USA

The week started strong with both the S&P 500 and the NASDAQ continuing to grow, reaching all-time highs, after the FED delivered a 50bps rate cut last Wednesday. Amongst stocks, companies like Lockheed Martin (+40.11% YoY), Caterpillar (+35.64% YoY) and Lowe’s (+23.33% YoY) reached all-time highs. The pharmaceutical sector slumped, with Johnson & Johnson hitting a 4-week low after a 1.26% decline and Regeneron Pharmaceutical reached a 7-week low of $1,045.00 after a 12.73% fall in the past month.

On Friday, US stocks were subject to a mixed performance, as investors digested information about inflation which hinted to further rate cuts. The S&P 500 slipped 0.1% and the Nasdaq 0,4%, pressured by a 2.1% fall in Nvidia shares. The Dow Jones however hit a new record thanks to a 0.3% surge. US consumer sentiment reached a 5-month high, further cooling inflation and supporting the 2% target for 2024. Costco shares fell 1.7% after the retailer missed expectations for fiscal fourth-quarter revenues. HP also fell 1.0% after being downgraded by Bank of America.

Ultimately, during the week almost every major index grew, led by a 0.95% rise of the NASDAQ Composite and a roughly 0.6% rise of the S&P 500 and the Dow Jones.

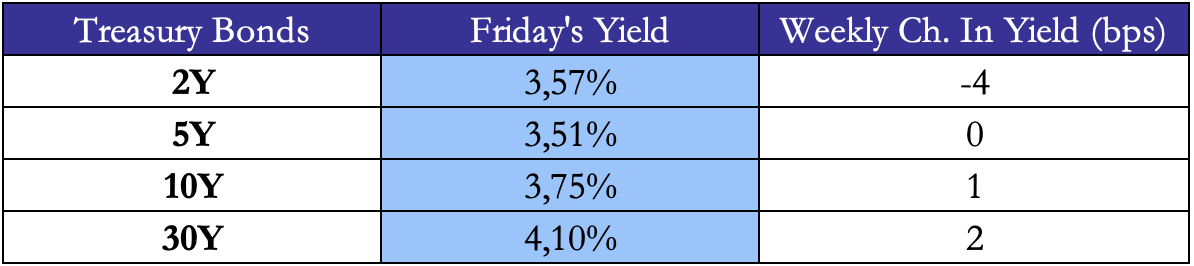

After an aggressive 50 bps cut last week, the US economy appears stronger and not falling into a recession. US government bond yields have mostly been steady, with markets waiting for the next FED meeting which will take place on November 6-7th: as of today, the markets are pricing in a 55% chance of another 50 bps cut, given the rising unemployment rate in the past months. However, FED Chair Powell stated that the FOMC’s decision should not be interpreted as the beginning of a trend and that further rate cuts will depend on economic data.

Source: Marketwatch, Bocconi Students Investment Club

Europe and UK

At the beginning of this week, European stocks surged as the markets digests the news from the FED meeting. Both the Stoxx 50 and the Stoxx 600 rose to their 2-month high. The FTSE 100 rose to around 8300 after a negative on Wednesday as the OECD significantly upgraded its forecast for the UK’s economic growth in 2025. In Germany, Inditex reached a 10-year high of €52.72 and a 49.62% surge YoY. On the other hand, oil companies took a hit, with Shell falling 8.94% to a 28-week low and TotalEnergies SE falling 5.69%.

On Friday Eurozone stocks closed sharply higher, as slowing inflation brightens the credit outlook for European corporations. The Chinese stimulus played a major role, with companies exposed to Chinese markets gaining traction: LVMH added 3.7%, also thanks to the company’s stake rise in Double R. Additionally, car manufacturers like BMW, Mercedes, Porsche and Volkswagen rose between 2% and 3.5% The Stoxx 50 (4% surge on the week) and the Pan-European Stoxx 600 rose significantly, with the latter reaching a new record high of 528.

The FTSE MIB rose by 0.92% on Friday, reaching a 2-month high and registering almost a 3% surge on the week. Luxury brands paved the way, with Moncler rising 10.9% and Brunello Cucinelli rising 3.8%, fueled by Chinese increasing demand. STMicroelectronics (+6%) and Stellantis (4%) also rose significantly. These surges also fueled France’s CAC 40, which closed the week registering a 3.9% rise, supported by the ninth consecutive month of falling domestic producer prices (-6.3% YoY).

The United Kingdom also felt the support of the Chinese stimulus package, with the FTSE 100 rising 1% in the week. Prudential led the index, with a 3% increase after striking two key deals in Nigeria and Indonesia: the firm is finalizing a 15-year deal with the country’s biggest Islamic lender worth hundreds of millions of dollars. Mining stocks continued to grow but not at the pace registered last week. Shares of HSBC (-0.4%) and Standard Chartered (-0.7%) slipped during the week.

In Germany the DAX closed the week with a 4% gain, hitting a new record high, and a 1.2% surge on Friday, led by car manufacturers, which saw a spike in expected demand after a monetary and fiscal stimulus package. Furthermore, BASF and Infineon each rose almost 7%.

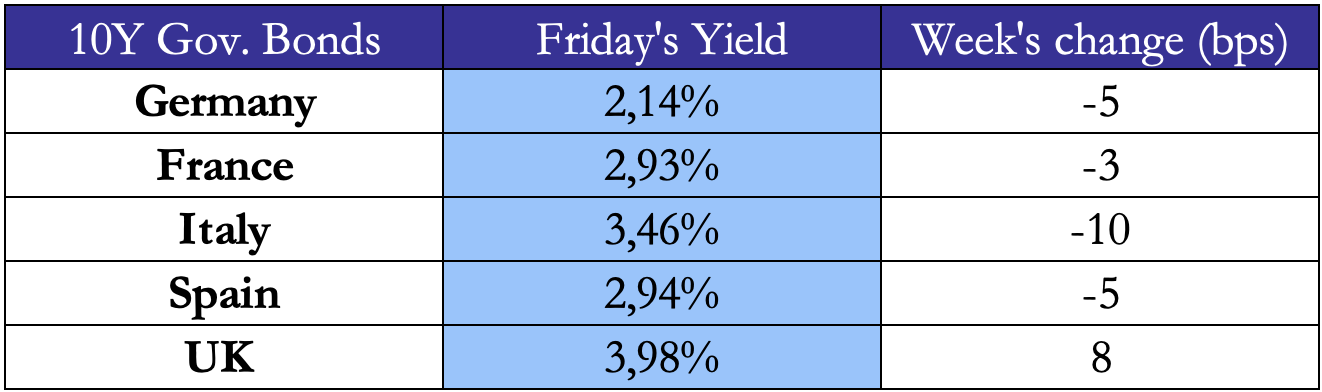

European government bonds fell on Friday as the markets welcomed lower-than-expected inflation rates for Spain and France. The ECB is set to deliver another 25 bps rate cut in October, with markets pricing in a 70% chance of such a move. The Swiss National Bank followed the footsteps of the ECB, delivering a 25 bps cut on Thursday, the third of the year, as Swiss inflation rate remains low.

Source: Marketwatch, Bocconi Students Investment Club

Rest of the World

The Nikkei 225 rose 2.32% on Friday to close at 39,829 reaching its highest level in two months: investors picked up the cue from Wall Street as solid economic data brightened market sentiment and reacted to Tokyo’s core inflation rate, which fell to 2% in September from 2.4% in August, suggesting that the BoJ will take a cautious approach to further rate hikes. The surge was led by the technological sector, especially Lasertec (+8.2%), Tokyo Electron (6.7%), Disco Corp (+3.7%), Advantest (+4.5%) and SoftBank Group (+2.3%).

On Friday the Shanghai Composite jumped 2.88%, reaching its highest level in about four months, and registering a 12.8% rise in the week, the best performance since 2008. The surge is due to the second rate cut of the year by The People’s Bank of China, which cut the banks’ reserve requirement ratio by 50 bps, in a move set to free up 1trl yuan in capital. The central bank also cut the 7-day reverse repo rate by 20 bps. The surge was led by technology, healthcare, consumer, new energy and financial stocks. Among stocks, significant advances have been registered by East Money Information (+20%), Wuliangye Yibin (+10%) and Jiangsu Hoperun (+20%).

Globally, both Brazil’s Bovespa and Mexico’s PIC Index registered similar gains of about 1.2%. Australia’s S&P/ASX 200 saw almost now change since last week. In Turkey, amidst tightening monetary policy (policy rates have been risen 50 bps to contain inflation), the BIST-100 fell 1.24%, declining 12.4% since its peak in July. The fall is also due to foreign investors which have been selling $3.2bln in equities since May. In South Africa, the JSE Index closed at 87,580 on Friday (registering a 4.5% gain for the week), hitting a new record high, after a sixth consecutive bullish trading session. The best performers were Montauk Renewables (+5.5%), Old Mutual (+4.9%) and South32 (+4.2%).

FX and Commodities

Brent and WTI futures gained traction on Friday, trading respectively at around $72 and $68 per barrel, after previous losses as Hurricane Helene forced Gulf of Mexico producers to cut output (according to the BSEE, production was down almost a 25%). Futures rallied also because global supply is also likely to increase as China, the world’s top brent importer, weighs its new stimulus package; however, on Thursday gains were wiped as OPEC+ will raise output to 180,000 barrels per day in December. Hurricane Helene also caused a 5% surge in US LNG futures, which were also supported by strong gas inflows to Venture Global’s Plaquemines LNG export plant in Louisiana.

On Friday gold price slightly fell (-0.9%) due to investors collecting profits after a record high of $2,672 in the previous session, but still concluding the week with almost a 1% gain. Gold has hit a number of record-highs as rate cuts and geopolitical instability reduce the opportunity cost of holding non-yielding assets. Similarly, to gold, silver reached decade-highs on Friday and then slid by more than 1% as investors rushed for profits. Silver is also fueled by the outlook for silver-intensive manufacturing processes, such as solar panels and electrification technologies. Copper also experienced a significant 6% rise, following China’s stimulus package.

The Euro weakened on Friday after inflation reports from Spain and France suggest further rate cuts down the road. The Japanese Yen rebounded after slipping almost to 146.5 per dollar at the end of the week, after former defense minister Shigeru Ishiba won the leadership of Japan’s ruling party, and will effectively be nominated as next prime minister. Ishiba had voiced his doubts about aggressive rate-cutting policies, even if he is known to favor expansionary fiscal policies. The Swiss Franc slightly strengthened, reaching levels near to the 12-year high observed at the end of last year, as uncertainty rules over the possibility of another rate cut in December.

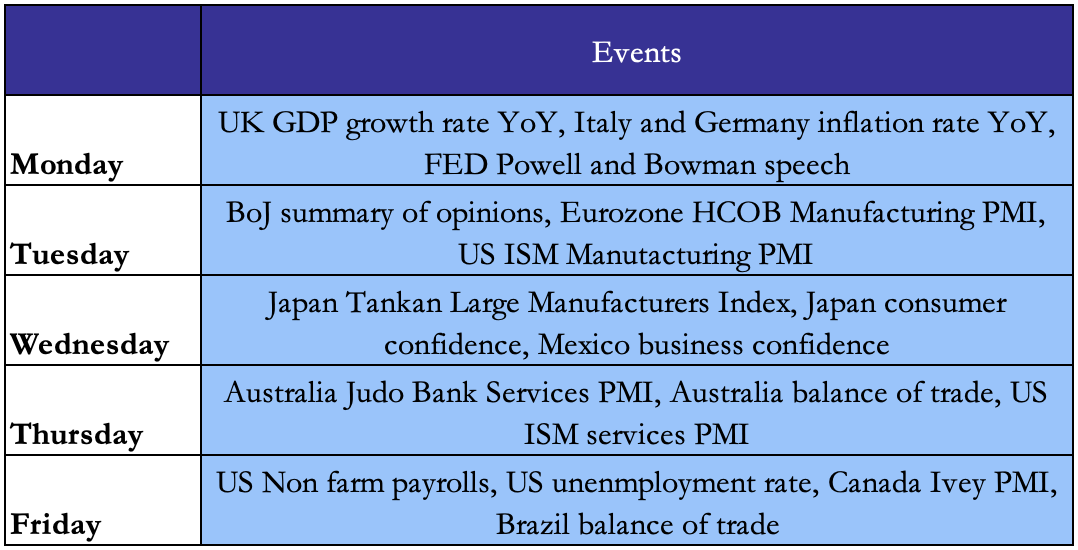

Next Week Main Events

Brain Teaser #19

You are invited to a welcome party with 25 fellow team members. Each of the fellow members shakes hands with you to welcome you. Since a number of people in the room haven’t met each other, there’s a lot of random handshaking among others as well. If you don’t know the total number of handshakes, can you say with certainty that there are at least two people present who shook hands with exactly the same number of people?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

SOLUTION

There are 26 people at the party and each shakes hands with from I-since everyone shakes hands with you-to 25 people. In other words, there are 26 pigeons and 25 holes. As a result, at least two people must have shaken hands with exactly the same number of people.

Brain Teaser #20

You need to communicate with your colleague in Greenwich via a messenger service. Your documents are sent in a padlock box. Unfortunately, the messenger service is not secure, so anything inside an unlocked box will be lost (including any locks you place inside the box) during the delivery. The high-security padlocks you and your colleague each use have only one key which the person placing the lock owns. How can you securely send a document to your colleague?

SOURCE: Xinfeng Zhou – Practical Guide To Quantitative Finance Interview

0 Comments