Introduction

The Japanese economy was a peculiar case in the last 50 years. From growing its GDP at 7% a year in the post-war boom period, after the 1990’s bubble, it sunk into a disastrous vicious cycle, made of negative growth, deflation, credit crunch, liquidity trap and a prolonged stagnation that remains unprecedented in the modern era for a developed country. In this article, we analyze the roots of this economic disaster, trying to understand whether the positive changes that we are witnessing today are structural and sustainable. Moreover, towards the end of the article, we take a closer look at the recent equity market rally, concluding with our outlook.

The roots of Japan’s economic failure

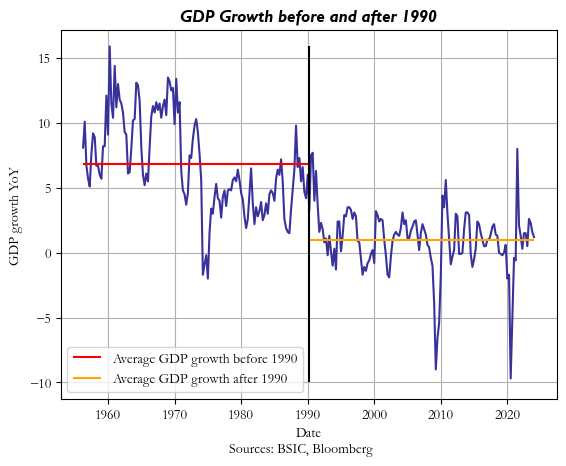

Japan’s economy saw tremendous growth in the post-war period, with a staggering 7% average GDP growth between 1957 and 1990 and the largest Gross National Product (GNP) per capita in the world in the 80s. This period, also known as the bubble period, was fuelled by a surge in private credit targeting the corporate sector and by speculations that drove land prices and equities to an all-time high. In particular, equities endured an enormous surge due to the Plaza Accord in 1985 and the following loose monetary policies.

However, both bubbles burst in the 90s, marking the beginning of what is now remembered as the “Lost Decade”, a twelve-year period spanning from 1991 to 2003, in which Japan suffered from stagnation, deflation, and extremely low interest rates. During this period GDP growth reduced to less than a third of the prior decade, to a mere 1.14%. Such a trend persisted in the following decades as well, exacerbated by the global financial crisis (2008), the Tohoku earthquake, which provoked the Fukushima nuclear disaster (2011) and the tax hike in 2014.

Labour productivity also slowed considerably, in comparison both to the earlier decades but also to other developed world countries. The two main factors contributing to weak GDP growth were a sharp decrease in both government and private fixed investment, and particularly the latter, which can be attributed to a credit crunch and an increase in systemic risk (both caused by the decline in asset prices after the bubbles).

Another consequence of Japan’s economic failure was represented by the stagnation of household consumption, induced primarily by the reduction of disposable income and a reduction in household wealth. As more and more people grew older, the percentage of the population casting concerns about public pensions increased from 55.5% in 1992 to 72.2% in 2003, and given the deflationary environment, households tended to sit on cash, therefore leading to further stagnation of consumption. However, an interesting and ambiguous trend highlights that the household savings rate during this period didn’t rise, but instead significantly declined, from 15.1% in 1991 to 6.4% in 2002.

Whilst Japan’s problems indeed originated from the bubbles bursting, there is a widespread consensus amongst economists that the government and the BoJ played an important role in worsening the crisis. In the early 90s, shortly after the bubbles burst, the BoJ aggressively cut nominal interest rates, in an effort to spur economic growth, mistaking the economic collapse for a simply cyclical downturn, and overlooking the real causes of the crisis. One element the BoJ failed to consider is that in times of economic uncertainty and deflation, both unemployment and real wages may rise; the first leads to a fall in aggregate demand whilst the latter disincentivizes workers from demanding higher nominal wages and causing prices to fall even more. Central banks typically tackle this issue by lowering the nominal interest to keep the real interest low. However, the BoJ had already cut interest rates and had no more margin to lower them any further. This meant that the deflation caught up into a spiral and the real interest rate remained high, effectively constraining economic growth. By the time any other response could be implemented, the economy had already caught up in a liquidity trap.

Once it became clear that monetary policy was insufficient to address the economic downturn, policymakers turned to fiscal policies. During the 90s Japan introduced various fiscal stimulus packages, but they didn’t produce the desired effect. The packages were mainly made up of public investments, support for the private sector and tax cuts. More than 40% of Japan’s stimulus was directed to public investments, particularly in infrastructure projects. The private sector didn’t respond well, especially because banks had vast balance sheet problems, due to their exposure to the real estate market, and induced a credit crunch, refraining from conceding loans to hold on to the cash. Banks started deleveraging as quickly as possible and this induced a balance sheet recession, which many have considered as the foundation of the country’s problems. The apex of the banking crisis came in 1997, when Hokkaido Takushoku Bank and Yamaichi Securities Co. Ltd. failed. In 1998 public funds began to flow in the banking sector and in the same year Nippon Credit Bank and Long-Term Credit Bank of Japan were nationalised, followed by Resona Bank and Ashikaga Bank in 2003.

Another problem was posed by the ineffectiveness of the tax cuts, which were often paired with declarations of future tax hikes, and created an environment of Ricardian equivalence, further dampening the already sluggish household spending.

Are these factors structurally changing?

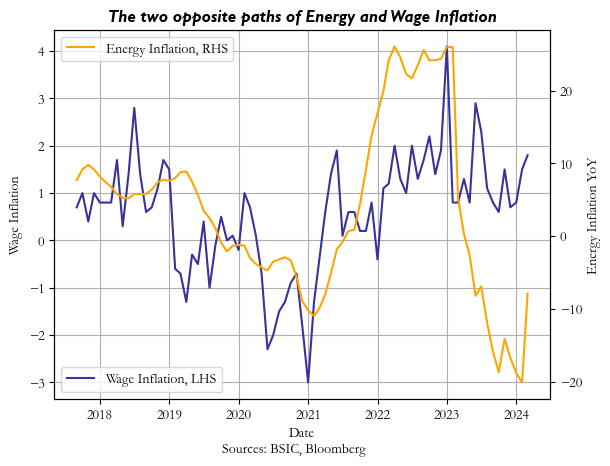

The first structural factor we must take into consideration when assessing Japan’s situation today is inflation, distinguishing between domestic and imported inflation. This distinction is very important as Ueda stated multiple times that the BoJ won’t necessarily intervene as long as inflation is due to temporary supply-chain distortions, given their transitory nature. Conversely, the Bank of Japan will take action when this inflation is structural and underpinned by core factors like wage growth. In this regard, while in 2022 Japan’s inflation was mainly due to higher energy prices globally, the latest CPI readings reveal that inflation is increasing in every one of its components, suggesting a shift from imported-transitory to domestic-structural inflation.

This indicates that firms are now willing to increase their prices, allowing for higher input costs, and, most importantly, higher wage costs to pass through. In particular, as of February 2024, the YoY Core Inflation Rate is up 0.8% and as of March 2024 the Tokyo CPI YoY is up 0.1%, mainly due to an acceleration in prices from goods inflation (+1.2%) and for culture and recreation (+0.5%).

Secondly, inflation expectations have substantially shifted. In the past decades, Japanese wage growth and CPI hovered near 0%, and over time, this led inflation expectations to be at the same constant levels. This meant that firms couldn’t afford to increase prices without making national news, therefore making it almost impossible to increase wages, and generating even more deflation. On the contrary, this year we have witnessed the county’s largest firms agree to an average wage increase of 5.3%, the largest since 1991. This follows last spring’s negotiation where workers obtained a 3.6% raise. It would be premature to state that these two rounds of nominal wage increases constitute a trend, but, if combined with the CPI increase, they place Japan at a significant inflection point, one we haven’t witnessed for more than thirty years. In addition, people are now expecting further wage and price increases, which means that firms can now pass through their higher costs without having to fear a drop in demand. On the other hand, more than 70% of the Japanese workforce isn’t employed by large firms, where wage growth is harder to measure. Therefore, there aren’t many elements that justify that this cycle of wage and price increases will persist.

Demographics also play a pivotal role in the normalisation of Japan’s economy, and demographic trends have been a focal point of analysis. The decline in Japan’s population presents challenges for economic growth, as it leads to lower levels of investment and contributes to a decline in the natural equilibrium interest rate (r*). However, this demographic shift goes beyond investment dynamics. As Japan’s workforce ages, the savings rate tends to decline as well. In recent decades, Japan has experienced a significant increase in savings, contributing to a drop in the equilibrium interest rate. However, the growing number of older workers exiting the labour force is now leading to a decrease in savings, potentially pushing the long-run equilibrium interest rate higher. This adjustment could signal a structural normalisation for Japan’s economy, potentially alleviating constraints on monetary policy, and fostering a more balanced economic environment. Additionally, labour shortages resulting from demographic shifts can lead to upward pressure on wages, further consolidating demographic trends.

Moreover, the wealth effect also plays a crucial role in assessing Japan’s structural shifts. Over the past three decades, Japanese households have exhibited a reluctance to invest in the stock market, driven by factors such as lingering stigma from the losses of the 1990s and a preference for the perceived safety of cash and bank deposits. As a result, more than half of Japanese household savings remain in bank deposits and cash, indicating a lack of confidence in riskier assets. However, as recent years have seen rising price pressures, this has incentivized individuals to search for higher returns such as the stock market. This shift in investment behaviour suggests a potential normalisation in risk appetite among Japanese investors, which can contribute to a more dynamic and resilient economy. Additionally, the housing market’s growth, with new highs reached in late 2023, contributes to a positive wealth effect which stimulates consumption and drives economic activity.

Finally, corporate dynamics also provide insights into Japan’s structural changes. Firms have completed the process of deleveraging, signalling the end of the “balance sheet recession”. Since 2015, private credit as a percentage of GDP has increased, indicating that firms are optimistic about future prospects and are willing to expand their balance sheets. This renewed confidence suggests a potential shift towards a more investment-driven growth model, which is essential for Japan’s long-term economic sustainability and normalisation.

Currency and monetary policy implications

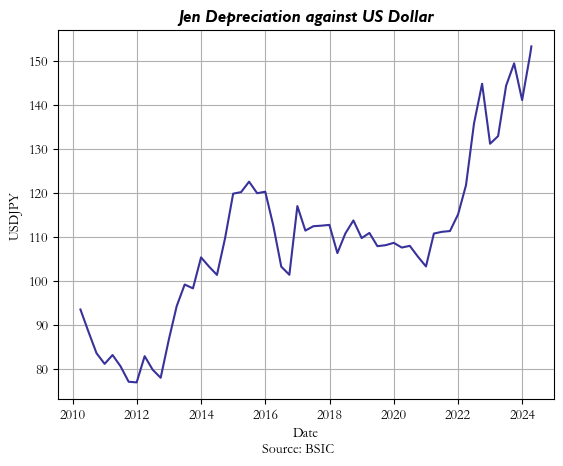

On March 19th, Kazuo Ueda, the BoJ’s governor decided to exit negative interest rate policy (NIRP), end yield curve control (YCC), and end ETF purchases. This was done in the light of the recent inflation surge in Japan. To give some context, the BoJ is Japan’s sovereign debt main purchaser, owning approximately 43% of the overall Japanese debt (standing today at 263% debt to GDP). After raising its interest rate to 0.1%, markets now do not expect another rate hike before the end of the year.

This is due mainly to two factors: inflation expectations and currency. Indeed, although inflation has spiked in recent years, the BoJ still believes that expectations have not yet reached the 2% target. Hiking too fast would break the positive cycle we have witnessed. The FX situation plays an important role as well. The USDJPY is at 30 year high, sitting at 153 at the time of writing, mostly due to the high interest rate differentials between the US and Japan. Today, the exchange rate’s main driver is the US monetary policy decision. As rate cuts in the US became more and more uncertain due to persistent inflation and a strong job market, the dollar strengthened. On one hand, currency depreciation stimulates inflation, making imports more expensive (as Japan has a trade deficit of 3.75% of GDP in 2022). On the other hand, this is also a political pressure point given its tendency to fuel inflation, hurting Japanese households in the short run. Both the prime minister and the ministry of finance have been very vocal about their determination to prevent a yen depreciation. However as seen in 2022 when they intervened to prop up the currency, these FX interventions don’t have a lasting effect. Undeniably, the differentials in interest rates relative to the rest of the world, as well as wider portfolio flows, will define JPY’s path ahead.

The implications of the shift in rate expectations in the US combined with the still relatively low-interest rate environment in Japan are numerous. One of them is keeping alive the popular carry trade strategy. This mechanically causes a further depreciation of the funding currency (the yen in this case) as investors sell the funding currency to buy a basket of higher-yielding currencies.

Overall, we believe that we can still expect in the medium run a depreciation of the yen relative to the US dollar and other G7 currencies. Whether the BoJ hikes or not its main borrowing rate, the spread between Japan and the US interest rate will tighten. One thing to look out for will be any unwinding of carry trade strategies, as this has a strong appreciating effect on the funding currency or a possible intervention by the Bank of Japan.

The Japanese stock market today

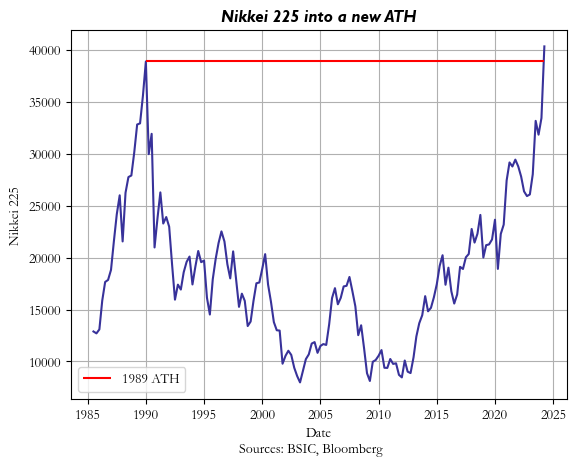

On February 22nd, the Nikkei 225 closed up 2.2% for the day, setting a new all-time high and surging past the precedent record of 38,915.87, set on December 29, 1989, unbeaten for almost 35 years. For an investor in US stocks, used to at least a 10% average annual return, this might sound unreal, but what is even more striking is that for more than a decade, from 2001 to 2013, the market return was negative and the price 75-80% pre-bubble highs. The music changed in 2013, thanks to a series of market-boosting measures known as “Abenomics” championed by the Prime Minister of that time Shinzo Abe. Since then, the Japanese equity market has returned an impressive 272%, slightly outperforming the S&P 500 (+267% since January 2013). The performance of the Japanese index is even more extreme in the last 12 months, up 42% vs 25% for the S&P 500.

This article has already discussed many of the reasons behind the rally, like the pick-up in inflation and growth, but another important contributing factor was the renewed interest in Japanese shares, both from Japanese people and foreigners. Domestically, fewer and fewer people still suffer the 90’s trauma, and, at least a fraction, of the colossal amount of savings held by Japanese families are now managed by the new generation, more eager to take risk exposure in the stock market, especially considering that positive rates and inflation are coming to erode the purchasing power of uninvested cash. On the other hand, foreign capital is really making a difference. The stretched valuations in the US stock market pushed many value investors (Warren Buffer is one of them) to move their capital away from the US to places like Japan, where multiples are more reasonable, and the currency has depreciated a lot. For context, even after the rally, the price-earnings ratio for the Nikkei 225 stands around 16, against 23 for the S&P 500. Moreover, many global investors have been pulling money away from China, which seems stuck in an economic meltdown and redirecting it to the Japanese equity market, where the economy is flourishing and the geopolitical situation easier.

Our outlook

Looking forward, we are bullish on the Japanese equity market as we believe there is a margin for the rally to continue, on the back of a structural shift to an inflationary economy. This is supported by the already mentioned wage hikes at large companies that are going to spur consumption and boost prices as well. Another contributing factor comes from governance reforms. From the start of 2024, the Government dramatically increased the size of the tax-protected investment scheme, the Nippon Individual Savings Account, to incentivize households’ investments in Japanese securities, while the Tokyo Stock Exchange has implemented a series of reforms to pressure companies to focus on shareholders’ returns.

Valuation-wise, despite both the Nikkei 225 and the Topik Index being close to all-time highs, Japanese stocks are still inexpensive, especially if compared with the US. To give some numbers, over one-third of Nikkei companies trade below book value, versus a mere 3% for the S&P 500. In terms of earnings, the 12-month forward ratio stands at 14.1, below the MSCI World Index’s 17.4 and the MSCI United States Index’s 20.1. The story is similar for dividends and cash flows. The comparison becomes even more striking if tackled in terms of risk premium, as the Japanese 10-year rate still trades below 1%, notwithstanding the end of the yield curve control.

Even so, there are several risks and possible headwinds that should be carefully analysed. The main uncertainty is whether the Japanese economy will embrace the desired wage-price virtuous cycle or if psychological and demographic factors will offset the progress made. In this regard, a risk to consider is that wage hikes may fail to be extended to small and medium corporations, which is where 70% of the Japanese labour force is concentrated. It is difficult to have reliable data on this dynamic, but a survey on small and medium-sized enterprises released by the Japan Chamber of Commerce and Industry revealed more than a third of companies are planning to increase wages by at least 3%. Another risk factor is constituted by the rising concentration of returns, as top-performing stocks (mainly large-cap and semiconductor-related equities) contributed to a larger share of index-level gains than in past rallies. Finally, foreign investors willing to buy Japanese stocks should carefully consider the currency situation. After the strong data on the US economy and the three in a row hotter than expected inflation prints, the policy rate differential between the two economies will likely remain elevated this year. This dynamic, excluding a direct intervention by the BoJ, might cause the yen to depreciate further, hurting the returns in hard currencies.

References

[1] Milburn, Robert A., “Japan’s Lost Decade: Escaping Liquidity Trap and Preventing Deflation”, 2010

[2] Akram, Tanweer, “Japan’s Liquidity Trap”, 2016

[3] Horioka, Charles Yuji, “The Causes of Japan’s ‘Lost Decade’: The Role of Household Consumption”, 2006

[4] Krugman, Paul R., “It’s Baaack: Japan’s Slump and the Return of the Liquidity Trap”, 1998

[5] Patterson Rebecca, “Making sense of a wrong-way bet on the yen”, 2024, Financial Times

[6] Harding, Robin, “The big test is yet to come for the Bank of Japan”, 2024, Financial Times

[7] Kurtenback, Elaine, “Japan’s Nikkei stock index breaks its 1989 record and surges to an all-time high”, 2024, Associated Press

[8] Inagaki, Kana, Lewis, Leo, “Is Japan finally becoming a ‘normal’ economy?”, 2024, Financial Times

[9] “Can the Nikkei’s record rally in Japanese stocks continue?”, 2024, Goldman Sachs Research

0 Comments