Introduction

ITV’s [LSE: ITV] future has been the subject of much speculation, having attracted interest from potential buyers such as CVC Capital Partners [AMS: CVC]. However, ITV’s silence was finally broken on November 7, 2025, in a 70-word statement. ITV told shareholders that Comcast-owned [NASDAQ: CMCSA] Sky has made a £1.6bn provisional bid for its media and entertainment division, including its TV channels and streaming service, ITVX. It leaves ITV’s shareholders retaining control of ITV Studios, its production and distribution unit.

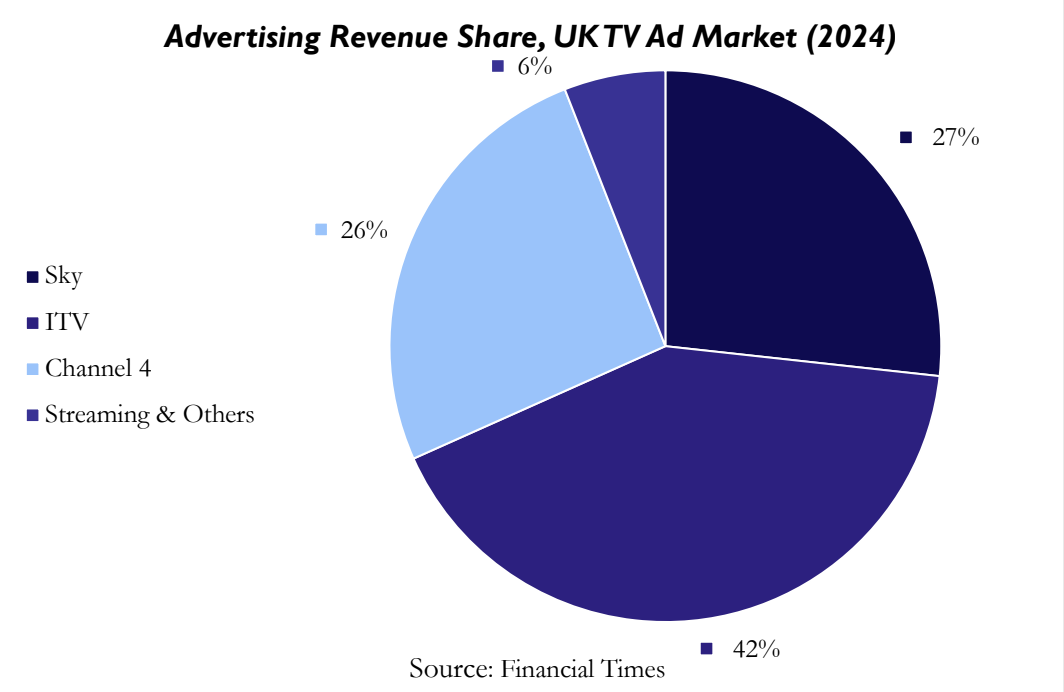

If passed, the deal would be monumental in transforming the British broadcasting industry, producing the UK’s largest commercial broadcaster, which controls 70% TV advertising revenue. While the US is familiar with such consolidation, as seen with the Paramount-Skydance [NASDAQ: PSKY] merger followed by a recent multibillion-dollar bid for Paramount to buy Warner Bros. Discovery [NASDAQ: WBD], the deal is notable within the UK, especially given its monopolistic nature. However, with an increasingly competitive landscape, where broadcasters are not only up against streaming services but also tech giants, capturing ad revenues, it is probable that the deal will receive the go-ahead from regulators.

The Historical Evolution of British Broadcasting

The evolution of British broadcasting reflects the broader changes in society and media consumption habits, from traditional radio broadcasts to modern digital streaming. Its history begins in 1922 with the establishment of the British Broadcasting Corporation (BBC), a publicly funded and editorially independent institution under a Royal Charter. The organisation adopted a mission to create a platform that would provide impartial information and promote national unity, following World War 1. Although ultimately answerable to Parliament, the BBC has virtually complete independence in conducting its activities. The broadcasting company is largely financed by annual television licensing fees, which are paid by those who own TV sets or watch live television transmissions on such devices as computers. It also offers radio networks as well as international and national channels. The BBC is now the largest broadcaster in the world, accounting for more than 30% of all television viewing in the UK.

The BBC held a monopoly on television in the UK from its conception until 1954, when the Television Act was passed, subsequently creating a commercial channel operated by the Independent Television Authority (ITV). At first composed of different regional commercial broadcasters, ITV emerged from a merger of private companies that gradually consolidated into a single national entity. Funded by advertising rather than public money, ITV offered a more entertainment-driven alternative to the BBC. The immediate popularity of ITV had a devastating effect on the BBC, and ITV revenues soared from an initial £2m to more than £60m. The BBC reacted by adding popular programming in prime viewing hours, and ITV programmers greatly enhanced their reputation by developing superiority in coverage of current affairs and in some documentary areas.

The arrival of Sky Television in 1898, which later merged with British Satellite Broadcasting to form BSkyB in 1990, marked a second structural change in the UK media landscape. Sky quickly became a major player, leveraging satellite technology to monetise also through subscriptions rather than advertising alone (pay-TV model). Sky’s channels not only brought popular American shows to British audiences but also introduced homegrown content. This helped to contribute to the development of British television production, exclusive sports rights, and premium entertainment packages.

Sky – ITV Deal: Rationale and Potential Setbacks

ITV’s much discussed and notoriously sticky share price jumped more than 10% after the bid by Sky was announced. However, Sky’s move left public opinion divided, with some viewing it as a necessary condition for the survival of British broadcasting, while others criticised it as an erosion of media independence.

The proposal follows years of underperformance at both companies. Sky has faced financial strain since Comcast’s acquisition in 2018 for $39bn, marked by value write-downs ($8.6bn in 2022) and layoffs, mainly due to the poor performance of European operations in Italy and Germany. Sky UK, which controls rights to crown-jewel assets including most of the rights to the Premier League, remains highly profitable. On the other hand, ITV’s market capitalization has fallen to £2.5bn, nearly 75% below its peak a decade ago, as the streaming revolution has hammered the stocks of traditional broadcasters.

Sky’s main objective is to bolster its finances and reaffirm Comcast’s commitment to its UK subsidiary after years of fluctuating results. With the deal, Sky could also complement its pay-TV platform with the UK’s biggest free-to-air commercial broadcaster, achieving a wider reach and improving advertising monetization against US streaming giants that have upended the entertainment business. Additionally, the deal would strengthen Sky’s content and distribution integration: with unified planning, cross-platform targeting, and shared measurement, there could finally be a modernization of how TV is traded and reported.

For ITV, the sale represents an opportunity to focus on its profitable studios division (valued at £3.5bn), which continues to generate strong production revenues from both domestic and international markets. At the same time, the deal would reduce exposure to the volatility of the advertisement market. The company said it expected advertising revenues, which still account for most of its income, to fall by 9% in the last quarter of this year. There would also be the opportunity to scale streaming, with the integration of ITVX’s 40 million registered users into Sky’s existing 13 million subscribers. ITV’s stock has remained under constant pressure due to cyclical weakness in advertising revenues, investor scepticism regarding ITVX’s long-term profitability, and a lack of visible growth catalysts within the core broadcasting segment. ITV’s largest single shareholder, Liberty Global [NASDAQ: LBTYA], which jointly owns Virgin Media O2 with Spanish telecoms operator Telefónica [BME: TEF], halved its 10% stake in ITV last month. In this context, Sky’s proposal offers shareholders a potential exit route and an opportunity to realize value in an environment where ITV’s independent recovery remains uncertain.

Sky’s data-driven advertising technology and advanced analytics could be complemented with ITV’s brand recognition built on a 70-year heritage, nationwide reach, and access to premium sports with entertainment rights. Analysts believe that the merger could bring potential synergies, including improved cross-platform advertising, streamlined operations, and meaningful cost savings through overlapping sales and marketing functions. The consolidation may come with headcount cuts or slower service and interruptions in the data system operations due to the huge differences between the sales operations.

There is, however, no guarantee that regulators would clear the takeover. If an agreement were reached, it would be closely monitored by the Competition and Markets Authority (CMA) and by the media regulator Ofcom. There is confidence for the success of the deal, reinforced by the UK government’s intention to make it easier for broadcasters to come together. Nevertheless, Sky and ITV are estimated to cover around 70% of the advertising market, raising regulatory hurdles of advertising monopoly power. A second challenge arises from the pure politics of Comcast’s US ownership, reviving long-debated talks about foreign control of UK broadcasting. There is also the question of the duo’s overlapping news businesses. Both are widely respected, but Sky News has been loss-making for years and its current funding guarantee from Comcast expires in 2028. Moreover, both companies continue to face competition from global players with far greater financial resources (Disney [NYSE: DIS], Netflix [NASDAQ: NFLX], YouTube (owned by Alphabet Inc. [NASDAQ: GOOG]), Amazon [NASDAQ: AMZN]), whose dominance of digital advertising and streaming accelerates the shift away from traditional linear television consumption.

Redefining the Advertising Landscape: Will a Monopoly Pass Regulatory Scrutiny?

Regulatory backlash over a potential monopoly is the biggest threat to the merger. Combined Sky-ITV would command roughly 70% of UK advertising revenue, merging Sky’s 27% with ITV’s 42%. Normally, the CMA, the UK’s monopoly watchdog, would almost certainly block such a deal given the resulting concentration of power. However, diversified rivals, including subscription video-on-demand platforms and tech giants like Meta, are disrupting the UK TV advertising landscape. As a result, it is feasible that consolidation could be permitted to “rescue” struggling public service broadcasters (PSBs).

TV advertising is a key revenue source for the UK’s commercial PSBs, which excludes the BBC. The functioning of this market typically involves the selling of advertising slots from PSB sales houses, such as ITV Media, to agencies, including Omnicom [NYSE: OMC], which represent a multitude of brands. These advertising agencies then allocate broadcasters a fixed share of their annual TV Budget, which is referred to as Share of Budget (SoB). However, it is increasingly common for advertising agencies to incorporate volume-based metrics, such as cost per view (CPV), in negotiations. This approach tends to lead agencies to favour video-sharing platforms (VSPs), such as TikTok, which can reach wider audiences supported by robust algorithmic targeting. YouTube is reportedly the second-most-watched media service in the UK after the BBC.

Thus, crucial advertising revenues for PSBs are being captured and displaced by other digital media services. Overall, revenues for commercial PSBs have declined more than £600m in real terms in 2019 to approximately £3.1bn in 2023. Individual broadcasters are also experiencing pertinent blows, as mentioned, ITV expects a 9% reduction in advertising revenues in the last quarter of the year, even with the run-up to Christmas. Moreover, the proportion of TV advertising in the advertising market has shrunk; in 2000, TV ad revenue formed one-third of total UK advertising, while in 2024 it contributed just £5.27m to the overall advertising market valued at £42.6bn.

However, while VSPs remain key rivals within the advertising space, the most severe threat to revenues lies with tech giants, Google [NASDAQ: GOOGL] and Meta [NASDAQ: META], due to their deeper capital pools. Sir Peter Bazalgette, former ITV chairman and current shareholder, stated “[Regulators] don’t realise we are already competing directly with the likes of Google and Meta…These two have 60% of the UK ad market”. Given such a reality, if regulators extend the scope of UK TV advertising competition to include tech companies within the framework, the relative dominance of the Sky-ITV merger would appear much smaller. Enders Analysis, a TMT-focused independent research firm, estimated the merger would hold 30% of the UK’s video ad market, and Omdia estimates 50% for Net Advertising Revenue, using broader market definitions. If these estimates are correct, then regulatory approval is much more likely to be granted.

Considering the present state of the UK TV advertising market and pressures posed by “new entrants”, it is thus possible that the CMA would seek to redefine its scope and approve the deal in line with a domestic “rescue” policy, rather than enabling a monopolistic broadcaster. However, the outcome of the CMA’s ruling remains uncertain. The CMA must balance public criticism, such as the erosion of public service obligations. Fears arise that while at present ITV is legally required to deliver a range of public welfare content, such as national and regional news, Sky, being a US-owned, commercial broadcaster, might neglect such obligations.

Transatlantic Parallels: The US Media Market

The Sky-ITV merger can be compared to the consolidation culture in the US media market. For instance, mergers such as Warner Bros. Discovery [NASDAQ: WBD] in 2021 or the Paramount-Skydance [NASDAQ: PSKY] in 2025. Their underlying rationale wasn’t necessarily higher market share, but survival, due to the increased popularity of streaming services. The three main streaming platforms, Netflix, Disney+, and Amazon Prime, are all US-owned, operating domestically before expanding globally. Hence, the US market was the first to set the trend for consolidation, resulting in some of the highest value M&A deals in the media industry.

The merger of Warner Bros and Discovery in April 2022 ($43bn) resulted in Warner Bros. Discovery. Warner Media, a major film studio and owner of networks, including CNN and HBO, was a subsidiary of AT&T [NYSE: T], one of the largest telephone services in the US. Discovery, on the other hand, is a mass media company with primarily cable networks, including Animal Planet, but also owns a streaming service, Discovery+. Upon the merger, Warner Bros. Discovery was valued at around $65.3bn. Both companies benefited from each other’s strengths, with Discovery’s ad-heavy channels proving extremely profitable and Warner’s subscription content. The synergies were high: Discovery was able to target ads based on what viewers watched, their region, and reach a higher audience, whereas Warner was able to increase its overall ad revenue. Discovery was predicted to have cost synergies worth more than $3bn annually. Overall, the companies expanded globally, reaching a more diverse audience. It could be argued that the rationale was scale. However, by uniting, the company, offering both scripted and unscripted content, was able to compete with Netflix and Disney+, and is now the fourth-most-streamed service globally.

Another relevant deal is the $8bn merger between Paramount Global and Skydance Media. It resulted in CBS (America’s most-watched broadcast channel), Paramount Pictures, and MTV, and films like Mission: Impossible operating under one name. Moreover, it allowed Paramount to benefit from Skydance’s superior expertise in AI and data analytics. Prior to the merger, Paramount was experiencing high executive turnover, in addition to declining demand for free TV channels, resulting in $20bn in debt, while at present, the company has cut $2bn in costs. The merger was approved by the US Federal Communications Commission (FCC) in the summer of 2025, after Paramount agreed to pay $16m to settle a lawsuit from President Donald Trump, following an edited interview with Kamala Harris during the 2024 presidential election. This is another example where both companies needed to stay competitive in a constantly changing market.

Now the UK is slowly following the US in the trend of consolidation in the media industry, evidenced by the Sky-ITV merger. However, the markets aren’t on the same scale, with the US being significantly greater. The US has the largest advertising market in the world, with a total ad spending of $466.3bn in 2025 and a domestic audience of over 330 million viewers. Moreover, the US has a much more extensive range of broadcasters, including NBC (Comcast), CBS (Paramount-Skydance), ESPN (Disney), and Fox News (Fox Corporation, [NASDAQ: FOX]). Contrarily, there are fewer channels in the UK, the main ones being the BBC, Channel 4 (state-owned, but commercially funded), and ITV. Thus, the US TV market is more diverse and commercial, while the UK is more concentrated. Additionally, due to the much smaller UK population, television advertising is considerably cheaper. It can be concluded that the UK cannot reach the same economies of scale as US companies due to these challenges.

However, what both the UK and the US have in common is the political influence on the media industry. The trend in consolidation has raised concerns about how the media is controlled and how this affects bias and diversity. The US and UK are suffering high political pressure, specifically from President Donald Trump. As aforementioned, when Trump sued Paramount, its Skydance merger was withheld by the FCC. Moreover, Trump declared to sue the BBC for anywhere between $1bn-$5bn for allegedly biased editing. Furthermore, he has cut funding from networks that have made critical remarks, including CNN (Warner Bros. Discovery), NBC (Comcast), and ABC (Disney). Additionally, following Trump’s appointment of Brendan Carr as the FCC President and Chairman, Carr has been pushing to eliminate the “39% rule”, which caps how many households a broadcast can reach. Eliminating this rule will allow some networks to reach 80% of households, possibly meaning that what is nationally broadcast will be controlled by only a few companies.

The UK is not far from this reality; aside from the fact that the UK already has very few diverse channels broadcast owned by corporate giants, the BBC is the only one not funded by the government but by the public. However, the government is pushing to remove funding from the BBC’s television licence, such that it will be funded partly by advertising, which the public worries will affect the BBC’s independence.

Conclusion

Ultimately, the future of the UK’s PSBs depends on their ability to adapt to compete in the age of streaming and tech dominance. As the proposed Sky-ITV merger highlights, the trend of consolidation prevalent in the US is part of the solution, creating synergies and capturing audience. Reportedly, Lord Vaizy, former UK Culture Minister, stated that ITV and Channel 4 should merge because “The UK only has room for two domestic broadcasters”. However, notably in the UK’s concentrated market, such consolidation is bound to be met by regulatory hurdles. An alternative pathway that should be considered is increased cooperation. One proposed solution is the creation of a unified streaming platform operating under the BBC iPlayer, which distributes content across the BBC, ITV, and Channel 4. However, it is improbable that commercial broadcasters would agree to share branding or forgo ad revenues in alignment with BBC standards. This proposal recalls “Project Kangaroo”, launched in 2009, a video-on-demand (VoD) joint venture by the BBC, ITV, and Channel 4 to rival Netflix in its early stages. However, the UK’s Competition Commission blocked the initiative, arguing it would create unfair competition in the emerging VoD market. Thus, unless regulators can balance competition whilst enabling British broadcasters to adapt to face American giants, not simply streaming services but also the likes of Meta, domestic players may cease to operate as we know them.

0 Comments