USA

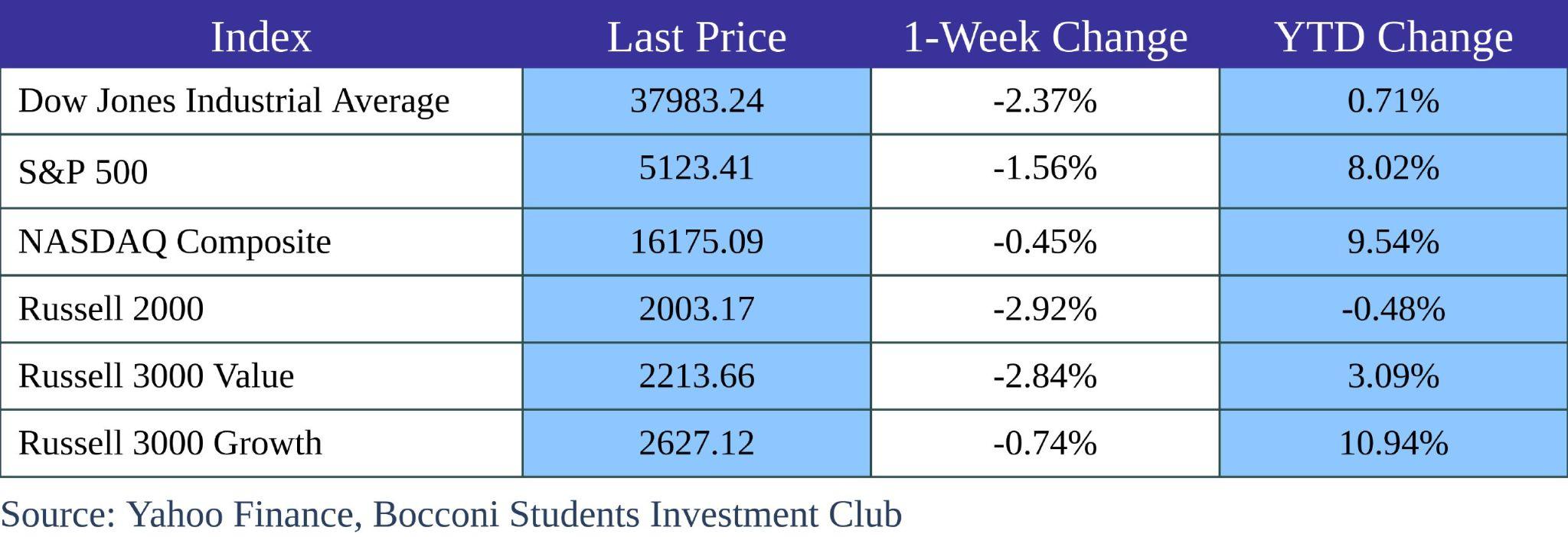

This week, U.S. financial markets faced mixed signals amid volatile inflation data and shifting expectations for Federal Reserve policy actions. The S&P 500 and the Dow Jones Industrial Average experienced fluctuations, closing down from their recent highs, reflecting investors’ reactions to economic indicators and central bank commentary.

Inflation in the U.S. surged unexpectedly, with the annual consumer price index (CPI) increasing to 3.5% in March, up from February’s 3.2% and surpassing economists’ forecasts of 3.4%. This rise was partly driven by significant increases in the cost of medical and transportation services, with car insurance costs notably contributing to the inflation spike.

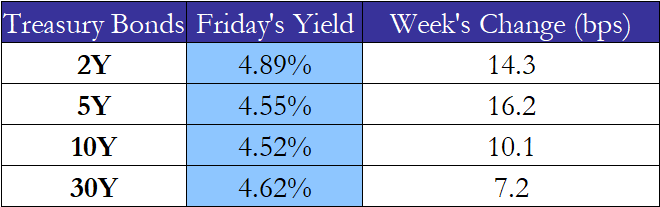

Supercore inflation, which excludes volatile items like energy and housing, also saw an unexpected rise, recording a 4.8% increase over the past 12 months—its highest in nearly a year. This has led to a recalibration of market expectations, with the probability of a Fed rate cut in June dropping dramatically from 56% to just 22%.

Despite these challenges, the stock market showed resilience towards the end of the week. While stocks dipped following the inflation report, the S&P 500 managed to close just 2.5% below its record high set late last month. This indicates that, while concerns persist, there remains underlying confidence in market fundamentals and future growth potential.

The bond market reacted sharply to these developments, with yields on two-year Treasury notes climbing over 20 basis points—the largest increase since the regional banking crisis in March 2023. High interest rates continue to pressure the real estate sector, notably dragging down indices related to housing and utilities, which are now significantly underperforming the broader market.

Source: worldgovernmentbonds, Bocconi Students Investment Club

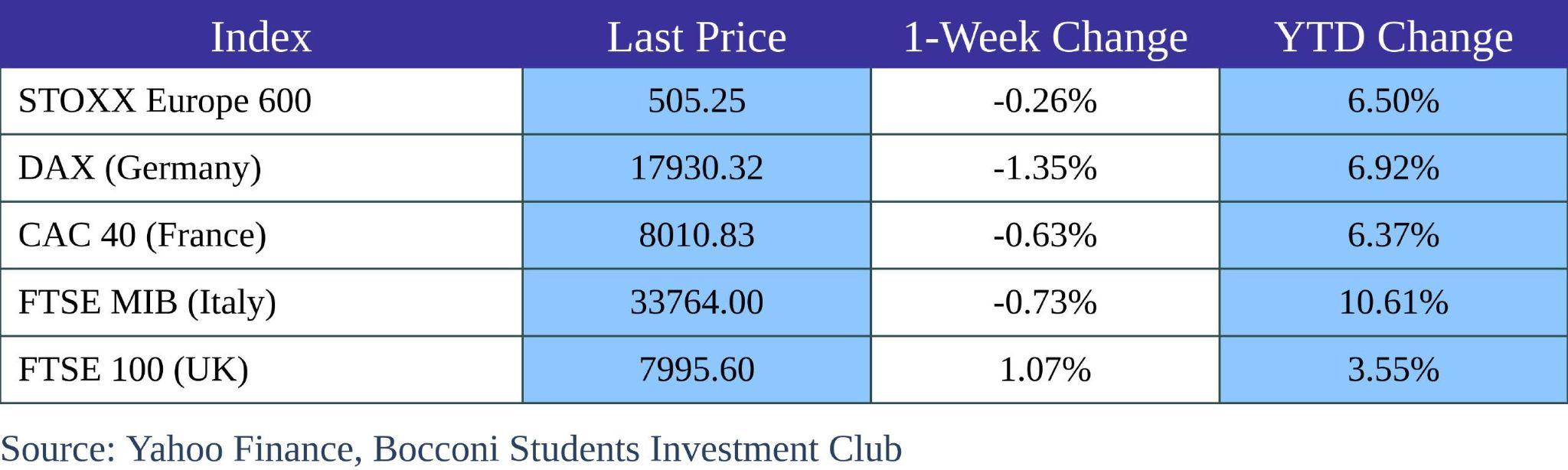

Europe and UK

European stock markets experienced mixed outcomes this past week. The pan-European STOXX Europe 600 Index closed down slightly by 0.26%, reflecting declines across major stock indexes with Germany’s DAX dropping 1.35%, France’s CAC 40 down by 0.63%, and Italy’s FTSE MIB falling 0.73%. However, the UK’s FTSE 100 Index countered the trend by rising 1.07%, aided by the British pound’s weakness against the U.S. dollar, benefiting multinational companies in the index.

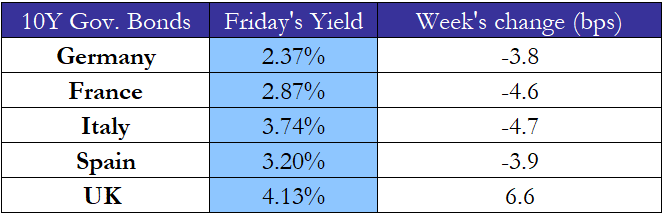

Bond markets reacted to U.S. inflation data, which indicated a faster-than-expected rise in March. Initially, this led to an increase in yields on French, German, and Italian government bonds, though these pulled back following the European Central Bank’s (ECB) decision to keep rates steady.

The ECB hints at possible rate cuts in the near future if inflation trends towards the target sustainably. In contrast, UK bond yields were pushed higher following hawkish remarks from Bank of England policymaker Megan Greene.

The ECB maintained its key deposit rate at 4.0% but expressed a readiness to adjust policy based on its upcoming inflation assessment in June, emphasizing its data-driven approach rather than following the Federal Reserve’s actions. This stance comes as the UK economy shows signs of recovery, with GDP growing by 0.1% in February, supported by a boost in manufacturing output, and an upward revision of January’s GDP figures suggesting an end to recessionary trends.

Yields on French, German, and Italian government bonds, which had been decreasing earlier in the week, surged following reports that U.S. inflation in March exceeded expectations. These yields later retreated from their peaks after the European Central Bank (ECB) maintained its key interest rates but strongly suggested potential rate cuts in the near future. Meanwhile, UK bond yields increased, influenced by remarks from Bank of England policymaker Megan Greene, who indicated that rate cuts were not imminent.

Source: worldgovernmentbonds, Bocconi Students Investment Club

Rest of the World

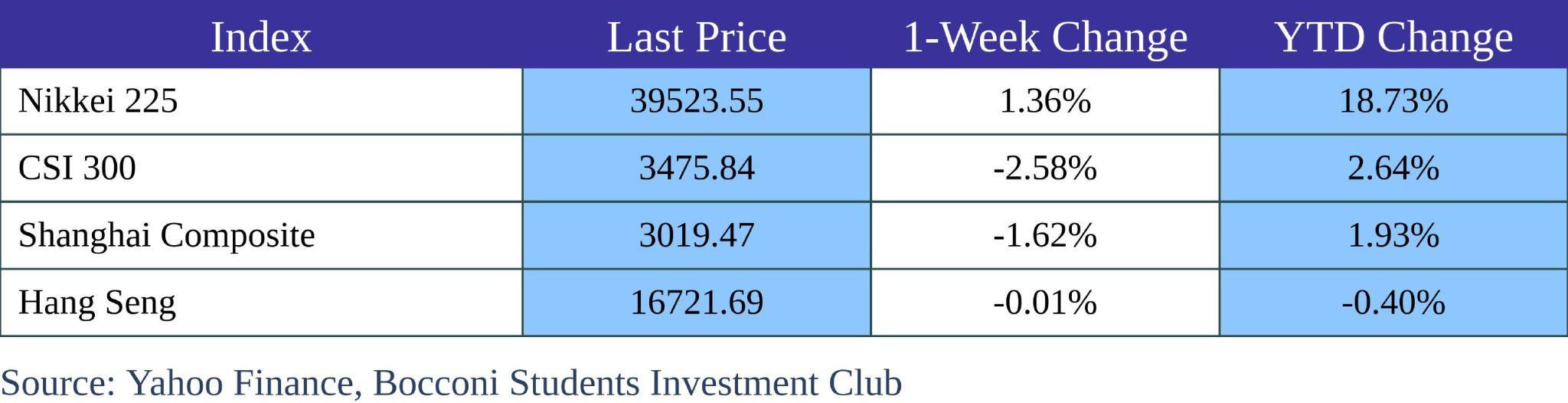

The Chinese stock indices declined amid weak inflation data, highlighting ongoing economic challenges. The Shanghai Composite Index dropped 1.62%, and the blue-chip CSI 300 Index fell 2.58%. The Hang Seng Index in Hong Kong ended the week almost flat, erasing initial gains due to recovery concerns.

March’s inflation figures added to the gloomy outlook, with the consumer price index (CPI) rising just 0.1% year-over-year, a slowdown from February’s 0.7% increase. This was partly due to falling food prices after the Lunar New Year. Core inflation also weakened, rising only 0.6% compared to 1.2% the previous month. Additionally, the producer price index (PPI) declined 2.8% year-over-year, intensifying from a 2.7% drop in February and marking its 18th consecutive month of decline.

During this week, Japan’s stock markets saw gains, with the Nikkei 225 Index increasing by 1.4% and the TOPIX Index experiencing a 2.1% rise. The 10-year Japanese government bond yield climbed to 0.84%, up from 0.77% at the week’s start, reaching a peak not seen since November 2023. This occurred in the context of rising U.S. Treasury yields, driven by a strong U.S. inflation report. Meanwhile, the Japanese yen remained near a 34-year low, drawing attention to potential interventions by Japanese authorities to stabilize the currency.

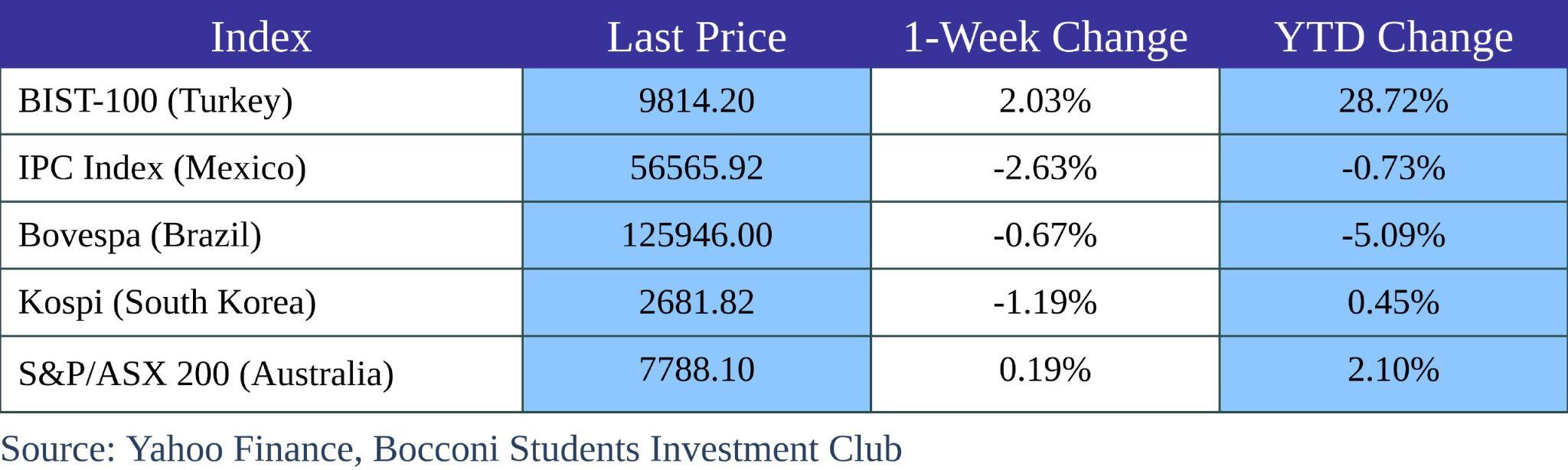

The most interesting news this week comes from Poland and the Czech Republic, highlighting significant updates on monetary policy and inflation trends. In Poland, inflation has continued to surprise on the downside, with March reporting a year-over-year rate of 1.9%, lower than February’s 2.8% and below the consensus expectations of about 2.3%.

Despite the continuing trend of disinflation, Polish central bank officials have maintained a cautious stance and have not indicated any plans to reduce interest rates this year. Additionally, economic growth in Poland is weak in a historical context, though it is slowly recovering. Positive “real” wage growth due to falling inflation and a substantial minimum wage increase this year is supporting a recovery in consumption, with retail sales and industrial production showing some signs of improvement.

In the Czech Republic, month-over-month inflation in March decreased to 0.1% from 0.3% in February, while year-over-year inflation remained steady at 2.0%, slightly below expectations. This inflation rate matches the central bank’s target and is notably below policymakers’ 2.9% estimate for the month. This situation could provide the central bank, which began reducing interest rates in December, with room to cut rates further.

FX and Commodities

This week, the Japanese yen approached a 34-year low, trading around 151.70 against the U.S. dollar, prompting discussions of potential intervention by Japanese authorities. Takehiko Nakao, a former top currency official, highlighted the possibility of stepping into the market “at any time” to counteract excessive movements in the yen’s value. The ongoing depreciation has had mixed effects, boosting exports but negatively impacting household real incomes in Japan. Nakao’s remarks underscore a readiness to act against speculative pressures that might further weaken the yen.

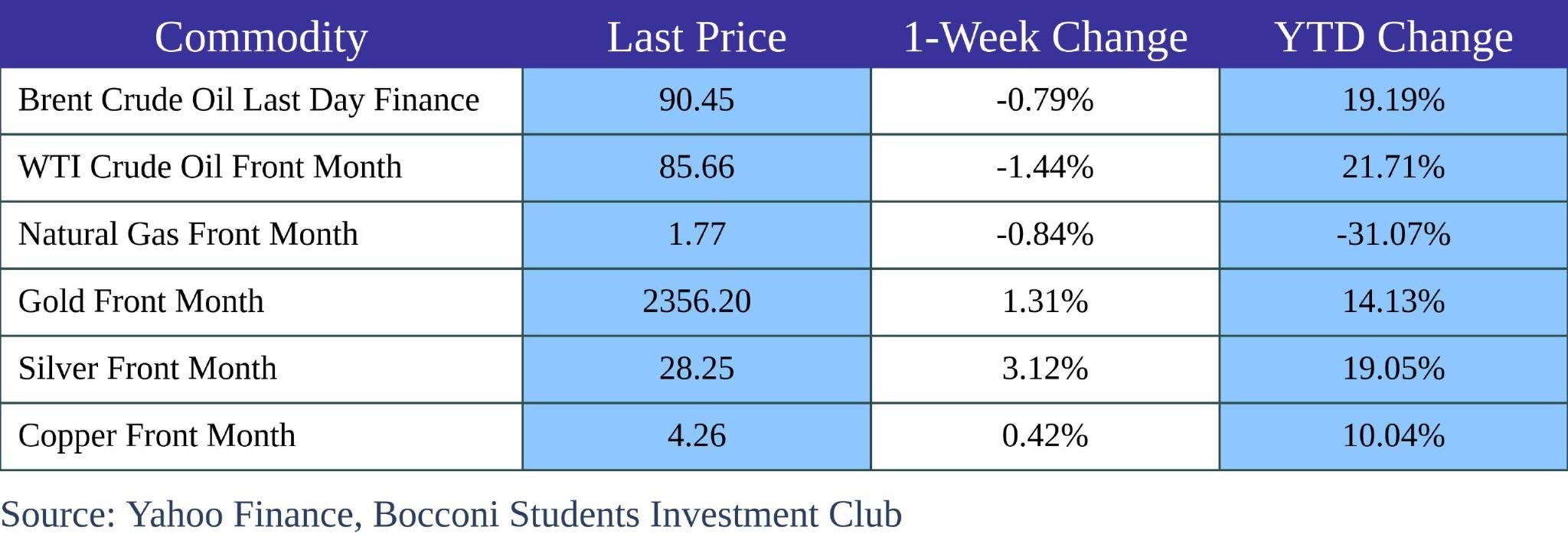

This week saw crude oil prices decline amid updated demand forecasts and persistent geopolitical tensions. The IEA significantly lowered its demand growth projection for 2024 to 1.2 million barrels per day, contrasting sharply with OPEC’s more optimistic outlook. This downgrade, coupled with sustained high inflation in the U.S., has dampened expectations for any near-term Federal Reserve rate cuts, which tend to influence economic activity and, consequently, oil demand.

Geopolitical risks also loomed large over the market, particularly due to escalating tensions between Iran and Israel, affecting investor sentiment. However, the actual impact on oil supply has been minimal, keeping price surges in check.

As a result, Light Crude Oil Futures ended the week lower at $85.66, reflecting a broader market cautiousness amidst these economic and political uncertainties. Despite the decline, there was a slight uptick in traders’ optimism, possibly anticipating market shifts based on forthcoming geopolitical or economic updates.

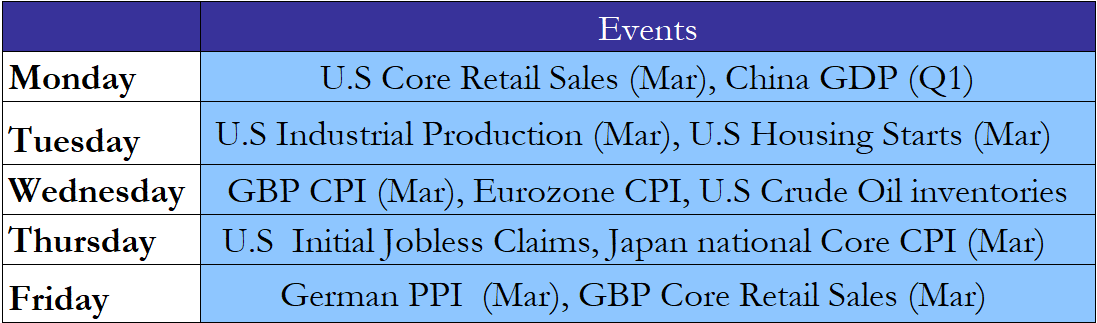

Next Week Main Events

Brain Teaser #15

Players A and B are alternately picking balls from a bag without replacement. The bag has k black balls and 1 red ball. The winner is the one who picks the red ball. Who is more likely to win, the one who starts first, or second?

SOLUTION

We can express the games to be:

(prob of A winning in first chance = 1/(k+1)) + (prob of A winning in 3rd chance = (1-(1/k+1)) * (1-1/k) * 1/(k-1) = 1/(k+1)) + … + (prob of A winning in 2r+1-th chance = 1/(k+1)) + … . When k=2n+1, there are n+1 such terms, giving the prob as (n+1) * 1/(k+1)=1/2. When k=2n, there are n+1 such terms, giving prob as (n+1) * 1/(k+1)=(n+1)/(2n+1)>1/2. Hence, it doesn’t matter who starts first when k is odd. The first player has higher chance of winning when k is even. Thus you should go first.

Brain Teaser #16

How many trailing zeros are there in 100! ?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

0 Comments