AerCap Holdings N.V. Market Cap (as of 16/05/2014): $9.61bn

American International Group Market Cap (as of 16/05/2014): $75.44bn

International Lease Finance Corp. Market Cap.: N/A

AerCap Holdings N.V., a Netherlands-based aircraft lessor, listed on the NYSE, completed a $7.6bn deal to acquire International Lease Finance Corp., the largest aircraft leasing company by value from American International Group, the American insurance conglomerate. The deal comprised a $3bn in cash and 97.56 million in shares, which represents 46% of AerCap ordinary shares.

The stock consideration value was estimated on the AerCap’s Stock at May 13 closing price of $47.01 per share. The cash portion was funded through a combination $2.6 billion in senior notes, which AerCap was arranging since summer, and company’s own cash. On May 14, the deal was preceded by voluntary delisting of all ILFC’s 5.875% notes due in 2022, as the notes will be guaranteed by AerCap. According to AerCap’s CEO, Mr. Aengus Kelly, Citigroup and UBS will provide the company with $2.75bn in financing.

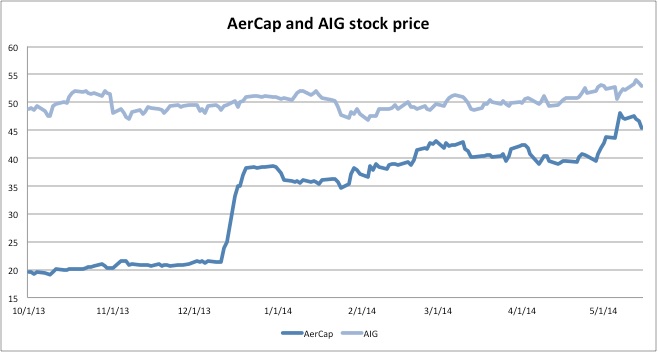

The price-tag has increased by more than $2bn since the announcement of the cash and stock deal in December 2013, as the price of AerCap shares almost doubled from roughly $24 at the time of the announcement to $45. As of the deal’s announcement on December 16, 2013, AerCaps’ stock portion was valued at $2.4bn resulting in the total ticket of $5.4bn and 30% discount to ILFC’s book value. This figure has jumped to $7.6bn in the past five months. The combined company will retain the name AerCap, and ILFC will become a wholly owned subsidiary of AerCap.

Prior to the deal, AerCap’s portfolio included only 373 aircrafts owned, managed or under purchase orders, representing one of the youngest fleets in the aircraft leasing industry. However, with the completion of the purchase, AerCap will become one of the world’s leading aircraft leasing company with the combined entity having over 1,300 aircrafts owned and managed, $45bn worth of assets, more than 200 customers and operations in 90 countries, making AerCap the aircraft lessor to leading airlines such as American Airlines, Air France, British Airways, Emirates, and KLM. In comparison, its main competitor and world’s largest aircraft lessor by number of units, GE Capital Aviation Services (GECAS), has over 1670 aircrafts and 230 customers in 75 countries.

Founded in 1973, ILFC is an American aircraft lessor headquartered in Los Angeles and was the main competitor of GECAS before the merger. Acquired by the insurer giant AIG in 1990, ILFC was put on sale after the financial crisis in 2008, as part of a restructuring plan aimed to repay the $182bn government bailout received by AIG, and comply with new regulations.

Interestingly, AerCap was not the first bidder for ILFC. At the end of 2012, AIG announced that it was in talks with a Chinese consortium, led by New China Trust Co. Ltd., which is part-owned by Barclays New China Life Insurance Co. Ltd., P3 Investments Ltd. and China Aviation Industrial Fund to sell a 90-percent stake in ILFC for $4.8bn. However, the deal fell apart in August 2013, after two of the Chinese companies withdrew their bids.

The transaction awards AIG with 46% stake in AerCap and two seats on the board of the company. AIG can sell its stake in tranches over the next 15 months, but may be reluctant to do so, in order to receive future earnings from AerCap. Further, as a result of the transaction, AIG will shed $21bn of debt from its consolidated balance sheet, to be assumed by AerCap, which will help the company to focus on its core insurance business.

Waha Capital, AerCap’s largest shareholder with 26.2% stake before the acquisition, will have its stake diluted to 14.1%. AerCap has been one of Waha Capital’s star investments. Waha bought a 20% stake in AerCap in 2010 at a cheap price of $388m, which is now valued at $1.4bn. Waha Capital will retain its two seats on the AerCap’s board of directors and representations on various board sub-committees.

Previous talks of selling 90% of ILFC with Jumbo Acquisition Limited, a Chinese Consortium, for $4.7bn, never materialized, as the buyer was slow in its payment for the business. The success of AerCap’s acquisition could be traced back to 2011, when it sold AeroTurbine to ILFC for $228bn in cash, thereby establishing good relationship between the two companies.

Source: BSIC, Yahoo Finance

AerCap’s stock price jumped 33% after WSJ wrote an article on the deal announcement, on 16 December 2013, adding $800m in market value. The market reaction supports last year’s trend of investors rewarding US companies announcing acquisitions. The trend, as reported by Dealogic, is highly pronounced in US, with acquisitions of $1 billion or more generating a 4% increase in stock price of the buyer within the day of announcement. Opinions vary on the cause of this trend. On one hand, investors may be searching for growth opportunities, rewarding companies with such acquisition potential. On the other hand, cheap debt, in combination with earnings growth expectations, pushes companies to leverage buying targets’ earnings at a cheap price.

UBS acted as the lead financial advisor to AerCap and Goldman Sachs acted as sole financial advisor to AerCap’s Board of Directors Citigroup was the lead financial adviser to AIG, along with Morgan Stanley, JPMorgan Chase & Co.

[edmc id=1752]Download as pdf[/edmc]

0 Comments