Introduction

The precious metals market is reaching sky-high valuations; gold (Au) has broken $4,000 per ounce for the first time in history, dragging silver (Ag) to its decade-best levels alongside. The rally emerges as geopolitical uncertainty and conflicts drive central banks and investors to these traditional safe havens. This momentum has also translated into promising performance from platinum (Pt) and other platinum group metals (PGMs).

Notably, however, it is unlikely that we are witnessing a sustainable revaluation, but rather an asset bubble, as evidenced by falling prices. As of mid-October, gold suffered a loss of 6%, and silver 8%. In the meantime, it appears that lofty valuations compared to previous years will endure, but with varying performances according to metal type.

“The Gold Standard”

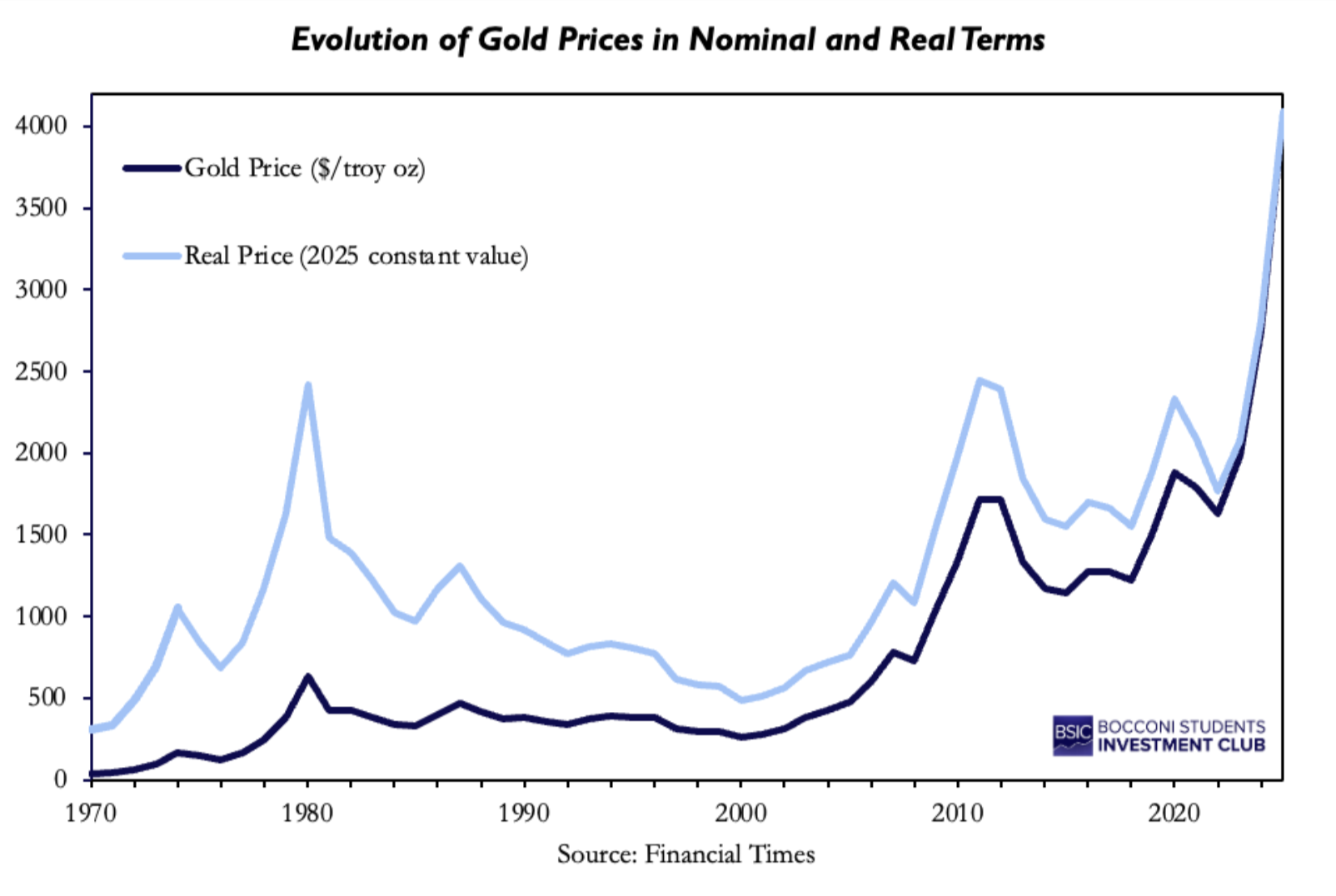

The current rise of gold’s price beyond $4,000 per ounce raises questions over whether this development represents an overvaluation or a structural revaluation of the metal’s role as a reserve asset. Gold’s price has risen by approximately 50% YTD, marking the strongest annual performance since 1979. This development reflects the current sustained fiscal imbalances, geopolitical uncertainty, and declining confidence in monetary policy. Recently, however, gold fell by more than 7% before partially recovering, highlighting its short-term volatility. In the past, gold has shown a trend of appreciating during periods of economic instability, reaching approximately $1,000 per ounce in 2008 during the financial crisis, $2,000 in 2020 throughout the pandemic, and $3,000 in 2023 following the banking crisis.

Unlike the previous cycles, the current increase in gold prices is not primarily driven by speculation or short-term inflation concerns, but by structural shifts in long-term demand. A significant share of this sustained demand originates from central banks. Institutions such as those in China, India, Turkey, and Poland have increased their holdings in recent years to diversify away from the US dollar and strengthen reserve resilience, a so-called “underlying de-dollarisation trend”. Official purchases exceeded 1,000 tonnes in 2023, representing the second-highest total on record. Since 2022, central bank gold purchases have nearly doubled, increasing gold’s share of global reserves to approximately 24%, a drastic increase to the 10% a decade earlier. This accumulation is driven by both strategic and macroeconomic factors. The freezing of Russian foreign reserves in 2022 raised many questions about the security of claims of Western governments in a crisis. The resulting diversification has been accompanied by concerns about the independence of the Federal Reserve and the long-term stability of the US fiscal position. In this environment, one of gold’s main appeals lies in its political independence. At the same time, limited growth in global supply has amplified the impact of this demand, sustaining an upward pressure on prices. With global mine output stable at around 3,600 tonnes per year, official purchases take up a substantial portion of available supply.

Alongside official sector demand, institutional investors have increased their holdings through ETFs and related funds. Inflows into gold-backed ETFs surpassed $60bn in 2025 so far. This institutional investor demand signals a wider reconsideration of portfolio strategy in response to inflation volatility and fiscal uncertainty. Morgan Stanley has suggested the 60/20/20 portfolio model, allocating 60% to equities, 20% to fixed income, and 20% to gold. This marks a significant shift from the traditional 60/40 model that has previously dominated asset management. Analysts describe the rationale behind this reallocation as the “debasement trade”. Persistent fiscal deficits, high levels of public debt, and expansionary monetary policy have increased concerns about the long-term decline in the purchasing power of major currencies. Gold serves as a safety measure against this decline in purchasing power that can result from sustained debt monetisation. In China, for example, gold demand has expanded across both the official and private sectors. The People’s Bank of China has consistently increased its official gold holdings for more than twelve consecutive months, while domestic retail purchases have risen sharply.

However, this demand also raises questions about the sustainability of the high price levels. Due to the drastic appreciation, parallels are being drawn to previous cycles, specifically 1979-1980 and 2010-2011. In both cases, concerns over inflation and central bank credibility drove similar price surges that later declined when economic conditions stabilised. The recent 7% price drop suggests that, despite structural demand, the gold market might start displaying similar volatility to that seen in earlier cycles. Some analysts warn that gold may be showing characteristics of speculative excess, tying back to the idea that investor sentiment is amplifying demand. Despite these concerns, many emphasise that the current environment differs significantly from earlier periods, as today’s price dynamics are supported by structural and macroeconomic factors, rather than just investor sentiment. If real interest rates remain low and public debt continues to rise, the conditions would remain favourable for the continued strength in gold’s value. While short-term volatility is likely, gold’s long-term trajectory will remain supported by ongoing central bank diversification and concerns about government debt.

Thus, the outlook for gold will depend on whether fiscal and monetary authorities can restore their credibility. Until then, its strength is likely to persist as a reflection of the uncertainty that continues to weigh on markets and investor confidence.

“High Beta Silver”

Silver has surged 70% this year, outpacing gold’s 55% gain, and reaching $53 per ounce on October 14. As a more volatile asset compared to its yellow counterpart, silver is often described by traders as “gold on steroids”. This stems from its tight liquidity, being that its market value is one-ninth of gold and that it is not held in significant quantities by central banks; thus, there is no “seller of last resort” in financial crises. However, historically, silver is no stranger to squeezes. The Hunt brothers’ 1980 attempt to “corner the market” sent prices above $49 per ounce, before a speculative burst on “Silver Thursday”, whereby prices plummeted to $11 per ounce.

Regarding price, silver typically moves in tandem with gold as it shares similar underlying drivers, which establishes it as a suitable proxy. For instance, geopolitical uncertainty surrounding potential Section 232 tariffs stimulated stockpiling of silver in New York, while Russia’s central bank has shown interest in diversifying its vaults with silver reserves. However, unlike gold, the silver rally has also been bolstered by industrial demand. In fact, it accounts for approximately 60% of silver output consumption, a 10-percentage point increase over the past decade. Silver’s industrial applications encompass technology (electronics), green energy (solar panels), and defence (missiles), which are tied to robust growth prospects. Moreover, silver’s aesthetic value has also contributed to recent demand, with prices rising in tandem with the Indian wedding season.

On the supply side, tightness in silver inventories has further contributed to spiking prices. Silver production has declined since its peak in 2017, given that it is primarily mined as a byproduct of lead, zinc, and gold, which limits supply flexibility. These supply constraints have been particularly prevalent in London, the world’s largest hub for physical silver trading, where a premium of $1 and $2 emerged over Comex futures in New York. These severe shortages prompted significant inflows of silver from the US and China. It is estimated that over 1,000 tonnes have been delivered to relieve market pressure. Traders even went to such extremes as flying silver across the Atlantic in the cargo holds of planes. This mode of transportation is usually reserved for gold, while bulkier silver is transported by ship. Consequently, these emergency inflows have contributed to recent falls in the price of silver.

Investors traditionally view gold as an inflation hedge and haven, while silver offers higher speculative potential due to industrial demand. Current trends of stabilising inflation and falling interest rates could slow momentum for both metals, as investors shift to other assets, such as bonds and equities. For instance, the 8% silver price fall in mid-October signals bubble fatigue and raises doubts whether silver may be a safer value hedge for gold. However, while gold excels during periods of economic and political uncertainty, silver may prove more resilient in a phase of sustained industrial demand and economic growth.

“The Platinum Comeback”

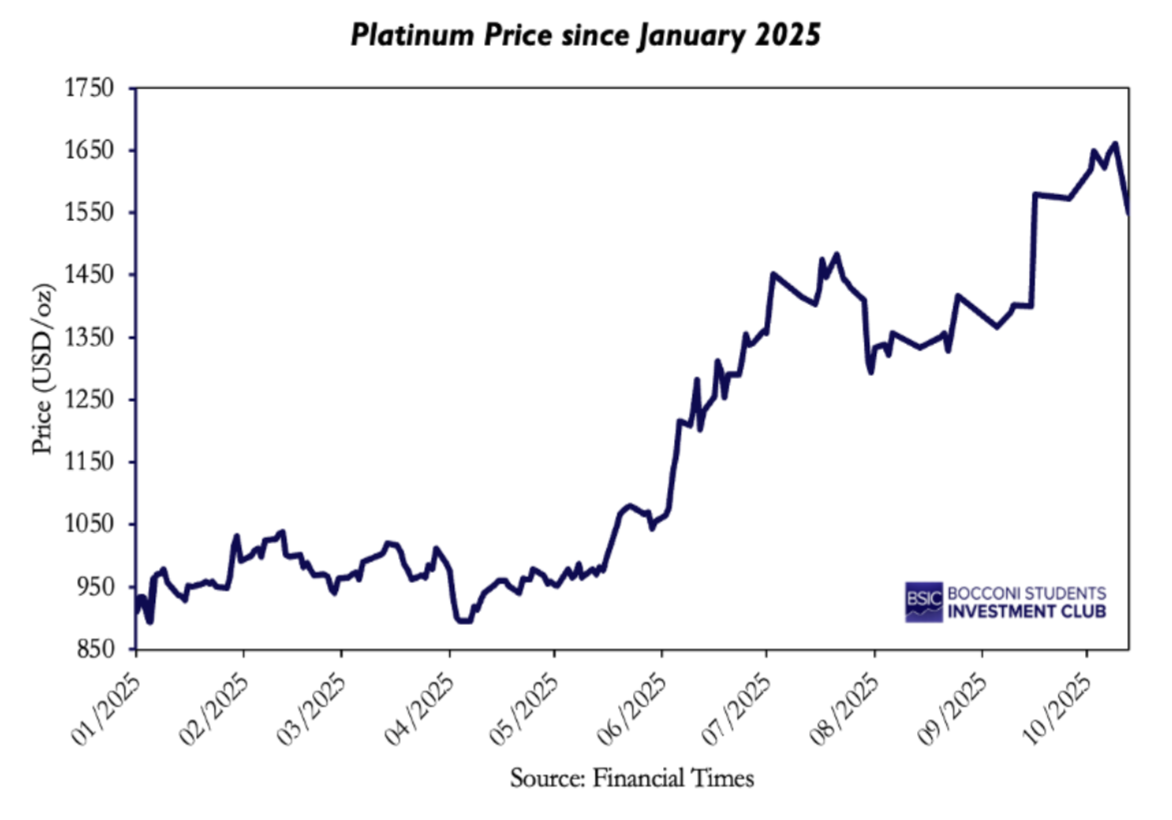

After years of weak performance, platinum has made a significant recovery. Prices recently reached above $1,630 per ounce, their highest level in more than four years and are up around 15% in the past month. June 2025 marked the metal’s strongest month since 2008, demonstrating a clear shift in market sentiment and the underlying industrial demand.

The main factors driving platinum’s rebound are renewed industrial demand, supply constraints, and rising investor interest as an alternative to gold. Platinum differs from other precious metals due its relatively high industrial use. According to the World Platinum Investment Council (WPIC), around 40% of demand comes from the automotive industry, 26.5% from jewellery and 26% from other industrial applications.

This mix gives platinum a dual nature as both an industrial metal and a store of value. High gold prices have played a major role in the comeback. As investors grow concerned that gold may be overvalued, attention has shifted toward gold alternatives such as platinum and silver. Both metals have risen as investors seek hedges against a weakening US dollar and excessive US government borrowing. Platinum is viewed as undervalued relative to gold, yet its industrial usage supports strong long-term demand. In the automotive sector, platinum remains essential. It is used in catalytic converters that reduce emissions from petrol and hybrid cars. While the rise of electric vehicles was expected to lower platinum demand, the transition has been slower than expected. High EV prices and concerns about the kilometre range have led consumers to favour hybrids, which still rely on catalytic converters. As a result, the auto industry continues to provide a stable source of platinum demand. Simultaneously, platinum is gaining strategic importance in the hydrogen economy. It acts as a catalyst in proton-exchange-membrane electrolysers, which produce green hydrogen and in hydrogen fuel cells used in vehicles and heavy industry. The WPIC expects hydrogen technologies to become a significant source of demand by 2030 and potentially the largest single segment by 2040. This connection to renewable technologies provides a substantial growth driver.

The jewellery market is also recovering. Record gold prices have led consumers, especially in China, towards platinum as a cheaper but also prestigious alternative. Chinese platinum imports rose in April, and the WPIC forecasts a 11% annual increase in global jewellery demand to 2.2m ounces in 2025. China is expected to contribute more than a quarter of that growth with demand up 42% to 585,000 ounces.

On the supply side, the platinum market faces a third consecutive year of structural deficit. South Africa, which produces nearly 70% of global output, continues to face power shortages, underinvestment, and weak recycling volumes. The WPIC expects global mine supply to fall 6% to 5.4m ounces this year. Stocks that previously balanced the market have now been heavily depleted. Although the price increase offers some relief to producers, it remains insufficient to ensure sustainable mining. The long-term shortage in investment and energy reliability means that supply constraints are likely to persist, supporting prices beyond 2025. Investor demand has increased alongside these supply constraints. Platinum-backed ETFs have seen inflows of around 70,000 ounces this year, reversing several years of outflows. Many funds now consider platinum a relative value opportunity compared to gold and silver. So far in 2025, platinum has outperformed both metals, delivering a year-to-date return near 80%.

Analysts expect volatility to remain high, but the most likely scenario is for prices to be in the $1,650–$1,750 range by the end of the year. A short-term correction toward $1,450 is possible if investors take profits, while worsening power issues in South Africa or faster hydrogen adoption could push prices toward $1,950, with $2,000 considered achievable in a positive scenario. Platinum is benefiting from the combined global decarbonization, constrained supply, and shifting investor sentiment. Its industrial relevance ensures demand, while its scarcity and undervaluation make it appealing.

Platinum is regaining attention as a strategic material with both economic and environmental importance. The combination of supply constraints, new technological innovations, and rising investor confidence suggests that this recovery is not temporary but rather leads to a long-term revaluation.

Platinum Group Metals (PGMs)

Palladium (Pd), Rhodium (Rh), Ruthenium (Ru), Osmium (Os), Iridium (Ir), and Platinum (Pt). These are the metals, alike physically and chemically, which form the Platinum Group Metals (PGMs). They share high melting points, a silvery-white appearance, high corrosion resistance, and powerful catalytic properties, making them viable to be used in a range of industrial processes, including in automotive, chemicals, electronics, and the green-energy transition. Mostly found in the South African Bushveld and Russian Norilsk region, platinum is the face of the group, but its lesser-known siblings are quietly shaping some of the most important technological and environmental transitions of the century.

Palladium/Rhodium

Palladium and rhodium are mined as by-products of nickel and platinum production. They are gaining prominence in the 20th century due to the automotive transitions. As catalytic converters, which convert carbon monoxide, nitrogen oxides, and hydrocarbons into less harmful gases, became mandatory across the industry, their attractiveness has increased tremendously. Palladium peaked in 2021 at $3,000 per ounce, fuelled by robust automotive demand and supply fears following geopolitical tensions with Russia. Contrastingly, rhodium, a less liquid and rarer sibling of palladium, rose even higher, nearly reaching $30,000 per ounce during the same period. At this point, it was the most expensive precious metal in the world. However, both metals have suffered drastic price declines since then, with palladium falling by around 70% to $1,000 and rhodium levelling at $4,500 in early 2024. Most recently, there has been a slight uplift once again, largely caused by flooding in South Africa, curtailing output from Anglo American [LSE: AAL] Platinum’s Tumela mine.

Still, in the long run, both markets face structural headwinds. The rapid shift to electric vehicles, which do not require catalytic converters, has eroded demand, while rising recycling volumes and substitution by cheaper platinum have added further pressure. As this trend of electrification continues, demand will continue to fall. However, hybrid vehicles will continue to act as a backstop to demand and innovation in hydrogen and fuel cells has revealed application possibilities for the catalytic properties of the metals in the respective technologies. Thus, both palladium and rhodium will remain relevant for now, acting as a symbol of how technological change can swiftly redefine the fortunes of even the rarest commodities.

Ruthenium

Discovered in 1844 and produced primarily as a by-product of platinum mining in South Africa, ruthenium appears as a pale grey, but very durable metal. It is valued by industry for its ability to enhance the corrosion resistance of alloys and make them more durable. Thus, it has a wide variety of applications, for example, in electrical contacts, resistors, chip components, and storage in data centres.

Recently, the metal has gained new attention, as scientists are experimenting with its potential role in hydrogen production and fuel-cell systems. Ruthenium-based catalysts might act as a cost-effective alternative to platinum in electrolysers that generate hydrogen from water. Thus, like its cousins palladium/rhodium, it is increasingly in demand to assist with the clean energy transition, marking a gradual transition from a specialty metal to a strategically significant one. Indications of this can be found in its price. After a significant spike in 2021, where it reached $850 per ounce, prices levelled around $400-$500 per ounce until late 2024. Due to the large increase in demand in data centres, ruthenium’s attractiveness has increased in 2025. As production is very limited, only around 30tn per year, this resulted in prices rising past its record levels of 2021 and settling at around $925 per ounce. This surge underscores how ruthenium, once an obscure industrial by-product, is fast becoming a critical metal at the crossroads of digital expansion and the global shift toward clean energy.

Iridium

Iridium is one of the rarest elements on Earth, with global annual production of less than ten tonnes. It was discovered in 1803 and is quite alike to ruthenium in properties and characteristics. It has a silvery white appearance, is exceptionally dense, has a high corrosion resistance, and can withstand extreme heat. Thus, its applications are in spark plugs, crucibles, high-temperature alloys, as well as in scientific instruments. Still, in recent years, its relevance soared due to its essential role in proton-exchange-membrane (PEM) electrolysers, the devices that produce green hydrogen from renewable electricity. Iridium has become an enabler of the energy transition and is at the forefront of government investment to ensure net-zero emission targets.

Prices surged to $6,500 per ounce in 2021 amid a wave of new electrolyser projects, and although they have since moderated to around $4,600 per ounce, supply remains extremely tight. Like most other PGMs, except platinum, it is mined as a byproduct due to its scarce nature, making independent exploration unprofitable. Thus, increases in supply are limited even if the demand would increase by much more. Its scarcity, combined with its irreplaceable catalytic performance, makes it both a technological bottleneck and a strategic asset.

Osmium

Osmium, with a bluish-silver hue and a density nearly twice that of lead, is produced in quantities so small, measured in kilograms per year, that it barely registers in global commodity statistics. It is one of the rarest, but also densest materials on the planet, making it attractive in applications such as fountain pen nibs, instrument pivots, and watch bearings, where hardness and wear resistance is essential. Today, its applications are confined mainly to scientific research and medicine: its compound, osmium tetroxide, is used as a staining agent in electron microscopy and in certain organic synthesis reactions. There are no large-scale industrial applications as in vapor form, osmium is highly toxic.

The market for the metal is entirely illiquid. Supply and demand are determined by niche buyers who trade with each other. During the second quarter of 2025, the osmium prices in the USA reached $2,400 per gram, with prices being influenced by steady demand from the electronics and aerospace sectors.

In summary, palladium and rhodium defined the combustion engine era but now face an uncertain future as electric mobility expands. They are being replaced by ruthenium and iridium, which are emerging as relevant materials in hydrogen production and advanced electronics. Osmium serves more as a scientific curiosity, underscoring the scarcity that unites the entire PGM family. Overall, the Platinum Group Metals illustrate how technological progress can transform the role of precious materials across industries and in the world.

Conclusion

The 2026 outlook for the precious metals market remains optimistic. All major banks have updated projections for gold’s performance, with Goldman Sachs [NYSE: GS] and HSBC [LSE: HSBA] forecasting $5,000 per ounce, and Bank of America [NYSE: BAC] producing an even more bullish $6,000 per ounce. The consensus reflects expected sustained demand from ETFs and central banks, alongside continued geopolitical, monetary, and fiscal uncertainty, which supports gold’s upward trajectory.

However, these revisions are not guaranteed. Should macro and economic drivers stabilise, there is potential for the price of precious metals to retreat sharply. Moreover, specific risks should be noted: silver may face liquidity issues, and EV adoption could reduce demand for PMGs, such as palladium and rhodium. Yet, unlike prior speculative periods, current demand for these metals appears to be rooted in more stable drivers. For instance, primarily gold demand stems from central banks and ETFs; moreover, industrial demand supports silver, platinum, and PGMs, rather than being based solely on speculative hedging.

0 Comments