USA

The main U.S. indexes gained this week after positive quarter releases and good economic data. Investors spent much of April grappling with two competing dynamics: signs of a strong economic rebound in the U.S., and worsening Covid-19 cases elsewhere in the world that threaten to hamper the global recovery. Robust corporate earnings helped major indexes hit records throughout the month. Data have also been encouraging, with figures released Friday showing U.S. household income surged by a record 21% in March.

The Dow Jones Industrial Average closed nearly parity with an increase of 0.05% that pushed it to $34,060.56. The biggest gainer among the main indexes was the S&P 500 which reached $4,211.47 followed by the Nasdaq Composite that gained 0.47% and closed at 14,082.55 on Friday. Both these two indexes were boosted by strong economic releases this week: Amazon, Apple, Facebook, Google and Microsoft all reported significant gains in profits and revenue, underscoring how the pandemic has helped strengthen technology companies and put them increasingly at the centre of daily life around the world. Apple’s profit more than doubled to $23.6 billion due to higher sales of new, higher-priced iPhones as well as Mac computers and iPads. A surge in digital-ad spending lifted Facebook and Google parent Alphabet Inc., while Microsoft posted a 19% increase in quarterly sales as more customers turned to its cloud and videogame services while staying home during lockdowns. The S&P 500 Value Index outperformed the Growth one this week widening further the gap in the YTD performance between the two indexes. Despite a loss of 0.41% the Russel 2000 is still the best performing index among the main ones on the YTD performance. Volatility kept surging also this week with the VIX gaining 5.25% since good quarterly releases were offset by the fact that President Joe Biden pitched his idea to raise tax on wealthy Americans and corporations to the Congress. The top performing sectors this week were energetic, transportations and financials ones while the healthcare and consumer non-cyclical lost ground.

U.S. government bond prices pulled back this week, reflecting the impact of an auction of seven-year debt and the looming conclusion of the Federal Reserve’s two-day policy meeting. For months, Fed Chairman Jerome Powell has repeatedly said that the time wasn’t right to even begin thinking about tightening monetary policy by reducing the amount of bonds that the central bank buys each month. Despite improvement in the economy, he has noted that U.S. employment remains well short of its pre-pandemic level. The yield on the benchmark 10-year U.S. Treasury note, which rises as bond prices fall, touched 1.688%, its highest intraday level in more than two weeks, before settling at 1.622%. On Wednesday President Biden’s night proposal for another round of fiscal stimulus spending, which could total $1.8 trillion, also weighed on the bond market. “The fiscal stimulus has been the single more important factor for the bond market this year. It’s delivered a huge boost to growth and really changed perception of where the U.S. economy is going, where the Treasury market is going,” said Seamus Mac Gorain, head of global rates at J.P. Morgan Asset Management. It remains to be seen if the latest proposed package gets passed by Congress, but it would be another contributor to growth, he said.

It isn’t entirely clear how the bond market would react if Mr. Powell opens the door to scaling back the Fed’s purchases of Treasurys. The prospect of reduced bond purchases would provide an obvious reason for yields to go up. That could be offset if investors think a policy shift could hurt the economy and respond by selling riskier assets and buying safer ones.

Europe and UK

Mixed performance for European equities this week with a prevailing pessimistic sentiment by investors, even as bank shares hit 14-month highs on strong quarterly earnings, as a rise in euro zone bond yields saw investors lock in profits at near-record levels. GDP data showed the euro zone economy dipped into a second technical recession after a smaller than expected contraction in the first quarter, but is now set for recovery as pandemic curbs are lifted amid accelerating vaccination campaigns.

The pan-regional STOXX 600 index fell 0.3%, hovering below its all-time high, and ending 8.92% higher YTD. Bank stocks were the best performers for the week, as Standard Chartered added another notch to a series of strong earnings reports this week, including those from HSBC and Santander. The FTSE 100 was the top performing European index this week gaining 0.45% to 6,969.81. The U.K. market was boosted also by AstraZeneca that jumped 4.3% as the British drugmaker posted better-than-expected results and forecast second half growth. DAX lost 0.94% to 15,135.91 but kept his YTD performance above the 10%. The German economy contracted by a greater-than-expected 1.7%, hit by renewed lockdowns. FTSE MIB too decreased by 0.44% to 24,278.20. On the other hand, despite reimposed restrictions to curb a surge in COVID-19 infections, the French economy returned to growth in the first quarter, sustained by consumer spending, official data showed Friday. The CAC 40 gained 0.18% to 6,269.48 and consolidated its position as the best performing European index on a YTD basis.

European sovereign bond yields climbed this week, with the yield on the 10-year German bund which signed its biggest weekly rise in two months and remaining the only negative one. The European Central Bank has said that it is seeking to preserve favourable financing conditions and ramped up the pace of bond purchases last month to temper the rise in yields. Despite this, an April 20 bank lending survey showed that credit conditions tightened for a third consecutive quarter for businesses, and lenders said they expect this to continue. “At this point it’s very clear that the ECB doesn’t have the situation of European sovereign yields under control,” said Althea Spinozzi, a fixed-income strategist at Saxo Bank. “I would expect, depending on the severity of the selloff, that we could expect an increase of purchases.” Furthermore, investors are closely watching for any signs that the economic recovery from COVID-19 is gathering sufficient pace for central banks to start scaling back extraordinary monetary stimulus, though both the U.S. Federal Reserve and the European Central Bank have said that is not the case yet. Key benchmark yields hit multi-month highs on Thursday after U.S. economic growth and German inflation data came in higher than expected, strengthening the case for a pullback. Preliminary data on Friday showed the euro zone economy shrank less than expected in the first three months of the year, while headline inflation picked up as expected.

Elsewhere, Germany announced investor meetings for its upcoming issuance of green bonds. After last year issuing five and 10-year green bonds securities that fund environmentally beneficial projects, Germany’s finance agency is planning a 30-year syndicated issue in May. The finance agency will hold bilateral calls from next Tuesday, followed by a global investor call on Thursday. Therefore, Germany is building a green yield curve, which other countries and companies could then use as a reference point for their own sales.

Rest of The World

Japanese shares lost this week, weighed down by technology firms’ disappointing outlook, while a spike in domestic COVID-19 infections hit investor sentiment. The Nikkei 225 Index fell 2.11% to 28,812.63, while the broader Topix slipped 0.87% to 1,898.24. Japanese tech stocks led the declines, as investors sifted through latest earnings reports and sold shares of companies that failed to live up to their lofty expectations for a robust rebound this year, analysts said. Investors are also growing more worried about COVID-19, as new infections in Tokyo and Osaka are rising even after the declaration of a state of emergency for the two cities at the start of this week, analysts said. Tokyo reported 1,027 daily infections on Thursday, the highest since Jan. 18. Chinese stocks fell too this week as data showed the country’s factory activity growth slowed in April, while worries over policy tightening and Sino-U.S. tensions continued to weigh on the market. The CSI300 index fell 0.2% to 5,123.49, while the Shanghai Composite Index ended down 0.79% at 3,446.86. China’s factory activity expanded at a slower pace and missed forecasts in April as supply bottlenecks and rising costs weighed on production and overseas demand lost momentum. In addition, on Thursday China is reining in the ability of the country’s internet giants to use big data for lending, money-management and similar businesses, ending an era of rapid growth that authorities said posed dangers for the financial system. Finally, Hong Kong stocks dropped in this week to post weekly losses, weighed down by tech firms, after Beijing widened crackdown on fintech companies as financial watchdogs might order them to strengthen compliance with regulations. The Hang Seng index fell 1.39% to 28,675.37 but it’s still the top performing Asian index YTD.

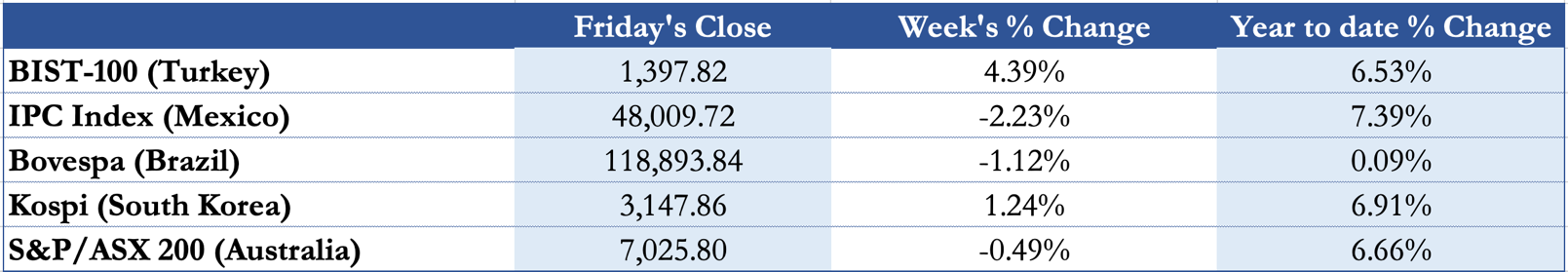

Brazil’s market dropped this week as unemployment jumped to record levels and a spike in coronavirus deaths dented sentiment, although expectations of interest rate hikes and a weak dollar led the currency to gain most among its Latin American peers in April. Brazil on Thursday became the second country to pass 400,000 COVID-19 deaths after the United States, and experts warned the daily toll could remain high for several months due to slow vaccinations and loosening social restrictions. Bovespa dropped 1.12% to 118,893.84. In Turkey, as expected, the bank raised its year-end inflation estimate to 12.2 percent from the 9.4 percent target set by previous governor Naci Ağbal in January. The bank cited higher import prices due to a significant depreciation of the lira as the main reason for the increase. Domestic demand, which Kavcıoglu said remained strong despite monetary tightening performed by Ağbal, contributed 0.4 percentage points to the hike, as did accelerating global good price inflation. The BIST-100 was the biggest gainer this week partially covering from the big loss of last week. The Turkish index closed at 1,397.82 after a gain of 4.39%. Ratings agency Moody’s Investors Service on Thursday confirmed Mexico’s credit rating, saying the country had contained a deterioration in its finances, and forecast a gradual recovery from the economic shock of the coronavirus pandemic. Aided by a robust recovery in the United States, Moody’s forecast the Mexican economy would expand by 5.6% in 2021 and 2.7% in 2022. Over the medium-term, it saw Mexican growth returning to somewhere close to 2% per annum. However Mexican market struggled this week due to low investors’ confidence in a short-term recovery, the IPC Index fell by 2.23% to 48,009.72, but it is still the top gainer index in this basket on a YTD performance.

FX and Commodities

Oil prices fell from six-week highs on Friday as investors unloaded positions after weak Japanese crude import data and on worries about fuel demand in India, where COVID-19 infections have soared. U.S. crude and global benchmark Brent logged their biggest daily drops in more than three weeks, but saw monthly gains of near 6% and 8%, respectively. Fuel demand worldwide is mixed, with consumption rising in the United States and China, while other nations resume lockdowns to stem the rising infection rate. Brent crude settled at $67.25 a barrel, falling $1.31, or 1.9% on the last day of trading for the front-month June contract. U.S. West Texas Intermediate crude for June settled at $63.58 a barrel, down $1.43, or 2.2%. Brent gained 1.7% on the week and WTI rose 2.3%.

A plus sign, on a monthly basis, also for gold (+ 3.6%) favoured by the weakness of the dollar and the relative easing of tensions on American rates. Despite the weekly loss of 0.84% to $1,765.77 it manages to preserve a strong YTD performance and is expected to gain from a possible loss of shine from the crypto side.

The US dollar was strong particularly against the euro, sterling and antipodeans. One of the main fundamental underpinning is that there was a definite pickup in risk aversion immediately after a study showing that one vaccine dose isn’t a great protector against covid variants. Looking deeper into the study, that might be premature, but it could delay the recovery and reopening so it’s something to watch. In addition, it’s the final day of the month and that means flow driven trade is part of the landscape. That was abundantly clear in EUR and GBP into the London fix as they plunged. The EUR/USD closed at $1.2022, while the GBP/USD at $1.3819 from $1.39 of the last week. The Dollar Index witnessed the rebound climbing to $91.30 after a 0.55% gain.

3 Biggest Movers

Twitter, Inc. (TWTR), recently set out an ambitious plan for growth, spurring a wave of optimism in the stock. Thursday’s earnings were the first opportunity to gauge the company’s progress around its goals, but an earnings beat wasn’t enough to assuage investors. Shares however fell $9.87, or 15%, to $55.22 Friday after the social media company warned that user growth could cool in the coming quarters.

Brooklyn Immuno Therapeutics, Inc (BTX), an American clinical stage biopharmaceutical company committed to developing IRX-2, a novel hd-IL-2 -based therapy, to treat patients with cancer, announced on Friday it has acquired an exclusive license for mRNA gene editing and cell therapies technology of Factor Bioscience Limited and Novellus Therapeutics Limited pursuant to an exercise of a previously announced option. The stock surged by approximately 50% after this news.

Barclays, PLC (BCS), delivered earnings of £2.4bn in the January-March period, up from £923m a year ago when the economic picture was darkened by the prospect of prolonged lockdowns. But shares fell nearly 7% as the UK-based group’s investment arm recorded a mixed performance and its Barclaycard business slipped with consumer spending still under pressure.

Next week main events

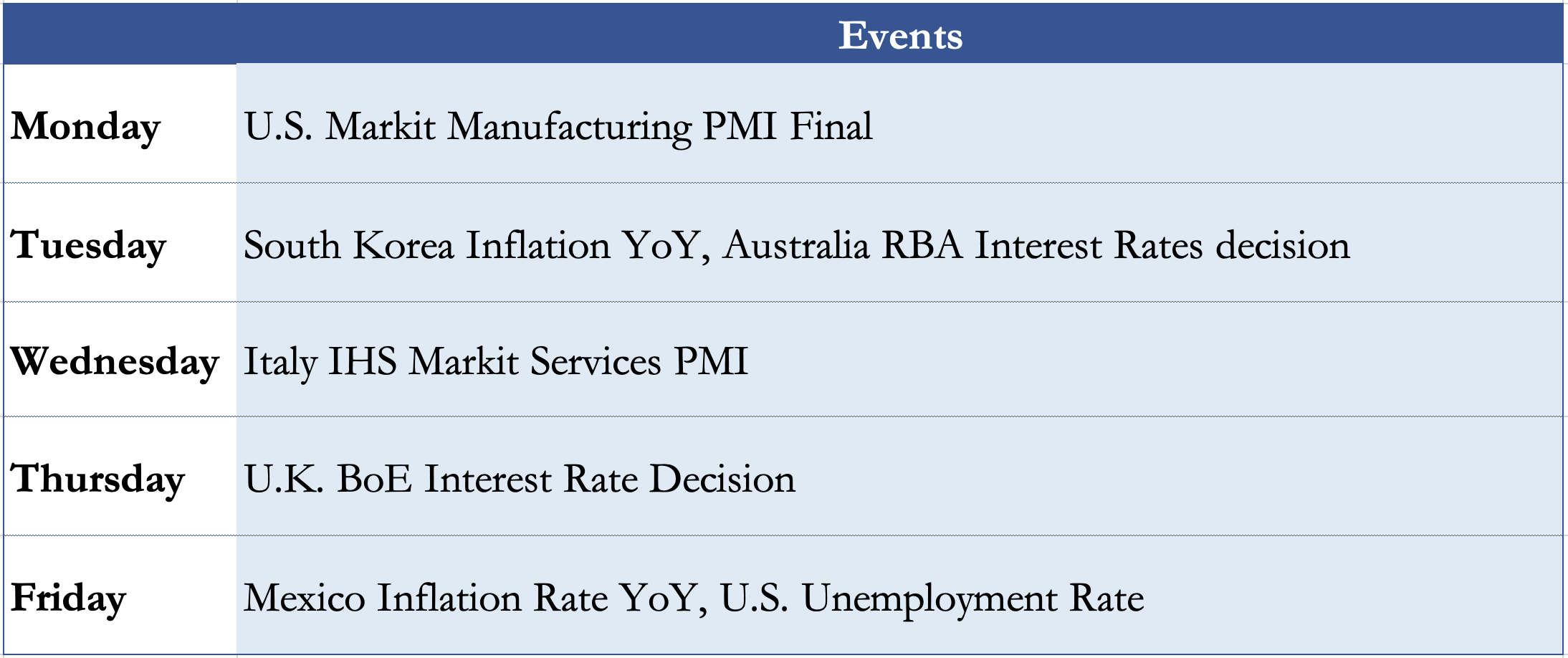

Not an empty calendar for the first week of May. The first main event is the U.S. Markit manufacturing PMI on Monday. In Europe certainly the Interest Rates decision by BoE is main event and will take place on Thursday. Ending the week on Friday the U.S. will publish the Unemployment Rate, the previous time was at 6% now the forecasts are telling 5.6%.

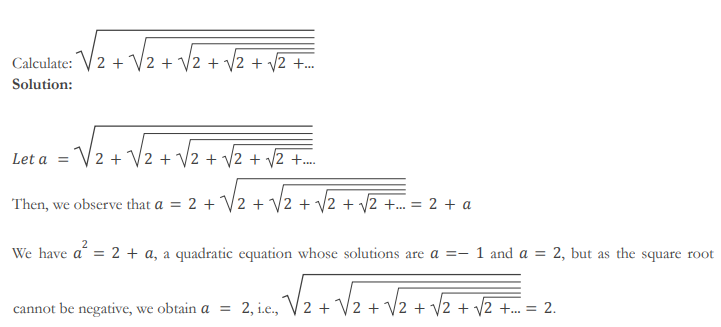

Brain Teaser #6

Brain Teaser #7

A BSIC member wants to reach another floor of the university. He can climb either 1 or 2 stairs at a time. In how many distinct ways can he climb all the stairs if there are N stairs to climb?

0 Comments