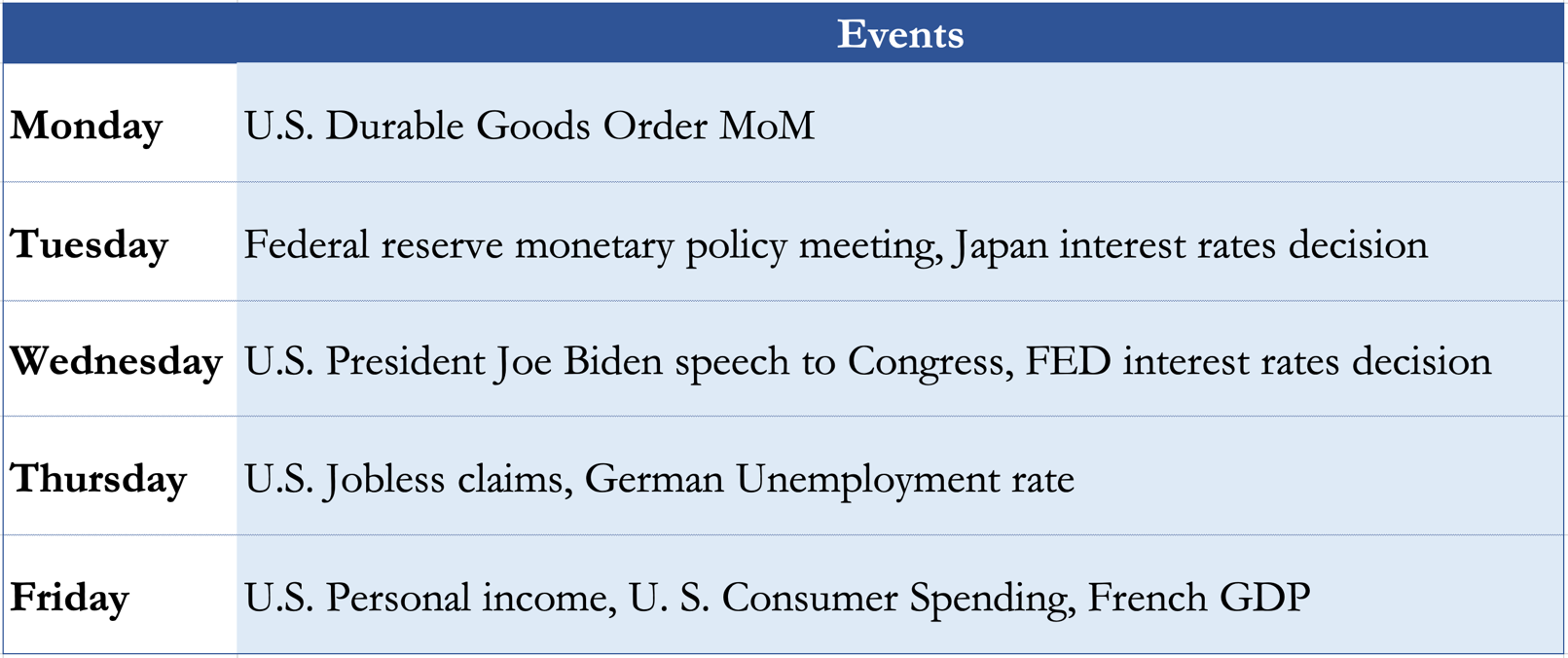

The calendar of the following week is pretty empty. First there are many big stocks releasing earnings from Tesla to Alphabet and Apple. Main events surely regard the FED meeting on Tuesday and its interest rates decision on Wednesday. In Europe all eyes are on the German Unemployment rate on Thursday to see how much the leading economy in the EU has recovered from the pandemic.

Brain Teaser #5

You have 100 red balls, 100 white balls, and 100 green balls. How to split them into three buckets such that you maximize the probability of selecting a white ball if the bucket and the ball are randomly selected?

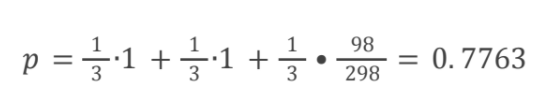

Solution:

You split the balls across the three buckets in the following way (0,1,0), (0,1,0), and (100,98,100), where (x,y,z) represents the number of red, white, and green balls, respectively. In this way, you get the maximum probability that a white ball will be selected when choosing a random ball and bucket.

Brain Teaser #6

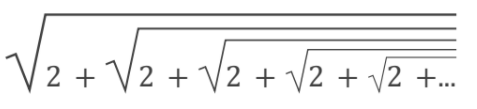

Calculate

0 Comments