Merck KAaG [ETR:MRK] – market cap as of 28/04/2019: €12.29bn ($13.77bn)

Versum Materials Inc. [NYSE:VSM] – market cap as of 28/04/2019: $5.68bn (pre-announcement undisturbed value: $3.28bn)

Intro

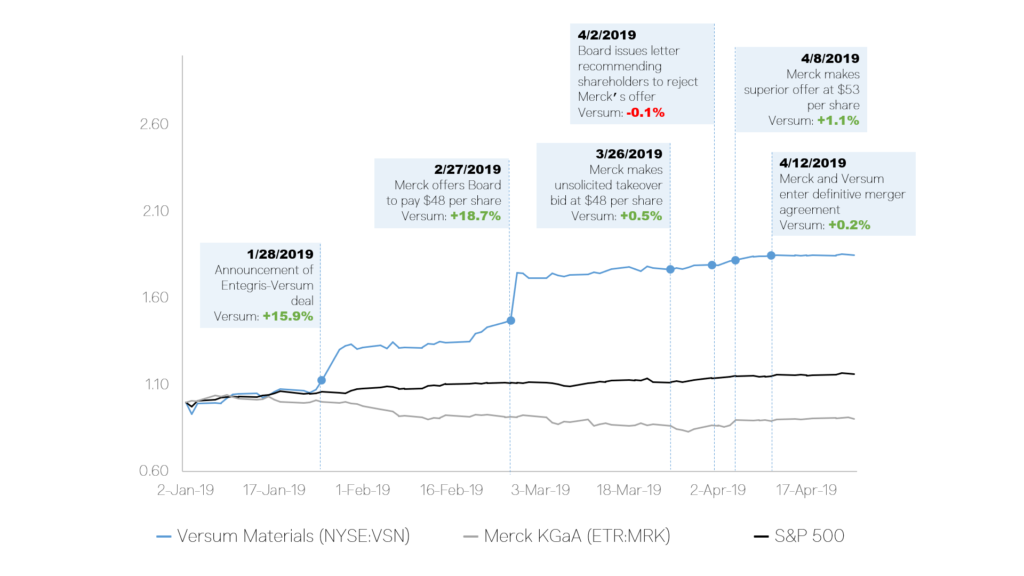

On April 12th the German Chem-tech company Merck KAaG signed the definite agreement to buy the American special materials company Versum in an all-cash transaction. The price tag per share ended up at $53, with a staggering 52% premium on undisturbed price. This was the result of a bid war with the American Semiconductor supplier Entegris that had previously proposed a merger of equal to Versum Board, which had already accepted. However the German company pushed offering an higher price and all the advantages of a cash transaction, managing to win the favours of Versum shareholders.

About Merck Group

Merck Group is a chemical, healthcare and technology company headquartered in Darmstadt, Germany. It boosts over 350 years of history and is arguably the oldest chemicals and pharmaceuticals company in the world. The operations include a rather wide range of activities, all linked by a technical chemical expertise, the first one of which is the proper healthcare division which accounts for roughly 40% of revenues and consists in the development of medicines used to treat cancer, multiple sclerosis, and infertility. The second division is Life Sciences, taking another 40% of sales, whose operations involve the research for lab equipment and services. The last one is the Special Materials division, responsible for slightly less than 16% of revenues, that develops specialty chemicals and materials for demanding applications – from liquid crystals and OLED materials for displays up to high-tech materials for the manufacturing of integrated circuits. The group revenues in 2018 amounted to €14.93bn, just slightly up from €14.52 in 2017. The EBITDA has been shrinking since the peak of $4.5bn in 2016 down to $3.8bn in 2018 suggesting cashflow generation issues.

About Versum Materials

Versum Materials was founded on October 3rd 2016, as a spin-off of the electronic materials division of the American company Air Products & Chemicals Inc., and listed through an IPO on the NYSE. The company focuses on chemical products and materials for the semiconductor industry, supplying all the top processors producers. The top line growth has been very solid, from $970m in 2016, $1.13bn in 2017, to $1.37bn in 2018, split 65% form the sale of Materials and 35% from the services linked to the operations of the equipment that it provides to manage the chemicals. The company is generating a solid stream of cashflows around $130m last year, down from an extraordinary $166m in 2017. The core value of the firm is innovation and in order to stay on top of the competition Versum invests between 10 and 15 percent of revenues in R&D yearly.

Industry Overview

Versum and Merck’s Performance Materials subsidiary operate in the electronic chemicals and materials industry. Electronic chemicals are high-purity chemicals such as photoresists, wet chemicals, acids, gases, and solvents, while electronic materials include products such as wafers and laminates. These products are used to manufacture electronic components such as semiconductors, integrated circuits and printed circuit Boards.

Currently, the Asia-Pacific region dominates the market for electronic chemicals and materials and is expected to grow faster than Europe and North America. In particular, China, Japan, Taiwan, South Korea and Brazil are the countries currently having the highest demand for electronic chemicals. The market for electronic chemicals has firms competing to sustain high-end performance and keep up with the increasingly high technical demands of chipmakers. As such, market players are actively fighting for market share, whether it is by expanding their geographical reach, launching new products, entering collaborations, or engaging in mergers & acquisitions like Merck.

The hustle to secure market share is understandable considering the industry’s promising outlook. The market for these chemicals was worth around $20.5 billion in 2018 and is expected to hit $30 billion by 2024, growing at a CAGR of 6.45% over this 6-year period.

Many trends are boosting the demand for electronic chemicals. The rise of cloud computing is a notable driver: the increasing demand for servers, data centers, and storage, which all use semiconductors, means the demand for the chemicals produced by companies like Merck and Versum will increase as well. The nascent Internet of Things also presents opportunities for the semi-conductor market to thrive in the upcoming years. In fact, the increased demand for semi-conductors is echoed across many industries such as aerospace & defense, automotive, and consumer electronics, which include the manufacturing of smartphones, tablets, computers, and more. Finally, technology firms’ push for the miniaturization of electronic components is anticipated to benefit the global electronic chemicals market.

Deal Structure

Merck sweetened its takeover bid after originally offering to buy Versum shares at 48.00$ per share on April 8th. Under the new terms of the agreement, Merck will purchase all issued and outstanding shares of Versum’s common stock at $53.00 per share, for which it will pay in cash. The $53 price-tag represents a premium of 52% on Versum’s stock price before it announced the Entegris deal. Merck will assume about $570 million of Versum’s net debt, bringing the total value of the deal to around $6 billion. Merck will finance the transaction using existing cash, an up to $4 billion bridge loan facility, and a $2.3 billion term loan provided by Bank of America Merrill Lynch, BNP Paribas Fortis and Deutsche Bank. The deal is expected to be completed by the end of June 2019, subject to approval by Versum shareholders and regulatory clearances.

In contrast to the current all-cash agreement, under the terms of Versum’s previous agreement made in January, Entegris would have purchased all of Versum’s shares in an all-stock transaction. Versum shareholders were to receive 1.12 shares in Entegris for each Versum share held.

Two factors explain how Merck managed to lure shareholders away from the Entegris deal. First, Merck offers a significantly higher premium: at the time of its announcement, the Entegris deal valued each Versum share at about $35.08 per share whereas the Merck deal now offers $53.00 per share. Secondly, the appeal of cash has charmed Versum: it offers investors certain value and shields them from the potential downside and integration costs of the merger.

Deal rationale

According to Merck’s chief executive Stefan Oschmann, the combination with Versum would not only reap cost synergies of around £85m annually, but also strengthen both companies. Indeed, artificial intelligence, the rise of the internet of things and the switch to 5G wireless technology are resulting in increased demand for semiconductors, an industry in which Versum is a supplier of critical components to Intel, Samsung and SK Hynix among many others.

The combined unit will benefit from a deep and complementary portfolio of electronic materials, equipment and services for the semiconductor and display industries, while merging R&D would enable faster innovation and a potential improvement of the products offered to customers.

The acquisition of Versum is in line with Merck’s efforts to strengthen its high-tech chemicals division, called Performance Materials, that caters to the electronics industry and is currently suffering from the shrinking liquid crystals business. Despite having had operating income margins around 40% in the past and the 2014 acquisition of the London-listed specialty chemicals group AZ Electronics for £1.6bn, an intensifying competition from Chinese rivals is putting pressure on the business. This deal will result in an increased exposure to the fast-growing electronic materials market, where it would ultimately become a leading player. It will also create a more balanced split between the company’s three core divisions of healthcare, life sciences and performance materials, boosting the share of profit that Merck derives from high-tech chemicals to 27 percent, from 19 percent previously.

Market reaction

Merck’s $48 a share offer in February pushed Versum’s stock price above that of its own offer at $48.7, showing an unequivocally positive reaction by capital markets and suggesting investors hope for a higher offer. Following the agreement on $53 per share, Versum shares edged 1 percent higher to $51.74.

On the other hand, Entegris made it clear that it did not intend to increase its offer, ending its pursuit of the company and receiving a $140m termination fee from Versum.

Stock performances, compared to the S&P 500

Source: Bloomberg

Financial advisors

Merck has been advised by investment bank Guggenheim Securities and has received legal counsel from Sullivan & Cromwell and it has secured financing from Bank of America, BNP Paribas and Deutsche Bank. On the other hand, Lazard and Citi provided financial advice to Versum, while Simpson Thacher & Barlett LLP served as legal counsel.

0 Comments