CenturyLink Inc. (NYSE: CTL) — market cap as of 04/11/2016: $12.58bn

Level 3 Communications Inc (NYSE: LVLT) — market cap as of 04/11/2016: $18.52bn

Introduction

On October 31, 2016, CenturyLink Inc. agreed to acquire Level 3 Communications Inc. in a cash and stock transaction valued at approximately $34bn. The new company will embody the second largest domestic communications provider, serving a global customer base and creating a stronger competitor to AT&T Inc.

Level 3 Communications shareholders will receive $26.50 per share in cash and 1.4 shares of CenturyLink for each of their own.

About CenturyLink

CenturyLink Inc. is a global provider of communications, hosting, cloud and IT services. These solutions aim at helping individual customers and businesses with data integration and strategy implementation. The company manages nearly 12 million access lines, and serves 6 million Internet and 280 thousand television subscribers.

CenturyLink has historically been very active in terms of M&A activity. In 2014, it announced the acquisition of Cognilytics, a predictive analytics and big data solution provider. Additionally, in 2013, the firm purchased the platform and advanced cloud management company Tier 3 for c. $25bn.

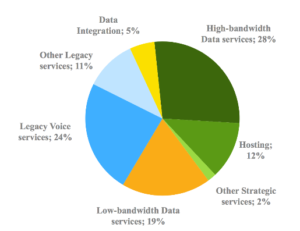

In 2015, CenturyLink reported operating revenues of $17.8bn and free cash flow of $2bn. It must also be noted that it returned $2bn to shareholders in dividends and share repurchases. The pie chart aside illustrates the contributions of each business segment.

Source: Google Finance

About Level 3

Level 3 Communications Inc. is a multinational telecommunications and Internet service provider based in Colorado that offers numerous services to enterprise, government and carrier customers. Reliable and widespread fiber networks across three continents, allow the company to reach more than 60 countries.

Solutions primarily include IP, voice, video and content delivery.

Most interestingly, Level 3 is one of the largest providers used by internet services such as Netflix Inc. and Google, to manage traffic across the  worldwide web. By managing traffic patterns using Level 3’s solutions, viewers benefit from shorter delays and buffering of TV shows or movies.

worldwide web. By managing traffic patterns using Level 3’s solutions, viewers benefit from shorter delays and buffering of TV shows or movies.

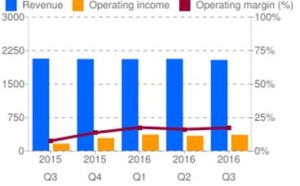

Over the past months, Level 3 reported relatively stable revenues, with $2.03bn in Q3 2016.

Source: Google Finance

Industry Overview

Wireless telecommunication in North America generated revenues for $228.4bn in 2015, with a CAGR of 3.2% between 2011 and 2015. Market consumption volumes increased at CAGR of 4.3% from 2011 and 2015, reaching a total of 516 million subscriptions at the end of 2015 and are expected to reach 629.6 million by 2020. The US telecommunications industry has witnessed considerable growth in the first half of 2016, with the stock price of the 4 major national wireless providers up by 22% driving the industry momentum. Nevertheless, the US wireless market will remain highly competitive due to strong pricing pressure and the threat of cable operators pursuing aggressive strategies, eroding industry margins and revenue growth.

Given the upcoming introduction of 5G Wireless Technology, the Federal Communications Commission conducted a record-breaking spectrum auction in January 2015, reaching $44.9bn in funds accumulated. According to ABI Research firm, 5G Network is forecasted to expand after 2020 and may reach a value of $247bn by 2025.

In Europe, despite the stricter regulatory framework, the great progress in 4G population coverage has boosted revenues, which are anticipated to grow for the first time since 2009.

Deal structure

Level 3 has been valued at $66.5 per share, which represents a premium of around 42% with respect to the company’s share price before announcement.

The $34bn deal (equity value of $c.24bn) will be financed 40% in cash and 60% in stock consideration. Thus, Level 3 shareholders will receive $26.50 per share in cash and a fixed exchange ratio of 1.4286 shares of CenturyLink stock for each Level 3 share they own. Upon the closing of the transaction, CenturyLink’s shareholders will own approximately 51% and therefore keep control, while Level 3 Communications’ shareholders will own approximately 49% of the combined entity. In order to finance the cash part of consideration, besides cash on hand, CenturyLink raised $10.2bn in new secured debt, financed by its advisors Bank of America and Morgan Stanley. The transaction values Level 3 at almost 12x its estimated EBITDA this year.

Deal rationale

This acquisition will result in the creation of the second largest domestic communications provider for number of enterprise customers, giving the group a global significance and creating a formidable player in the competitive landscape.

Following the industry’s trend, CenturyLink is looking to boost its revenues and gain scale through acquisitions. Bringing the business services of these 2 companies together will allow the combined firm to offer an even broader range of services and solutions and be better positioned to meet the evolving needs of customers.

Overall, the complementary domestic and international networks will provide cost efficiencies by focusing capital investment on increasing capacity and extending the reach of the combined company’s high-bandwidth fiber network. Indeed, if the proposed merger is successfully completed, it will increase CenturyLink’s fiber optic network by 200,000 route miles, including 64,000 route miles in 350 metropolitan areas and 33,000 subsea route miles connecting multiple continents.

CenturyLink expects the transaction to be accretive to free cash flow from the first year following the closing of the deal. In addition, tax savings are an important aspect of the acquisition – the deal will give CenturyLink about $10bn in tax credits which can be used as a future tax shield. Furthermore, CenturyLink confirmed it expects $1bn of annual cost savings, through operational, capex and integration synergies.

Market reaction

On Thursday October 27, the day on which the WSJ announced the companies were in advanced talks, CenturyLink’s share price increased by 9.7% with respect to the previous day of trading, before plunging 12% the following Monday. On the other hand, Level 3 gained 5% on Monday bringing the price of its shares up to $56.7, with an overall 19.7% increase with respect to the day before the WSJ announced the talks. The reaction might be a signal that the market believes the premium to be excessively high.

Advisers

Bank of America Merrill Lynch and Morgan Stanley are advising CenturyLink and have committed to lending $10.2bn in new secured debt to the company; Evercore Partners has issued a fairness opinion. Level 3 is being advised by Citigroup with a fairness opinion by Lazard.

[edmc id= 4261]Download as PDF[/edmc]

0 Comments