Aston Martin Lagonda Global Holdings Plc (AML: GB) – market cap as of 8/10/2018: €3.6bn

Introduction

Aston Martin Lagonda Global Holdings Plc, one of the world’s leading manufacturers of luxury sports cars, completed its Initial Public Offering on the London Stock Exchange on October 3rd, 2018. The issue price of £19 a share corresponds to a £4.33bn implied valuation. After its first trading day, the stock closed at £18.10, reporting a 4.74% decline on IPO price.

About Aston Martin

James Bond’s favourite carmaker was founded in 1913 by Robert Bamford and Lionel Martin. Throughout the years, the car company has developed into an iconic brand, synonym of high performance and elegance. Aston Martin currently develops and produces both “ordinary” – the likes of Grand Tourer and Super GT – and special edition – such as Vulcan – models. Last year, the company manufactured 7,000 cars – in line with the numbers reported by its rival, Ferrari – and when its full 102-year history is taken into consideration, the company has produced 80,000 cars, 95% of which are still working.

Unlike mass-market players – typically betting on a one click buying sort of logic – the car company offers detailed and bespoke product specifications and ordering process, as well as the possibility to directly meet the craftspeople. It also matured a longstanding racing tradition dating back to 1922 which has been witnessing Aston Martin’s cars competing in the prestigious French Grand Prix. Besides several stops, the racing division is nowadays still alive, mainly thanks to a partnership – started in 2004 – with the engineering group Prodrive.

Since over the last 20 years Aston Martin’s consumer base demographics proved closely related to the global trend followed by high net worth individuals – shifting from West to East – the company decided to enhance its Asian Market coverage. In 2015, Aston Martin Japan Limited was established in Fukuoka, leveraging on Andy Palmer’s – Aston Martin’s reputable CEO – prior experience in the Japanese market, as well as on the simultaneous positive economic outlook of the country.

As already mentioned in the opening, Aston Martin’s cars are immediately associated to James Bond. The decades-long relationship with Agent 007 – started in 1964’s Goldfinger on a Martin DB5 – is deeply believed as an integral part of the fabric, culture and history of the brand. Like James Bond himself, the company is clearly not a risk averse type. Having gone bankrupt seven times and having changed multiple hands – the previous owners’ list includes Ford – Aston Martin made its first profit since 2010 only last year. Specifically, in FY2017 the company reported revenues amounting to £876mn (+47.6% YoY, +31% 15-17 CAGR) and a £148.8mn EBITDA (4.6x greater than the operating loss reported in FY2016) corresponding to a 17% EBITDA margin. Last year also represented a tipping point in terms of profitability: after FY2015 and FY2016 witnessed £100mn+ losses, Aston Martin was finally able to reverse a trend which had been affecting it since 2010, reporting a £76.8mn net income. Finally, last year’s NFP settled at £670.9mn (+5.3% YoY, +16.8% 15-17 CAGR).

Turning now to its forecasted business evolution, it is worth pointing out how the British carmaker came to market in the aftermath of a highly ambitious and unproven turnaround plan, centred around a step-change in car production under which the company is expected to deliver between 9,600 and 9,800 units by the end of December 2020 (+18% over the 5,000 cars sold in 2017 only). Under plan’s assumptions, Aston Martin expects strong sales growth and a medium-term target marginality in the region of 30%. However, it must be kept in mind that carmaker’s sales could be materially altered by the economic cycle as demand for luxury goods – including HLS cars – is inherently volatile and it depends to a large extent on the geopolitical scenario. In Aston Martin’s specific case, an economic recession could not just cause sales volumes and profitability to decline, but it may have a more pronounced effect on the overall business, due to the relatively small scale of its operations and its limited product range. This could also be investigated as a potential explanation to the company’s seven bankruptcies.

Business Model

Focused on the delivery of masterpieces, Aston Martin has been pursuing the concepts of “Power, Beauty and Soul” since the very beginning, aiming at – in L. Martin’s words – “designing, developing and engineering cars as if they were individuals”. On these grounds, the corporation has been pushing on both performance and design, laying the foundations for the unique brand recognition it can nowadays boast.

The company’s stream of revenues is tightly linked to its current model line-up, encompassing the Grand Tourer – DB11-like cars – the sport car – Vantage – the super GT – DBS Superleggera – and the four-door, four-seats sports coupé Rapide S. Beyond these iconic models, Aston Martin regularly develops special edition models, such as the aforementioned Vulcan and Vanquish Zagato. Passionate and “traditional” drivers are now waiting for the next special edition hyper car – the Aston Martin Valkyrie – expected to hit the market in 2019. The most environmentally friendly and “innovative” drivers are instead waiting for Rapide E – Aston Martin’s first full electric vehicle – which is likely to be put on the road by next year. Moreover, the carmaker is nowadays enlarging its product portfolio, through the introduction of its first SUV, DBX. This enriched value proposition, spanning the spectrum of product alternatives, is one of Aston Martin’s Second Century Plan’s pillars. Aimed at introducing seven new models in the seven years timespan 2016-2022, the project earned Aston Martin the prestigious L.E.A.D.E.R. (Leaders in European Automotive Development, Excellence and Research) award from Automotive News in Europe, and the recognition as the fastest-growing auto brand of 2018 in the UK.

One of company’s key success factors is to be found in its customers’ relationship management. As a matter of fact, Aston Martin has committed to substantial investments aimed at turning the buying process into a true, exclusive, boutique-like experience, to be achieved through a maniacal care of interior design and through ad-hoc training programs for dealers. To the same extent, in an advertisement-based era as the one we are currently living in, the British carmaker has also been exploiting alternative marketing tools, such as the hiring of effective brand ambassadors or a differentiation of its traditional portfolio of activities towards the construction of luxury buildings in Miami. These efforts are expected to bolster the firm’s perception of luxury and design.

The company’s cost structure, instead, is clearly representative of Aston Martin’s core assets: its employees, a team of 900+ designers and engineers that lies at the heart of company’s worldwide recognition. Precisely on this point, it is worth pointing out how steps have been taken by the company to ensure a more efficient cost structure, based on a flexible, modular architecture and on the innovative Beyond Lean manufacturing method. More specifically, under the former organization, Aston Martin assembled new components either by exploiting previous models’ pieces or by creating parts for the models to come, thus abating warranty costs and boosting capital efficiency. Under the recently introduced method, instead, the company ensures just-in-time delivery of customized parts to each specific line, leaving to the skilled workforce the final responsibility of completing their own cycles, estimated in the range of 25-40 minutes. The above-described fine-tuned mechanism allows Aston Martin to keep costs under control, keeping quality and attention to details bulletproof.

One further source of cost savings in the company’s business model lies in the strategic partnerships successfully implemented by the company. Among the most significative, it is worth mentioning the one with Daimler AG, German multinational automotive corporation, henceforth committed to supplying Aston Martin with the exclusive Mercedes-Benz AMG V8 engines, electrical architecture and entertainment systems. Thanks to this agreement, Aston Martin counts on world-class components, and abates the potential capex burden connected to their development. Another example is the firm’s collaboration with Red Bull Advanced Technologies, which paved the way to Aston Martin’s path towards becoming the cutting edge of motors, both in terms of performance and engines. In this case, the agreement has enabled the company to outsource a potentially considerable source of R&D expenses. Backing these smart moves from the very beginning, Aston Martin’s consulting branch – Aston Martin Consulting – has always been in charge of making sure that the company engaged into credible partnerships, key success factors to efficiently build its global brand recognition.

The important evolution Aston Martin’s operating framework underwent in the last few years could be interpreted as a response to the multi-period lossmaking – and more generally to its seven-time bankrupt track record – trend, pushing towards greater efficiency and an even more perceivable brand identity. In fact, according to some analysts and industry specialists, the implementation of the aforementioned Second Century Plan might be the final, soundest attempt to drive the company on the road to long-term growth. As a matter of fact, the impressive costs connected to the handcraftsmanship of the old times have been progressively reduced and car design has nowadays been reshaped on targeted customers’ tastes.

The 1974’s Lagonda model is a very good example of the change occurred in Aston martin’s business model. Bloomberg described it as “one of the ugliest cars ever”, entirely hand-made in the UK and endowed with electronic systems that were even more complex than those of the finest Soviet space crafts. This can be taken as one of the most iconic examples of how the company failed both in terms of efficiency and customers’ satisfaction. After several adjustments were made, Aston Martin seems to have finally found a profitable balance between cost efficiency and buyers’ loyalty.

IPO Structure and Analysis

Initially uncertain on which Stock Exchange to choose for the listing, Aston Martin landed on the London Stock Exchange on October 3rd, 2018, with the clear objective of breaking into the FTSE 100 at December’s reshuffle.

IPO price was set at £19 a share and the plan for one of Aston Martin’s big day provided for a secondary sale of 25% of company’s stock held by existing shareholders, namely two Kuwaiti private equity funds (Investment Dar and Adeem Investment) holding a combined 54.5% of total ownership, Bonomi’s Investindustrial for 37.5%, Mercedes-AMG for 5% and the management for the remaining 3%. Tenfold gains were realized by virtually all selling shareholders. The IPO also provided for the conversion of the entirety of preferred shares into ordinary ones and opened the door to an over-allotment of up to 15% of the global offer.

Once the registration documents had been submitted to the British Financial Conduct Authority on August 29th, market expectations started to rule out several potential scenarios. Analysts considered this IPO as a testing ground for the talked sentiment that Brexit would eventually hit the markets with, especially considering the close ties – about two thirds of imported components – that the company has with European suppliers.

A second driver of concern, later addressed in the article, was represented by the negative trend affecting Eurozone’s IPOs in 2018. Investors seem to be reluctant to risk-taking on IPOs also due to this unfavorable macro trend.

Recent London-based IPOs market trends

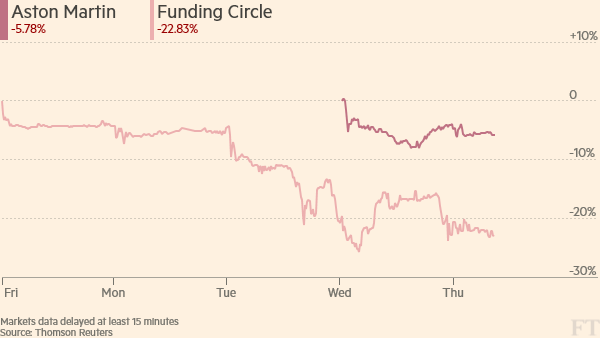

Aston Martin was not the only high-profile market debut to take place on the London Stock Exchange during the last month or so. Funding Circle, the world’s leading platform for small business lending, went public on September 28th but, on their first official trading day, shares fell 17% from their IPO price.

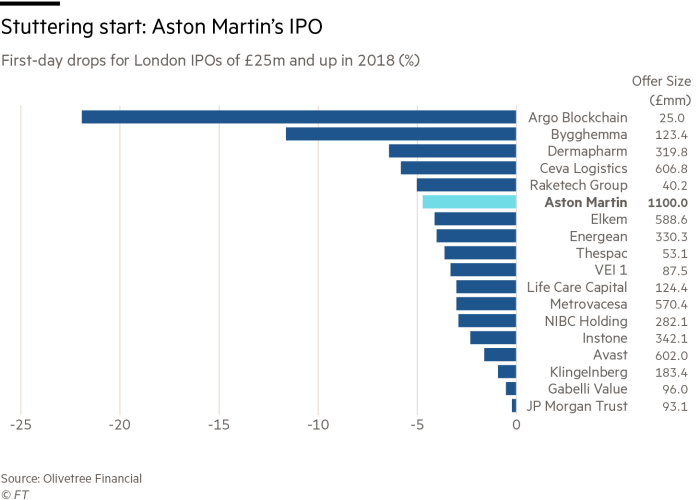

More generally, 2018 first three quarters have yielded $37bn worth of European IPOs, approximately a 16% decrease YoY if compared to last year’s first three quarters’ value, which exceeded $44bn. Moreover, according to Broker Olivetree, more than 300 IPOs sized £25m or above took place over the last three years on the London Stock Exchange and approx. 20% of them reported losses, sending first trading day’s closing prices below their offer prices.

Source: Financial Times, Thomson Reuters, Olivetree Financial

In spite of the very different activities characterizing Aston Martin’s and Funding Circle’s businesses, the two companies could be lumped together by the fact that both of them are lossmaking firms: Aston Martin made losses until 2017, while Funding Circle never really performed on the high notes. Therefore, a possible explanation of current market underperformance of lossmaking firms right after their IPO may be found in the opposite views held by investors from different financial – and nonfinancial – cultures with respect to the idea of value.

Ex-post IPO analyses raise an issue of potential cultural divide among European and US investors. If on one hand the latter have long believed in lossmakers the likes of Amazon, Spotify, SurveyMonkey and Dropbox, whose market cap increased by 50% three months after the IPO in spite of a prospectus warning that profitability might never be reached, European – and British in particular – investors seem to take more pragmatic approaches, making value prevail over potential and perhaps punishing transactions that they deem too audacious.

Rationale

Entirely come in the form of a secondary sell-down of a portion of the existing shares held by selling shareholders, Aston Martin’s IPO is not aimed at raising any proceeds from the Offer, but solely at giving selling shareholders the opportunity to profitably cash in on a portion of their investment in the British carmaker.

Moreover, company’s management believes that the admission to trading on the London Stock Exchange will benefit Aston Martin in terms of market positioning, capital structure and attractiveness to the eyes of top management and key employees.

On one hand, the listing would help the company extract full value from its two proprietary brands, Aston Martin and Lagonda. Specifically, it would allow a consolidation of James Bond’s carmaker as a global leader in the automotive industry’s high luxury segment, while it would lay the foundations for the relaunch of Lagonda’s brand as the world’s first fully electric luxury vehicles producer. These planned developments are in line with Aston Martin’s 2015 Second Century Plan’s assumptions, under which the company is expected to launch – with focus on the SUV sector – one new car each year, from 2016 to 2022.

On the other hand, given its not so brilliant financial management historical track record, Aston Martin’s capital structure has been subject to careful analysis. For its IPO, the British carmaker introduced itself to the markets with a conservative leverage policy, targeting – by year-end – a net debt to adjusted EBITDA < 2x. The listing would make its perspective financials even sounder, unlocking a wide range of capital raising options which could come in handy to spur future growth.

Finally, the IPO would serve as a strong marketing tool, allowing the company to improve its visibility on global markets. The greater visibility and reliability derived from the listed-status could implicitly certify the quality of Aston Martin’s organizational structure, reducing information asymmetries with outsiders and making company’s managerial processes more transparent. Moreover, given the wide consensus depicting Aston Martin’s CEO as one of company’s most valuable assets, the listing would also help in retaining – and attracting – top management and key employees, whose compensation packages could get lifted – and linked to firm’s performance – with stock option plans.

Market Reactions

The market mood driving Aston Martin towards the IPO was of robust investor appetite: besides its seven-time bankrupt company heavy legacy and delays due to global trade tensions, books were covered within a day. The British luxury carmaker was on target for a valuation – considering Aston Martin as a luxury company rather than a simple premium or super-premium automotive player – in the region of £4bn and £5bn, setting the price range at £17.50-£22.50 per share. If priced at its mid-point, this valuation could have ensured the carmaker a spot in the FTSE 100 after December’s reshuffle.

In spite of the enthusiasm perceived around Aston Martin’s IPO, on October 1st the company announced a quite unexpected price range adjustment, with the valuation floor being lifted to £18.50 a share – for a total of £4.2bn (approx. +5% vis-à-vis previous target range’s bottom-end) – and the ceiling being revised downwards, settling at £20 – for a total of £4.5bn (approx. -10% vis-à-vis previous target range’s top-end). The cut also raised concerns about Aston Martin’s planned inclusion to the FTSE 100.

On October 3rd, after the price range downward adjustment mentioned above, the British luxury carmaker finally went public at a price of £19 a share, set slightly below revised range’s top-end and implying a £4.3bn valuation, corresponding to 10x 2020 Earnings.

However, markets seemed to give it a colder welcome than it was expecting. As a matter of fact, Aston Martin’s shares lost as much as 8% in early trading – their Midday price was £17.65 (-7.1%) – and closed at £18.10, recording a 4.7% loss for the day. Goldman Sachs’ intervention was needed in order to stabilize the situation, with the bank buying substantial amounts of stocks to counterbalance the free fall.

Syndicate Structure

The Joint Global Coordinators for the Offer are Deutsche Bank, Goldman Sachs and J.P. Morgan, with the latter also acting as sole sponsor and Goldman Sachs playing the stabilizer role. Lazard is instead acting as Financial Advisor to the Company. Merrill Lynch, Credit Suisse, HSBC and UniCredit are Joint Book Runners, while Ci Capital, Numis, Houlihan Lokey and Mediobanca are acting as co-lead managers.

0 Comments