Introduction

In 2024, over 240 activist campaigns were launched globally, the highest number since 2018, according to a Barclays report. The US and APAC remained the primary regions for activism, with 44% and 29% of campaigns initiated in these areas, respectively. Meanwhile, activity in Europe saw a slight decline from 28% in 2023 to 21% last year. Within Europe, the UK remains the leading jurisdiction for activism, accounting for 39% of campaigns in the region. A challenging M&A environment has led shareholders to focus more on strategy and operations-related demands, accounting for 23% of total campaigns. However, M&A continues to be a key focus for global activists, with an increasing number of market participants adopting activist tactics in relation to transactions. This trend is expected to persist in 2025, with activist investors likely to target industries such as technology, healthcare, financial services, energy, and consumer goods. These sectors are attractive due to their growth potential, large cash reserves, and opportunities for operational improvements. Even well-managed companies with strong financials can become targets if their stock is undervalued, drawing the interest of activists seeking to unlock shareholder value through strategic changes.

Another ongoing trend is the growing global share of activity initiated by first-time activists. Newcomers continue to emerge, with first-timers responsible for 22% of campaigns, surpassing the efforts of major activists for the first time. The top ten active activists now account for just 30% of campaigns through 2024, down from 46% in 2023. This shift shows that activist tactics are no longer limited to the traditional activist group. Institutional and minority shareholders, including those who have previously supported the board, are increasingly vocal and willing to publicly challenge transactions, board recommendations, or even propose their own M&A initiatives. Additionally, there has been a rise in involvement from occasional activists and a growing engagement of activist “swarms,” where multiple activists target a company over a specific issue, either together or independently.

Moreover, the trend of targeting large and mega-cap companies has strengthened, with activists increasingly moving away from their traditional focus on mid-cap companies. Notable examples of this shift can be seen in the US (Starbucks [NASDAQ: SBUX], BlackRock [NYSE: BLK]) and the UK (Reckitt [LSE: RKT]). This trend is especially prominent in Europe, where 21% of campaigns are directed at companies with a market capitalization over $25bn, compared to 15% in the US. Additionally, in the UK, there has been a rise in activist calls for companies like Rio Tinto and Glencore to move their primary listings to the US or other jurisdictions, following several high-profile relocations.

There is also a growing trend of public engagement with boards and the expression of concerns that align more closely with US-style activism. Many traditional investors, who were once reluctant to publicly criticize management, are now more willing to support activist campaigns or use activist tactics themselves. Activists are employing more innovative methods in their campaigns, including the use of social media. For instance, Elliott Investment Management launched a podcast as part of its intense boardroom battle with Southwest Airlines [NYSE: LUV]. The effect of activist campaigns and the increasingly volatile market has been significant, leading to record levels of CEO turnover, with over 27 CEOs resigning in 2024 due to pressure from activist investors. High-profile activist campaigns have led to leadership changes at major companies such as Starbucks, Masimo [NASDAQ: MASI], Gildan [TSE: GIL], and Sensata [NYSE: ST]. These shifts highlight the powerful influence activists can have, particularly when leaders are seen as failing to seize opportunities to maximize shareholder value.

Elliot’s Campaign on BP

Activist investor Elliott Management has become BP’s [LSE: BP] third-largest shareholder, behind only BlackRock and Vanguard, holding nearly a 5% stake valued at around £3.8bn. The US hedge fund is pushing BP to reduce its spending on renewable energy and make significant divestments. This position is one of Elliott’s largest, potentially including both shares and derivative positions that replicate an economic interest in the stock, a strategy the firm has used in previous campaigns. As BP’s shares fell to a two-year low last November, Elliott was already building its stake in the struggling company. The move is proving effective, with BP’s shares rising more than 26% from that low. Trump’s rallying cry of “drill, baby, drill” has boosted the mood surrounding oil and gas companies, refocusing attention on their core business of selling fossil fuels. BP’s shares surged by 8% after the disclosure of Elliott’s stake.

Elliott is widely known as a radical activist investor, unafraid to engage in boardroom battles when it disagrees with a company’s strategic direction. This campaign is led by John Pike, an expert in energy and industrial investing, and Gaurav Toshniwal, an energy-focused portfolio manager. Pike has previously led campaigns at US oil companies Hess [NYSE: HES] and Marathon [NYSE: MPC], Canadian oil sands producer Suncor [TSE: SU], and refiner Phillips 66 [BIT: 1PSX]. Earlier in February, Elliott disclosed that it had increased its stake in Phillips 66 and called for the company to sell off its pipeline and chemicals assets. The hedge fund might make a similar request for BP, as it intends to be a long-term holder of the company’s shares, noting that its campaigns with Hess and Marathon lasted between six and eight years. However, a group of 48 institutional investors has urged BP to allow shareholders to vote on any plan to scale back its climate goals, potentially creating a conflict with Elliott. This intervention, supported by investors like Rathbones Investment Management, Phoenix Group, Robeco, and Royal London Asset Management, follows BP CEO Murray Auchincloss’s promise to “fundamentally reset” the company’s strategy due to pressure from Elliott to improve performance. Thus, some investors are worried that Auchincloss may dilute BP’s climate commitments and refocus on oil and gas production.

To understand the rationale behind Elliott’s campaign, it’s essential to examine what went wrong with BP. The company has significantly underperformed in recent years for two main reasons. Firstly, BP made a miscalculated move towards renewable and low-carbon energy, diverting focus from its most profitable oil and gas business. Since 2020, BP has increased its spending on energy transition projects from about 3% of its capital expenditure to between 20% and 40%, reaching a peak of $4.9bn in 2022. This investment included wind, solar, biofuels, and hydrogen. As a result, its refining business became less profitable, with the margin per barrel falling from an average of $25.80 in 2023 to $17.70 in 2024. BP’s refining and trading businesses went from a pre-tax profit of $3.8bn in 2023 to a pre-tax loss of $67 million last year. In response, BP has put its Gelsenkirchen petrochemical complex in Germany up for sale and took a $1.34bn impairment in 2023 after reducing output at the plant, which could process 88 million barrels of crude annually. Last year, to reduce debt, BP spun off its offshore wind assets into a joint venture with Japan’s Jera.

Secondly, BP suffered from poor management for over five years. Murray Auchincloss became permanent CEO in September 2023 after the former CEO, Bernard Looney, was accused of “serious misconduct” for failing to disclose relationships with colleagues. While some board members believe Auchincloss has been too slow in implementing the strategic changes necessary to restore investor confidence, others point to BP’s struggles being a result of a relatively inexperienced board and its chair, Helge Lund, who splits his time between BP and the same role at Novo Nordisk. In its latest report, BP revealed an underlying profit of $8.9bn for the full year, down from $13.8bn in 2023 — its worst annual result since losing $5.7bn in 2020. Following a year of disappointing financial and operational results, the company informed its employees that their annual cash bonuses would be only 45%. BP’s share price dropped by more than 5% last year, and it made nearly $7bn in write-downs, particularly in refining. Over the past five years, BP’s stock has failed to deliver value to shareholders, while Shell’s [LSE: SHELL] and Chevron’s [NYSE: CVX] stock prices increased by 54% and 70%, respectively.

Therefore, a radical change in BP’s strategy is highly needed and Elliot’s campaign can accelerate this. On February 26, the company announced that it would increase its oil and gas spending by 20%, reaching $10bn annually, while cutting renewable energy investments by 70%. Auchincloss described the change as a “fundamental reset of BP’s strategy,” abandoning targets to reduce fossil fuel production and to develop 50 gigawatts of renewable energy. BP plans to raise at least $20bn by 2027 through asset sales, potentially including its lubricants division Castrol and a stake in its solar business Lightsource. He also indicated that BP was open to selling a broad range of assets, possibly even a share of its new Gulf of Mexico project, Kaskida. Following the announcement of the new strategy, BP’s shares fell by 2.3%, reflecting investor skepticism about whether the changes were significant enough. Additionally, a source close to Elliott mentioned that the hedge fund was dissatisfied with the strategy, as it lacked substantial divestments.

Auchincloss also mentioned that BP would face some short-term financial challenges as it rebuilds its pipeline of oil and gas projects after years of reducing its portfolio. However, he emphasized that his focus would be on attracting American investors, with most of the BP’s growth expected to come from the US and the Middle East. He clarified, though, that relocating the company’s listing to the US was “not on the agenda.” Moreover, Auchincloss defended BP against claims that it is less valuable than its competitors, such as ExxonMobil and Chevron, which have market capitalizations of $481bn and $279bn, respectively. With BP’s current market capitalization at $89bn, the CEO aims to more than double it to $200bn within five years, a level it reached before the 2010 Deepwater Horizon disaster. “Our size is smaller, but the quality of our assets is exceptionally high,” he stated, listing BP’s extremely valuable oil and gas fields.

Indeed, the company is developing several upstream projects, including promising fields in the Gulf of Mexico, and has announced plans to return to Iraq’s large Kirkuk field, alongside launching 27 new projects over the next five years. However, the Kaskida project in the Gulf of Mexico is not expected to come online until 2029, and it will take 2-3 years to increase production at Kirkuk. As a result, BP will likely produce slightly less oil and gas in 2030 than it did in 2019. Furthermore, Auchincloss emphasized that the company has not abandoned its goal of being a diversified energy business. However, Auchincloss indicated a lower rate of shareholder returns but committed to cutting at least $4bn in costs and reducing net debt by at least 20% over the next two years. He also stated that there are many options for raising $20bn by selling parts of the business, including infrastructure, upstream and downstream assets, and some of its petrol station network. While it is unclear whether the new strategy will unlock significant value for shareholders, one thing is certain: rebuilding BP will require considerable time and effort.

Smiths Group’s Spin-off

Smiths Group recently announced a strategic plan to spin off their divisions, first selling its’ electrical components business, Interconnect, then demerge or sell its’ Smiths Dection Group, their second-largest business contributing 28% of their revenue in 2024. This decision came after activist investor pressure from Engine Capital (holding a 2% stake) and Elliott (holding a 5% stake), who believe Smiths Group is undervalued, partly due to its congolomerate strucuture being discounted. Additionally, the selling of Smiths Interconnect will allow the company to target its focus more on industrical technology divisions, including Flex-Tex, responsible for producing heating elements, and John Crane, responsible for producing components controlling liquid and gas. Following this announcent, shares already rose 11%, and Smiths Group announced a large portion of the gains from the spin-off will be returned to shareholders, “around an extra £350m by the end of the year”, and have raised their share buyback scheme to £500m.

• Previously, in January 2022, Smiths Group sold the subsidiary Smiths Medical to ICU Medical, at a $2.7bn enterprise value, with a similar rationale as medical was a non-core asset, not aligning with the rest of their portfolio and was also believed to be undervalued.

• Other examples include the divestment of John Crane’s Bearings to Miba AG for $35m in March 2018 and the sale of the Explosive Trace Detection Business, formely owned by Morpho Detection to OSI Systems for $75.5m.

The CEO Roland Carter claimed the board had already been considering strategic actions before the activist invervention and also made sure to express that the potential risk of regulatory scruitiny from Smiths Detections will not impact their plans. Elliott, who built a stake of around £300m in Smiths Group, fully supports the breakup and is said to support Smiths’ management with the ongoing process, as they hope to benefit from the potential upside from the rally in shares. Smith’s Groups plan to break up their conglomerate strucuture aligns with the current trend among industrial companies to streamline their operations and avoid the “conglomerate discount” lowering their valuations. For example, in 2024, General Electric chose to divide into 3 independent entities, Energy, Healthcare and Areospace, alongside Johnson Controls spin off of Adient, to focus more on its other divisions, which traded independently in 2016. 3M also chose to spin-off its healthcare business, Solventum, which is now trading independently, due to its’ unalignment with the rest of their operations.

Honeywell’s Spin-off

Early in February 2025, the US industrial conglomerate Honeywell [NASDAQ: HON], valued at $145bn, announced plans to spin off its aerospace division and automation business and looked at seperating its advanced-materials businesses in the second half of 2026. The automation division generated $18bn revenue in 2024 and the areospace business contributed to $15bn of Honeywell’s total revenue in 2024. This decision followed from Elliott acquiring over a $5bn stake in the company. Unlike the markets reaction to Smith’s Group similar announcement, Honeywell shares fell 5.6% the day of the announcement, however Elliott has said it sees the stock increasing as much as 75% in the next two years. Following Elliott’s $5bn stake they began pushing for the breakup, arguing the conglomerate strucuture was undervaluing its individual businesses, comparing the potential value creation to the cases previously mentioned. Aside from the undervaluation, the aerospace and automation division needs to focus and priortize very different goals, and if independent, the businesses could attract specialized investors instead of being bundled together.

• This is not Honeywell’s first spin-off, in October 2018, they spunoff their turbocharger business into Garrett Motion to focus on higher growth technologies; however following this, Garrett Motion accumulated significant debt and filed for bankruptcy two years later.

• Another example of an unsuccessful spin-off, is in August 2018, where they spun-off Resideo Technologies, which underwent restructuring following poor stock performances.

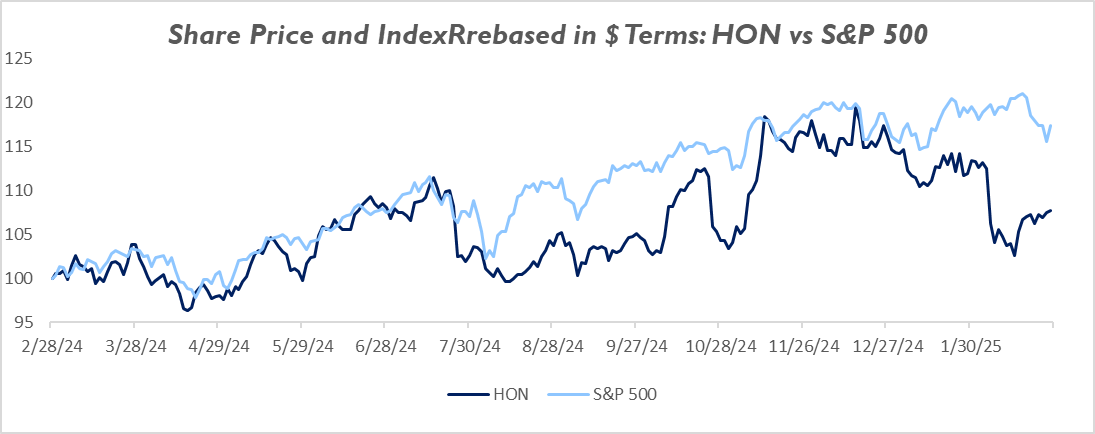

These two examples, help to justify the bearish market reaction post spin-off announcement. Honeywell stock has been underperforming relative to the S&P 500, and struggled to perform against competitors like GE Aerospace.

Source: Yahoo Finance, BSIC

The poor stock performance as shown above is partly due to their largely diversified portfolio experiencing a “conglomerate discount”, as well as having little to none synergies between the divisions, with resources being spread too thin and the investment needs and business models between the aerospace and automation divisions being vastly different. Their disappointing performance is also credited to their M&A strategy; Honeywell has made numerous acquisitions recently:

• $1.9bn for CAES and $1.8bn for Air Products’ LNG Process Technology & Equipment Business in September 2024

• $4.95bn acquisition of Carrier’s Global Access Solutions Business in June 2024.

However, due to the vast volume and variety of acquisitions, they have struggled to integrate these companies successfully into the conglomerate and allocate the sufficient resources. Honeywell’s aerospace business can be valued anywhere “between $90bn and $120bn including debt” (Reuter’s), however post-separation, analysts expect the individual entities to be valued much higher, as the market undervalues diversified companies compared to individual companies, who have streamlined operations and a more strategic focus. Recently, when conglomerates have broken up, in general the newly independent companies are valued higher, due to their increased specialization and the strategic flexibility the individual entity now has. Thus, despite the initial market reactions, when looking at a similar case with General Electric’s’ split-off, and the strong performance of GE HealthCare post-spin off, it supports the idea that specialising helps to build investors support and leads to higher shareholder returns post-separation, as Elliott expects.

Farallon Capital Management’s Stake in Astellas Pharma

Farallon Capital Management, a San Francisco-based investment fund managing $39bn in assets, has acquired a stake exceeding 3% in Astellas Pharma [TYO: 4503], one of Japan’s leading pharmaceutical firms, with a goal to “quickly and significantly increase its share price.” This move positions Farallon among Astellas’s top three shareholders. The fund is advocating for accelerated cost reductions, a shift in its merger and acquisition (M&A) strategy towards late-stage drug candidates with higher market potential, and a comprehensive overhaul of Astellas’s research and development (R&D) initiatives, which have historically failed to advance enough drugs past trial stages. By doing so, Farallon aims to enhance Astellas’s financial performance and streamline its drug development pipeline. The fund believes that prioritising late-stage drug candidates with higher market potential will reduce the risks associated with early-stage research failures and expedite revenue generation.

As one of its most successful drugs, Xtandi, which treats prostate cancer, is expected to reach the end of its patent exclusivity period in 2027, Astellas’ leadership sees mounting pressure to rapidly and effectively invest the cash flow from the drug’s sales, potentially into acquiring other pharmaceutical companies with late-stage drug candidates as discussed above. We have seen this strategy applied successfully several times in the pharmaceutical industry. Developing a new drug is a lengthy and expensive process. On average, it takes 10-15 years and over $2 billion to bring a drug from discovery to market, with a high chance of failure at each stage. Acquisitions offer a shortcut to this process. There are several recent examples of such transactions:

• Bristol-Myers Squibb’s acquisition of Celgene for approximately $74bn to primarily expand its Phase III assets with six near-term product launches, representing greater than $15bn in revenue potential.

• Pfizer’s $30bn acquisition of Seagen to gain access to its promising portfolio of cancer treatments and strengthen their oncology pipeline.

• Merck’s $10.8bn acquisition of Prometheus, granting Merck access to Prometheus’ lead candidate, PRA-023, an optimistic reatment for ulcerative colitis and Crohn’s disease.

This campaign by Farallon is part of a broader surge in shareholder activism within Japan, encouraged by governance reforms instituted by the Tokyo Stock Exchange, compelling companies to take investor demands more seriously. Astellas’s management has been in dialogue with Farallon since 2020 and has articulated plans to increase its core operating margin from 20% to 30%, reflecting a mutual commitment to improving operational efficiency. The company’s share price, which has declined by nearly 40% since its peak in 2023, initially fell by 2% on Wednesday but eventually turned positive after news of Farallon’s involvement, closing with a 3.5% increase. With Farallon increasing its engagement with the company, Astellas has asked a group of external directors to provide “objective oversight of the execution” of its priorities, as well as explore other strategic possibilities, including partnerships or an outright sale. Farallon has a history of investor activism in Japan. In the past, it held a stake in Toshiba and successfully pressured the company to restructure its management and consider buyout offers. Given this track record, investors are optimistic that Farallon’s involvement with Astellas will lead to better efficiency and higher shareholder value.

Starboard Value’s Stake in Becton Dickinson

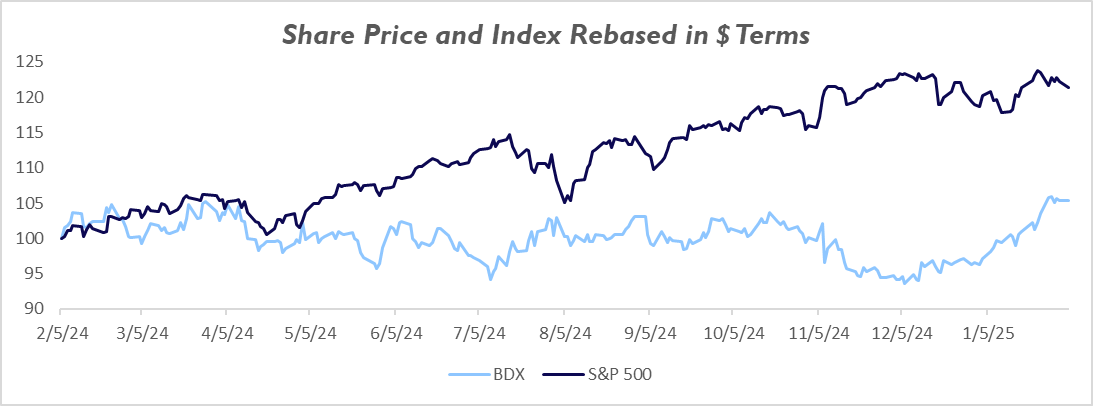

In a parallel development, Starboard Value, a notable activist investment firm, has acquired a stake in New Jersey-based Becton Dickinson [NYSE: BDX], a medical technology company with a market capitalization of $72bn, and is urging the company to divest its life sciences division. This division generates approximately a quarter of its annual revenues—roughly $5.2bn—and is valued between $33bn and $35bn. In December, analysts from Bank of America argued that the “sum of the parts is getting too wide to ignore” and that splitting the business from the rest of the group could increase its value by as much as 30%. Recently, Becton Dickinson has significantly underperformed market benchmarks. The company’s stock gained just 4.4% in the past year, compared to a nearly 22% rise in S&P 500, intensifying shareholder pressure for a spin-off. This lackluster performance can be observed through the graph below:

Source: Yahoo Finance, BSIC

Underscoring the shareholders’ demands for restructuring, Becton Dickinson’s shares jumped by 3% in pre-market trading after Starboard’s stake was revealed. Historically, Becton Dickinson has undertaken similar restructuring efforts, notably the spin-off of its diabetes care business into a separate entity, Embecta, in April 2022. However, Embecta’s stock has struggled as a standalone company, with its share price sinking about 60% since its listing.

Starboard Value has a strong track record of engaging with healthcare companies to drive reform and create value. Recently, it has acquired positions in companies such as Kenvue and Pfizer. In the case of Pfizer, Starboard amassed a 0.6% stake — worth $1bn as of October 2024 and is advocating for a reassessment of the company’s operational focus and potential divestitures. Initially, it is considering the sale of Pfizer’s Hospital unit, which focuses on antibiotics and sterile injectables used in hospitals and clinics. This unit was formed after the $17bn acquisition of Hospira in 2015, generates nearly $500mn in EBITDA, and could potentially be worth a few billion dollars. The pharma giant has hired Goldman Sachs to gauge initial interest from potential buyers. This activism has been welcomed in response to a 52% drop in Pfizer’s share price from its pandemic peak and a $70bn acquisition spree that delivered disappointing returns, failing to inspire investors. It is already gaining support from executives at the company.

Conclusion

To conclude, we anticipate that global activism will remain at high levels, with UK companies continuing to be major targets in Europe due to lower share price valuations and the UK’s relatively activist-friendly legal and corporate governance environment. Moreover, we expect that some UK-listed companies will face ongoing pressure to move their primary listings to the US, with arguments centered around higher valuations and better liquidity. Additionally, as established activists keep innovating their strategies and more first-time and occasional activists launch campaigns, activist tactics are becoming increasingly unpredictable. We also anticipate mainstream institutional investors adopting more activist approaches with the companies they invest in. However, this will likely continue to be done primarily through private engagement and off-the-record media briefings.

0 Comments