US

Over the course of last week, the most important data concerning the United States came out on Friday 14th, when the University of Michigan’s Consumer Sentiment was released. The Consumer Sentiment was 97.8, below the consensus 100.5 and the previous 101.4. This drop seems to due to concerns about the potential impact of President Trump’s trade policies on the domestic economy.

On the equity side, the US market experienced little volatility and showed a slightly upward trend. Particularly, the S&P500 and Dow Jones Industrial Average closed on Friday 14th at 2,656.30 and at 24,360.14, respectively. The closing values on Friday 6th were 2,604.46 and 23,932.76, and hence the two indexes registered a WoW return of 1.99% and 1.79%, respectively.

On the fixed-income side, the yield on the 10-year US government bond gradually increased, closing on Friday at 2.8267%, down 6 basis points from the previous Friday rate of 2.7735%.

On the currencies side, the US Dollar appreciated with respect to both the Euro and the Pound. Indeed, the EURUSD increased from 1.2281 (previous Friday) to 1.2331 (this Friday) and GBPUSD decreased from 1.4092 (previous Friday) to 1.4238 (this Friday).

To conclude, let’s look at the data planned to be published in the near future. Next week is going to be quite calm with no major data coming out except for Retail Sales (MoM, whose release is scheduled on Monday 16th. Finally, it is worth remembering that GDP Growth Rate (QoQ), Fed Interest Rate Decision, Non-Farm Payrolls and Unemployment Rate, and Inflation Rate (YoY) will be released on Friday April 27 2018, Wednesday May 02 2018, Friday May 04 2018 and Thursday May 10 2018, respectively.

Europe

Coming out of pressure on Wednesday due to the possibility of a US military action against Syria that could spook markets, European equity markets slightly increased during this week with stocks in Germany leading the region. Additionally, although investors seem to be more optimistic about the scale, concerns over trade war strains between the two largest economies persist wherefore volatility remains unchanged compared to last week. Overall, major indexes show similar movement (DAX +1.25%, CAC 40 +0.98%, FTSE MIB +1.20%, Euro Stoxx 50 +0.97%) bringing EU markets to a one month high with positive weekly closings over three straight weeks.

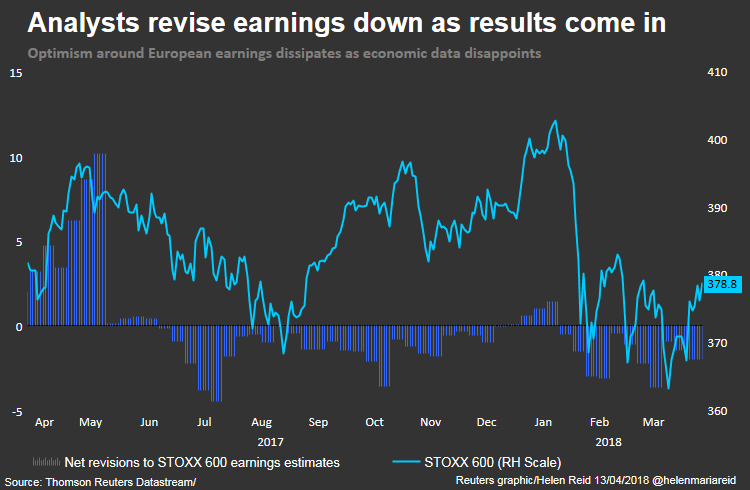

Looking at the key drivers, it was an interesting week with first-quarter results starting to roll out. Following these, once again analysts revised estimated earnings down for European companies. The biggest loser in the Euro Stoxx 600 Index was British software firm Sage which presented underperforming revenues that struck its share price down by 19% on Thursday. Furthermore, the French commercial real estate firm Klépierre stepped back from its bid for British mall owner Hammerson on Friday after its last offer raise on Wednesday. Investor’s early response erased all of Hammerson’s share price gains it had made from the takeover bid bringing it down by 13% so far while Klépierre’s stock appreciated by 4.2%.

With the USD depreciating against major currencies because of geopolitical stress the EUR/USD exchange rate had its first significant appreciation of +0.41% since two weeks. This may have negative consequences on the German exporter-heavy DAX soon. EUR/GBP is down again by -0.51% and thereby in line with its one month trend.

Borrowing costs remained generally flat in the European area as geopolitical concerns decreased by little. Towards the end of the week, the German benchmark 10Y government bond yield rose and is up to 0.511% coming from 0.504% at the beginning of the week which thereby marks the first weekly gain since February. Other key bonds showed a peak mid-week but went down again to their week’s starting point (Spain 10Y at 1.237%, France 10Y at 0.749% and Italy 10Y at 1.804%). Focus was especially on Spain’s long-term debt since Moody’s revised its credit rating and decided to lift the country’s rating to Baa1, up one notch, thus following S&P’s and Fitch’s latest revisions. The reason for this is a generally stronger economy and substantial improvements in its banking fundamentals.

UK

The last week passed without major disruption in the UK economy and finance industry. Compared to other global developments, the UK lived through an unexciting week without any major announcements.

New or confirming data was published regarding February manufacturing and industrial production as well as construction output. While the latter fell markedly on a year on year basis by 3%, production remained largely stable month on month and grew on an annual basis. The trade balance of February was estimated at a deficit of less than 1 billion pounds, reducing it significantly from its previous value. However, all these indicators were largely expected or already known. Hence, their impact on economic and financial indicators was muted.

On Friday the FTSE100 closed at 7,264.56 points, up by 0.09% over the day and by 1.1% over the course of the week. This positive development may still be justified by the resolution of more and more fears regarding hard Brexit. Complementing the stronger stock market, the appetite for UK 10 year gilts seems to have decreased over the past week as their yields increased from 1.396% in the previous week to close at 1.435% on Friday.

On the back of strengthening equity developments the pound appreciated against the dollar by 1.04% to close the week at 1.435 USD per GBP. Analogously, Sterling appreciated towards the Euro to end the week at 0.8662 GBP per Euro.

The next week will bring several more important news that are likely to shift markets significantly. On Wednesday, details regarding PPI output, the retail price index and UK inflation for March will be published. Although all indicators are expected to remain largely constant, market participants may still be curious to receive a confirmation of these expectations. Data on prices will then be followed by retail sales figures for March on Thursday.

Rest of the World

China has banned exports of items to North Korea with potential dual use in weapons as Pyongyang suggested it is prepared to discuss the denuclearization of the Korean Peninsula. President Xi Jinping spoke at the annual Boao Forum for Asia about plans to further open up the Chinese economy. He promised to “significantly lower” import tariffs as well as improve the investment environment for foreign companies. Chinese manufacturing PMI fell to 51. Hang Seng index advanced 3.23% with closing value of 30,808.38, while Shanghai Composite rose 0.89% ending at 3,159.05

Japan’s Nikkei 225 closed at 21,778.74, marking 1% increase.

Indian Sensex 30 raised 1.7% during the week and closed at 34,192.65.

Brazil’s Lula da Silva surrendered to police last Saturday to begin serving a 12-year jail sentence for corruption ahead of October presidential elections. Bovespa index declined 57 bp to 84,334.44.

Aluminum price increased to $2,325 per metric ton, as U.S. sanctions on major Russian producer Rusal sent buyers scrambling to find supplies.

With all the concerning news regarding the oil-rich Middle East, traders pushed oil prices higher this week. WTI crude oil increased 6.26% this week and settled at $67.39/bbl. Moreover, tripartite attack by US, UK and France on Syria have provoked reply from Russia, which additionally increases uncertainty and fear. Such situation could cause a boost in crude oil price and safe haven assets like gold.

MSCI emerging market ETF and MSCI Asia Pacific index increased almost 1% and 53 bp respectively.

0 Comments