Allergan (AGN) – Market cap as of 07/10/2016: $94.6bn

About Allergan

Allergan plc is a diversified global pharmaceutical company headquartered in Dublin, Ireland. It is considered to be a leader in “growth pharma”, after its newfound focus on branded pharmaceuticals. Since 2007 Allergan has made a number of acquisitions to enrich its portfolio and improve its global position.

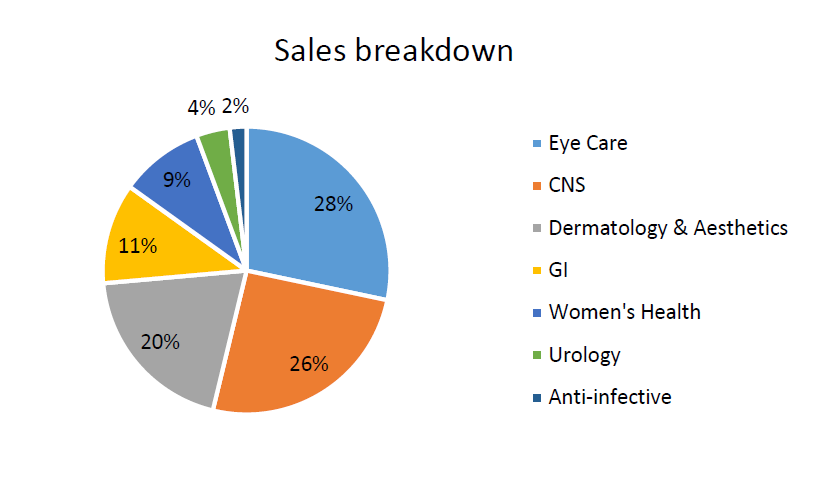

Allergan’s brand portfolio is made up of products in the categories of dermatology and aesthetics (Botox being among the best known), eye care, women’s health and urology, GI and cystic fibrosis, cardiovascular and infectious diseases.

In 2015 Allergan’s financial results were the following: total revenues of $15.07m, adjusted EBITDA of $7.198m, adjusted EBIT of $6.886m, Non-GAAP net income attributable to shareholders of $5.191m and GAAP Net Income – $3.683m.

In late 2014 Actavis announced the purchase of Allergan for $66bn and in June 2015, three months after completion, it changed its name from Actavis plc to Allergan plc, and began its rebranding campaign.

In July 2015, the company announced the sale of its generics business to Teva for $40.5bn in cash and stock, which provided Allergan with cash to pay down debt and will allow the company to strategically focus more on brand-name drugs.

Most recently, in October 2015 Pfizer and Allergan announced a $160bn merger which would have dramatically changed the industry. However, the deal did not conclude as synergies expected from tax savings dropped to zero after the US government introduced new rules on tax inversion.

Industry overview

Despite being a fast growing environment, the pharmaceutical industry has been challenged in recent years. The scientific base is strengthening while at the same time the sector is facing on one hand growing demand for medicines and on the other hand removal of former impediments to free trade. According to a recent estimate by PwC, the market for medicines will be worth nearly $1.6 trillion by 2020. Demand for pharma’s products is rising dramatically, as the global population increases together with life expectations. In September 2016, there were an estimated 7.4 billion people. By 2020, there will be more than 7.8 billion and all of them will require pharmaceuticals.

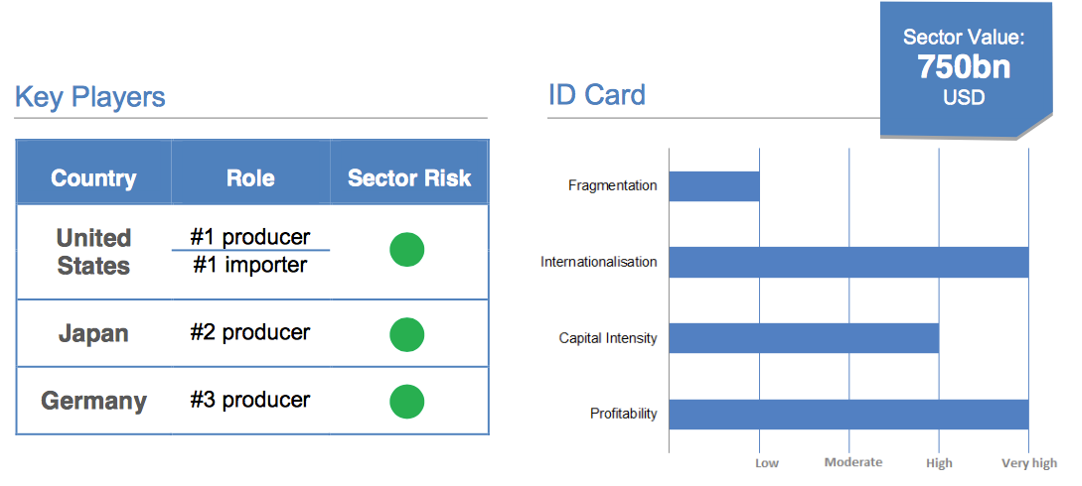

The Pharma industry has a strong position in terms of profitability with average gross margins over 60% and in the case of Allergan an astonishing 78% (as of 31/03/2016). The major players are all from the US followed by Japan and Germany. Italy is the second major producer in Europe. The market generated $750bn revenues in 2015. However, the global prescription drug market is expected to grow to $770bn in 2016.

Source: Allergan, BSIC

Another interesting point is that demand for medicines is increasing faster in developing economies than in developed ones. This indicates the opportunity for big pharma players to make a real impact gaining new markets and customers. At the same time, in developed countries, governments are beginning to focus on prevention rather than treatment.

Pharma companies are expecting to come up with innovative solutions in the upcoming 5 years as in the last decade research has expanded a lot thanks to new technology and discoveries. Yet, when analyzing this industry one should keep in mind that the R&D cycle for pharmaceuticals may be long and expensive. Sometimes these costs may become huge and difficult to handle.

As the research costs spike, the big pharma names are concentrating on M&A activity as a faster mean to achieve growth. Small specialized biotech companies being acquired by major players would provide the ground for further research expansion and innovative solutions.

Allergan’s acquisition spree

In the past years, Allergan has undertaken several acquisitions and divestitures, which have helped the company increase its product portfolio as well as its geographical scope.

Allergan is particularly focused on the development of innovative products for unmet medical needs and is currently in a very solid position: the company has a strong pipeline of products in mid-late stage of development in several sectors, including eye care, CNS (i.e. central nervous system) and medical aesthetics.

To further strengthen its R&D efforts, in the last 6 months, Allergan has made several small and medium purchases of companies that are developing potential ground-breaking drugs and treatments.

Topokine Therapeutics

On April 21, 2016, Allergan announced the acquisition of Topokine Therapeutics, a biotechnology company that develops fat reducing medicines, for an upfront payment of $85m and further milestone payments based on the development and sale of the drug XAF5, which is a potential treatment for Steatoblepharon (i.e. under-eye bags). The acquisition is expected to strengthen Allergan’s innovative medical and facial aesthetics product pipeline.

ForSight Vision & RetroSense Therapeutics

In August 2016, Allergan acquired the eye care biotechnology company ForSight Vision. Just as in the previous takeover, the terms of the deal include both an upfront value ($95m) and future milestone payments. The rationale is also similar: ForSight Vision 5 (the key product) will enter Allergan’s eye care pipeline, which already includes 20 products. In the same franchise is to be placed also the $60m acquisition of RetroSense Therapeutics, a private company which has developed a gene therapy treatment for photosensitive retinas.

Vitae Pharmaceuticals

In September 2016, Allergan agreed to acquire Vitae Pharmaceuticals, a clinical-stage biotechnology company. The terms of the deal, which is expected to close by year end, expect Allergan to pay $21 per share in cash, more than double the company’s closing price of $8.10 on the day prior to the acquisition, in a deal valued in total $639m. According to Allergan’s CEO, “the acquisition will add strength and depth to Allergan’s dermatology franchise”.

Tobira Therapeutics & Akarna Therapeutics

Finally, with the intent of boosting its liver disease therapies portfolio, Allergan has made two more acquisitions in September. First, it has agreed to acquire Tobira Therapeutics for $1.7bn, 19x Tobira’s market value. The biopharmaceutical company focuses on products that treat NASH (i.e. non-alcoholic steathepatitis), which is a common liver disease associated with obesity and type-2 diabetes. The very high premium paid is a clear sign of the interest in companies that are developing NASH treatment and also suggests that there might have been multiple bidders for Tobira. The following day, Allergan further bolstered its NASH pipeline by purchasing Akarna Therapeutics for $50m.

[edmc id= 4115]Download as PDF[/edmc]

0 Comments