USA

Following significant increases in stock market enthusiasm, particularly in technology and AI sectors, over the past few weeks, concerns have emerged regarding the sustainability of this growth. Consequently, the market cooled down this week, with the sell-off from the end of last week continuing. Not even Nvidia’s strong Q3 financial results, released on 19 November, could prevent this. Although Nvidia exceeded expectations with revenue of $57 billion (+62% year on year) and an expected revenue of $65 billion for Q4, this only caused a short-lived positive reaction and did not alter the overall downward trend. After the shutdown officially ended last week, delayed US economic data was released: despite the addition of 119,000 new jobs in September, the unemployment rate increased to 4.4%. Due to uncertainty in the labour market and a lack of information on October’s inflation, there is increased uncertainty about the Fed’s decision in December, which is negatively affecting the market.

This resulted in a 1.65% decrease for the S&P 500. Looking at different sectors and types of stocks, industrial stocks were less affected than tech companies, resulting in the NASDAQ Composite negatively beating the DJIA with losses of 2.26% and 1.75% respectively. As technology companies are often growth stocks, this phenomenon was also reflected in the Russell indices: the Russell 3000 Growth underperformed its value-oriented equivalent by -2.77% to -0.85%.

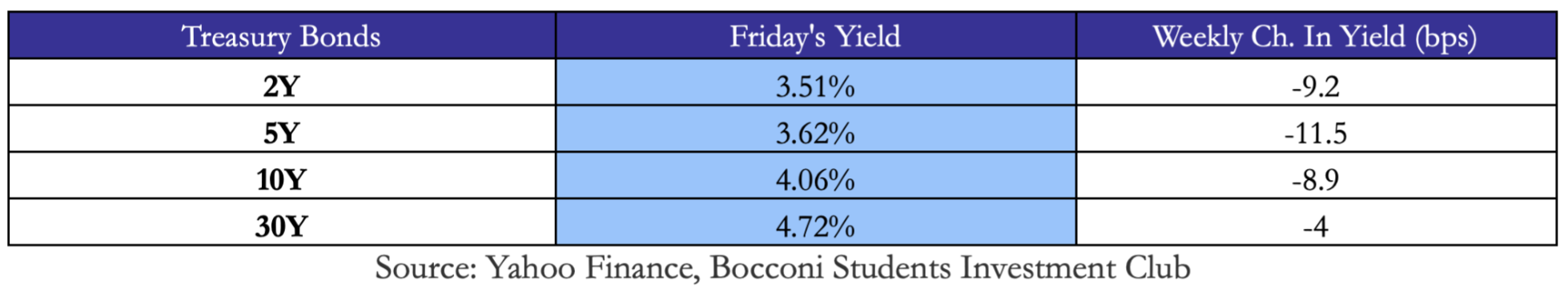

Unlike last week, yields on US treasury bonds dropped significantly. Those with shorter maturities lost the most, such as the 2-year and 5-year bonds, which fell by 9.2 and 11.5 basis points respectively this week. The longer-maturity bond, the 30-year Treasury bond, remained relatively stable but still lost 4 bps of yield. This is closely connected to the significant sell-off of equities on the stock market. The related uncertainty caused the prices of US treasury bonds to rise, as they are considered safe havens.

Fears about growth stocks and an eventual ‘AI bubble’ also spread to Europe, resulting in a significant sell-off. On Friday, the STOXX Europe 600 index closed at 562.1, which was 2.23% lower than at the beginning of the week. The uncertainty surrounding the Fed’s decision also impacted the export-driven European market. The DAX in industrial powerhouse Germany was particularly affected, closing the week down 3.34%. Germany was not alone in closing the week with a significant loss; the other major European players also experienced significant losses. The FTSE MIB in Italy closed with a loss of 3.04%, while the CAC 40 in France fell by 2.12%. Additionally, retail sales in the UK unexpectedly dropped by 1.1% month-on-month in October. These impacts caused the FTSE 100 (UK) to close 1.64% lower over the week.

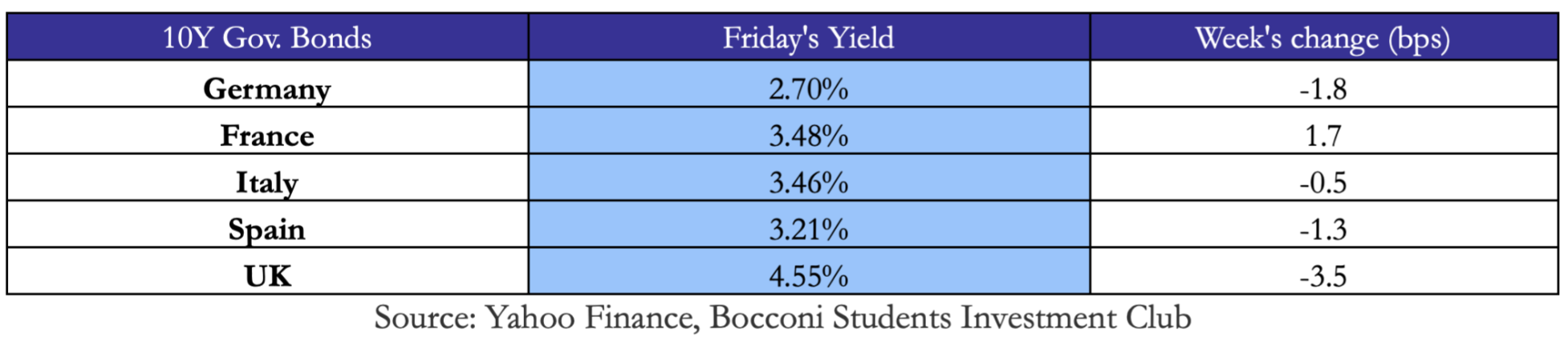

European 10-year government bonds remained stable this week, with yield changes not reaching 2 bps. The only exception was the 10-year UK government bond, which saw a yield change of 3.5 bps. This change was caused by released data about inflation in October. With inflation cooling to 3.6%, hopes of imminent interest rate cuts have risen, leading to increased demand and higher prices for bonds.

Rest of the World

As in Europe and in the USA, concerns about the overvaluation of technology and AI stocks had a significant impact on Asian markets. Furthermore, political tensions between China and Japan have contributed to significant declines in Asian indices. Following Japan’s Prime Minister Takaichi’s suggestion of taking military action in the event of a Chinese attack on Taiwan, China responded with anger. This included the suspension of imports of Japanese seafood and a travel warning for Japan. In contrast, Japan warned its citizens in China to take safety precautions. Consequently, the Japanese Nikkei 225 fell by 3.29% this week, while the Chinese CSI 300 and Shanghai Composite fell by 3.53% and 3.85% respectively. The index that was hit hardest, however, was the Hang Seng (Hong Kong), which closed 4.62% lower this week.

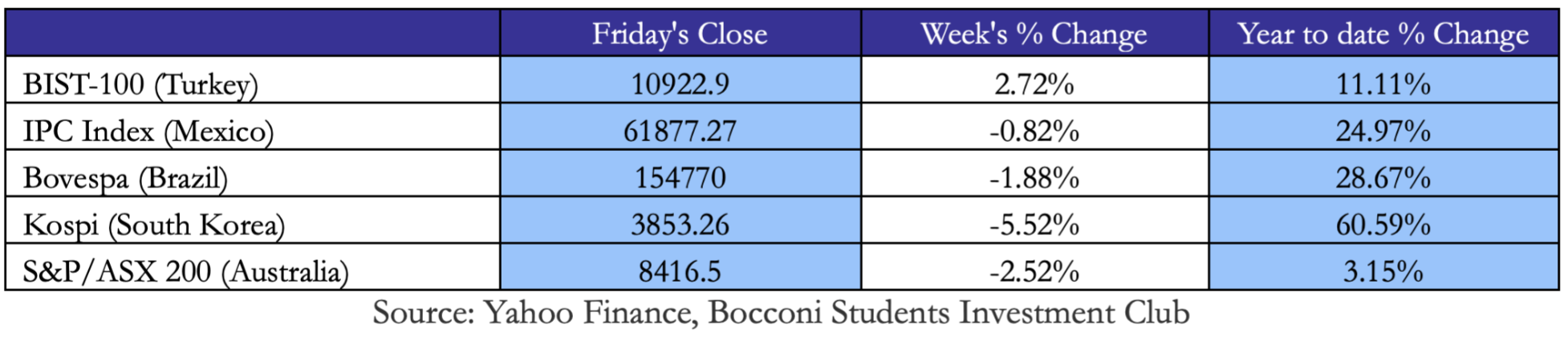

Japan’s neighbour South Korea was hit even harder, with the Kospi falling by 5.52%. This was mainly due to the decline in technology stocks, as South Korea is heavily dependent on the technology sector. Furthermore, in Australia, the S&P/ASX 200 fell by 2.52%. Australia’s index was not only impacted by rising investor caution, but also by lower commodity prices due to the importance of commodities for the country. The movement in the commodities market also affected South America, particularly Brazil, where the Bovespa closed 1.88% lower on Friday than it started on Monday. Mexico also experienced uncertainty, with the IPC falling 0.82% this week. In contrast to the overall market movement this week, Turkey was one of the few countries to move positively. Its index, the BIST-100, won a significant 2.72%.

FX and Commodities

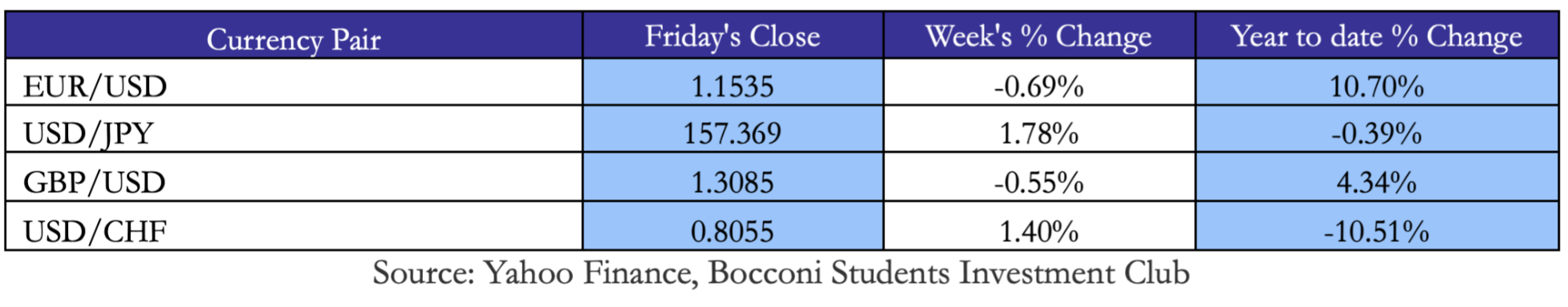

The increasing uncertainty surrounding interest rate cuts by the Fed in December strengthened the USD, resulting in a 0.69% decrease in EUR/USD and a 0.55% decrease in GBP/USD. While interest rates in the Eurozone and Great Britain are above 2% and at 4% respectively, those in Japan and Switzerland are much lower at around 0%. Government bonds in Eurozone countries and the UK therefore have higher yields, making them more attractive to investors. Consequently, the USD strengthens relatively more against JPY and CHF than against EUR and GBP. This caused USD/JPY to rise by 1.78% and USD/CHF by 1.40%.

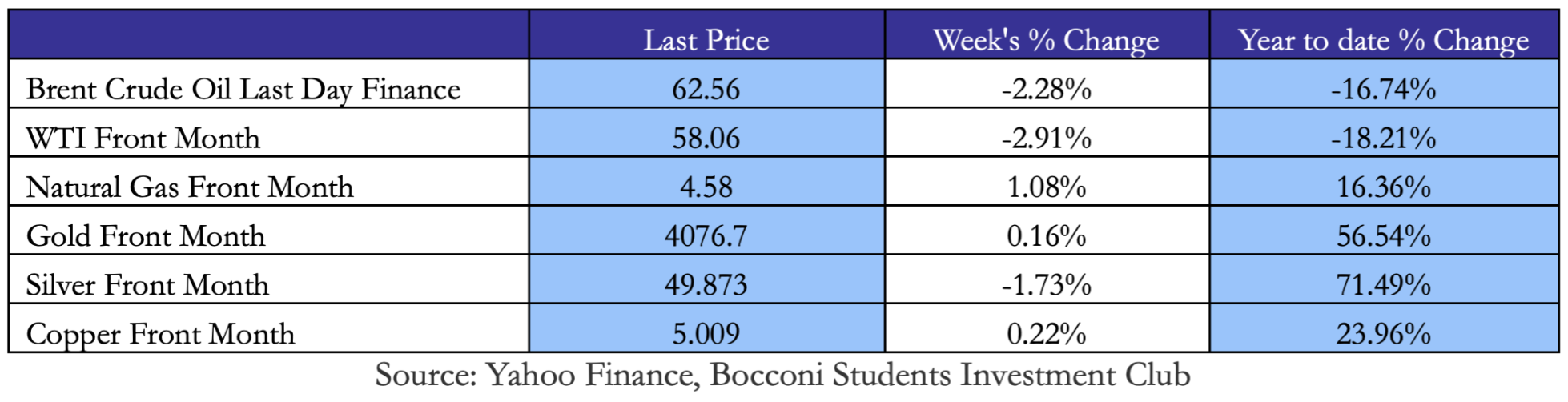

There was a mixed picture in the commodity market this week. Slowing demand optimism for oil caused oil prices to fall. This was exacerbated by a stronger USD, leading to falls of 2.28% in Brent Crude and 2.91% in WTI Front Month this week. Gas prices, on the other hand, were boosted by tight inventories and a cold winter. Demand is therefore expected to be high, potentially resulting in a winter rally. Consequently, the price of Natural Gas Front Month rose by 1.08% and closed on Friday at 4.58.

Gold remained stable this week despite a strong USD. This was due to the sell-off in the stock market, as gold is often used as a stable investment in periods of market volatility. Copper also stabilised its price with a slight 0.22% increase in the Copper Front Month this week. However, silver could not withstand the pressure, causing the price of Silver Front Month to decrease by 1.73% to 49.873.

Next Week Main Events

An interesting macro week awaits us, with lots of important data for global markets and central banks. The USA and Germany, in particular, will release important economic information. We also await new insights from the ECB. In addition to macroeconomic data, there will be some interesting earnings reports, with Dell Technologies, HP Inc. and easyJet releasing their figures on Tuesday.

Brain Teaser #39

Four people, A, B, C and D need to get across a river. The only way to cross the river is by an old bridge, which holds at most 2 people at a time. Being dark, they can’t cross the bridge without a torch, of which they only have one. So each pair can only walk at the speed of the slower person. They need to get all of them across to the other side as quickly as possible. A is the slowest and takes 10 minutes to cross; B takes 5 minutes; C takes 2 minutes; and D takes 1 minute. What is the minimum time to get all of them across to the other side?

Solution: 19 minutes. Since there is only one torch needed to cross the bridge, one of the two people crossing the river must return with the torch so that the others can also cross. Therefore, the fastest person out of the four should go back every time, since they need the least amount of time to do so. Consequently, it is person D who carries the torch back. He accompanies each other across the river; the order is irrelevant. He goes with the first person, returns, accompanies the second person, returns again, and finally crosses the river with the third person. The time taken on the way to the other side always depends on the slower person, so on the other one. The total time is therefore the sum of the time needed by the other three people to cross the river plus twice the time needed by D to cross the river (he has to return with the torch twice). Total time = 10 minutes + 5 minutes + 2 minutes + 2 × 1 minute = 19 minutes.

Brain Teaser #40

Show that, if there are 6 people at a party, then either at least 3 people met each other before the party, or at least 3 people were strangers before the party.

0 Comments