Introduction

Activist short sellers have existed for a long time but have only recently gained significant attention due to their increased exposure in the media. After opening short positions on a company, the investment firms disclose research accusing the firm of fraudulent behaviour. By revealing their findings to the public, they achieve high profits and pride themselves on acting in the interest of society by uncovering these frauds. Although the practice is not illegal, it is controversial as it is difficult for regulators to supervise how the funds gain information on the targeted companies and how they carry out their operations. For example, some of Hindenburg’s allegations on Adani Group might be based on private information that could be considered insider trading. Furthermore, in a recent study looking at the effects of activist short sellers on firms and markets, out of a sample of 159 cases of alleged fraud by activist short-sellers, only 30% of cases concluded with the confirmation of fraudulent activity. This article focuses on how activist short sellers operate, their performance, how they are regulated, and, finally, how their publications impact the targeted companies.

The Adani Case

The Adani case is the most recent example showcasing the role of forensic finance firms in bringing such information to light. Investigations by Hindenburg Research uncovered several malfeasances by the Adani group, including a potential fraud scheme, stock manipulation, and ties to political leadership. Particularly in these cases where traditional regulatory and legal channels have failed to identify or address the issue, the growing importance of such short-selling activists is highlighted.

To uncover such findings, Hindenburg used plenty of tools and methods common to the industry, such as data analysis, investigative research, and financial modelling. With a team consisting of analysts, researchers, and investigators, with a background in finance, journalism, and law, Hindenburg leveraged its experience and network to conduct interviews with former employees, including multiple former senior executives, and industry experts, and site visits to Adani Group’s facilities. The forensic finance firm also relied on information provided by whistle-blowers, whose identities remain confidential, but which were later corroborated by independent accountants.

Activist Short Selling Investment Funds

In practice, activist short sellers aim to profit from the fall of the stock prices of their targeted companies. The difference between passive short-sellers and activist ones is the rather aggressive approach taken by the latter. After looking for evidence of fraud, mismanagement, or other unethical behaviour through extensive research, they publish reports on the accused companies expecting to drag their share prices down. Nonetheless, they argue it is for a good cause — enhancing the transparency, accountability, and efficiency of the financial sector. Along with Hindenburg Research, some of the most prominent short-selling activists include Muddy Waters Research, Viceroy Research, Gotham City Research, and Citron Research:

Hindenburg Research was founded in 2017 by Nathan Anderson, a former investment banking analyst. The New York-based firm first gained attention for its investigation into electric truck maker Nikola, which led to a sharp decline in the company’s stock price and the resignation of its founder, and its report on Chinese coffee chain Luckin Coffee, which resulted in the company being delisted from the NASDAQ stock exchange.

Muddy Waters Research gained international attention in 2011 when it published a report accusing Chinese forestry company Sino-Forest of fraud. In one of the most high-profile cases recently, the report published on the Chinese firm led to a 74% drop in the company’s stock price and sparked an investigation by the Ontario Securities Commission. Further notable cases also include Noble Group and Burford Capital, with similar accusations of fraud and overvaluation.

Viceroy Research was founded by Fraser Perring in 2016. The British firm came into the international spotlight soon after in 2017, publishing a report accusing South African retail company Steinhoff of accounting fraud. The report led to Steinhoff’s share price plummeting and investigations by regulators in South Africa and Germany. Viceroy has also targeted other companies, including Capitec Bank and Blue Sky Alternative Investments, with allegations of overvaluation and accounting irregularities.

Gotham City Research, founded by Daniel Yu, is known for its short-selling campaigns against companies such as Chinese paper company Orient Paper and US health insurance provider Health Insurance Innovations. In both cases, Gotham City published reports accusing the companies of fraud and overvaluation, leading to significant drops in their stock prices.

Citron Research, founded by Andrew Left, has also been involved in several high-profile short-selling campaigns. In 2015, Citron published a report accusing Valeant Pharmaceuticals of accounting fraud and overvaluation. The report led to a significant drop in Valeant’s stock price and ultimately contributed to the company’s bankruptcy. Citron has also targeted other companies, including Chinese e-commerce giant Alibaba and Canadian cannabis company Tilray, with accusations of overvaluation and deceptive business practices.

How Activist Short Sellers Invest

Activist short sellers may use a variety of instruments and methods to trade target companies, which are all also used by conventional short sellers. In all of them, the objective is to exploit the negative backlash of the published report in the most profitable way, be it directly at the stock prices, or through its creditworthiness.

Short selling and put options are certainly the most explored by activist short-selling funds. Short selling may be more appropriate when a short seller has a high conviction that a company’s stock price will decline. Nonetheless, it also involves significant risk, as the potential losses are unlimited if the stock price rises instead, whereas, with put options and derivatives, both potential losses and gains are limited by the option premium and strike price respectively.

Further, when a short seller believes that a company’s creditworthiness is likely to decline, even if the stock price does not, activist short sellers have in the past used Credit Default Swaps to bet against the financial stability of the target company. CDS pay out in the event of a company’s default, and investors can profit if they correctly predict that a company is likely to experience financial distress, without taking a position in the company’s stock.

Performance of Activist Short Sellers

The main characteristic distinguishing passive short sellers from active short sellers is that the activists openly publish their position explaining the reasoning behind their move to the public. The main objective behind the public campaign is to drive the target company’s stock price down by accusing the latter of fraudulent behaviour. To understand whether this practice leads to significantly higher returns than passive short selling, it would be useful to compare the performance of the two short selling types. However, gaining information on passive short sellers is difficult because they usually do not disclose their trades to the market. Therefore, it is not possible to examine their performance to depict which type leads to higher returns.

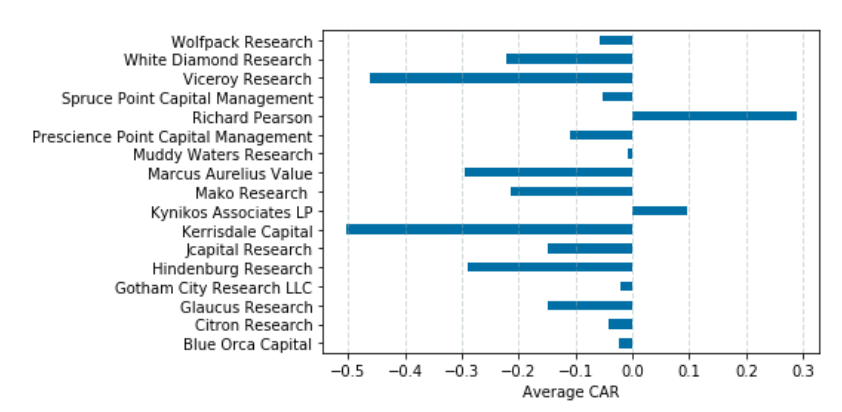

The best method to uncover the profitability of active short sellers is by understanding the stock price reaction after the disclosure, finding out whether the campaign was a success, and estimating its returns. To do so, the two essential elements are the abnormal and expected returns. The expected return of a stock is the return an investor expects to receive on an investment, and the difference between the effective return and the expected one corresponds to the abnormal return. These are associated with a direct change in a company’s market capitalisation. Negative abnormal returns reflect a profit for the activists that shorted the stock of the target company. According to a research paper written by Raquel Da Fonseca Salvador in 2021, the announcement of campaigns is associated with negative abnormal returns for target companies that decrease on average by 7% around the publication date. The study in the paper tested the cumulative abnormal returns of 17 US activists observing that almost all of them  were able to lower the target company’s stock price with their publications.

were able to lower the target company’s stock price with their publications.

Source: “Activist short sellers: what are their performances?” – Raquel Da Fonseca Salvador

Viceroy Research, for example, took a strong short position on Paretum Corporation [TEUM], which had a CAR of -1.059. After announcing its position on June 26, 2019, the stock fell drastically one month later.

The research analysed a database containing 247 shares and discovered that on average, the activist short-seller campaign made the share price of the targeted company decrease by 14.82% over 135 days. This proves that usually activist short sellers achieve greater returns than passive ones because the public disclosure of their reports leads to a greater reaction in the company’s share value.

An essential factor to take into consideration when assessing the performance of active short sellers is the geographical area of the companies sold short by activists. Activist short sellers outperform in the US and Asian markets compared to Europe. The main reason for the difference in performance is that European markets are becoming increasingly regulated, especially concerning short selling. On the other hand, the Asian markets are proving to be very profitable for short sellers. This is mainly because it is difficult to obtain accurate information on Asian companies and this phenomenon leaves more room for fraud and, as a result, more short selling opportunities. Another critical element affecting the returns for these funds is the target company’s size. It has been proven that shorting companies with small market capitalisation leads to higher returns than larger-cap companies. Companies with large market capitalisation are generally more liquid in the markets and, therefore, their shares are less volatile. Furthermore, smaller-cap companies are often less transparent as they are less supervised, which could more easily lead to fraudulent behaviour and, consequently, be the best target for short sellers.

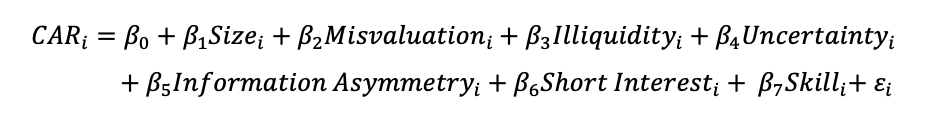

A research paper from the Stockholm School of Economics ran a cross-sectional regression model of cumulative abnormal returns (CARs) on stock-specific characteristics for the sample of target firms. The regression is based on the variables’ impact on the success of the campaign, expressed by the short-term post-campaign returns:

From this equation, it can be inferred that more negative CARs one-day post announcement are driven by higher ex-ante price run-ups, lower market capitalisation, and higher short seller’s reputation (skill) on the market. Moreover, one-week and two-week CAR regression outcomes suggest that the negative coefficient before price run-up increases monotonically for longer event windows. This indicates that short sellers tend to correct stocks with high valuations and drive prices towards their fundamental values.

It is important to mention that another factor playing an essential role in the performance of active short sellers is media coverage and social media platforms. Although traditional channels used to disseminate the reports, such as word of mouth and traditional media, play an influential role in society, social networks have significantly increased the number of short-seller activist campaigns. In addition, digital platforms for reporting have grown in importance, allowing activists to reach a wider audience more quickly than was possible with traditional media.

The effects of unconfirmed or false allegations on firms and capital markets

A research paper written by Antonis Kartapanis, titled “Activist Short-Sellers and Accounting Fraud Allegations”, found that out of a sample of 159 samples of alleged fraud by activist short-sellers, further investigations were carried out by the SEC or attorneys in 43% of cases, with only 30% of cases concluded with the confirmation of fraudulent activity. It is hence crucial to investigate the effects of such unconfirmed, and in some cases false, allegations on firms, shareholders, markets, and the legal systems.

Focusing on one of the cases included in Kartapanis’ sample provides insight into how activists may cut corners or distort information to reap higher profits. A hedge fund manager, Jon Carnes, uses his website named after his pseudonym “Alfred Little” to publish his “long” and “short” investment opinions of publicly traded companies, with a focus on firms with operations in China. In one specific case, he began publishing reports in September 2011, alleging that Silvercorp Metals Inc. [SVM:NYSE], a Vancouver-based mining company with most operations in China, was committing fraud by exaggerating production and revenues. Jon Carnes had opened several short positions before publishing the multiple reports, one of which sent Silvercorp’s stock down 20% in one day, winning him a $2.8m profit. He was later accused of making false statements in his reports by the British Columbia Securities Commission (BCSC). Most shockingly, the BCSC stated that he misrepresented the work of one of the two geologists he hired to analyse filings on production levels and the number of resources the firm currently owned. Alfred Little asked one of the geologists to change his conclusions as they were “too vague and not damaging enough” to the firm. He then published his article using these twisted findings and likely profited more from doing so.

These false and unconfirmed allegations can pose substantial costs to targeted firms, especially auditing and legal costs, and any other costs the firm may need to appease shareholders and regain investor confidence. Silvercorp, for example, spent $14m to settle one of numerous class action fraud lawsuits brought about due to the allegations. Furthermore, capital markets may be negatively affected as the allegations lead to asymmetric information, as investors may make decisions based on misinformation, and unjustifiably depress prices.

Regulating activist short-sellers and outlook for the industry

In the case of Alfred Little’s allegations against Silvercorp, the BCSC cleared the short seller of any market manipulation stating: “While we may find Carnes’ conduct unsavory, we do not find it was clearly abusive to the capital markets.” The decision statement read that “Carnes did not give a full and fair picture of (the geologists’) opinion on the topic. That, however, fails short of deceit or falsehood for the purpose of fraud and is therefore not a prohibited act.” Based on this case, the BSCS must have evidence of clear deceit or falsehood by the activists in their reports to act. Hence, regulators have strict rules on prohibited conduct which they enforce, but there is still room for unconfirmed and biased allegations to come to light without punishment for activists.

Critics of short sellers in the US have proposed SEC rules which they claim would prevent abuse by activist short sellers. Among the proposed ideas is the 10-day “cooling-off period” after an activist short-seller releases their report. This was first mentioned by Joshua Mitts, a professor at Columbia law school, who is an avid critic of activist short sellers claiming that they deceive the market to make profits and that the stocks they shorted usually bounced back up a couple of days after. The idea of a cool-off period would involve a 10-day holding period for all short-selling activists once they publish their reports to prevent market manipulation and unethical behaviour. However, officials from the SEC have stated that the idea is “dangerous” as it would also punish “good” short sellers and would create significant potential for short squeezes.

There are both proponents and critics of activist short sellers, however, there is undeniable potential for unethical market manipulation to take place, negatively impacting firms, markets, and the legal system. Regulators are becoming more cognizant of such malpractice and may increase efforts to crack down on activist short sellers, who cut corners and publish false allegations to drive up their profits.

References

[1] Da Fonseca Salvador, Raquel. Activist short sellers: what are their performances?. Louvain School of Management, Université catholique de Louvain, 2021. Prom. : Nguyen, Anh. http://hdl.handle.net/2078.1/ thesis:30166

[2] Brendel, J. and Ryans, J. (2021), Responding to Activist Short Sellers: Allegations, Firm Responses, and Outcomes. Journal of Accounting Research, 59: 487-528. https://doi.org/10.1111/1475-679X.12356

0 Comments