Introduction

Followed by decades of history Disney [DIS: NYSE] has been a company in the hearts of generations, therefore, we thought it deserved to be analysed further. In this first edition of our BSIC Equity Research reports we bring to you a detailed valuation highlighting key market events and catalysts for the stocks. Through intrinsic and relative valuation methods including comparables analysis, sum of the parts and a discounted cash flow model we have tried to give a detailed analysis of the company focusing on certain recent headlines including Disney’s streaming business, Bob Iger’s comeback and the Cedar Fair [FUN: NYSE] – Six Flags Merger [SIX: NYSE].

Lights! Camera! Cash Flow!?

Under the tutelage of Bob Iger, Disney has had a storied history when it comes to M&A transactions: the most notable acquisitions being those of Pixar in 2006, Marvel in 2009 and Lucasfilm in 2012 for $7.4bn, $4bn and $4.05bn respectively. These acquisitions were seen as remarkably successful and were all crucial turning points in Disney’s recent history. Pixar had emerged as an industry leader in 3D computer graphics before the acquisition, whilst Disney had been lagging behind with only a few hits in 2D animation. The merger with Pixar allowed Disney to implement the company’s animation techniques into its films that were incredibly successful in the box office, cumulatively grossing a profit of $5.9bn over the last 18 years. Bob Iger says the acquisition of Pixar is his “proudest decision” because it lead to the revitalisation of Disney animation and put Walt Disney on the path to other meaningful investments. Disney’s acquisition of Marvel was transformative for the entertainment industry as they developed the franchise into an interconnected cinematic universe that grew across distribution channels and business units. The Marvel Cinematic Universe has raked in $26.4bn of box office revenue across 28 films, all stemming from a $4bn acquisition and $5.6bn of production costs. The acquisition of Lucasfilm gave Disney the rights to Star Wars, Indiana Jones and Willow. Despite it seeming like Disney had overpaid for this acquisition at the time and some weak theatrical releases at the box office, they were still able to produce some of the highest grossing films in Hollywood history including Star War: The Force Awakens. The real beauty of these acquisitions of various franchises was not only the profit from producing subsequent films, but also the ability to monetise iconic characters through theme park attractions and merchandise. In the case of all three, Disney was able to leverage the acquisitions across business units but also across platforms by producing popular spin off shows such as the Mandalorian, for their Disney+ streaming platform driving strong subscriber growth.

Iger looks to extend his deal-making success through the acquisition of the remaining 33% stake not already owned in Hulu LLC from Comcast Corp [CMCSA: NASDAQ] at fair market value. This is expected to set them back at least $8.6bn based on the $27.5bn floor value that was set when the companies entered into the agreement in 2019. The deal is expected to close next year following intense negotiations between the media giants over the Hulu’s valuation with Comcast chief executive Brian Roberts recently saying that he believed that Hulu is worth $60bn. Given the sharp downturn in valuations of streaming companies in the last two years, it will be interesting to see if Disney will be willing to spend much more than the floor price. However, with roughly $14bn of cash and $10.5bn of revolving credit facilities and commercial paper, the company’s current position seems to be able to sustain the deal despite an upwards revision in valuation of Hulu. The question that investors are asking is whether the combined streaming service provided by Disney+ and Hulu will knock the service onto the path towards profitability.

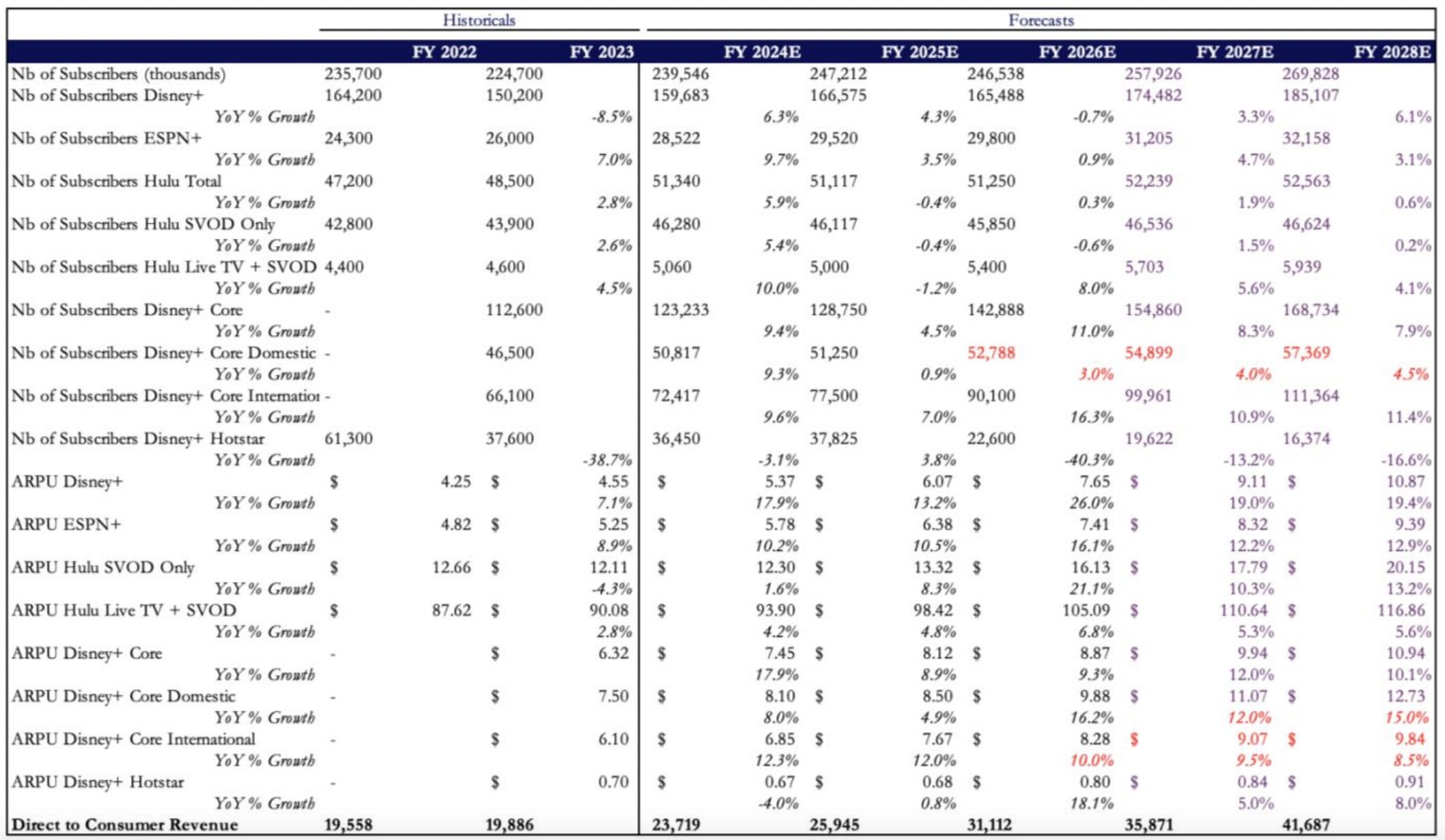

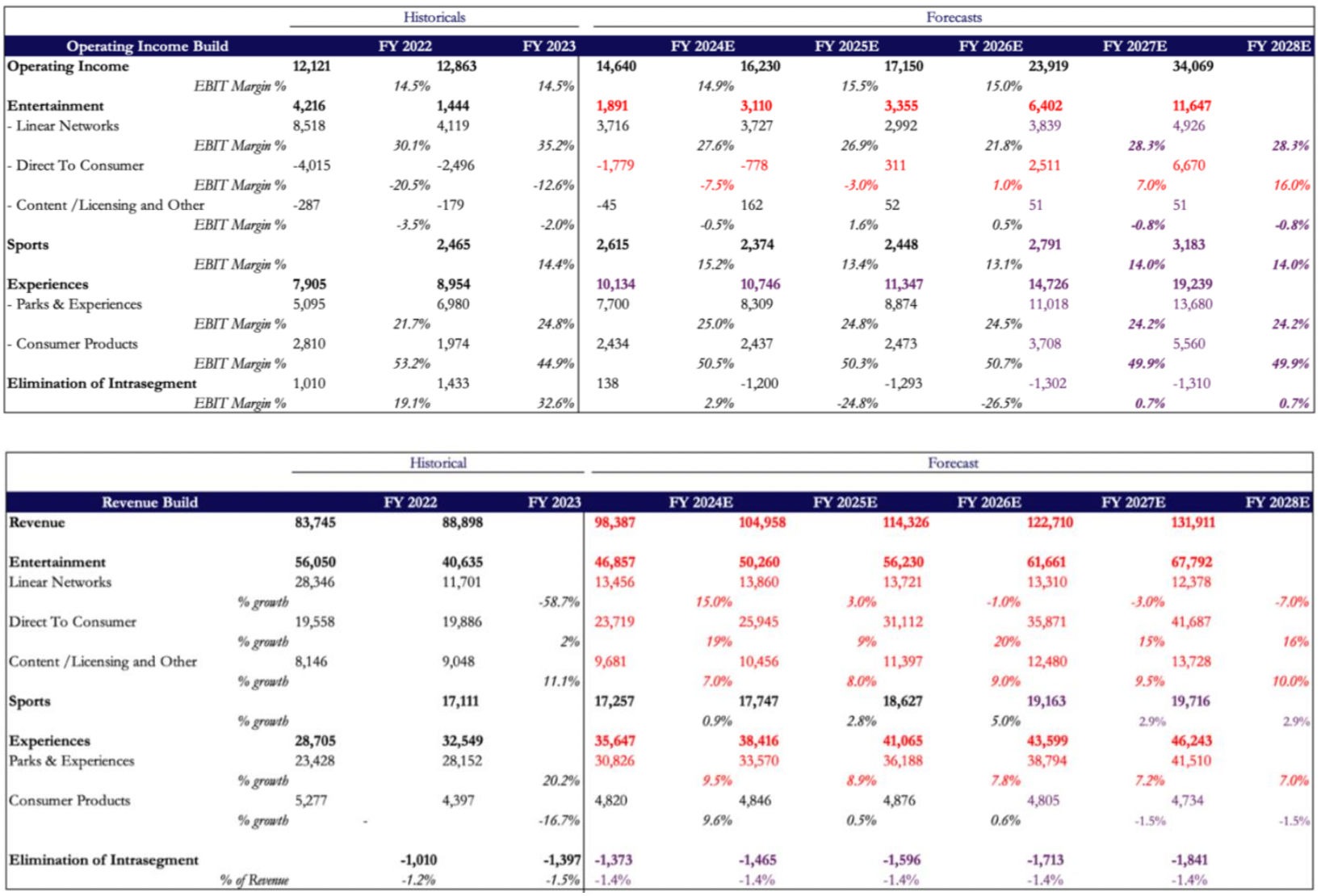

Bob Iger’s current strategy is to integrate Hulu’s more adult-oriented content with Disney+’s family friendly shows, giving Disney a stronger product to compete with the streaming giants such as Netflix [NFLX: NASDAQ]. Assuming the merger does go through next year, we can expect the integration of Hulu within Disney+ to happen in FY2025 with revenue synergies beginning to materialise in FY2026. Despite recent subscriber losses over the last year, we are confident that Disney will be able to achieve consensus targets of 6.3% and 4.3% Disney+ subscriber growth over the next two years. Given the integration of Hulu content by 2026, we believe that the combined entity will be able to beat consensus of a year-on-year 2.6% decline in Disney+ domestic subscribers and 0.3% growth in Hulu subscribers in 2026 and the years following. Attracting subscribers, however, is just one side of the coin; Disney will also need to strategically price its joint product offering, seizing opportunities to leverage its differentiated platform with an aggressive pricing structure where possible, whilst ensuring that consumers are not priced out to support sustained growth in paid subscribers. They have already recently raised subscription prices by 28% for domestic consumers, whilst still growing the consumer base suggesting mildly inelastic demand. We are likely to see similar moves in the international markets with the expansion of ad-supported plans and price hikes for ad-free subscriptions abroad. Average revenue per user (ARPU) for domestic Disney+ Core International is expected to grow 12% for the next two years and then 8% in the year after that. We expect Disney to beat the latter figure by an additional 2% driven by higher advertising demand following a global economic recovery, coupled with the increase in subscribers.

It is important to note however, that subscriber growth can only be driven through the production of new streaming content. Streaming is a capital-intensive business, with heavy investment needed in production costs in order to attract new customers. Although Disney believe that the combined streaming business will reach profitability by the fourth quarter of 2024, Disney may need to sustain losses for a while longer in order to grow and maintain the subscriber base. Iger has already brought down the company’s cash content budget by $2bn and restructured the nature in which content is managed and organised. Although this will help operating margins, we believe that it is really revenue growth that will pull streaming services into profitability, given the semi-fixed nature of costs. Consequently, we believe that operating margins in direct-to-consumer will remain negative until FY2026, before showing strong profitability growth in the next two years but not yet necessarily catching up to the margins of streaming rival Netflix, roughly 25%.

Perhaps the biggest piece of dead weight pulling Disney’s valuation down is Disney+ Hotstar in India. The platform has lost almost 40% of subscribers over the last year following Viacom18, a company backed by billionaire Mukesh Ambani’s Reliance Industries [RELIANCE: NSE], winning the rights to last season’s rights to the Indian Premier Cricket League (IPL). What used to attract tens of millions of customers in the past decade, making it a crown jewel in 21st Century Fox’s portfolio, is now struggling to keep subscribers despite offering almost 4000 other titles. To make matters worse, JioCinema streamed this year’s IPL for free in an aggressive move to win subscribers and Sony’s [6758: TYO] local unit’s merger with Zee [ZEEL: NSE] was approved by regulators in August, making the streaming industry in India that much more cutthroat for Disney. Iger’s recent comments seem like he may be open to offloading this business unit to strengthen up Disney’s balance sheet in a move to focus on other business units.

Disney’s content licensing business presents another opportunity for growth, despite having been neglected during Iger’s previous reign. When Disney focused efforts on streaming, it pulled titles from other platforms when the licensing agreements expired, with Marvel films disappearing from Netflix, for instance. Iger is now considering licensing out titles again to stabilise revenue. In fact, a shrewd strategy could involve licensing the early seasons of a TV show or films in a series but keep the latest releases on their own captive streaming platform. This would serve as a bait to viewers, before bringing them onto Disney’s platforms as new paid subscribers. Consequently, we believe that Disney will be able to utilise this strategy and beating consensus of decline and achieve annual revenue growth of 7% in the next year.

Source: Factset, BSIC

Eye of the Iger

With an announcement in July 2023, Disney’s board arranged for its iconic CEO Bob Iger to maintain his executive role until at least 2026, when he will turn 75. Iger had previously led the company for 15 years, from 2005 to 2020, overseeing it in a period of significant growth. He then resumed his position on November 20, 2022, as the successor he had chosen for himself, Bob Chapek, failed in dealing with multiple challenges such as the impact of a global pandemic and the launch of Disney’s streaming service, Disney+. The latter’s ‘Direct-to-Consumer’ Entertainment segment notably incurred a $1.4bn loss in Q4 2022. Originally, Iger’s reinstatement was aimed at executing a 2-year turnaround and stabilise the company before identifying a long-term successor. However, the board unanimously decided to extend this timeframe, suggesting potential challenges beyond what he initially anticipated.

The company is currently facing various issues, prompting Iger to announce concrete solutions and propose long-term measures since his return. One pivotal element of his strategy involves a cost-efficiency campaign initiated in February 2023, initially targeting $5.5bn in annualized cost-cutting. This comprised of $3bn from content expenses (excluding sports) and $2.5bn from non-content expenses. In Q4 2023, Disney’s earnings announcement revealed an additional plan to increase the target for annualized cost cuts by $2bn. Comparing these figures to the 2022 financial statements, they represent 10% of total operating expenses, 7% of content-related expenses, and 21% of SG&A for non-content expenses. To achieve such figures, Disney announced the intention to reduce its workforce by 8,000 units, as well as planning to strategically focus on fewer productions while enhancing overall efficiency. In the words of CEO Bob Iger: “We will be spending less on what we make and making less.” Recent declarations, including those by Iger himself, suggest that the “making less” aspect may involve a gradual divestment from Disney’s cable networks, notably ABC. In an interview with CNBC, in fact, Iger suggested the possibility of selling ABC and FX, stating, “They may not be core to Disney.” Additionally, in September, it was reported that Disney was in talks with Nexstar Media Group, the largest U.S. TV station owner, to sell the ABC network and stations. Following this, media mogul Byron Allen, CEO of Allen Media Group, allegedly offered $10bn to acquire ABC, FX, and National Geographic, as reported by Bloomberg. No official statements were made by the group, and it is not clear whether Disney will actually carry on such divestiture.

Having talked about Iger’s plan of redirecting Disney towards a successful outlook, it is necessary to highlight the concern of investors about who will be his eventual successor in 2026. Bob Chapek’s appointment as CEO in 2020 is, in fact, viewed as a misstep on Bob Iger’s behalf. The selection of a new CEO is expected around the beginning of 2025, while options being considered to reduce the risk of a Bob Chapek sequel include firstly naming a chief operating officer as the heir apparent, with Iger either staying on as CEO or transitioning to an executive chairman role in 2025 to aid in the process. The potential successor might emerge from within the company or be an external candidate. However, neither of internal candidates have comprehensive leadership experience across all three of Disney’s business segments; it is also hard to imagine that Disney could appoint one between Kevin Mayer and Tom Staggs, having been looked over by Iger in his 2020 decision.

New Parks

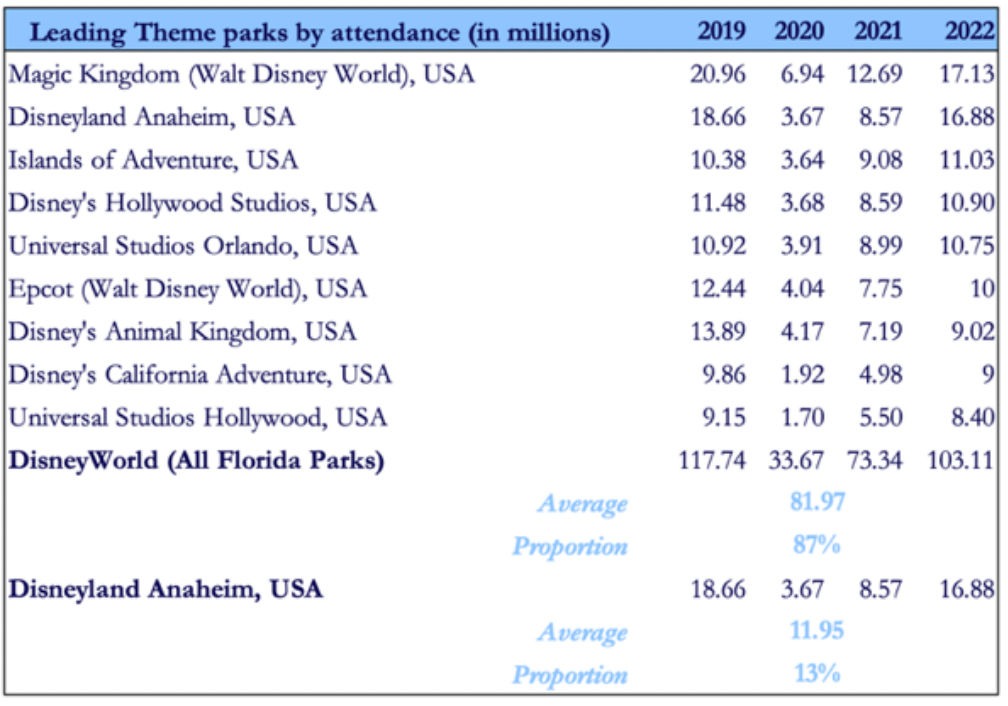

Every year, millions of people visit Disney’s magical parks, which are spread over 12 destinations across 6 resort campuses worldwide. These include Walt Disney World Resort in Florida, Disneyland Resort in California, Disneyland Paris, Hong Kong Disneyland Resort (with a 48% ownership interest) and Shanghai Disney Resort (with a 43% ownership interest). In addition, Disney licenses its IP to Oriental Land Co., a Japanese leisure and tourism subsidiary of the Keisei Electric Railway Company, to operate Tokyo Disney Resort. Finally, Disney possesses a cruise line that currently operates five ships: Disney Magic, Disney Wonder, Disney Dream, Disney Fantasy and Disney Wish.

The Disney Parks & Experiences division contributed $7.049bn in revenue during Q4 2023, constituting 33% of the total revenues. This segment divides into two key components: Domestic, including US-based resorts (Walt Disney World Resort, Disneyland Resort), accounting for 76% of the division’s total revenues; and international parks, comprising Disneyland Paris, Hong Kong Disneyland Resort, and Shanghai Disney Resort, responsible for the remaining 24%. The operating income figures highlight a substantial growth focus within the international parks, recording an operating margin of 26% compared to the domestic parks’ 15% in Q4 2023. Both segments witnessed increased operating income compared to Q4 2022, with international parks showing exceptional growth, exceeding 100%, while domestic parks registered a modest 9% increase.

On October 11, Disneyland announced price hikes in its US-based resorts—Walt Disney World Resort in Florida and Disneyland Resort in California. The yearly pass prices at Walt Disney World Resort surged by up to 10%, with the priciest one now at $1,449, a $50 increase. Meanwhile, various tickets, including one-day and multiday passes at Disneyland, grew nearly 16%. These increases are part of a series of price raises that began in early 2022, affecting domestic parks. Following the announcements, a rush of headlines appeared in international media. This led to public criticism, with many families complaining that Disney parks were too expensive. However, from a business perspective, these price adjustments represent a strategic move to maximize profits without alienating fans. Disney is indeed implementing a dynamic pricing model, characterized by prices fluctuating in response to various parameters such as the time of day, the day of the week, current supply and demand, special events, or seasonal factors. The company aims to manage park crowds, steering visitors away from high-attendance dates and toward days when crowds are usually lower. The fact that attendance did not change significantly in 2023 despite the price increases suggests that this strategy is effective. We can expect that the Park Division will become a crucial part of the overall Disney business, given the company’s substantial investments in this field. Through the introduction of numerous innovations, Disney can further distinguish itself from competitors and sustain its gradual price increases without heavily impacting attendance. Moreover, by employing a pricing model that set prices that correspond to the balance between supply and demand, especially considering the growing demand in the amusement park industry post-global pandemic, increasing prices might indeed be the optimal approach to maximizing profits.

Disney is heavily investing in its theme park sector, announcing, in September 2023, a $60bn investment plan over the next decade, doubling its previous commitments. The cruise line segment is set to benefit the most, with plans to almost double its capacity by adding two ships in FY2025 and another in FY2026. Furthermore, there are high expectations for significant growth in the international parks. Hong Kong Disneyland is anticipated to experience substantial expansion. Its fourth-quarter performance displayed remarkable positive trends with heightened guest spending, increased attendance, and higher occupancy rates for room nights. This park has received substantial investments, leading to the introduction of exciting new guest experiences. Notably, the much-anticipated “Frozen” land is set to open this month, promising an exhilarating expansion for park visitors. Additionally, Shanghai Disney Resort holds potential with the upcoming introduction of a Zootopia land set to open on December 20, 2023. This park experienced an increase in operating results, driven by growth in guest spending linked to an increase in average ticket prices and higher volumes due to a rise in attendance in Q4 2023.

Projected revenues within the Parks business segment are estimated to be 7% for the forthcoming two years, maintaining a steady EBIT margin of 25%. While we agree on the constant EBIT margin, we expect a 2% higher growth in revenue over the subsequent two years, stabilizing to a 7% growth rate post-2025. These expectations are attributed to Disney’s substantial investments in both domestic and international parks, alongside the adoption of a dynamic pricing model by the company.

Six Flags & Cedar Fair Merger – Headwind or Tailwind?

The consolidation of the theme park industry has seen new rivals emerge for Disney and Universal Studios due to the Six Flags Entertainment [NYSE: SIX] and Cedar Fair [NYSE: FUN] merger announced on the 2nd of November. The combined entity would span an $8bn amusement park company comprised of 27 amusement parks, 15 water parks and nine resort properties across 17 states, Canada and Mexico. The growth for the entity is expected at $200m in the 3 years following the deal thanks to higher revenue and cost savings. Additionally, the company has the intellectual property for Looney Tunes and DC Comics which could prove useful in the shift towards online media we have seen in recent years. The synergies created by offering expanded park access to season pass holders are expected to increase their profitability.

In the 12 months through the end of the third quarter of 2023, the two park operators welcomed a combined 48 million guests in their venues and generated a combined $3.4bn in revenue, $1.2bn in adjusted EBITDA and $826m of free cash flow. The combined company believes its increased free cash flow will provide it with greater flexibility to invest in new rides and attractions, more food and beverage selections, additional in-park offerings, and cross-park initiatives like consumer technology and enhanced guest services. The merger is expected to close in the first six months of 2024 after receiving Six Flags shareholders’ approval.

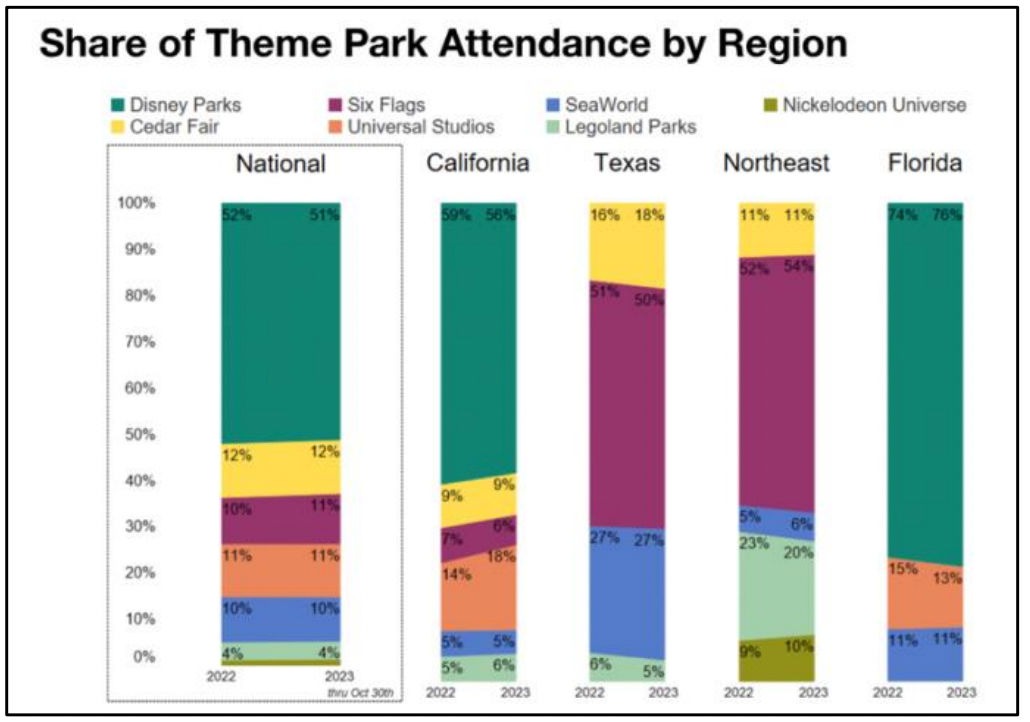

Following approval, the company will have doubled their market share (6.54%) according to a 2021 study compared to Disney’s 23.27% slice. Although there are no Cedar Fair or Six Flags parks in Florida, the combined entity will have 5 parks to challenge Disney’s west coast location. Due to the ability to capitalize on economies of scale and further intellectual property rights to DC Comics, Looney Tunes and Snoopy it is reasonable to believe that market share in the Californian market by Disney will lag its peers. According to Earnest Analytics Disney’s market share in the Californian market already dropped from 59% in 2022 to 56% in 2023.

Source: Earnest Analytics, Foot Traffic location data

In our estimates we believe it is reasonable to assume that the novelty of a new park merger from CedarFair-SixFlags which benefits from revenue synergies will be able to poach a relevant amount of clients and further increase their combines respective market share from 15% to 20%. It is reasonable to believe that the combined 5% increase will be eroded from both Universal Studios and Disneyland Anaheim’s market share as they are the closest comparable parks unlike SeaWorld. This would cause a decrease in Disney’s market share from 56% to 54.5% over the next five years.

According to Mordor Intelligence the American theme park industry is projected to grow at a Compound Annual Growth Rate (CAGR) of 3.5% until 2028 due to the “increasing adoption of the technological advancements in the form of augmented and virtual reality. The inculcation of advanced motion simulators, hydraulics and pneumatics along with the focus on customers’ experience is expected to increase the market demand in the coming years.” Assuming a similar growth rate of 3.5% for California, we can project how this will affect Disney’s financial statements due to its dwindling market share.

Source: Statista, BSIC

Disney’s domestic parks & experiences revenue for the year ended on Sept. 30, 2023, was $5.384bn of which 13% can be attributed to Disneyland in California $700m assuming an even distribution of revenue based on attendance. Assuming a 56% market share in the California market we can estimate total revenue from parks in California to be $1.25bn in 2023. Projecting a 3.5% CAGR and Disney’s market share until 2028 we can estimate the amount of Parks & Experiences revenue from the California Region after the Six Flags merger.

Source: BSIC

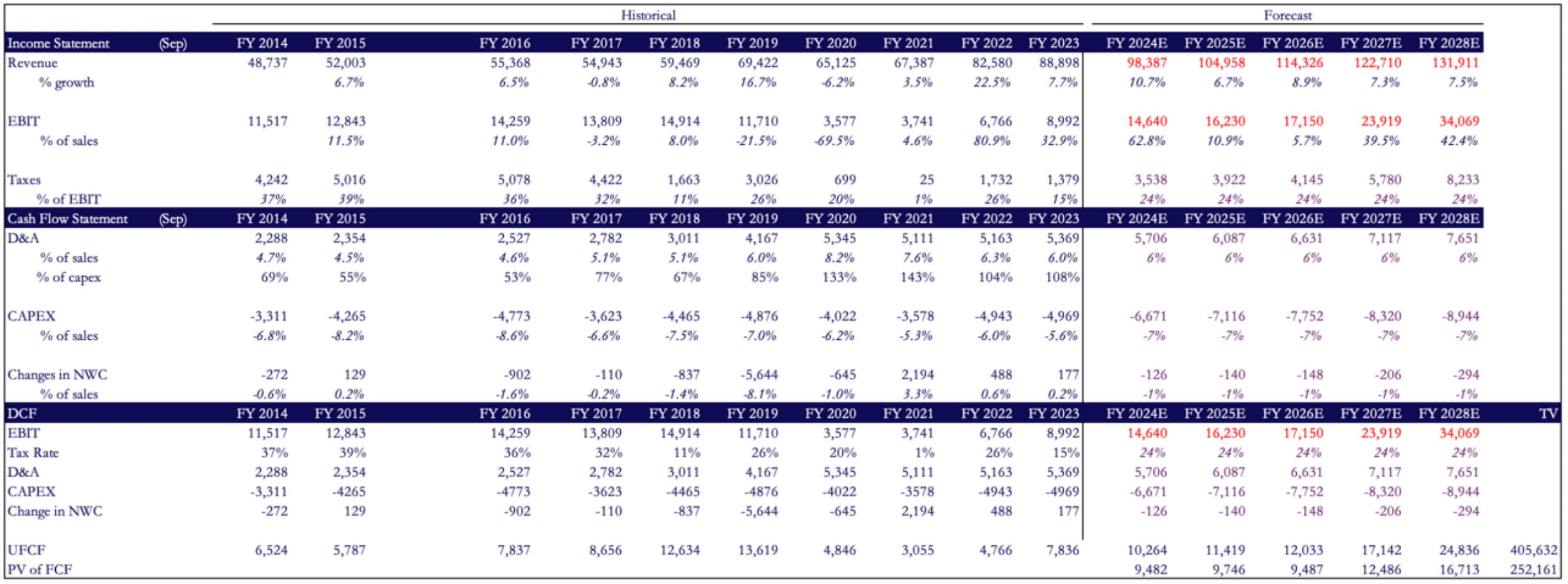

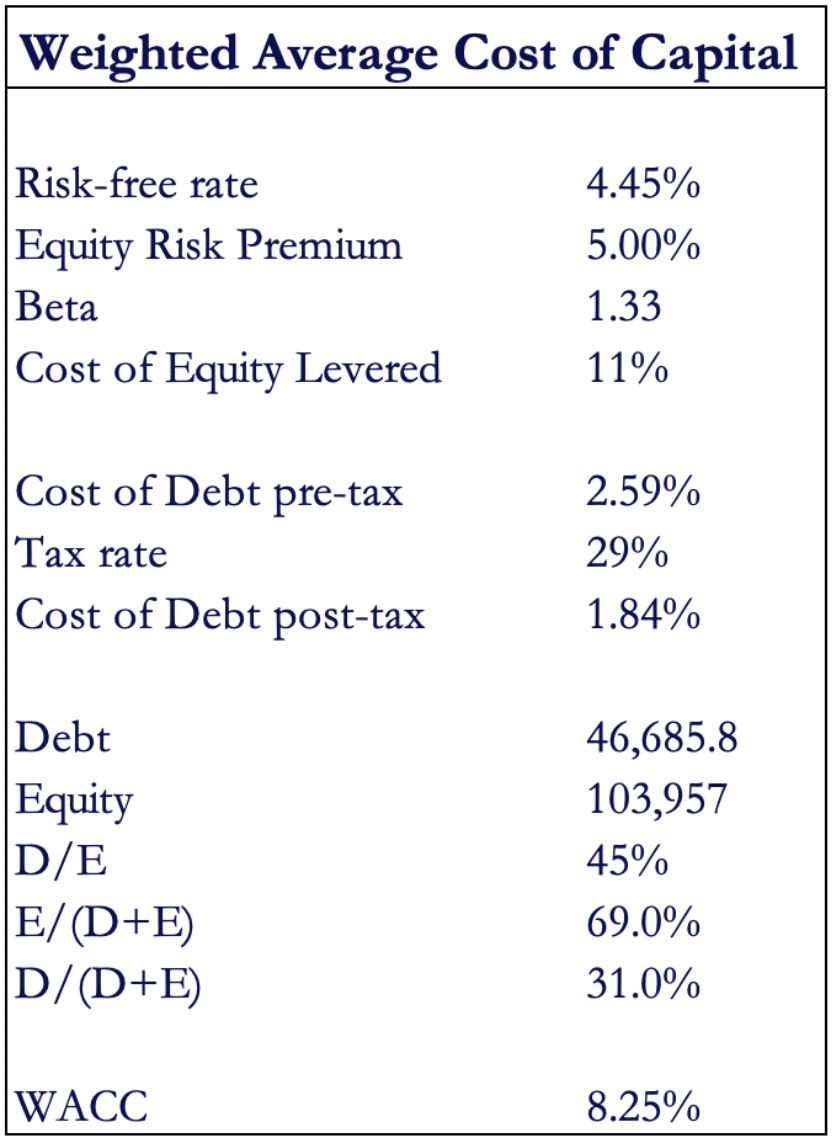

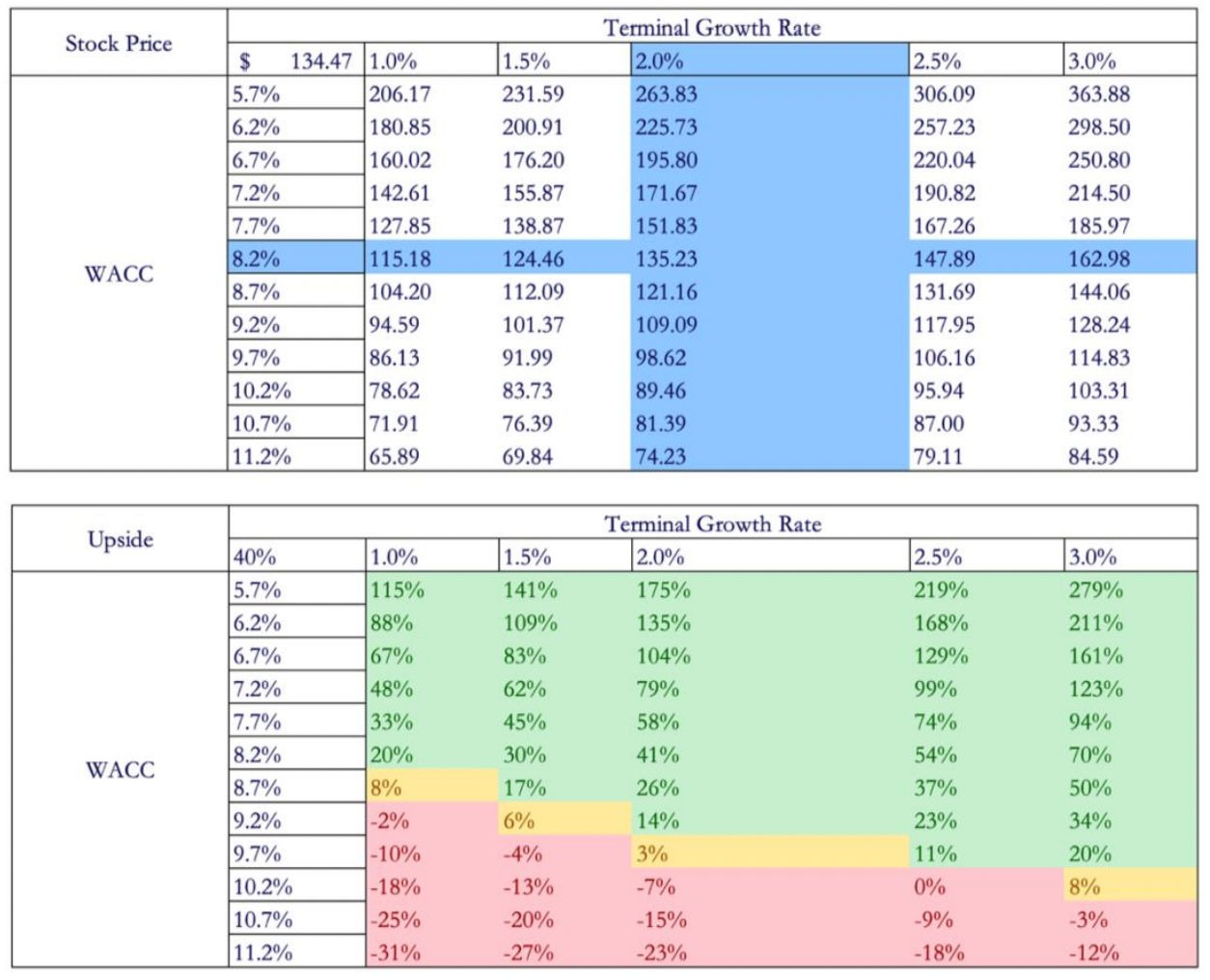

DCF Analysis

Source: Factset, BSIC

Comparable Company Analysis

Aiming to achieve a more comprehensive valuation, we integrated the DCF analysis with a multiples analysis. In particular, the trading multiples approach and the sum of parts method were both utilised, thus focusing on addressing the diverse nature of Disney’s businesses – specifically, its worldwide famous entertainment parks.

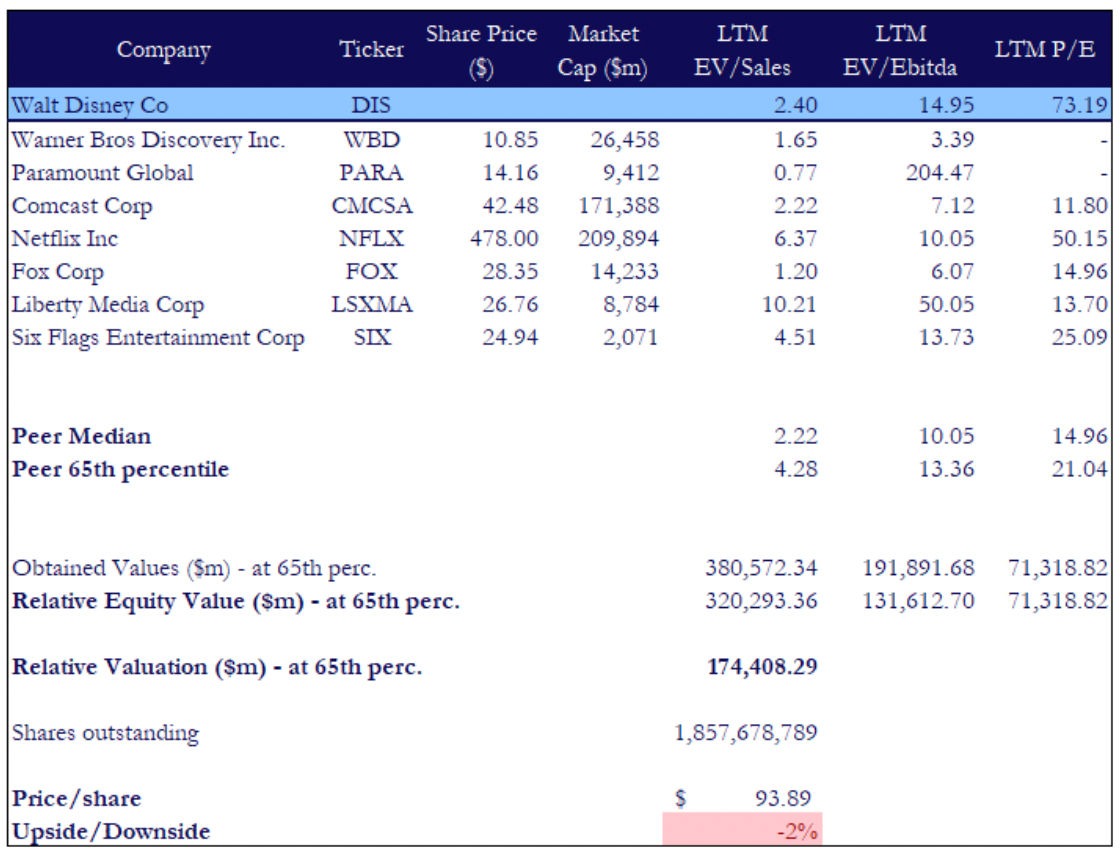

Firstly, we will present the results obtained from the multiples analysis of public comparables, considering the whole of Disney as a unique entity. Comparable companies were identified based on industry, market capitalisation, and business models. Seven comparable companies were chosen, spanning entertainment and broadcasting, streaming services (such as Netflix), and amusement parks (like Six Flags Entertainment). This diverse selection was once again aimed to account for Disney’s involvement in various industries.

The Enterprise Value multiples of EV/Sales and EV/EBITDA were considered – we preferred to exclude EV/EBIT due to potential discrepancies in depreciation and amortisation unique to Disney and Six Flags’ parks – while a typical LTM Price/Earnings ratio was used for the equity side. The 65th percentile was chosen over the median, considering Disney’s globally recognized brand, its control over major production companies like Pixar, Marvel and Lucasfilm, as well as its leading market share in entertainment parks, exemplified by Disneyworld. The decision to opt for a higher percentile also considered what we perceived as recent positive factors such as the reappointment of Bob Iger and the strategic decision to expand investments in parks and cruise lines. However, a cautious approach was maintained, avoiding an excessively high percentile due to the challenges that the business is facing. These include a decline in cable network viewership and revenues, losses from its streaming business Disney+, and recent disappointing results at the Box Office for various movies (e.g., “The Little Mermaid”, Pixar’s “Elemental” and “Indiana Jones and the Dial of Destiny”). Therefore, balancing historical and current factors, the 65th percentile was ultimately deemed a fitting choice for a more nuanced valuation of Disney.

Source: Factset, BSIC

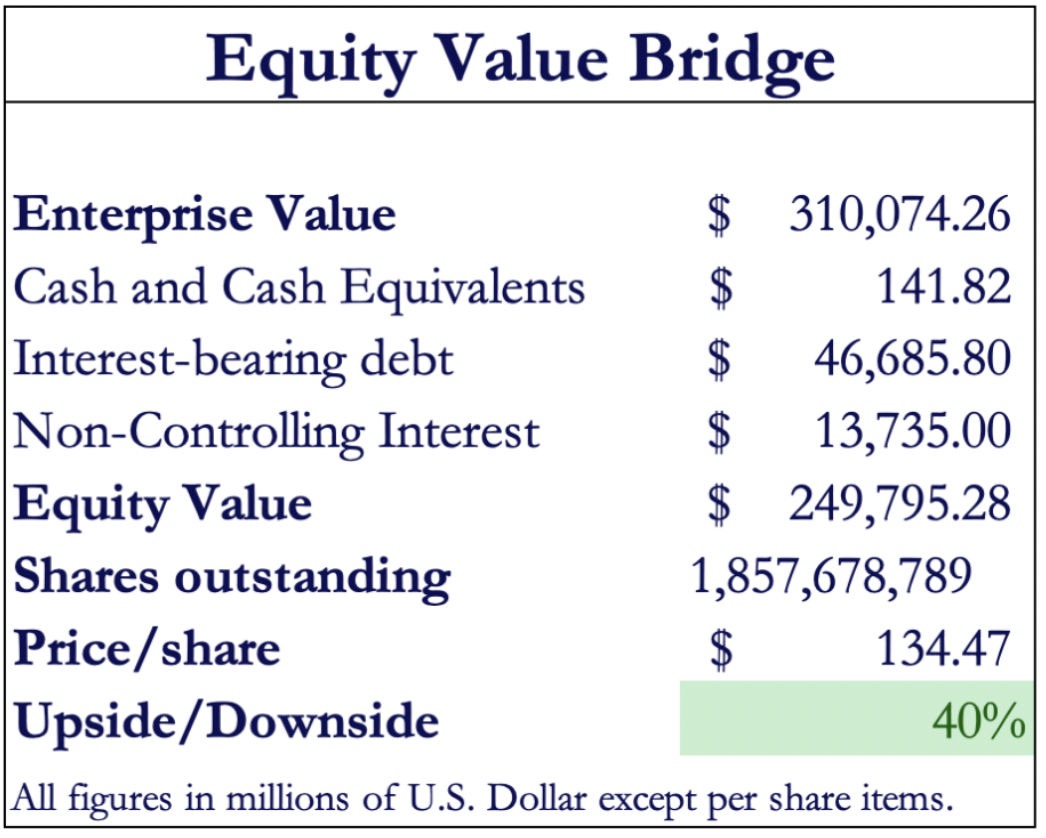

The calculations on the market multiples resulted in an EV/Sales multiple of 4.28, an EV/EBITDA of 13.36 and P/E of 21.04. To obtain the Equity Value for Disney under the selected multiples, we then applied the Equity Bridge Value to the asset-side multiples and ultimately calculated a simple average of the different valuations obtained. Adopting the 65th percentile, we therefore obtained an Equity Value of $174.4bn that corresponds to a fully diluted share price of $93.89. The lower price per share obtained with a relative valuation approach, with respect to the DCF analysis, can be justified by the recent challenges faced by Disney, particularly the impact on earnings of Disney+ operating losses. On top of that, the DCF valuation was positively impacted by our long-term assumptions on future company fundamentals and growth opportunities.

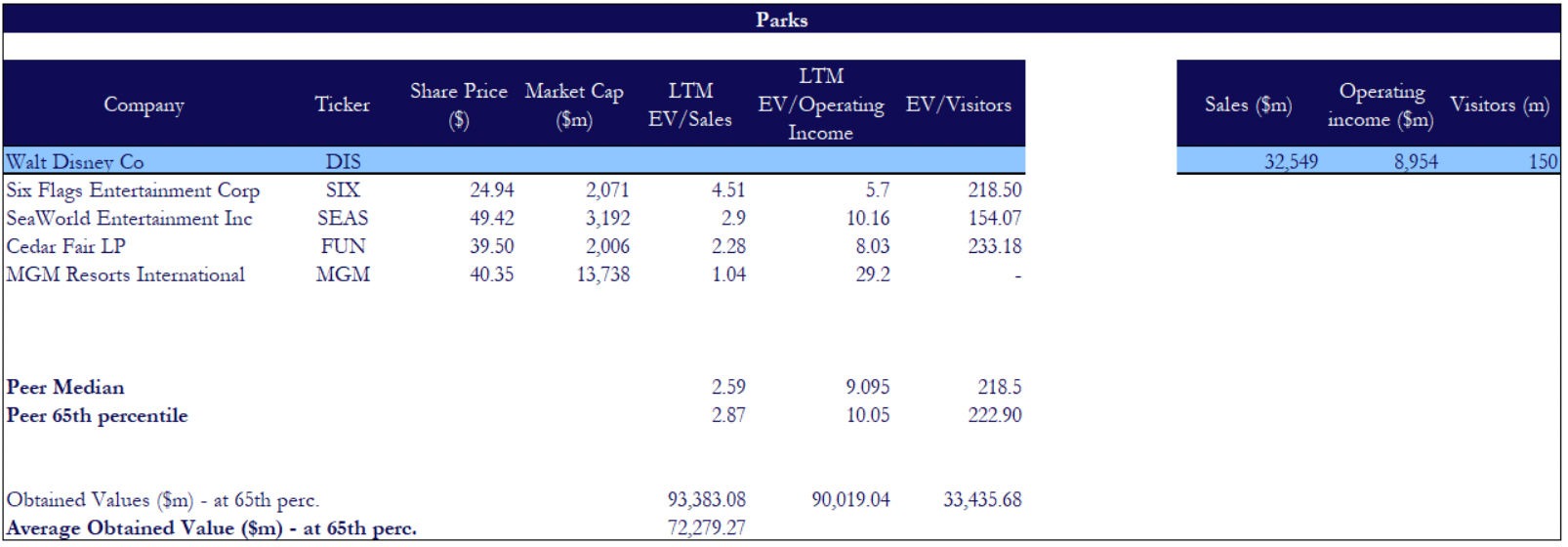

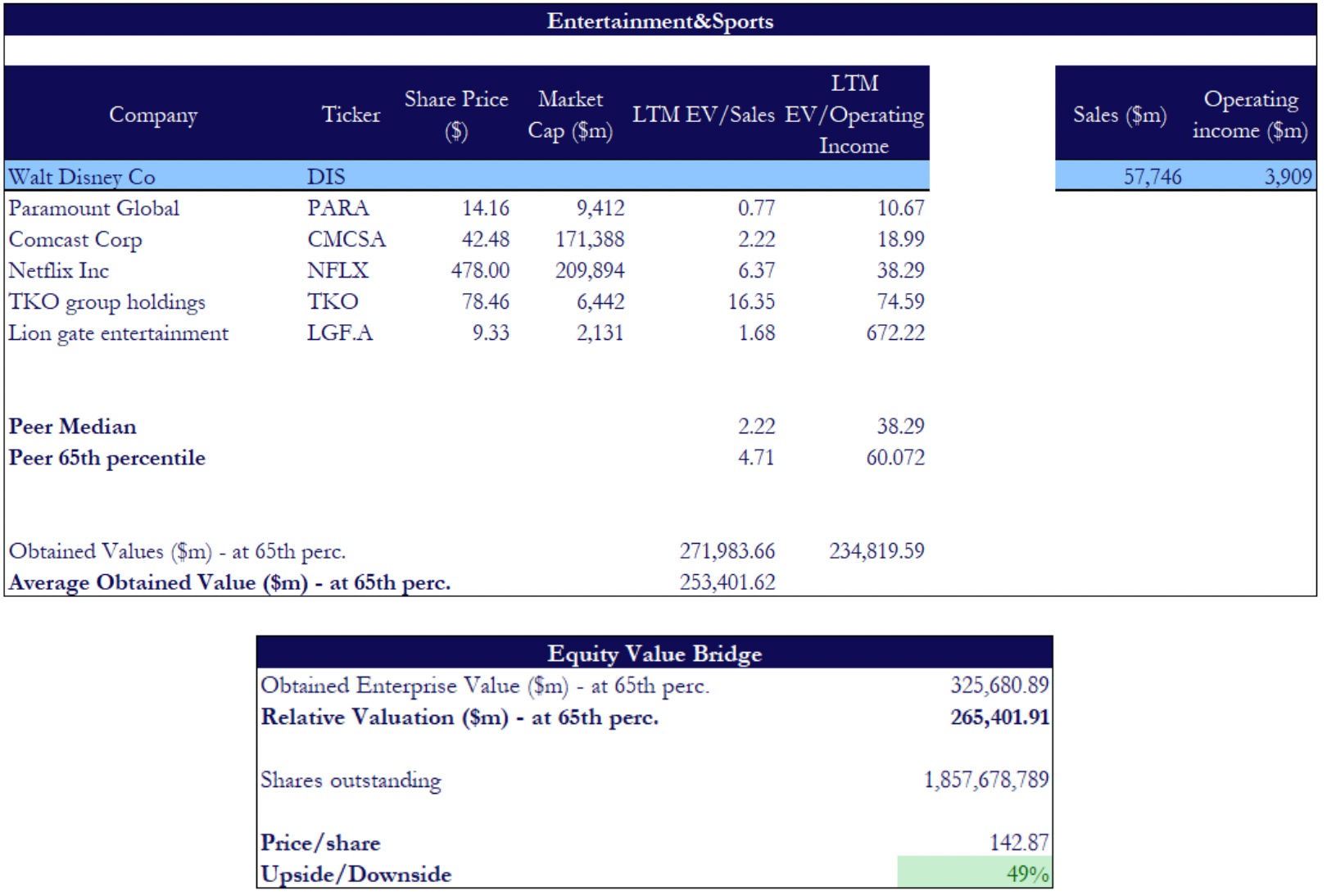

In the sum-of-parts analysis, the business was split into two distinct segments: Entertainment & Sports and Parks. This strategic breakdown aimed to attain a more precise valuation of the enterprise, recognizing its operations across two entirely disparate sectors.

For the Parks division, in addition to the comparables employed in the general valuation, two additional comparables were introduced: Cedar Fair LD, a prominent US company managing over 20 amusement parks and water parks, and MGM Resorts International [NYSE: MGM], known for its operations in hotels and casinos across 7 US states. The inclusion of MGM Resorts International was particularly strategic, representing not only the theme park aspect but also the hotel business within Disney’s Parks segment. Given Disney’s ownership of over 25 hotels, which accounted for approximately 20% of the Division’s revenues in 2022, this addition provided a more complete view of the Park Division. To compute the Fair Enterprise Value, we employed two key multiples: EV/Sales and EV/Operating Income. These multiples were used to evaluate the financial performance of the business. Additionally, an industry-specific multiple (EV/Visitors) was utilized to compare Disney parks’ attendance with that of similar companies. This was crucial, considering the challenge Disney faces with the balance between rising entrance prices and potential declines in attendance, that we discussed above. Finally, similarly to the approach taken in valuing the entire business, the fair Enterprise Value was calculated using the 65th percentile.

Similar methodologies were applied to the Entertainment & Sports segment, where Lion Gate Entertainment [NYSE: LGF.A], a US-based entertainment company, and TKO Group Holdings [NYSE: TKO], formed post-merger between World Wrestling Entertainment, Inc. and Zuffa, were included as comparables for this Disney’s Division. In this segment’s valuation, EV/Sales and EV/Operating Income multiples were employed, with the Fair Enterprise Value computed using the 65th percentile approach.

Source: Factset, BSIC

A fair price of $142.87 was determined through the sum of parts valuation, recording an upside of 49%, compared to Disney’s closing price on November 24th.

Conclusion

The multifaceted nature of Disney’s business results in the firm being affected by many internal and external factors; the key ones highlighted above being the cutthroat nature of the streaming industry, Bob Iger’s return as CEO, planned investment in their parks business and the merger between Six Flags and Cedar Fair. Both our DCF and sum of the parts analyses demonstrates significant upside to the Disney stock showing high levels of intrinsic value, however our comparable company analysis suggests that the market is fairly valuing Disney. We believe that the market is not recognising the intrinsic value in the face of uncertainty around Iger’s turnaround and succession plan and that future divestitures of the Hotstar platform, certain cable networks and a journey to profitability in streaming services can act as a catalyst to reflect this value in the stock price.

0 Comments