Why is an Airport a Good Investment?

The airport industry is far more complex than airplanes arrivals and departures. Initially revenue came from passenger fees, but over time airports have become complex business with multiple revenue streams. On one hand, there are the passenger related fees which are no longer restricted to landing fees and the use of the jet bridges. They now also include passenger spend in food, beverages and shopping, airline terminals rentals, among others. Then, there are also other associated services as parking lots and VIP lounges. On the other hand, there are the fees paid by the agencies that provide Air Cargo Services (ACS) or Ground Handling Services (GHS). These companies support the airport infrastructure by providing services as fueling, cleaning the planes, transporting bags/cargo, tie-down, parking, maintenance, among others. Also, some income is derived from the lease of hangars. Hence, airports no longer rely on a single service offering and have diverse sources of income. This is very useful because in periods as the Covid-19 lockdowns, airports still received fees associated to Cargo and ACS.

Why Should Airports be Privately Owned?

In recent years, many airports around the world have moved to private ownership or public-private partnerships (PPPs), driven by the need for greater efficiency and better investment. The trend of airport privatization started in the 1980s, with the lead of the UK thanks to Margaret Thatcher’s privatization policies. The British Airports Authority (BAA), which included major hubs such as Heathrow Airport, was listed on the London Stock Exchange in 1987. By 2020, over 18% of airports worldwide had been privatized, with regions like Europe, Latin America and parts of Asia at the forefront. Airports are special infrastructure assets which need huge initial capital, require a large amount of space and usually are subject to political and local tensions. Despite their crucial role, publicly funded airports often struggle to modernize infrastructure and ensure adequate investment. Privatization has emerged as a solution, allowing private operators to invest in modernization and expansion projects.

Airports generally generate revenue through two main channels: aviation fees (paid by airlines), which represent about 60% of total revenue, and non-aviation revenues (from commercial activities, parking and real estate), which make up the remaining 40%. Heathrow Airport charges airlines an average of $9,000 per landing and $55 per departing passenger. Commercial activities, such as restaurants and duty-free shops, contribute about $5.15 per passenger, while parking adds another $2.03 per passenger. This diversification allows privatized airports to reinvest profits in infrastructure improvements, benefiting both passengers and airlines.

A study by the National Bureau of Economic Research (NBER) found that ownership by PE increases passenger traffic by 87% and net income by 108% after privatization. These results are attributed to increased investment in physical capacity, such as terminal expansion, bigger commercial area and parking which bring higher level of costumers’ satisfaction and provide more effective negotiation strategies with airlines.

Indeed, PE-owned airports are more likely to introduce advanced and costly technologies, allowing larger aircraft and more passengers per flight. Privately managed airports are also more likely to win international awards for excellence, reflecting better cleaning, commercial offerings and waiting areas, thus increasing passenger spending within the terminal.

Although privatization has positive effects in most cases, it also presents challenges. Some private operators may put profits before the public interest, with the tangible risk of increasing fares for airlines and passengers, the International Air Transport Association (IATA) reported that average airport fees in Europe rose from €16 to €33 per passenger between 2006 and 2016. Indeed, private ownership tend to prefer focusing on long-haul international flights, which are more profitable compares to domestic or short-haul routes. This strategy may disadvantage local communities that depend on airports for regional connectivity.

To balance profitability with public service, many airports adopt a hybrid model known as a public-private partnership (PPP). These agreements combine private investment with public oversight, ensuring that airports meet both commercial and community needs.

Airport Infrastructure Investments in the US

Differently from other countries in the world, in the United States almost the totality of airports is owned and managed by government agencies, with just around 1% of passengers flying through privatized airports. This peculiar airport’s ownership traces back to the attempts made by the US government to privatize these assets, along with the stringent conditions that made it difficult to happen.

The first opening towards privatization began in 1997, when the Congress established the Airport Privatization Pilot Program. As the name suggests, this program had been designed to serve as a test for the possible privatization of airports, and indeed, it only allowed 5 airports to go through this procedure. Moreover, cities were not actually allowed to sell the airports, but rather they could arrange long-term leases to private owners for the management and development of the airport.

This program did not raise particular interest for various reasons. First of all, airlines had a strong veto power, as the airlines representing 65% of the landing weight had to agree with the privatization. Moreover, airport fees charged to airlines could not increase faster than the increase in the Consumer Price Index. Secondly, the time required to complete such a privatization could well require years, as different authorizations from the FAA (Federal Aviation Administration) were required. This implied the risk of changes in the market and macroeconomic conditions, which hindered private investments.

As a result, although several airports started privatization procedures, only one major airport, i.e. Luís Muñoz Marín International Airport in Puerto Rico, is now privately managed. The private operator Asur signed a 40-year lease with an upfront pay of $615m and the agreement to pay up to 10% of revenues to the Ports Authority during the tenure period. The private investor then spent around $1.4bn to renovate the airport, and since then the passenger volume has increased by about 4 million.

The Congress program has been changed through the years; it’s now called Airport Investment Partnership Program, but there has not been a pick-up in the privatization activity. Nonetheless, a new trend is emerging, as several airports have engaged in Public-Private partnerships (PPP). For instance, La Guardia Airport, owned by the Port Authority of New York and New Jersey, back in 2015 initiated a call for proposals to rebuild and manage Terminal B. At the time, La Guardia airport had a very bad reputation for its inefficient terminals. At the beginning of 2016, though, the final approval was obtained, and the $4bn project began its construction. The “La Guardia Gateaway Partners”, i.e. the private investors in the project, signed a leasing agreement for 35 years with regard to Terminal B, which has been completed in 2022.

Following the success of the PPP at La Guardia, the Port Authority of New York and New Jersey also signed new agreements for the replacement of the Terminal 1, 2 and 3 of the JFK airport through a $9.5bn project started in 2022. Among the private investors, Ferrovial [BME: FER] and The Carlyle Group [NASDAQ: CG] took part in the deal.

Overall, instead of leasing the whole airport, private investors are starting to join PPP projects, which only focus on certain terminals or areas of the airports, but still open up the ownerships of these crucial infrastructure assets to private investors.

Airport Infrastructure Investments in the UK

The ownership structure of the airports in the UK is unique, with a significant number of them privately owned. This trend can be largely attributed to the strategic attractiveness of airports as infrastructure investments, their stable revenue-generating potential and the long-term growth opportunities they offer. Investors, particularly PE funds and infrastructure groups, are attracted by the constant cash flows and relative monopoly position of these assets, as airports are crucial for national and regional connectivity, in this analysis we have analyzed the most relevant cases of privatization among the 60 national UK airport.

London Southend Airport located in the Essex region and considered to be the smallest among London airports has faced significant difficulties since the pandemic, which has led airlines like EasyJet and Ryanair to consolidate at others major London airports which caused a sharp drop in passenger numbers. Indeed, Southend Airport handled just over 150,000 passengers in 2023 a sharp decline compared to the 2 million passengers in 2019, a clear sign of the airport’s difficulties in recovering from the COVID-19 pandemic.

The previous owner Esken Limited [LSE: ESKN] is a British infrastructure, aviation and energy company in a critical financial situation because of the COVID-19 pandemic. During the pandemic, Esken had borrowed £125m from the US Private Equity group Carlyle in 2021 to support its operations. However, Carlyle later accused Esken of breaching the terms of the loan, leading to the debt rising to £193.8m including interest. Carlyle demanded immediate repayment, but Esken did not have the financial resources to pursue a long legal battle and eventually agreed to a restructuring deal. This agreement led Carlyle to convert the loan into an 82.5% share in Southend airport, leaving Esken with a minority stake of 17.5%. Carlyle has identified Southend Airport as a strategic investment opportunity. Esken’s difficult financial position allowed Carlyle to acquire the airport at a discounted valuation. Despite the current difficulties, the aviation sector is known for its ability to recover significantly. As part of the acquisition, Carlyle has committed to invest £32m to ensure future growth of the airport, including £5 million in short-term bridge financing. This funding is intended to improve infrastructure and attract more airlines, positioning Southend for future success, moreover, Southend is the only London airports able to operate 24/7 with no curfews which could make this process even faster.

AGS Airports Limited operates Aberdeen, Glasgow, and Southampton airports making it a significant player in the UK aviation sector. It was established in 2014 as a joint venture between Ferrovial [BME:FER] and Macquarie Group [ASX:MQG]. However, at the beginning of November 2024 Avi Alliance a German airport management company with expertise in sustainable development and route expansion acquired AGS Airports for an agreement worth around £1.53 bn, comprising both equity and debt.

The acquisition poses the attention to the strong interest in the UK airports assets, particularly those with diversified revenue streams in fact AGS have distinct market positions, Aberdeen is key hub for the UK’s oil and gas industry, Glasgow serving as Scotland’s second-largest airport with 7.7 million passengers in 2023, and Southampton a fast-growing airport for regional and European connections. Avi Alliance announced its plans for the improvement of the airports infrastructure. Glasgow Airport is investing in green technologies to align with sustainability goals of carbon neutrality by becoming the UK most efficient airport-based solar. Aberdeen airport has just finished a £18m renovation which brought 51% of terminal increased as well as doubled the commercial area, while, Southampton is projected a possible terminal expansions to handle the increased volume of passengers with the aim to target 5 million passengers by 2045 compares to the 755,000 of 2023.

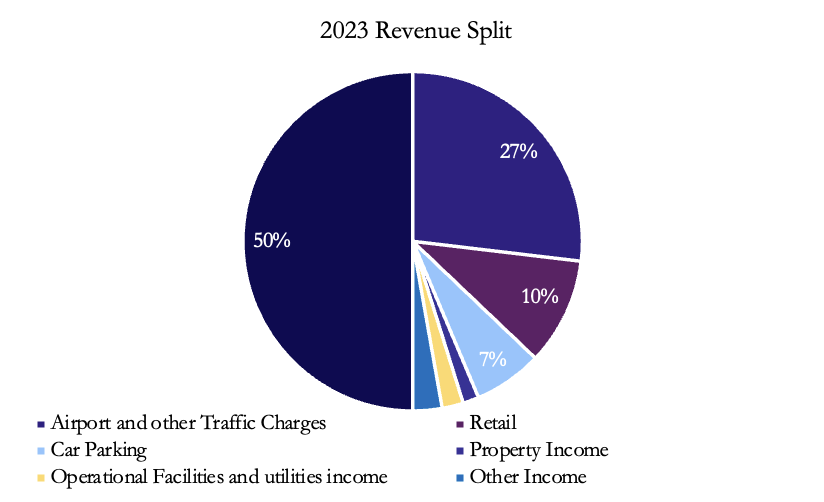

Gatwick Airport is strategically located just south of London, and is the second busiest airport in the UK, flying 41 million passengers per year claiming the busiest single-runway airport in Europe. Since May 2019, Vinci Airports, a global leader in airport management and operation have been the majority shareholder with a 50.01% stake. It is a subsidiary of the French multinational construction company Vinci SA. It was reported to have paid £2.9bn for the stake, with the remaining 49.99% owned by others including Global Infrastructure Partners (GIP). “GIP halved its stake to 21%, while Abu Dhabi Investment Authority kept 7.9%, California Public Employees’ Retirement System 6.4%, National Pension Service of Korea 6% and Australia’s Future Fund Board of Guardians 8.6% (Reuters)”. The GIP-led consortium initially bought Gatwick from BAA for £1.5bn in 2009 who were forced by the Competition Commission to sell it due to competition concerns. The sale to Vinci valued the airport at just under £6bn. Since 2009 Gatwick has paid dividends of about £1.5bn. Despite GIP and partners buying at £1.5bn, paying out £1.5bn in dividends and selling half of the airport for almost £3bn, they still hold a stake valued at £3bn. The large dividends paid out, and the increasing valuation despite the pandemic, show the high growth potential of Gatwick. Below is the revenue split for 2023. Interestingly only 54% of revenue is generated from Airport traffic.

Source: London Gatwick Bond Base Prospectus 2024, BSIC

Investing in airports comes with risks. One of the major risks is exposure to airlines. According to London Gatwick’s Bond Base Prospectus 2024, there is a reliance on a few major airline customers. The top five airline customers (easyJet, British Airways, Vueling, Wizz and TUI) “accounted for 78% of total air transport movements and 79% of passengers” in 2023. Historically, some airlines have had financial difficulties as they have faced fluctuating demand, volatile fuel prices among other issues. If individual airlines faced financial problems in the future, both the aeronautical and non-aeronautical revenues would be vulnerable. Despite the general optimistic outlook for the airport, the key to long term growth is a successful decision on its planning application to bring its spare runway into routine use which could double the number of passengers to 78 million.

Heathrow Airport is the main international airport serving London and is the UK’s busiest airport by passenger numbers and is the fourth busiest airport in the world. Heathrow generates 67% of its revenues from aeronautical, a significantly higher percentage than Gatwick. On 17th June 2024, it was announced that the largest shareholder, Ferrovial and various other shareholders agreed to sell a 37.62% stake, with 22.6% going to Ardian and a 15% to Saudi Arabia’s sovereign wealth fund. The consideration of the deal was £3.26bn. Ferrovial have been trying to sell their stake since 2023, but the deal was delayed as other shareholders chose to exercise their right to sell a portion of their shares under “tag along rights” embedded in the shareholder agreement. For Ferrovial, the deal represents a large windfall, and some analysts have said the deal will assist Ferrovial with reducing their net debt and potentially paying more dividends. The Saudi Public Investment fund (PIF) has recently been a major investor around the globe, and they were also part of a consortium that bought Vodafone’s towers unit in 2022, as they aim to reach $2tn in assets by 2030. This purchase illustrates their willingness to diversify their portfolio away from oil, and into more stable assets like infrastructure.

Like Gatwick, Heathrow is heavily exposed to a few airlines. The outlook for Heathrow is bullish, with strong demand for air travel globally contributing to revenues due to its role as a hub airport providing a steady stream of passengers. If the airport was able to expand, including the provision of a third runway, it could significantly increase capacity and revenue, although this looks unlikely at present. There is some uncertainty over regulation and government policy on aviation in general as the new labour government have not revealed policy positions in any detail.

London City Airport is the most central of all the London airports and is in close proximity to Canary Wharf and the City of London. It is owned by a consortium made up of Alberta Investment Management Corporation (25%), OMERS Infrastructure (25%), Ontario Teachers’ Pension Plan (25%) and Wren House Infrastructure Management (25%). They purchased it form GIP and Highstar Capital in February 2016 (reportedly for around £2bn). Since the acquisition, the airport grew revenues 14% in the year to December 2023 transporting 3.4 million passengers in the year. The airport returned to operating profit (£6.7m) for the first time since the pandemic. With the ownership being more shared amongst investors, conflicts of interest surrounding the future plans of the airport may arise, with each institutional investor potentially having a different outlook.

The main reason turnover rose was due to passenger numbers increasing from 2.9m to 3.4m, however these numbers still remain well below the peak of 5.1m in 2019. In August this year, the new Labour government signed off on the airports plan to grow passenger numbers by nearly one third from 6.5m per year to 9m by 2031.

London Luton Airport is owned by London Luton Airport Limited, a company owned by Luton Council. In 1998, London Luton Airport Operations Limited (LLAOL) entered into a Concession agreement with the Council for the management and development of the airport, with the agreement lasting until 2032. Aena [BME: AENA] (51%) and Infrabridge (49%) are the two shareholders of LLAOL and LLAOL is required to pay Luton Council a Concession fee based on passenger volume. Revenue in the year 2023 was £296m with profits of £68m (2022 £51m). Aeronautical income is 46%. In 2023 Luton served 16.2m passengers. The joint ownership structure allows the burden of risk to be shared between the private and public sector, which may help the airport stay focused on long-term goals rather than achieving short-term profits.

Moreover, a recent study by University of Alberta showed airports performed better when owned by private equity funds. A total of 2,400 airports around the world were examined and “those owned privately rather than publicly were more efficiently run”. Furthermore, the study found that of the 437 privatized airports, the 102 that had been acquired by an infrastructure fund outperformed. The authors of the study believed that this is because PE infrastructure funds are “closed in with a limited term of about 20 years” and they are motivated to invest in improvements to increase efficiency. Take Gatwick for example, who are constantly innovating and investing and were the first airport to install e-gates, leaders in self-baggage drop-offs, aircraft queuing systems and continue to innovate and drive efficiencies. This long-term outlook of improving efficiency and customer service at airports is they key driver for the growth of airports as an infrastructure asset.

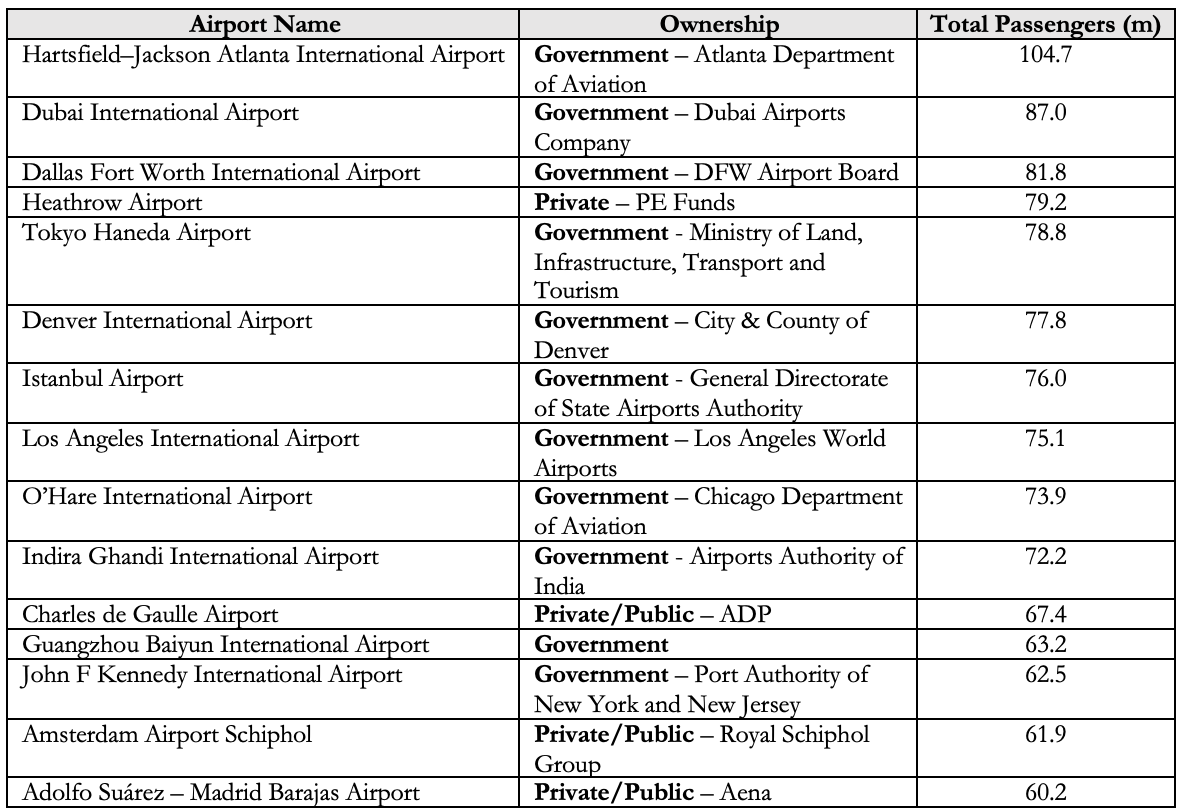

Ownership of the Largest 15 Airports by Passenger Traffic (2023)

Recent Deals

During the course of 2024, M&A activity in the airport industry has been strong. Looking at Europe, the private equity fund Vinci [EPA: DG] bought a 20% stake in the Budapest airport through a concession agreement expiring in 2080. Vinci also completed the acquisition of the 50.01% of Edinburgh airport for £1.27bn, becoming the major shareholder along with Global Infrastructure Partners (GIP). Within Italy, Asterion Industrial Partners bought a 49% stake in 2i Aeroporti, which in turns holds direct and indirect participations across the main airports, including Milano Malpensa and Milano Linate.

In addition, GIP and Abu Dhabi Investment Authority (ADIA), along with other investors, launched a tender offer to acquire the outstanding shares of Malaysia Airports Holdings Berhad [KLSE: AIRPORT] and thus privatize the main operator of airports in the country. Lastly, KKR [NYSE: KKR], with Skip Essential Infrastructure Fund, announced in September the acquisition of Queensland Airport’s Limited, the holding company of several airports across Australia.

Conclusion

Airports went from being a public good to business enterprises. Airports have become good and stable investments with some of the largest Private Equity, Insurance and Pension funds owning airport assets around the world, along with PPP’s between governments and privates. Moreover, the pressing infrastructure needs around the world, along with the ongoing energy transition, will potentially increase investments in airports and its associated businesses in the coming years. From Sustainable Aviation Fuel to “greener” terminals, investments will continue transforming the industry.

0 Comments