USA

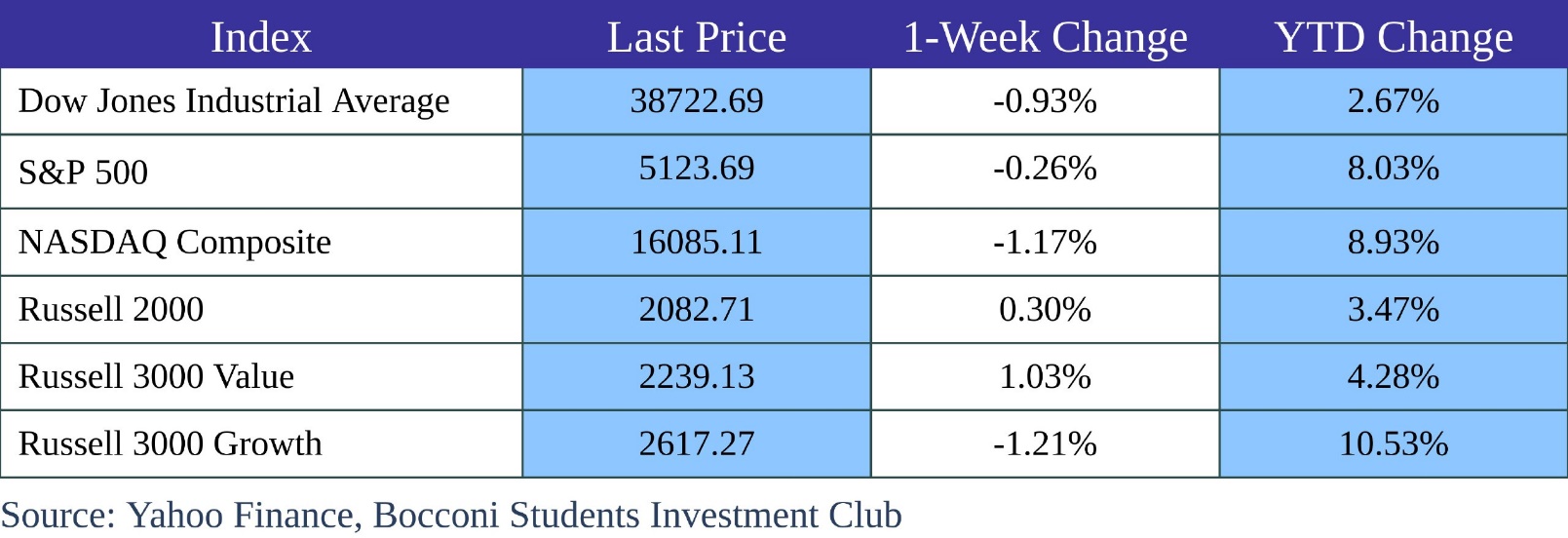

This has been a pretty volatile week for the US market. As in the past, this rally was majorly led by the tech sector. On Monday the S&P 500 reached a new all-time high of 5147 points but still closed the session in red with Apple losing 2.5% after the European Commission imposed a fine on the company for over $1.8bn. The volatile session finished on Friday with Nvidia’s share falling by 5.4% causing the Nasdaq 100 and the S&P 500 to dip respectively by 1.5% and 0.6%. The Dow Jones also incurred losses in the past week but a 1% rebound in shares of Apple limited the losses of the blue-chip index.

The data released on Thursday showed that ISM Services PMI fell to 52.6 on February 2024 after a four-month high of 53.4 in January and below forecasts of 53. This pointed to a slightly lower growth in the services sector. Other important news came from Fed Chair Powell’s testimony who said it was likely to be appropriate to begin lowering policy restraint at some point this year. However, he also pointed out that the economic data is uncertain and the ongoing process toward the 2% inflation target is not assured.

On Friday, the Non-Farm Payrolls data for February showed that the US economy added 275k jobs this month, beating forecasts of 200k. Job gains occurred mostly in healthcare (68k), care services (28k), hospitals (28k) and government (52k). Employment also increased in construction (23k) but changed little in other major industries, including manufacturing.

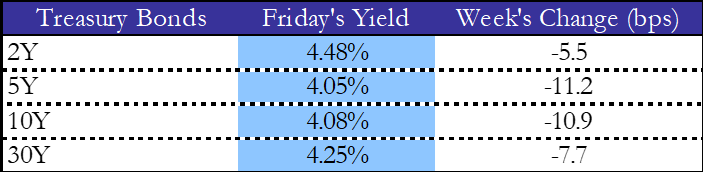

US Treasury yields fell marking a one-month low after a drop in interest rate expectations led by the latest job reports, which reinforced the idea that interest rate cuts might be imminent. Still, Chair Powell told Congress that the Fed needs to become more confident that inflation is moving sustainably at 2% before starting to cut the rates.

The 10-year Treasury note dropped by more than 10 bps as for the 5-year note, recording one of the biggest weekly declines of 2024.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Source: worldgovernmentbonds, Bocconi Students Investment Club

Europe and UK

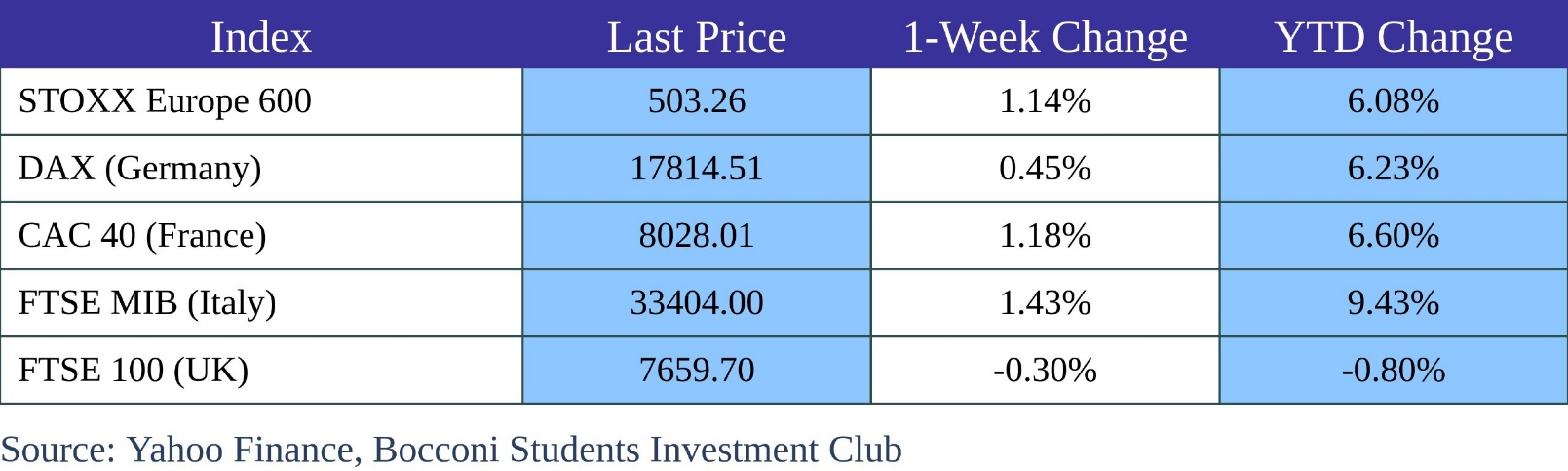

This week STOXX Europe 600 reached a record high of 503 points and booked its seventh consecutive weekly gain after the good news from the US jobs reports and expectation of rate cuts in 2024. The FTSE MIB had the best overall performance recording a 1.43% positive 1-week change getting around levels not seen since 2008. It was a good week also for the CAC 40 with a renewed record high of 8028 points on Friday. The Frankfurt DAX performed a bit worse than the other but still marked its fifth consecutive week of gain after the country’s jobless rate unexpectedly rose to a two-year high of 3.9%.

Of course, the past week was signed by the ECB interest rate decision that came out on Thursday. The ECB confirmed expectations by maintaining its rates at historically high levels, as policymakers balanced concerns over a persistently elevated underlying inflationary pressure. They also revised the growth projection for 2024 downward to 0.6% and inflation expectation to average 2.3% in 2024.

In the UK, the FTSE 100 closed the Friday session at 7660 points halting a three-day consecutive of gains, with a -0.30% 1-week change. Among the top losers were Entain (-5.4%), Melrose (-2.4%), and Rentokil (-2.4%) after realizing trading updates on Thursday.

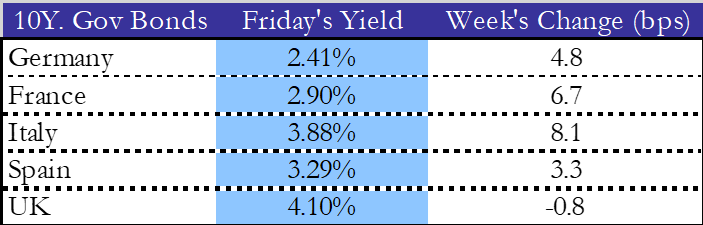

All Eurozone 10-year government bonds fell back after speculations that the Federal Reserve could start rate cuts in June and ECB downwardly revised inflation forecasts. Yields touched their lowest level since the beginning of February while good news came from Italy with the spread between the Italian and German 10-year yields that stands at approximately 130 points, the lowest data since November 2021.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

For the first time since August, China’s consumer inflation rose by 0.7%, above market forecasts of 0.3%. Food prices decreased the least in 8 months and food inflation sharply accelerated to 1.1% from the prior 0.4%, but still, the core CPI increased by 1.2% yoy in February, the most since January 2022. The Shanghai Composite registered another positive performance this week still boosted by enthusiasm over artificial intelligence. Domestically, investors continued to assess the economic outlooks in China after the government set a GDP target of around 5% during the National People’s Congress held this week.

The Nikkei 225 slightly rose on Friday recouping some losses from the previous session but still closed the week with a -0.56% 1-week change as a wave of profit-taking hit the market after the index reached all-time highs earlier this week. To lead the charge were again Technology stocks that as for China, benefited from enthusiasm over artificial intelligence.

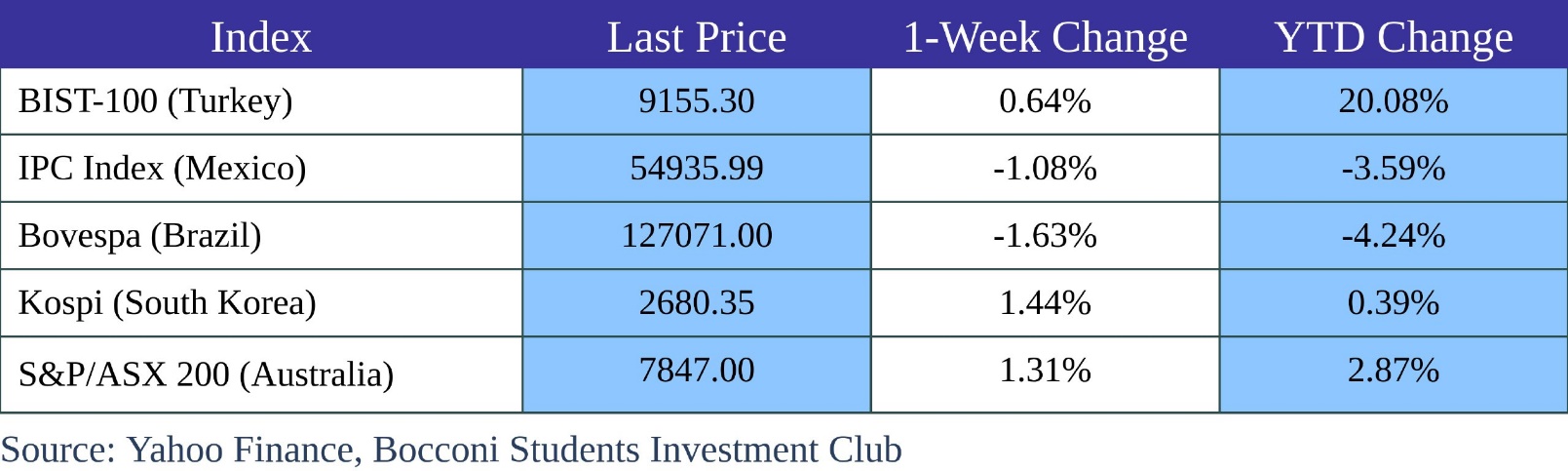

Other global markets across the world showed mixed results. Brazil’s Bovespa declined by 1.63% over the week after the state-owned oil giant Petrobras reported significant losses. On the other hand, S&P/ASX 200 jumped at 7847 points, scaling new record highs tracking a tech-led rally. Good performances also for the Korean Kospi with a positive 1.44% 1-week change. In Turkey the central bank, in line with market expectations, decided to keep interest rates high suggesting the possibility of tightening the policy even more if necessary. The BIST-100 responded with a slight growth but still below the levels reached in February.

FX and Commodities

The Japanese Yen strengthened itself in the past week climbing to its strongest level in a month after growing speculation that the BoJ could raise interest rates this month. The Yen also benefited from the decline in the Dollar after the communication by Fed Chair James Powell’s Testimony on Wednesday. On the other side of the Atlantic, both the British Pound and the EURO gained too from the weakness of the Dollar. Boosted by lower expected inflation for the year, the Euro reached its strongest point since mid-January, while the British Pound gained also from optimistic forecasts for the UK economy.

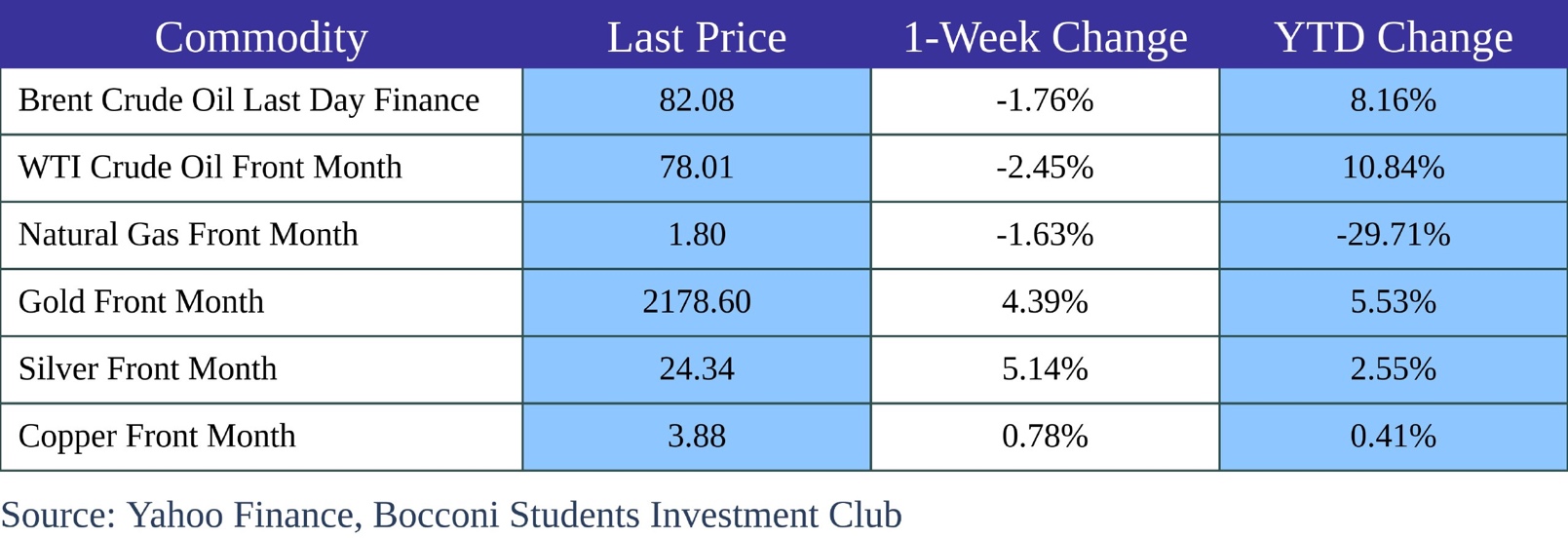

Oil prices fell this week after the market’s sentiment remained cautious about Chinese demand, despite the OPEC+ groups extending supply cuts. These concerns are due to the fall of Chinese oil imports by 5.7% in the first two months of 2024. On the other hand, Powell’s indication of potential rate cuts bolstered the outlook for global growth and energy demand.

After the good performances of last week, gold reached another all-time high on Friday after rising expectations of interest rate cuts for this year and a mixed report on employment in the US setting its value above $2170. Again, Silver also followed the good performances of gold reporting a 5.14% change over the week. Natural Gas confirmed its downward trend with a -1.63% 1-week change.

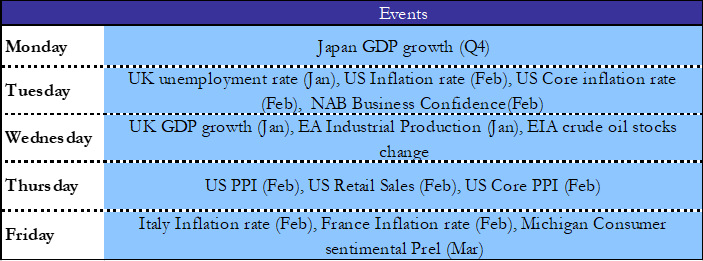

Next Week Main Events

Brain Teaser #13

Suppose that you roll a dice. For each roll, you are paid the face value. If a roll gives 4, 5, or 6 you can roll the dice again. Once you get I, 2, or 3, the game stops. What is the expected payoff of this game?

Source: A Practical Guide to Quantitative Finance Interviews

SOLUTION

Your payoff differs depending on the outcome of the first roll. Let E[X] be your expected payoff and Y be the outcome of your first throw. You have 1/2 chance to get Y belonging to {1, 2, 3}, and E[X|Y belongs to {1,2,3}] = 2; you have 1/2 chance to get Y belonging to {4, 5, 6}, in which case you get expected face value 5 and an extra throw. The extra throw(s) essentially means you start the game again and have an extra expected value E[X]. So we have E[X| Y belongs to {4,5,6}] = 5 + E[X]. Apply the law of total expectation, we have E[X] = E[E[X|Y]] = 1 + 0.5*(5+ E[X]). So E[X] = 7.

Brain Teaser #14

Mary learns that John’s sister has three children. “How old are the children?” asks Mary. “Well,” replies John, “the product of their ages is 36.” Mary thinks for a while and says, “I need more information.” “Hmmm, the sum of their ages is the same as this figure right here,” says John pointing at the spreadsheet. “Still not enough information,” says Mary after thinking for a minute. “The eldest is dyslexic,” says John. How old are the children?

Source: Heard on the Street: Quantitative Questions from Wall Street Job Interviews

0 Comments