Introduction

Once seen as too unpredictable, consumer brand leveraged buyouts have grown in popularity over the past two decades. Fashion cycles and shifts in consumer preferences increase the risk of such buyouts, as cash flow generation is, in general, less certain. Yet deals such as Permira’s acquisition of Dr. Marten’s [DOCS: LON] or Carlyle’s [CG: NASDAQ], Golden Goose proved to perform well, through strong brands creating consumer stickiness and private equity firms increasing their portfolio companies’ efficiency. Today, the growing deal flow and activity in this sector reached a height, highlighted by unconventional investors like Kim Kardashian entering the market with her newly founded consumer and media fund, Skky Partners. She aims to solidify future portfolio companies’ brands through her image and reach. It is thus worth understanding the attributes sponsors seek in targets, how they create value in this space, and the challenges a sponsor may face when investing in consumer brands.

What is Consumer Brand Private Equity?

In consumer brand private equity, financial sponsors take a majority stake in consumer, retail, and e-commerce companies such as clothing, cosmetics or accessorize brands. They scrutinize their potential targets on various factors. First, it is essential to assess how strong the brand is. Consumer awareness is the first indicator. If the brand is already well known, it can attract more customers and will require less marketing efforts to reach a broader audience. More importantly, the qualitative analysis is then crucial to understand the brand’s customer retention. For this, sponsors evaluate the emotional connection that consumers attach to the brand, which will determine the pricing power of the target company. A high emotional connection implies lower price elasticity and a stickier consumer behavior, significantly contributing to the success of the LBO. Therefore, investors highly value a brand’s outreach but are more appealed by its degree of retention. Typically, brands with decades of heritage combine both. They are particularly attractive investments, as their customers range across multiple generations, and they have stood the test of time through surviving multiple fashion cycles. Lastly, deal teams see a great opportunity when the brand is bigger than the underlying business. This means that relative to comparable companies based on reach and brand power, the business is considerably smaller. Hence, sponsors can generate high returns by implementing new strategies as there is a broader room to grow the company to its expected brand’s magnitude level.

In the monitoring of a consumer portfolio company, funds alongside management teams focus their efforts on improving the brand’s efficiency. Across numerous successful deals, like CVC’s acquisition of Breitling or Carlyle’s Golden Goose, specific strategies are recurrent. An initial goal is to increase consumer awareness and retention. Marketing campaigns through strategic ambassadors will broaden the brand’s reach and will help consumers identify with the product, creating an emotional connection. Effective campaigns will thus improve the brand’s customer attraction and pricing power, essential for strong top line growth. Furthermore, owned single brand stores are a key to a stronger profitability. Direct to consumer sales imply higher margins, consumer satisfaction, and a greater control. Indeed, multiple brand stores charge commissions or fees and cannot offer product expertise with a personalized customer service. In addition, single brand stores highly contribute to the brand’s recognition and customer appeal. An online presence through e-commerce platforms is also crucial for the potential growth of brands. It enables a wider customer reach, reduces costs, offers a broader range of products to consumers, and tracks their behavior. Managers can then profit from the data collected to steer the business further in line with the consumers’ desires. Today, the share of online sales represents 15-20% of total sales in the consumer brand sector, underlining the growing significance of digitalization for brands. Lastly, the most important factor in the success

of a consumer LBO is finding the fine line between the opposing forces of brand creativity through appealing designs and financial efficacy.

During the holding period of the portfolio company, sponsors can face certain challenges. Tara Alhadeff, a partner at private equity firm Permira, describes the process as crossing a “valley of death”. In fact, a successful leveraged buyout can require overcoming a series of limitations across several years before creating significant value and revitalizing a brand. This longevity makes it attractive for private equity funds as they can take up to 10 years to overcome limitations and create value. Along the way, risks such as shifts in consumer preferences must be controlled by maintaining a strong emotional connection and up-to date collections. Counterfeiting can be fought with unique digital IDs for each product, offering a unique sales experience and long-term quality to consumers. A strong threat to expanding businesses is notably the customer acquisition cost (CAC). Management teams must ensure to keep a strong Consumer Lifetime Value/CAC ratio and come up with creative, less costly marketing campaigns. Furthermore, consumer purchasing power highly affects brands. In current times of surging inflation, large ticket items in discretionary consumer spending such as cars and TVs will be hurt first. However, the pent-up consumer savings from the pandemic are still flowing towards small ticket items like shoes. In a recession, there are even signs of the “lipstick effect”: consumers cutting their large expenses but still seek the satisfactory feeling of buying an expensive lipstick. In addition, brands that target a high-income customer group are less likely to suffer from the current situation. Lastly, technological disruption affecting consumer spending can represent a short-term threat for consumer companies. On the longer term, it is seen as positive development, as it gives great brands new channels through which they can sell their products.

Permira and Dr Martens

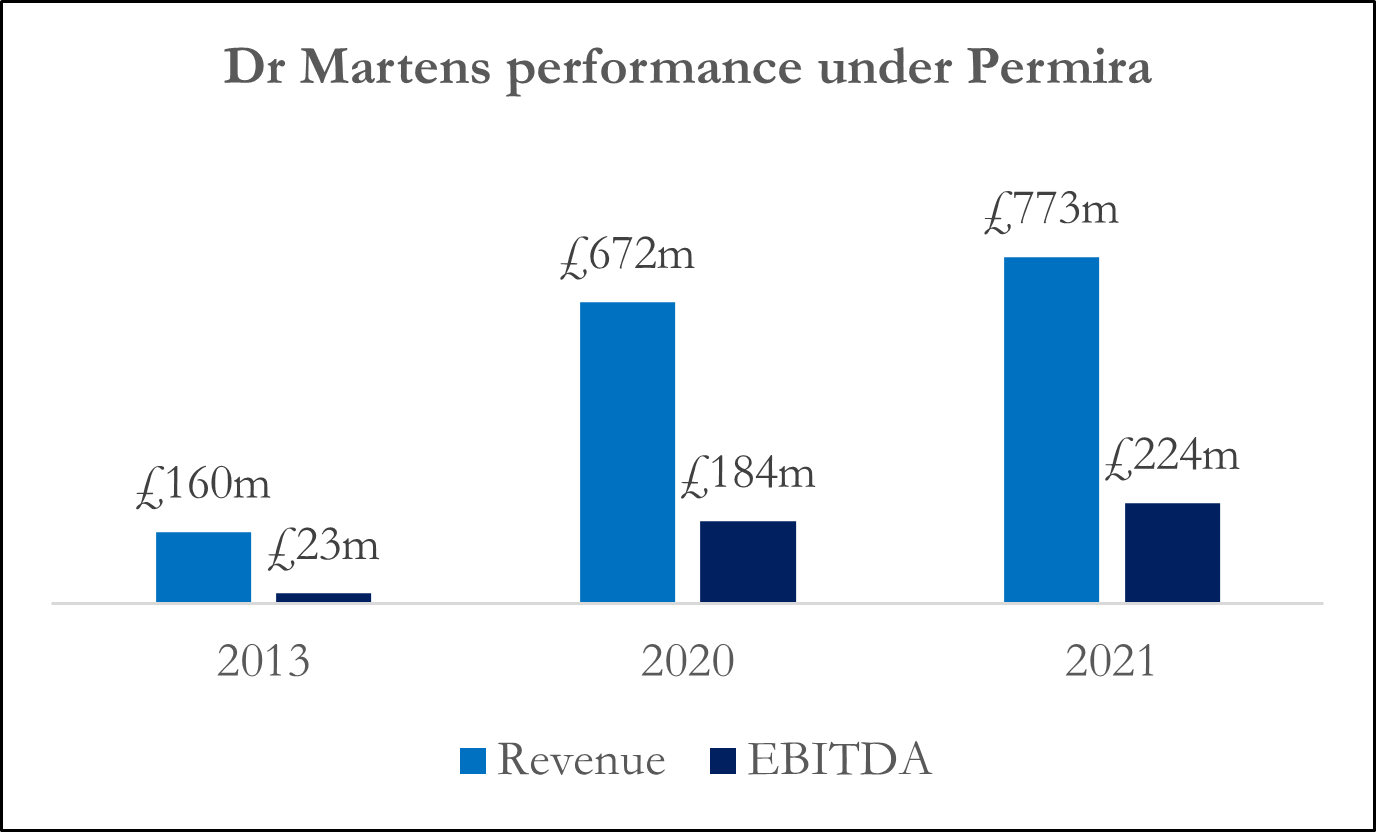

An example of a successful consumer brand private equity deal that we can use as a case study is the Dr Martens Permira deal. Dr Martens, an iconic staple of British design, was created in the early twentieth century by the Griggs family and sold to Permira in 2014 for £300m. With sales of £160m and EBITDA of £22.9m in 2013, the firm was sold for an EV/Revenue multiple of 1.87X and an EV/EBITDA multiple of 13X. Under the management of Permira, an already experienced manager of high-profile brands such as Hugo Boss [BOSS: ETR], Dr Martens consolidated its position in the 60 countries in which it operates, optimizing business operations and bringing them up to par with the legacy brand that influenced British pop culture for decades. It began by returning to its roots, developing the “original series,” which comprises of ten classic leather boots that have shown to be resistant to trend cycles over the years. This series currently accounts for two-thirds of all sales, up from one-third in 2013. With Kenny Wilson as CEO, the bootmaker spotted an opportunity in online retailing, which accounted for one-fifth of total sales in 2020, while also being the fastest growing sector of the business and demonstrating resilience

Source: Bocconi Students Investment Club

to the pandemic shock that prompted retail outlets to close. As a consequence, eight years after Permira’s acquisition, the shoe company had revenues of £773m and an EBITDA of £224m, propelling it back to the top of British fashion, and this time as a world-wide phenomenon.

Source: Bocconi Students Investment Club

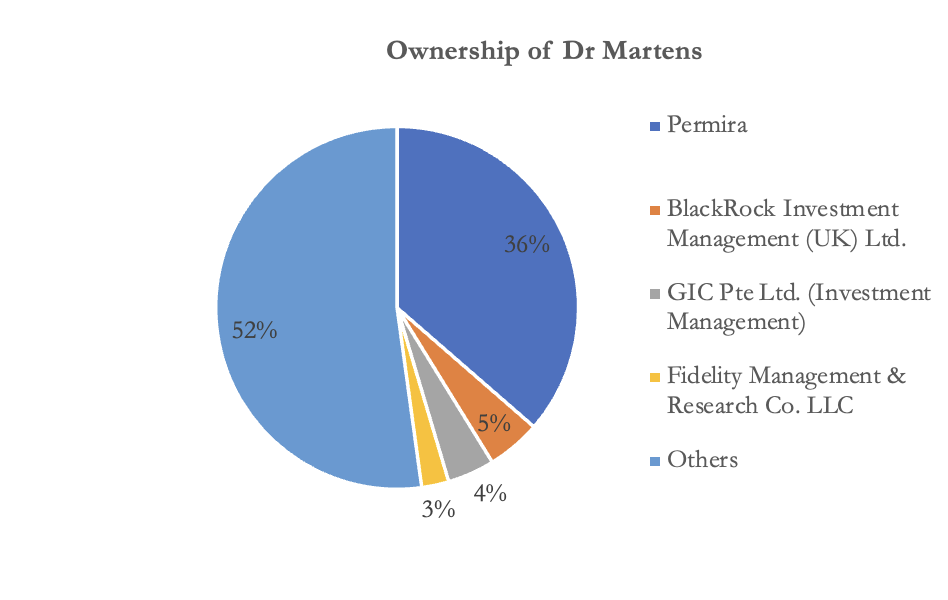

Permira decided to take Dr Marten public in January 2021, selling 35% of the company for £1.3bn and bringing its total market cap pre-IPO to £3.7bn, one of the largest listings on the LSE in 2021 and one of Permira’s most successful investments, bringing a 10X return for the fund in 8 years. With an initial offer of 370p per share, the stock soon rose to 500p per share by February. However, the firm has been hampered by supply chain concerns, manufacturing closures in Asia, and, most recently, decreased demand—the company sold the same number of shoes as previous year. As of Nov 2022, Dr Martens is trading at around 200p, almost a 50% discount to its IPO price. Currently Permira still holds 36% of Dr Martens’ shares, with funds like Blackrock [BLK: NYSE], Fidelity, and GIC holding significant portion of the company.

Carlyle and Golden Goose

Source: Bocconi Students Investment Club

Golden Goose, founded in 2000 in Venice, Italy, by two young Italians is one of the fastest growing and most distinctive luxury fashion labels, well known for its famous shoes and their distinctive star. The company is emblematic within the luxury sneaker industry, being the initiator of the “ugly sneaker” trend, with a pair of Golden

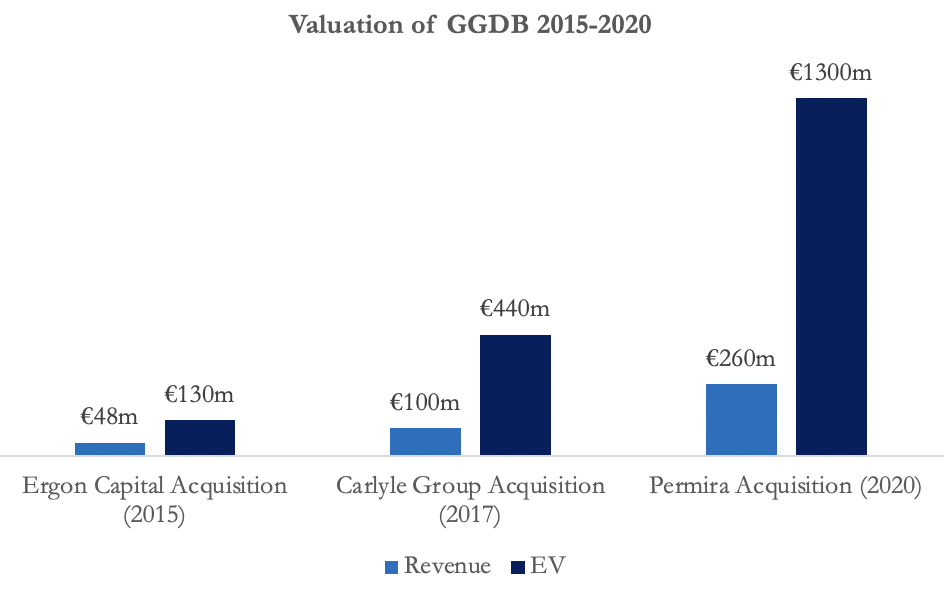

Goose selling for up to 1000 euros. Since its inception, the firm has changed hands between funds. Belgian fund, Ergon Capital acquired 75% of the brand from APD Capital in 2015 for €130m, then in 2017 American fund. Carlyle acquired the company for €440m, and more recently in 2020 Permira, the owner of Dr Martens, acquired the luxury shoemaker for €1.3bn.

Over the last seven years, the firm has grown tremendously, with sales increasing from €48m in 2015 to €260m in 2020 and the EV/Revenue multiple increasing from 2.7X to 5.0X. Under Carlyle, Golden Goose saw the greatest expansion to date, growing internationally and sustaining a CAGR of 37%. With the help of Carlyle, the company rapidly expanded outside of Europe into profitable markets such as the United States, China, Japan, and South Korea, spearheading the sneaker frenzy of the 2010s with a heavy focus on Gen Z and their need for premium, well-crafted items. Carlyle’s consumer investment team, which had previously built luxury brands such as Moncler [MONC: BIT] and Twin Set, provided the company with the operational expertise needed to bolster its digital capabilities and e-commerce platform while selectively expanding wholesale distribution in more than 100 newly opened stores and diversifying into accessories and clothing.

As previously stated, Permira purchased GGDB in 2020 for €1.3bn at a 5X multiple, which is remarkably close to the 4.73X valuation multiple earned during Dr Martens’ IPO, both firms being deemed a “uniquely powerful brand that resonates with customers.” Silvio Camapara, CEO of GGDB, stated in a recent presentation that Permira is the finest partner in transforming the luxury shoemaker from a worldwide business to a global brand. Permira is also able to maintain its talent acquisition efforts, having hired a Chief Sustainability Officer and Bastien Renard, a former director at FENTY, as the new Chief Brand Officer. Furthermore, under new management, the shoemaker has increased its online sales from 5% in 2020 to more than 15% by 2022 and is leading the shoe industry’s environmental revolution by procuring renewable materials and pursuing a more diverse style.

Conclusion

Bernard Arnault, the owner of LVMH [MC: EPA], became the richest man on May 24, 2021, with a net worth of more than $186bn Obtaining the title of richest man alive as a result of developing a luxury consumer brand empire demonstrates the value and potential of the luxury market, with young generations spending more money than ever on apparel that follows the following principles: demonstrates prestige, is comfortable, and looks good. Recent deal flows of investment funds buying and growing brands with a large consumer following, such as Dr Martens, GGDB, Birkenstock, and Breitling, have supported the concept of a rising consumer brand sector. Furthermore, with media stars and influencers launching their own funds, such as Kim Kardashian’s Skky Partners, there is more activity than ever in developing legacy brands while also on the lookout for the next generational mega blockbuster.

0 Comments