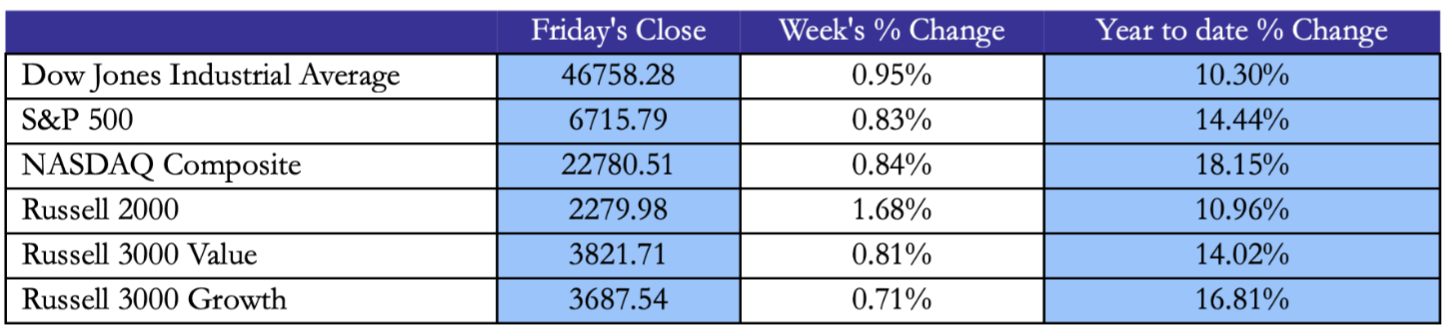

USA

US equities ended the week on a stronger note: despite the US government shutdown on Wednesday, the market has seen all-time highs during the week for both S&P500 and DJIA. The S&P 500 and Dow each gained about +0.83% and +0.95% respectively for the week, while the Nasdaq Composite rose +0.84%, after peaking on Thursday.

As briefly mentioned above, central to the past week was the new of the US government shutdown as the congress was unable to pass a funding bill by the September 30th deadline. This immediately had a tangible effect as Friday’s crucial Non-Farm Payroll data weren’t released being the Bureau of Labor Statistics among the first infrastructure to be shut off. Due to this temporary “data blindness”, investors look at the consensus of 50,000 jobs added and an unemployment rate remaining steady at 4.3%. Moreover, big emphasis was put on the ADP Private Payroll count that saw private employers cutting 32,000 positions during the past month, documenting how the labor market in the US remains weak, despite rate cuts in September that will, of course, require some time to kick in. In general, US equities have proven to be resilient to the uncertainty of this week continuing with the momentum that we have been seeing during the last weeks, driven by AI stocks.

Source: Yahoo Finance, Bocconi Students Investment Club

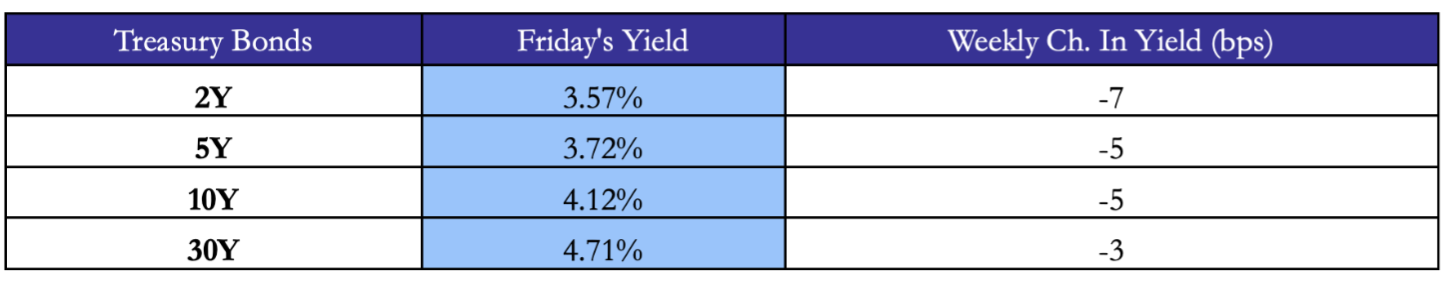

U.S. Treasury yields see-sawed this week, ultimately steepening the yield curve as short-term rates inched down on Fed dovish bets. The 2-year Treasury yield sank to around 3.57%, marking a two-week low, by Thursday, reflecting growing expectations of future rate cuts. Meanwhile, the 10-year yield hovered near 4.1%, little changed week-over-week, and the 30-year yield held around 4.7%. It is interesting to see how a prolonged shutdown, might cause further steepening due to lower supply of T-bills by the treasury department.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

The Fed’s next meeting is later in October, and as noted, markets now see a 25bps cut as highly likely given the absence of a jobs report and signs of softer labor demand, continuing J. Powell’s stance indicating the higher inflation as a one-time price increase and allowing thus the FED to focus on the labor side of their dual mandate.

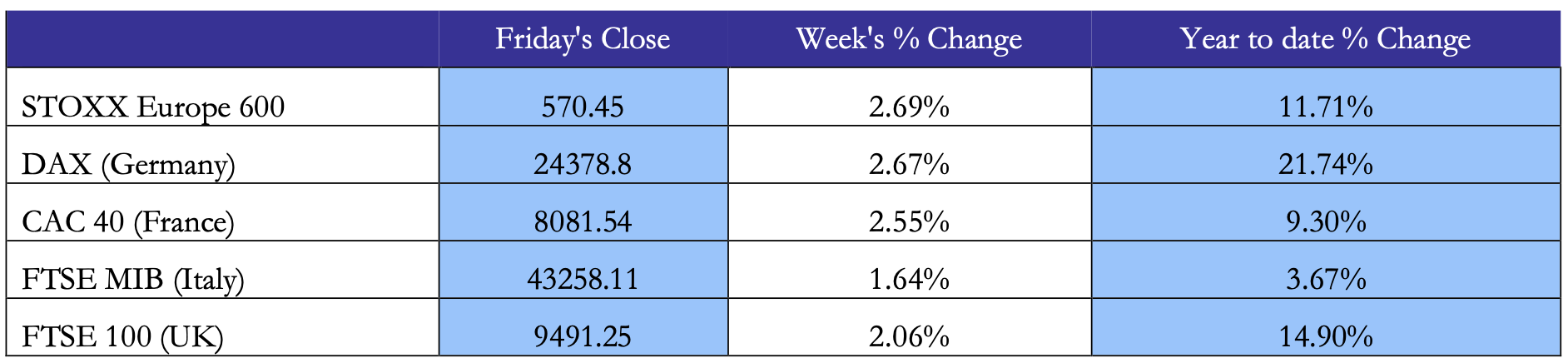

Europe and UK

European equities just saw their strongest week since April, with an EuroStoxx600 index climbing +2.69%. The same narrative arises when we look at country-specific indexes: Germany’s DAX 40 and the Netherlands’ AEX each hit all-time highs, while France’s CAC 40 and Italy’s FTSE MIB also posting strong gains.

These gains were primarily driven by the healthcare sector (EuroStoxx Healthcare +1.3% last week), showing relief after European pharmaceutical companies found an agreement with the US on medicare drug pricing, effectively erasing the fears of the announced 100% tariffs on pharmaceuticals and, for now, the tariff rate will remain at the general 15%, helping this industry thanks to a less uncertain environment.

In the UK we saw a strong FTSE 100 (+2.06%) reaching all-time highs as well, mainly driven by banking sector, and energy stocks.

Source: Yahoo Finance, Bocconi Students Investment Club

European economic data are showing a mixed but improving picture. Particularly we saw Eurozone inflation data for September coming out at 2.2%, little above the 2.0% recorded in August. However, core inflation remained stable at 2.3%, despite a strong pickup of services inflation. This was described as a temporary blip in prices across the Euro area by the ECB President, also highlighting that the actual 2% policy stance is well set to promptly respond higher inflation or new shocks. The HCOB Eurozone Manufacturing PMI slipped to 49.8 in September 2025 (from a three-year high 50.7 in August), signaling a return to contraction after one month of expansion in a downturn that began in June 2022. New orders fell again—fastest since March—amid weaker export demand, while thinner backlogs let firms lift output slightly.

In the UK we have seen PMI notching down on Friday, indicating the slowest business activity growth since April. This can be reconducted to fiscal policy uncertainty over potential tax hikes. Finance minister Rachel Reeves is due to present her second annual budget on November 26, with many economists indicating a high probability of significant tax hikes or spending cuts putting pressures on output. Moreover, UK inflation is still elevated (~4.1% headline and 3.8% core in August).

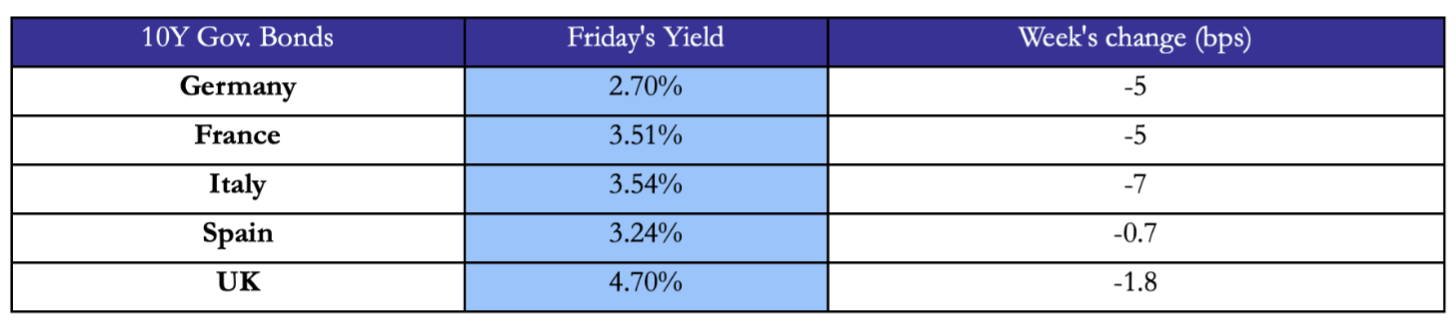

European government bond yields were relatively steady. Germany’s 10Y Bund yield ended near 2.70%, roughly unchanged and about 10 bps below recent highs. France’s 10Y OAT yield is 3.51%, and Italy’s 10Y BTP eased to 3.54%, reflecting improved sentiment toward Italian fiscal policy with a spread of just 84bps.

The UK 10Y gilt yield at 4.70% was practically flat, with markets balancing sticky UK inflation against slowing growth.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

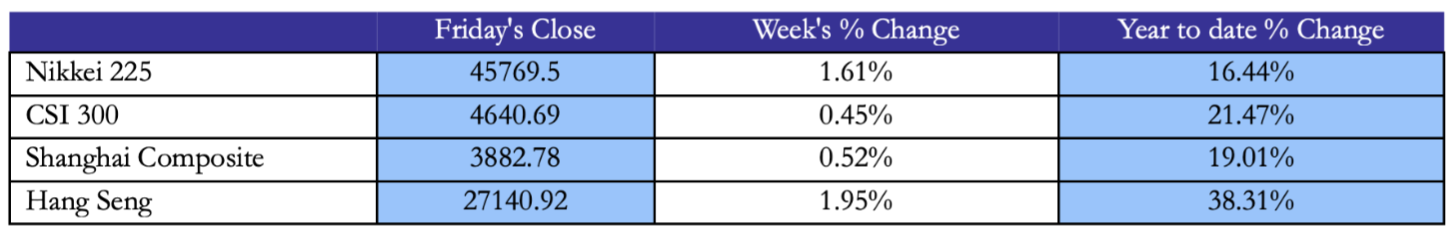

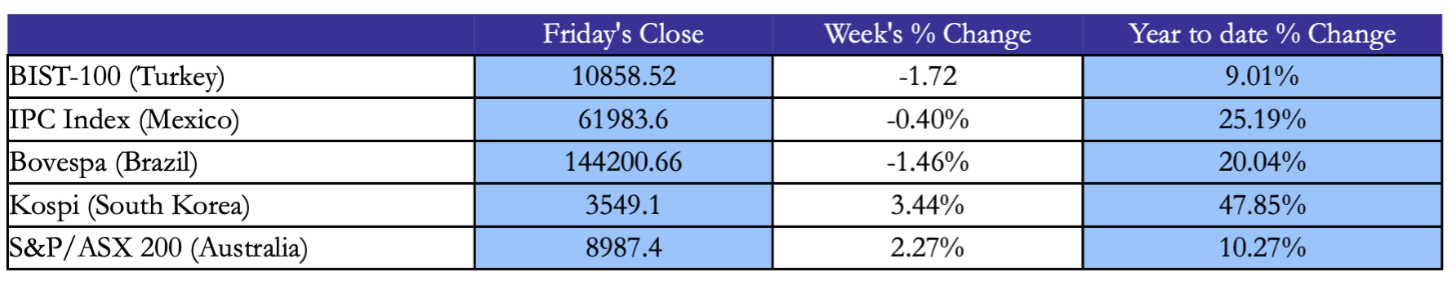

Rest of the World

Asian markets largely joined the global upswing, some hitting multi-year or record highs. In Japan, the Nikkei 225 index soared to levels not seen since the 1980s. It rose about +1.61% this week to ~45,770, and then jumped above 45,700 on Friday, setting a new post-bubble record. A weaker yen and strong tech earnings have fueled Japan’s rally. Tech and electronics shares led the charge again – for instance companies like Advantest and Tokyo Electron saw solid gains on the AI chip optimism. Japanese investors also cheered the Tankan business sentiment survey: the BoJ’s Q3 Tankan released Wednesday showed large manufacturers’ confidence improved to +14 (highest since end-2024) and big non-manufacturers held at a strong +34.

Importantly, firms raised their capital expenditure plans to +12.5% for FY2025 (vs 11.5% prior), signaling corporate Japan is ready to invest. This positive Tankan, “shrugging off trade tensions,” cleared another hurdle for a possible BOJ rate hike as soon as this month. Markets now see ~60% odds that the Bank of Japan will raise rates to 0.75% (from 0.50%) at its late-October meeting – which would be its second hike of the year.

China’s markets had a shortened trading week due to the Golden Week holidays. Mainland exchanges were open through Tuesday and then closed Oct 1–7 for National Day. Before the break, Chinese stocks were modestly higher. Hong Kong’s Hang Seng Index instead (which traded most of the week) delivered a standout performance, surging +1.95% for the week mainly driven by a strong tech sector. On Sept 30, China’s official Manufacturing PMI for September came in at 49.8, a 6-month high and up from 49.4 in August (though still just below the 50 mark of expansion) while the Non-Manufacturing PMI came out at 50.9, showing signs of slight expansion. These strengthening trends suggest China’s stimulus measures (rate cuts, infrastructure spending) are gradually gaining traction, even if the property sector remains a drag.

Source: TradingEconomics, Bocconi Students Investment Club

In Turkey, September CPI re-accelerated to 33.29% y/y, forcing investors to question the central bank’s easing path; the lira slid to record lows and the BIST 100 softened as rate-cut hopes were repriced.

Source: TradingEconomics, Bocconi Students Investment Club

FX and Commodities

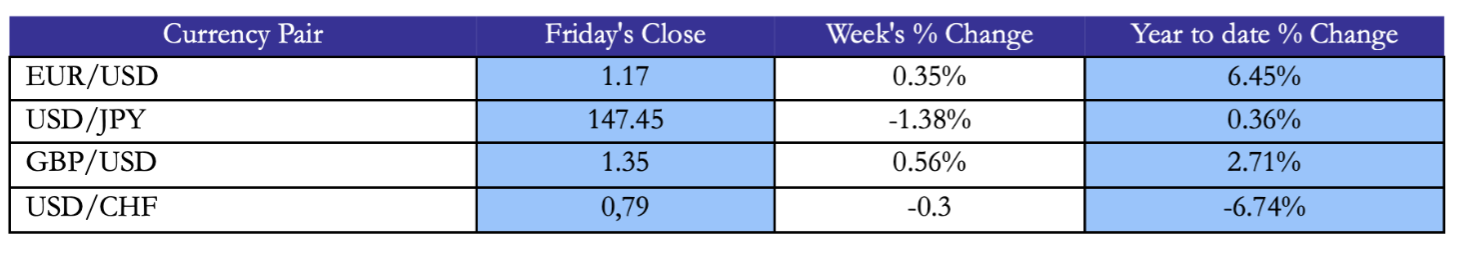

It was a rather volatile week in the FX markets, with the U.S. dollar easing off recent highs as risk appetite grew. The U.S. Dollar Index (DXY) fell for much of the week, reaching a one-week low around 97.46 on Thursday before ending near 97.8. That’s down from ~99 in mid-September. The prospect of Fed rate cuts and the U.S. government shutdown dented the dollar’s yield appeal, and with investors in “risk-on” mode, some capital flowed out of safe-haven USD.

The Euro remained at a strong level ~1.17$ throughout the week. Similarly, the British pound traded near $1.345, down about –0.3% this week. Sterling was weighed by the weaker UK data (soft PMIs) and by the dollar’s late-week stabilization. Still, at $1.348, GBP/USD remains near its highest levels in over a year, reflecting the UK’s still-high-rate differential.

The Japanese yen saw some volatility. Early in the week, USD/JPY dipped from ~149 to about ¥147.45 as speculation grew that the Bank of Japan might finally tighten policy.

Source: TradingEconomics, Bocconi Students Investment Club

Source: TradingEconomics, Bocconi Students Investment Club

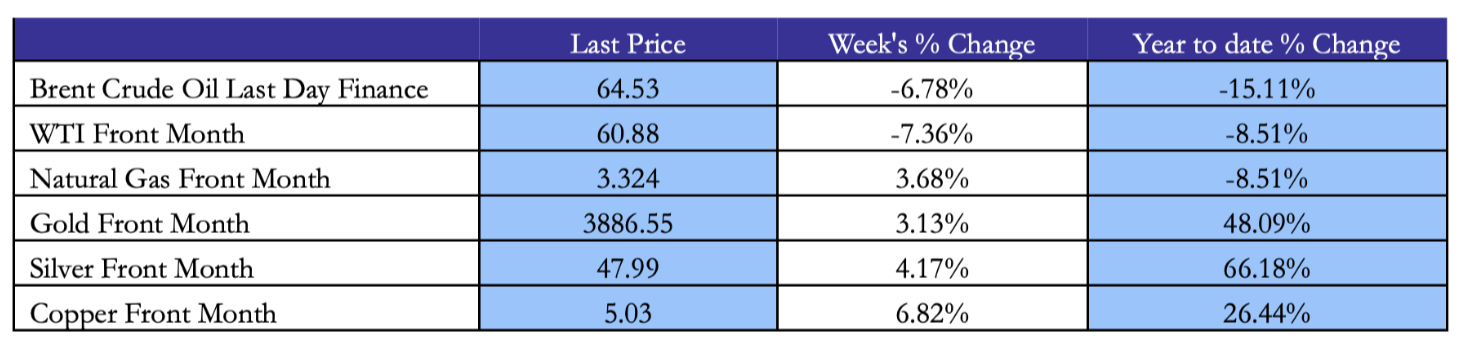

Commodities saw a mix of very different stories. Gold continued its rally reaching all-time highs just above the 3,900$ level, driven by the period of renewed uncertainty and expected future higher inflation in the US, favoring inflows of capital into safe haven assets.

On the oil markets we saw instead a sharp fall in prices (~-7% both Crude and WTI), on expectations of a global supply hike in the upcoming OPEC+ meeting, and after Iraq’s Kurdistan region resumed crude oil exports via Turkey over the last weekend.

In the base metal space, we have seen a rally of the copper around 4%, mainly due to supply disruption caused by a large accident happening at the Grasberg mine in Indonesia, the second largest copper mine.

Source: TradingEconomics, Bocconi Students Investment Club

Source: TradingEconomics, Bocconi Students Investment Club

Next Week Main Events

Brain Teaser #34

There are N distinct types of coupons in cereal boxes and each type, independent of prior selections, is equally likely to be in a box. If a child wants to collect a complete set of coupons with at least one of each type, how many coupons (boxes) on average are needed to make such a complete set?

Solution: The hunt unfolds in stages. Early on, almost every new box adds a new type; later, as your album fills, repeats become common and progress slows—this is the diminishing-returns core of the puzzle. When you already have i-1 distinct types, the chance the next box gives a new one is (N-(i-1))/N, so the expected wait for that next new type is N/(N-i+1). Add these stage-by-stage waits from the first type to the N-th and you get the average total number of boxes. Intuitively, the last missing coupon is the hardest—each box has only a 1/N chance of being it—so you spend about N boxes on that final step alone.

Brain Teaser #35

You toss a fair coin till you get five consecutive heads. Since the outcomes of the tosses are random, the number of tosses required to get five consecutive heads will vary. So, what is the expected number of tosses to get five consecutive heads?

0 Comments