Introduction

With the AI trend currently dominating markets highlighted by NVIDIA’s earnings announcement this week, Palantir has gained a fresh breath of momentum over the last year. It has yet to reach its all-time high which was during the meme-stock frenzy in January of 2021 fuelled by redditors, although the origins of its past meme ability remain hard to point out, its Lord of the Rings inspired name and pop culture references in product naming certainly helped the part. The company has recently beaten expectations this quarter with its AIP bootcamp. We will try to make the case that the former memestock -the 54 thousand redditors of r/PLTR would beg otherwise- is quality and its current valuation sitting at a 70 P/E ratio is not as expensive as it might suggest.

Brief history

Peter Thiel, being libertarian and the cofounder of both PayPal and Founders Fund, was looking to start a company that would apply software to reduce risks of terrorist events happening in the aftermath of 9/11 without impacting civil liberties too much. The Seven Seeing Stones, Palantiri in plural, from Lord of the Rings served as an inspiration for the back then primarily intelligence focused start-up. In 2004, Thiel appointed Alex Karp whom he used to debate with in Stanford Law School surrounding civil liberties as CEO and funded the creation of the prototype. The only other backer besides Thiel in the beginning would be the CIA.

Business segments

Currently the business of Palantir can be separated into two distinct parts, one being the government/defence part of the business with software deployed to the U.S. department of defence, various intelligence agencies, and U.S. Allies. What set Palantir’s software apart in the beginning from pre-existing ones in use by the D.O.D. was its approachable UI for better situational awareness on the battlefield. The second part is commercial business, helping small enterprises and businesses.

The main defence focused platform product Palantir currently offers is Gotham, which is an operating system for improved decision makers on various levels and widely different roles and across security classifications. The Gotham Platform works in the case of the U.S. Army as a data fabric and analytics platform that transforms the integration of advanced analytical capabilities through machine learning and AI models to prepare the Army for possible future near peer conflicts. One application case for Gotham given by Palantir would be in the monitoring of training exercise in South China Sea highlighting its capabilities in tracking military vessels through the combination of various data sources ranging from satellites to unmanned aerial vehicles to intelligence provided by allies, its analytics suite of possible courses of action to deter moves against Taiwan in that case- giving the different risks, times taken for the action and success probabilities, both machine generated as well as possible human inputs. The Gotham system can also be used for predictive policing projects such as seen in Denmark, and Germany. The interoperability of the Gotham system with pre-existing infrastructure is across the full stack with most U.S. allies.

This interoperability and customisation is one of the main differentiators of Palantir in the commercial sector as well. The forward deployed engineers, referred to as “Deltas” within the firm, allow for a more personalised interface and feature suite for various use cases, as well as create new abilities which can be done through new data models or upgrades on top of pre-existing platforms such as Gotham.

The barriers to entry in this part of their business is extremely high due to both legal requirements and approval processes that can take years, and the 20 year head start that Palantir has which allowed it to develop economies of scale and have more training data for their algorithms and models than a new-comer could dream of. Gotham is also currently used in the Russia Ukraine conflict and has proven its capabilities there in a modern conflict. We deem the likelihood of pre-existing large technological companies posing a threat to Palantir in the defence part of its business to be very low at this point of time which is mainly due to the ideological opposition of Silicon Valley towards military technology, highlighted by Google’s withdrawal from Project Maven. Project Maven included developing artificial intelligence powered drones for intelligence gathering as well as bombing, Google employees protested against this which led it to set guiding principles on AI for defence forbidding such use cases. This means that it is highly likely in our view that Palantir will be uncontested in the future in this regard, albeit having observed some pushback from US allies against the dependence, due to the complexity and increasing costs of training more complex models.

On the Commercial side, the main three products are Foundry, AIP with AIP bootcamps, and Apollo. Foundry is essentially the commercial version of Gotham in the sense of being a Platform for quantitative decision making for operations. In contrast to regular platforms used in companies which have linear flow of data, the best explanation of it would be “an assembly line of data”. This data then gets analysed and put into reports and dashboard but in the traditional way the feedback loop is not closed. Foundry allows companies to close that feedback loop and make it continuous by connecting data producers and consumers within the firm. More specifically Foundry consists of one Ontology with three layers of capability: semantic, kinetic and dynamic. The semantic layer has dynamic objects & links, used to portray relationships between objects in a real-time and interactive way, multi-modal properties concerning object properties from various data sources with configuration capabilities, and lastly ontology primitives. The kinetic layer consists of AI-driven actions & functions, process mining and automation, action orchestration and real time monitoring. The dynamic layer consists of what they call AI guided decision – AI models use reasoning across both semantic as well as kinetic variables to calculate most optimal decisions-, Multi step simulations, and Learning. The modular architecture of Foundry allows companies to plug in pre-existing models and architectures. One of the example use cases of Foundry is the Airbus A350 production, where Foundry, according to Palantir, helped increase delivery of A350s by 33% through creating a single interface for troubleshooting, and guide planning. Palantir in combination with Airbus created Skywise connecting in-flight data coming from engines and other systems within planes in use with engineering and operations data to help improve reliability of platforms. Currently there are over 10 500 aircraft connected to the system. There are currently concerns in the UK over how NHS uses and shares data with Palantir.

The newest and currently fastest growing part of their business is AIP, short for Artificial Intelligence Platform. In essence it is a platform that applies large language models to the commercial side, what makes it special in comparison to using conventional LLMs as such is that it has access to vast arrays of data and documents within the organisation. This works through connecting the AI to enterprise data meaning real time integration of data from sources of the business, which helps mitigate the risk of hallucinations of the LLM and allows for the decisions to be trustworthy. For those unfamiliar with the concepts of hallucinations, large language models sometimes tend to “invent” things that did not happen for some questions while expressing them in a coherent and a grammatically correct way. This poses large issues for businesses wanting to use LLMs and one of the ways to mitigate it is through curated datasets and domain specific training. This domain specific training can be seen as being part of the AIP’s connection to enterprise logic such as business logic, and machine learning models, which leads to pre-existing models being incorporated and help the AI in its reasoning. The third part of it is connecting the AI to the systems of action within the companies to synchronise decisions with databases and enabling auditing for all actions. One of the most important aspects of AIP is that access and the extent of access can be different on a user basis, meaning that whilst a senior executive who has clearance for all information would be able to use AIP fully for all business processes, a manager in production would only be able to use AIP for decision making concerning his needs but not more than that. One of the main ways Palantir sells AIP to customers is through its AIP bootcamp which is five days long and consists of developing and understanding use cases for AIP, and training users for it. Bloomberg intelligence has projected the generative AI market to grow to 1.3 trillion by 2032. In an interview with Bloomberg Technology Alex Karp stated that Palantir currently does not have a pricing strategy with the reasoning that pricing will work through Pareto optimization on an academic level. He also said that in contrast to PowerPoints “that don’t deliver value” where you want to be paid upfront -possibly alluding to management consulting- with software that creates value you want to be paid after the fact because companies will realise the value of your product.

Q4 2023 earnings release and FY24 guidance

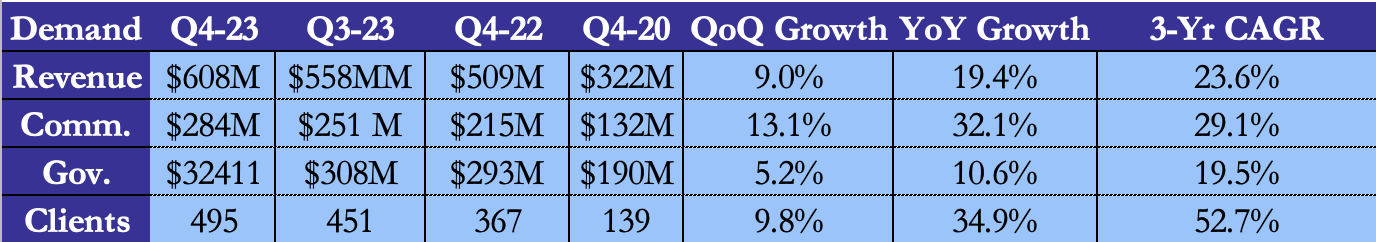

It is essential to analyse Palantir’s last quarter to understand earnings trends and whether the company is meeting investors’ estimates. We firstly take a look at the demand side of the business; Palantir beat revenue estimates by 0.9% and beat guidance by 1.2%. As we mentioned before, the business is mainly divided into two segments: commercial and government. Commercial revenue beat expectations by 5.2% while government revenue was 2.7% worse than expected.

Chief Revenue Officer Ryan Taylor told investors that the strength Palantir is seeing within the government segment is “not reflected in Q4 results.” Furthermore, the U.S. government is behind in its software revolution vs. the U.S. enterprise. For example, software makes up 0.015% of the Department of Defense’s 2024 budget. That’s set to shift over the long haul. Importantly, Palantir sees contract closures leading to a U.S. government re-acceleration in 2024 beyond 2023’s 14% result, which could act as a tailwind for the following years.

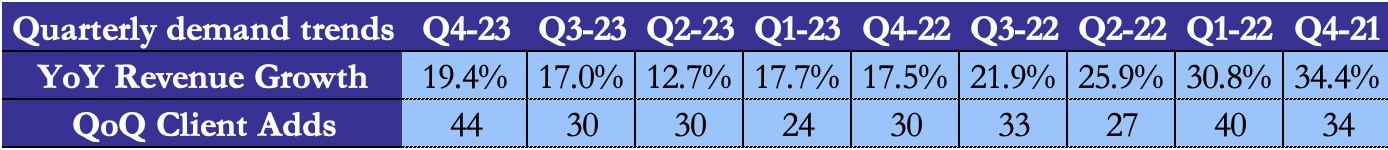

As shown by Exhibit 1 overall revenue grew 9% QoQ and almost 20% YoY. What particularly stood out was the rapid growth in the US. US commercial revenue grew 70% YoY and 12% QoQ to $131 million, with US commercial customer count growing 55% YoY and 22% QoQ to 221 customers. The cause of this was the thriving demand for its Artificial Intelligence Platform (AIP). This platform is vastly expanding use cases for Palantir customers while making onboarding those use cases much easier as well. It’s making Palantir less complex to use and work with. That’s diminishing the internal talent a client needs to select its product suite. This means there is less friction, implying more revenue and better margins due to less onboarding help. Another factor to take into consideration is seasonality; typically Q3 and Q4 are much better compared to Q1 and Q2.

Exhibit 1: Demand trends (Source: Company Filings)

Exhibit 2: Quarterly demand trends (Source: Company Filings)(Source: Company Filings)

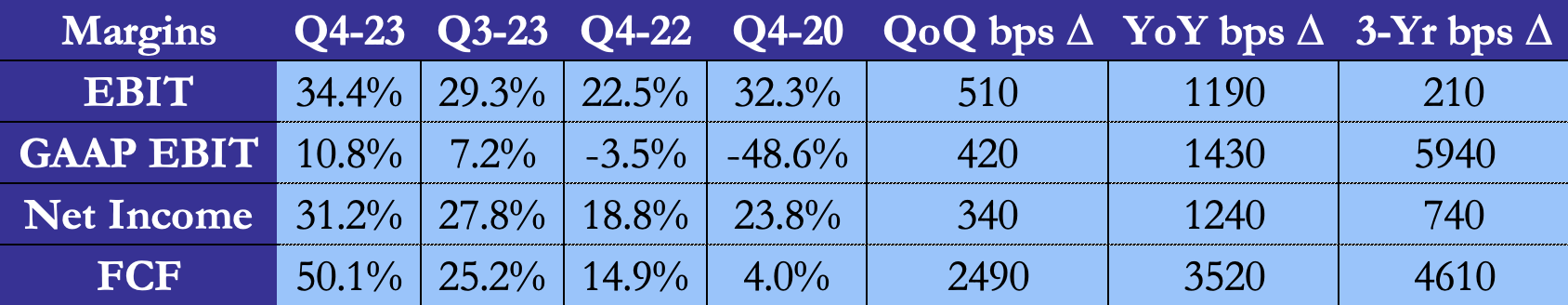

It is particularly interesting to note how this is the fifth consecutive quarter of GAAP profitability and the fourth consecutive quarter of operating profitability. In the last quarter Palantir:

- Beat EBIT estimates by 6.8% and beat EBIT guidance by 12.6%.

- Beat $0.03 GAAP earnings per share (EPS) estimates by $0.01.

- Beat 81.7% GAAP gross profit margin (GPM) estimates by 40 basis points

The company guided for 40%+ YoY commercial revenue growth for 2024, with revenue of between $2.652 – $2.668 billion. Palantir beat annual EBIT estimates by 14.2%, with a FCF guidance of $800 million – $1 billion, which is much better than expected. Furthermore, it sees positive GAAP EBIT and EPS for all four quarters, as expected, despite an increase in OpEx in 2024 (to support growth). Palantir sees EBIT and net income margins expanding Y/Y, which is better than the flat Y/Y margins analysts expected coming into this report. This could be a driver in the short term as one may expect analyst upgrades.

What was negative about this earnings release, apart from the miss in the government revenue, was the increase in diluted shares. Diluted shares rose 7% YoY and basic shares rose 4.6% YoY, which is more than the historical average.

Exhibit 3: Company’s margins (Source: Company Filings)

Given the strong seasonality in Q4 it is particularly important to see how the forth quarter evolved over time. What really is impressive is the continued margins expansions; both EBIT, Net income and FCF margins are increasing, especially in the last quarter. This symbolizes extremely good business performance and efficiency as the company is trying both to increase customers and profitability measures.

Financials

Overall, the company has $3.7bn in cash and cash equivalents which is 7.5% of the market cap and 82% of the total assets. Out of that $3.7bn, the company holds $2.8bn into marketable securities, which are mostly government treasuries. Other short-term assets include accounts receivable (as the company generally grants non-collateralized credit terms to its customers) and prepaid expenses. The cash available for the business is available to fund working capital, capital expenditures, strategic acquisitions or business opportunities, and other general corporate purposes.

Within the long term assets, the company holds leases and some property and equipment. Having lots of current assets puts the company in a very good position to finance the growth and development of the company.

The company holds only $961.4M of liabilities, with the majority of them being deferred revenues, customer deposits and operating lease liabilities. Deferred revenue represents billings under non-cancellable contracts before the related product or service is transferred to the customer. The non-existing debt offers the company an immense advantage as it is not particularly affected by interest rate movements in their financial statements. In fact the company stated on the annual report: “Due to the short-term nature of the financial instruments, we have not been exposed to, nor do we anticipate being exposed to, material risks due to changes in interest rates”.

The quick ratio is a liquidity ratio, which measures the ability of a company to use its cash or short-term assets to cover their current liabilities immediately. To calculate it you take the current assets and remove inventory and divide everything by the current liabilities. For Palantir, the quick ratio is 5.55 which is extremely good, especially considering that the company has no debt.

In August 2023 the Company’s Board of Directors authorized a stock repurchase program of up to $1.0 billion of the Company’s outstanding shares of Class A common stock. However, the share repurchase program does not obligate the Company to repurchase any specific number of shares, in fact Palantir did not buy back any shares in FY 2023. If the company decides to buy back its shares this year, it could further increase investor’s confidence and by decreasing shares outstanding the stock could appreciate further.

Palantir generates revenue from the sale of subscriptions to access their software platforms in their hosted environment along with ongoing O&M services (“Palantir Cloud”), software subscriptions in their customers’ environments with ongoing O&M services (“On-Premises Software”), and professional services.

Revenue for FY23 was $2.2bn vs $1.9bn in FY22, with commercials revenues outpacing the growth of government revenues. Gross margins expanded to 81% from 79% in the previous year driven by a decrease in stock-based compensation expense and related expense. Cost of revenues for the company include salaries, stock-based compensation and mainly cloud hosting services.

The primary operating expense for Palantir is sales and marketing which represents 33% of total sales, then accompanied by R&D and G&A expense. All expenses rose in FY23 mostly due to higher average headcount.

One important ratio for the company is the contribution margin. Contribution margin is intended to capture how much the company has earned from customers after accounting for the costs associated with deploying and operating the software, as well as any sales and marketing expenses involved in acquiring and expanding the partnerships with those customers, including allocated overhead. For FY23, contribution margins stand at 56%, up from 54% of FY22.

The company in 2023 was able to generate positive cash flow from operations. Net cash provided by operating activities was $712.2 million and $223.7 million for the year ended December 31, 2023 and 2022, respectively. The increase was primarily driven by timing of payments to vendors and timing of the receipt of payments from our customers, as well as an increase in interest income. Net cash used in investing activities was $2.7 billion and $45.4 million for the year ended December 31, 2023 and 2022, respectively. The increase in cash used in investing activities was primarily due to purchases of marketable securities, primarily comprised of short-term U.S. treasury securities. Lastly net cash provided by financing activities was $218.8 million and $86.0 million for the year ended December 31, 2023 and 2022, respectively, each of which primarily consisted of proceeds from the exercise of common stock options.

AI sector

We have the view that one of the driving factors in Palantir valuation over the next couple of years is going to be the growth of the AI sector, especially generative AI. This is due to the fact that most products currently offered by Palantir incorporate or facilitate the use of AI and defence spending for software services likely to be along expectations as well as the limitation of providing software to Allies of the U.S. which are highly unlikely to change drastically over the next ten years or even more. One of the main issues in valuing a software/AI company currently is that there is very little consensus as to how much exactly the sector is projected to grow. One of the drivers of the variability of sector forecasts is the fact that the sector is relatively new and has the potential to change dramatically with technological changes in computing as well -quantum computing would change the capabilities and costs of training models immensely. The sector is estimated to expand ranging from a relatively conservative estimate of a compound annual growth rate of 15.83% to a market size of USD 738.80bn by Statista to less conservative estimates of USD1.3tn by Bloomberg Intelligence and a projected market size of USD 1.8tn by Forbes Advisor. Overall the software sector market size is expected to grow at a compound annual growth rate of around 11.74% until 2032. This makes it extremely hard to do accurate predictions of the market size in the following years.

One of the main catalysts for the sector could be innovations in technology such as developing quantum computers to be on a commercially useful scale, as most forms of Artificial Intelligence, especially LLMs or General AI, take an ever increasing amount of computing power to develop. This is highlighted by the fact that GPT-5 has been assumed to exceed 17 trillion parameters and costs exceeding USD 2 bn if growth between models is assumed to be constant. This means that a substantial leap forward in computing power would likely prove to be a pivotal moment in the AI sector. It will be seen if and when exactly quantum computing will be good enough for those use cases. Another catalyst for the sector could be the increasing technological improvement as well as ability to generate data of production equipment across industries, this would greatly improve the ability of AI platforms such as Foundry to work on the commercial side.

One of the main challenges to growth facing generative AI currently -besides computing power and its energy consumption- is legal challenges and regulations for LLMs. The EU being notoriously late to the party of innovation compared to the U.S., but world champions in regulating industries before they have matured sufficiently to understand them well enough to not hinder growth, has enacted its AI Act this year. Other issues facing the sector are concerns regarding copyright law especially with LLM that are publicly available, we believe that this will not affect Palantir to the same extent as others such as OpenAI as their platforms are on the commercial side meant for enterprise use instead of the general public.

Recommendation

In our opinion, Palantir is positioned to benefit from the surge in AI related products. Their commercial business sector is already benefitting from the increase in demand of AI as more and more businesses decide to use Palantir products to increase efficiency through advanced data analytics and better feedback loops. We could make the case that this is rather the beginning of their earnings growth (as this is only their 5th quarter of GAPP profitability) and we justify the valuation of Palantir due to margins, EPS, and revenue growth. Another catalyst could be the beginning of the shares repurchasing programme, which was initiated August 2023, which could drive up investors’ confidence. Lastly, their AIP bootcamp is going extremely well, driving up sales for the company and its current limitation is not being able to match demand for it. Overall, we believe that sentiment towards integrating AI into traditional business functions will become better and Palantir’s experience in the market plus unique product offerings will help drive the bottom-line. If this continues, their main expense (marketing and advertising) could be dragged down, thus increasing margins and bottom-line profits. We see Palantir as a growth stock, with some pockets of value into it. We recommend to buy the stock for a duration of around 5 years.

0 Comments