USA

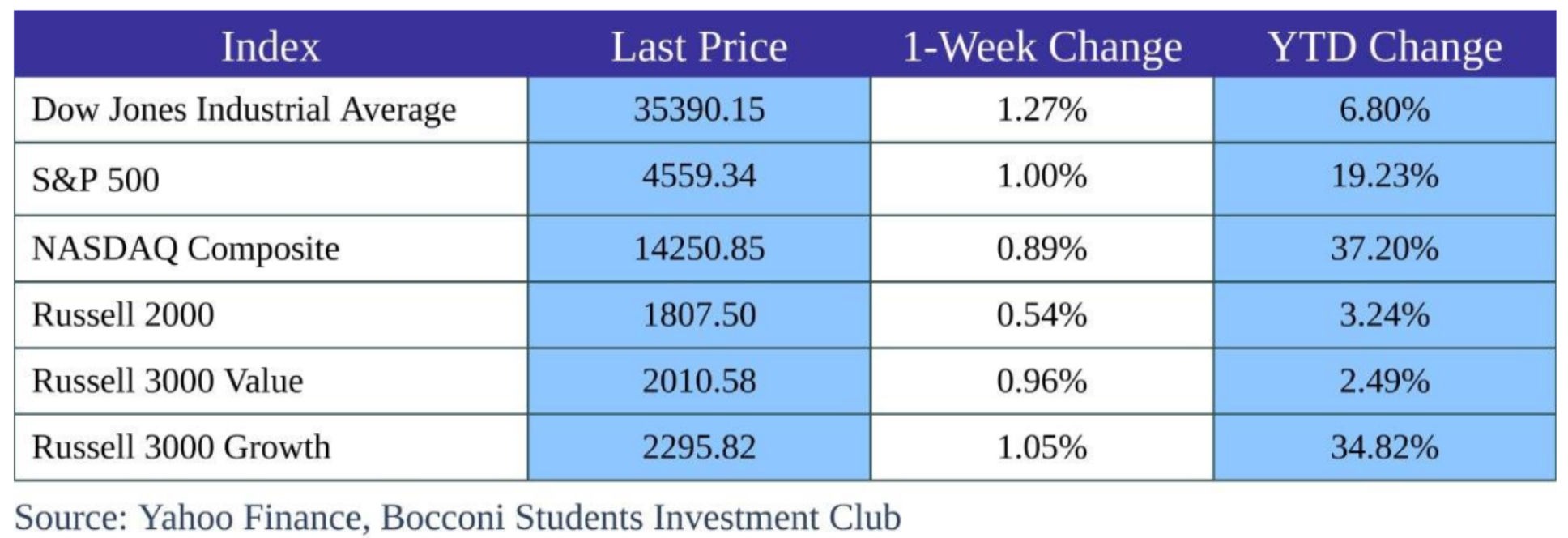

This week’s US trading session has been relatively quiet considering the Thanksgiving holiday on Thursday and an earlier market close on Friday. Nonetheless, there were a few relevant economic indicators starting with the Fed’s minutes released on Tuesday which showed that the FED’s members unanimously believe monetary policy must remain restrictive “for some time” until inflation is clearly moving toward the Federal Reserve’s 2% target, challenging the market’s hope for an early rate cut in March 2024. Otherwise, economic data was mixed with Existing Home Sales slightly under expectations at 3.79 million vs. 3.9 consensus and weekly initial Jobless Claims better than expected at 209K vs. 225K. Also, S&P’s PMIs came above consensus at 50.8 vs. 50.4 but the survey responses also showed that service providers trimmed their workforces for the first time since June 2020. In addition, investors will closely look at this Black Friday’s sales of large retailers such as Amazon, Walmart and Macy’s, target and Ross Stores in US.

Among the reporting companies this week, Nvidia topped Q3 analyst expectations with revenue increasing 203% over Q3 2022 largely due to the AI boom. Nonetheless the stock closed almost 4% down due to news of delayed H20 chip delivery to the Chinese market because of US export restrictions.

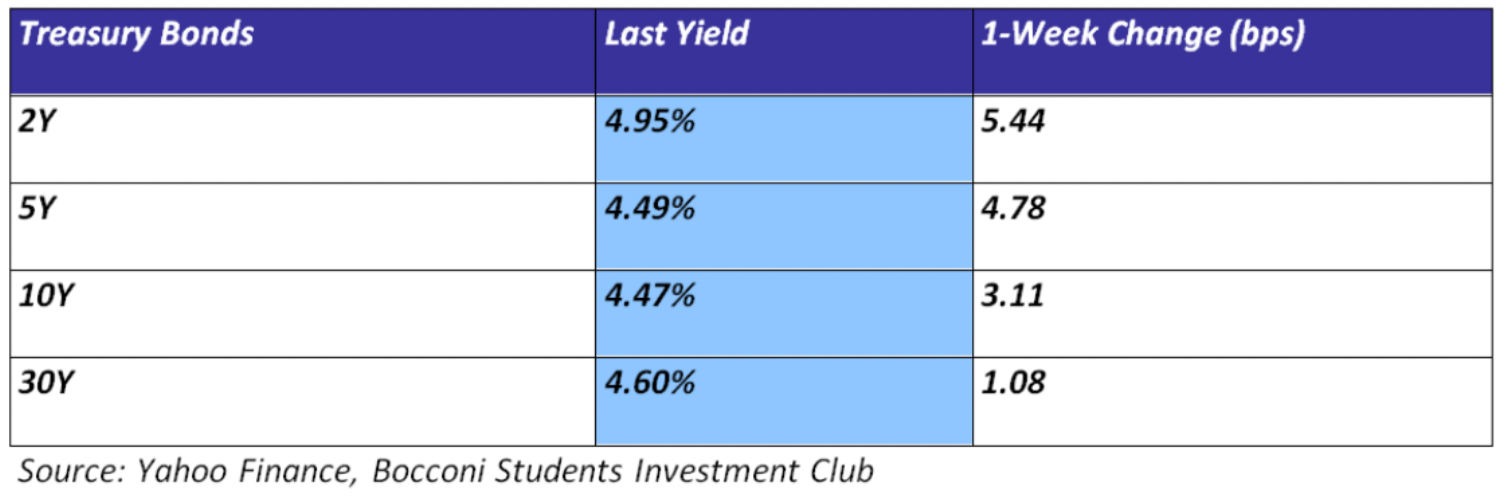

On the fixed income front, treasury yields closed higher this week following better than expected PMI data which reinforced the idea of sticky inflation. In addition, US treasuries followed a selloff in European bonds where investors are growing more concerned over interest rates and government borrowing needs.

Europe and UK

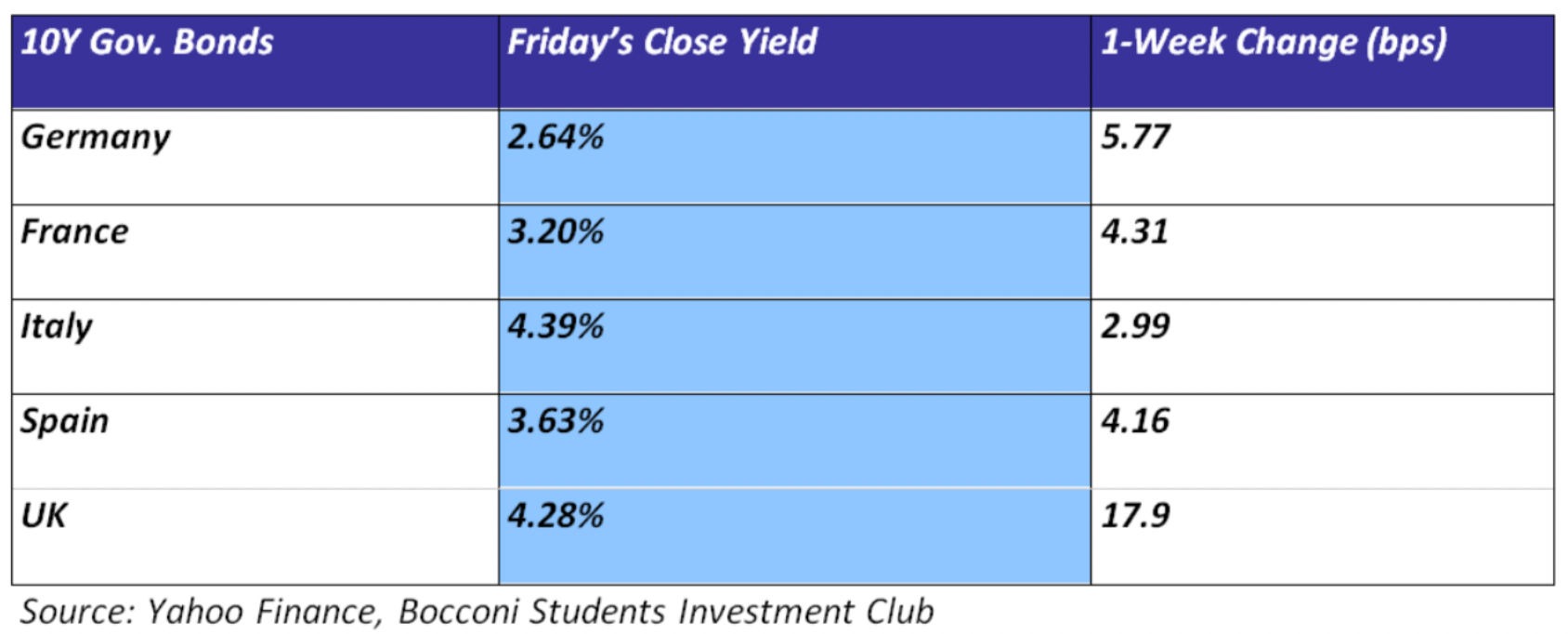

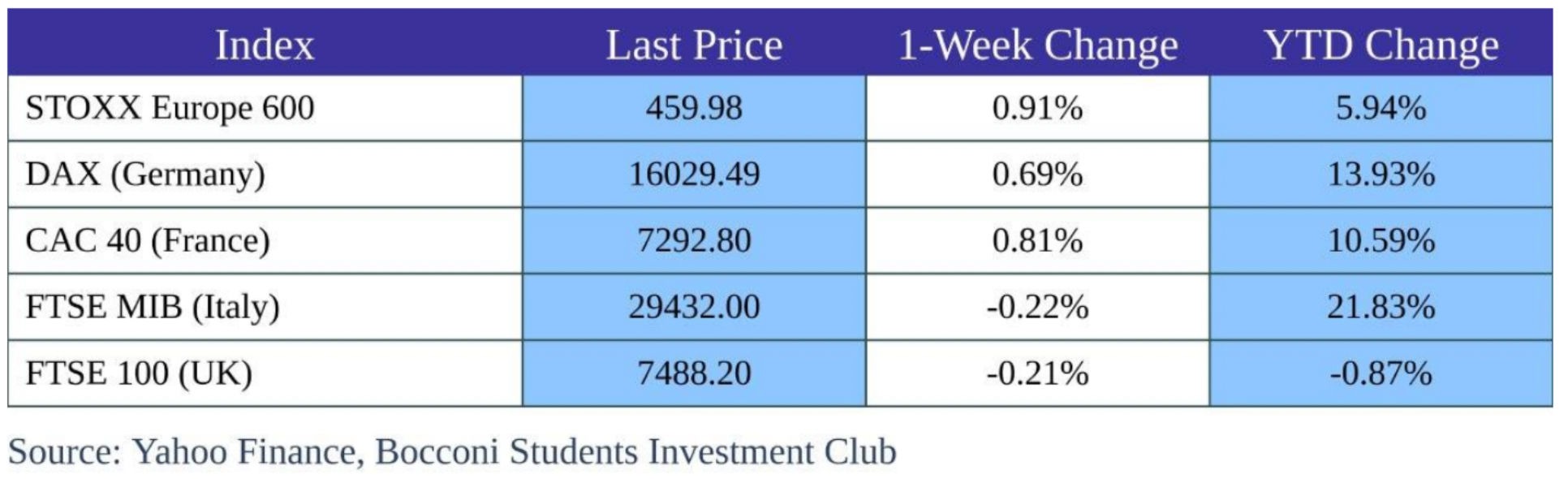

In Europe, the main stock market benchmarks were only slightly up from last week, while the main focus in the region has been economic data and ECB’s policy outlook. After Euro consumer price increases slowed to 2.9% in October, this week’s November Eurozone Composite PMI (47.1 vs 46.9) beat expectations, showing a slight improvement in business sentiment. However, ECB’s president Christine Lagarde warned that borrowing costs would need to stay restrictive for many months ahead. In addition, ECB officials including Schnabel and McCaul talked down market expectations that the central bank would lower its main deposit rate from a record 4% as soon as April 2024. Policy makers remain wary of any hopes for rate cuts spilling over into increased bank lending and household spending renew inflationary pressures. Across the Channel, Bank of England’s Governor Andrew Bailey had a similar message pointing out that it is “far too early to be thinking about rate cuts” and borrowing costs might have to go up again if there were signs that inflation was proving more persistent than expected. Consequently, Euro zone bond yields, stuck in a narrow range, reflecting the friction between market optimism and central bank caution.

Among European companies experience large stock price moves, German pharmaceutical firm Bayer plunged around 18% on Monday after announcing late Sunday it had stopped trials of a new anti-clotting drug due to “lack of efficiency.”

On the political front, in Netherlands, Geer Wilders’ far right party won 37 of the country’s 150 parliament seats becoming the dominant party in Dutch politics. Following the election results, the AEX index rallied, ending up the week up 1.03% in relief of the end of uncertainty surrounding the election outcomes.

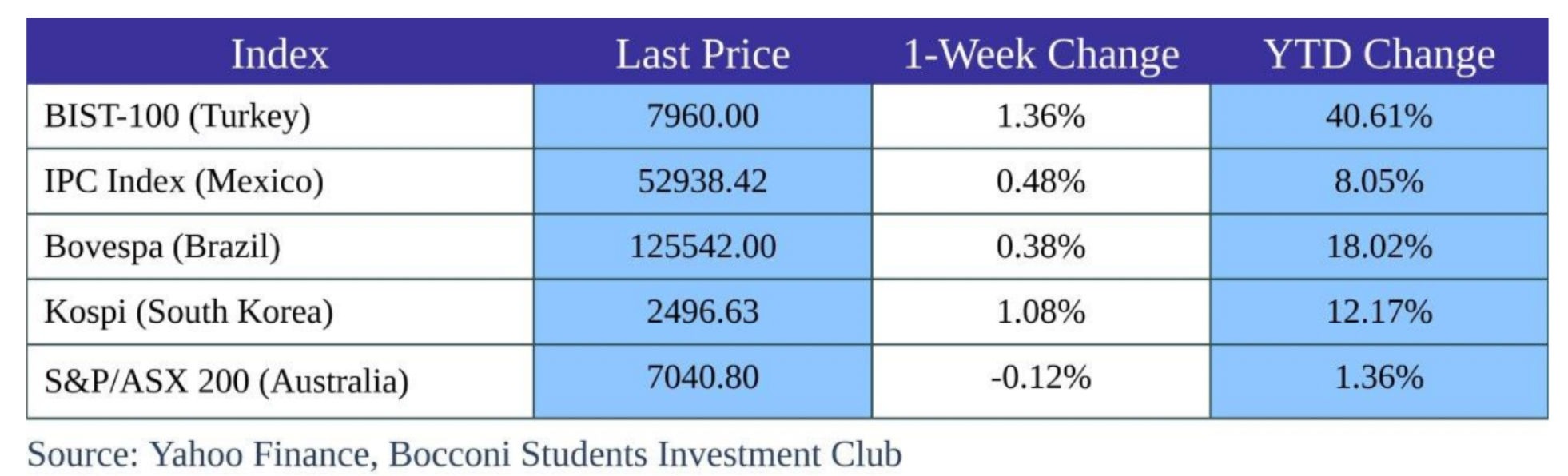

Rest of the World

One of the most surprising events this week comes from emerging markets, namely Argentina, where the libertarian candidate Javier Milei has won the presidency on Monday. He is set to take office on December 20th and while he proposed drastic measures such as dollarization and closure of the Argentina’s central bank, he has also promised to cut government spending, taxes and privatize non-performing government businesses resulting in the Argentinian stock and bond markets rallying 40% and 14% for the week respectively. In addition, rumours say that Louis Caputo is the frontrunner for the economy minister position, something positive for the markets given that Caputo is the former Argentinian Central Bank head and is seen more conservative than Milei.

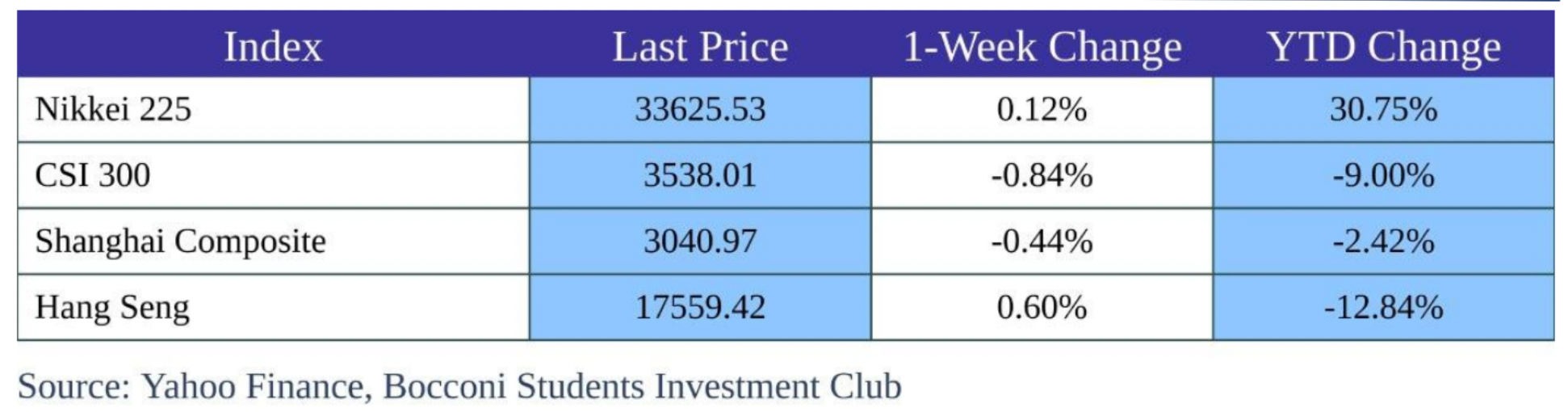

In Asia, Japan had a quiet trading session this week given the Workers holiday on Thursday, but the Nikkei ended the week positive supported by a lower reading of the CPI at 2.9% vs. 3%. Otherwise, the Chinese equity markets had a rough week with CSI, Shanghai Composite and Hang Seng in red for the week. This was mainly due selloff in equities from the technology, materials production and banking sectors, with earnings felling short by a 7.2% average margin for the 31 out of the 80 Hang Seng components that have reported so far this quarter.

FX and Commodities

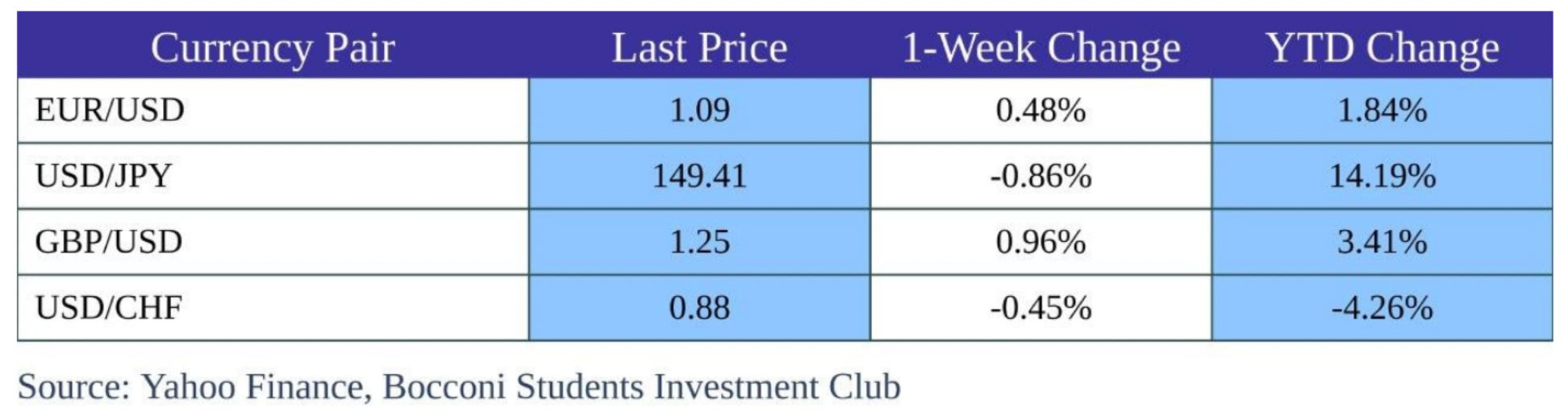

Optimism has surged in the UK financial markets, leading the GBP/USD exchange rate to reach a twelve-week peak, buoyed by improved consumer confidence and a promising business outlook despite persistent recessionary pressures. On Thursday, the pound sterling climbed to 1.2615 against the US dollar, reflecting positive reactions to the latest S&P Global/CIPS data and a sell-off in Gilts that pushed bond yields higher.

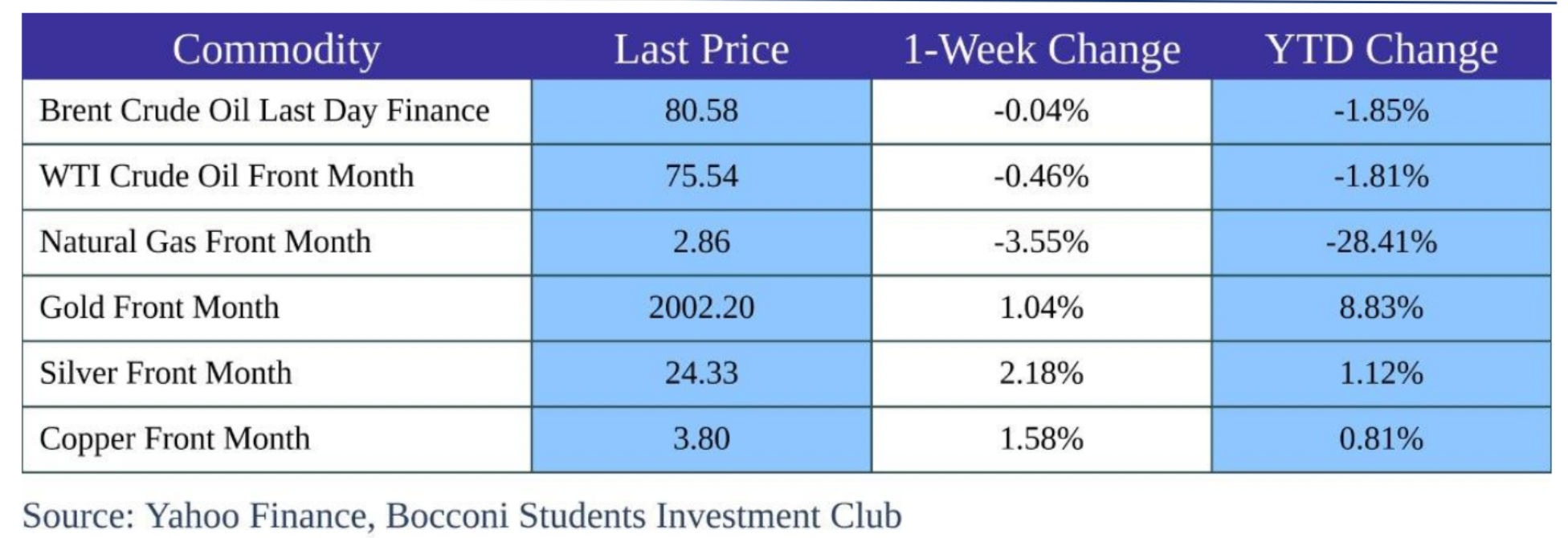

The US Dollar index ended up this week in negative territory following indications that the FED will wait longer before cutting rates in 2024. Gold futures stood steadily above the psychological barrier of 2000 USD per troy ounce amid a week with mixed signals regarding the direction of rates in US considering the FED’s hawkish minutes stood in contrast with the market’s expectations of 25% chance of US rate cut in March 2024.

In the energy markets, the downside pressure on crude prices was mainly due to OPEC+’s decision to delay their November 26th meeting for November 30th, a meeting which was expected to focus on output cuts needed to counter the fall in demand due to a weak Chinese economy, higher US oil stockpiles and poor refining margins. Also, this Friday’s release of Israeli prisoners by Hamas eased tensions in the Middle East and reduced the price premium of crude further, leading the two main benchmarks ending the week in red.

In the agricultural markets, insufficient rainfall in Brazil’s top soybean and corn growing state of Mato Grosso raised questions about the country’s soybean potential and led to increased volatility. Forecasts late on Tuesday suggested that Mato Grosso’s heaviest crop region will finish November with total rainfall around 45% below normal, and that follows a 35% deficit in October. The volatility in US Soy beans futures spiked during the week, however, on Friday prices returned to the initial 1330 USD/bushel level recorded on Monday.

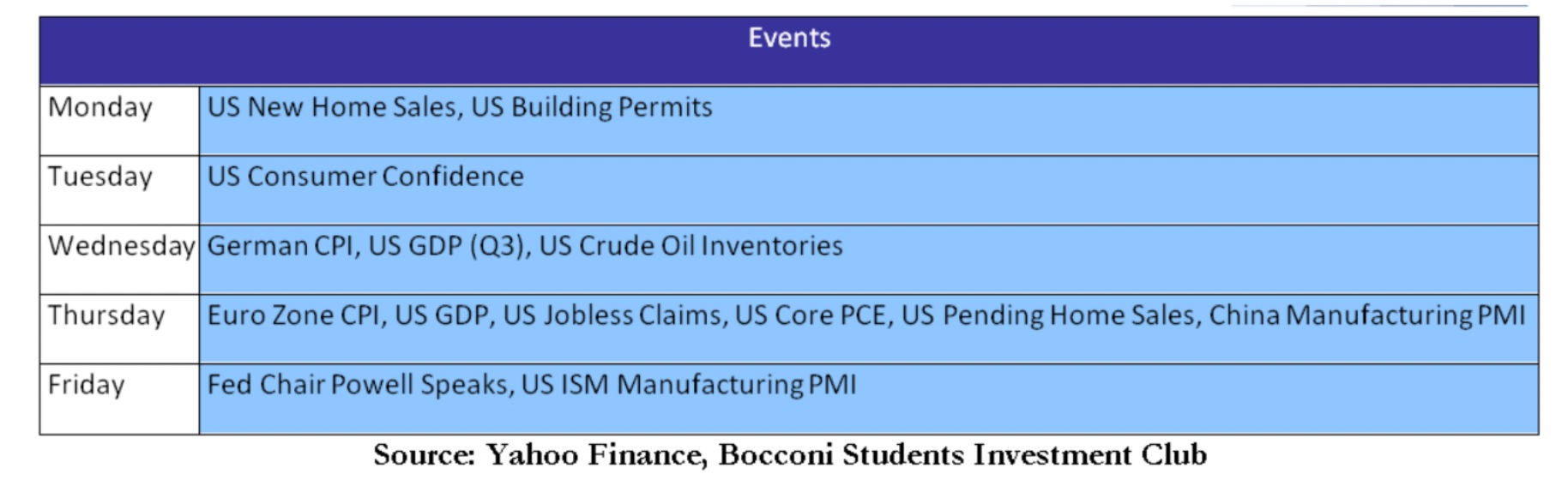

Next Week Main Events

Brainteaser #08

Given that p and q are two points chosen at random between 0 & 1. What is the probability that the ratio p/q lies between 1 & 2?

SOLUTION

In a unit square, all possible pairs of (p,q) lie within the 1X1 square. When p/q lies between 1 and 2, we are essentially trapping the points within the region below the line p = 2q and above the line p = q. This region forms a triangle within the unit square. The area of this triangle will be the probability we have been looking for and it is half of the area of the triangle obtained by splitting the square across the diagonal. Hence, the probability is a half of a half of the square area, hence it is 25%.

Brainteaser #09

In a certain matriarchal town, the women all believe in an old prophecy that says there will come a time when a stranger will visit the town and announce whether any of the men folks are cheating on their wives. The stranger will simply say “yes” or “no”, without announcing the number of men implicated or their identities. If the stranger arrives and makes his announcement, the women know that they must follow a particular rule: If on any day following the stranger’s announcement a woman deduces that her husband is not faithful to her, she must kick him out into the street at 10 A.M. the next day. This action is immediately observable by every resident in the town. It is well known that each wife is already observant enough to know whether any man (except her own husband) is cheating on his wife. However, no woman can reveal that information to any other. A cheating husband is also assumed to remain silent about his infidelity. The time comes, and a stranger arrives. He announces that there are cheating men in the town. On the morning of the 10th day following the stranger’s arrival, some unfaithful men are kicked out into the street for the first time. How many of them are there?

0 Comments