USA

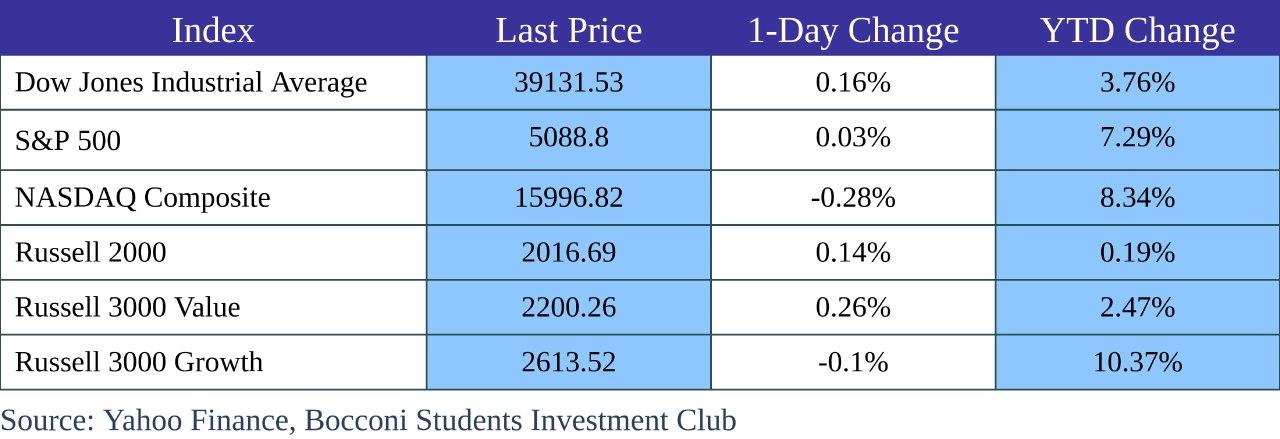

In a strong week for the broad U.S. stock market, equity indexes generally trended upward, except for the small-cap Russell 2000 Index, which was down 0.8% for the week. Both the S&P 500 Index and the Nasdaq Composite Index reached new intraday highs, with the latter experiencing its largest daily gain in about a year, driven by NVIDIA’s remarkable performance. The chipmaker reported strong quarterly revenue and earnings, surpassing Wall Street estimates, and raised its full-year guidance due to robust demand for its chips used in artificial intelligence applications.

Economic data for the week, including weekly jobless claims and early estimates of manufacturing activity PMI, generally met expectations, with jobless claims coming in below consensus estimates, indicating a tight labor market. Additionally, S&P’s manufacturing PMI unexpectedly rose to its highest level in 17 months, while services PMI slightly cooled but remained above the expansionary threshold.

Federal Reserve Board Governor Christopher Waller cautioned against rushing to cut rates despite higher-than-expected inflation in January. He emphasized the need to monitor inflation progress over the coming months to ascertain whether it will return to the Fed’s 2% target, suggesting that January’s inflation uptick may be temporary.

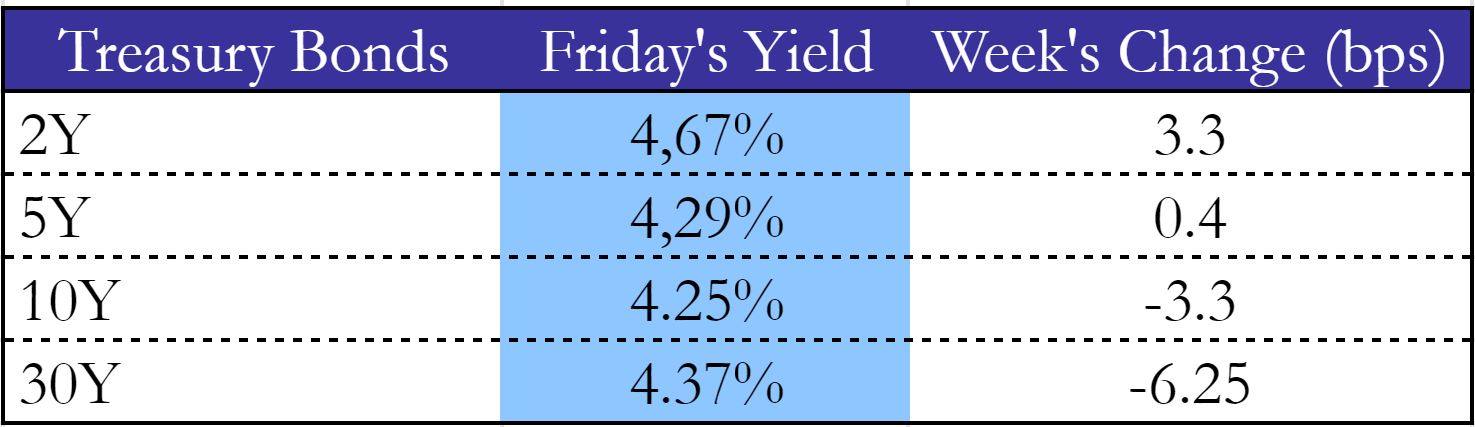

Following the FED’s minutes released on Wednesday, the FED made it clear that it is worried about cutting rates too soon and that it would want to see consistently lower inflation, meaning a few consecutive readings at or below 2%. So far economic indicators have shifted rate cut expectation from March to June, and the result was a further inversion of the US yield curve, with the short-end up 3 bp for the week while the 10 year and 30-year bonds dropped 3 and 6 bps.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

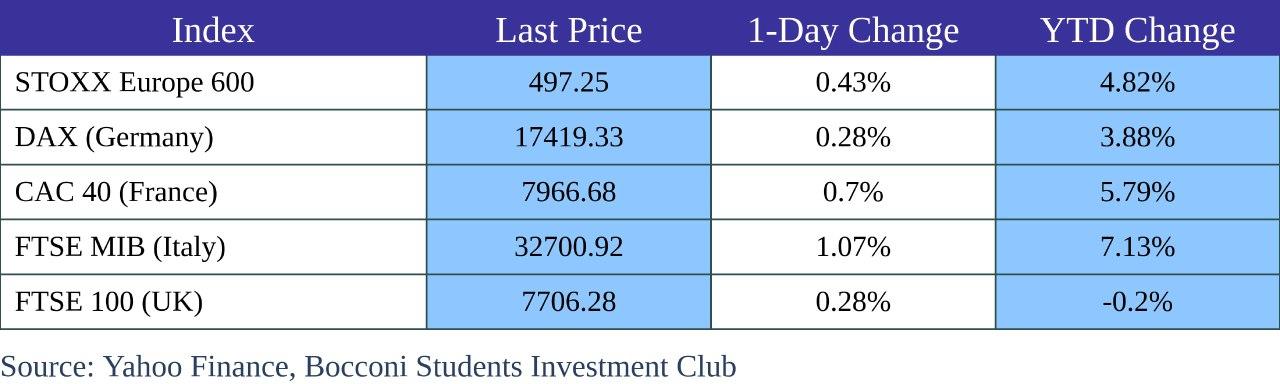

The pan-European STOXX Europe 600 Index reached a new record high, closing the week with a 1.15% increase. The surge was fueled by NVIDIA’s impressive quarterly results, which ignited a global rally and boosted demand for technology stocks. Across Europe, France’s CAC 40 Index climbed by 2.56%, Italy’s FTSE MIB rose by 3.05%, and Germany’s DAX saw a 1.76% advance. In contrast, the UK’s FTSE 100 Index remained relatively unchanged, with weakness observed in mining and energy stocks.

Early February PMI data hinted at a potential eurozone economy stabilization, driven by a recovery in the services sector. While still contractionary, the eurozone composite PMI rose to 48.9. Also, Germany’s PMI fell for the eighth consecutive month while Germany’s Q4 GDP reading confirmed that the country’s economy contracted by 0.3%, driven by shrinking government consumption and investment.

Meanwhile, the UK’s composite PMI output index increased for the fourth month to 53.3 in February, reflecting better customer demand. Bank of England Governor Andrew Bailey expressed comfort with market expectations of rate cuts this year, noting signs of economic improvement post-recession without endorsing specific predictions.

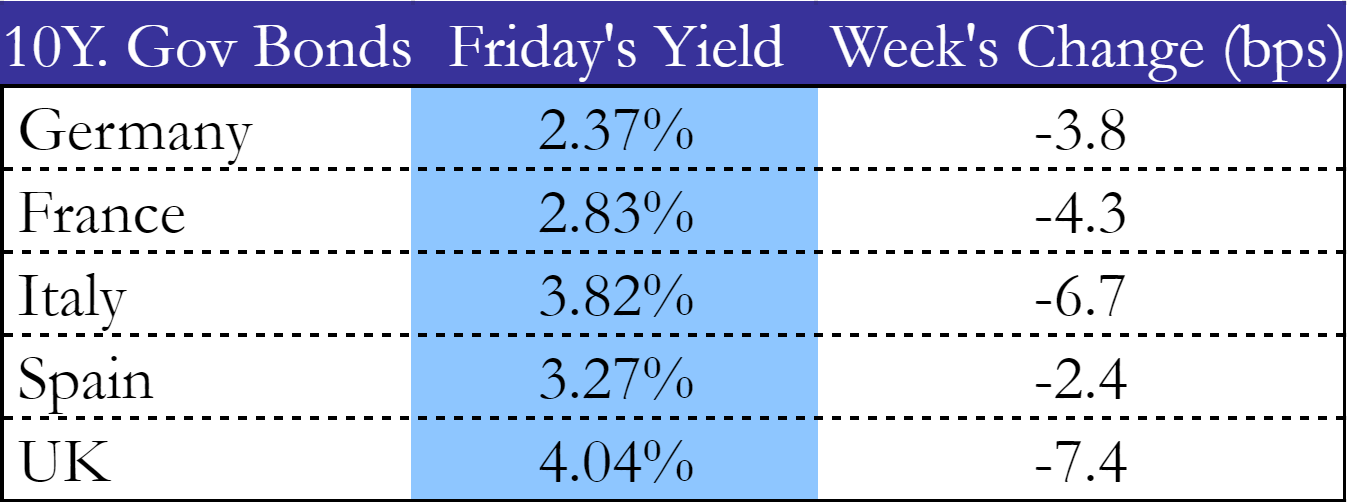

This week, UK government bond yields fell on Friday following PMI report falling short of expectations. European bonds too ended the week lower across the board, after Euro CPI matched expectations of 2.8% YoY.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

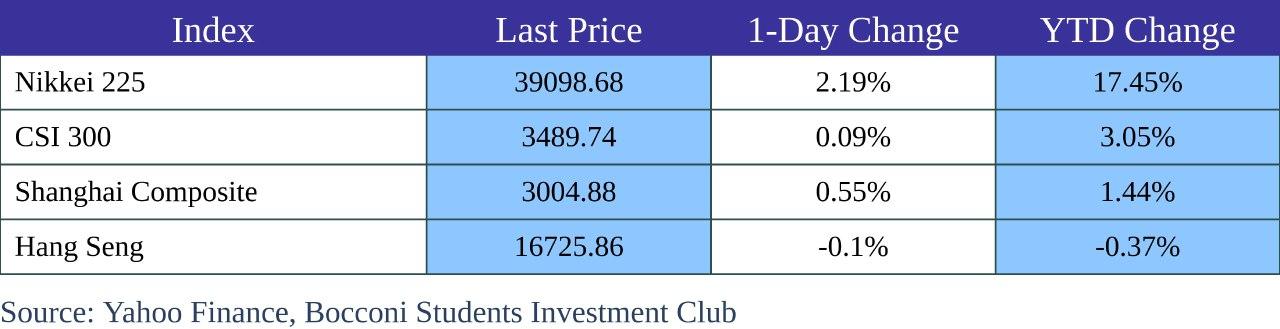

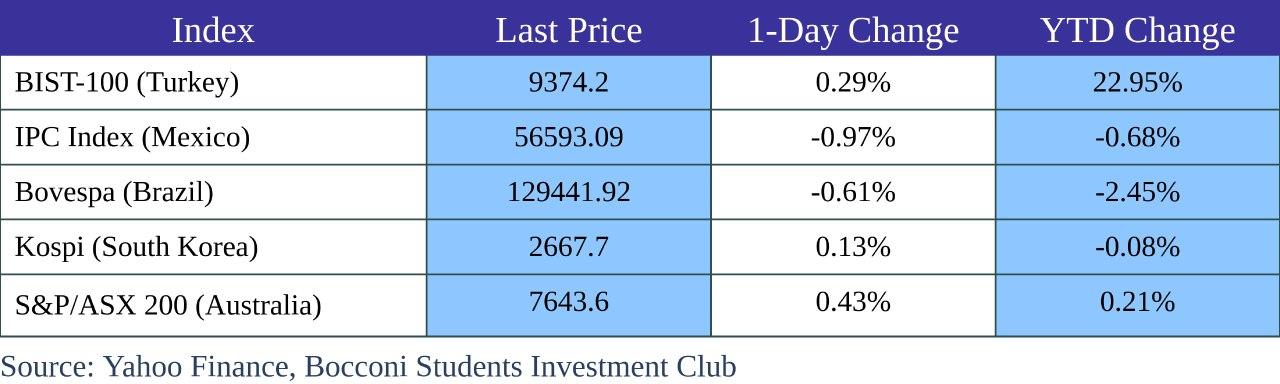

In a shortened week, Japanese equities surged to new all-time highs, with the Nikkei 225 Index surpassing its previous record set over 30 years ago. The broader TOPIX also reached its highest level since February 1999, reflecting confidence in Japan’s steady economic growth and corporate profitability. Despite disappointing manufacturing PMI data (47.2 down from 48), the week saw positive indicators including strong machinery orders and record-high exports in January up 23%, which helped reduce Japan’s trade deficit.

Chinese equities surged as hopes for economic recovery grew following robust holiday spending during the Lunar New Year holiday. The Shanghai Composite Index climbed by 4.85%, while the blue-chip CSI 300 rose by 3.71%. In Hong Kong, the benchmark Hang Seng Index advanced by 2.36% for the week. However, Lunar New Year tourism data presented mixed signals. Although during the holiday tourism revenue soared 47% compared to the previous year and surpassed pre-pandemic levels, average spending per trip decreased by 9.5% from 2019, indicating lingering consumer caution. Also, new home prices in 70 cities fell 0.3% sequentially in January, marking the seventh monthly contraction, according to the statistics bureau.

On Thursday, Turkey’s central bank maintained its key interest rate at 45.0%, in line with expectations. The bank’s post-meeting statement was hawkish, indicating a commitment to tighten monetary policy if inflation worsens significantly and persistently. This could also mean the bank is shifting its focus to rebuilding its foreign exchange reserves and looking at a possible appreciation in the Lyra an inflation-fighting tool.

In Mexico, the headline inflation rate fell to 4.5% year-over-year from the previous 4.9%, while core inflation decreased to 4.6% year-over-year from the previous 4.8%. These has led to anticipations of sooner than expected interest rate cuts.

FX and Commodities

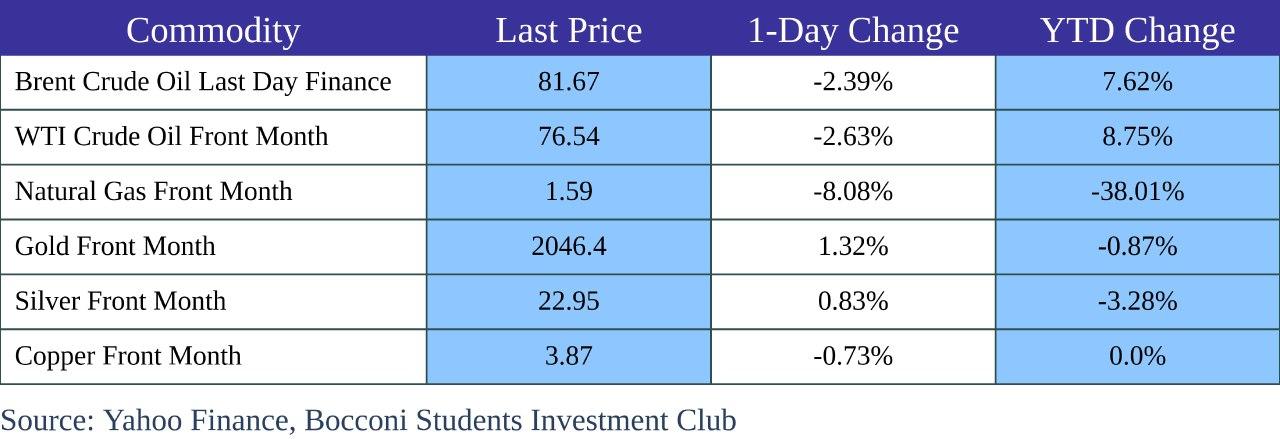

Oil prices remained relatively calm with Brent and WTI only down 3.4% and 3.3% for the week, after a relative pause in Houti’s activity in the Red Sea. However, the January decision of shipping conglomerates Maersk and Hapag-Lloyd to divert all shipping away from the Suez channel was further reiterated on Friday, when Diana shipping too decided to stop all its routes passing through the red sea. The week ahead is likely to add additional pressure for oil given the intensification of Houti attacks, which hit an oil tanker this Saturday.

Natural gas finished this week unchanged but down 38% for the year, following high production levels as a result of high shale activity, consistently mild weather, and reduced heating demand which pushed current inventories 22% above average for this time of year. Also, current market trends and the continued selling of futures contracts indicate a widespread belief that the winter peak demand season has passed.

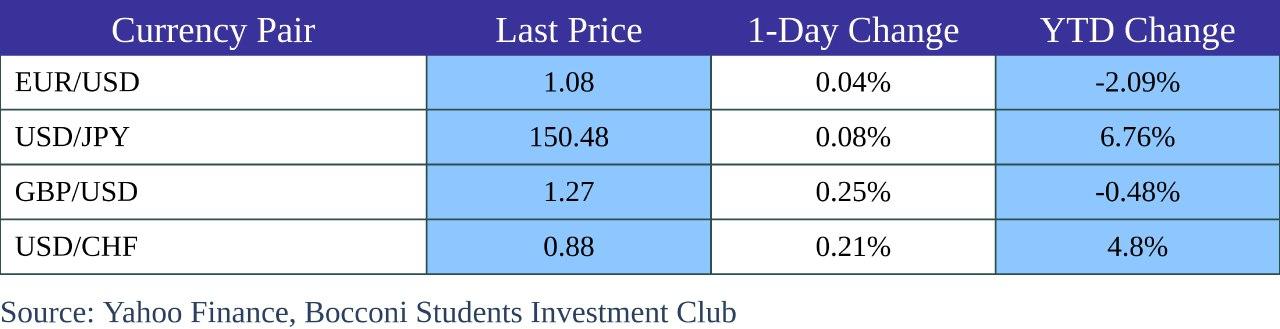

In the currency markets, the US Dollar index was 0.3% down, in line with changing expectations regarding the timing of the FED rate cuts, with fed funds futures implying a 52% probability of a 25 bp cut in June. In contrast, Gold From month futures ended the week up more than 1%. Also, the Japanese Yen continued depreciating against the dollar and finished the week above 150 as investors wait for signs that BofJ will start raising rates, so we will watch closely the upcoming Core CPI reading this Tuesday.

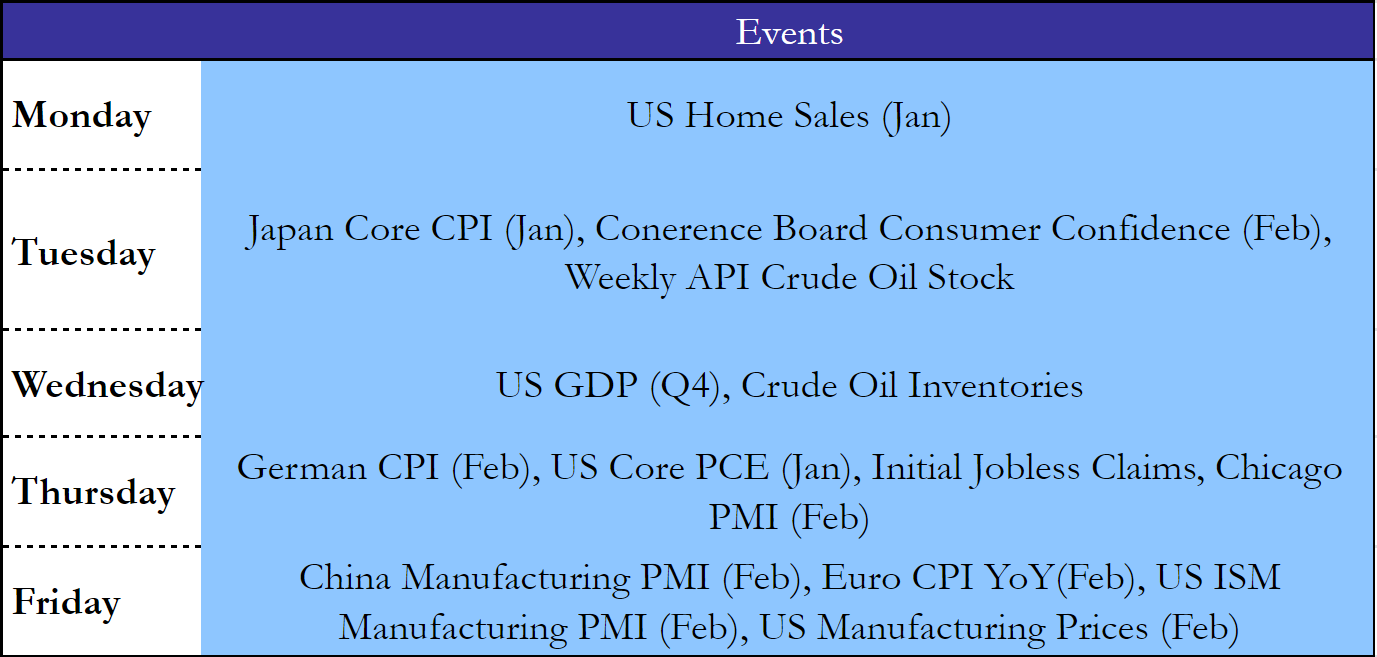

Next Week Main Events

Source: TradingEconomics, Bocconi Students Investment Club

Brain Teaser #10

We are given 4 numbers, denoted a, b, c, d, which can be multiplied in 6 different ways – a*b, a*c, a*d, b*c, b*d, c*d. The results of five of these products are know (though not which product corresponds to which) and are: 2, 3, 4, 5, 6.

What is the sixth product?

SOLUTION

Consider the quantity a*b*c*d, we can obtain it using 3 pairs of products that together employ all the different ways of multiplying a, b, c, d. Indeed (a*b)*(c*d) = (a*c)*(b*d) = (a*d)*(b*c) = a*b*c*d.

Assume (without loss of generality) that a*b was the unknown product, then (a*c)*(b*d) and (a*d)*(b*c) are multiplications of 2 known values and moreover they are equal. From our list of possible values {2, 3, 4, 5, 6} we just have to find 4 numbers such that the product of 2 numbers is equal to the product of the remaining 2. In this case it’s easy to notice that 6*2 = 3*4 = 12. This must mean that a*b*c*d = 12, but now we can find the value of a*b: since all the other values have been used up this implies that (c*d) = 5 and since (a*b)*(c*d) = 12 then a*b = 2.4. Thus the sixth product is 2.4.

Brain Teaser #11

You have a large jar containing 999 fair pennies and one two-headed penny. Suppose you pick one coin out of the jar and flip it 10 times and get all heads. What is the probability that the coin you chose is the two-headed one?

Source: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

0 Comments