Introduction

On September 22th Singapore’s sovereign wealth fund GIC announced it would acquire a majority stake in the Mediterranean luxury resorts operator Sani/Ikos Group. The transaction, which values the group at €2.3bn, is expected to close in the fourth quarter, subject to customary regulatory approval. This is the largest deal in the European hospitality sector since the start of the pandemic and the two partners will face many challenges as geopolitical tensions worsen and inflation rises.

This article will first provide an overview of the two parties and of the hospitality sector, it will then focus on the rationale behind the deal as well as its structure and lastly, we will touch upon the advisors that facilitated the deal.

About GIC

Government of Singapore Investment Corporation (GIC) is one of Singapore’s two sovereign wealth funds. Alongside Temasek holdings, GIC’s 2,000 employees are responsible for the management of Singapore’s foreign reserves, ie. cash or gold held by the central bank – the MAS for Singapore – primarily used to balance payments of the country and influence the foreign exchange rate. Since its inception in 1981, GIC’s mission has been to enhance the international purchasing power of the central bank’s reserves, by achieving long-term returns above global inflation.

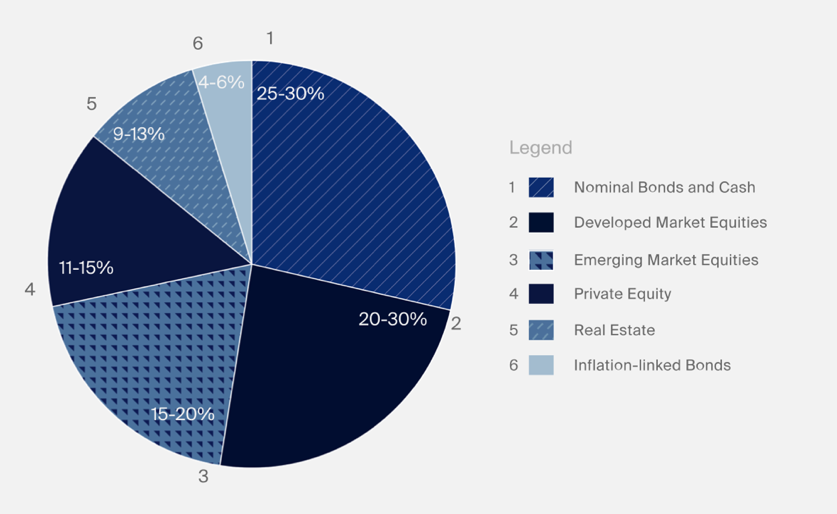

GIC’s ten offices scattered around the world have enabled it to invest in over forty countries, and in diverse asset classes on both public and private markets: public equities, fixed income, infrastructure, real estate and private equity, amongst many others. SWIFI, the Sovereign Wealth Fund Institute, estimates GIC’s assets at $690bn and Temasek Holdings’ at $405bn. Looking at the geographic mix of GIC’s assets, we see that most investments are made in three countries: the US (37%), Japan (7%), and the United Kingdom (4%).

In 2008, GIC took part – alongside the Abu Dhabi Investment Authority and the US Treasury – in the creation of 9 Generally Accepted Principles & Practices for sovereign wealth funds. These principles are now known as the Santiago Principles, and are designed to promote good governance, accountability, and transparency. Today, they are followed by more than twenty sovereign wealth funds.

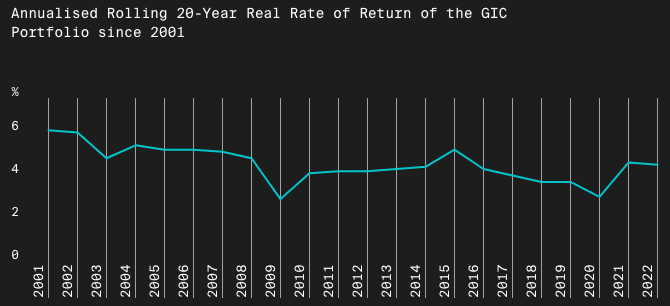

GIC’s investments have recently been challenged, as the Covid-19 pandemic and growing geopolitical tensions have contributed towards elevated inflation, forcing central banks to take action. Weighing all of this, GIC has been looking for new convenient investments, which will allow it to preserve the MAS reserves’ international purchasing power.

Source: GIC

About Sani/Ikos Group

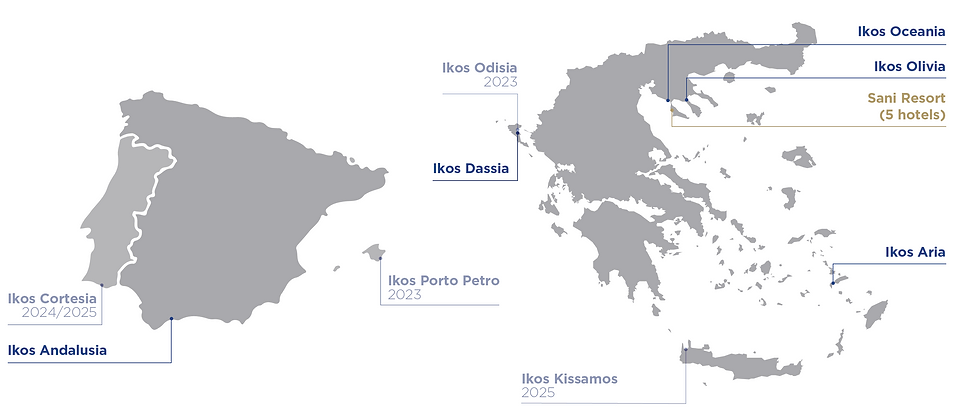

The Sani/Ikos Group is the result of family-owned Sani Resorts’ merger with Ikos Resorts in 2015. Since then, the Group has grown into one of the largest owner-operators of the Mediterranean luxury hospitality industry. In fact, under the brand names of Sani Resort & Ikos Resorts, the Group owns and operates almost 3,000 rooms and suites across 10 beachfront resorts in Greece and Spain.

Source: Sani/Ikos Group

Continuing European expansion is the Group’s main concern. Bookings in the last two years have increased by 60%, and the Group has secured four additional projects, totalling 1600 rooms for the expansion of the Ikos brand in Greece, Spain and Portugal opening from 2023-2025. Up to now, these costly projects were only possible thanks to the financial backing provided by funds managed by Oaktree Capital Management L.P., Goldman Sachs Asset Management, Moonstone, and Hermes GPE. Since these are the firms GIC is buying its majority stake in the Group from, GIC will be responsible for providing the resources available for Sani/Ikos Group’s five-year investment plan into these new hotels, which stands at €900mn.

Another interesting aspect of the Group is its ambitious ESG strategy, which perfectly fits GIC’s commitment to responsible investments. For example, the Group is a member of the United Nations Global Compact, a voluntary initiative based on executives’ commitments to implement sustainable practices. Also, the Sani Green program, which launched in 2008, and Ikos Green, which began at the brand’s inception, have evolved into a strong and complete ESG program focused on delivering positive environmental and social results.

The European Hospitality Sector

Europe stands as the number one tourist destination globally. Each year, it welcomes 500mn tourists – a 50% market share – and earns €350bn in international tourism receipts. Together with tourism, the hospitality sector makes up the third largest socio-economic activity in the European Union: 5% of the Union’s GDP. However, in recent years, this sector has taken heavy blows and the road to recovery seems far from easy.

The hospitality industry was one of the hardest hit sectors by the Covid-19 pandemic since the restrictions made it almost impossible for businesses to operate. Hotels, which rely mostly on international customers, were at a complete stop. A recent study published by McKinsey estimates that recovery to pre-Covid-19 levels could take until 2023 or later. Economy hotels are expected to have the fastest return to pre-pandemic levels, and luxury hotels to have the slowest, since economy hotels benefited from segments of consumer demand that remained relatively healthy despite the travel restrictions, including truck drivers and extended-stay guests. Regardless, the Sani/Ikos Group’s outlook seems positive: bookings across the 10 resorts this year were up 52% compared to last year, and 60% compared to pre-pandemic levels. The Group said early 2023 bookings are strong.

The next challenge appears to be rising inflation, as it affects hotels through interest rates, pricing, and substitution effects. To face rising inflation, central banks are raising interest rates and thus making it harder for expanding businesses to finance their projects through debt – such as Sani/Ikos’ €900mn investment plan in new resorts. However, hotels are better off than other businesses: due to their uniquely short lease periods – days rather than months or years – hotels can adjust prices to account for short-term variations in inflation. However, adjusting prices too quickly tends to drop the occupancy rate, which translates into diminished revenues. While luxury hotels serve less price-sensitive clientele, the price elasticity of demand is high for economy hotels, which risk a huge drop in the occupancy rate by raising prices to keep up with inflation. Essentially, in an inflationary environment, real returns can only rise for luxury resorts, so investors looking to hedge losses from inflation-sensitive assets can only rely on them.

Fitch Ratings estimates that the Sani/Ikos Group positioned in the luxury sector is well placed to face these challenges, as it benefits from “lower demand sensitivity” to a consumer downturn and so can pass on rising costs to consumers with more ease than economy hotels and other activity sectors.

Deal Structure

Singapore’s sovereign wealth fund GIC has agreed to buy a majority ownership in the Sani/Ikos Group, a Mediterranean luxury resort, for an undisclosed sum. The acquisition values the company at €2.3bn ($2.2bn). The NYSE-listed wealth management Oaktree Capital Management, Goldman Sachs Asset Management, the UK-based investment company Moonstone, the family office-backed Florac, and Federated Hermes’ private equity subsidiary Hermes GPE all sold their holdings to GIC and made exits through the deal, in which they had invested throughout the years, significantly contributing to Sani/Ikos growth. Florac and Hermes GPE had co-funded the combination of Sani and Ikos, with an objective to expand the Ikos concept throughout the Mediterranean region in December 2015. Later also Goldman Sachs Asset Management joined, investing in the company in 2016, while Oaktree invested in 2019.

Sani/Ikos Group was formed from the merger of the family-owned Sani Resorts in Greece and Ikos Resorts in 2015. Andreas Andreadis — a second-generation heir of Sani Club, which was founded by his father Anastasios Andreadis, will remain as co-CEO and co-managing partner — alongside the ex-Oaktree veteran, Mathieu Guillemin, while Stavros Andreadis will become Honorary Chairman of the Group. Subject to regulatory approval, the purchase is anticipated to be completed in the fourth quarter of 2022.

Deal rationale

The acquisition by GIC comes as concerns about a recession this winter in Europe were raised due to the energy crisis brought on by Russia’s full-scale invasion of Ukraine. The majority of Sani/Ikos’s customers are from the UK and Germany. However, the Singapore state fund is making a wager that the luxury market will survive the recession. Fitch Ratings downgraded the group’s long-term debt from “stable” to “negative” last month while maintaining the rating of B minus. The company’s massive growth ambitions could put a strain on its cash flow, but it will still benefit from reduced demand sensitivity to a consumer downturn especially considering its notable above-average recovery post-pandemic compared to rivals. The dry season for business travel to Europe, which has plagued the hospitality sector ever since the outbreak, doesn’t seem to be deterring GIC. Governments are also progressively relaxing COVID-related travel restrictions, raising prospects for a sector comeback.

The expansion and tenacity of Sani/Ikos Group’s business, notably during Covid, have demonstrated its durability. Bookings at SIG resorts increased by +52% in 2022 compared to 2021 and by +57% compared to 2019. In beach resort properties, the Sani and Ikos brands are both delivering exceptional tourist satisfaction rates. Ikos has successfully integrated authentic elegance with the benefits of all-inclusive travel, as seen by its five-year run at the top of TripAdvisor’s Travelers’ Choice Best All-Inclusive category. The revenues of the Greek-based company, which owns and manages 10 seaside resorts with roughly 2,700 rooms in Greece and Spain, have more than quadrupled since 2015, rising from €88mn to an estimated €319mn this year. Sani/Ikos is also moving on with a €900mn five-year growth plan that would increase its portfolio of resorts by four more rebuilt properties.

In a $14bn take-private transaction last week, GIC teamed up with the real estate private equity division of Blue Oak Capital to acquire the commercial real estate investment trust Store Capital. Additionally, according to its website, four additional projects (in excess of 1,600 rooms) have been negotiated for further Ikos brand expansion in Greece, Spain, and Portugal, opening from 2023–2025.

The “excellent hospitality experiences” for visitors, according to Lee Kok Sun, chief investment officer of GIC’s real estate division, were what made Sani/Ikos stand out. He also stated that the Group believes this investment will produce resilient returns, expressing confidence in the Greek and larger European tourism sectors over the long term. GIC thinks that Sani/Ikos Group is in a good position to benefit from the expansion of the Mediterranean European resort market and that, particularly in the wake of the pandemic, it has the potential to increase in value by strengthening current assets and providing alluring resort lodging in the area. In July, GIC announced that it was concentrating its investment strategy on companies that could pass on cost increases to clients while insulating themselves from inflation, goals that a company in the luxury industry can achieve. The luxury industry has proved to be more isolated to demand shocks compared to other industries that provide leisure services. This is because it relies on a niche of highly wealthy individuals, whose demand is less affected by macro shocks. Due to this, the investment may reveal itself, even in a period of crisis, as the best macro-agnostic investment, defeating almost completely inflation effects and demand shocks.

Deal Advisors

Morgan Stanley acted as financial advisor and Kirkland & Ellis LLP acted as legal counsel to Sani/Ikos Group in this transaction.

0 Comments