Introduction

On March 6th Altria [NYSE: MO], one of the largest cigarette companies in the world, announced their agreement to acquire e-cigarette startup NJOY for approximately $2.75 billion, making it the largest transaction up to date in the Consumer segment for 2023. The deal comes a couple of days after Altria swapped its minority stake (35%) in Juul Labs for intellectual property rights in an effort to try to salvage some of the value lost following Juul Lab’s legal issues.

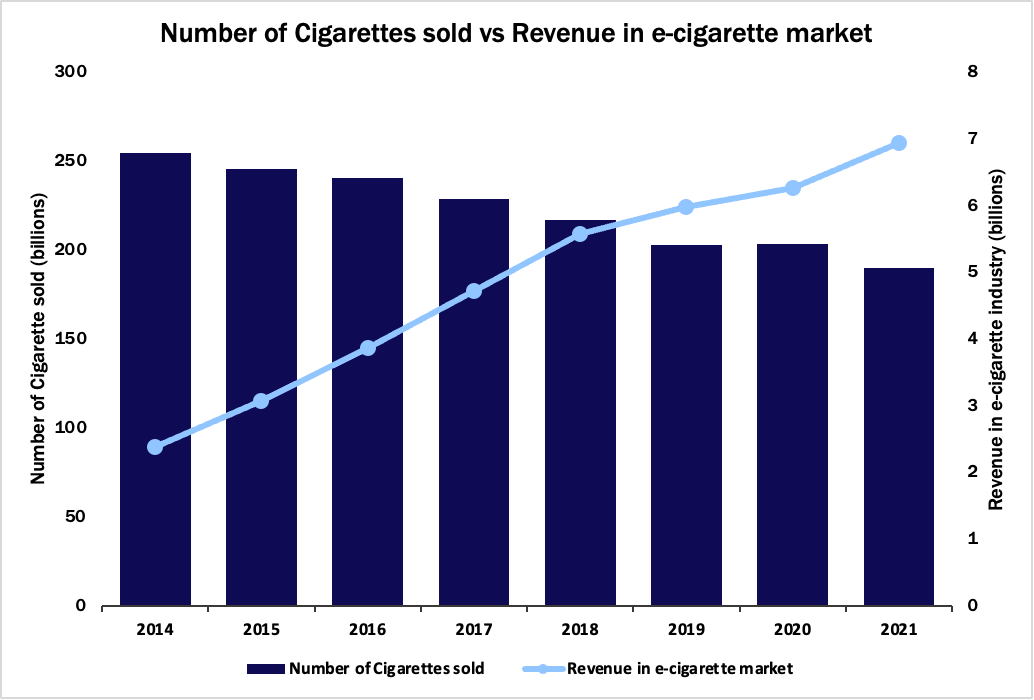

With cigarette sales declining and e-cigarette revenues growing rapidly hitting revenues of $7bn in 2022 (Figure 1), traditional tobacco companies are attempting to position themselves in the fast-growing e-cigarette market. Altria’s new venture with NJOY seems to offer a competitive advantage in the e-cigarette market but some investors aren’t sure whether it’s the right decision to take.

Figure 1, Source: United States Federal Trade Commission Cigarette Report for 2021, Statista

As of 2022, the e-cigarette industry was heavily concentrated in two main players, Juul and Vuse, with 37.3% and 30.3% respectively of the dollar share of e-cigarette sales in the US. NJOY lags behind heavily as the third largest market player, with a market share of 3.2%, followed by Blu with a 3%.

About Altria Group

Altria [NYSE: MO], a Fortune 500 company, is one of the world’s largest producers of tobacco, cigarettes and related products. The firm is the parent company of Phillip Morris USA, John Middleton Inc, and US Smokeless Tobacco Company. As of March 2023, the largest shareholders are the Vanguard Group (8.5%), BlackRock (5%), SSgA Funds Management (4%), Capital Research and Management (3.9%), and Charles Schwab (2.5%). In 2022, the company reported revenues of about $25.1 billion, as well as a net income of about $5.8 billion.

The Altria Group Inc. emerged in 2003 as a rebranding of Phillip Morris Cos. At the time, the group was the parent company of Kraft Foods, Phillip Morris International, Phillip Morris USA and Phillip Morris Capital Corporation. In 2007, the Altria Group spun-off Kraft Foods, distributing all the shares owned by the group to its Shareholders, thereby effectively specializing in the production of smoking related products. Following this trend, that same year, Altria Group acquired John Middleton, a Cigars and Pipe Tobacco company. In 2008, due to issues with litigation, regulation, and declining sales, Altria Group spun-off of Phillip Morris International.

The spin-off was part of the company’s strategy to improve each unit’s focus on its specific markets and their respective dynamics. The spin-off was aimed at protecting the cigarette business from US litigation at the time which in turn cleared the international tobacco business from the legal and regulatory constraints which were faced by its domestic partner Philip Morris USA. The spin-off saved $250 million in corporate costs between the two companies which included the closure of Altria Group’s corporate headquarters near Grand Central Station in Manhattan. Not only did the spin-off save costs, but it also provided Phillip Morris International with the opportunity to penetrate more effectively into global markets and tap into global demand without having to adhere to the strict US anti-smoke policies. Despite the distinct separation of the two entities there are still strong business ties between them. In 2022, Phillip Morris International agreed to pay Altria Group $2.7bn for the exclusive right to sell IQOS heated tobacco products in the US, providing Altria Group an substantial increase in cash flow.

Recently, Altria Group has begun to shift its investments towards alternative tobacco products. In 2009, Altria Group purchased UST Inc. a holding company composed of U.S. Smokeless Tobacco Company and International Wine & Spirits. Through this purchase, Altria Group was able to end an era of competition between their new smokeless products, and those from UST, which held over 50% of the market at the time. In December 2018 Altria Group acquired a 35% stake in Juul, an e-cigarette company, for over $12.8 billion. Furthermore, in 2019, Altria Group acquired both The Cronos Group, a global cannabinoid company, as well as 80% of certain Burger Söhne Holding AG companies, entering in the oral nicotine products segment. Altria Group then established Helix Innovations LLC, a parent company to the acquired subsidiaries, to commercialize and distribute On!, an oral nicotine pouch. In 2021 Altria Group acquired the remaining 20% of the global On! business. Additionally, Altria Group holds a 9.6% economic and voting interest in Anheuser-Busch InBev SA/NV (AB InBev), the world’s largest drink and brewing company.

Altria Group has been working towards Moving Beyond Smoking™ as a marketing campaign over the past few years and has committed itself towards tobacco harm reduction. Currently, Altria Group’s portfolio includes traditional tobacco products such as Marlboro – the leading cigarette brand- and Black & Mild – the leading tipped cigar brand. Additional products that Altria Group manages include a growing number of smoke-free brands such as Copenhagen and Skoal, as well as oral nicotine pouches through On!.

In February 2023, Altria Group finalized its involvement with Juul as it swapped its minority stake (35%) for intellectual property rights to some of Juul’s heated tobacco prototypes. Altria Group’s decision to divest from its Juul investment comes after regulatory and legal problems which included costly settlements for over 5,000 lawsuits claiming its advertising campaigns targeted underage customers, as well as a ban on the sale of its products in the US. Altria Group’s investment in Juul resulted in a costly write-down of about 98%, passing from an initial investment in December 2018 valued at $12.8 billion to about $250 million by the end of 2022.

About NJOY

NJOY, founded as Sottera in 2007, is a producer of e-cigarettes and vaping products. NJOY was a pioneer in the vaping industry and was one of the first main producers of vapes in the US. It gained traction in 2009 when it sued the FDA and won a case regarding the classification and thereby also the regulation of e-cigarettes as tobacco products rather than medical devices. By 2012, the company was the largest e-cigarette manufacturer in the US not owned by the tobacco industry. In addition to producing disposable e-cigarettes, the company also entered the e-liquid market. Nonetheless, because of the high regulatory and compliance standards, low sales, a 3-year free fall in market share, and the significant losses incurred, the company declared bankruptcy in 2016. Following an acquisition by Mudrick Capital Management and Homewood Capital, two investment firms specialized in turning around distressed or out-of-favor companies, a restructured company by the name of NJOY was formed.

Currently, out of the 23 Marketing Granted Orders (MGO’s) issued by the FDA for e-cigarettes products, NJOY has received 6 of them. Receiving an MGO allows companies to legally market their new products in the US marketplace. The authorized NJOY products have met FDA standards as it was proven that their toxicological risks were lower compared to those of traditional tobacco products. Furthermore, two more products’ Premarket Tobacco Applications (PMTA’s) are under review by the FDA.

As part of the firm’s compromise of safe use, it is developing an access restriction technology that will use Bluetooth to authenticate users before unlocking the devices. NJOY is currently preparing two MPTA filings for two e-cigarettes menthol-flavored ACE pods that will be paused with the access restriction technology. Two possible $125 million contingent payments, out of the $500 million, can be issued if the FDA issues MGOs for these products. Additionally, NJOY products were not included among the most used by underaged users in 2022. This is highly positive as it decreases the risk of regulatory intervention and even litigation due to underage use, two factors associated with Juul’s downfall.

Deal Structure

Altria Group stated on Monday 6th March that it would buy the e-cigarette startup NJOY for $2.75bn. This deal would give Altria Group full global ownership of NJOY’s vapor product portfolio including the only pod-based e-vapor product with market authorization from the FDA. This is an important second chance for Altria Group following its failed investment in Juul, another pod-based e-vapor product manufacturer which allegedly targeted minors in its advertising. Following the disastrous collapse of Juul, Altria Group dissolved its noncompete with Juul, thereby legally allowing them to enter the market and acquire NJOY. This deal will bring Altria Group’s e-cigarette market share up by around 3% but the question that is yet to be answered is whether it will make up the rapidly declining market share that Juul holds.

The rumored price of the deal would represent 18x trailing sales, with sales being around $150m in 2022 which is a big bet considering NJOY declared Chapter 11 bankruptcy in 2016 and only emerged from bankruptcy in 2017. However, considering the 25x sales that Altria Group paid for Juul back in 2018, one only hopes that they have learnt from their former blunder. The deal for NJOY also includes an additional $500m earnout if certain regulatory milestones linked to FDA approval are met.

Deal Rationale

The key driver of the acquisition is found in Altria Group’s positive outlook on the e-cigarettes industry, especially considering a continuing decline in its core business – traditional cigarettes. The company’s CEO, Billy Gifford, openly described e-vapor as the largest smoke-free category in the US and at the same time the most successful category in transitioning US smokers away from cigarettes. Altria Group’s official statement for the acquisition outlines the assumption of a low single-digit CAGR for total US e-vapor over the next 10 years.

The Virginia-based firm has, as of now, been able to balance a decreasing demand for its more traditional products thanks to considerable pricing power – comparing 2012 figures with those of 2021, Altria Group managed to increase revenues of smokable products from $6.2 billion to $10.4 billion despite selling almost 40 billion units less. However, testified also by previous deals, its management has been looking at related diversification opportunities in the tobacco industry and smoke-free products may represent a significant growth opportunity.

As we know, Altria Group already held a Bullish stance on the e-cigarette industry with its 35% stake acquisition in the then industry leader Juul. However, with a write-down of 98% on its investment due to legal disputes that affected Juul, Altria Group has tried to minimize further losses. Such a substantial loss surely constitutes a particularly negative precedent for Altria Group in the smoke-free industry and may also raise concerns about the outcome of NJOY’s acquisition – not too long after Juul’s troublesome one. However, if we consider that the main cause of the $12bn loss was not related to a declining demand for the product, it is possible to see why Altria Group maintains a positive look on the industry and is willing to give it a second try. At the same time, it is questionable whether an acquisition is the best way to gain exposure to it and one may ask why, especially considering Juul’s experience, in-house development was not preferred.

It is also true that there are some considerable differences that may reduce the risk of this operation, at least compared to Altria Group’s previous move. Firstly, by becoming the only owner of NJOY, rather than having a simple equity stake as for Juul, the company will gain control over strategy and operations. Crucially, NJOY has also obtained approval from the FDA to sell six of its tobacco-flavored e-cigarettes in the US – regarding products NJOY ACE, NJOY ACE POD and NJOY DAILY for different nicotine concentrations – something that is yet to be achieved by US market leaders Vuse and Juul. As officially stated by Altria Group, there is the strong belief that the e-vapor category will be strongly impacted by the FDA determinations, making NJOY’s approvals a unique competitive advantage in a market that has price-inelastic demand features.

Altria Group recently announced a $1 billion share repurchase program by the end of the year that boosted stock performance as it was positively received by investors, who also enjoy a particularly high dividend yield of 8%. The buy-back has been reaffirmed even in light of the completion of the deal. However, considering its apparently undervalued stock – 8.7X forward earnings against competitors British American Tobacco’s 9.4X and Philip Morris International’s 14.4X, it is not certain that NJOY’s acquisition consists in a better capital allocation of its generous Free-Cash-Flow than a more aggressive buy-back program would be. The argument for increasing the value of share repurchase is even stronger when considering that $1bn represents a significant decrease from last year $1.8bn repurchase. Furthermore, Altria Group will receive in July a $1.7bn payment from Philip Morris as compensation for returning US IQOS sale rights, which already accounted for a $1bn payment in October 2022 – a considerable cash inflow that could be redistributed to shareholders. However, the high multiples paid for the deal may also suggest that the management is worried about the traditional cigarette industry outlook and is willing to accept less favorable conditions just to diversify in a growing sector.

Outlook for Altria Group

We identified two different fronts which could be impacted by this acquisition. From a purely business-related view, NJOY allows Altria Group to differentiate its sources of income from an apparently declining industry. Forecasts released by the firm indicates that the deal will be accretive to current cash flow and adjusted earnings per share in only three-to-four years and is set to generate a Return on Invested Capital higher than the current Weighted Average Cost of Capital.

At the same time, it also constitutes an important step for Altria Group’s future-oriented campaign Moving Beyond Smoking™. The declared aim of such a program is to lead the transition of adult smokers to smoke-free products – defined Reduced-Risk Products (RRPs). NJOY’s products integrate in Altria Group’s portfolio of RRPs ranging from oral tobacco to the more popular Heated Tobacco Products. The company’s commitment is confirmed by the Tobacco Transformation Index, where it ranks third among largest tobacco companies with a score of 3.50 out of 5. Managed by the Foundation for a Smoke-Free World, the index provides a quantified measure of firms’ commitment in pushing the industry towards RRPs as it evaluates distribution of sales and investments with respect to different risk-profile products, marketing policies and eventual lobbying impeding the progress. Given NJOY’s research and development with its Bluetooth access-restriction technology, this acquisition presents an opportunity to continue Altria Group’s engagement in achieving a more socially responsible status.

Despite many companies only engaging in these initiatives to clean their public image, NJOY’s technological advancements directly target a fundamental problem in the e-cigarette industry. The main concern regarding the use of e-cigarettes, is related to underaged consumers: according to the US Center for Disease Control’s National Youth Tobacco Survey (NYTS), the use of e-cigarette among middle and high school students peaked at 20% in 2019, while estimated to be 9.4% in 2022. At the same time, a study partially funded by the American Lung Association – “Cigarette-E-cigarette Transitions and Respiratory Symptom Development” – indicated significant lung health impacts on previous non-users, with young adults using e-cigarettes being more likely to present respiratory issues within one year. Strict rules administered by the FDA could severely impact profits of companies acting in this industry; an example of disruptive legislation was observable through a law passed in California and Massachusetts that banned the sale of flavored tobacco products due to its high popularity among youth. Altria Group, having already invested a considerable sum of money in the e-cigarette industry, will certainly have to consider the risk and uncertainty related to rapidly changing regulations. It is foreseeable that companies may require onerous R&D projects, such as NJOY Bluetooth device, to reduce side effects especially on minors and respect FDA indications just to keep selling their products.

Outlook for NJOY

Altria Group’s CEO commented on the deal and hinted towards unlocking NJOY’s potential by leveraging benefits derived from his company’s notably bigger size. NJOY currently represents only 3% of the market, according to a study by Nielsen which tracked e-cigarette brands in US stores, but preliminary research shows that in blind tests NJOY’s flagship product performs on par with leading brands. This promising study gives hope that with more capital available to increase its limited sales force and distribution, a higher visibility and consequently market share could be achieved.

There is, however, a recent precedent in the category of RRPs – specifically in nicotine pouches – that may indicate a less positive outlook for NJOY. In 2019-20, Altria Group itself and British American Tobacco respectively purchased majority stakes in companies On! and Dryft to challenge the dominance of Swedish Match’s ZYN. Despite significant investments, as of the fourth quarter of 2022 ZYN still enjoyed a commanding 67.5% share by volume of nicotine patches sold against Altria Group’s 23%. Even more disappointing is that British American Tobacco even lost market share since its initial investment. From this case study, we observe that in similar industries brand recognition, consumer loyalty, and scale advantages play a crucial role, thus making it more difficult to quickly grow market share once a clear leader has formed. Applying this to the acquisition of NJOY, while NJOY is currently the only brand to have received approval for its products, putting itself in a privileged position, it has a long way to go from its 3% market share to become a dominant player in the industry. It is a risky bet for the company to assume that it will sustain a period in which it is the sole player to have received regulatory approval from the FDA.

Nonetheless, the e-cigarettes and vape industry, currently valued at around $22billion according to Grand View Research, has extremely promising growth forecasts – the same research indicated a CAGR of 30.6% from 2023 to 2030, far higher than the single-digit one assumed by Altria Group for the deal. Only time will tell whether the deal succeeds or, similarly to Altria Group’s Juul investment, it will go up in smoke.

0 Comments