USA

The biggest news of the week was delivered on Wednesday when the House passed the agreement to end the government shutdown and President Trump later in the day signed the bill. It marked the end of the longest government shutdown, lasting 43 days, and importantly allowing investors to receive the important government data on inflation and labor. Even though the shutdown has officially ended the recovery won’t be immediate, most of the data necessary to produce the monthly reports wasn’t collected during the period, a total of thirty reports spanning from construction to GDP reports were skipped during the 6 weeks. It will definitely be a challenge for the US statistical agencies to release the missed reports and we note that the Trump administration warned that the October inflation and job figures would likely never be released, certainly complicating the decision in the Federal Reserve’s December meeting.

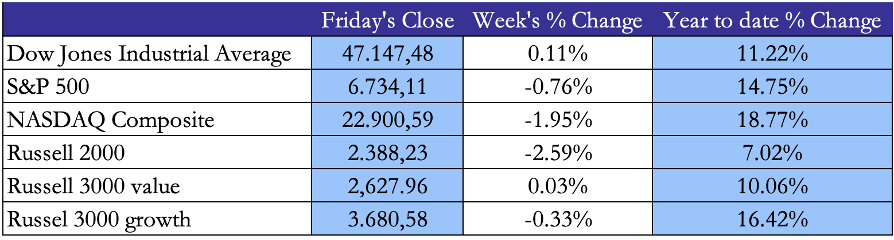

The major US equities had a mixed week characterised by high volatility. The S&P 500 fell by 0.76%, the DJIA inched up by 0.11% and the Nasdaq Composite lost 1.95%. Stocks were mostly lower through Thursday as investors’ increasing probe on AI spending circles and very generous valuations helped drive away from many growth-oriented stocks, the loss was partially recovered after Friday’s volatile trading session.

These doubts were coupled with hawkish commentaries from several Federal Reserve officials, during the week, St. Louis FED president Alberto Musalem stated that the that he believes the Fed has limited space to cut rates and should wait for clarity, and Atlanta FED president stated on Wednesday that he considers “signals from the labor market as ambiguous and difficult to interpret”. These cautious comments cooled the probability of an expected cut, which on Friday reached a probability of 44.4%, certainly highlighting the ambiguity that investors and policymakers are facing.

Growth oriented indices underperformed the value benchmark, respectively -0.33% and 0.03% as we saw during the week a projection in prices of increasing doubts on the valuations of growth stocks.

Source: Yahoo Finance, Bocconi Students Investment Club

Source: Yahoo Finance, Bocconi Students Investment Club

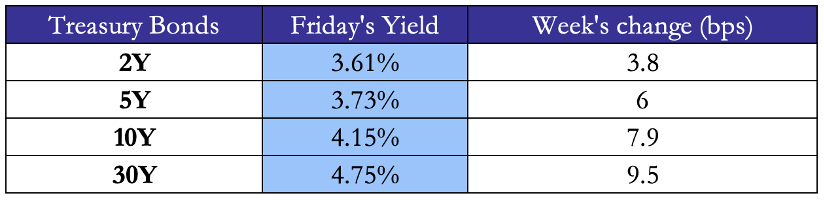

US Treasuries posted negative returns during the week. The back end of the curve rose the most with a steepening effect due to the FED’s official hawkish ton e and general uncertainty on the economic outlook. The 2-year yield edged up by 3.8 bps to 3.608%, while longer maturities rose, with the 10-year up by 7.9 bps to 4.150% and the 30-year climbing by 9.5 bp to 4.750%. Interestingly, throughout the week municipal bonds outperformed treasuries, with new issuance in the muni market ramping up and the new offerings being generally oversubscribed.

Source: Yahoo Finance, Bocconi Students Investment Club

Europe and UK

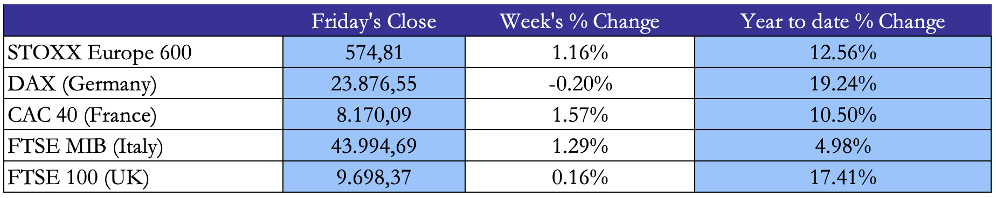

European equities posted a positive performance throughout the week, on relief that the US government reopened and local equities performance, the gains, however, were curbed by the global trend in cooling sentiment on AI. The Euro Stoxx 600 ended 1.16% higher with the DAX (-0.20%) underperforming the CAC 40 (1.57%) and FTSE MIB (1.29%). The increase was driven in large part by Italian and Spanish banks.

Surveys from Germany, conducted by the ZEW economic research institute highlight a decrease in confidence of Germany’s economic policy to tackle pressing issues. Whereas in the United Kingdom, a weaker labour market and economic growth data disappoints investors which have increasingly raised their bets in a BoE’s December cut.

Source: Yahoo Finance, Bocconi Students Investment Club

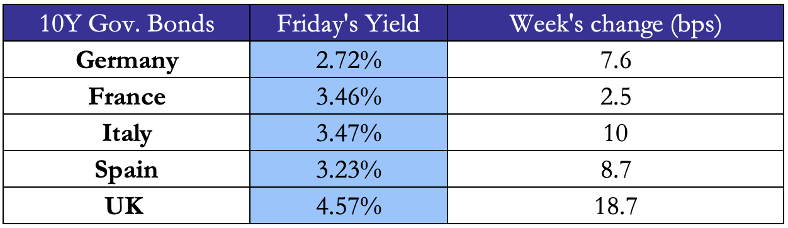

The European sovereign bond yields edged higher during the week, mostly reflecting a growing confidence in the hold for the next ECB meeting. In the United Kingdom, as uncertainty around the November 26th budget mounted, particularly about how funds are going to be raised Gilts yields rose double digits basis points on Friday, in response to Rachel Reeves comments about income tax.

Source: Yahoo Finance, Bocconi Students Investment Club

Rest of the World

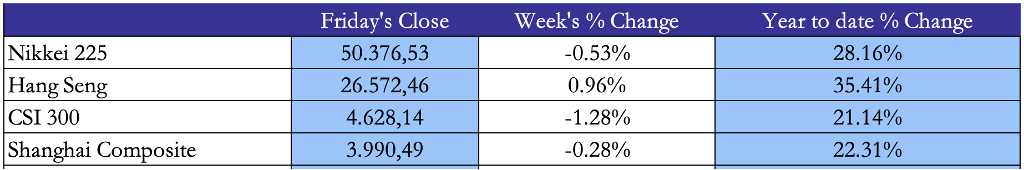

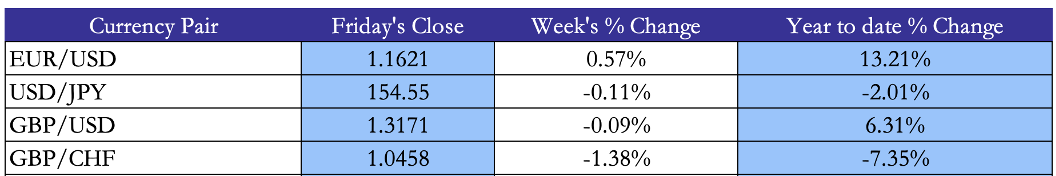

Asian equities declined during the week. The Nikkei 225 fell by 0.23%, with lofty tech valuations alongside a mixed set of economic indicators in China and cautious comments by the Federal Reserve officials denting the general sentiment. Advantest and SoftBank (which sold on Wednesday all of its NVDA shares to raise capital) were hit the hardest both losing 6-7 percent, continuing last week’s drop.

China’s Shanghai Composite index fell by 1.26% during the week, following concerning data on manufacturing capex and government investment coupled with a decline in fixed-asset investments and property prices. Hong Kong’s Hang Seng index inched up by 0.62% but followed the global equity trend on Friday marking a one day decrease of 1.85%.

Source: Yahoo Finance, Bocconi Students Investment Club

In Asia-Pacific, the Kospi increased by 0.49%, after an initial increase during the week with the US agreeing to lower tariffs on Korean cars and auto parts together with recalibration of tariff rates on semiconductors, aligning with the levels set to Korea’s competitors, such as Taiwan, offset by a 3.81% decrease on Friday. Australian markets hit a new four month low amid uncertainty on the Fed December decision and sluggish economic data in China, with the S&P/ASX 200 closing at 8,634.50 marking a decrease of 1.79% over the week.

Latin American equities had mixed performances. Mexico’s IPC declined by 1.65% following last week Banxico’s 25 bp cut with officials setting a cautious tone on future cuts. Bovespa gained 2.39% over the week continuing the rally that started after the second week of October.

Source: Yahoo Finance, Bocconi Students Investment Club

FX and Commodities

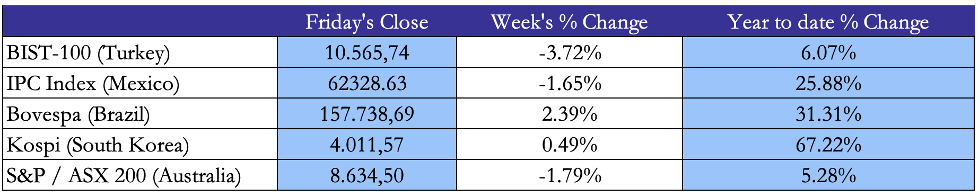

In the currency markets the GBP and JPY underformed during the week, with weaker UK economic data increasing the probability of a future cut for the BoE. In Japan there has been a renewal in sovereign bond selloff with the economic policy set by the new female PM, Sanae Takaichi yet to be detailed.

The USD was fairly stable, with the EUR/USD pair edged up by 0.57% to 1.1621, the USD/JPY decreased by 0.11% and the GBP/USD with a very marginal decrease of 0.09%. The GBP/CHF weakened by 1.38% with investors betting on a cut in the next meeting.

Source: Yahoo Finance, Bocconi Students Investment Club

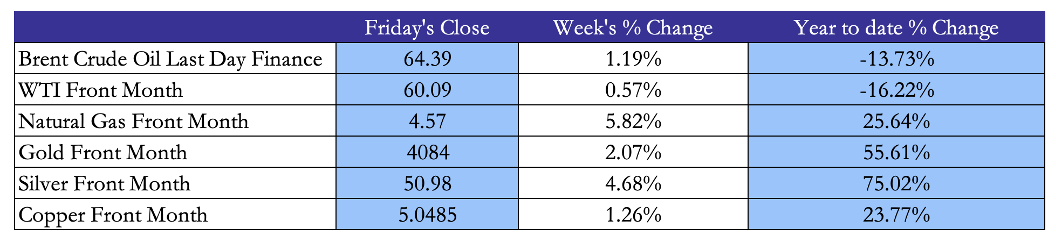

Commodity markets were positive during the week. Oil prices increased as demand expectations increased with the US government reopened and India and China dumping Russian oil following the latest sanctions. Brent Crude rose to 64.39 with a weekly change of 1.19% and WTI Front Month rose to 60.09 with a 0.57% change. Regarding energy, natural gas increased amid seasonal demand and colder weather forecasts.

Gold, Silver and Copper all increased with their closing front month respectively at 4084, 50.98 and 5.05, reflecting increase in overall uncertainty surrounding the next meetings for both the United States and United Kingdom continuing the astonishing YTD rally.

Source: Yahoo Finance, Bocconi Students Investment Club

Next Week Main Events

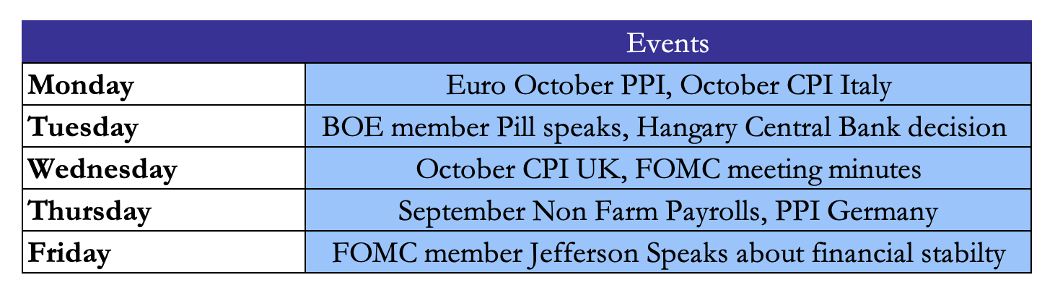

A busy macro week lies ahead, with key policy and data releases likely to guide global markets. The end of the government shutdown means that investors and policymakers can grasp a more accurate picture of the current state of the US economy. Following the AI bubble narrative on Wednesday NVIDIA will publish their earnings reports and it’s expected to be a very volatile week as highlighted by the IV of 51.0 (73 percentile over the last year).

Brain Teaser #38

Your drawer contains 2 red socks, 20 yellow socks and 31 blue socks. Being a busy and absent-minded MIT student, you just randomly grab a number of socks out of the draw and try to find a matching pair. Assume each sock has equal probability of being selected, what is the minimum number of socks you need to grab in order to guarantee a pair of socks of the same color?

Solution: 4, as in the worst case you grab one of each color first (red, yellow, blue) with no pair after 3 socks. The 4th sock must match one of those colors (pigeonhole principle), guaranteeing a pair.

Brain Teaser #39

Four people, A, B, C and D need to get across a river. The only way to cross the river is by an old bridge, which holds at most 2 people at a time. Being dark, they can’t cross the bridge without a torch, of which they only have one. So each pair can only walk at the speed of the slower person. They need to get all of them across to the other side asquickly as possible. A is the slowest and takes 10 minutes to cross; B takes 5 minutes; C takes 2 minutes; and D takes 1 minute. What is the minimum time to get all of them across to the other side?

0 Comments