Introduction

Europe is recalibrating its industrial strategy for an era of geopolitical rifts and economic rivalry. After decades of prioritizing open markets and strict competition policy, EU leaders are now increasingly willing to foster “European champions” in critical sectors to secure the continent’s strategic autonomy. Supply chain shocks – from semiconductor shortages to an energy crisis – and rising US–China tensions have laid bare Europe’s vulnerabilities. In response, Brussels has adopted a doctrine of open strategic autonomy, aiming to enhance domestic capacity in key industries while maintaining connections to global trade. The push is clear: to build Europe’s industrial backbone by nurturing homegrown giants (or at least continental alliances) in vital fields like digital infrastructure, chips, clean energy, and defence.

We begin with data centers and cloud infrastructure, where Europe hopes to protect its data sovereignty in a market now dominated by foreign tech firms. We then assess semiconductors — the chips powering the digital age — and Europe’s bid to double its share of global production. Next is energy, especially batteries for electric vehicles, as the EU races to lead the clean-tech supply chain. Finally, we look at defence and aerospace, where Russia’s war in Ukraine has jolted Europe into bolstering its own military-industrial base. Across these arenas, the EU is intervening more actively than ever, channelling billions into joint ventures, new regulations, and alliances to spawn the “next Airbus” in each domain. The challenge is immense: can Europe translate public ambition into private-sector success, or will plans falter in the face of global competition and internal hurdles? Each sector offers a case study in Europe’s new industrial playbook.

Data Centers & Cloud Infrastructure

In the digital realm, Europe’s sovereignty push starts with where its data lives. Today, Europe remains heavily reliant on US tech giants for cloud services. Globally, Amazon Web Services, Microsoft Azure, and Google Cloud controlled about two-thirds of the cloud market by the end of 2023; in Europe, their grip is even tighter, with roughly 72% combined market share as of late 2022. This dominance is poised to grow as more businesses digitize. In 2023, only 42% of European firms had adopted cloud computing, meaning the hyperscalers (as these big cloud providers are known) have ample room to expand. European cloud companies complain of unequal playing fields. In fact, an EU trade group has lodged antitrust complaints alleging that the giants use their scale and software licensing practices to stifle competition.

Beyond market share, where data is stored has become a strategic concern. European regulators and courts have repeatedly challenged the legality of shuttling EU citizens’ data to US-based servers, given that US surveillance laws fall short of the EU’s stringent GDPR privacy rules. After transatlantic data-sharing pacts were struck down, companies operating in Europe faced the risk of hefty GDPR fines if they didn’t keep sensitive data (from, for example, the finance or healthcare sectors) on European soil. This reality has made “data sovereignty” more than a slogan – it’s a business imperative driving demand for cloud infrastructure under European jurisdiction.

Brussels and national capitals have responded with initiatives to cultivate indigenous cloud capacity. The most high-profile is Gaia-X, launched in 2019 by Germany and France as an attempt to create an “Airbus of the cloud.” Initially envisioned as a single European cloud provider to rival Amazon or Microsoft, Gaia-X evolved into a different model – a federated ecosystem of multiple providers adhering to common standards. In practice, Gaia-X is developing an open architecture and certifications to enable users to mix and match services from different European clouds as easily as from a single hyperscaler. The goal is to offer the benefits of scale and interoperability while keeping data under European governance.

Progress, however, has been mixed. Hundreds of firms have joined the Gaia-X association, and some “lighthouse” projects are underway to demonstrate data-sharing frameworks across sectors such as finance and manufacturing. Yet critics point out that this is a far cry from the original vision of a true European hyperscaler. Even Gaia-X insiders admit the project became bogged down in bureaucracy and competing interests – perhaps inevitable with over 350 member entities, including American tech companies whose involvement raised eyebrows. As a result, the initiative’s focus tilted more toward abstract standards and “data spaces” rather than building physical cloud infrastructure. Whether Gaia-X can meaningfully blunt the dominance of foreign clouds remains uncertain.

Meanwhile, the EU has put real money on the table for cloud sovereignty. In December 2023, the European Commission approved its first Important Project of Common European Interest (IPCEI) in cloud computing – a transnational investment plan supporting 19 companies across 7 countries. Backed by up to €1.2bn in public funds (expected to unlock another €1.4bn in private money), this IPCEI aims to develop an “interoperable and openly accessible” cloud and edge continuum in Europe. In essence, Europe aims to leapfrog into next-generation cloud technology – encompassing distributed networks that span large data centers to edge devices – with a focus on energy efficiency and trusted security. Projects under the IPCEI will develop greener data centers, open-source cloud stacks, and new software tools to integrate multiple providers. The investment is also tied to Europe’s Digital Decade targets, which include doubling cloud usage by businesses and the public sector. Additionally, EU regulations, such as the upcoming European Cloud Rulebook and data-localization requirements under the Data Act, are set to reinforce home-grown solutions by standardizing cloud interoperability and mandating that specific data be stored in-region.

It’s too early to tell if Europe’s cloud gambit will pay off. Building a competitive cloud infrastructure is technically and financially daunting – even global leaders spend tens of billions of dollars annually on their data centers. Europe may never have a single “Champion” cloud provider. Still, by federating what it has (from French, German, and other national clouds) and enforcing sovereignty safeguards, the EU could carve out a protected sphere for European data. Success might not resemble a European AWS; it could be a patchwork of smaller providers offering services under common standards, with government and regulated industries as anchor customers. What is clear is that Europe is no longer content to entrust its digital fate entirely to foreign hyperscalers. The new mantra: if data is the new gold, it should be stored and processed on European soil whenever possible.

The EU Chips Act – Do or Die

A sovereign cloud only stays sovereign if the compute behind it is dependable on European terms: the chips, the packages, and upstream tooling are all of European oversight.

Against this backdrop, the European Chips Act emerged from COVID-era chip shortages to bolster Europe’s semiconductor supply chain. Proposed in early 2022 and legally in force since September 2023, the Act aims to tackle the kind of microchip shortfalls that slowed car factories and to “strengthen the EU’s technological leadership” in chips. It sets an ambitious goal of doubling Europe’s global semiconductor market share to 20% by 2030, and rests on three pillars: a “Chips for Europe” initiative funding pilot lines and design infrastructure; incentives (including looser state-aid rules) for new chip fabs deemed first-of-a-kind in Europe; and a coordination mechanism for member states to monitor supply, flag crises, and jointly respond. This structure, inaugurated under pressure and urgency, reflects the EU’s newfound aim to treat semiconductors as strategic assets on par with energy and defence.

Despite lagging in high-volume chip manufacturing, Europe brings considerable strengths to the table. It is home to world-leading equipment and materials firms. Most notably, the Dutch ASML [AMS: ASML] holds a global monopoly in advanced lithography tools. European suppliers also specialize in semiconductor chemicals, wafers, and production gear, forming a critical part of the worldwide chipmaking supply chain. Europe houses additional powerhouses in chip manufacturing, including integrated device makers such as Infineon [ETR: IFX] (Germany), NXP [NASDAQ: NXPI] (Netherlands), and STMicroelectronics [EPA: STM] (France), as well as auto supplier Bosch, which dominates automotive, power electronics, and sensor niches worldwide. These companies focus on chips for cars, industrial machinery, and energy — areas where Europe leads in design and end-user demand. This presents itself as Europe’s R&D base, anchored by institutes such as IMEC in Belgium and CEA-Leti in France, as well as a network of university labs. Europe plays a significant role in research-intensive fields such as semiconductors, leveraging strong fundamental science and engineering talent. The combination of research, tooling expertise, and specialty-market leadership provides the EU with a platform to build on through the Chips Act’s programs.

Two years on, building on this foundation, the Chips Act has generated a wave of investment commitments across Europe’s semiconductor sector. The European Commission reports that by early 2025, the Act had encouraged over €80bn in planned public-private investments to boost chip manufacturing capacity. Seven major projects were approved as first-of-a-kind facilities eligible for state aid, ranging from advanced logic fabs to specialty material plants.

In Dresden (Saxony), construction is underway on a new foundry: the European Semiconductor Manufacturing Company (ESMC), a joint venture led by TSMC with Bosch, Infineon, and NXP as minority partners. Backed by around €10bn, ESMC’s fab will target 28nm to 16nm process nodes — mature by leading standards but ideal for automotive chips — and is slated to start production by 2027. Infineon is concurrently expanding in Dresden with a €5bn “Smart Power” fab for analog/power semiconductors, which secured final funding in May 2025 and is due to begin operations in 2026. Additionally, STMicroelectronics has broken ground on a €5bn silicon carbide (SiC) device facility in Catania (Italy), acting as Europe’s first fully integrated SiC fab — crucial for next-gen electric vehicle chips. The European Commission approved a €2bn Italian state grant for ST’s project in 2024, highlighting Brussels’ determination to build up capacity for these specialized, energy-efficient chips. Each of these investments plays to Europe’s strengths in automotive and power electronics, suggesting the Act is helping create an ecosystem around domains where European firms are most competitive.

Yet for all the positive momentum, structural and execution risks are very much present. The most high-profile setback was Intel’s planned mega-fab in Magdeburg (Germany), which was initially Europe’s bid for 2nm logic production. After long funding negotiations and a global PC market slump, Intel’s new CEO abruptly cancelled the Magdeburg project in July 2025, abandoning what was to be a €30bn investment. Intel’s retreat demonstrated Europe’s difficulty in attracting top-tier foundries and left the EU’s Chips Act without its poster child logic facility.

More broadly, the European Court of Auditors delivered a firm conclusion in late 2025. The Chips Act’s flagship goal of 20% global market share by 2030 appears “essentially aspirational,” given the current pace of progress. The auditors project Europe will reach only about 11–12% share by decade’s end, noting that even a quadrupling of EU capacity might not keep up with surging worldwide demand. They warn that high energy costs, dependence on imported raw materials, and a shortage of skilled workers in Europe will remain hurdles to scaling up production. In addition, with the EU budget contribution being relatively modest (€4.5bn), fragmentation of execution may arise as funding must come from member states and industry. Hence, in 2025, a coalition of all 27 EU countries and dozens of companies began pushing for a “Chips Act 2.0” to reinforce the first Act. Industry leaders argue that Europe should quadruple its semiconductor spending and adopt a dedicated budget line, speeding up approvals and focusing resources on critical gaps that have not been addressed previously. In short, while the Chips Act gave Europe’s chip renaissance aims a boost, it faces multiple hurdles in delivering on its vision.

At the same time, the EU’s chip strategy is executed alongside parallel efforts in the United States and Asia, and these comparisons reveal where Europe is competitively positioned — and where it lags. The U.S. CHIPS Act (2022) marshalled $52bn in federal funding plus generous tax credits, pushing multiple new fabs by TSMC, Samsung, Intel and others onto American soil. The US has moved quickly to entice leading logic and memory manufacturers with all-in-one incentives on a scale and speed that Europe struggles to match. Similarly, Taiwan, South Korea, Japan, and now China have poured vast subsidies into their semiconductor sectors for decades, resulting in a dense cluster of ultra-modern fabs and advanced packaging facilities that Europe simply cannot replicate in a short span of time.

This global competition demonstrates why Europe’s initial Chips Act investments skew toward mature-node and specialty capacity rather than chasing 2–3nm processes. European policy is prioritizing areas that play to the continent’s strengths: 28nm+ logic, analog and power chips, and emerging technologies like SiC and GaN for electric vehicles and renewables. This can be clearly seen in Germany’s current expansion strategy, which prioritises specialty nodes and power semiconductors over sub-5nm logic in an effort to generate balance.

Where Europe does hold a competitive edge globally is in equipment and tooling, as well as specific materials. This “silicon backbone” of the supply chain gives the EU leverage. For example, ASML’s lithography tools are indispensable to any cutting-edge fab. Europe is working to leverage these advantages — for instance, by expanding advanced packaging and chip assembly capabilities at home, an area long dominated by Asia. European industry voices acknowledge that the EU must address the need for advanced packaging and manufacturing capacity, even as it leverages its world-class R&D powerhouses, materials science, and automotive know-how.

Meanwhile, another area of relative weakness is financial incentives: Europe’s state-aid approvals, while significant, often come with more strings attached and have been slower to deploy than the swift tax breaks in the US or direct subsidies in Asia. Furthermore, the pace of fab construction and operations in Europe can be hampered by permitting delays, higher energy and labour costs, and a narrower pool of trained semiconductor engineers. These factors make it harder to scale volume quickly. In terms of volume of leading logic capacity, Europe remains a minor player — accounting for under 10% of global chip output. The hope is that by excelling in niche volume (for example, producing a major share of the world’s automotive microcontrollers, power devices, and industrial chips), Europe can achieve strategic importance without matching the brute output seen in Asia. The Chips Act strategy thus implicitly acknowledges that Europe will not outbuild Taiwan or the US in the near term. Instead, the EU should seek to ensure it stays in the game technologically and secures a self-sufficient supply for critical sectors.

Looking ahead, as the EU approaches 2030, the emphasis of its semiconductor policy is gradually shifting from high market-share targets to a goal of technological sovereignty. European success for a future Chips Act 2.0 should be measured less by percentage of global output and more by Europe’s ability to secure key chips and competencies onshore. This means creating capacity in areas like AI accelerators, aerospace and defence chips, automotive power modules, and advanced packaging — thereby acting as the backbone of sovereign compute capability amidst geopolitical instability.

By 2030, a positive outcome would see Europe with a strong network of fabs and pilot lines that, while possibly only ~12% of world production, could meet a much larger share of its own demand for critical chips. Throughput will be a key metric: the volume of semiconductors Europe can produce annually (especially in mature and specialty nodes) must rise significantly, closing supply gaps so that another sudden shortage would not cripple the European industry. Finally, the EU must derisk its supply chain — i.e. have diversified sources, whether domestic or allied, for crucial components — reducing any overreliance on a single foreign supplier or region.

The EU’s strategy by 2030 envisions a semiconductor ecosystem that delivers a form of strategic autonomy without isolating Europe from global innovation. More EU funding, streamlined state aid rules, and coordinated talent are necessary. Europe’s institutional investors remain optimistic, as the Chips Act has undeniably brought new momentum to Europe’s chip sector. The EU’s wager is that by 2030 it can show tangible progress through a suite of successful European fabs and tech hubs. If Europe can demonstrate a higher degree of self-reliance in chips — output, innovation, and security of supply — while remaining integrated in global value chains, the EU Chips Act will have achieved its purpose, even if the 20% target remains out of reach.

Energy & Batteries

In recent years, the European Union has moved important steps towards the independent production of energy, moved by the geopolitical events that characterized the first part of the 2020s. In particular, Russia’s invasion of Ukraine was the triggering event for the REPowerEU Plan, a strategic path to phase out Russian fossil fuel imports across oil, gas and coal. The rationale behind the plan was to ensure a reliable supply of energy for European citizens, while simultaneously boycotting one of Russia’s main economic sectors and move towards cleaner energy with more stable prices. The plan has achieved tangible results from 2022 to 2024, with oil imports from Russia falling from 27% to 3%, gas imports from 45% to 19%, while coal imports completely stopped over the same period. Additionally, measures regarding practices such as common gas procurement have been proposed, allowing Europeans to access to affordable energy and avoid any energy supply disruptions by acting as a single energy buyer and avoiding competition between Member States.

One of the goals of REPowerEU is securing the Union’s energy independence, both by improving energy efficiency and with the internal production of needed electricity, preferably through the development of renewables. So far, the EU has not seen a radical improvement in reaching independence: for example, in 2023, the energy import dependency rate was 58%. However, it varied across EU countries, ranging from 98% in Malta, 92% in Cyprus, and 91% in Luxembourg to 3% in Estonia. Out of the continent’s total energy production, renewables accounted for 46% of the total, followed by nuclear energy (29%), solid fuels (17%), natural gas (5%), and crude oil (3%), while the main imported energy product category was oil and petroleum products which accounted for 65% of energy imports.

The importance of renewable energy production in the EU has driven the expansion of incumbent utilities and OEMs, which have the capital and the network to build and connect renewable projects on a pan-European scale. Enel [BIT: ENEL], the main integrated energy company in Italy for electricity and gas, laid out a strategic plan that foresees capital expenditures for about €43bn between 2025 and 2027, of which Europe will represent about 75% of the total, while the remaining 25% will be shared by Latin America and North America. Enel’s strategic priority lies in grid infrastructure, with an investment of about €26bn, mainly for further expansion in Italy and Spain due to their favourable regulatory frameworks. Enel Green Power, Enel’s specialised renewables subsidiary, already manages 67.2 GW of global renewable energy capacity, and this strategic plan aims to develop 12 GW of new capacity, particularly onshore wind, hydrogen, and batteries, for a total investment of €12bn. Iberdrola [IBE.MC], a global leader in energy production, has commissioned its largest plant producing green hydrogen for industrial use in Europe. The plant is located in Puertollano (Spain), and it consists of a 100 MW photovoltaic solar plant, a lithium-ion battery system with storage capacity of 20 MWh, and one of the largest electrolytic hydrogen production systems in the world (20 MW). Commissioned in 2022, the aim is to promote decarbonization of industrial sectors with the use of green hydrogen. Iberdrola [BME: IBE] and Fertiberia, the largest fertiliser manufacturer in Spain, have laid out a plan to develop 830 MW of green hydrogen with an investment of €1.8bn until 2027, through a partnership driven by the key role played by hydrogen in the fertiliser industry. However, the proposed capacity represents 20% of the national target of 4 GW installed by 2030 in Spain, a significant portion, and ensuring the feasibility of these projects will be the first step towards scaling this innovative technology for the Spanish energy producers. Nonetheless, Iberdrola has outlined further investments of €21bn across offshore wind, onshore wind, battery energy storage systems (BESS), and solar. From the perspective of developers, Ørsted [CPH: ORSTED], the largest Danish energy company and one of the leading global players in offshore wind project development, has a construction portfolio of 8.1 GW across three continents, with a primary focus in Europe. In 2025, the company went through a rights issue for about DKK59.6bn (around €8bn) to finance its expansion and pipeline, as well as to manage unexpected funding requirements after failing to find a partner for the partial divestment of Sunrise Wind, a 924 MW wind farm off the coast of New York.

The main reason why Ørsted failed to find a partner for Sunrise Wind is President Trump’s hostility to wind power. The president suspended new federal offshore wind leasing on his first day, pending an environmental and economic review, saying wind farms are ugly, expensive, and harm wildlife. The current administration’s policy shifts may be causing investment uncertainty in renewables, with planned projects being cancelled or postponed due to regulatory or subsidy risks. Before the start of this year, the US had been the clear winner when it came to attracting capital to renewable energy projects, mainly due to its Inflation Reduction Act (IRA), signed in 2022, which includes $369bn in incentives for energy and climate projects, and it aims to steer private capital towards clean energy, transportation, and industry. One of the primary mechanisms is corporate tax credits, valued at $270bn, many of which may be transferable or refundable through the direct pay mechanism. In contrast, the EU has the Green Deal, an extension of existing EU programs complemented by new ones that aim to create a net-zero green economy by 2050 through a series of non-tax incentives, including EU and national funds, as well as the EU’s Covid-specific NextGen Fund.

One of the differences, which has contributed to making US-based renewables projects more attractive so far, lies in the relative accessibility to the IRA compared to the EU Green Deal. While IRA applications are very competitive, accessibility to EU funds is particularly complex. Not only are there many different programs available, making applications cumbersome while the outcome is not always clear, but EU funds are sometimes administered by EU Member States instead of the EU, adding to this complexity. Additionally, Europe’s clean-tech investment environment has several structural disadvantages relative to the U.S., including higher energy and production costs, more complex regulatory and permitting frameworks, and less generous blanket subsidies. The consequence, at least until the current US administration, has been increased competition for capital and manufacturing. However, weakening of support for renewable projects in the US means that the financing risk is higher as investors may face uncertainty about tax credits, subsidies, and permitting. From a strategic autonomy perspective, there is a possible window of action for the EU. If the U.S. renewables sector slows down and the EU doubles down, European firms may have a chance to gain a competitive advantage and attract capital.

Another fundamental sector in driving Europe’s clean-tech push is battery manufacturing. As the EU aims to have all new cars, vans, and buses be zero-emission by 2035, building a local electric vehicle (EV) industry will be crucial to achieving this goal. However, political uncertainty and geopolitical tensions call for the development of a fully independent EV supply chain, with a focus on critical parts such as batteries. Northvolt, a Swedish battery manufacturer founded in 2016 by former Tesla executives, was one of the companies selected to undertake the task. Its backers, including Volkswagen [ETR: VOW], Goldman Sachs [NYSE: GS], BlackRock [NYSE: BLK], and Siemens [ETR: SIE], believed it would become a European battery champion. The company raised $2.8bn in private investment in 2021, $2.7bn in a convertible note in 2022, and $5bn in a 2024 debt round backed by JPMorgan [NYSE: JPM], Citigroup [NYSE: C], Deutsche Bank [ETR: DBK], and BNP Paribas [EPA: BNP]. By 2024, the company had 7,000 employees. Still, it faced significant issues due to its over-reliance on Chinese machinery and its production ramp-up, leading to many abandoned or suspended projects. In 2025, Northvolt filed for bankruptcy in Sweden, with some of its assets later sold to Lyten, a manufacturer of lithium-sulphur batteries.

As Northvolt highlighted the challenges of achieving independence in battery production, other European players face similar headwinds. Automotive Cells Company (ACC) was founded in 2020 as a joint venture of Stellantis [EPA: STLAP], Mercedes-Benz [MBG.DE], and TotalEnergies [EPA: TTE] (through Saft). Headquartered in Bruges (France), the company is also supported by French, German, and European authorities in its efforts to become a European EV battery champion. In 2023, ACC opened its first large-scale plant in France, with plans to open two more in Italy and Germany. However, the €2bn “gigafactory” planned for Termoli (Italy) was suspended in June 2024, and in March 2025, Italian authorities withdrew €350mn in public funding. Similarly, the plan for its factory in Germany was paused as the company faces slowing demand for electric vehicles. Although ACC shows that substantial capital has been raised to support the ambition of independence, long-term success depends on market demand, technology fit, and scalability. The company still must prove it can deliver at scale in Europe, at a competitive cost, and at the pace needed to build a self-sustaining ecosystem.

The European Union has laid the foundations for an integrated clean-tech system, but it remains far from a closed-loop system. Recent years have seen significant progress in segments such as the localisation of renewables. Companies such as Enel, Iberdrola, and Ørsted demonstrate Europe’s ability to deploy and operate renewable infrastructure at scale, yet the road to complete energy independence is still far from its end. At the same time, Europe is further behind in achieving independence across the whole EV value chain. The story of Northvolt exposes the vulnerabilities of building large-scale cell production in Europe. ACC, initially seen as the industrial alternative, is also struggling to meet expectations. These setbacks show that strategic autonomy in energy remains aspirational until the continent can manufacture and scale these technologies competitively within its borders.

Defense & Aerospace

“Never let a good crisis go to waste.” – Rahm Emanuel (2008)

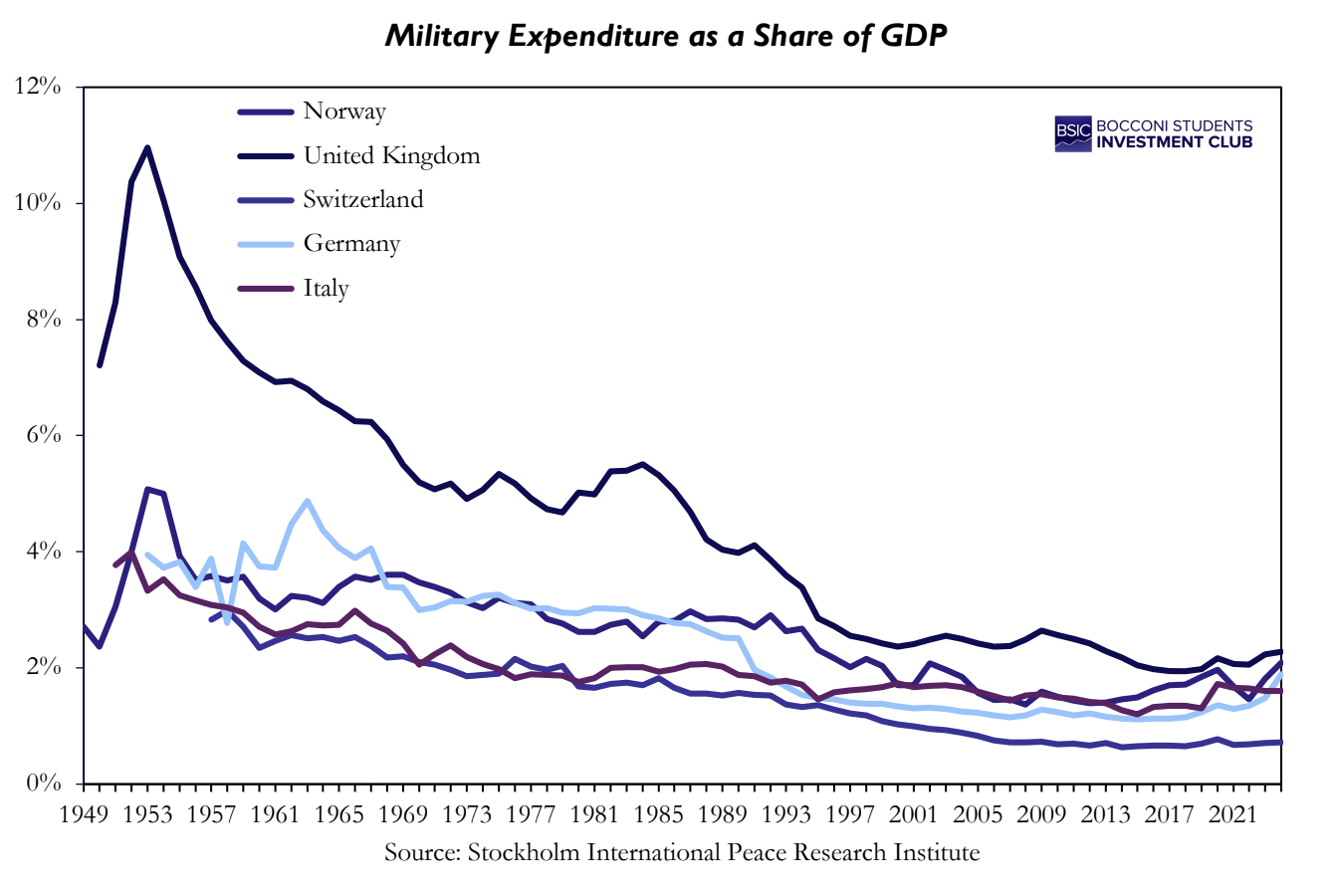

National sovereignty depends on a nation’s ability to assert its borders and defend itself. While having evolved from elephants and spears to tanks and missiles, the defence and Aerospace Industry represents markets vital to a nation’s very survival. In World War 2, one key factor that aided in Germany’s conquest of Europe and the United States’ eventual reconquest was a robust defence and Aerospace Industry. Post-1945 Europe was decimated. Entire cities, such as Warsaw and Dresden, required complete reconstruction. In addition, governments began participating more proactively in society with the rise of the welfare state, providing services such as healthcare and state pensions. One may think government spending on Defense (the primary source of revenue for the Defense and Aerospace Industry) may drop to account for the increased priorities. The USSR, however, represented a constant threat to the Western Bloc (eventually leading to NATO), giving European governments an incentive to institute (or, in many cases, retain) mandatory service and maintain high military spending to deter Soviet aggression.

A myriad of factors influenced Europe’s minimal defence spending after the 1980s. Through NATO, US domination in this sector reduced fear in the minds of European Governments. If any major threat appeared, the belief was that NATO, specifically the US, would defeat it. The lack of any apparent major threat also minimized fear, reducing the desire to invest. The primary factor influencing this slow decline is straightforward: budget constraints. Staggeringly, high debt-to-GDP ratios and extremely high state expenses led to cuts across several areas, including military spending. This slowdown was also supported by a wave of abolitions of mandatory military service, mainly reducing the induced demand for defence and Aerospace goods. As government funding slowed, two trends emerged in the defence and industry sectors: consolidation and strategic pivots toward civil products. A series of mergers throughout the 90s led to a few key players, such as Airbus [EPA: AIR], Indra Sistemas [BME: IDR], Leonardo [BIT: LBO], Dassault Systèmes [EPA: DSY], Rheinmetall [ETR: RHM], and BAE Systems [LSE: BA]. As evident from the listing locations, national fragmentation prevailed over a unified European market strategy, resulting in a reduced competitive advantage compared to the rest of the world, such as the US or Asia. In addition, due to the lack of small firms, innovation stagnated, further limiting growth. Due to adverse conditions in the military portion of the market, these firms began pivoting to civil applications, such as Airbus’s A320 (aircraft) and Leonardo’s AW139 (helicopter). These pivots to civil applications in the Aerospace market enabled these firms to grow, but reduced defence readiness in Europe. Domestic supply chains shrivelled as local firms began importing specific parts from the US and Asia. Additionally, production capacity dropped, limiting future ability to ramp up production in the event of war or exclusion from foreign suppliers. After decades of underspending, with a decimated industrial base, the EU woke up from its slumber with the advent of the Ukraine war. Depleted supplies and underprepared armies pose a survival risk in turbulent geopolitical times.

With the rise of Trump and his alienation of the West, past beliefs about safety through NATO became fiction in the eyes of politicians. Europe’s plan to resolve this security issue was simple: joint procurement. Through coordinated efforts, Europe has invested and plans to invest in funds targeted at the development and production of specialized machinery and vehicles. These initiatives involve the previously mentioned consolidated firms. Eurodrone is a project led by Leonardo, Dassault, and Airbus Defence & Space (the Military branch of Airbus) to develop drones for France, Germany, Spain, and Italy. FCAS (Future Combat Air System) is another program led by France, Spain, and Germany to develop the next generation of fighter jets and combat aircraft. Airbus, Dassault, and Indra will lead this effort. This union of all the major players could be the catalyst for European dominance in this sector if handled appropriately. The European Union has established institutions and frameworks to spur this collaboration, such as the EDF (European Defense Fund), EDA (European Defense Agency), and EDIRPA (European Defense Industry Reinforcement through Common Procurement Act), which will hopefully incentivize collaboration and increase economies of scale and reduce waste in similar research. The issue that could doom this spur of collaboration is national priorities. In a tense political and economic climate, it is unclear if coordination will continue. While the future is significantly bright for European Defense firms, it remains to be seen how tight these pacts will hold.

Conclusion

From cloud servers to silicon chips, from EV batteries to fighter jets, Europe’s grand project of “industrial sovereignty” is unfolding on many fronts. Part I of this series has traced how the European Union and its member states are striving to create or bolster champions in four foundational sectors. A clear pattern emerges when faced with external dependencies that threaten its autonomy, Europe is leveraging the power of cooperation (and lots of public money) to build up homegrown capabilities. Each sector has its rallying cries – digital sovereignty for cloud and data, technological sovereignty for chips, energy independence for batteries, strategic autonomy for defence – but they are ultimately facets of the same ambition. The EU does not want to be caught unprepared, whether in the event of a future chip embargo, a gas cutoff, or a security crisis. Thus, it is crafting an industrial backbone to undergird its political sovereignty.

The journey, however, is anything but smooth. We have seen successes, such as the attraction of massive semiconductor investments and the sustained strength of Airbus, as well as setbacks, including the cloud initiative that lost momentum and the battery champion that went bankrupt. Europe’s internal dynamics – its bureaucracy, as well as the tug-of-war between national interests and common goals – often complicate the picture. Yet, if there is a silver lining, it’s that challenges have bred a new resolve in Europe. Ten years ago, talk of European industrial policy or champions was controversial, even taboo, in Brussels; now it’s mainstream. The EU is revisiting its competition rules, its trade policies, and its fiscal stance to better support strategic industries. In a fragmented world, Europe is convinced that unity is strength – not just political unity, but industrial unity too.

As Europe races to fortify its industrial base, attention is also turning to other pillars of sovereignty beyond traditional industry. These initiatives include efforts to promote digital sovereignty, such as regulating Big Tech, investing in AI and telecommunications, and safeguarding critical data (building on the cloud infrastructure discussed here). They also encompass moves toward financial sovereignty – for instance, reducing dependence on the US-dominated financial system by boosting the international role of the euro, creating European payment networks, and even exploring the possibility of a digital euro. Just as with factories and fabs, Europe recognizes it must control key levers of the digital economy and global finance to be the master of its fate truly. The story of European champions, therefore, is far from over. If this article has been about digging foundations – steel, silicon, lithium, and launchpads – we also must explore the softer, yet equally crucial, architecture of rules and systems that ensure Europe’s autonomy in the 21st century. The race for European champions spans both realms, and it is only by succeeding in all of them that Europe can secure its sovereignty in an age of uncertainty.

0 Comments