Introduction

Liquified Natural Gas (LNG) is natural gas that has been cooled to at least -162°C to transform the gas into a liquid for ease and safety of non-pressurized storage or transportation. This innovation has revolutionized the utilization of natural gas, addressing the historical challenges associated with the fuel. In the earlier part of the 20th century, natural gas was ultimately useless when produced in areas inaccessible by pipelines and was even flared (burnt off in a gas flare tower) in gas-producing oil fields as it had little use without the ability to be transported.

The absence of a viable method of transportation or storage, apart from compressed gas pipelines, confined natural gas to local markets. This placed the fuel at a competitive disadvantage compared to other fuels like oil, which could be conveniently stored for extended periods. The revolutionary solution arrived with the invention of cryogenic storage and LNG technology. When liquified, natural gas can be stored at a volume 1/600th as large as its gaseous state, enabling efficient non-pressurized storage and transportation.

After the first LNG plants were built in the US for peak-shaving – storing natural gas during periods of surplus and using it during periods of low supply – the fuel was exported internationally to England in 1959 when the country was experiencing an energy shortage. The LNG market further evolved in 1964 with the introduction of purpose-built LNG carriers, facilitating the seamless movement of natural gas on a global scale. Later, natural gas fields discovered in Algeria prompted the wide-scale international trade of LNG, connecting the world’s natural gas markets.

Energy markets and geopolitics are closely intertwined, especially with regard to energy security. Russia’s invasion of Ukraine in 2022 severely impacted energy markets and caused deep economic and political uncertainty. As Europe moved away from Russian pipeline natural gas imports, the continent looked towards LNG as the key to ensuring energy security. Europe saw a 60% increase in LNG imports in 2022 compared to 2021, mainly facilitated by supply growth from the US and a drop in imports from Asian countries.

The prominence and use of LNG are expected to grow significantly throughout the next decade, as natural gas may prove to play a key role in the pivot towards the use of renewable and zero-emission energy production. The fuel can produce electricity at relatively low emissions compared to other fossil fuels such as coal and is set to be key in ensuring energy security during the development stages of wide-scale renewables. LNG itself may prove to be a vital fuel for sectors which will be difficult to electrify, for example, trucking and shipping.

Global LNG Market Overview

Liquefying natural gas is a way to move natural gas long distances when pipeline transport is not feasible. In its compact liquid form, natural gas can be shipped in special tankers to terminals around the world. For large-volume oceanic transport, LNG is loaded onto double-hulled ships, which are used for both safety and insulating purposes. For shorter distances, LNG can be shipped in smaller quantities. Over the last years, there has been a growing trade of small-scale LNG shipments, which are commonly made using the same containers used on trucks and in international trade with outfitted cryogenic tanks.

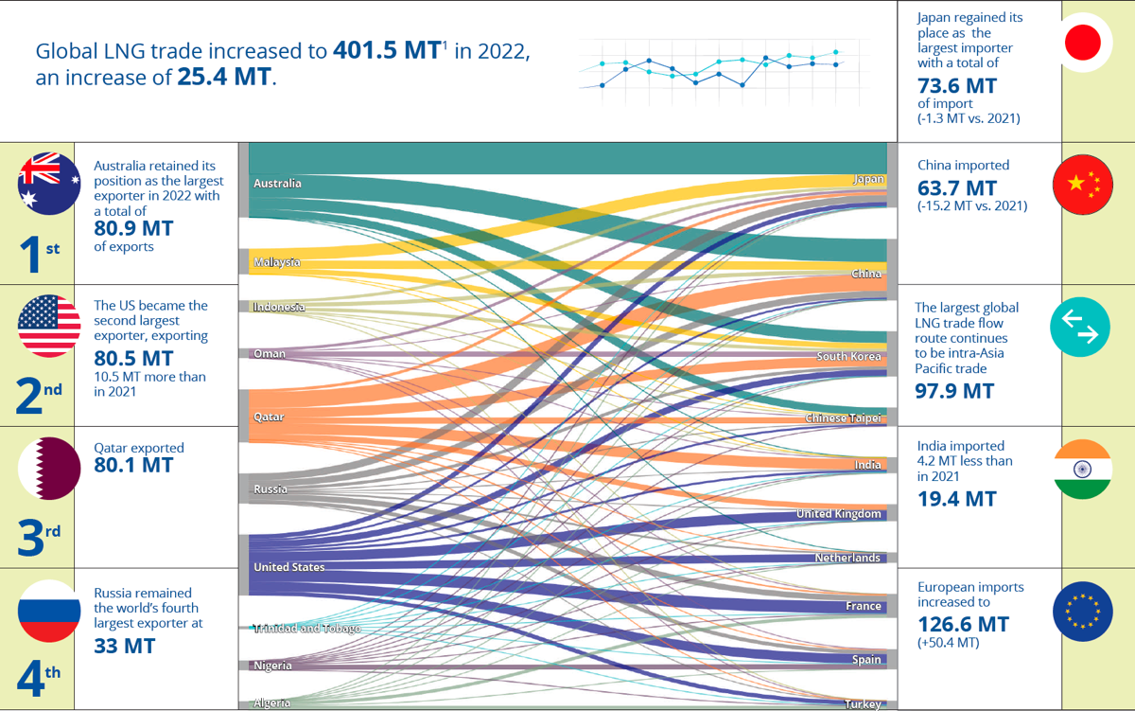

Global LNG trade grew by 6.8% between 2021 and 2022 to around 401.5 million tonnes (MT). Exports growth was mainly driven by the United States (+10.5 MT, +15%), following the start of the Sabine Pass Train 6 and the Calcasieu Pass projects. The US overtook Qatar as the world’s second-largest LNG producer in 2022, exporting 80.5 MT compared to 70 MT in 2021. Australia retained its position as the largest LNG exporter in 2022, exporting 80.9 MT compared to 79 MT in 2021. The largest exporting region continued to be Asia Pacific which saw total exports of 136.6 MT, having grown 5.2 MT over the course of one year. Furthermore, it is expected for the US to overtake Australia as the number 1 producer in FY 2023 as preliminary data showed the US leading H1 2023 on exports with 11.6 billion cubic feet per day (Bcf/d), closely followed by Australia and Qatar with 10.6 and 10.4, respectively. On the other hand, the Asia Pacific region also remained the largest importing region with net imports of 160.9 MT in 2022, showing a 4.6 MT increase compared to 2021. Moreover, Japan once again became the world’s largest LNG importer, bringing in 73.6 MT compared to 74.9 MT in 2021.

As of April 2023, LNG trade now connects 20 exporting markets with 48 importing markets. Some of the recent joiners to the industry include Germany, El Salvador and the Philippines, which over the course of the last year made their first imports.

Source: Rystad Energy

To create LNG, Natural Gas must go through several stages of processing at liquified natural gas plants, which can be either off-shore or on-shore. The first step is to clean the natural gas at a liquefaction plant. Natural gas is most commonly made up of methane, however, it can include other compounds and gasses such as butane, propane, and C02, among others. In order to ensure a good quality – a composition of around 85-99% methane – for it to be safely and efficiently used and transported, it must be purified. After obtaining the cleaned gas, it must be liquified. At this stage, the gas is processed through an LNG train, where the gas is cooled and turned into a liquid. LNG is much denser than natural gas and takes up 1/600th of the volume. This allows for large amounts to be transported via tankers or trucks, rather than pipes, which have limited reach. Nonetheless, for LNG to remain liquid, any transportation vehicle must be properly equipped with the necessary technology to maintain a low temperature. Due to the popularity of transportation via ship, LNG is frequently received at terminals located on the waterfront, or at onshore locations reachable via trucks. The LNG is transferred from the transportation vehicle to the storage via arms, which are gradually cooled to match the temperature of the LNG. Finally, for LNG to be used, it must be reheated to turn it back to its gaseous form through a process called re-gasification. Once turned back to gas, it undergoes safety analysis, and then it is ready to be distributed via local gas pipeline infrastructure.

The LNG industry has mainly been concentrated on big players, but small-scale LNG plants have begun to increase in prominence significantly since 2015 thanks to advances in technology and equipment that made production more cost-efficient. Nonetheless, the market is still dominated by global players who have been active for several decades. The largest LNG producer is called Qatargas, which was originally established in 1984 as a joint venture between Qatar Petroleum and ExxonMobil [XOM:NYSE], among others. Currently, the company controls over 200 wells that supply over 18.5bn standard cubic feet of gas, as well as operated 14 LNG trains, six of which are “mega trains”, and all add up to a production of 77m tons per annum (mtpa). Cheniere Energy [LNG:NYSE] is currently the largest LNG producer in the United States, and it exports to 5 different continents. Its 2 LNG facilities, located in Texas and Louisiana, have a combined total production capacity of around 45 mtpa. Also, ExxonMobil is one of the most relevant companies in the industry with more than four decades of experience and a current production capacity of over 23 mtpa. The company has its production facilities located in different countries and currently exports to over 30 different countries.

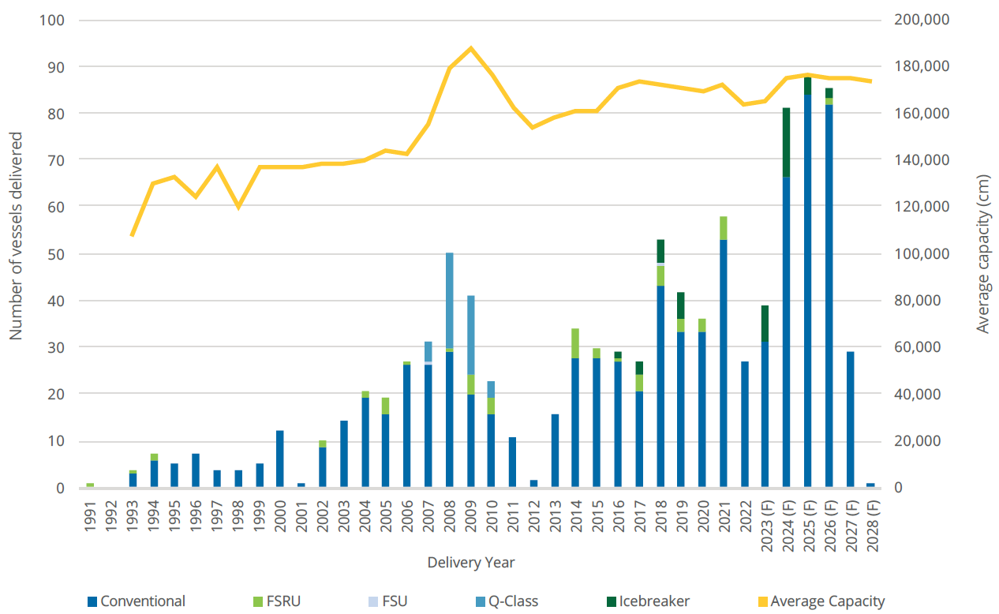

Moreover, as previously stated the majority of LNG trade is done through shipping. As of April 2023, there were 668 active vessels, including 45 Floating Storage Regasification Units (FRSU’s) and 8 Floating Storage Units (FSU’s). 27 vessels were delivered in 2021, representing a 4% growth in the fleet size, comparable to the 2.7% growth in the number of LNG voyages. Most of the newbuild vessels have a capacity between 170,000 and 200,000 cm, which positions them on the upper limit of the Panama Canal capacity, which is extremely important due to the additional LNG capacity being developed in the US Gulf and being exported to Asia. Nonetheless, moving forward, larger ships could become more common due to their economies of scale for long-haul voyages. Furthermore, given the increase in LNG trade over the past couple of decades, the global LNG fleet is young compared to the shipping industry standards. Vessels under 20 years make up 87.75% of the active fleet, and only 14 active vessels are 30+ years, including 6 that were converted into FRU’s or FSU’s. Moreover, the order book for LNG vessels includes 312 vessels under construction as of April 2023, equivalent to 46% of the active fleet. This illustrates the expectations that LNG trade will continue to grow in the upcoming years.

Source: Rystad Energy

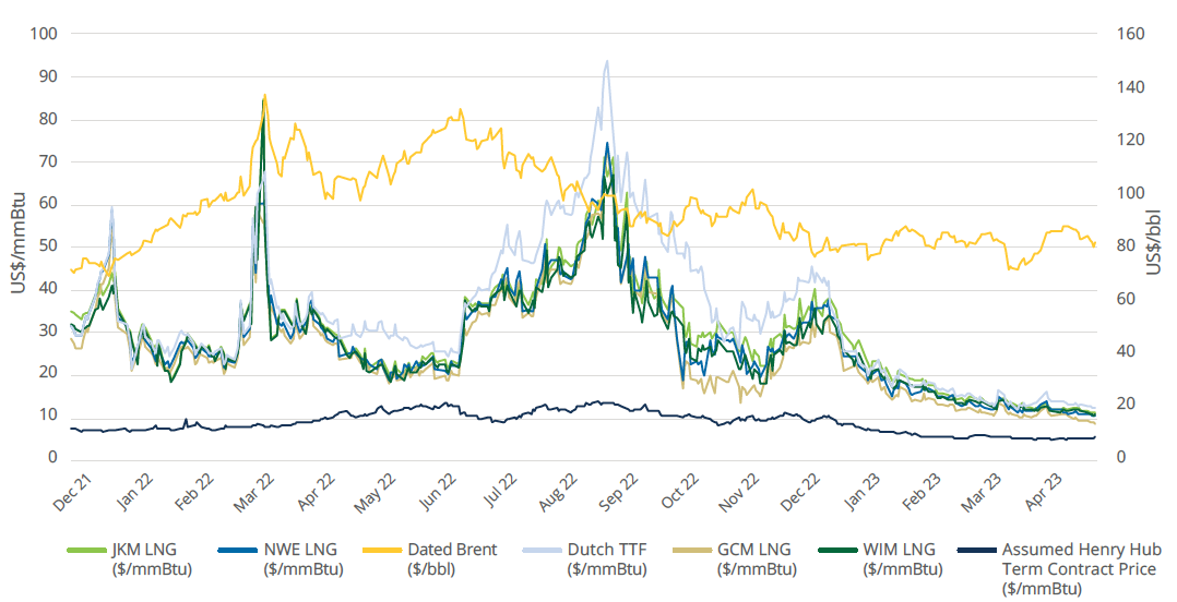

Regarding pricing, 2022 was a very volatile year for LNG. The high demand of 2021 continued in 2022 and even grew with the Russia-Ukraine conflict. The invasion led to Europe’s sudden need to offset Russia’s pipeline imports with short-term LNG deliveries. Nonetheless, government-induced energy-saving measures and a decrease in demand because of the higher prices and high stock, led to an eventual decrease in prices, causing a very volatile year. Moreover, there was a major reversal in the Asian demand, as it reduced significantly in most geographies, including Japan and China, two of the major LNG markets. The high spot LNG prices throughout most of 2022 caused Asian buyers to reduce their spot purchases and instead rely on volumes from long-term LNG contracts, or even switch to other competing fuels, when possible, to avoid paying the premium prices for spot LNG.

Overall, in 2022 there was a significant decoupling of LNG cargo benchmarks and gas hub prices. The JKM (Japan Korea Marker) LNG was at a discount to Europe’s main gas hub (TTM), for approximately 85% of the period between February 2022 and January 2023. In Europe, the Platts Northwest Europe (NWE) LNG Market, which is the benchmark for cargos delivered in Europe, averaged $32.738 mmBtu throughout 2022. This represents a large discount of $7.624 mmBtu compared to the Platts TTF (Europe’s main gas hub) price of $40.362 mmBtu for 2022. Throughout 2023, prices resemble historical averages, which are lower than the 2022 values, but there are still high risks of returning to the volatile conditions of 2022 because of Europe’s reliance on short-term LNG.

Source: S&P Global Commodity Insights

Market Trends

Estimates show that global demand for LNG is expected to reach 700m tonnes by 2040 as a result of growing demand for natural gas across Asia and increased traction in powering sectors that have been historically hard to electrify. In comparison, in 2000 LNG trade was at 100m tonnes, increasing to under 300m in 2017, showing the huge growth the industry has had over the last years, and its enormous potential in the years to come. Moreover, 2022 had 6,888 LNG trade voyages, a 2.7% increase from the 6,708 from 2021.

The Russia-Ukraine conflict led to a reduction in Europe’s pipeline natural gas imports from Russia, resulting in an increase in Europe’s imports of LNG in order to preserve energy security. In 2022, Europe imported over 66% of additional LNG (+50.4 MT), compared to 2021. This led to an increase in prices, which simultaneously caused imports in Asia to fall, as well as prompted further investments in LNG to improve supply security in Europe.

Furthermore, because of the higher geopolitical tensions and market volatility, more than 10 European nations have initiated construction plans since the beginning of the conflict in Ukraine. This includes more than 26 projects with a combined regasification capacity of over 104.5 MTPA. In Europe, there has been a trend towards floating terminals (70% of new capacity), rather than onshore, as they can be built faster. Moreover, they offer more flexibility as a shorter-term solution and require less fixed investments, which is advantageous because, at the end of the day, Europe is trying to reduce their dependence on natural gas. On the other hand, Asia has shown a preference for onshore terminals, which allow for increased short and long-term LNG demand and allow for further expansions.

Environmental concerns surrounding LNG could limit its future development. Despite being considered the least environmentally harmful fossil fuel, natural gas does still pose concerns regarding its emissions and the underground storage of LNG. Despite this natural gas transported as LNG has lower emissions than piped natural gas on a per-kilometre transport basis, supporting the growth of LNG as a key method for transporting the fuel.

As with most oil and other fossil fuels, security concerns remain high with LNG. In 2018, when the US reinstated sanctions against Iran’s nuclear programme, Iran threatened to close off the Strait of Hormuz. Given that a third of the world’s LNG passes through the Strait of Hormuz from Middle Eastern producers, this blockade could have had significant effects on global energy markets.

M&A Activity

The increasing role of LNG is poised to significantly impact the oil and gas sector. As the world embraces the trade and utilization of LNG, recognized for its cleaner attributes and ease of transport, major energy corporations are redirecting their investments toward LNG infrastructure. This includes developments and investments in liquefaction plants, storage facilities, and transport vessels.

In late November, Saudi Aramco [2222:TADAWUL], the world’s largest oil producer, announced its first-ever LNG deal and purchased a $500m stake in MidOcean Energy, a company acquiring interests in four Australian LNG projects. The oil giant will also spend another $110 billion developing the Jafurah gas field, the world’s biggest conventional onshore oil field, in Eastern Saudi Arabia, and will double its gas output by 2030. The area is expected to start production in 2025, with a plan to gradually increase natural gas deliveries to 2bn standard cubic feet daily by 2030. The increased gas production will also help replace oil burnt for power production, freeing more crude for export.

Russia’s invasion of Ukraine has disrupted Russian natural gas supplies to Europe and heightened concerns about energy security, prompting a rush for natural gas assets. In 2022, the Polish company PKN Orlen acquired PGNiG for $7.6bn, representing the largest upstream deal of the year and securing natural gas supplies amid uncertainties.

The rising concerns and the growing role of natural gas have driven exploration activities. For the first time in a decade, the deals for gathering and processing assets exceeded transmission assets.

Regarding midstream, Brookfield Renewable Partners and EIG offered $12bn to acquire Origin Energy, Australia’s largest energy producer. Under the plans, Origin will be broken up, and EIG will take the liquefied natural gas unit, one of Asia Pacific’s largest. Meanwhile, Brookfield plans to invest in decarbonizing Origin’s generation business, which serves more than 4.5 million homes and businesses and currently runs Australia’s biggest coal plant. The industry is seeing a pivot towards investments in infrastructure that supports natural gas storage and processing, reflecting the growing demand for flexible and secure energy sources in light of geopolitical tensions and the broader energy transition.

Long-term LNG contracts

European energy companies are strategically signing long-term contracts with Qatar. The Middle Eastern country has recently secured long-term (around 30 year) LNG deals with the Netherlands, France, Italy and others. This shift guarantees a lasting energy supply and favourable pricing mechanisms for European firms amid the current uncertainty in the regional energy market. Unlike traditional contracts that use a hybrid pricing formula benchmarked by oil prices, Qatar Energy’s new long-term agreements include exposure to Europe’s natural gas hub prices, better reflecting the market value for downstream natural gas sales.

Furthermore, these contracts are tied to Qatar’s LNG capacity expansion, which major European energy companies like TotalEnergies, Shell, and Eni have invested in, with expected operational commencement in 2026. Their investment signifies a commitment to securing LNG supplies, helping stabilize cash flows, and enhancing the ability to fund large-scale, capital-intensive projects. From an economic standpoint, Qatar’s competitive edge is clear: its LNG production comes at a lower average cost than other global competitors, bolstered by Qatar’s considerable financial resources, stable government, and small population with relatively low domestic energy consumption.

Geographically, Qatar’s relative proximity to Europe is a significant advantage, providing shorter and less expensive export routes than other suppliers like the US and Australia. Aligning with the EU’s environmental targets, Qatar has also committed to reducing the carbon emissions of its LNG operations, aiming for a 35% cut by 2035. This environmental commitment is crucial as the EU reconciles its diversification strategy with climate objectives, positioning Qatar as a preferred partner in transitioning to a lower-carbon future.

Qatar’s push to increase LNG exports to the EU is also a strategic move to balance its export portfolio, which is currently Asia-centric. With the anticipated increase in competition from other LNG exporters and the expiry of existing contracts in Asia, Qatar is proactive in securing new agreements, offering favourable terms to European counterparts.

Qatar’s response has also been notably cooperative during the ongoing energy crisis, especially compared to other Persian Gulf producers who have adhered strictly to OPEC+ production agreements. The country’s political willingness to support Europe in reducing its reliance on Russian gas further solidifies its position in the global LNG market as a reliable partner for European energy security.

Conclusion

In conclusion, LNG plays a crucial role in facilitating the trade of natural gas and providing energy security to numerous exporting and importing nations globally. The innovation of cryogenic storage and LNG has not only enabled the efficient storage and transport of natural gas but also contributed to the diversification of energy sources and reduction of geopolitical vulnerabilities, especially in recent years with the Russia-Ukraine conflict.

Looking ahead the prominence of LNG is expected to grow significantly in the coming decade as it enables a secure transition to renewable energy and fills the gap in sectors difficult to electrify. Many countries, for example, have started to implement plans to replace diesel trucks with LNG trucks to reduce emissions and have already started building networks of LNG stations for refuelling along highways.

Mergers and acquisitions in the oil and gas sector are reflecting the growing role of LNG in the global energy market. Major energy corporations are investing in LNG infrastructure, recognizing its potential and future growth. European and Asian countries and their energy companies have been setting up long-term LNG contracts with suppliers in Qatar and the US to ensure constant LNG supplies for years to come.

0 Comments