Definition

Over the past years, Private Equity Co-Investments have been on the rise. A PE Co-Investment is a minority investment that is made directly into a company alongside a private equity sponsor who is acquiring a controlling/majority stake on said company. GPs may want Co-Investor for some deals as it allows them to pass on a portion of the equity ticket to another investor. This is something that can be of interest for GPs as it expands the range of deal opportunities as through co-investments there’s more capital available, allows for more investment diversification, it reduces the concentration of risks and strengthens the relationships with the LPs, who on many occasions act as Co-Investors. Moreover, according to Dechert’s 2025 Global Private Equity Outlook, there are 3 types of Co-Investments arrangements. Of firms that offer Co-Investments, 48% do so on an opportunistic basis, giving LPs ad hoc access to selective deals whenever the GP wants to, 40% do so through more formal formats as Co-Investment funds, and the remaining 12% rely on letter-based structures.

The aforementioned distinction is very important since it will impact the fee structure. For example, when Co-Investors are coming in a deal-by-deal basis, they will probably only pay the transaction costs and no other fees, while Co-Investments funds are likely to have management fees and carried interest. Moreover, the co-investment fund management fees and carried interest fees are lower than on direct PE funds. According to Gallagher, a global leader in insurance, risk management and consulting services, in 2024 the average management free for co-investment funds as of 1%, with carried interest ranging from 10% to 12.5% on a hurdle rate of 8%. Hence, similar to a fund-of-funds, co-investments funds allow investors to have access to multiple PE sponsors at much lower fees.

Co-Investments must not be confused with Secondaries. On one hand, a Co-Investment fund has a narrower focused as it decides what deals to join and on what specific individual companies to invest in. On the contrary, a Secondary fund invests directly on GPs, not on single companies. Moreover, Co-Investors and GPs negotiate deal terms and their relationship through the ownership period, while Secondaries will accept the existing structure. Additionally, a Co-Investment marks the start of a new investment at a company, while a Secondary investment is when a fund purchases the commercial interests from an existing LP, allowing the LP to exit and generating them a liquidity event. Moreover, Co-Investments and Secondaries are similar in the sense that they both benefit from the GPs knowledge and network, as well as both benefit from the continuous expansion of the PE market.

History of Co-Investments

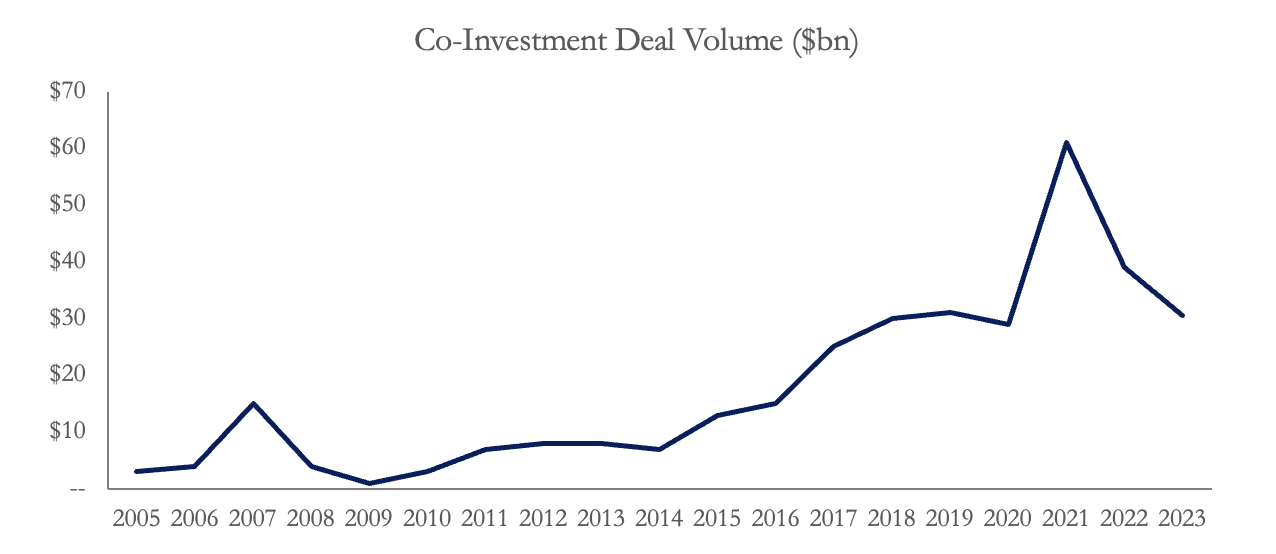

Given a lack of earlier records of the creation and utilization of co-investments, discussing its inceptive history is quite unreliable. However, there are details which may be expanded upon. In its infancy (60s-70s), PE firms informally utilized co-investments as a bridging tool to close deals. Trusted LPs with close ties would be brought in with minimal structure. These deals were merely practical solutions to a shortfall of cash. As the PE industry matured, frameworks and official co-investment avenues were implemented. In the 2000s, accounts became significantly clearer as co-investment began transitioning from a peculiar exception to a relative normality in deals. Co-investment deal volume since has ballooned from $3bn in 2005 to a high of $61bn in 2021.

Peaking at $15bn in 2007, the golden age of PE saw widespread adoption of Co-Investments for varied aspects. The entrance of institutional investors, such as pension funds and sovereign wealth funds within the PE space, coupled with lower fees and higher selectivity, rapidly fed growth. The global financial crisis slashed this growth, requiring 10 years to reach previously achieved deal volume. 2017-2020 brought increased formalization in the market with the creation and expansion of secondary markets for co-investments coupled with increased investment opportunities in niches such as growth equity, venture capital, real estate, and infrastructure. This relative plateau at $30bn ended with 2020 carrying an onslaught of exceptionally low interest rates, driving M&A activity and, consequently, co-investment deal volume up to $61bn in 2021. The market has since declined with $30.6bn deal volume in 2023 and only $7.3bn in the first half of 2024. This is primarily attributed to the slowdown in PE activity (especially in 2023). High costs of debt, slower fundraising, and reduced exit activity have led to a collective cooling of PE deals. As co-investments are dependent on PE activity, a cooldown occurred. As PE firms rebound, we can expect this co-investment deal volume to surge.

Peaking at $15bn in 2007, the golden age of PE saw widespread adoption of Co-Investments for varied aspects. The entrance of institutional investors, such as pension funds and sovereign wealth funds within the PE space, coupled with lower fees and higher selectivity, rapidly fed growth. The global financial crisis slashed this growth, requiring 10 years to reach previously achieved deal volume. 2017-2020 brought increased formalization in the market with the creation and expansion of secondary markets for co-investments coupled with increased investment opportunities in niches such as growth equity, venture capital, real estate, and infrastructure. This relative plateau at $30bn ended with 2020 carrying an onslaught of exceptionally low interest rates, driving M&A activity and, consequently, co-investment deal volume up to $61bn in 2021. The market has since declined with $30.6bn deal volume in 2023 and only $7.3bn in the first half of 2024. This is primarily attributed to the slowdown in PE activity (especially in 2023). High costs of debt, slower fundraising, and reduced exit activity have led to a collective cooling of PE deals. As co-investments are dependent on PE activity, a cooldown occurred. As PE firms rebound, we can expect this co-investment deal volume to surge.

Advantages of Co-Investments

Advantages for LPs

- Direct access to specific deals instead of having to invest in numerous companies through “fund-of-funds” can lead to higher potential returns.

- Fee savings for LPs; management fees (1-3%) and carried interest (20%) are reduced or eliminated, as GPs choose to make the terms more favourable for LPs so they can gain access to more capital.

- Improved control over investment decisions and can tailor their portfolios to align with their risk tolerance and allocate assets into specific sectors which many funds may not offer.

- Independent due diligence means increased transparency for LPs compared to typical pooled investments.

Advantages for GPs

- Access to additional capital to make large deals without exceeding concentration restrictions or needing to raise a new fund so enables them to execute more complex/larger deals.

- By involving LPs in specific deals, GP’s fund exposure to risk is reduced as they share the financial burden with LPs.

- GPs can earn carried interest based on the performance of individual deals, which is smaller than that of a traditional fund, however higher incentive to seek high-return opportunities.

Overlapping Advantages

- Faster deployment of capital compared to a traditional fund which has a longer fundraising and strategic planning process; this can also reduce the J-curve.

- Alignment of interest between GPs and LPs is stronger than in traditional funds, as GPs are more motivated to see specific deal succeed due to their compensation structure, so both parties share risk and rewards.

- Greater access to larger deals; GPs can use additional capital to make deals which may usually exceed their funds capital requirements and LPs can be part of exclusive deals which they may not otherwise have access to.

Disadvantages of Co-Investments

Disadvantages for LPs

- Higher risk exposure from specific deal unlike traditional fund where risk is spread across wider portfolio.

- Illiquidity concerns for LPs as in private equity, exist options may not arise for several years.

- Co-investment typically involves LPs carrying out their own due diligence which is time consuming and requires LP to have their own expertise’s/resources.

- May incur additional fees to GPs for setting up the co-investment vehicle.

Disadvantages for GPs

- Increased operational cost for managing and monitoring this specific investment vehicle and there may be need for legal oversight.

- Neglection from main fund, as co-investment will use up lots of resources and time so performance of main fund may fall.

- Reduced management fee and carried interest revenue may lead to GP earning less if co-investment does not bring high returns.

- Higher risk of GPs catching bad publicity around their fund if co-investment fails, which can hurt future capital raising success.

Overlapping Disadvantages

- Arising of conflicts of interest from LPs demanding a say in the management of the investment and the structure of the deal, diluting GPs control over the deal.

- GPs can struggle to balance prioritizing certain co-investments to keep a good relationship with LPs whilst also maintaining the funds main portfolio.

- Raised administrative fees for both, stemming from due diligence, legal oversight, compliance reporting etc.

- Overexposure of risk from specific deals may lead to poor returns for both parties.

How to be a Co-Investor

Co-Investment allows Limited Partners (LPs), such as Pension Funds or Asset Managers, the opportunity to invest directly into businesses along the General Partners (GPs), just as if they were Private Equity funds. Generally, Co-Investments can be described as investment opportunities that are offered to investors by GPs either on a deal-by-deal scenario, a Co-Investment fund or through letter-based structures. Moreover, Co-Investments can be structured as Alternative Investment Funds (AIFs) or simple partnerships. AIFs must comply with the AIFMD test, meaning they need to have a designated Alternative Investment Fund Manager and have a Depositary.

In time of crisis, Co-Investors have the ability to invest at lower entry valuations and more attractive terms. Moreover, in times where liquidity is scarce and M&A activity is down, having close relationships to GPs will potentially be beneficial for LPs. This as GPs have industry expertise, a larger network, hence, can get better deals. Also, when Co-Investing, LPs have a limited Due Diligence (DD) capacity, so they rely on GPs. The more DD accessibility provided will allow LPs to better evaluate the GPs investment process, past investment, and target company. Hence, one can conclude that closer relationships between LPs and GPs will lead to potential better Co-Investments.

Moreover, when investing through a Co-Investment funds, rather than analyzing individual targets, LPs must analyze the PE funds that offer this type of investment vehicles. Some of the strongest PE that offer Co-Investment fund are Ardian, Neuberger Berman, HarbourVest, LGT Capital Partners, among many others. When investing through this mechanism, LPs will focus their DD process on the GP past vintages, looking at their returns, rather than on specific companies.

Conclusion

Despite its recent slowdown, co-investment has come a long way since the 60s, from an informally bridging tool to close deals, into the now commonly used investment strategy in private equity. The success of co-investments comes as no surprise given the solutions they offer GPs in addressing diversification mandates and capital constraints, alongside the benefits offered to LPs with greater access to more exclusive deals, lower management and carried interest fees and greater control over their investments. Their recent decline highlights their link to PE activity, cost of debt and the available exit opportunities; however with the consensus that PE and M&A activity are expected to rebound, and interest rates will continue to fall, co-investment volumes should surge once again.

0 Comments