Geopolitical Context

The currently ongoing Red Sea Crisis, initiated as a reaction by the Houthi movement to the Israel-Palestine war, has greatly exacerbated Egypt’s ongoing political and economic turmoil. Most commercial shipping firms have announced their withdrawal from the Suez Canal. As recently as this week, the Houthis launched missiles aboard a commercial shipping vessel navigating in the Gulf of Aden, killing at least three sailors aboard. According to the IMF, the Suez Canal, one of the main sources of foreign currency for the Egyptian government, has seen a 55% YoY reduction in shipping volumes as of February 13th.

On the geopolitical front, Egypt is surrounded by 3 conflicts: the wars in Libya in the west, the war in Sudan in the South and the Israel-Palestine war in the North. The key consequence has been that Egypt faces the most severe refugee crisis of the past years. In Gaza, over 1.4 million displaced Palestinians are currently taking shelter in the city of Rafah, which sits at the border with the Sinai region; as Israeli forces prepare their ground offensive of the city, fears arise that the civilian population will be forced to flee to the Sinai region. While in Sudan since the start of the civil war in April between Sudan Armed Forces and Rapid Support Forces over 450,000 Sudanese have sought safety by crossing the border into Egypt. The refugee crisis has already begun taking a toll on Egypt’s already weakened economy and is forecasted to worsen as the conflicts continue raging on.

Somewhat surprisingly this weaker position Egypt finds itself in has made it easier to obtain investments from foreign entities, as many of the main actors in the Gulf area fear that an economic collapse could bring about worse consequences than even those witnessed during the Arab Spring of 2011. Over the past few years Saudi Arabia, the UAE and Qatar have bankrolled Egypt, providing much needed foreign currency to the Central Bank through loans, deposits, and investments. Most recently a deal was struck with the UAE regarding a record $35 billion investment. Representing the largest investment in Egypt’s history, the money is expected to be deployed in the next two months and will go towards the development of Ras al-Hekma into a touristic and financial center.

Macroeconomic Context

Egypt’s economy is now facing several problems. An increase in national debt, a devaluation of the Egyptian pound, the crisis in the Red Sea, and a struggling tourism sector are the main factors contributing to worsening the economic outlook for Egypt, which is experiencing its worst crisis since the Arab Spring in 2011. The rising tensions in the Red Sea, with Houthi missiles targeting Israeli containers, pile on top of an already precarious macro scenario for Egypt: since the Russian invasion of Ukraine, Egypt has suffered from a US $20 billion portfolio outflow and was forced to take out a 3-billion-dollar loan from the IMF in September 2022, which is set to increase to at least $6 billion. Government debt has now reached 90% of GDP, with 29 billion dollars alone in interest payments due this year. The trade volume in the Suez Canal (which alone contributes to 30% of global container trade) has dropped 80% as many containers are rerouting toward the Cape of Good Hope. This has had significant effects on Egypt’s economy, both fiscal and on exports: transit across the Suez Canal is controlled by the Egyptian government via the Suez Canal Authority (SCA), and a decline in traffic poses a serious threat to the country’s export and tax revenue. President al-Sisi stated on the 19th of February that the revenues coming from the canal had dropped 40 to 50%, a catastrophic hit to the government’s finances. To put into perspective, the fees the SCA collected in the 12 months up to June ‘23 alone amounted to $9.4 billion.

Furthermore, the tensions in the Red Sea are contributing to maintaining inflationary pressures, with inflation standing at 29.7%, well above the CBE target rate of 5-9%. Inflationary pressures also heightened due to the 50%-add-on to minimum wage announced in February, which is likely to push prices even higher. To maintain inflation under control the CBE has extended its tightening cycle, raising the overnight deposit rate to 21.75%, the overnight lending rate to 22.25%, and the main operations rate to 21.75%. It is interesting to note how the Egyptian government bonds yield curve has flattened significantly, with the 1-2-5-10-year yields on government bonds enclosed in a 0.715 % bracket, which indicates the lack of faith investors place in the economy’s potential to recover soon. The yields on said bonds have more than doubled over the last two years, led by the 1-year yield that has hiked from 14.341% to 29.449%.

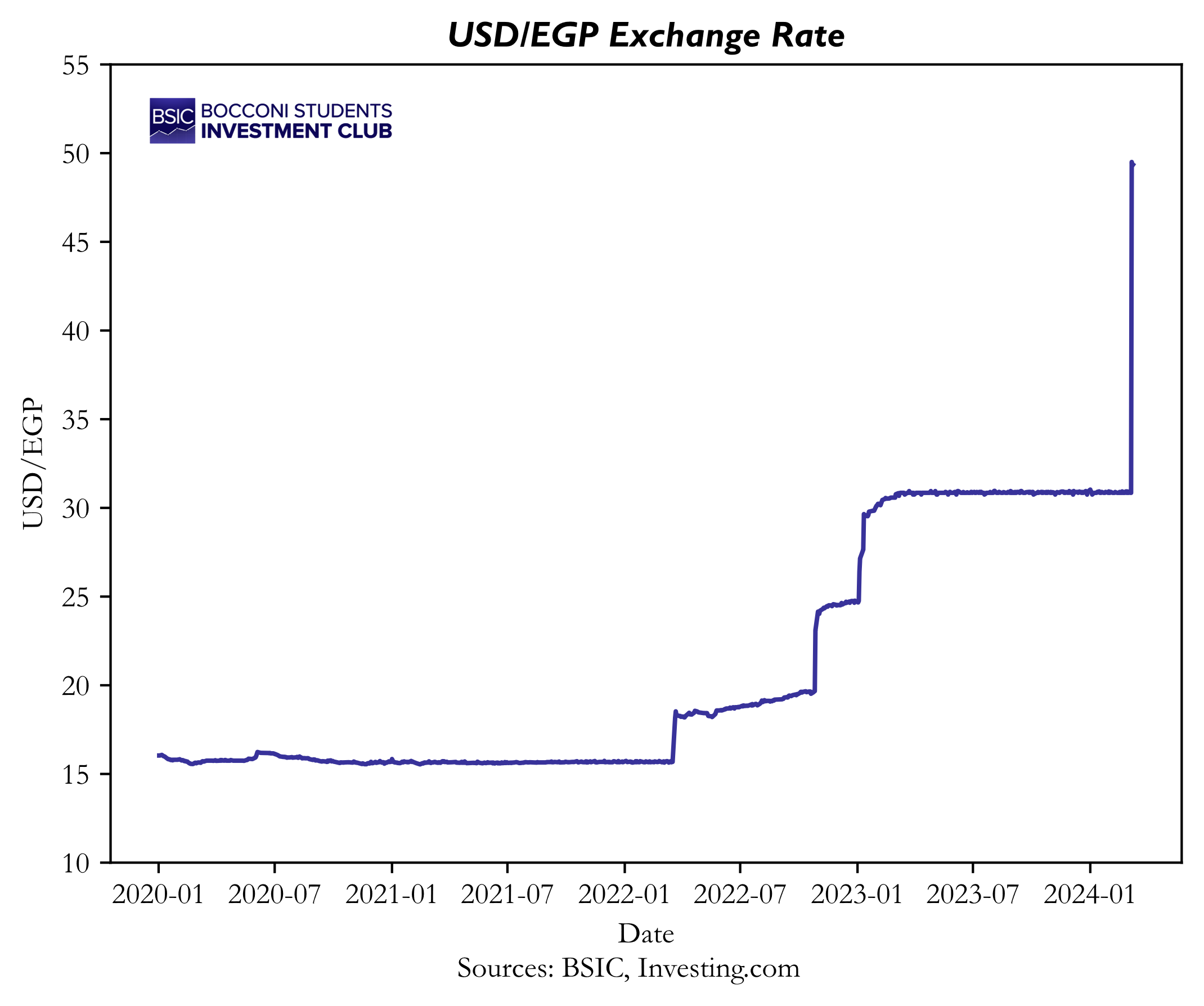

Another significant problem tied to the disruptions in the Red Sea is the difficulty for Egypt to source foreign currency. The Egyptian pound has been devalued three times since 2022, in an effort to shrink trade deficit, and is now worth half of its original value. It is now trading at 49.05 pounds for the dollar (US) but is trading at almost twice that on the black market. The war in Gaza has also provoked a collapse of the tourism sector, which last year represented 14% of the country’s total dollar inflows. Egypt is now facing difficulties sourcing hard currencies to pay for commodities such as tin, lead, wheat, oats and eggs, prices of which have spiked, and foreign investors are becoming more and more reluctant to pour capital into the country as fears of further devaluations increase. To tackle the shortage of foreign currency, Egypt turned to foreign investments, negotiating the above mentioned $35 billion investment package with the UAE. This investment provides short-term relief for the country whilst also being a pivotal step to advance negotiations with the IMF for a loan package expected to exceed $10 billion. The falling pound also means that the country is now using 15% of GDP just to service its debt, which has risen drastically in the past years due to infrastructural mega-projects commissioned by President al-Sisi. These projects have significantly widened Egypt’s deficit and have yet to break even. The most prominent example of said projects is the new capital al-Sisi envisioned, for which he has devoted $60 billion (15% of GDP), and is now empty.

Another significant problem tied to the disruptions in the Red Sea is the difficulty for Egypt to source foreign currency. The Egyptian pound has been devalued three times since 2022, in an effort to shrink trade deficit, and is now worth half of its original value. It is now trading at 49.05 pounds for the dollar (US) but is trading at almost twice that on the black market. The war in Gaza has also provoked a collapse of the tourism sector, which last year represented 14% of the country’s total dollar inflows. Egypt is now facing difficulties sourcing hard currencies to pay for commodities such as tin, lead, wheat, oats and eggs, prices of which have spiked, and foreign investors are becoming more and more reluctant to pour capital into the country as fears of further devaluations increase. To tackle the shortage of foreign currency, Egypt turned to foreign investments, negotiating the above mentioned $35 billion investment package with the UAE. This investment provides short-term relief for the country whilst also being a pivotal step to advance negotiations with the IMF for a loan package expected to exceed $10 billion. The falling pound also means that the country is now using 15% of GDP just to service its debt, which has risen drastically in the past years due to infrastructural mega-projects commissioned by President al-Sisi. These projects have significantly widened Egypt’s deficit and have yet to break even. The most prominent example of said projects is the new capital al-Sisi envisioned, for which he has devoted $60 billion (15% of GDP), and is now empty.

Currency Crisis

Although Egypt CB is expected to receive a $6bn inflow of reserve through the deal reached with UAE, foreign reserves remain scarce. In our expected scenario, the Suez Canal crisis maintains itself through H2 2024 and the currency devaluation we witnessed this week (30 to 50.1 pounds per USD) doesn’t facilitate Egypt’s status quo. However, in the medium term, this devaluation can be seen as a major step towards accessing the IMF’s $8bn loan. Indeed, this move, alongside lifting some capital controls, paves the way for Egypt to pursue negotiations with the IMF (floating Egyptian pound was a precondition for the loan). Although this has positive implications for the medium term, we expect the short-term situation to significantly deteriorate. The devaluation alongside the foreign currency shortage will have key implications for imports.

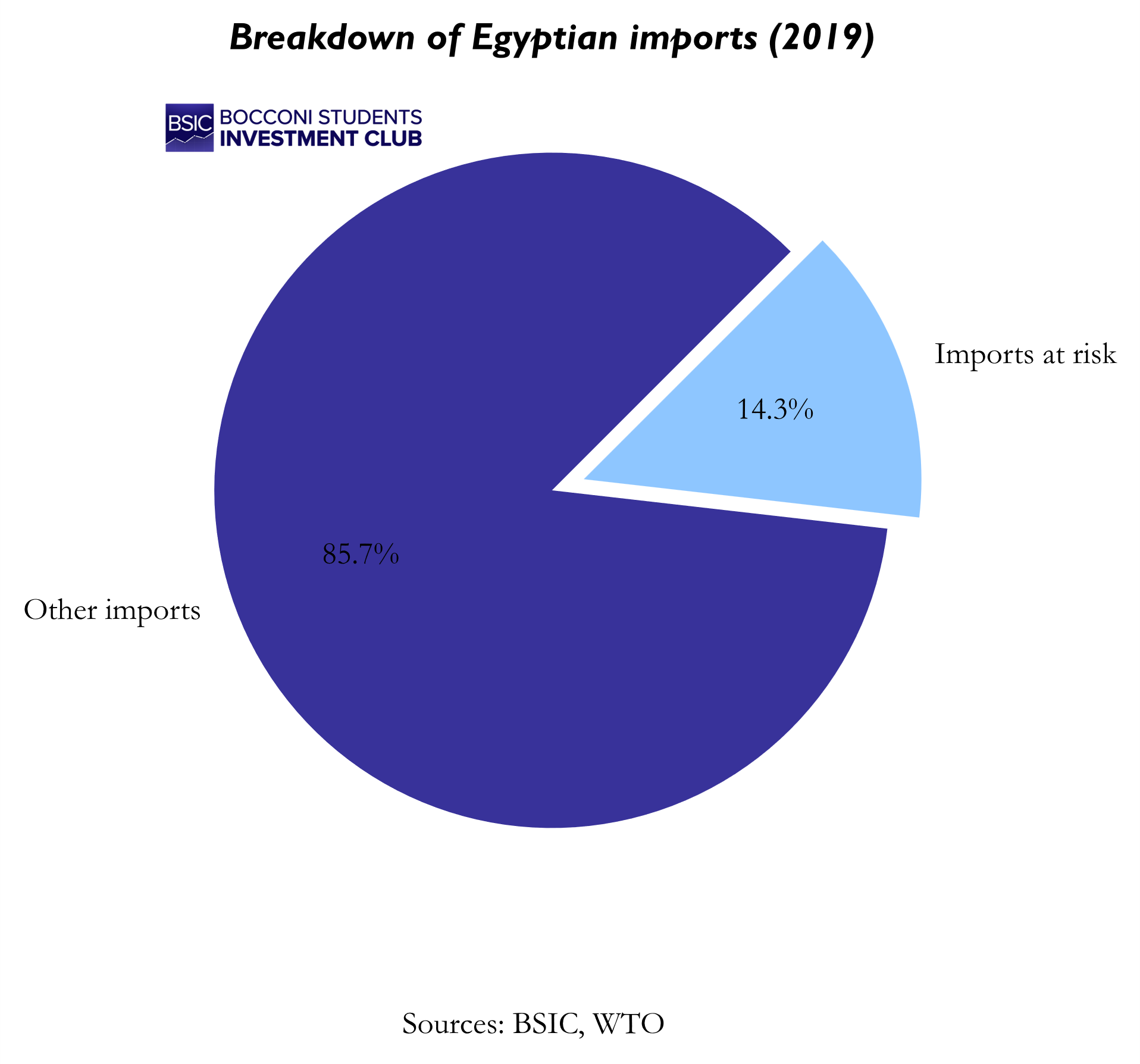

From our analysis of all of Egypt’s import components in 2019 (similar structure to 2023), Oil and mineral fuels from Saudi Arabia and Kuwait seem the main imports (in value), representing 7.06% of Egypt’s overall imports. As seen through the UAE financing recently announced and discussed previously, countries of the MEA region have strong interests to maintain economic stability in the region. This implies making sure that the region’s most populous country doesn’t default on its foreign debt nor lacks vital energy supply. Therefore, in the medium term, we exclude the possibility of oil and gas delivery interruption from its neighbor partners.

Moving forward, a potential issue could arise with two main product categories: cereals and electric machinery. They both represent Egypt’s most important imports (by value, 2019) after oil. The overall low level of foreign reserves (~$35bn in Feb. 2024) combined with a drastic reduction in inflows due to the Suez Canal Crisis ($10.25 bn of foreign income in 2023) will affect Egypt’s ability to import such goods. Furthermore, the devaluation of its currency will further impede its ability to purchase foreign goods. We are therefore expecting some import restrictions to be announced in the coming months, with some sectors more severely impacted.

Trade Pitch

To translate our views of the current situation, we have decided to initiate a short of a basket of shares that have important exposure to such imports. Although we agree that the medium-term economic situation looks more promising with both the expected resumption of activity in the Suez Canal and the release of the IMF loan, we still believe that there is a short-term foreign currency risk. The trade pitch has therefore a maturity of one month.

To translate our views of the current situation, we have decided to initiate a short of a basket of shares that have important exposure to such imports. Although we agree that the medium-term economic situation looks more promising with both the expected resumption of activity in the Suez Canal and the release of the IMF loan, we still believe that there is a short-term foreign currency risk. The trade pitch has therefore a maturity of one month.

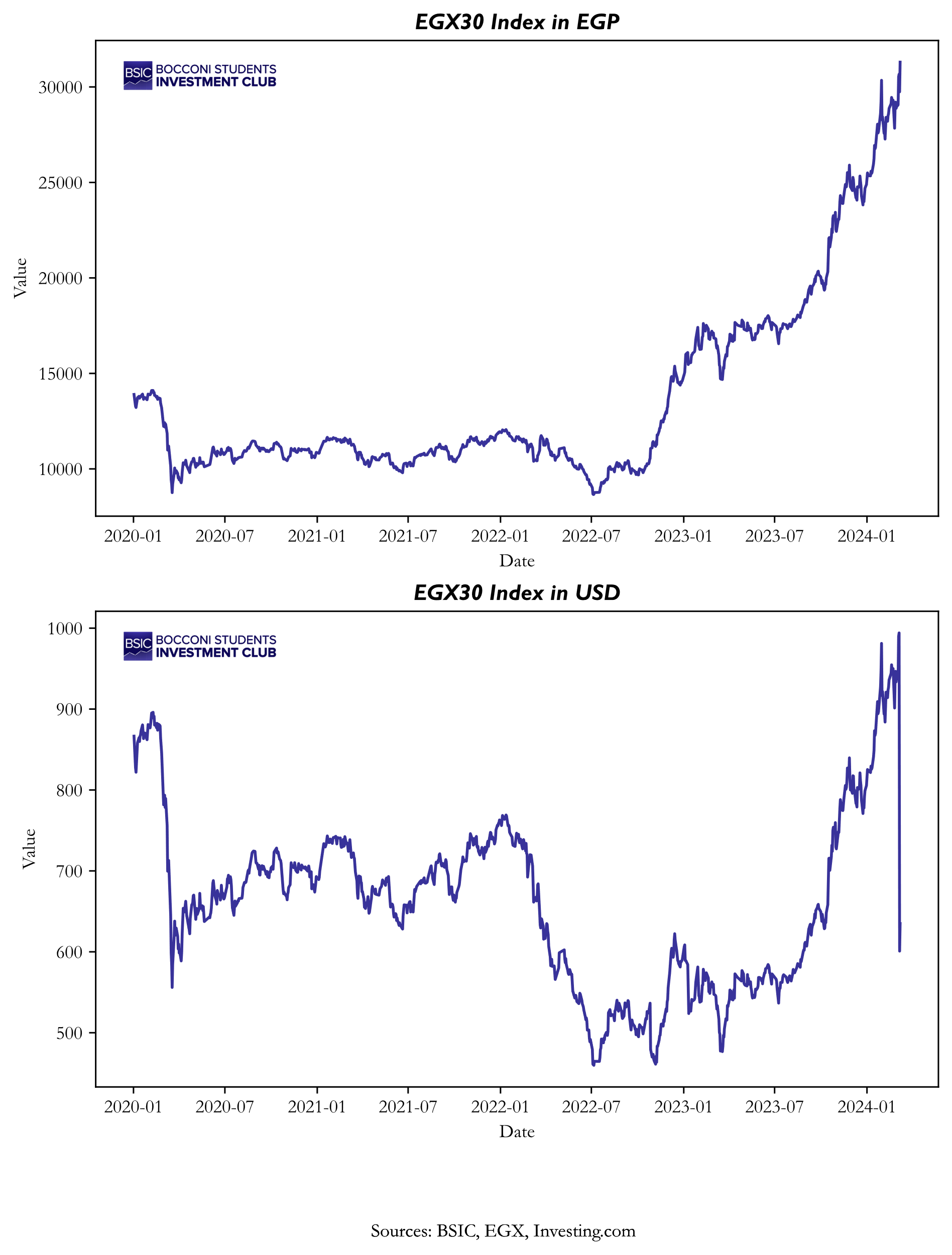

A brief overview of the country’s main equity index (EGX 30) reveals it is now at an all-time high, expressed in local currency. In dollar terms, the index is far from performing as well, 20% below its historic peak. The recent devaluation fears have not prevented the market from recording a 24% gain YTD. We however believe that some of its components are overpriced.

Two of the main sectors that will be the most impacted will be the grains and telecom sectors. Selecting companies in the EGX 100 (for liquidity purpose and to reduce shorting costs), we have identified 8 firms that will be severely impacted by Egypt’s foreign currency scarcity.

For the telecom sector it represents 8.75% of total import value in 2019, 50,6% of the broadcasting equipment imported comes from China and it includes transmission apparatus for radiobroadcasting or television, television cameras, digital cameras, and video camera recorders.

Regarding the grains sector, Egypt’s exposure to cereal imports is $4.7 billion for a total of 5.96% in 2019. The companies included in our trade are all involved in the processing, packaging, storing, and distributing grains. Three of the companies are controlled by the “Holding Company for Food Industries”, one of Egypt’s biggest players in the domestic food industry which also holds the highest exposure to fluctuations in grain import prices.

| Company Name | Ticker | Price (09-03-2024) |

| Middle Egypt Flour Mills | CEFM.CA | 55,80 |

| North Cairo Flour Mills | MILS.CA | 39,74 |

| South Cairo & Giza Mills & Bakeries | SCFM.CA | 39,81 |

| Juhayna Food Industries | JUFO.CA | 18,50 |

| Egyptian Satellites (NileSat) | EGSA.CA | 7,00 |

| Global Telecom Holding | GTHE.CA | 1,78 |

| Egypt-South Africa For Communication | ESAC.CA | 0,15 |

| Telecom Egypt | ETEL.CA | 37,82 |

| Source: BSIC, Reuters, Investing.com | ||

The most important risk to this trade is the release of the ~$10 billion loan from the IMF, which would pull Egypt out of its currency crisis, leaving imports unaffected. A mitigant however remains the uncertainty surrounding the release of the loan, as the initial agreement was signed in December 2022, with concerns related to Egypt’s capital controls at stake.

References

[1] “The war in Gaza is exacerbating Egypt’s economic collapse”, The Economist

[2] “How Israel’s war on Gaza is bleeding Egypt’s economy”, Aljazeera

[3] “Red Sea Disruption, Market Dislocations”, Morgan Stanley Research

[4] “2024 Petroleum Outlook Update”, MacroVoices #412

[5] “Abu Dhabi steps in to ease Egypt’s currency crisis with $35bn investment”, Financial Times

[6] “Egypt secures $8bn IMF deal after removing currency controls”, Financial Times

[7] “Egypt Grapples With Worsening Currency Shortage”, Bloomberg

0 Comments