Introduction

The aim of this article is to analyse the current CDS spread of France with respect to Germany, and propose a profitable strategy for betting on the convergence of the spreads. The article is going to provide a brief introduction on the topic of CDS, followed by a short overview of the political instability in Europe, concluding with an analysis of a trading strategy with respect to the CDS spreads of France and Germany.

What is a CDS?

In their very essence, as defined by The JP Morgan Guide to Credit Derivatives: “Credit derivatives are bilateral financial contracts that isolate specific aspects of credit risk from an underlying instrument and transfer that risk between two parties”. Specifically Credit Default Swaps (CDS) are protection contracts that provide the protection buyer an insurance against the occurrence of credit events of a reference entity, in exchange for periodic payments to the protection seller. These periodic payments consist of the so called CDS premium or spread. This spread is determined by no arbitrage risk neutral valuation[1] by equating the premium leg (i.e. the PV of the stream of CDS premiums paid by the buyer to the seller) to the protection leg (i.e. the PV of the one-off payment from the seller to the buyer in case of a credit event). In case of a credit event[2], the CDS seller (the insurer) will pay the buyer the so-called Loss Given Default (LGD). The LGD is equal to the par value of the underlying bond minus the recovery rate. Since the CDS buyer purchases an insurance on a risky bond, it is evident that the position formed by a long risky bond plus long CDS on the same bond should approximately replicate a risk-free investment. Hence, we say that the CDS spread serves as a good approximation for the implied credit risk premium in the bond: this means that in events of distress, the CDS spread will increase, as the perceived credit risk on the reference bond rises and investors increase their demand for insurance. The market for CDS is very liquid and their price is heavily influenced by supply and demand. As a final consideration, through bootstrapping the market spreads that we find in the marketplace we can determine the probability of default for a certain entity, or at least the probability that the investors price in.

Current Political Situation in Europe

In France, several percentage points in the lead is Marine Le Pen of the far-right “National Front (FN)”, who placed third in the 2012 presidential election. On present trends, she is assured a place in the second run-off round of the election, faced by ex-investment banker Emmanuel Macron and his party “En Marche!”. Terrorist attacks have helped her popularity due to her praise of Islamophobia. Furthermore, embezzlement allegations have crippled Francois Fillon’s chances of victory. Ms. Le Pen promised to restore the franc in place of the euro, which would be considered as a default from the international community as it stops payments in a stipulated currency. Further to that she has vowed to hold a Frexit referendum.

The other side of the equation is Germany, where the next election is in six months. The current chancellor Angela Merkel took a huge political hit with her refugee policy. The rise of the right wing party “Alternative for Germany” may be partially characterised by their anti-refugee policies. Despite the seemingly political instability, Germany is still seen as a stable country, since the right wing party still hasn’t caught up any significant ground.

CDS Analysis

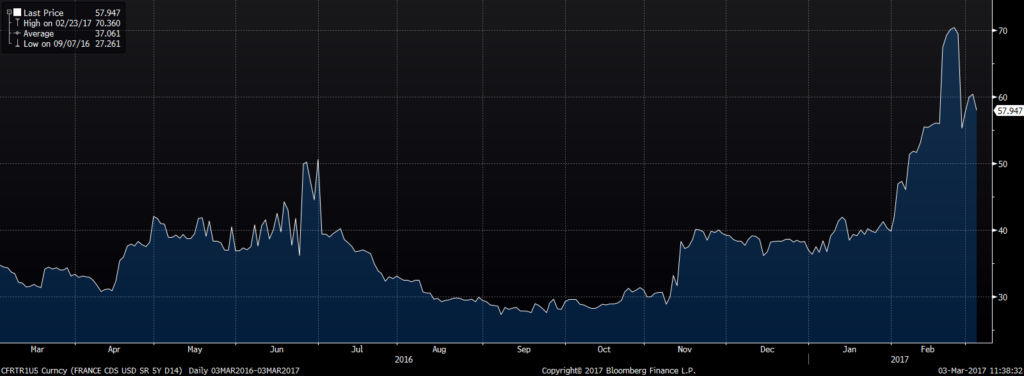

In the first part of our analysis we will examine the evolution of the CDS spread of the 5-year French Government Bond.

Chart 1: France CDS USD SR 5Y (source: Bloomberg)

We can see that for the past year the CDS spread has been low, having three notable spikes: during Brexit, the Trump election and, most recently and significantly, after Francois Fillon was charged with embezzlement charges, increasing the chances of a Le Pen win. Interesting to note is that investors, after heavily underestimating the chances of both Trump and Brexit, do not want to be caught off-guard again, thus are pricing in the probability of a Le Pen win from early on. The fundamental reason of the bond becoming riskier is the fact that Le Pen claims she would take France out of the Eurozone, thus having to redenominate its current debt. Investors are greatly worried that this might lead to big losses, or even, as the credit agency S&P has speculated, that the government would default on its debt once it is redenominated.

The second part of our analysis is comparing the CDS spread with the actual 5-year bond on which it is based. We can see that the spread and bond price are, intuitively, inversely correlated. The French government bond has continuously depreciated from about the 1st of January, as uncertainty increased regarding the French presidential election.

The third part involves comparing the France govies with German govies. Analysing the German 5Y Bund we can clearly see the inverse correlation with the French Bond. As Germany is considered a safe haven, and investors flee to safety in the slightest sight of political trouble, the Bund yield reached its lowest since the Brexit referendum during the past month, but has rebounded in the last week, closing at approximately -0.417%.

Finally, we compare the 5Y CDS spreads of France and Germany. Despite the volatility of its spread, Germany 5Y CDS still remains at a significantly lower level than the French one (Chart 2). The intuition is that Germany still is perceived as a European safe haven, thus every time political uncertainty rocks the continent its Bunds yield and CDS spread fall significantly.

Chart 2: Germany CDS USD SR 5Y (source: Bloomberg)

Chart 2: Germany CDS USD SR 5Y (source: Bloomberg)

Strategy: A Tightening of the Spread

Our trading strategy is based on the view that the spread between 5Y CDS spreads of France and Germany will narrow, given that Ms. Le Pen will not win the election. Investors currently are over-frightened by a third surprise vote outcome. We propose a short position on the French 5Y CDS spread (selling insurance) and a long position on the German one (buying insurance). [3]

We believe that a Le Pen’s win in the first round of elections (23rd of April 2017) might be a credible outcome, while a final win in the second one-to-one round (7th May 2017) is a far more unlikely scenario. In our opinion, Emmanuel Macron’s profile might appeal to both centre-left and centre-right voters during a possible second round, given that he is a candidate for the centre-left but knows well the business world, given his past as an investment banker. Hence, France 5Y CDS might widen as investors will be pricing in Le Pen’s victory in the first round. This is why setting up the aforementioned strategy now may imply mark-to-market losses in March. However, as we take the position that Le Pen will lose the second round of the election, the 5Y CDS spread will converge, thus realizing profits.

The reason not to take the positions in-between the two election rounds is the fact that it may go the opposite way: investors may become more skeptical of her win, thus pricing in her loss, and decreasing our overall trade win. The fundamental idea behind the trade is to overcome the short-term loss for a longer term gain.

Our exit strategy would involve closing the deal up to one month after the presidential elections, when the French CDS spreads fall at around 30, which is the level before Ms. Le Pen actually was considered to have a chance to win the race. The same time horizon would be considered with respect to the German spreads, closing the deal.

The reason to go long German 5y CDS is that this could provide a partial hedge in case Le Pen wins the first round: the rationale would be that increased uncertainty in France would prompt investors to price in more uncertainty at a European level, thus driving a partial widening of German 5Y CDS, also in light of the uncertainty regarding the incoming German elections.

[1] We use risk neutral default probabilities (q) in discrete time or intensities in continuous time.

[2] Default, but also restructuring of the debt, redenomination and other major credit events as per legal prospectus.

[3] While the strategy would be rational even now, we suggest that the best entry moment would be during the period before the first round of elections, assuming that CDS spreads will be trading at levels comparable to today’s ones.

0 Comments