US

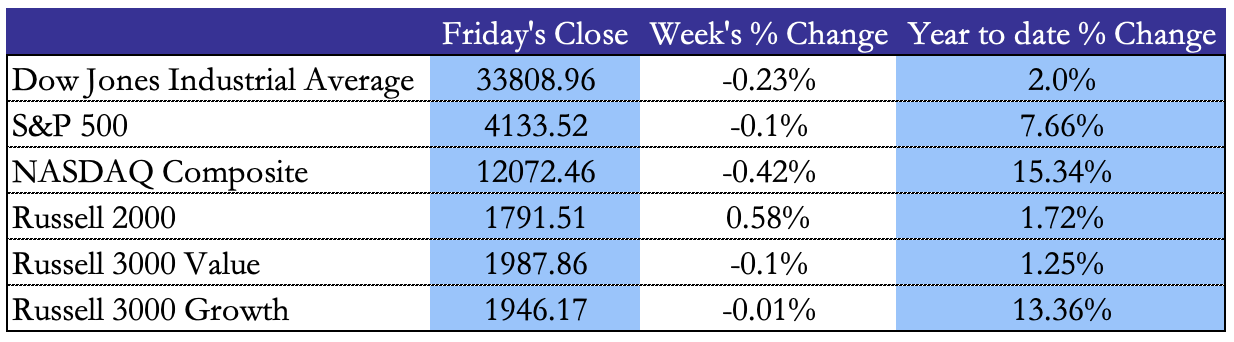

The US stock market closed the third week of April with marginal losses, as the first full week of earnings season ended. The main indexes ranged from -0.42% for the Nasdaq, to +0.58% for the Russell, while the CBOE Volatility Index hit its lowest since January 2022, remaining below 17. The weekly performance was affected mainly by mixed earnings results and by the comments of two Federal Reserve officials, favoring continued rate hikes up to 5.5%-5.75%, The benchmark currently sits between 4.75% and 5%.

The earning season has been characterized so far by better-than-expected results, roughly 20% of the S&P 500 Index has posted quarterly earnings and more than 77% of the reports were better than expectations. Additionally, the S&P Global flash April composite PMI rose 1.2 points to 53.5, the highest since May, further clouding the Federal Reserve’s monetary policy outlook.

Among the stocks, Tesla was one of the worst performers. The companies’ shares dropped by more the 10% after CEO Elon Musk suggested the company will keep cutting prices to stoke demand. The car producer operating margin shrank to 11.4% in the first quarter, a roughly two-year low, after the company marked down its electric vehicles in January and March. AT&T also suffered a 10% slump in Thursday’s session, after showing particularly negative free cash flow in the results. On the other hand, Procter&Gamble shares rose by 3.5%, benefitting from the increase in profit margin and sales caused by higher prices.

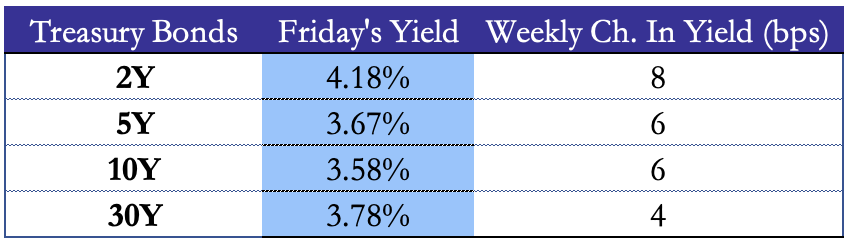

The US jobless claims reading on Thursday jumped to the highest since November 2021: continuing claims increased by 61,000 to 1.87 million through April 8; meanwhile, initial unemployment claims rose by 5,000 to 245,000 in the week ended April 15, indicating some softening in the labor market. Finally, the treasury bond yields slightly rose by 6 bps, following the comments of Fed officials.

EU

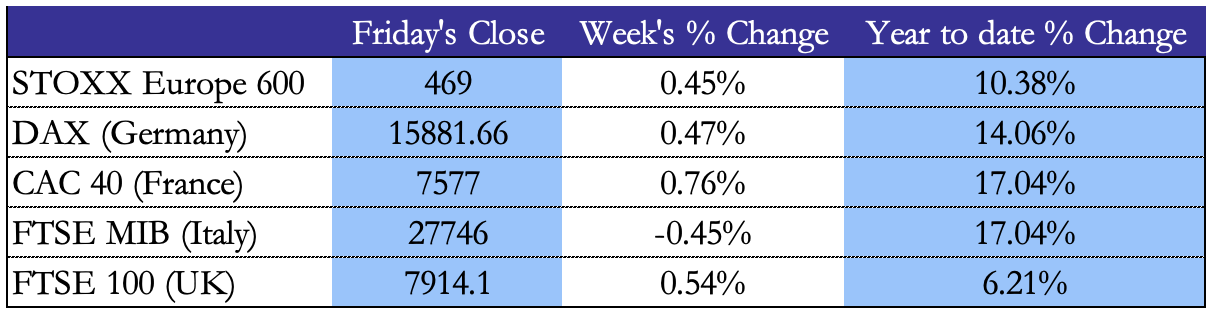

European markets were up this week, with the main indexes gaining more than 14% in Germany, France and Italy. The UK’s FTSE 100 rose by 6.21% and the STOXX 600 Europe by 10.38%. European equities edged higher on another earnings week as investors weighed unexpected purchasing managers’ index data.

The euro area’s economic rebound firmed up in April thanks to the resurgent service-sector activity, while the business outlook withstood the recent banking stress. The composite PMI rose to 54.4, while it was expected unchanged at 53.7. The services industry soared to 56.6 from 55.0, exceeding expectations for a decline to 54.5 and the new business index rose to a one-year high of 55.8 from 54.2. However, the manufacturing PMI fell to 45.5 from 47.3, at its lowest level since the coronavirus pandemic.

UK businesses reported the fastest growth in a year, the composite PMI jumped to 53.9 from 52.2 the previous month. However, the inflationary pressure is still the major concern: driven by the strongest increase in food prices in more than four decades, the Consumer Prices Index rose 10.1% from a year ago, while a 9.8% increase was expected.

European stocks have recovered from last month’s selloff spurred by the banking-sector crisis, with the STOXX 600 Europe hitting its highest level since February 2022. Big individual movers included EssilorLuxottica SA, which soared by 6.6% after its sales jumped. Meanwhile, miners including Glencore Plc and Rio Tinto Group fell with iron ore.

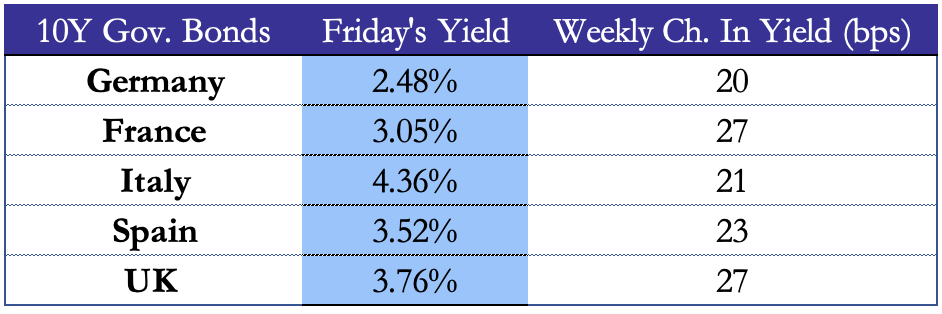

The European Central Bank is widely expected to increase its deposit rate at its next policy meeting on May 4: as Vice President Luis de Guindos said on Friday, underlying inflation in the euro area is proving to be very strong and sticky. European government bond yields edged higher as investors weighed the prospect of another interest rate hike from the European Central Bank (ECB) in May. Yields on 10-year German government debt climbed toward 2.5%, while yields on French sovereign bonds of the same maturity also ticked higher. In the UK, yields also rose on benchmark 10-year debt on strong inflation and wages data.

Rest of the world

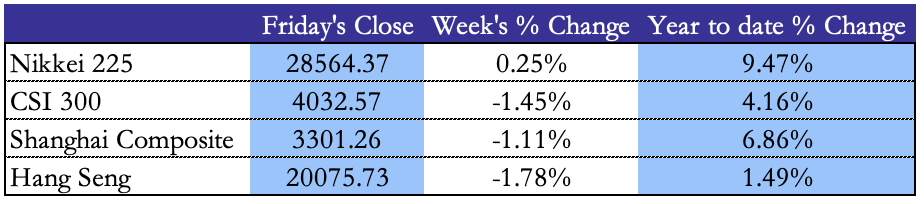

Asian markets closed a negative week, with the major Chinese indexes down from -1.78% to -1.11%. Despite strong China’s Q1 GDP (+4.5% YoY), the heightened US-China and cross-strait tensions weighed on sentiment. Japan’s stock market gained 0.25% over the week, as CPI readings confirmed expectations and new Governor Kazuo Ueda reiterated the BoJ’s commitment to its easing stance until price stability is achieved.

In the first quarter, China’s economy grew at the fastest pace in a year, GDP expanded 4.5% last quarter from a year earlier, official data showed Tuesday, beating economists’ expectations. However, markets were affected by the news that US President Joe Biden is aiming to further restrict US investments in the country. The US administration is planning to sign an executive order in the coming weeks that will limit investment in high-tech industries, with a focus on chips, AI, and quantum investments. Meanwhile, as tensions don’t stop rising, China’s military plans to conduct at least five drills in the South China Sea.

Again, on Thursday Japan’s CPI came out at 3.1% YoY in March, in line with expectations and matching February’s reading. Even if consumer inflation remained well above the BoJ’s 2% target, the consensus is that the new Bank of Japan governor Kazuo Ueda will keep the ultra-dovish policy unchanged in his first meeting on April 28. Still, economists expect the BOJ to move toward tightening by the end of this year. April Flash Composite Purchasing Managers’ Index decreased from 52.9 to 52.5, showing that Japan’s private sector (54.9) continued to expand solidly at the start of Q2, helping to offset a weak manufacturing sector performance (47.5).

The Kospi index was down 1% despite foreign inflows as EV names underperformed. Non-Asian markets had a bad week too, driven by the Brazilian BOVESPA down 2% and by the Turkish BIST 100 down 1.6%.

FX and Commodities

Crude prices declined until Thursday, with both Brent and WTI down 5.6%, as the persistent U.S. rate hikes and recession fears ended a rally in place since the OPEC+ announced new cuts to oil production. Even if the price was supported by a report from the Energy Information Administration showing that stockpiles fell 4.58m barrels last week, the news was overshadowed by increasing perceived risks of a US recession.

Gold prices dropped from 2015 to 1990. This week’s decline in gold began after the hawkish remarks by U.S. Federal Reserve officials through the week bolstered bets for at least one more interest rate hike and buoyed the dollar.

Finally, in the FX space, the Dollar index rose from 101.5 to 101.8, peaking at 102.1 on Tuesday. The USD fell on Thursday as weak labor market data reinforced expectations the world’s largest economy is likely headed toward recession, but it quickly cut its losses after the hawkish comments from Fed officials.

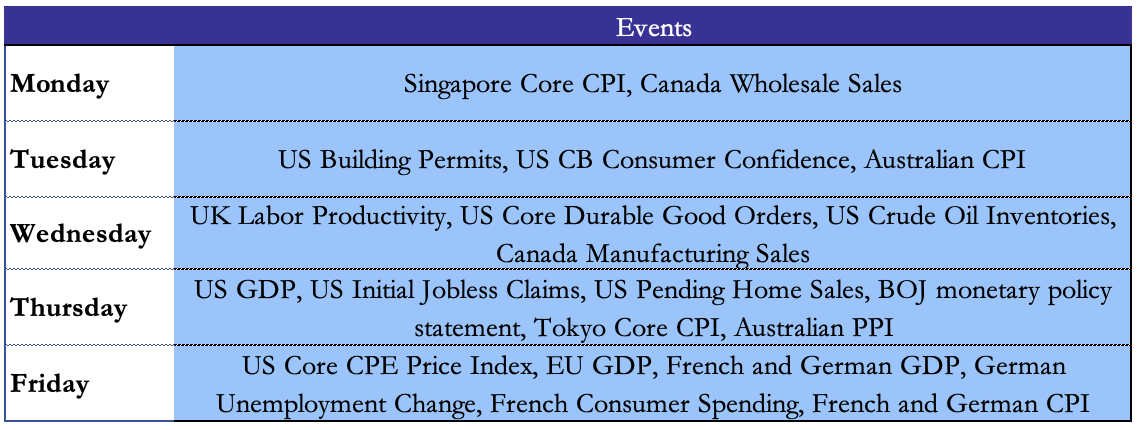

Next Week’s Events

Brain Teaser #40

Adults made up 5/12 of the crowd of people at a concert. After a bus carrying 50 more people arrived, adults made up 11/25 of the people at the concert. Find the minimum number of adults who could have been at the concert after the bus arrived.

Source: 2022 AIME II – Problem 1

SOLUTION: Since in the beginning, adults made up 5/12 of the concert, the number of people must have been a multiple of 12. Let’s call the number of people in the beginning x. Then x must be divisible by 12, in other words: x must be a multiple of 12. Since after 50 more people arrived, adults make up 11/25 of the concert, and x+50 is a multiple of 25. This means x+50 must be a multiple of 5.

Notice that if a number is divisible by 5, it must end with a 0 or 5. Since 5 is impossible (obviously, since multiples of 12 end in 2, 4, 6, 8, 0,…), x must end in 0. Notice that the multiples of 12 that end in 0 are: 60, 120, 180, etc.. By trying it out, you can clearly see that x=300 is the minimum number of people at the concert. So therefore, after 50 more people arrive, there are 300+50=350 people at the concert, and the number of adults is 350*11/25=154. Therefore the answer is 154.

Brain Teaser #41

Ms. Three, Ms. Five, and Ms. Eight are making a cake. For this project Ms. Three contributed 3 lbs of flour, Ms. Five contributed 5 lbs of flour, and Ms. Eight, who has no flour, pays $8 cash. If the deal is fair, how much cash do Ms. Three and Ms. Five get back?

Source: Isichenko, Michael. Quantitative Portfolio Management: The Art and Science of Statistical Arbitrage. 2021.

0 Comments