Introduction

Emerging Markets have long been just that: markets that are only just in the process of becoming developed, and are still lagging behind established market economies. Recently, however, the pace of development has increased drastically in these economies, particularly in their technology sectors. Reasons for this are diverse and often dependent on the respective country, but common factors that often accompany these changes are reductions in the share of the population living in poverty, more widespread adaptation of internet and the inefficiency of existing institutions. In the following we will highlight the tech boom in Latin American and Caribbean countries (LAC) as well as in India, shedding light on the details of this development and how investors are reacting to it.

Technology sector in LAC

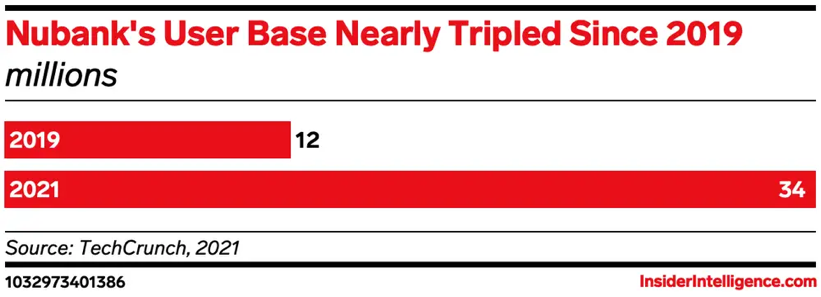

Startups in the Latin America & Caribbean (LAC) region have been on a roll recently. Encouraged by success stories such as Nubank, the Brazilian neobank which reached a $30bn valuation in a recent funding round, investment in young firms in the region per year has exploded from US$143m in 2011 to US$4.1bn in 2020. A new peak in investor enthusiasm for the region was marked with Japan’s Softbank recently announcing a $5bn LAC venture fund. This raises the question of what exactly makes LAC startups so exciting and whether the sector’s growth is sustainable.

Source: LAVCA Data

A main driver of success in the region has been its fundamentals. LAC is one of the most populous regions in the world, with over 660m inhabitants. Even though these people are spread across 33 different countries, they mostly speak Spanish and Portuguese, making expansion across the region easier for fast-growth companies. The region is particularly attractive for technology firms, due to its young and therefore tech-friendly population with a median age of 31 years. Furthermore, internet adoption is growing rapidly, having recently hit 72%.

However, having a large population doesn’t differentiate LAC from other areas, such as China, the US, or India. Instead, it is the nature of the challenges that must be solved that provides such an interesting opportunity for startups and their financial backers in the area. Banks, used car dealerships and other basic services exist in the region, but are mostly very unpleasant to use for customers. Hence, when a new firm comes in and provides the service at an adequate level that alone will allow the firm to experience success. A textbook example of such a market is the banking sector in Brazil.

Traditional Brazilian banks were and still are amongst the most profitable in the world, due to the market for banking in the country being an oligopoly. They charged an annual interest rate of 120% on consumer loans in 2018, whilst credit card debt cost 272% a year, according to a Harvard Business School Study. In addition to these exorbitant fees, bills could only be paid physically at a bank branch, meaning customers had to wait for hours in queues under the hot Brazilian sun before finally being able to make their payments.

Hence, banking in Brazil was ripe for disruption by Nubank. The bank offers digital bank accounts and international credit cards without fees, as well as personal loans, life insurance, and investments. In its offerings, Nubank focused on customer experience, enabling the opening of bank accounts in hours, instead of previously weeks and making payments possible online. Also, it reached Brazilians everywhere, not just in the 80% of regions that previously had bank branches. This was only possible because of it being an online bank, showing the large opportunity that increasing internet usage in the region brings. Finally, it has recently started its expansion across other countries in the region, expanding to Colombia and Mexico.

Source: TechCrunch

Due to being so superior in product offering relative to incumbents, the startup managed to grow to 34 million users and an operating revenue of around $800m in 2020 (198% CAGR over the last three years), with a $0 customer acquisition cost. With more than 15% of the Brazilian population still unbanked, and this number being even higher in neighboring countries, Nubank still has plenty of room to grow.

Apart from disrupting markets such as the above, startups in the region have also seen success with business models which have worked well in other areas. A good example of this is the super-app Rappi, which started off as a food delivery business and now offers services as diverse as dog walking. It recently raised a series F at a $5.25bn valuation with an estimated revenue of $750m in 2020.

To summarize, LAC is a large market with many opportunities for disruption, due to incumbents that have made use of their oligopolies in order to charge high prices for weak product offerings. Through the increasing adoption of technology and the internet, new firms can now disrupt these markets at relatively low costs. Furthermore, business models that have worked well in other regions are being duplicated in LAC as well. The question, however, is whether this boom in LAC startups is sustainable.

Susana Garcia-Robles, senior partner at Capria ventures who has been engaged in LAC VC for over 25 years, raised two main concerns. The first was the Series A funding gap that the region was experiencing. According to her, there is sufficient early stage (less than $500k) and growth stage ($5m+) funding, but a lack of funding in-between. Also, she expressed concern over high valuations in the region, due to US startups valuations being used to value LAC startups. This overvalues them, as LAC has more economic and political risk than the US, making firms in the region riskier investments.

Overall, however, due to the large markets and numerous areas for disruption, this overvaluation should not be overly harmful, due to the large potential profits to be made by disruptors. A key test for this assumption will be Nubank’s upcoming IPO, which it hopes to undergo at a $55bn valuation.

Technology sector in India

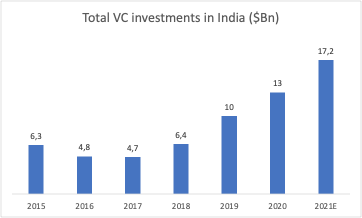

The Start-up scene in India has been strongly growing for the past years. If in 2019 India´s start-ups attracted $10bn dollars from Venture Capital and Private equity funds, in 2021 this amount grew to more than $17bn in the first 9 months of the year, placing it only behind China and The United States. These funds have mainly been invested towards technology start-ups, which often provide familiar services like food delivery (Zomato), or e-commerce (Flipkart). With new financial centres in Bangalore and New Delhi attracting huge amounts of capital, is India set to become the new start-up hotspot of the world, or is this just an investing bubble?

There are a number of factors influencing the development of the Indian market. Recent flops in the Chinese market, like the crackdown on Didi, the Chinese equivalent of Uber, or the Evergrande bonds scandal, hint that China is becoming a very risky place to conduct business, reducing its attractivity for future investments and long-term growth. As a result, many foreign investors are exiting the market and searching for new opportunities, India being the big winner. With the second largest population of more than 1Bn people, an increasingly better infrastructure, and a new generation of highly skilled workers with expertise in engineering, coding, and finance, India has become very attractive for companies that want to invest in innovative start-ups, as it is shown by Total VC Investments in India in the past 6 years. There are now 100 unicorns in India with a combined market capitalization of $240bn, making it clear that India’s technology sector is undergoing a boom.

The increased listings on the Indian market represent a coming of age for the nation´s tech start-ups and pave the way for the emergence of Fintech, E-commerce, and IoT sectors. Large parts of activity in Indian markets are attributable to the new “Reddit generation”, young retail investors that have an affinity for tech companies and want to capitalize on dynamic, cutting-edge start-ups, with huge potential for profits. This comes as traditional conglomerates like Tata Group operate in sectors like mining or metallurgy that have fallen out of favour with the young generation. In 2021 active retail investors accounts In India increased by 14.2 million, which can be attributed to the excitement surrounding the digitalization of the country and opportunities to invest in innovative companies like Zomato and Paytm. As of 2021, retail investors on the National Stock Exchange account for a 45% share, making them a strong force on the market.

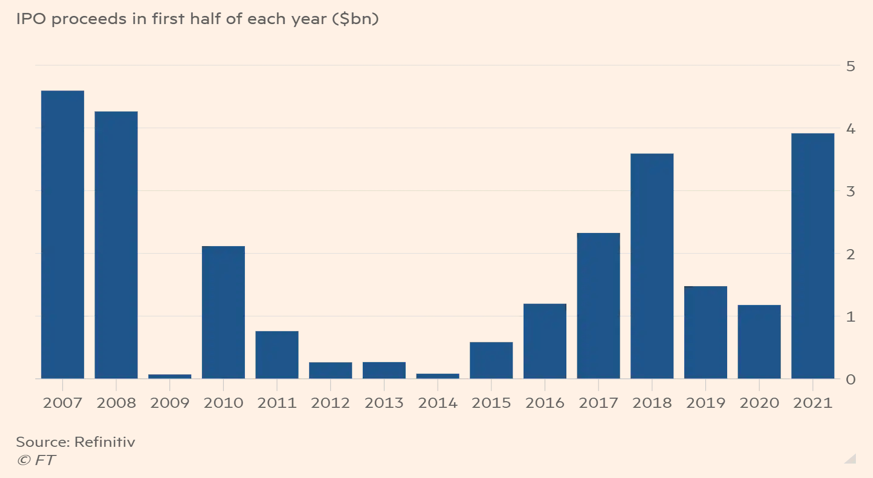

The $1.25bn Public offering of Zomato, a food delivery app, on the Mumbai Stock Exchange might be the most influential of the year in South-East Asia, as it makes global investors turn their attention to India’s tech environment and is the first in a series of potential listings that will make 2021 one of the best years for equity markets in India- it is expected that this year’s IPO proceeds will be valued at around $4bn. Backed by Jack Ma´s Ant Group, Zomato operates in a market undergoing a boom, as online food deliveries have experienced a huge growth during the pandemic, which have hit urban India hard, forcing people to stay inside their homes and closing restaurant dining. Even if revenues increased from a value of $189M in 2019 to more than $350M in 2020, Zomato still lost $343M in the same year. However, the competition is fierce between Zomato and its biggest rival Swiggy, which is backed up by SoftBank´s Vision Fund. As it battles with negative net margins, Zomato is also part of a very cash intensive war, burning billions of dollars every year. This is caused by food delivery apps trying to offer huge discounts to attract more customers and struggling logistics in Tier-2 and Tier-3 cities.

Source: Financial Times

Another company in the spotlight is Flipkart, an e-commerce giant, backed by Walmart and SoftBank, most probably planning for an IPO in 2022. Valued at $37.6bn, Flipkart is the market leader in India, offering diverse products from smartphones to furniture, and fashion products. With a market share of 31.9%, it is outperforming Amazon in the Indian e-commerce market, projected to reach $188bn in revenue by 2025. This is in large part due to an increase in Indian internet users, propelled by rising smartphone penetration, launch of the 4G network, and increasing consumer wealth. Over the past years, its revenue has grown at a 51.7% CAGR reaching $4.62bn in revenue last year. However, this was down from $5.82bn in 2019, as a result of COVID-19’s effect on purchasing power in the country. Flipkart relies heavily on influencer marketing and influencers to spread the word about their campaigns, focusing on reducing prices and delivering their products to middle-class customers. This may be a sign that local start-ups, with the appropriate funding, are capable of facing international giants, due to a better understanding of local business culture and consumer’s needs.

The Indian start-up scene is hotter than ever, making investors wonder if these trends are here to stay or they are just part of a financial bubble. Raising suspicion for investors is that start-ups in India have received huge valuation multiples. Zomato is valued with an EV/Sales multiple of x14.8 compared to Deliveroo, its United Kingdom peer, which has an EV/Sales multiple of x4.9. Oyo Rooms, a start-up which sells tech-infused budget-hotel franchises, has had to sack workers and faces questions about its viability. It now seeks a valuation of $9bn. Other problems would be that these companies still have negative profits and are burning a lot of cash to acquire more customers.

0 Comments