Introduction

Structured financial products are complex and customized financial instruments that combine traditional assets with derivatives. They are designed to meet the specific needs and preferences of investors who are not satisfied with the conventional financial products available in the market. Structured financial products can offer various benefits, such as capital protection, yield enhancement, risk diversification, access to new markets, or exposure to asymmetric payoffs. However, they often include higher costs, risks, and complexity than standard financial products.

Structured products have emerged as a result of financial innovation and the demand for more sophisticated and tailored investment solutions. They have become popular in Europe and the United States since the early 1990s, and have expanded to other regions and markets over time. According to the European Structured Investment Products Association (EUSIPA), the turnover of structured products in the EU reached €132 billion in 2022, and the number of newly listed products in the year nearly touched 7,000,000.

Structured products can be divided into two main segments: investment certificates and leverage products. These products are portfolios of exotic derivatives that have been securitized and are usually traded on regulated exchanges or multilateral trading facilities. Investment Certificates can be used by investors implementing risk management and yield enhancement strategies. On the other hand, Leverage Certificates allow investors to gain a magnified exposure to the performance of the underlying assets, thanks to the leverage feature specific to this category of financial products. At the end of Q2 2023, the combined market volume of investment certificates and leverage products issued in the EU was €384 billion.

Key types of investment certificates in Europe are Autocallables, Equity Protection, Reverse Convertibles, Bonus certificates, and Express certificates. These products have different features and characteristics, depending on the underlying assets, the payoff structures, the maturity dates, and the embedded options. The main rationale for investing in structured products is to access asymmetric payoffs, which means that the investor can participate in the upside potential of the underlying assets while limiting or eliminating the downside risk. The profitability of structured products is debated in the literature, as their complexity can be leveraged to exploit behavioural biases in investors and charge higher fees.

Structured Products Groups and Risks

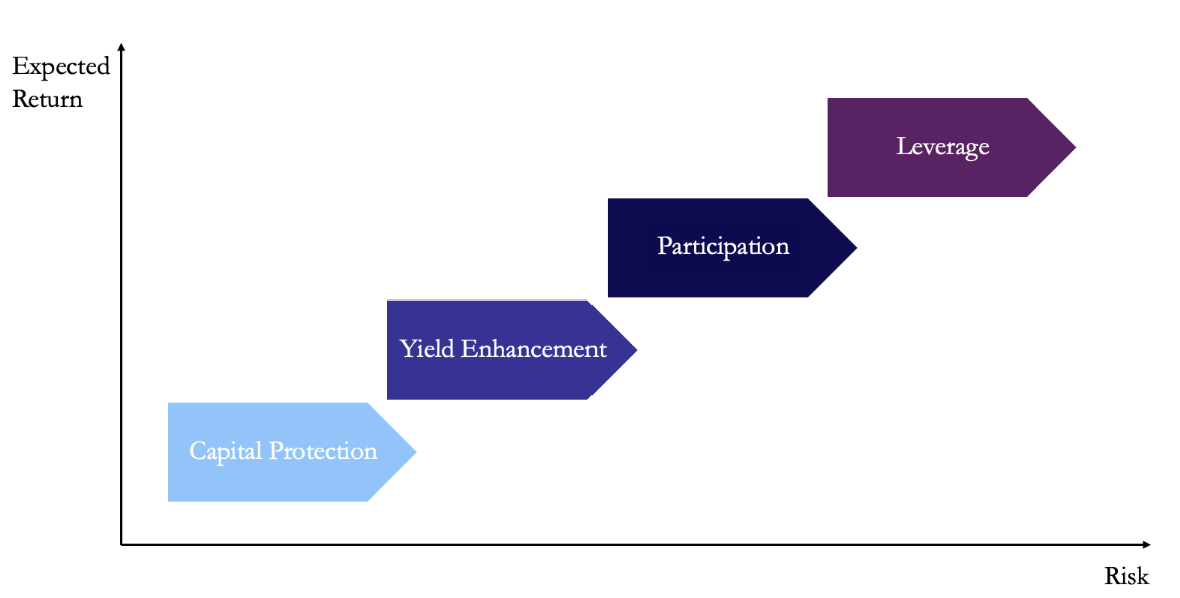

Depending on the customer’s need they fulfil, structured products can be classified into different groups, as they can offer different levels of capital protection and yield enhancement. Capital protection means that the investor is guaranteed to receive at least the initial investment amount at maturity, regardless of the performance of the underlying assets. Yield enhancement means that the investor can earn a return higher than the underlying assets, depending on certain conditions or scenarios. The below groups follow the European Product Categorization sponsored by EUSIPA:

- Capital-protected products: these ICs usually guarantee the redemption of the invested capital at maturity and a fixed or variable coupon, which may depend on the performance of the underlying assets. For example, the amount redeemed at maturity for an Equity Protection certificate equals the invested capital plus participation in the positive performance of the underlying asset.

- Yield Enhancement products: these types of investment certificates, such as Bonus, Cash Collect, and Express, are designed to enhance yield in seemingly fixed-income products. Typically, the upside exposure to the underlying is given up in exchange for high coupons, while limiting participation in downside risk. For example, a Bonus certificate pays a fixed coupon at maturity if the underlying asset does not fall below a certain barrier. If the barrier is breached, the certificate pays the value of the underlying asset at maturity, realizing a loss on the invested capital.

- Participation products: these are certificates that provide direct or magnified exposure to indexes or baskets of assets, usually from alternative or sophisticated asset classes, such as emerging markets, ESG, or thematic strategies. For example, an Outperformance certificate pays the performance of a predefined index or basket at maturity, with a leverage factor in case of positive performance.

- Leverage products: these certificates offer exposure with leverage, either to the upside or the downside of the underlying assets. For example, a Turbo certificate pays a multiple of the performance of the underlying asset at maturity, with a knock-out feature that acts as a stop-loss mechanism.

Source: Bocconi Students Investment Club

Investment certificates include several types of risks that require investors’ additional consideration. Some of the specific risks of investment certificates can be classified as follows:

- Market Risk: characterized by variations in derivative prices within the investment certificate. This risk includes factors such as interest rates, forex rates, and underlying asset price movements.

- Liquidity Risk: despite the presence of dedicated market makers and specialists in official electronic trading venues, investment certificates still face liquidity risk. There is a regulation imposed by the exchange in terms of quantity and maximum bid-ask spread, nevertheless, the potential lack of liquidity can strongly affect investor returns, as there is a notable imbalance of power between them and market makers. The bid-ask spread indeed is not fixed, as it depends on the liquidity conditions of the market, which are not always granted by market makers or liquidity providers.

- Issuing Counterparty Risk: investment certificates are structured by financial institutions with specific credit merits, the inherent counterparty risk associated with the issuing entity is therefore present unless protective measures are implemented. To mitigate such risks, Deutsche Bank introduced in 2007 and 2008 the products Dws Go and Dws Go Safe, where collateral postings were employed. This initiative however has not been replicated by competitors in subsequent years.

Market Evolution

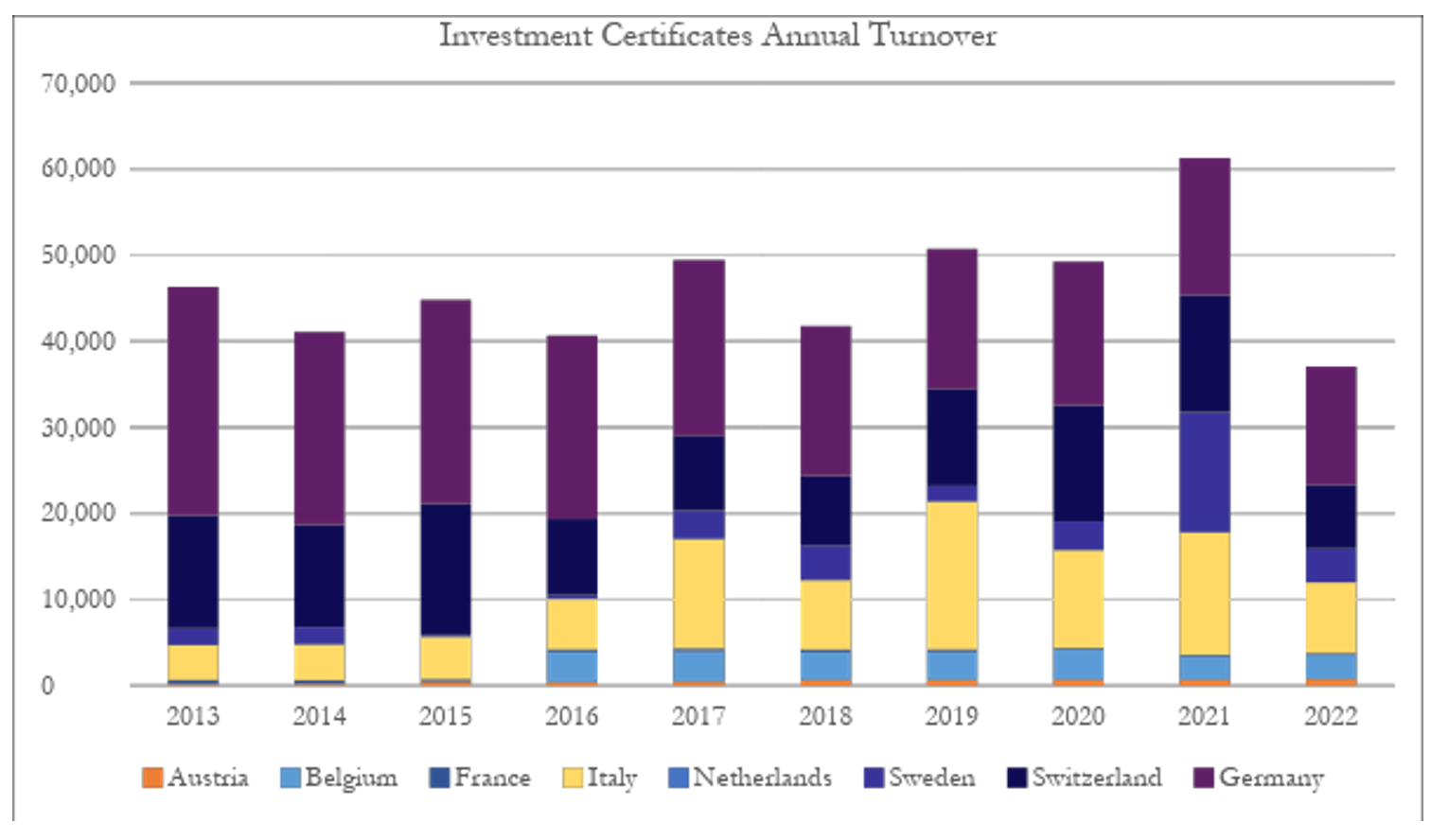

The history of structured products dates back to the early 1990s when they were first introduced in Germany and the UK, with the Swiss and German markets experiencing steady growth over the decade. The technology spread soon throughout Europe and the Italian, French, and Dutch markets also recorded a boom in the 00s. The market boom ended with the subprime crisis: in the sole Germany during the summer of 2007, open interest in certificates peaked at €140bn and the monthly trading volume of the secondary market approximated €18bn [2]. The insolvency of Lehman Brothers, a well-known issuer of investment certificates, entailed a sustained loss of confidence in the product group. A recovery commenced in 2009: in the year the monthly open interest in Germany rose indeed from €80bn to more than €100bn.

Over the past decade, the market has witnessed moderate growth, but the Fed and ECB hiking cycles terminated this trend in 2022, resulting in a drop in the annual investment certificates turnover in the EU from €61bn to €37bn. Investment certificates are currently listed on at least 14 European exchanges, with Stuttgart, Frankfurt, Zurich, Milan, and NYSE Euronext being the main hubs. The German market remains the largest, driven by the active participation of individual investors.

Source: EUSIPA annual reports

Main Products

The flexibility offered by structured products has facilitated the development of numerous variations on the structure. The below products are the most popular in Italian and European markets:

- Equity Protection

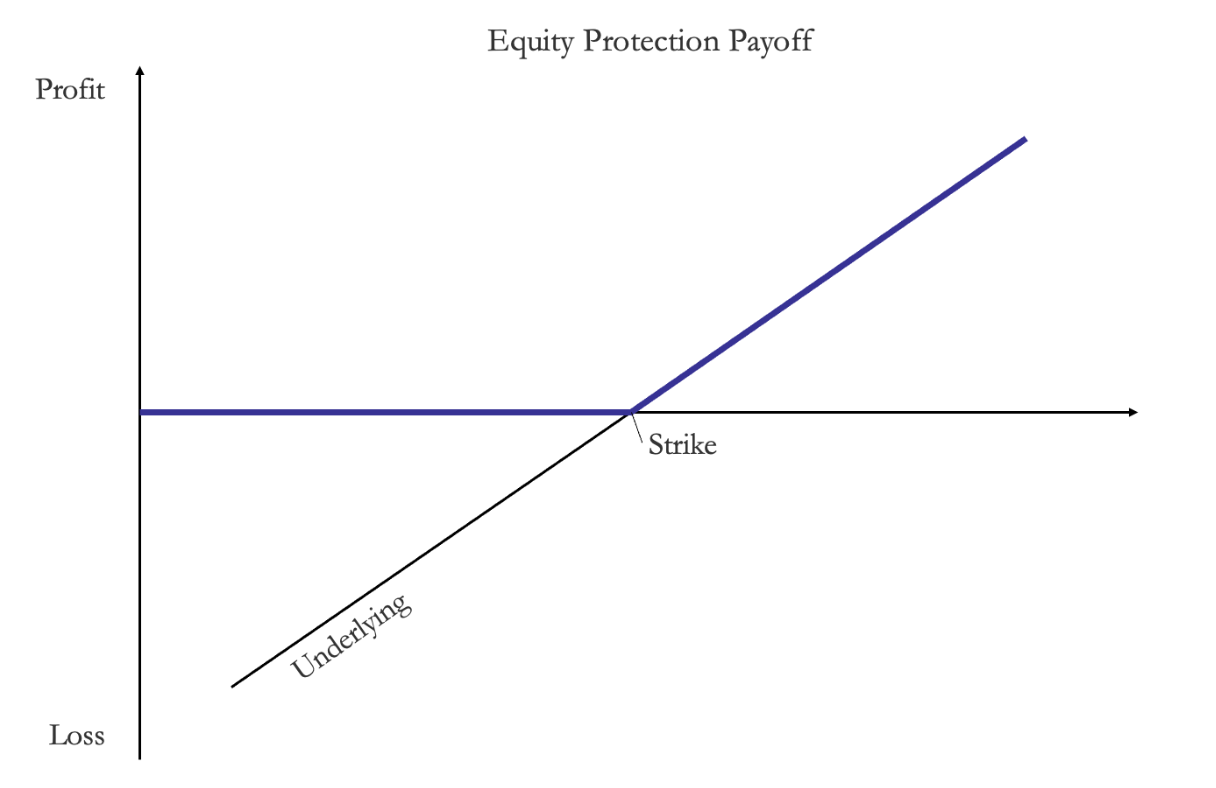

Equity Protection certificates are among the simplest capital-protected products. They provide full capital protection plus participation – whether either linear, leveraged or capped – to the upside of an underlying asset. ACEPI, the Italian Association of Certificates and Investment Products, reports that, in the investment certificates segment, Equity Protection certificates constitute 20.4% of the outstanding in the Italian market.

This product can be structured by combining a zero-coupon bond and a call option on the underlying asset. The zero-coupon bond functions as the protective component, guaranteeing that at maturity, the investor receives the bond’s face value, equivalent to the initial investment. The residual capital is allocated to the call option on the underlying asset, and, depending on the option’s cost, the payoff may vary by either increasing the leverage of the call or by selling an OTM call to cap the payoff. The below diagram illustrates the payoff of the vanilla Equity Protection certificate:

Source: Bocconi Students Investment Club

2. Cash Collect

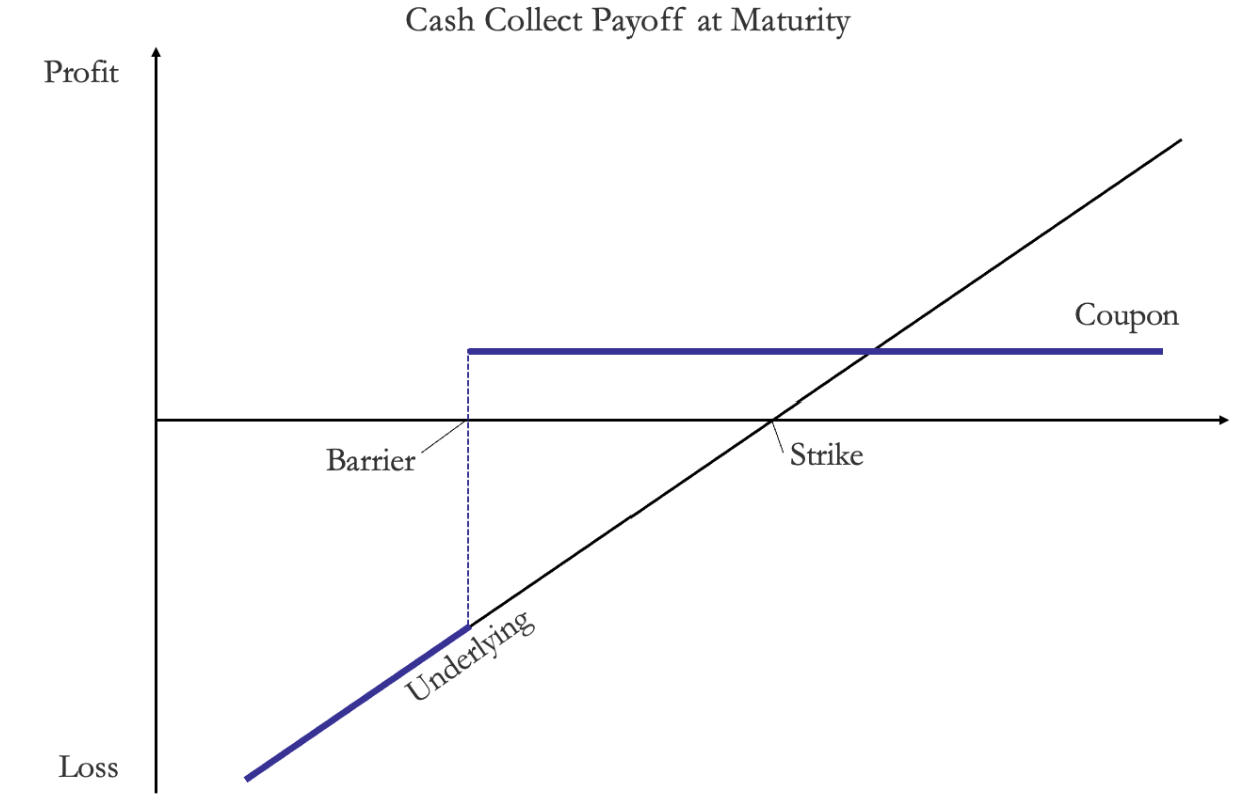

A cash collect certificate provides periodic coupons if the underlying asset exceeds a “Coupon Barrier” level, typically lower than the initial level, on predefined observation dates. Capital protection is conditional on the underlying asset not falling below the “Capital Barrier” level at maturity. If the barrier is breached, the certificate pays the performance of the underlying asset at maturity, resulting in a loss on the initial investment. Cash Collect certificates may also incorporate autocallability or callability mechanisms at each observation date. As of the end of Q3 2023, Cash Collect certificates accounted for 7.2% of the outstanding certificates in the Italian market.

A method for structuring a Cash Collect involves purchasing a zero-coupon bond and a set of digital options on the underlying asset, aligning their strike dates with the coupon observation dates. Simultaneously, a put down-and-in is sold with an expiration at maturity and a knock-in level set at the “Capital Barrier” level.

Source: Bocconi Students Investment Club

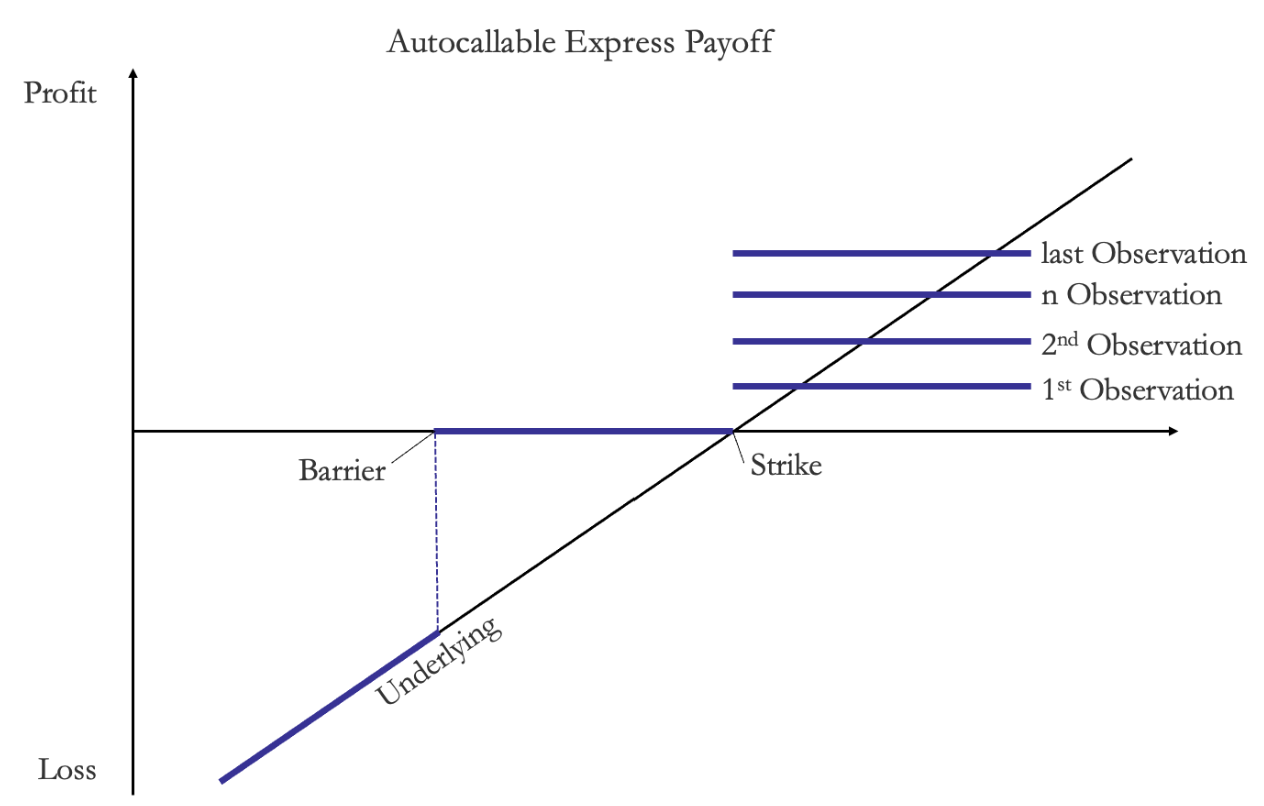

3. Autocallable Express

The Autocallable Express certificate offers a fixed, cumulative coupon in case of automatic early redemption on an observation date. Indeed, if the underlying asset meets or exceeds a certain level, usually 100% of the initial value, the certificates “Autocalls”, automatically triggering an early redemption event and paying a fixed coupon multiplied by the number of years elapsed. At maturity, there is partial capital protection: if the underlying asset falls below a certain “Capital Barrier” level, the certificate pays the performance of the underlying asset at maturity, resulting in a loss. As of the end of Q3 2023, Cash Collect certificates accounted for 12.0% of the outstanding certificates in the Italian market.

An Autocallable Express certificate can be structured by buying a zero-coupon bond, selling a put down-and-in with expiration at maturity and a knock-in level set at the “Capital Barrier” level. Additionally, it is necessary to buy a series of digital calls of knock-out type. These calls should have a strike equal to the Autocallable Express strike, maturities aligned to the liquidation dates, and a quantity equal to the coupons paid in case the option remains active.

Source: Bocconi Students Investment Club

Conclusion

To conclude, structured products serve as a valuable tool for individual investors, providing access to sophisticated risk management strategies and asymmetric payouts that were once exclusive to institutional players. Their flexibility serves to diverse risk profiles, offering a spectrum from capital protection to leveraged exposure. However, it is crucial to acknowledge the specific risks. The complexity of these products may lead to misperceptions of their riskiness, emphasizing the need for thorough understanding. Additionally, there are concerns regarding liquidity, which is strongly impacted by market makers’ activities. As investors navigate the landscape of structured products, a well-informed strategy is fundamental for a successful investment journey.

0 Comments