Introduction

In the last two months, we have seen a flurry of bids come in for the most prized assets in the world of football, namely Tottenham Hotspur FC and the infamous Manchester United. The astronomical valuations that analysts had speculated for some of these football clubs have come to be realised through these bids made by various global billionaires. Iranian American billionaire, Jahm Najafi is leading a $3.75bn takeover bid for Tottenham Hotspur, meanwhile a bidding war has ensued between Sheikh Hamad bin Jassim bin Jaber Al Thani, a son of Qatar’s former prime minister, and British chemicals billionaire Sir Jim Ratcliffe. Also in the background are the “continental” clubs from Spain, Germany, Italy, and France who on their own deal with several problems – namely how to sustainably run a football club.

Tottenham Hotspur – impending sale?

The $3.75bn bid for Tottenham Hotspurs values the club’s equity at roughly $3bn before adding the $750m of debt on the club’s balance sheet. This puts the bid at a 7x EV/Revenue multiple, considerably higher than that of Chelsea which was sold at a 5x EV/Revenue multiple. This is mainly due to the recent investment in Tottenham’s new stadium with a capacity of 62,850 guaranteeing future cash flows, whilst Chelsea’s current infrastructure is in dire need of investment.

The bid itself is brought by MSP Sports Capital, which is chaired by Najafi, who are working with a consortium of investors to provide the capital and structure the bid. MSP Sports Capital is a New York City based private equity fund that focuses their investments on sports teams, leagues, and other businesses within the sports ecosystem. They currently already have stakes in McLaren Racing as well as other European football clubs, such as FC Augsburg in Germany. Najafi himself serves as Vice Chairman for McLaren Racing, governor on the board of the National Basketball Association (NBA) and Vice Chairman for the Phoenix Suns. This is a continuation of the growing trends of the rise of portfolio owners where investors own multiple sports assets, and the increase of private equity investment in the sports industry, particularly from foreign investors. Portfolio owners can benefit from diversifying their investments by region and sports as well as through both commercial and sporting synergies. This can include combined sponsorship and marketing efforts and a global talent network like RedBull have effectively utilised.

The timing of the bid itself for Tottenham Hotspurs is however rather peculiar. Just last month it was reported that MSP were interested in acquiring a minority stake in rival Premier League side Everton FC. These discussions have continued since then, but a takeover of Tottenham Hotspurs would be a major blow to Everton. Furthermore, the ENIC Group, who own an 86.58% stake in the club, have not announced that they are looking for a sale of the club, despite plenty of interest in the recent years, including a consortium led by Todd Boehly, now part-owner of Chelsea, in 2019. Daniel Levy, owner of the ENIC group, has found himself under increasing pressure from the Tottenham fanbase to sell the club, with anti-Levy and anti-ENIC banners displayed outside the match against Manchester City earlier this month. However, this pressure to sell is unlikely to force them into rushing into a sale of an asset they have held since 2000. Finally, this bid comes at a time when many other clubs, such as Liverpool FC, Manchester United and Paris Saint-German, have been put up for sale. This begs the question as to why MSP would approach a club whose owners are not looking to sell, driving up the premium on their bid.

Chelsea sale – a prelude?

Historians prefer analysing events only after the dust has settled. Having a longer perspective allows for a protracted time of reflection which is necessary for an analysis to have any substantial value. More than half a year has passed since the news broke out that Todd Boehly, atop a consortium comprised of Hansjorg Wyss, a billionaire, Guggenheim Partners CEO Mark Walter, and Clearlake Capital, reached a deal to acquire Chelsea F.C. The deal sparked heated debate all along, mainly thanks to the club’s Russian owner – Roman Abramovich. Yet, arguably, excluding the now former owner from the equation, the new management entices an even more fascinating debate.

Despite Todd Boehly, an American financier and, among others, owner of the NBA outlet Los Angeles Lakers, constantly atop of news headlines, it is Clearlake Capital that should inspire the focus of the analysis. For the American private equity firm, with $75bn assets under management (AUM), that provided the deal’s financial firepower it is a first deal of a kind. With its main business focus on buying out and then reselling midsized companies for a profit, acquiring a loss-making (£153.4m loss in the 2020-21 season) football club might raise eyebrows. Yet, Chelsea, despite being a part of the “Big Six” Premier League clubs, is a peculiar case. With Stamford Bridge, its home ground situated in London’s Chelsea Borough, boasting a capacity of only 40.3k, the lowest of “Big Six” clubs, there is a potential for a significant infrastructural upgrade.

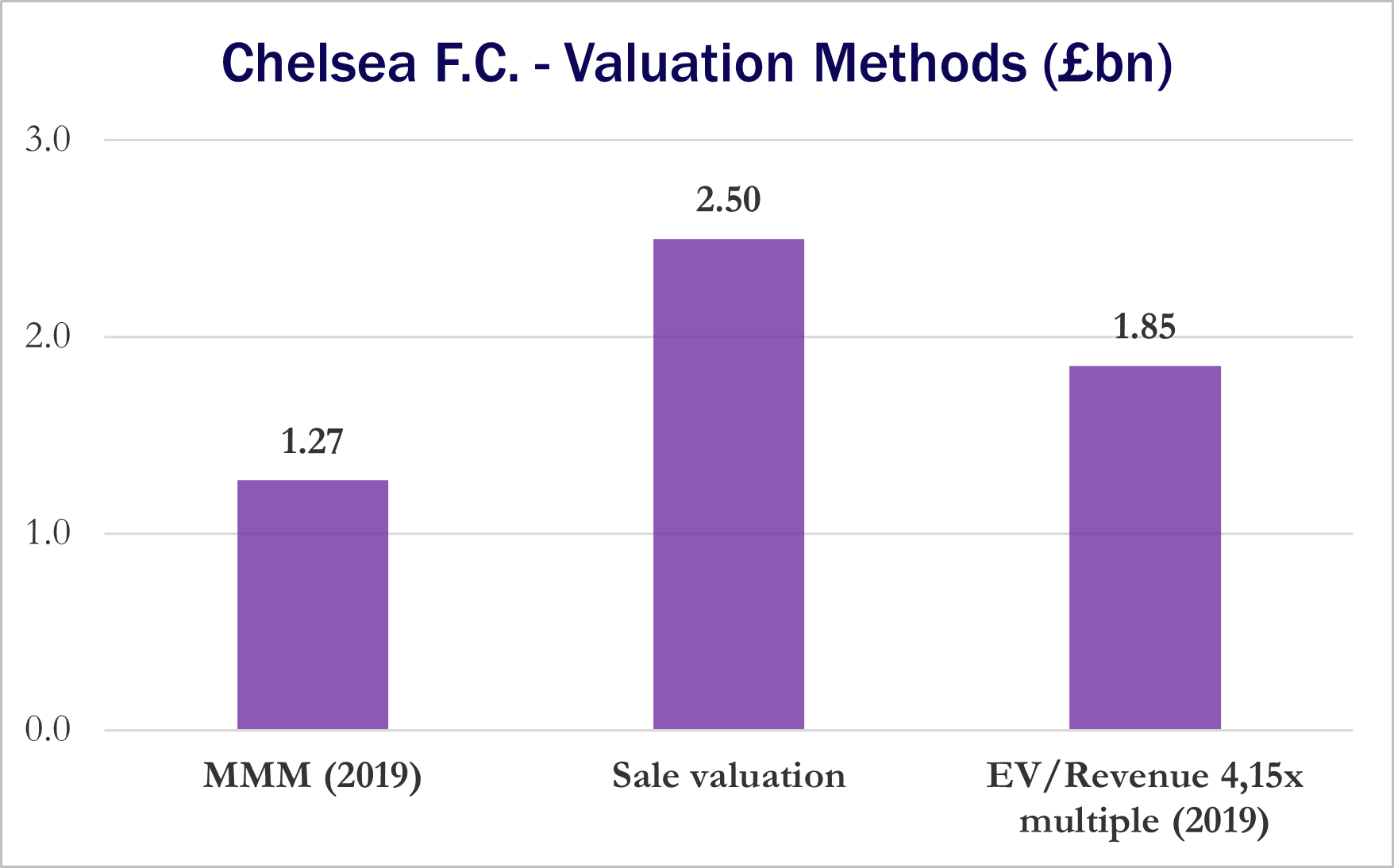

The new owners paid £2.5bn to acquire the club, with the latter £1.75bn that was part of the headline figure of £4.25bn being pledged as future investments into the club – mainly into the infrastructure, as well as developing the women’s team. According to a model for valuing football clubs developed by Dr Tom Markham, Chelsea’s implied valuation (based on the 2018-19 financial statements to remove COVID19 from the equation) amounts to £1.27bn, more than £1bn less than what has been paid. To complete the picture, we’ve calculated an EV/Revenue multiple of a comparable “Big Six” club – Manchester United. According to a comparable valuation, using a 4.15x multiple, Chelsea is worth £1.85bn. As we see, regardless of the valuation method used, we arrive at a transaction premium of 97% and 35%, respectively. Of course, any transaction is bound to include a premium, yet we can clearly see that football clubs provide for an exceptional example where a perennially loss-making entity is bought not because of its financial performance, but due to its perceived prestige and global brand. Arguably, that fits the general approach of prospective owners who buy a club either to promote their cause/global brand (like in the case of Manchester City or Newcastle United owned by UAE and Saudi Arabia, respectively) or by providing significant investment into fixed assets, namely stadium or training ground, hope to generate a return on a sale in eight to ten years from the acquisition date. In case of Chelsea, there have already been out plans in place to increase Stamford Bridge’s capacity to over 60k, on top of the announced desires to invest in other related infrastructure. That all leads to a probable conclusion, that Clearlake Capital aims to increase Chelsea’s attractiveness through investment into “hard” assets that will allow to improve the revenue generation capacity – like Tottenham Hotspur F.C. who unveiled its 62k seater stadium in 2019.

Source: BSIC

Recent dynamic of the M&A activity

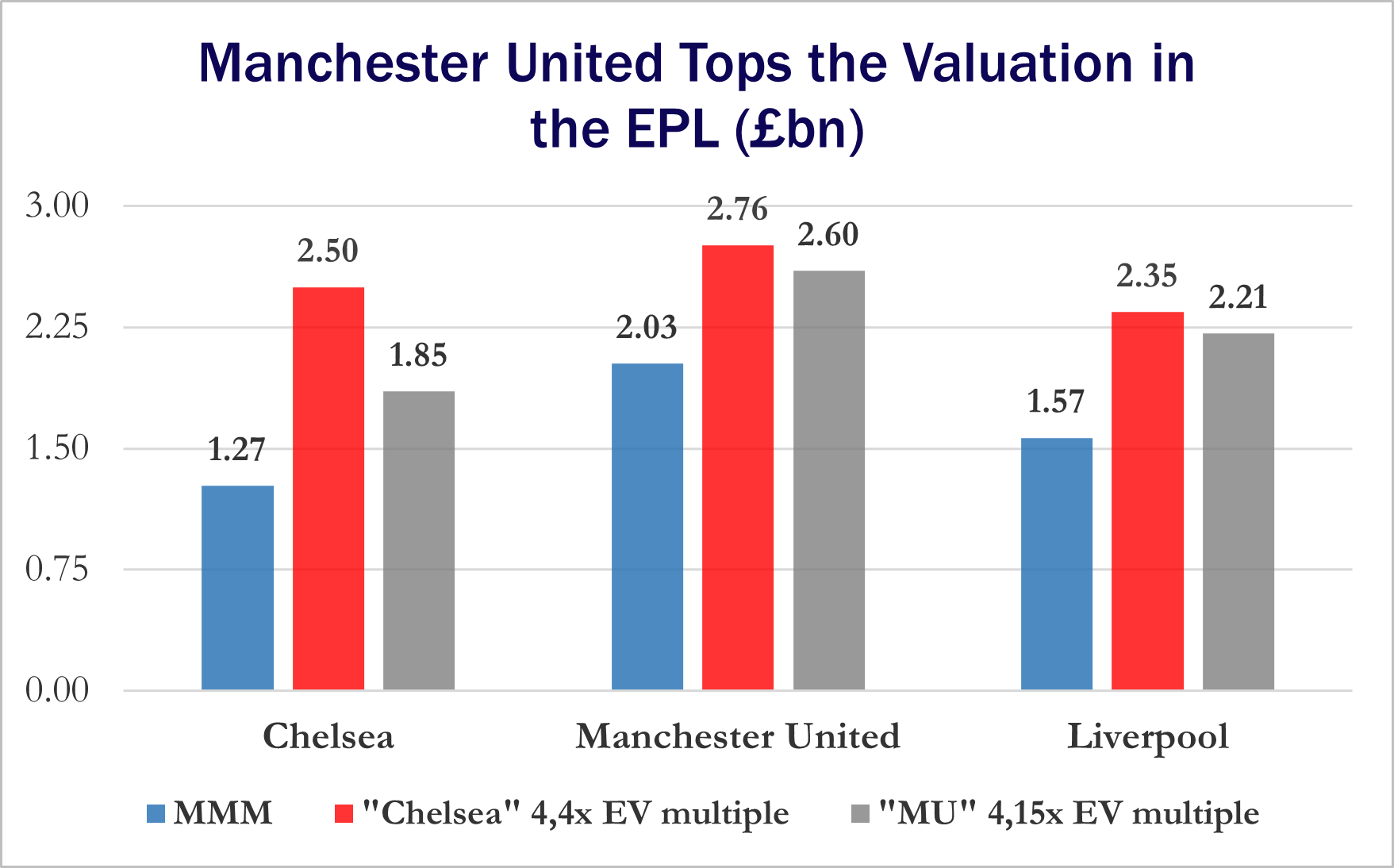

Chelsea’s record-breaking £2.5bn deal has arguably initiated a new wave of potential transactions on the English market. Following the sale, late last year rumours have arisen claiming that both the owners of Manchester United and Liverpool are looking to entertain bids for their respective entities. The Glazer family, holders of the previous record sum paid for a football club (£790m in 2003), never enjoyed a cosy relationship with the fans who from “day one” put forward claims that the American family is looking to “squeeze” the club for money and nothing else. While the claim can be disputed, it is a fact that since 2003, the owners have taken out more than £1bn from the club in the form of dividend payments and interest charges. The club’s infrastructure has also lost its top-tier status, falling behind rivals Manchester City and Liverpool who doubled-down on improving their stadiums training facilities in the recent years. On top of that, “Red Devils” haven’t enjoyed a flurry of successes on the pitch too, with their last Premier League title coming in the 2012-13 season. Hence, the Glazers are looking to cash-in on their initial investment. Our analysis of the club’s financial statements indicates an implied valuation of £2.76bn according to the Chelsea deal revenue multiple of 4.4x and a £2.03bn when using Dr Markham’s model. Given the premium present on the Chelsea deal, it is conceivable that any potential bidder is looking at a valuation between £3.51bn and £5.43bn.

To complete what football fans, refer to as “hat-trick” (the act of scoring three goals in a game), we’ve also looked at Liverpool’s financial statements and plausible valuation considering the rumours that Fenway Sports Group, the current owner, is also looking to sell at least part of the club. Having bought the club for £300m in 2010, FSG has brought a complete turnaround of fortunes at the iconic club. With investments ranging from a new, elite training complex, expanded and renovated Anfield Stadium (54k capacity), to improvements in off-the pitch, organisational functioning of the club, the Merseyside team has come a long way from being on the brink of administration in 2010. Topped with the success the club has enjoyed under the German manager, Jurgen Klopp, hired in 2015 (first Premier League win since 1992, Champions League glory in 2019), our analysis indicates an implied valuation of £1.57bn (Markham Model) or £2.35bn (Chelsea deal revenue multiple). When coupled with the premium on the Chelsea sale, any entity willing to take over a majority stake in the club would need to spend between £2.98bn and £3.09bn. That said, given we have used the 2018-19 accounts, the figure is likely to be even higher. Forbes’ most recent valuation implies a figure closer to $4.5bn (£3.74bn). It is also worth noting the recently surfaced rumours that FSG could opt for a minority stake sale (10-15%), hoping to receive an amount that would recoup the group’s initial £300m investment.

Source: BSIC

Fightback from the continent?

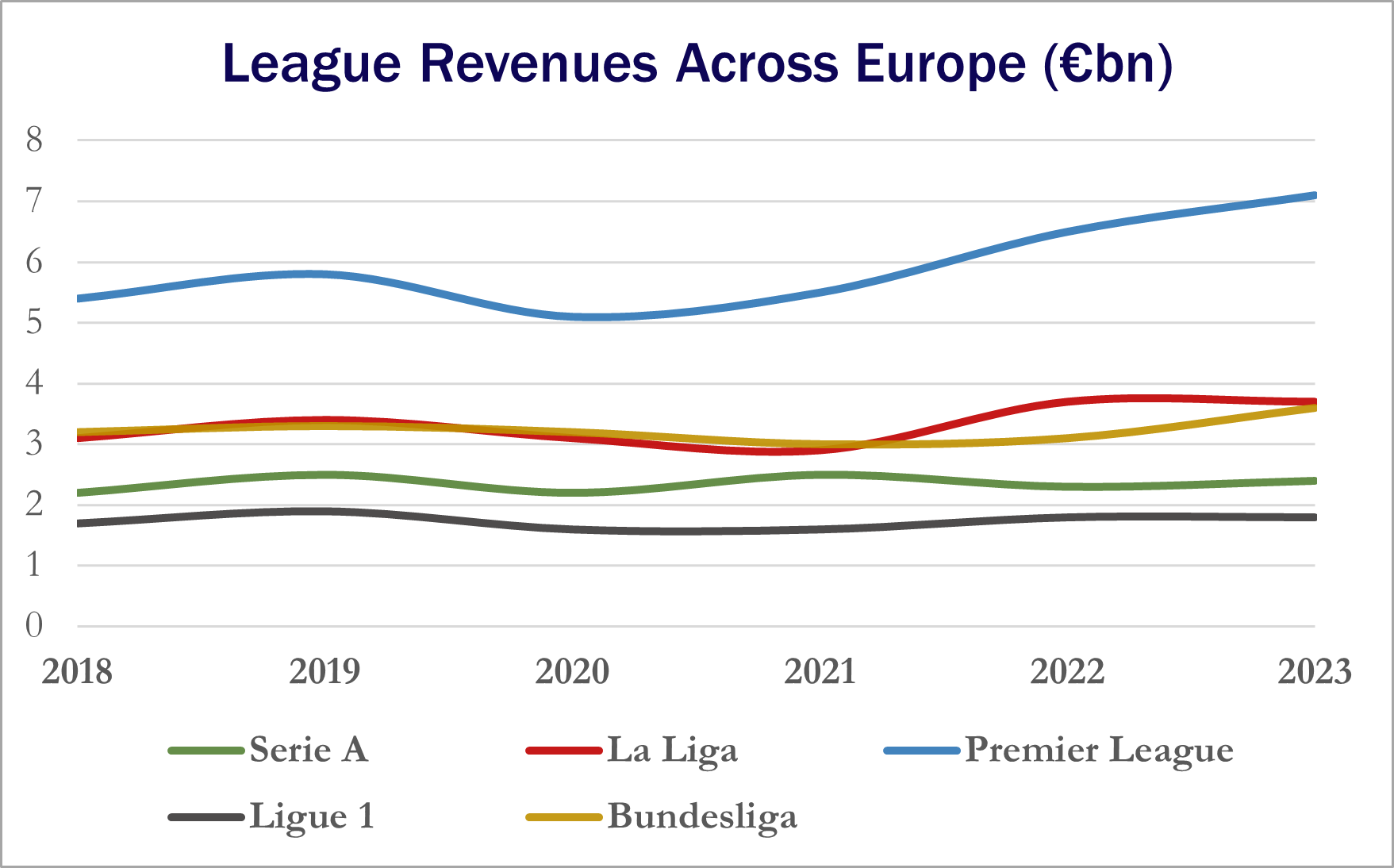

Arguably, in the recent decade the gap, mostly financial, between the English Premier League and the other four top European leagues (La Liga, Bundesliga, Serie A, and Ligue 1) has gown even bigger. According to Bloomberg, the cumulative revenues generated by the top five European Leagues have seen a disparity between the top performer (English Premier League) and all the rest. In the most recent season (2021-22), the EPL has generated more than €7bn. The closest contender, Spanish La Liga, saw its figure decrease slightly from the previous season, to around €3.8bn. The revenue CAGR across the last six years amounted to a meagre 2.9%, and 2.2% if the Premier League is not included.

Source: Bloomberg

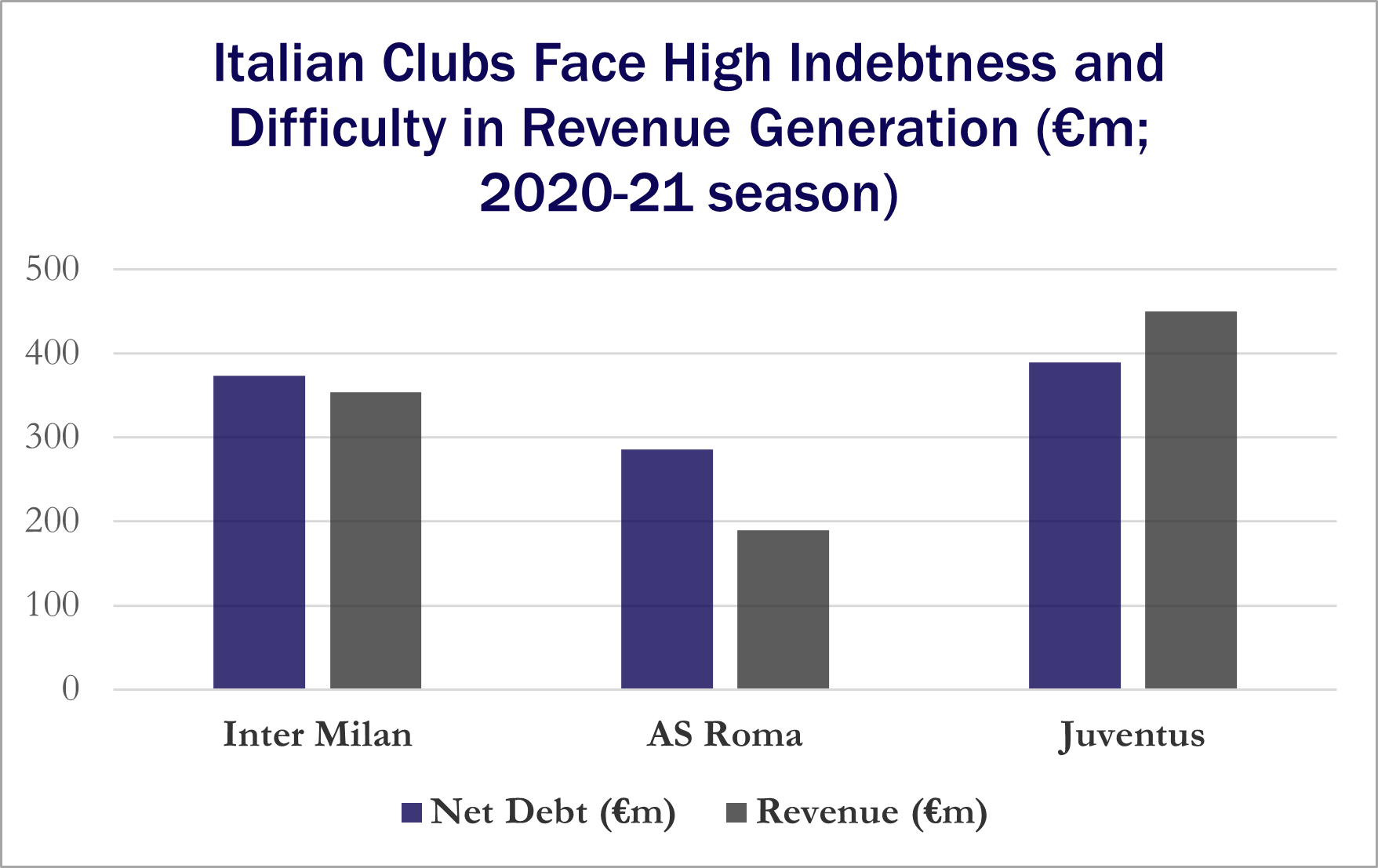

Whereas the English clubs are in somewhat better financial position due to the revenue baseline set at a much higher levels than other peers, the main problem lies on the continent. Excluding some outliers, like Real Madrid, Bayern Munich, and Borussia Dortmund, who manage their finances much more effectively, many top clubs have been arguably living above their means. Only last summer, because of years of mismanagement, F.C. Barcelona had been forced to sell part of its broadcast rights to external entities to be able to invest in new players. Top clubs of the Italian Serie A, Inter Milan, AS Roma, and Juventus, all possess net debts equal to at least 80% percent of their revenues (in case of AS Roma, the figure stands even higher, at 150%).

Source: BSIC

This undeniably dire situation has led to a flurry of interest from private equity firms and banks willing to invest into dedicated companies that manage the broadcast rights of the respective European leagues. In late 2021, CVC Capital Partners bought an 8.2% stake in La Liga’s broadcasting rights company for €2.1bn. The deal involved direct payments to clubs who have agreed to participate in the deal (37 of 42 Spanish clubs, excluding, among others, Real Madrid, and F.C. Barcelona), with 70% earmarked for investments in infrastructure. Other European leagues are likely to follow, too. With clubs in Italy having troubles with managing their finances following the consequences of COVID19, the once rejected deal to sell the league’s broadcasting rights is likely to resurface soon, with rumours of Goldman Sachs and JP Morgan actively monitoring the situation. Finally, the German Bundesliga is allegedly in negotiations to sell up to a 20% stake in its respective broadcasting company in a potential €18bn deal.

All in all, the question begs for the continental leagues – how to generate more stable and sustainable revenues? Generating a capital injection by selling parts of broadcasting rights is only a short-term, one-off solution. Without a major rethink of the foundation of the football business, financial problems will continue, and it will be the “continental” leagues that will suffer first, not the English Premier League.

0 Comments