The Carlyle Group (NASDAQ:CG) – market cap as of 08/04/2019: USD 6.34bn

Introduction

On April 8, 2019, the US PE giant Carlyle announced its decision to acquire up to 40% of the capital of the Spanish multinational Cepsa from the sovereign fund of the United Arab Emirates Mubadala for up to $4.8 bn. The transaction should be paid in cash including the debt. This sale gives Cepsa an overall business valuation of $ 12 billion. The agreement comes at an opportune moment for both parties, given a recent increase in oil prices and overall recovery in the oil and gas sector. Furthermore, the transaction is in line with Carlyle’s goal of raising $ 4 billion of oil and gas assets outside of North America, as evidenced by the acquisition of Neptune and Varo Energy. The Carlyle investment will therefore contribute to improving Cepsa’s growth and providing opportunities in the global energy sector.

Currently, Carlyle has agreed to purchase only 30% of Cepsa. The final portion of both parties will be confirmed at the end of the transaction, which should be completed by the end of 2019, subject to customary regulatory approvals.

About The Carlyle Group

Founded in 1987, Carlyle is a US-based PE firm headquartered in Washington DC. Carlyle invests across 4 major segments: Corporate Private Equity, Real Assets, Global Credit and Investment Solutions. The PE firm has grown significantly, as seen from the YoY growth in AUM:

At the time this article was written, the firm managed $212bn in assets in 343 investment vehicles across 10 core industries and 6 continents, and currently employs more than 1,650 professionals across 31 offices. Of the total assets, 74% has been invested in the North American region, 17% in the EMEA region, and the remaining 9% in APAC. For the financial year of 2018, Carlyle generated $2.4bn in revenue and $116.5m in net profit. In terms of its energy platform, Carlyle has constructed an established broad-based global energy, natural resources and infrastructure platform in efforts to grow oil and gas assets outside North America. In a series of strategic acquisitions, Carlyle-backed Assala Energy acquired Royal Dutch Shell’s onshore assets in Gabon for a total of €846m in March 2017. Furthermore, in February 2018, Carlyle-backed Neptune Energy Group acquired an Engine E&P for $3.9bn. The energy platform alone currently has $27bn in assets under management and 95 active portfolio companies. Hence, it is evident that the acquisition of Cepsa is in line with Carlyle’s efforts to expand its influence in the oil and gas industry.

About Cepsa

Founded in 1929 and headquartered in Madrid, Spain, Cepsa engages in exploration and production of petroleum, refining as well as distribution and sale of crude oil, natural gas and electricity. For the financial year of 2018, Cepsa generated revenue of €24.7bn, EBITDA of 1.8bn and net profit of €830.1m. On average, the firm produces 175,000 barrels of oil on a daily basis, inclusive of its stakes in 2 oil fields in Abu Dhabi. In terms of organic growth, Cepsa is involved in numerous projects, such as 2015 Bir El Msana project which expanded the firm’s presence in Algeria, and the 2015 Shanghai Chemical Plant project in China which was awarded the Best Petrochemical Plant of the Year. Cepsa also acquired Spanish gasoline station operator Sociedades Villanueva & Sociedades Paz in 2017 to increase sales. As a result, Cepsa’s petroleum value chain has grown significantly, operating in more than 20 countries across 5 continents. Cepsa is also a global leader in the production of linear alkyl benzene, an integral component in manufacturing biodegradable detergents. The Spanish firm is also the second largest producer of phenol and acetone.

Industry Overview

The Oil Industry is recovering from the past years of weak oil prices. The Brent Crude benchmark is stabilizing itself around $70 per barrel, coming from lows of $40 in 2016 and $50 in 2017, considering differentials of values in countries such as Canada and the Permian. The recovery of prices is the result of a mix of factors, some of them achieved through efficient coordination and others due to geopolitical coincidences in some countries. There has been a successful attempt at restraining oil production through agreements between OPEC and non-OPEC countries. In addition to this, global supply has been impacted by cuts in production from challenged producers such as Venezuela, Iran and Qatar, which set to leave OPEC in 2019. Overall oil inventory has gone down by 175 million barrels since 2016 and, according to estimates of the Energy Information Administration, a strong oil demand still benefits the industry.

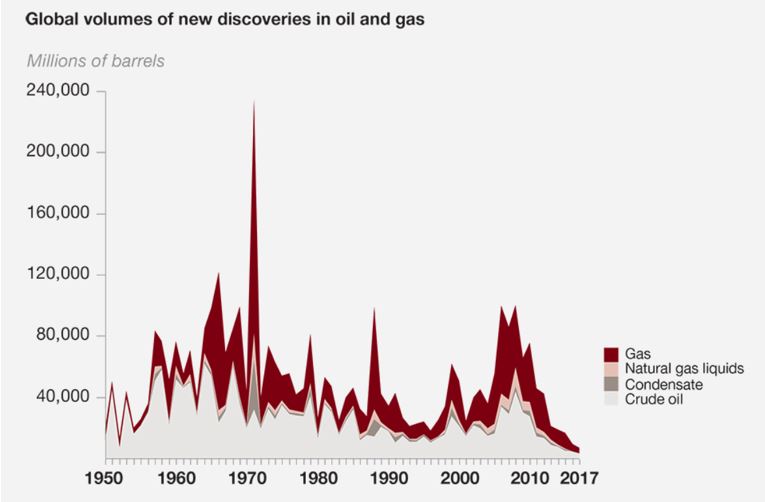

Furthermore, the International Energy Agency (IEA) has increased its probability estimates of a possible supply crunch since 2016, with warnings of one possible crunch occurring by the end of the decade, coming from the CEOs of Total, Eni and Saudi Aramco. The main causes are a struggle from some world producers to keep up with the robust and growing global oil demand and a decline in new oil and gas discoveries. Indeed, 2017 saw the lowest levels since the beginning of the 1950s due to the fact that it is becoming harder and harder to find large discoveries, the so called “elephants”. Lastly, the price collapse of oil between 2014 and 2016 determined a slowdown in exploration spending, going from $153 bn in 2014 to $58 bn in 2017, a decrease of nearly 60% and a foreseeable modest increase of 7% compounded annually from 2017 on.

A third important issue to be considered is the production disruption in existing oil fields. The decline rate is accelerating, reaching a 4% annually and this, combined with the fall in Exploration and Discovery spending, makes it harder to replenish the decline in barrels of oil produced. The effect is amplified if we consider geopolitical problems affecting some important oil producers in the world. The economic distress in Venezuela has caused a collapse of 40% from its peak of 2.5 million b/d in 2015 and Libya is experiencing the same problem with a decline from its 1.5 million b/d produced in 2012 to 900.000 b/d in 2017.

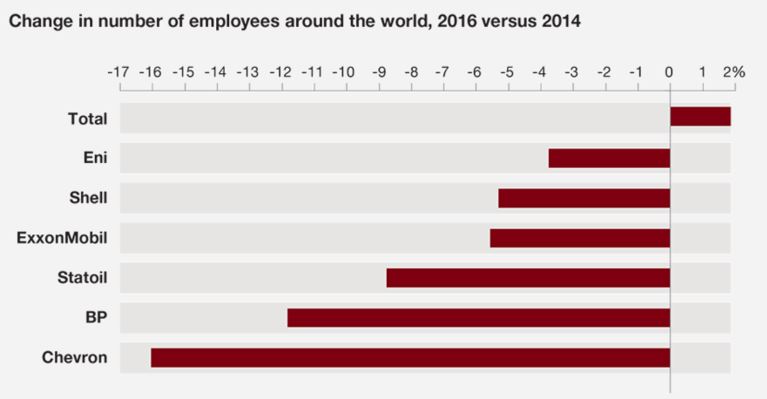

The industry is also facing diminished workforce capabilities due to the cuts executed between 2014 and 2016 by the major operators during the downturn. This resulted in an inevitable loss of technical skills and reduction in the capability of attracting new talent in times when a shift in generations occurs as a large portion of the industry workforce is looking forward to retirement. Finally, evolutions of the current business models can be expected within the immediate future as the major players of the industry have to face a growing momentum towards a low-carbon world, electrification of transport and possible stabilization of oil demand in 2030, as highlighted by BP in its 2018 outlook.

Deal Structure

The Carlyle Group and Abu Dhabi based strategic investment company Mubadala Investment Company have agreed the former’s acquisition of a significant minority stake between 30% and 40% in CEPSA. The acquired shareholding has been valued at $3.6 bn with debt, giving the company an Enterprise Value of $12 bn. The transaction is subject to customary regulatory approval and will be complete by the end of 2019. At transaction closure, shareholding stakes will be confirmed. Mubadala will remain the majority shareholder of the Spanish company. Equity for the investment will come from Carlyle International Energy Partners I & II, Carlyle Partners VII, Carlyle Europe Partners V and co-investors.

Deal Rationale

The transaction marks a successful end of a Mubadala’s dual-track process, through a public offering and private placement, for a new partner in the Spanish energy company. This operation represents UAE’s latest effort to diversify revenue sources as well as to bring private capital and more commercial management into its wealth fund. Mubadala bought the 100% of Cepsa’s shares in 2011 in a takeover bid of €7.5bn and thus paying a 23% premium. Today, after several years of consistent good performances, the company has an enterprise value of around €10.6bn. Mubadala therefore succeed in its portfolio management strategy of bringing new partners and achieving capital gains.

This operation follows a cancelled initial public offering of a 25% stake in the Spanish multinational energy group’s stock which was shelved amid the late 2018 market volatility. Moreover, the IPO’s market in Europe and specially for industrial companies was not particularly encouraging as in 2018 the industrial sector offering value raised decreased by almost €3 bn from €8.6 bn in 2017 to €5.7 bn.

Carlyle, however, is not susceptible to day to day movements in market prices and, as the head of Carlyle International Energy Partners said earlier this week in an interview with CNBC, they focus on “the fundamental value of the company, and found Cepsa a very attractive company to invest in”. The energy group operates in more than 20 countries and across the full petroleum value chain. Its assets include significant oil reserves located offshore in Abu Dhabi, two refineries in Spain and a network of service stations along the Iberian Peninsula. Furthermore, Cepsa is well positioned to respond to the upcoming quality and emissions requirements, scheduled to take effect in January 2020. Overall, according to Carlyle’s management, Cepsa owns some very attractive world-class assets with low break-even prices.

A crucial asset for Carlyle in Cepsa’s acquisition was its petrochemicals business, which by being highly integrated with its refining business, is a leading actor worldwide in a fast-growing industry. In its petrochemical unit, Cepsa uses petroleum derivative products to make some raw materials used in several industries. For instance, Cepsa is the world leading producer of linear Alkylbenzene, the raw material used to make biodegradable detergents, and phenol used to produce high-quality plastics. In 2018, Cepsa’s chemical business contributed €111m to its net Clean Current Costs of Supplies and petrochemicals are set to account for over a third of the growth in oil demand to 2030, and nearly half to 2050, ahead of trucks, aviation and shipping.

Market reaction

Since 2011, when Mubadala bought the entirety of Cepsa’s shares in takeover bid, Cepsa has not been listed in the IBEX35 despite last year’s plans for an IPO of a 25% stake. However, as all Cepsa’s business units rely heavily on oil prices, the management decided to go for the private placement to limit its exposure to a weak year in oil prices, as the prices decreased by 10.89% in 2018, and to a highly volatile market.

As Cepsa is not a public company listed in the Spanish IBEX35, the market reaction is harder to understand. Generally, analysts in the industry feel that Mubadala got at least its money’s worth as Carlyle’s offer was deemed generous, especially considering the risk of lawsuits against Cepsa’s Coastal Energy fund, which was partially funded by 1MDB, the famous Malaysian fund under investigation, and acquired in late 2013. However, analysts foresee strong revenues for Carlyle as Cepsa is, and will be, facing great growth opportunities as expected demand in the coming decades for oil and gas continues to rise.

Financial advisors

Rothschild was the sole financial advisor to Mubadala while HSBC and J.P. Morgan advised Carlyle.

0 Comments