Introduction – SPVs as the Backbone of Structured Finance

Special Purpose Vehicles (SPVs) are separate legal entities formed by a sponsor, designed to acquire assets, issue securities and manage cash flows. SPVs are typically thinly capitalized with their own balance sheet, and many structured to be bankruptcy remote. In modern structured finance, SPVs serve as the backbone of transactions, through acquiring assets, issuing notes, and providing their proceeds to investors.

The primary purpose of an SPV is risk isolation, achieved by transferring specific assets or exposures into a legally distinct vehicle. This distinctness protects the parent company from any financial risk linked to those assets, and vice versa, if the sponsor becomes insolvent, the SPV’s obligations and asset pool remain protected. Another core use of SPVs is funding efficiency, in which SPVs provide an efficient way to raise capital for deals. In structured finance, this efficiency lowers a sponsor’s funding costs by allowing investors to evaluate an isolated asset pool directly, without pricing in the sponsor’s own credit risk. SPVs also play a vital role in regulatory capital management. By transferring assets or credit exposures to an SPV, financial institutions can modify their balance sheets to improve regulatory capital ratios.

The structure of an SPV determines how credit rating agencies evaluate its debt instruments, influencing investor demand. SPVs are rated solely on the quality of their structure and underlying assets, including factors such as seniority hierarchy and liquidity provisions, rather than the sponsors balance sheet. Given this, SPVs enable sponsors to access capital markets on more favourable terms than their corporate credit standing might otherwise allow.

Today, SPVs are widely used across capital markets, underpinning transactions of all sizes ranging from consumer-loan securitisations to project finance. In Project finance, SPVs own and operates projects, providing investors exposure to a given project with limited liability. Another common use of SPVs is for synthetic risk transfer (SRT). SRT allows corporations to manage regulatory capital without the need to sell any underlying assets, enabling institutions to achieve capital relief while retaining ownership. SPVs have become critical to modern markets, with their design allowing investors to access certain asset exposures, whilst enabling sponsors to achieve greater protection and regulatory protection.

SPVs risk analysis

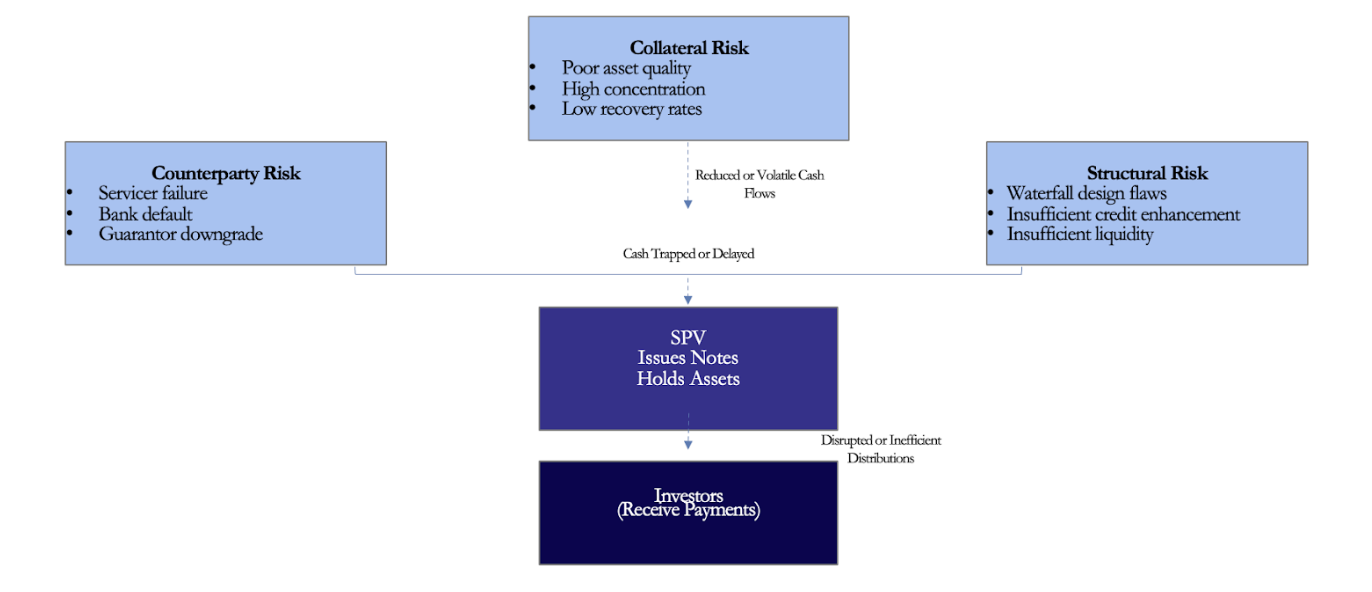

As previously discussed, credit rating agencies focus is not on the sponsor itself, but instead on a transaction structure, the quality of the collateral and the exposure to counterparty risk. Risk analysis plays a pivotal role in SPVs because it creates transparency and comparability for investors.

Rating logic is derived partly from structural risk analysis, which focuses on how the design of an SPV affects the distribution of cash flows, including timing and priority of payments to investors under adverse asset-performance scenarios. Features such as cash-flow waterfalls, credit enhancement, liquidity provisions and legal features drive estimates and note ratings.

At the core of SPV’s structure is the cash-flow waterfall, a predetermined function allocating cash from assets based on a priority system, determining the order in which noteholders should be paid. It is this hierarchical system which creates such divides between the ratings of different tranches in structured finance. Another features of SPVs is credit enhancements, which determines each tranche’s tolerance to withstand losses. Liquidity provisions are also commonly found in SPVs, aiming to address timing mismatches between asset inflows and note payments, covering temporary shortfalls and ensuring investors receive proceeds on time. An SPVs structure is underpinned by a strong legal framework. A key legal feature is whether the SPV is bankruptcy-remote, most importantly whether the SPV is bankruptcy-remote, i.e. the SPV is protected from insolvency of the originator. Through analysing the existence or effectiveness of such structural features, agencies can assess the risk of an SPV, and provide a rating reflecting such risk.

While structural analysis focuses on how an SPV distributes cash flows, collateral risk analysis examines the generation of these flows. A key aspect of this risk analysis to consider is portfolio quality, conducted through the examination of the types of assets, credit profiles of the borrowers and historical performance data. The logic is clear; higher quality pools reduce expected losses and support justification for stronger ratings. Another consideration is diversification of the asset pool across borrowers and sectors. For highly concentrated pools, such as project finance, rating agencies model the distribution of potential losses, using techniques such as Monte Carlo simulations. This technique randomly stimulates default and recovery paths and captures how the failures of exposures can affect losses. Collateral risk analysis also looks into expected recovery rates. Features improving recoverability, such as senior collateral rankings, lead to higher ratings. The link between asset-level performance and expected tranche losses, which collateral risk analysis captures, makes it a fundamental component to assess any SPV.

Regardless of an asset pools performance, losses will occur if counterparties fail to perform their obligations. Counterparty risk analysis is therefore used to evaluate the SPVs exposure to entities such as servicers, banks and insurers, whose financial health are essential to a transaction’s cash flows and expected losses. Servicers manage day-to-day administration of the underlying assets, and a disruption in their role threatens delays in cash flows or slower recoveries. To mitigate this risk, backup servicers can be implemented, if any operational challenges occur.

Structured transactions are also reliant on banking and derivative counterparties that perform essential functions. Banks hold transaction accounts and collections, while swap providers hedge interest-rate between the assets and notes. These hedges are crucial because mismatches in rate type can cause cash-flow volatility. To reduce dependency risk, deals require such counterparties to maintain minimum credit ratings and to post collateral if they fall below agreed thresholds.

Many transactions rely on third-party credit enhancement, such as guarantees, to protect specific tranches. While these can improve investor protection, they introduce dependency on the guarantor’s solvency. As S&P Global Ratings notes, “When insurance or guarantees are a key source of credit enhancement, the rating of the insured tranche cannot exceed the guarantor’s rating unless additional structural protections are present.” Consequently, counterparty exposures can cap or limit the achievable rating of an SPV’s notes.

Each counterparty exposure is assessed for materiality, i.e. whether its default would have a measurable impact on investors’ expected loss, allowing rating agencies to distinguish between minor operational dependencies and counterparties whose failure could disrupt the payment stream. Counterparty risk analysis ensures that an SPV remains protected from external failures, and similar to other risk analysis, it ensures predictability for the investors.

After assessing structural, collateral and counterparty risks, rating agencies quantify the overall credit risk of a structured finance transaction through an expected-loss based approach on each tranche, combining the probability of default and severity of loss given default. Thus, the expected loss, is the product of the probability a tranche defaults, and the percentage of loss given default. Each rating category corresponds to a specific expected loss range over a given time frame, allowing the standardisation of ratings across diverse asset classes.

To derive tranche specific expected losses, agencies use cash flow models that replicate the behaviour of a given transaction under various stress scenarios, integrating assumptions surrounding asset defaults, recoveries and interest-rate movements, along with a transaction’s structural features such as waterfalls and different triggers. Such simulations assess a structures ability to make interest payments and principals under various stress assumptions. These quantitative frameworks improve the comparability across different SPVs.

The Anatomy of an SPV

The effectiveness of a Special Purpose Vehicle (SPV) in structured finance depends on its legal, accounting and governance set-up, which ensures risk segregation and investor protection. From a legal and accounting perspective, two key concepts support the integrity of an SPV: bankruptcy remoteness and non-consolidation. Bankruptcy remoteness ensures that the assets of the SPV are isolated from the insolvency of the sponsor, through the actual disposal (true sale) of the assets, separation clauses and limitations on the corporate purpose.<

Non-consolidation ensures that SPV’s financial statements remain separate from those of the sponsor, preventing the assets or liabilities of the vehicle from being consolidated in the sponsor’s financial statements according to accounting standards. Together, these characteristics preserve the independence and credit integrity of the SPV.

Governance protections further strengthen that independence. Clauses such as limited recovery mean that investor rights are limited to assets held within the SPV, while non-petition clauses prohibit creditors from initiating insolvency proceedings against the vehicle. The presence of independent directors offers an additional layer of control, ensuring that the SPV operates exclusively according to its predefined purpose and in the interests of the holders of the securities (noteholders).

- Originating bank which transfers assets or credit exposures to the SPV, initiating the transaction.

- Issuer (SPV) which is a ring-fenced legal entity that issues notes backed by the acquired assets or credit, managing cash flows according to the transaction’s structure.

- Servicer which is responsible for collecting payments, managing recoveries, and maintaining the performance of the underlying assets.

- Rating Agency responsible for providing independent oversight, verifying cash-flow distributions, monitoring covenant compliance, and maintaining transparency for investors regarding the issued securities (notes)

- Servicer that manages recoveries and cash collections from the underlying assets in the case of non-performing assets or credits.

Together, these legal, governance, and operational components form the anatomy of an SPV, ensuring its stability, transparency, and functional independence within the structured finance ecosystem.

Together, these legal, governance, and operational components form the anatomy of an SPV, ensuring its stability, transparency, and functional independence within the structured finance ecosystem.

How Credit Ratings Assess SPVs

Diving into the methodology used by credit ratings to analyze Special Purpose Vehicles, the process encompasses an assessment of the collateral quality of the asset being acquired, the transaction structure, and counterparty risk. All these aspects are used to arrive at a standardized view of the risks creditors face in structured finance transactions. The section below provides a comprehensive overview of the rating approach, addressing each fundamental risk division, the tools employed, and the specific factors incorporated into the analysis.

Collateral Risk

The first pillar of the credit rating framework involves a detailed evaluation of the collateral pool, which consists of the portfolio of financial or physical assets underpinning the SPV’s obligations. Rating agencies assess the granularity of the pool and the degree of diversification of exposures across obligors and asset types. A granular pool, reflected in a low Herfindahl index (a Measure of market concentration, calculated by summing the squares of the market shares of all firms in an industry), indicates broad diversification and lower sensitivity to any single asset default, thereby reducing systematic risk. In contrast, concentrated pools, which are more common in project finance or non-performing loan (NPL) transactions, are more volatile, as a single default can weaken the overall performance of the collateral pool.

To quantify these dynamics, agencies typically employ Monte Carlo simulations, executing thousands of stress scenarios to model loss distributions and recovery expectations, particularly for less diversified portfolios. The default and loss analysis begins with an examination of historical performance data to estimate both the probability of default (PD) and the loss given default (LGD). Recovery assumptions are derived from previous workout results, asset-specific characteristics, and the operational strength of servicers and asset managers. Servicing platforms, in this case, play a decisive role in NPL deals, as strong servicing can mitigate losses while weak servicing can exacerbate them. Then, in the specific case of project finance transactions, the asset manager’s expertise on both operational and financial oversight is equally critical, given the direct influence on project outcomes.

Structural Analysis:

The second pillar focuses on the transaction’s structural design, particularly the mechanisms governing cash flow distribution and credit protection. At the core is the waterfall structure, which consists of the contractual hierarchy that determines the order of payments to different investor tranches. This prioritization ensures that senior tranches bear the least credit risk, while Junior tranches absorb residual losses.

The rating agencies evaluate the adequacy of credit enhancement measures such as overcollateralization which consists on a case where assets exceed the SPVs obligations, also through the sure of reserved funds to measure liquidity and create loss-absorption buffers, also through subordination which organizes the tranches and the order in which they absorb losses as well as guarantees which consists on third-party credit support in the case of a default.

The robustness of these mechanisms determines how much stress the structure can endure before cash flow disruptions occur. Insufficient or weak enhancement typically leads to lower ratings. At the same time, strong guardrails and creditor support can elevate the tranches to investment-grade or even AAA levels, irrespective of the sponsor’s credit rating. A key aspect of structural analysis is the liquidity risk test. In this field, rating agencies generally require liquidity coverage to meet 2-6 months of scheduled Senior (and sometimes junior tranches) interest and principal payments. This buffer shields the structure from payment delays caused by collection irregularities. Inadequate liquidity coverage significantly heightens downgrade risk, especially for high-rated tranches.

Counterparty risk

The third axis of rating analysis scrutinizes the transaction’s dependence on external parties, for which the agency identifies key counterparty entities such as banks, servicers, and insurance providers, and evaluates their ability and commitment to perform under both normal and stressed conditions. Suppose the financial or operational failure of a counterparty could materially disrupt the SPV’s cash flows or loss protection. In that case, the exposure is classified as material or excessive and may cap or downgrade the rating of relevant tranches. Counterparties whose default would have only a minor or self-curing impact are classified as immaterial, though agencies track their risk profile over time.

Counterparty review incorporates an assessment of each entity’s credit quality, operational capacity, and the legal enforceability of replacement and back-up arrangements. Transaction documents in this case often mandate minimum rating thresholds and collateral posting triggers for critical counterparties. Servicers and managers are also monitored for business continuity and operational resilience, often with back-up servicing arrangements in place. Insurers and guarantors, if relied upon for credit enhancement, must maintain ratings above the targeted level for the notes they support; otherwise, the transaction’s rating will be capped at the provider’s own rating.

In conclusion, the credit rating is affected by the qualities above; however, we will further explore how this plays out across different aspects of corporate finance, which can lead to variations in their role and in how they are properly evaluated.

SPVs in the Corporate Finance Practice

As SPVs have evolved far beyond their traditional role in securitizations, they have become highly adaptable tools used across the spectrum of corporate finance. Their flexible legal form and ring-fenced structure allow for the isolation of risk, enhanced funding efficiency, and optimization of accounting and regulatory outcomes.

Project Finance SPVs: Infrastructure and Energy with Ring-Fenced Debt

In the field of project finance, SPVs serve as the foundational architecture for raising non-recourse or limited-recourse funding while strictly isolating project-specific risks. Large-scale infrastructure and energy projects, characterized by long payback horizons, complex stakeholder ecosystems, and high capital intensity, often rely on SPVs to segregate assets, liabilities, and cash flows within a legally distinct vehicle.

By ring-fencing obligations, sponsors ensure that lenders’ recourse is confined solely to project assets and cash flows, without exposure to the patent’s broader balance sheet. This structure appeals to investors by creating transparent, collateralized debt backed by their own project-specific performance metrics. The SPV typically holds ownership of project assets, manages key contractual relationships (such as power purchase or concession agreements), and issues the debt instruments, achieving clean risk segregation.

For sponsors, the benefits are significant, including capital attraction, risk compartmentalization, and potential off-balance-sheet treatment. In the context of corporate M&A or divestiture, such SPVs can also facilitate asset carve-outs, enabling investors to acquire discrete, self-contained project entities without inheriting unrelated liabilities.

Synthetic SPVs: Transferring Credit Risk for Capital Relief

Beyond tangible assets structures, SPVs are also central to synthetic risk transfer mechanisms. In these cases, the SPV assumes exposure to the underlying asset not through ownership but through credit derivatives, notably credit default swaps (CDS) or total return swaps (TRS). The originator (often backed by a corporation) purchases credit protection from the SPV, which issues notes to investors who absorb the credit risk in exchange for yield. Such arrangements enable regulatory capital relief without outright asset sales, as credit risk weightings can be reduced under the Basel III and IV frameworks. While these structures were initially pioneered in banking, corporates increasingly deploy synthetic SPVs to manage contracted counterparty or customer exposures. However, since the 2008 financial crisis, post-crisis reforms have placed synthetic transactions under heightened regulatory and accounting scrutiny, emphasizing transparency, robust documentation, and verifiable risk transfer.

Asset Monetization: Leasing and Receivables SPVs

SPVs are equally prominent in asset monetization strategies, enabling corporates to convert illiquid assets into immediate liquidity. Typical structures include leasing SPVs and receivables securitization vehicles, in which the company transfers assets, such as equipment, real estate, or trade receivables, to an SPV that can secure debt with those specific assets. This approach supports working capital management, leverage reduction, and liquidity enhancement. The SPV’s debt service is typically funded by cash flows from the leased or receivable assets, while recourse to the patent remains limited. Properly structured, these vehicles can unlock trapped capital and create financing flexibility, particularly valuable in distressed and restructuring contexts where liquidity preservation is paramount.

Accounting and Regulatory Treatment: Off-Balance Sheet vs. Risk Retention

SPV use interacts deeply with accounting standards and prudential regulation. Under IFRS 10, consolidation hinges on the concept of control and whether the sponsor directs relevant activities and derives the majority of economic benefits. Where control is demonstrably absent, the SPV may qualify for off-balance-sheet treatment, thereby allowing leverage and capital ratios to appear firmer. However, regulators have tightened oversight considerably as the Basel III and IV frameworks impose risk retention requirements, mandating that originators retain at least 5% of net economic interests in securitizations or synthetic transfers, thereby aligning incentives and curbing moral hazard.

Historical misuse of SPVs, epitomized by the Enron scandal, catalyzed a paradigm shift toward transparency, board independence, and stricter consolidation rules. Today, auditors, regulators, and rating agencies subject SPV structures to granular scrutiny to verify that risk transfer is genuine and not cosmetic.

Impact on Corporate Ratings: Separation of Risk vs. Implicating Support

SPVs are designed to shield the parent’s credit profile from transactional or project-specific risk. Rating agencies typically assign standalone ratings to SPV-issued debt, focusing on the underlying collateral, structure, and cash flow mechanics.

In practice, however, the boundary is often blurred. Where there are signs of implicit or explicit sponsor support through cross-default clauses, guarantees, or a track record of financial intervention, which can lead agencies to consider the parent and SPV partially linked, such perceived support can mitigate the parent’s ability to achieve complete risk isolation, and conversely, SPV distress may still weigh on consolidated credit assessments. In this case, effective structuring requires balancing financial flexibility with rating transparency, ensuring that credit benefits are preserved without undermining the integrity of legal separation.

Lessons from NPL and Public Guarantee Schemes

The Italian GACS and Greek HAPS programs offer a clear example of how Vehicle Companies (SPVs), supported by public guarantees, can act as effective tools for the large-scale restructuring of bank balance sheets. Both schemes were born in response to the increase in non-performing loans (NPLs) after the financial crisis, with the aim of re-establishing the stability of the system and reviving lending capacity without direct intervention by taxpayers. By transferring impaired assets to SPVs and applying sovereign guarantees on senior tranches, banks achieved an effective risk transfer, regulatory capital relief and improved market access for their securitized debt.

From a structural point of view, these operations highlight how SPVs can act as neutral intermediaries between originators, servicers and investors. State guarantees functioned as a form of external credit enhancement, elevating senior tranches to investment grade level and allowing investor participation in an otherwise illiquid market. Crucial was that guarantees were priced with market premiums linked to sovereign CDS spreads, ensuring compliance with EU State aid rules and avoiding implicit subsidies. This design demonstrates that public–private models can be efficient and fiscally neutral if structured correctly.

Ultimately, the GACS and HAPS programmes show how structured finance can be used to solve systemic credit problems through coordinated public–private mechanisms. They confirm that SPVs, when combined with rigorous supervision and credible collateral, can transform impaired assets into investable instruments; however, sustainable success still depends on consistent recoveries, efficient servicing and transparent reporting standards throughout the life cycle of each transaction.

0 Comments