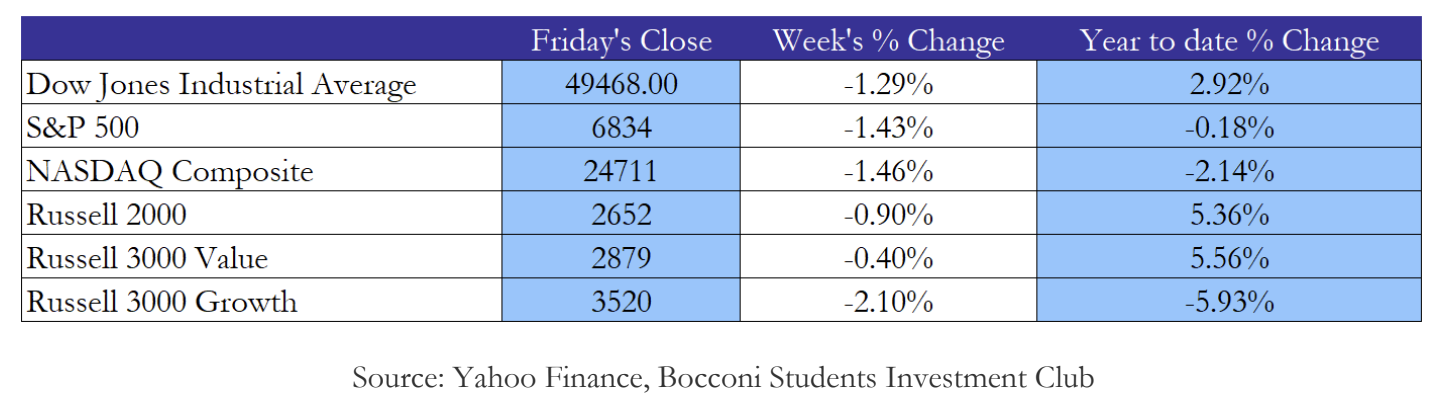

USA

Markets cooled down this week, due to important factors starting from AI concerns. Amazon, Google, Meta and Microsoft collectively expect to spend around $650 billion to compete in the race, however investors start to be worried about this ambitious capex spending. We see a fall in major sectors, from software and brokerage to semiconductors. Despite the increase of non-farm payrolls to 130,000 and the unemployment rate going to 4.3%, the labor market’s health is not yet cured with only 181,00 jobs added in 2025 instead of the previously estimated 584,000. Release of CPI on Friday went well for the US with a 2.4% down from the previous 2.7%, however players are still on hold due to data not still clean as they would want.

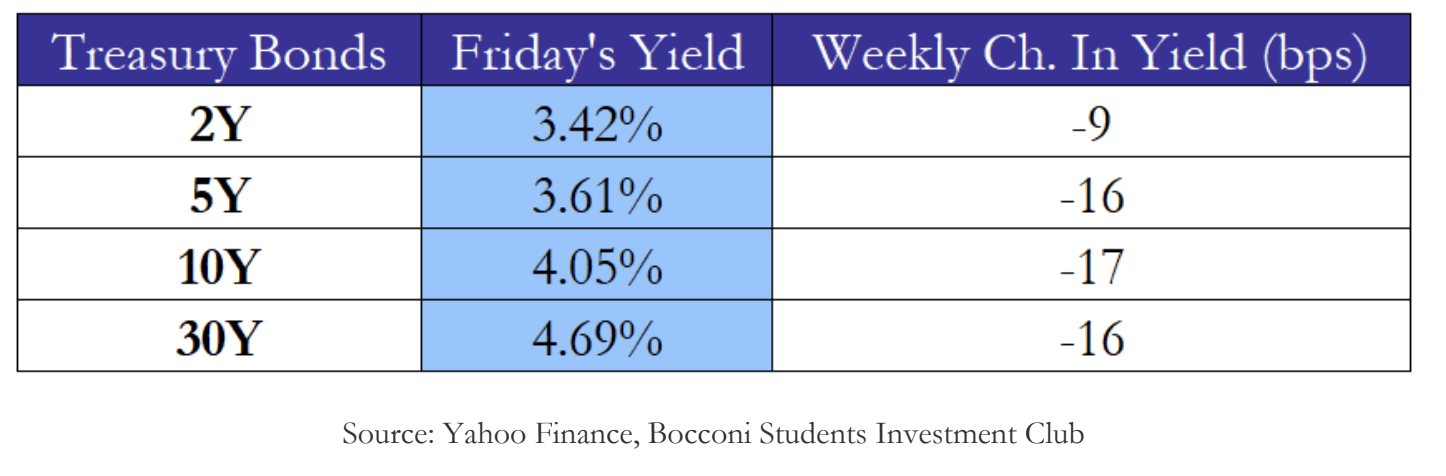

Yields confirmed last week’s trend, with CPI that have not influenced a lot the previsions for a near-cut, confirming the position of the Fed to hold for the moment like analysts suggest and maintain a two cut strategy for the year. By looking at the fed watch we see little difference between before and after CPI. Still we see some movement both in the long and the short term, especially on Friday we saw a decrease of two year yields of about 5 basis point confirming a slight change in expectation.

Yields confirmed last week’s trend, with CPI that have not influenced a lot the previsions for a near-cut, confirming the position of the Fed to hold for the moment like analysts suggest and maintain a two cut strategy for the year. By looking at the fed watch we see little difference between before and after CPI. Still we see some movement both in the long and the short term, especially on Friday we saw a decrease of two year yields of about 5 basis point confirming a slight change in expectation.

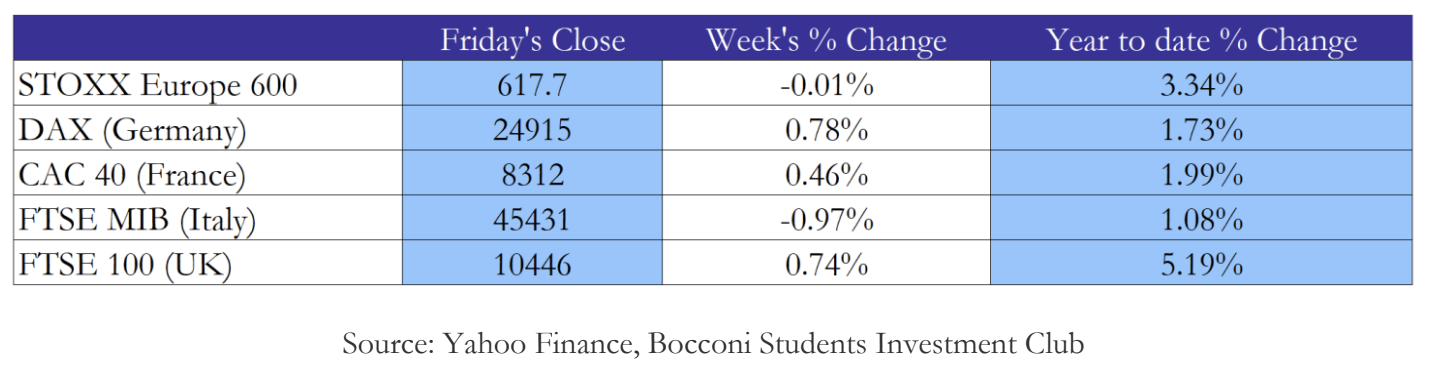

Europe and UK

European markets had a pretty steady weak, better than the American peers. Also European markets faced AI fear, with tech shares making the move, like ASML that went a bit below recent ATH. Also related sectors, such as logistics, commercial real estate and financial services were influenced. The surprise for the week was the French aerospace company Safran with a more than 7% performance after they raised their revenue and earnings projections for the upcoming years.

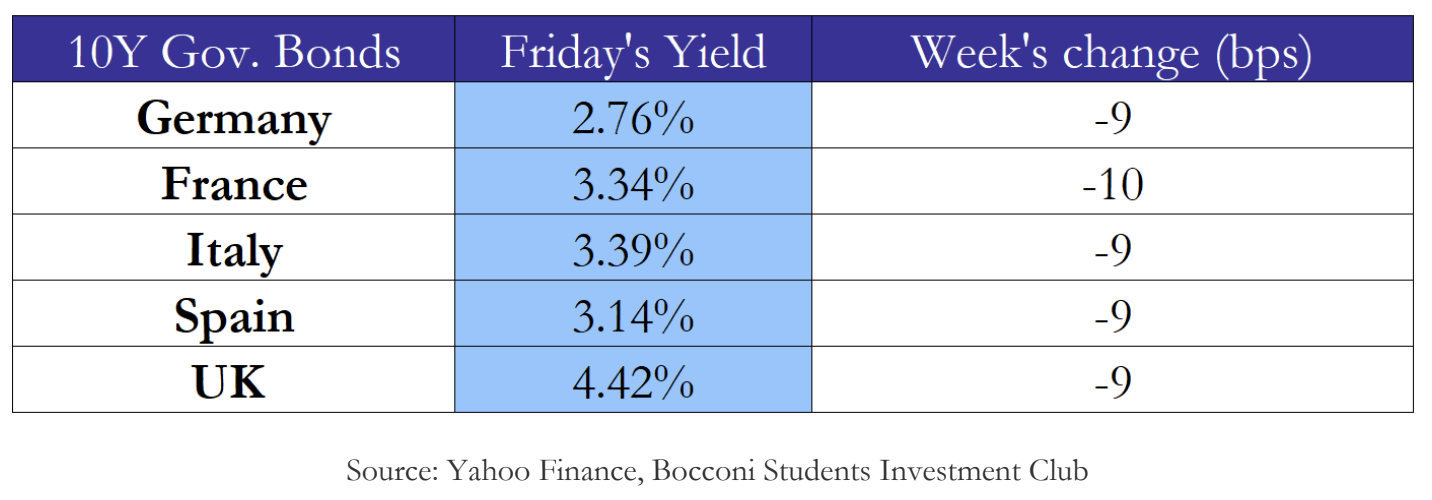

Moving to European yields the absence of local movers led them to follow global rates impulse with a reduction of about 0.10% across major European countries. A more interesting story is what happened for UK gilts were we had a close call that decided in favor of holding at 3.75% with 5 vs 4 votes, which pulled short-term gilts lower signaling more interest for a future cut.

Moving to European yields the absence of local movers led them to follow global rates impulse with a reduction of about 0.10% across major European countries. A more interesting story is what happened for UK gilts were we had a close call that decided in favor of holding at 3.75% with 5 vs 4 votes, which pulled short-term gilts lower signaling more interest for a future cut.

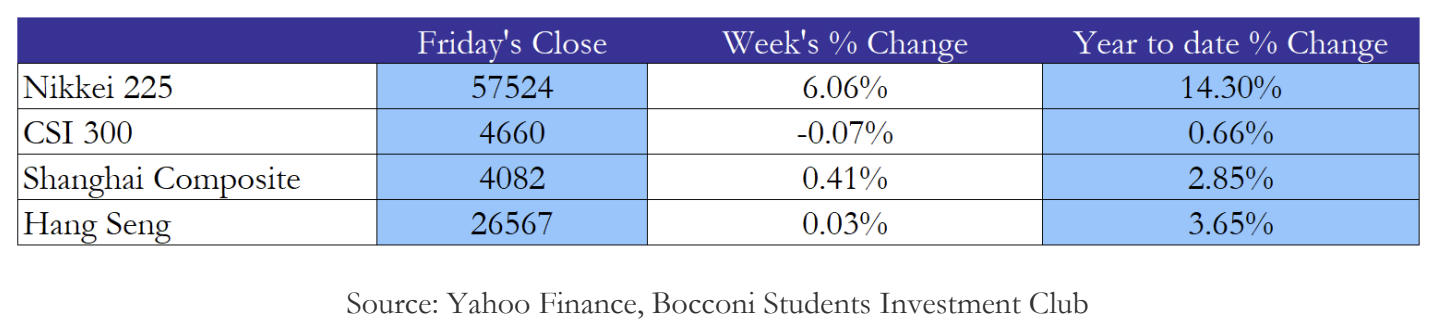

Japan surged this week with a positive 6.06% driven by the optimism after new election of prime minister Takaichi, with players that hope she will support domestic growth without worsening delicate Japan fiscal position. Not all Japanese stocks, however, can say it was an easy week with Softbank losing over 8% on Friday, even though they reported positive results after the loss in the same period one year ago. Chinese markets were pretty firm, with the premier Li Qiang speech where he pushed the desire for AI innovations saying the sector has still a lot of potential.

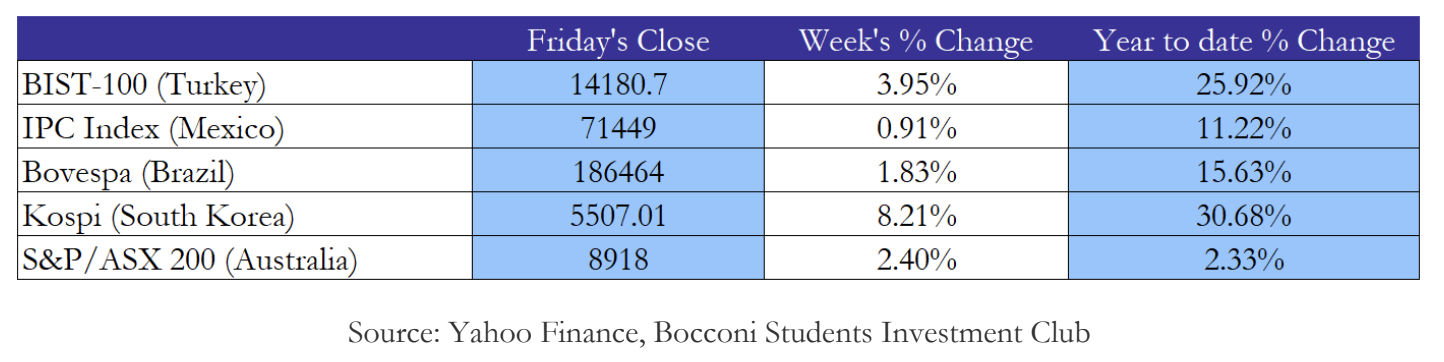

Latin American equities did a great week with Mexico and Brazil leading the other, benefitting from still-supporting global conditions and strong local moment. Australia also did well though they fell on Friday. South Korea had one of his best weeks with a week’s change of 8.21%. reaching ATH. The move was led by tech, semiconductors and financial services with Samsung electronics up more than 6% and battery maker LG increased more than 4%.

Latin American equities did a great week with Mexico and Brazil leading the other, benefitting from still-supporting global conditions and strong local moment. Australia also did well though they fell on Friday. South Korea had one of his best weeks with a week’s change of 8.21%. reaching ATH. The move was led by tech, semiconductors and financial services with Samsung electronics up more than 6% and battery maker LG increased more than 4%.

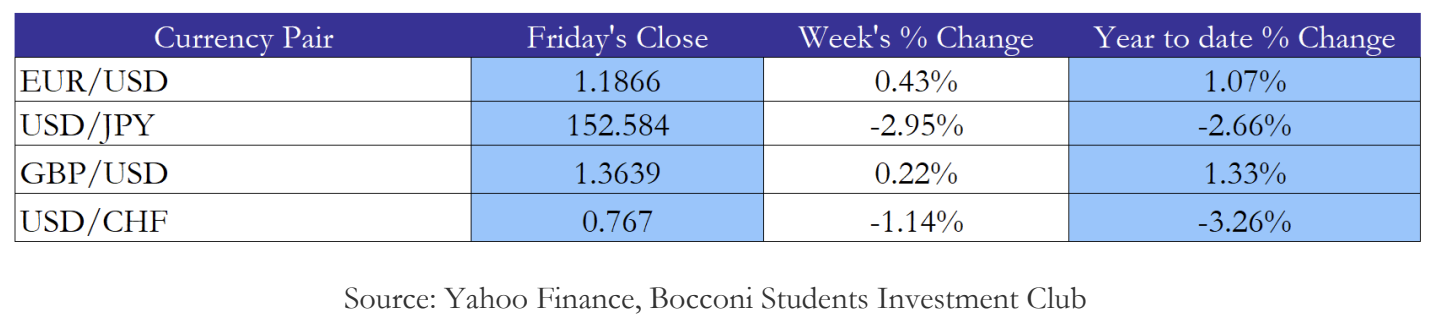

In FX, the USD softened modestly against the major European currencies, consistent with a week in which rate differentials moved against the dollar and investors were more willing to hold non-USD exposure. The euro edged higher, with EUR/USD closing at 1.1866 (+0.43%), while GBP/USD also increased to 1.3639 (+0.22%). The bigger story was in the traditional havens: the yen and Swiss franc outperformed, with USD/JPY falling to 152.584 (-2.95%) and USD/CHF down to 0.767 (-1.14%), a pattern consistent with what happened in equities with fear that is increasing.

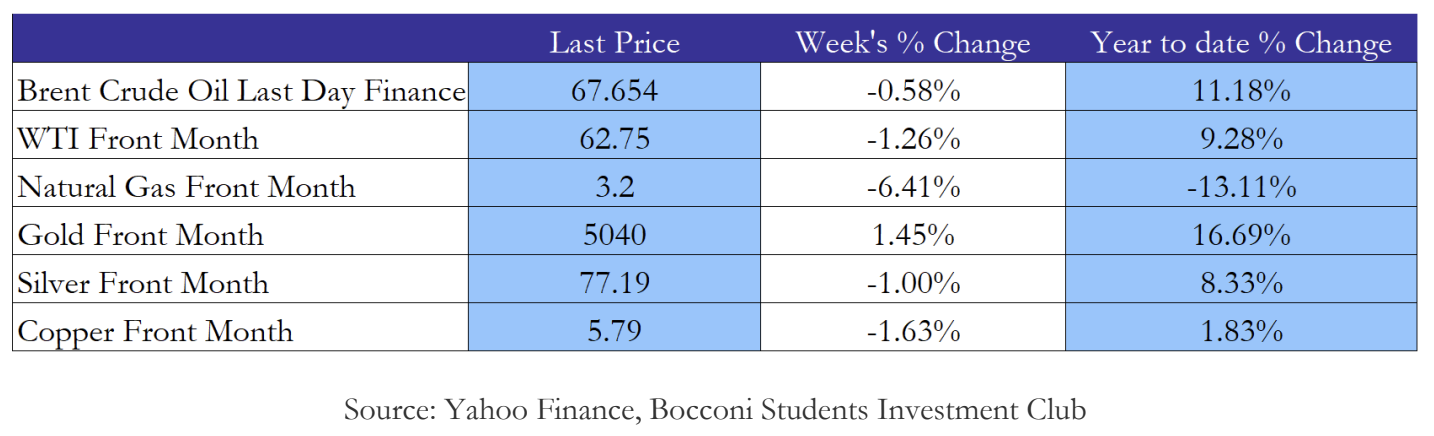

Commodity markets were mixed but tilted softer, with the energy complex giving background while gold held up. Brent slipped to 67.654 (-0.58%) and WTI to 62.75 (-1.26%), while natural gas saw the sharpest move, falling to 3.2 (-6.41%). Precious metals diverged: gold rose to 5,040 (+1.45%), aligning with a modest “hedge bid” during the week, even as silver eased to 77.19 (-1.00%). Copper declined to 5.79 (-1.63%), consistent with a more cautious cyclical demand into the end of the week.

Commodity markets were mixed but tilted softer, with the energy complex giving background while gold held up. Brent slipped to 67.654 (-0.58%) and WTI to 62.75 (-1.26%), while natural gas saw the sharpest move, falling to 3.2 (-6.41%). Precious metals diverged: gold rose to 5,040 (+1.45%), aligning with a modest “hedge bid” during the week, even as silver eased to 77.19 (-1.00%). Copper declined to 5.79 (-1.63%), consistent with a more cautious cyclical demand into the end of the week.

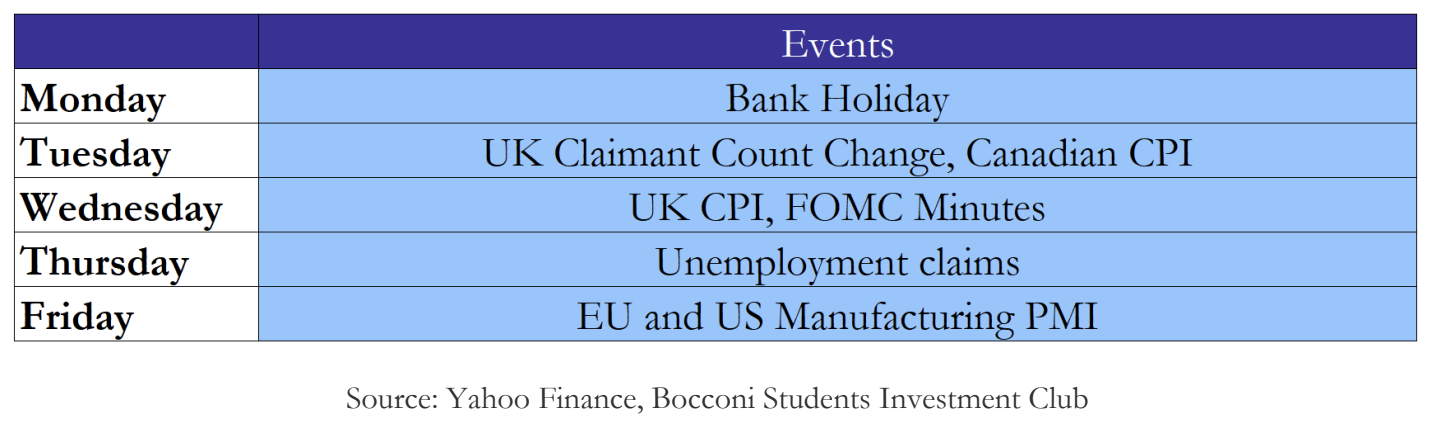

It will be an interesting week starting from a relaxed Monday due to bank holidays. Moving we will have the claimant count change in Uk and the Canadian release of CPI, followed by the UK CPI and the FOMC meeting on Wednesday. We conclude the week with the unemployment claims on Thursday and a busy Friday with the release of Manufacturing PMI both for EU and the US.

Poker is a card game in which each player gets a hand of 5 cards. There are 52 cards in a deck. Each card has a value and belongs to a suit. What are the probabilities of getting hands with four-of-a-kind (four of the five cards with the same value)?

Solution:

A 5 card poker hand is chosen uniformly from ![]() possibilities. To have 4 of a kind, we first choose the rank for the quadruple that is 13 ways then we take all four suits of that rank that is 1 way and after that we choose the 5th card from the remaining 48 cards. Concluding the number of four of a kind hands (4 of a kind + another card) is 13*48=624 and the probability will be 624/

possibilities. To have 4 of a kind, we first choose the rank for the quadruple that is 13 ways then we take all four suits of that rank that is 1 way and after that we choose the 5th card from the remaining 48 cards. Concluding the number of four of a kind hands (4 of a kind + another card) is 13*48=624 and the probability will be 624/![]() =0.024%.

=0.024%.

Brain Teaser #42

In a primitive society, every couple prefers to have a baby girl. There is a 50% chance that each child they have is a girl, and the genders of their children are mutually independent. If each couple insists on having more children, what will eventually happen to the fraction of girls in this society?

0 Comments