USA

On Monday, the ISM Manufacturing PMI for September came in below expectations at a level of 50.9 against the consensus estimate of 52.2. This also marked the lowest level since May 2020. This reading supported stocks and bonds at the beginning of the week as markets interpreted the print as a first sign of the Fed’ interest rate hikes feeding through to the real economy. A slowdown in US activity was commonly cited by Fed officials as a necessary condition to bring down inflation, therefore raising hopes for a less drastic hiking path in the future.

The following day, job openings in August were also lower than expected, displaying their biggest month-on-month decrease since April 2020. This led to a continuation of Monday’s trend in equity and interest rate markets. Hopes for a quick pivot were then curbed on Friday, as both the non-farm payroll and unemployment data showed a stronger-than-expected resilience of the US economy. The print showed that 263,000 jobs were added in September while the unemployment rate fell to 3.5%. These releases led to a partial reversion of the early-week gains in bond and stock markets.

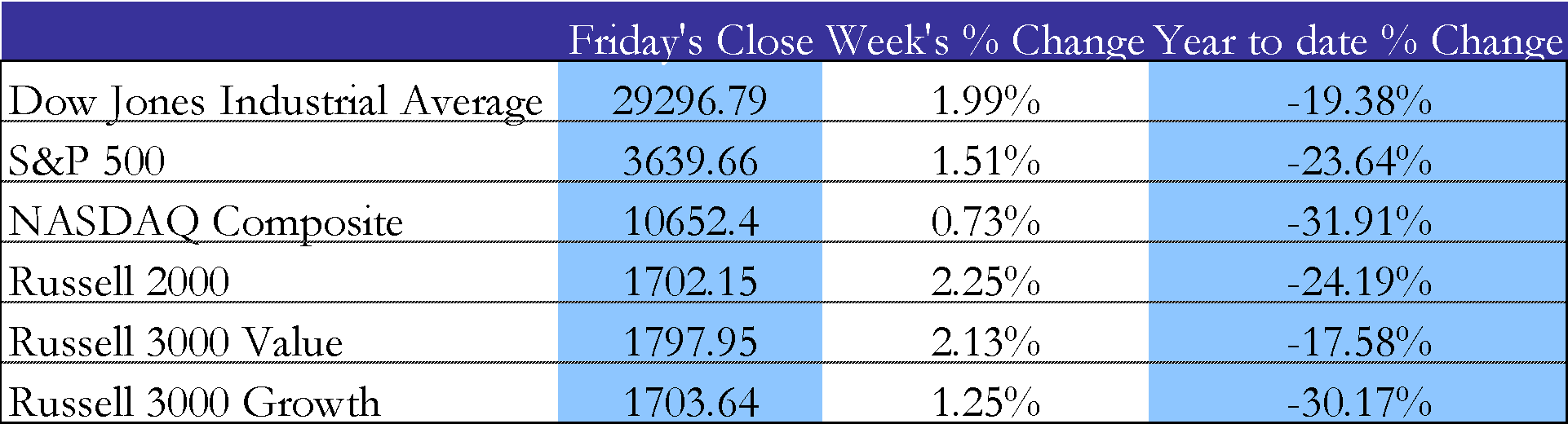

Overall, the main US stock indices ended the week higher despite losses after stronger than expected employment data on Friday. These gains came after the end of last week marked the third consecutive quarters of negative returns, manifesting the longest series since the Global Financial Crisis. The gains were rather uniformly distributed in a range between 1.25% and 2.25% with the NASDAQ being a notable underperformer, solely gaining 0.73% over the week.

In other news, Elon Musk announced this week that he wants to close the acquisition of Twitter at the level of his initial proposal of $54.20 per share, valuing the company at $44bn. This move came shortly before the scheduled start of a trial between Musk and Twitter over his attempts to cancel the Merger Agreement, claiming that bots make up a significantly larger portion of the network’s users than officially reported. The stock jumped upon this announcement, trading close to $50.

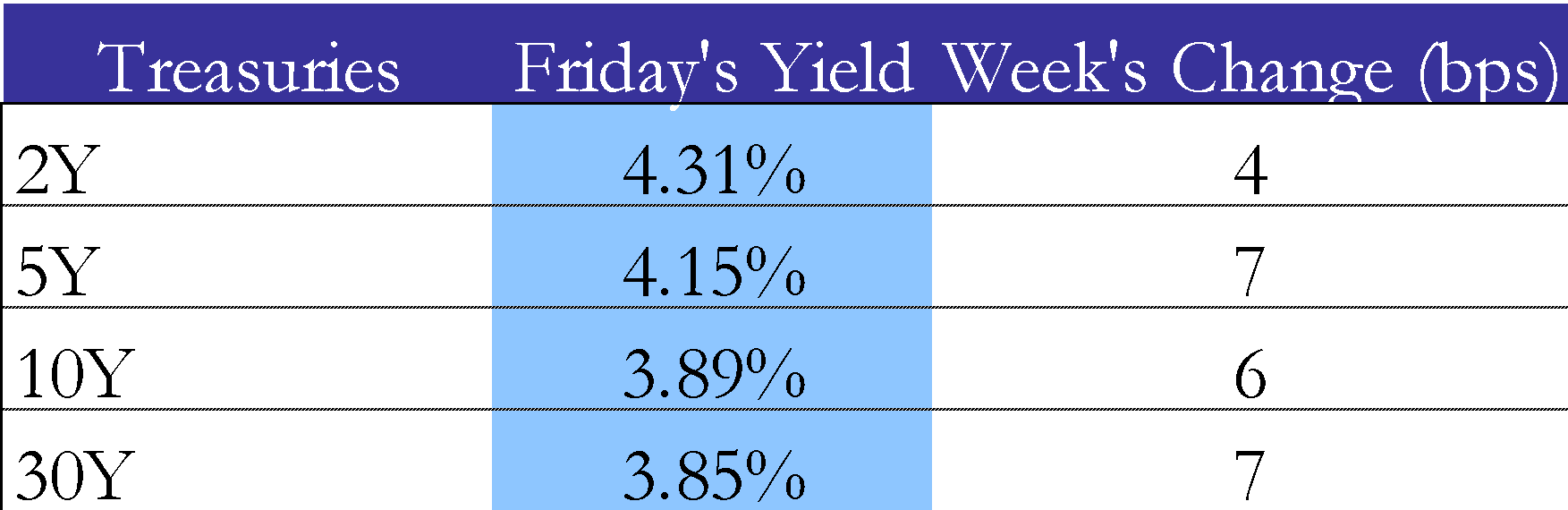

The US Treasury curve bear-steepened over the course of the week as traders assessed the opposing signals coming from the different job market data releases.

Europe and UK

After the presentation of UK Prime Minister Liz Truss’ ‘mini-budget’ caused substantial turmoil in financial markets over the last few weeks, the government scrapped parts of this plan on Monday. Specifically, Chancellor Kwasi Kwarteng announced on the Conservative conference in Birmingham that the government would not go ahead with its proposition to abolish the 45 per cent maximum tax rate for individuals earning more than £150,000 per year. The move came after several Conservative party members openly criticized the proposal, raising questions whether a majority in the House of Commons would be achievable. Markets initially reacted positive to the announcements, as Gilts rallied, and the Pound strengthened.

During this week, the European Union agreed on a new sanctions package in response to Russia’s annexation of four Ukrainian regions last week. The proposal includes a price cap for oil exports from Russia. This measure was discussed for several months within the G7 after being adopted by the EU on Wednesday. The cap prohibits companies from taking part in the export of Russian oil to third-party countries through e.g. insurance, financing or navigation services if the respective shipment is priced above the cap level. The exact level of the cap is yet to be determined.

In the war in Ukraine, President Zelensky reported further gains from its counteroffensive in the south of the country. After the city of Lyman was liberated on 1 October, the Ukrainian army broke the frontline near Kherson, a strategically important city along the Dnipro river.

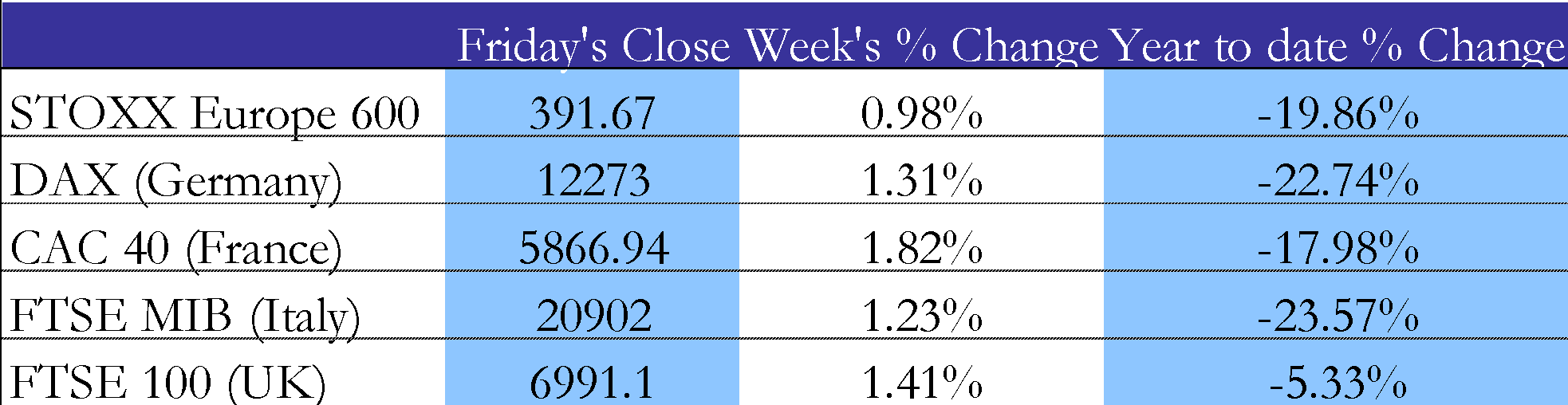

Overall, European stocks followed the US trend and ended the week higher. The French CAC40 thereby posted the best performance with a gain of 1.82%. The broader STOXX 600 moved up by 0.98% week-over-week.

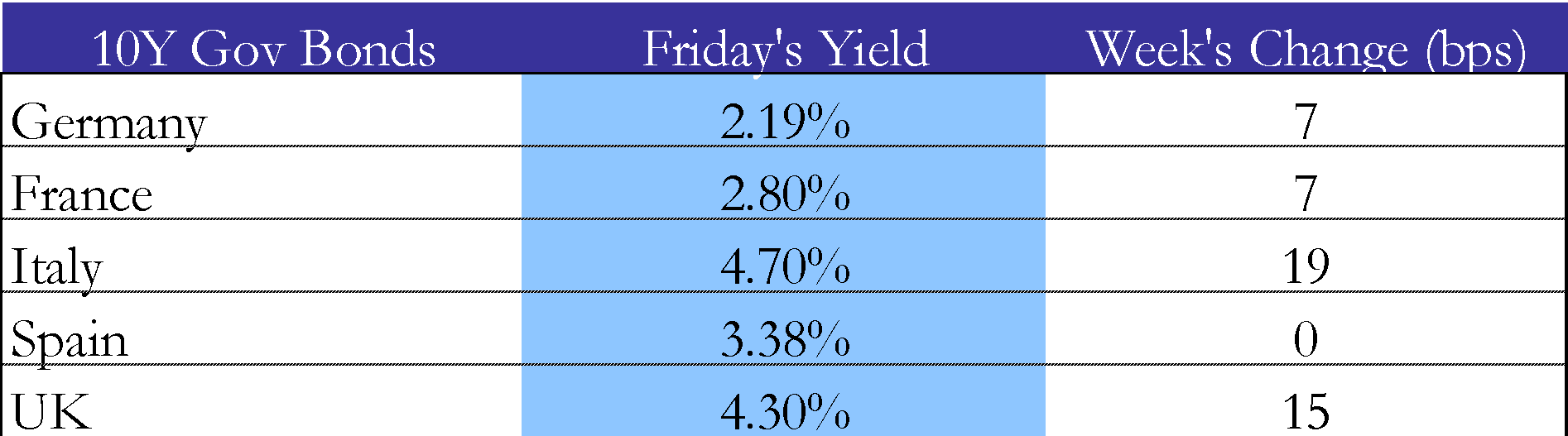

During the week, the BoE announced it had not purchased any securities under the emergency program for two consecutive days, indicating a normalization of the Gilts markets. In line with moves in the US yield curve, European government bond sold off during the week with the 10-year Italian and UK government bonds, giving in the most.

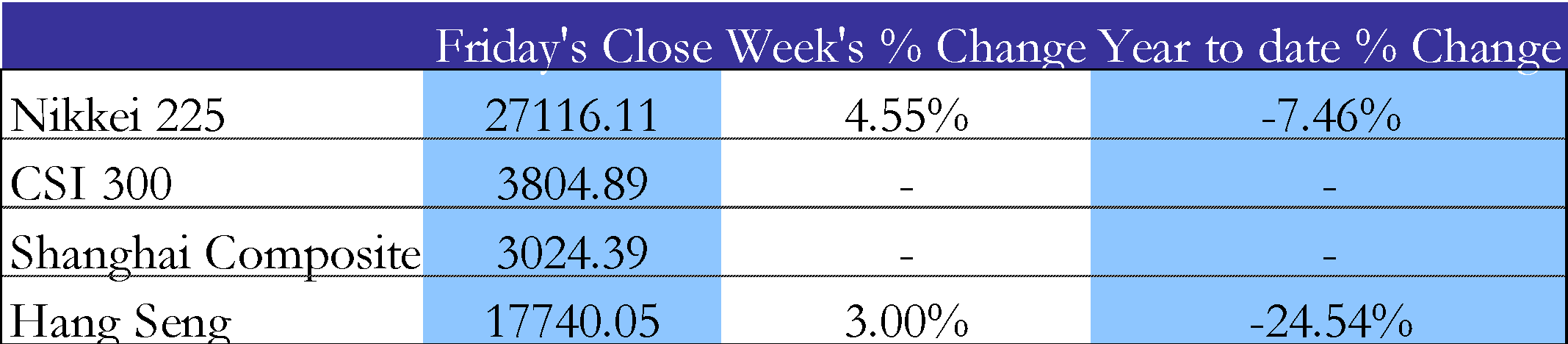

Rest of the world

Stock exchanges were closed for five days in mainland China due to the Golden Week holidays. In the beginning of the week, the Chinese government stepped up its support of the housing sector. It lowered the interest rate for housing loans, introduced further tax incentives for home purchases, and removed mortgage rate floors for first-time homebuyers. The Chinese housing sector remains in a precarious condition after the default of developer Evergrande raised fears about a broader contagion.

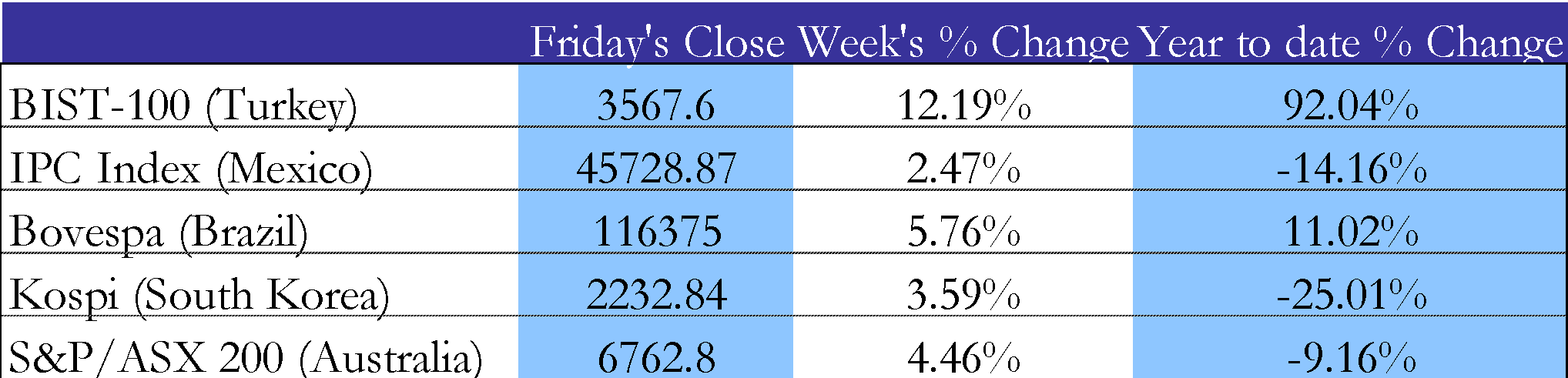

In Australia, the RBA delivered a smaller-than-expected rate hike of 25 basis points on Tuesday, bringing the policy rate to 2.6%. After previously hiking by 50bps, the central bank justified its slower pace with the lag with which monetary policy affects the real economy. Specifically, it pointed out the uncertain impact on the housing market. The RBA forecasts inflation to remain elevated around a level of 7.8% during this year before falling to around 3% in 2023. The decision led to a rally in Australian stock and bond markets, while the national currency dropped.

In Brazil, the first round of the presidential election resulted in a simple majority for the former president Lula da Silva. He obtained 48.4% of the votes while the incumbent Bolsonaro obtained 43.2%. Before the elections a larger spread between the two candidates was expected. The runoff election is now scheduled for the 30 October, with more room for political uncertainty in the meantime.

North Korea continued its series of missile test during this week. On Sunday, South Korean and US military conducted joint drills around the Korean peninsula in response to earlier missile launches. On Tuesday, the North Korean regime fired a missile flying over Japan for the first time in over five years. These developments raised concerns over growing tension in the region.

Emerging markets followed the global rally in stocks with the equity indices of Turkey, Mexico, Brazil, and South Korea showing modest gains, while also the Australian stock market benefitted from the global sentiment.

FX and Commodities

On Wednesday, the Opec+ group agreed to reduce output quotas by 2mm barrels a day to counter dropping oil prices. The decision came to the disappointment of the US government which tried to convince its partners to refrain from such a step over the last several weeks with President Biden even taking a trip to the Middle East during summer. The US announced in response that it would continue to release oil from its strategic reserves. Nevertheless, oil prices spiked after Opec’s announcement with WTI gaining almost ten dollars per barrel, closing the week at $92.64.

Besides commodities, the British Pound regained some of its strength after the new government scrapped a plan to reduce the maximal marginal text rate for people earning less than 250,000$/year. The Pound rallied beyond the 1.14 level before giving up most of its gains over the course of the week, closing on Friday at 1.11. Beyond that, the EUR was relatively range-bound, still trading below parity against the dollar and closing around 0.97 on Friday. Finally, after the BOJ’s intervention two weeks ago, the Yen volatility remained subdued with spot rates staying below the level of 146 that triggered central bank intervention the last time.

Next week main events

Brain Teaser #27

Two squares of a 7×7 checkerboard are painted yellow, and the rest are painted green. Two colour schemes are equivalent if one can be obtained from the other by applying a rotation in the plane board. How many inequivalent colour schemes are possible?

Problem source: AIME 1996

Solution: We can select the two yellow squares in ![]() ways, and we can rotate the board from one to four times (ultimately getting the initial distribution). The colour schemes in which the two squares are symmetric about the centre will appear only in two forms, while the ones that are not symmetric will appear in four (check it on your own). There are

ways, and we can rotate the board from one to four times (ultimately getting the initial distribution). The colour schemes in which the two squares are symmetric about the centre will appear only in two forms, while the ones that are not symmetric will appear in four (check it on your own). There are ![]() pairs of the first type, and pairs of the second. Hence, the total number of inequivalent colour schemes will be

pairs of the first type, and pairs of the second. Hence, the total number of inequivalent colour schemes will be ![]() .

.

Brain Teaser #28

1, 11, 21, 1211, 111221. Can you tell us which will be the next numbers in the sequence?

0 Comments