Introduction

On November 11th, crypto trading startup FTX filed for bankruptcy protection in the US just three days after admitting to being unable to meet $5bn in customer withdrawals. Sam Bankman-Fried, a 30-year-old trader and founder of the crypto exchange, resorted to filing in a Delaware federal court after a failed rescue by rival Binance, the second-largest digital currency exchange (DCE) led by Changpeng Zhao, fell through. Binance decided to not go through with the deal after due diligence revealed that FTX’s financial problems were too great for Binance to solve. The US Securities and Exchange Commission is now investigating FTX, focusing on the firm’s cryptocurrency lending products and the gaps in the platform’s balance sheet, where $8bn in customer deposits appear to be missing. FTX’s collapse shocked the digital asset industry, which now might be facing a financial crisis comparable to the Great Recession of 2008, with bitcoin falling to a two-year low of $15,255 on November 21st. Sam Bankman-Fried, once considered the “new J.P. Morgan” for his efforts in trying to reassure investors and prevent the fall of several platforms, had a personal fortune of $24bn just before the collapse, when he resigned as FTX’s chief executive. He has been replaced by John J Ray, who oversaw bankruptcy cases such as Enron and Nortel Networks.

The New J.P. Morgan

FTX is a Bahamas-based cryptocurrency exchange. Founded in 2019 by Sam Bankman-Fried, it was valued at $32bn in its most recent funding round and, at its peak in 2021, had over 1m users, which made it the third-largest crypto exchange by daily trading volume. Sam Bankman-Fried created the platform after co-founding quantitative trading firm Alameda Research in 2017, which specialized in cryptocurrencies. The success of both enterprises made the 30-year-old MIT graduate one of the most respected figures in the industry, with FTX attracting a list of blue-chip investors, including venture capital firm Sequoia Capital and Canada’s Ontario Teachers’ Pension Plan. The platform was endorsed by celebrities such as Tom Brady, Gisele Bündchen and Stephen Curry. While a period of uncertainty in the crypto industry posed a threat to smaller crypto firms, Bankman-Fried tried to mitigate its effects with his strong position in the market.

As a matter of fact, the digital assets industry has been in a bear market since January 2022. Between the end of 2021 and the first months of 2022, many regulatory authorities threatened to introduce stringent laws on cryptocurrencies to protect investors and preserve financial stability, creating fear and hesitancy in the market. For example, the US Securities and Exchange Commission issued a lawsuit against settlement system Ripple, while China banned Bitcoin mining, resulting in most of its BTC miners having to relocate to other countries. Furthermore, the global increase in inflation and rise in interest rates have reduced investments in risk assets like cryptocurrencies, partly because investors could get higher yields on traditional investments than before and because, when central banks raise interest rates, liquidity decreases and riskier investments draw in less financing. While traditional markets have circuit breakers and protections against market fear and skepticism through centralization, this is not the case for cryptocurrencies. For this reason, the collapse of the Terra blockchain and its tokens TerraUSD and Luna in May sparked panic in the industry, causing Bitcoin to fall 60% from its peak in November 2021, while the entire cryptocurrency space suffered an estimated loss of $500bn, around 29% of its market capitalization. The reason for this is that the crash of the Terra ecosystem was a cause for contagion, as many owners of Luna and TerraUSD would often borrow against them to invest in other assets, such as other cryptocurrencies. Thus, when the value of the two tokens fell, investors had to meet margin calls by selling those assets, driving down prices for the whole crypto market.

Consequently, several crypto firms filed for bankruptcy or were forced to look for emergency capital infusions. New Jersey-based crypto lender Celsius suspended withdrawals on June 12th and filed for Chapter 11 bankruptcy a month later, listing a $1.19bn deficit on its balance sheet. It had been valued at $3.25bn in October 2021. Three Arrows Capital, a crypto hedge fund based in Singapore, filed for Chapter 15 bankruptcy on July 1st. After the Terra ecosystem collapsed the firm, which was highly leveraged, was unable to meet margin calls from counterparties it had borrowed from, who claimed to be owed more than $2.8bn. Another Singapore-based digital asset platform, Vauld, filed for protection against its creditors in July, after suspending withdrawals days earlier. The firm has been discussing a possible sale to crypto lender Nexo while exploring potential restructuring options.

As many companies navigated this unstable environment, Sam Bankman-Fried and FTX attempted to rescue two smaller crypto firms, Voyager Digital [VYGVQ:OTCMKTS] and BlockFi Inc. The former had filed for bankruptcy protection on July 6th after suffering losses of more than $650m on a loan to Three Arrows Capital, collapsing less than a week after having suspended trading and prevented customers from withdrawing funds. In June, trading firm Alameda Research issued a rescue loan that totaled about $485m in bitcoin and cash, for a maximum of $75m over a 30-day period, becoming Voyager’s largest unsecured creditor. After the crypto-asset broker filed for bankruptcy, FTX and Alameda proposed to acquire Voyager’s crypto assets and loans, excluding that of Three Arrows Capital. Moreover, in an attempt to boost confidence in the digital assets market, they would allow customers the chance to regain access to frozen funds at Voyager through new accounts at FTX, where they could continue to invest. Voyager said that Bankman-Fried’s firms had violated obligations to debtors and the court by making the proposal public, and that the offer itself was self-serving. FTX won a bankruptcy auction in September to buy the firm’s assets out of Chapter 11 for $1.42bn. Just a week after the first loan to Voyager Digital, FTX extended a $250m loan to BlockFi, a New York-based crypto lender valued at $3bn in a funding round in 2021. The firm was hit hard by the crypto crash and implemented multiple cost-cutting measures in June, including laying off 20% of its employees and cutting executive compensation. On July 1st, the two firms signed a deal that provided BlockFi with a $400m revolving credit facility and included an option for FTX to buy the platform for up to $240m, a price based on performance triggers.

The measures to keep the two crypto platforms afloat, along with the acquisition of Japanese crypto exchange Liquid Group in February 2022, were taken in Bankman-Fried’s best interest to prevent the market from facing what, in traditional finance, was the 2008 financial crisis. “I do feel like we have a responsibility to seriously consider stepping in, even if it is at a loss to ourselves,” said FTX founder. “Even if we weren’t the ones who caused it, or weren’t involved in it. I think that’s what’s healthy for the ecosystem, and I want to do what I can help it grow and thrive.” Due to his efforts to bail out smaller firms in order to restore investors’ trust and, at worst, to prevent a market crash, Bankman-Fried was often described as the “new J.P. Morgan”, referring to when the latter supported several failing financial companies during the Panic of 1907 to contain a financial crisis.

Liquidity Issues and Temporary saving from Binance

Things seemed to be going great for FTX and his founder: Sam Bankman-Fried, also known as SBF, was becoming the icon of the crypto space, FTX was starting to get the support of regulators, and the exchange was rapidly growing in popularity and seen as one of the most solid by investors.

However, on November 2nd, CoinDesk published a report that marked the beginning of the downfall for FTX: a reporter managed to get his hands on a copy of Alameda Research’s balance sheet and found out that the financial position of SBF’s proprietary hedge fund was rather worrisome, with most of the fund’s assets being tied up in FTT. FTT is the token created by FTX, of which Sam Bankman-Fried was also Founder and CEO, and was closely correlated to the company’s performance due to its tokenomics: FTX would buy back FTT tokens with its profits, increasing its value; thus, investing in FTT meant investing in the exchange’s future cashflows, and the performance of the two moved pretty much in tandem (it was similar to buying shares in FTX). Having most of your assets tied in FTT, the money that you yourself invented, distributed and whose price you could easily manipulate (to then possibly using it as collateral to get loans) was extremely dangerous, almost the same as using the equity of the company you are lending to as collateral: the moment that the collateral has to do its job, it becomes worthless. This meant that if the price of FTT went down, FTX and Alameda would be at risk of insolvency: that would drive FTT’s price down even more, causing a death spiral.

However, it was not the report from CoinDesk that lead FTX to bankruptcy, but rather an announcement by Binance CEO, Changpeng Zhao (also known as CZ): on Sunday, November 6th, he announced that Binance would sell off all its FTT tokens, because of the new findings on the company’s financial position. The selloff, which would have amounted to an equivalent of $400m, was huge when compared to FTT’s $2.99bn market cap and $600m 24h volume on the day of the announcement; even though Binance assured that the liquidation would be split over several months to minimize the market impact, it was enough to crash the price of FTT. The sudden drop in FTT’s price made FTX’s customers concerned about the exchange stability, and caused a bank run for more than $5bn.

The situation went out of control, and as more and more people withdrew their money from FTX, on Tuesday, November 8th, SBF had to turn to its rival for help: Binance signed a letter of intent to buy FTX, and the CEO announced that they would be conducting the due diligence in the following days, reserving the right to pull out of the deal at any time. But it was not for long: after less than 48 hours from the initial announcement, Binance tweeted that they would not pursue the acquisition anymore; after conducting the due diligence, they said, they realized the hole in FTX’s balance sheet was much larger than initially expected, so much so that they didn’t see themselves fit to backstop the company. Furthermore, they concluded that there had been a mishandling of customer funds and they did not want to get in trouble with the US Regulators that were starting to investigate into FTX’s product offerings.

However, let’s address the elephant in the room: did Binance not know what that announcement would have caused? Obviously, they knew. But why did they do this, then? Well, the relationship between Changpeng Zhao and Sam Bankman-Fried has been quite turmoiled, and the two companies were outright competitors in the Centralized Exchanges (CEX) space. Recently, Sam Bankman-Fried had been increasingly trying to get closer to regulators and lobbying against the competing exchanges: although specific details about Binance are not known, both the CEO and Co-CEO of FTX made million-dollar donations to US’ Republican and Democratic parties to get political influence. Furthermore, SBF was pushing for a brokerage-like licensing system for Decentralized Finance: this would have subjected DeFi agents to stringent regulatory policies and procedures (e.g., KYC – Know Your Customer), requiring enormous capital and resources and making DeFi more centralized towards the biggest players.

Bankruptcy and Effects

After the deal with Binance was no more, SBF tried to raise money from investors as a last resort to save the company from collapsing: according to the CEO, FTX needed funding of up to $8bn to fulfil all withdrawal requests from customers. Therefore, he started shopping for rescue financing, with little success: FTX Balance Sheet was not any better than Alameda’s, with the majority of assets being holdings in FTT, Serum (SRM) and Solana (SOL), all projects with which the company was closely intertwined, at implausible valuations.

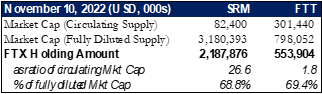

Having your own token (or any token of which you control the majority of supply, for that matter) listed as an asset on your balance sheet is completely deceiving, and the reason is very simple: taking the example of SRM, FTX controlled more than 2/3 of the fully diluted supply, and more than 25 times the value of all circulating supply; to calculate the value of those holdings, FTX just multiplied Number of Tokens * Current Market Price, which is complete nonsense, since they would never be able to sell all those tokens at the current market price. And anyway, it is extremely easy to manipulate the prices when you have such a huge amount, you just have to go on the market and make a few trades; it even had to be seen if anyone other than Alameda/FTX were trading SRM.

Figure 1 – Source: BSIC, FT, CoinMarketCap

However, the fact that the actual value of these tokens was way off from what FTX reported is just one side of the coin, since most of these assets were not even bought by FTX at market price: they were rather awarded to the company (or sold at significant discounts) for being partner and advisor in the projects. This leads to the most important question that investigators are trying to answer: if FTX didn’t use customers’ money to buy these assets, where did all the customer deposits go? The main hypothesis is that Sam Bankman-Fried secretly transferred $8bn of customer deposits to Alameda Research, to cover the huge losses it had been suffering ever since the crypto market started to lose value.

Due to the state of the balance sheet, Sam Bankman-Fried was not able to get even one investor onboard to rescue his company: everyone was shocked by FTX’s balance sheet, and major investors started to distance themselves from the company. Sequoia Capital deleted the article about SBF on its website and wrote down its stake from $210m to 0, apologizing to investors during a conference call and remarking that they had done careful due diligence on FTX; the Sovereign Wealth Fund of Singapore wrote down its $275m investment and is being questioned by several members of Parliament that will discuss the matter at the next Parliament setting on November 28. Eventually, after not managing to secure any financing, FTX halted withdrawals on Thursday, November 10, and eventually filed for Chapter 11 bankruptcy in the morning of the following day.

Just a day after the bankruptcy, there were several abnormal transactions on the exchange for a total of hundreds of millions of dollars: Elliptic, a blockchain forensics firm, stated that $473m of assets were moved out of the exchange, most probably stolen, on Friday night. The rumor was later confirmed by FTX’s Telegram support group, that admitted a hacker had stolen some funds and invited users to steer away from the exchange’s app and website for security reasons. Rumors say the hacker managed to get to customers’ funds through a backdoor which was known only by a few key developers at FTX, thus creating some allegations of an inside job; however, it is unlikely that the hacker(s) will ever be identified, since he/they started to launder the stolen funds into Bitcoin, Ether and other tokens, avoiding centralized exchanges.

After the bankruptcy filing, SBF stepped down as CEO, and John Ray III took his place as Chief Executive and Chief Restructuring Officer. John Ray III is an insolvency professional that oversaw the liquidation process at Enron, and was shocked from what he saw at FTX: a complete absence of corporate control and financial information, defining it as the worst case of corporate failure he has seen in the last 40 years; he announced that he would try to either sell or reorganize FTX business, since several subsidiaries of FTX still have solvent balance sheets and responsible management.

How was all this possible? The complete failure of Corporate Governance

The company was found to be chronically understaffed and run like a “feudal court”, with decision making concentrated in the hands of a very small group of “inexperienced, unsophisticated and potentially compromised” individuals, led by SBF, most of which lived together in a $40m penthouse in the Bahamas’ Albany Resort; the majority of them was also romantically involved, generating favoritism and an even more toxic environment. Some employees even reported that they didn’t know the majority of business decisions being taken up until the official Twitter announcement had been made. FTX, although having blue-chip investors, among which BlackRock, Sequoia Capital, the Ontario Teachers’ Pension Plan, had a board with only 2 members: SBF and FTX executive Jonathan Cheesman, who stepped down in June.

Employees had long before raised concerns about security, but they were never heard; additionally, only a handful of developers had full access to the core code and the company’s systems, and only Gary Wang, FTX’s co-founder and CTO, and Bankman-Fried controlled access to digital assets, using unsecured email accounts to share private keys and confidential data. FTX did not even have an accounting department, and used to outsource this function; they did not have a list of its own bank accounts, or even a list of all the employees, and Ray warned that the figures seen in the balance sheet may be inaccurate since they were drawn up by SBF. Additionally, the company’s funds were repeatedly used to buy homes in the Bahamas and other personal items for the top management of the company; FTX spent about $300m in home and vacation properties used by senior executives of the company.

The Outlook for FTX and Crypto

As detailed above, FTX filed for bankruptcy on the 11th of November. With the assets side of its balance sheet made up mostly by crypto tokens with a dubious value, it is likely that most creditors will be wiped out. However, the true extent of the damage will probably still take some time to figure out, due to the lack of professional accounting at the company. Some of the firm’s assets are relatively easy to identify and value, such as the 7.6% stake in the broker Robinhood (HOOD:NASDAQ) or the Bahama’s real estate. The value of its diverse token holdings is harder to determine and will probably only be identified when they will be sold into their respective, mostly illiquid, markets. Further, previously unrecorded assets are constantly being found by the new management team handling the bankruptcy, with $1.24bn in cash holdings announced on the 22nd of November. The new management team will also attempt to sell off FTX’s healthy businesses, such as its subsidiaries in various countries. One can, however, assume that the proceeds from this sale will hardly be substantial, given FTX’s negative reputation, the current crypto winter, and the lack of buyers in the market, with many firms struggling for survival themselves. To add to the already challenging task of selling assets to satisfy the firm’s creditors, FTX will also see itself be targeted by lawsuits, both by the Bahamas and US governments and retail investors.

The main question of the whole FTX saga is that of where the $8bn of customer deposits that FTX cannot pay back went. SBF has changed his story on this as time progressed, with the most recent account being that the firm ‘accidentally’ wired the funds to Alameda. Even though there were clearly governance issues at FTX, many people struggle to believe that this kind of a sum would be transferred to Alameda accidently. After all, the moment that Alameda would have received an unexpected $8bn transfer from FTX, they would have probably called FTX asking them whether this transfer was a mistake. Hence, a theory that has gained traction is that Alameda lost its original funds in the early stages of the crypto crash, meaning it required a bailout. SBF and Alameda’s CEO (with whom SBF was romantically involved) then decided that the lower crypto prices were a great buying opportunity, so SBF transferred $8bn of FTX’s deposits to Alameda, bailing it out in the process. However, instead of making everyone involved a lot of money, Alameda lost this money as well, bringing us to today’s situation, where Alameda and FTX are out of business. As mentioned above, this is only a theory and cannot be verified as of today. Nonetheless, it appears somewhat plausible. Regardless of whether the above is true, SBF will probably face both federal prosecution and civil lawsuits, with sufficient controversial and potentially illegal actions to discuss. A selection includes the above mentioned buying of real estate in the Bahamas with FTX’s funds and investing in the same venture capital firm that invested in FTX itself (Sequoia Capital).

Looking at the effect this bankruptcy will have on crypto in general, we think it is fair to state that it will reduce investment appetite in the sector. FTX was heralded as one of the leaders in the space, with blue-chip investors and celebrity endorsements. Thus, when this posterchild of the sector goes down, it is bound to reduce enthusiasm. Then, we can expect an increasing centralization of the crypto space. As many players are going bankrupt due to lower token prices and the effects of FTX’s collapse, we can expect that only a few, well capitalized players will survive. When looking at exchanges, this appears to be Coinbase and Binance. With such few large players, the infrastructure of the crypto industry will hardly be as decentralized as the tokens themselves try to be. Another thing that may add to crypto’s centralization is the demand for a ‘crypto central bank’, which was voiced by Binance CEO CZ. If such a lender of last resort would come into existence, this would further centralize the space, as there would be one entity that could decide over whether a firm (or project) can survive.

Finally, we can expect a new wave of regulation for the crypto markets. As billions have been lost with FTX and further billions through other bankruptcies and the collapse of crypto markets, the space is yet again drawing the interest of regulators. With members from both U.S. political parties calling for more regulation and the head of the SEC, Gary Gensler, having advocated for that for a long time, we expect that regulation, and therefore further centralization, is only a matter of time.

Conclusion

Bubbles in financial markets create overconfidence, which results in bad behavior. As Warren Buffet likes to say, when the tide goes out, you can see who has been swimming without a bathing suit. In the same way, as cryptocurrencies have collapsed in value, we can see which companies are built on solid foundations and which have not done their homework. It is obvious that FTX was in the latter category. Even though this doesn’t mean that all crypto companies are worthless or run like FTX, it is clear that investors will be less interested in crypto for some time. Many investors, both professional and retail, didn’t understand what they were buying and jumped on the train, due to a fear of missing out. These ‘crypto tourists’ will now stay away. Still, it would be unwise to call the death of crypto just yet, as it has provided innovations with genuine value, such as its decentralized ledger technology. When it does come back, we will hopefully see a safer version for all stakeholders.

0 Comments