Introduction

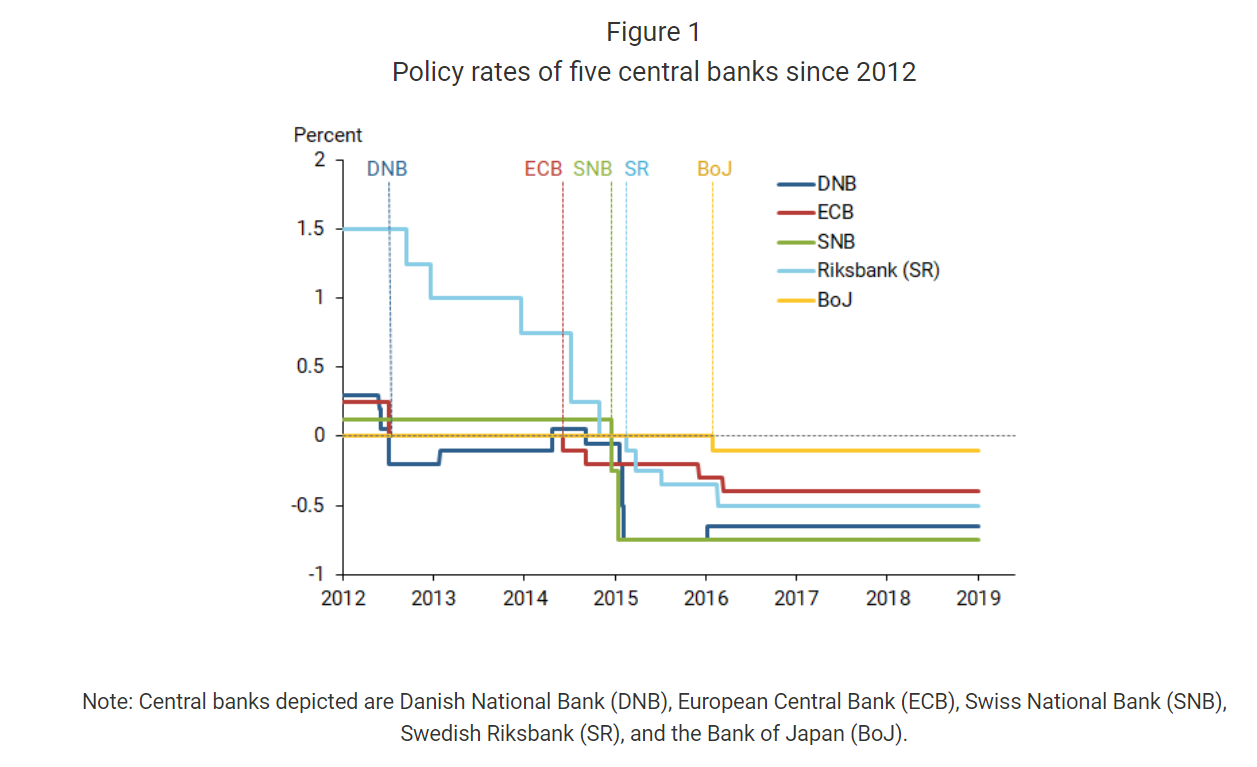

Interest rates have been persistently low across several advanced economies since the Global Financial Crisis. As short- and medium-term rates approached zero, central banks were compelled to turn to increasingly forceful measures in order to provide an adequate monetary stimulus. In 2012, the Danish National Bank was the first one to lower its key interest rate to the negative territory. In subsequent years, the ECB and the central banks of Sweden, Switzerland and Japan followed suit. As a result of this accommodative policy, long‑term rates gradually shifted down too. Although initially viewed as an unprecedent and unconventional measure, negative rates have become a new reality and it seems that they will remain with us for quite some time.

There has been an intensive discussion about the impacts of the negative interest rate policy (NIRP). In this article we will review some empirical evidence on these issues, focusing mainly on the eurozone economy. In particular, we will investigate the existence of a theoretical zero-lower bound (ZLB) and how this affects banks’ profitability and their ability to pass negative rates on to depositors. Further, we will examine whether the ECB’s policy has been successful in stimulating GDP growth and boosting inflation. Finally, we will consider some side-effects of the NIRP, most notably reduction in productivity growth.

Figure 1. Policy Rates of Five Central Banks since 2012. Source: Christensen (2019)

Does the ZLB makes further rate cuts ineffective?

The main aim of NIRP is to increase the amount of loans granted to consumers and businesses and thus to stimulate spending and investment activity. If banks are charged for holding excess reserves at the central bank, they are encouraged to take this money back on their balance sheets and in turn extend more loans. Moreover, if the transmission mechanism works, companies face costs on their deposits holdings and are therefore induced to reduce their cash balance and make new investments instead. However, according to the conventional assumption, interest rates on bank deposits cannot become negative because market agents would rather opt for holding cash. Therefore, once interest rates reach zero, there is no room left for an additional monetary stimulus and the economy falls into a so‑called liquidity trap.

However, it seems to be crucial to distinguish between household and wholesale (corporate) deposits. The ZLB might well exist for retail clients, who can easily withdraw their (usually relatively small) deposits and hold them in cash, if the deposit rate turns negative. Yet, companies need bank deposits to smoothly run their operations and holding large amounts of cash would be too costly. As a result, banks can venture to charge negative rates on wholesale deposits without facing a reduction in deposit volumes, meaning that the transmission mechanism works even when rates sink below the zero threshold. Altavilla et al. (2019a) show that the in the euro area, the proportion of negative rate deposits of non‑financial corporations increased from 10% in 2014 to 20% in 2018. This trend is particularly evident in Germany, where the percentage is as high as 50%. Notably, the ability to successfully pass negative rates on to depositors is most evident for banks with sound balance sheets. On average, the deposit volumes of these banks do not fall; on the contrary, they tend to increase. This finding is not that surprising when we consider that the NIRP periods are usually associated with demand for liquidity and for safe assets. Hence, by charging negative rates, banks can reduce their cost of funding, which gives them the capacity to increase lending. Moreover, data suggest that companies that hold excess cash (and are thus more exposed to negative rates) tend to decrease their liquid holdings and expand their fixed investment. Thus, the transmission mechanism is further enhanced. This suggests that monetary policy can be effective even below the ZLB.

Figure 2. Volumes of bank deposits and loans. Source: Altavilla, et al. (2019a)

Does the NIRP hurt bank profitability?

One of the most cited side-effects of the NIRP is its adverse impact on profitability of banks. Negative rates can hurt net interest income (NII) because even if deposit rates are not as downward sticky as initially assumed, banks might still not be able to reduce deposit rates by the same amount as they reduce loan rates. This obviously creates a pressure on margins. Indeed, Claessens et al. (2018) find that the net interest margins fall with falling interest rates, especially in an already low-interest environment. Molyneux, Reghezza and Xie (2019) discover that the net interest margin for banks from countries that adopted the NIRP fell by 16% on average. Such a contraction was not experienced by banks from countries where interest rates stayed above zero. However, the effects of NIRP clearly depend on bank-specific characteristics; the adverse impact appears to be stronger for small banks whose funding depends mostly on household deposits (which brings us back to the ZLB question).

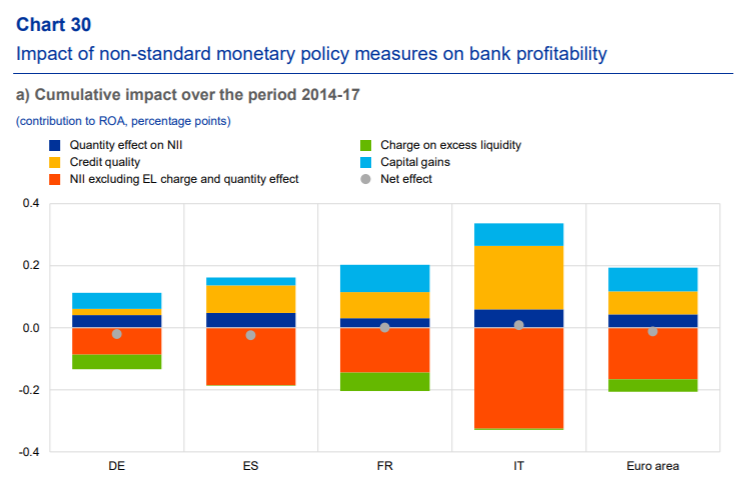

Let us look at the empirical evidence from the euro area (Andreeva et al., 2019). Importantly, one has to keep in mind that the NIRP impacts bank profitability through several channels, which are summarized in Figure 3. It has to be noted that this chart depicts not only the effects of the NIRP, but also includes other non-standard policy measures, such as APP or TLTROs.

Firstly, it is true that the difference in duration of assets and liabilities results in a reduction of the NII, since savings in funding costs (from deposits) do not fully offset the decrease in interest income (from loans). What is more, charges on holding excess liquidity with the ECB inevitably increase. At the same time, however, an accommodative policy has a positive impact on macroeconomic conditions, which reduces firm default risk, lowers the debt servicing cost of borrowers and in turn improves credit quality. Moreover, lower interest rates and other measures such as APP increase the value of assets held by banks and lead to capital gains. Overall, we can conclude that the effect of the NIRP and other complementing monetary policy measures in Europe has been fairly neutral.

Figure 3. Impact of non-standard monetary measures on bank profitability. Source: Andreeva et al. (2019)

Effectiveness of the NIRP

In the first section we established that the ZLB appears to be less bounding than traditionally assumed, allowing banks to transmit the negative rates and increase their lending capacity even if interest rates fall below zero. Yet, has this policy really been effective in stimulating the eurozone’s economy and promoting inflation?

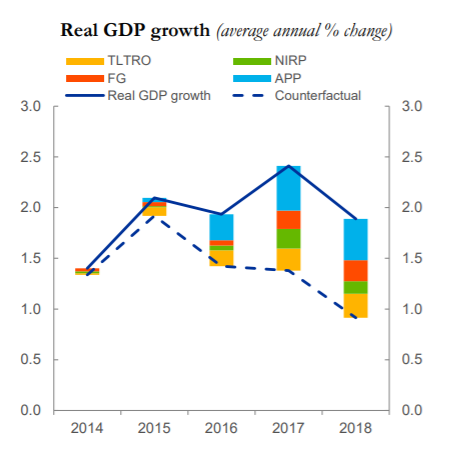

In their comprehensive study, Altavilla et al. (2019, b) estimate that in the absence of a NIRP-FG-APP-TLTROs package, real GDP would have been ca. 2.7% lower at the end of 2018. Yet, as we can see in Figure 4, the largest contributor to this phenomenon is the APP and not the NIRP. When it comes to inflation, the impact has been rather weak; the easing measures made the annual inflation increase by one third of a percentage point (average over 2015‑2018). Additionally, market-based long-term inflation expectations have fallen since the Crisis and don’t show signs of picking up. Still, the accommodative policy has contributed to an increased demand for risky assets, as stock prices have on average been on the rise. Overall, the NIRP seems to be successful in relaxing markets conditions and partially contributing to the revival of the economy.

Figure 4. Impact of non-standard monetary measures on real GDP growth. Source: Altavilla, et al. (2019b)

Long-term dangers of the NIRP

So far, we have seen that the effects of the NIRP on the eurozone’s economy have been predominantly positive. Nevertheless, there are concerns that that very expansionary monetary policy administered for a sufficiently long time can bring some serious adverse effects. First, it can erode the stability of financial system and make it more vulnerable to sudden exogenous shocks. Second, even though the ZLB does not seem to be a constraint (at least for corporate deposits), there is a reason to believe that even corporations will not endure an unlimited decline in deposit rates. Hence, the scope of rate cuts is constrained by a so-called effective lower bound. Once key interest rates reach this bound, banks will not be able to pass negative rates to clients and net interest margins will be squeezed even further. This would hinder banks’ ability to increase lending capacity and thus undermine the aim of monetary easing (Jobst and Lin, 2016).

However, in this section we want to focus on a different effect – one that is not so commonly discussed but might be very relevant in the long-term. Specifically, there appears to be a link between very low interest rates and a slowdown in productivity growth, which in turn hinders economic growth. Liu, Mian and Sufi (2019) suggest that a fall in long-term interest rates incentivizes industry leaders to make use of low financing cost and invest more aggressively in order to gain a competitive advantage over competitors. Conversely, industry followers find themselves discouraged from investing, because the prospect of enhancing their position in the market becomes less attainable. This causes the gap between industry leaders and followers to widen, business dynamism to weaken and market concentration to increase. Empirically, the rise in market concentration has indeed been associated with a decline in productivity growth in many advanced economies since 2005. More specifically, there is evidence that industries in which the productivity gap between leaders and followers rises the most are also industries that experience the strongest reduction in productivity (Andrews et al., 2016).

Cette, Fernald and Mojon (2016) provide additional explanation of this phenomenon: the adverse effect of long-term interest rates on productivity growth is a result capital misallocation. Lower interest rates encourage more entrepreneurs to start businesses and also induce less productive companies to take on more debt. Banks are willing to allocate part of their funds to these firms since it is not feasible to fund the most effective companies only (all companies face collateral constraints and their debt capacity is limited). As a result, the efficiency bar for entrepreneurs is lowered, as even less productive companies get access to financing. Consequently, the aggregate productivity growth slows down.

Historically, real interest rates have been on decline even before the Global Financial Crisis and data suggest that this was associated with a negative effect on productivity. Whilst this effect is relatively modest for most countries, it is stronger for Italy and Spain, where the real interest rates declined the most. This is depicted in Figure 5. The dashed line shows the contribution of real interest rate shocks on labour productivity. It is evident that from the Figure 5. Contribution of real long-term interest rate to labour productivity growth.

Source: Cette, Fernald and Mojon (2016)

end of the 1990s to the beginning of the Crisis, this contribution has been negative (in case of Italy, this trend was reversed in 2009, though).

In summary, there are reasons to believe that large negative decline in long-term interest rates can have a non-negligible adverse impact on total factor productivity.

Conclusion

Negative interest rates have become a new reality in several advanced economies over the world. With sluggish economic growth and elevated global risk, recently exacerbated by the COVID-19 outbreak, the NIRP is expected to continue. Recent history has undermined theories about the zero-lower bound and demonstrated that banks are able to pass negative rates on to depositors and at the same time increase lending volumes. Thus, the transmission mechanism can function even with rates in the negative territory. Indeed, the NIRP has so far been successful in promoting GDP growth in the eurozone, although without complementing measures such as the APP and the TLTROs, its effectiveness would have been limited.

Nevertheless, a prolonged period of negative interest rates can pose some serious dangers for the economy. First, if rates decrease further, the economy might reach its effective lower bound. This would make further cuts ineffective and might even cause the accommodative monetary policy to reverse and become contractionary. What is more, low levels of long-term interest rates seem to be associated with a slowdown in productivity growth and thus with reduced economic growth. This is another reason why the easing monetary policy can, in the long run, have exactly the opposite (tightening) effect.

With interest rates already below zero, central banks have less room to act and steer the economy in the desired direction. It remains to be seen whether the NIRP will be successful in providing the necessary stimulus, or whether the adverse side-effects of this policy start to prevail.

References:

Andreeva, D.C., Altavilla, C., Bouncinha, M. and Holton, S. (2019). Monetary policy, credit institutions and the bank lending channel in the euro area. ECB Occasional Paper Series, No 222 / May 2019.

Altavilla, C., Burlon, L., Giannetti, M. and Holton, S. (2019a). Is There a Zero Lower Bound? The Effects of Negative Policy Rates on Banks and Firms. ECB Working Paper Series, No 2289 / June 2019.

Altavilla, C., Carboni, G., Saint Guilhem, A., Lemke, W., Motto, R., Rostagno, M. and Yiangou, J. (2019b). A tale of two decades: the ECB’s monetary policy at 20. ECB Working Paper Series, 2346 / December 2019.

Cette, G., Fernald, J. and Mojon, B. (2016). The pre-Great Recession slowdown in productivity. European Economic Review, 88, pp.3-20.

Christensen, J.H. (2019). Yield Curve Responses to Introducing Negative Policy Rates. FRBSF Economic Letter, 2019-27.

Claessens, S., Coleman, N. and Donnelly, M. (2018). “Low-For-Long” interest rates and banks’ interest margins and profitability: Cross-country evidence. Journal of Financial Intermediation, 35, pp.1-16.

Jobst, A. and Lin, H. (2016). Negative Interest Rate Policy (NIRP): Implications for Monetary Transmission and Bank Profitability in the Euro Area. IMF Working Papers, 16(172).

Liu, E., Mian, A. and Sufi, A. (2019). Low Interest Rates, Market Power, and Productivity Growth. SSRN Electronic Journal.

Molyneux, P., Reghezza, A. and Xie, R. (2019). Bank margins and profits in a world of negative rates. Journal of Banking & Finance, 107, pp.1-20.

0 Comments