The Change in Deal Structure

Recent macroeconomic activity has impacted the private equity industry dramatically. A strong reliance on leverage in your business model means that when the market for leveraged loans tightens significantly, you must resort to using lower levels of leverage.

In December 2022 the private equity firm Advent International announced the acquisition of Maxar Technologies [MAXR: NYSE] in a $6.4bn deal. This particular leveraged buyout was peculiar, as Advent International’s equity contribution was unusually large. Advent contributed a large amount of equity without deploying much leverage, meaning that they were unable to underwrite the deal completely. This led to the British Columbia Investment Management Corporation co-investing with Advent International in the Maxar Technologies deal. They invested $1bn alongside Advent International’s $3.1bn of equity to finalize the $6.4bn LBO.

This leverage ratio is much lower than what we have previously seen in marquee transactions that have left their mark on the private equity industry. One of the largest leveraged buyouts occurred in 2007 when Energy Future Holdings (TXU corporation) was bought by a series of private equity firms including KKR [KKR: NYSE], TPG [TPG: NASDAQ] and Goldman Sachs [GS: NYSE] for $45bn. This transaction had an extremely high 10:1 ratio of debt to equity and a debt component of 88%, which is circa 2.4 times the 37.5% debt that was used to finance the Maxar Technologies deal. For reference, the average debt to equity ratio from the last decade has been 4.0x, meaning that the debt contribution was around 75%.

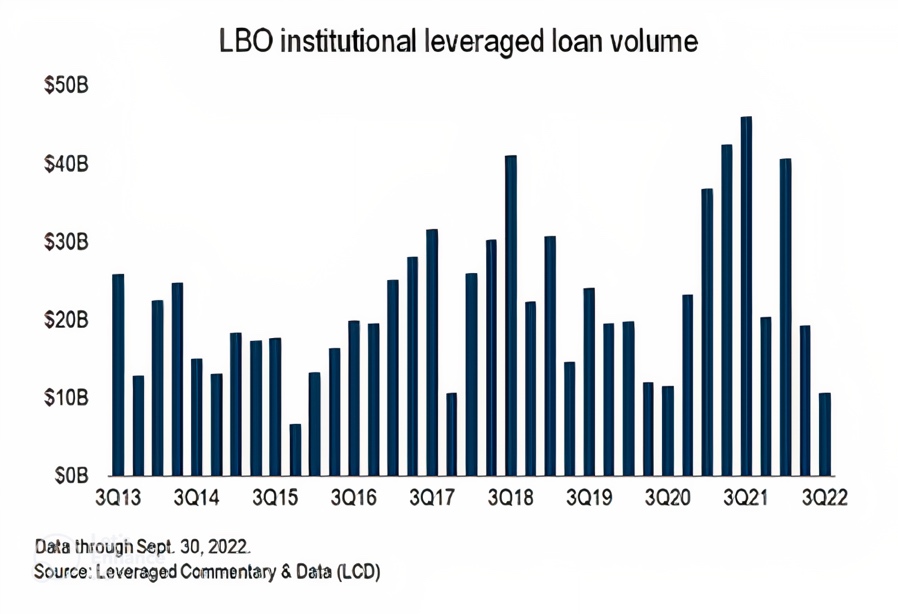

The Maxar Technologies acquisition has provisions that could enable Advent to replace a portion of the equity with debt in the future. This is unlikely to happen in the near future, due to the unfavorable funding environment, with the leveraged lending markets a lot tighter than they were just two years ago. The issuing of loans decreased by 44% through the first three quarters of 2022 in comparison to 2021, while the leveraged loan market saw yields increase by a factor of 2 to nearly 10% in 2022.

The reason for the increased use of equity over debt can also be attributed to central banks that have hiked interest rates over the last 4 months across the world. In an effort to tame inflation, the Federal Reserve, along with the majority of the other central banks around the world, has hiked interest rates, which increases the cost of borrowing. This has in turn caused an increase in the cost of financing for private equity businesses by making leverage more expensive. Banks have decided to pull back from financing private equity transactions due to them having taken large losses in leveraged lending throughout 2022. This causes a lack of loans to be available on the market, which inherently makes financing more expensive. This begs the question of what this means for private equity firms and what their future entails.

We have seen several large investment companies such as Sixth Street Partners [TSLX: NYSE] and Oaktree Capital Management [OAK-A: NYSE] shift their focus to private debt. Sixth Street provided a $2.3bn loan for the LBO of Maxar Technologies and earlier in December helped lead the financing of a $2.6bn loan for the acquisition of Coupa Software by the private equity firm Thoma Bravo. This heightened involvement shows the pattern of firms filling the gap that banks left in the leveraged loans market. Oaktree Capital Management recently announced that they are raising $10bn for a new private credit fund, to compete with the likes of Blackstone [BX: NYSE], Apollo Global Management [APO: NYSE], and Sixth Street Partners in financing buyouts. Oaktree Lending Partners is the proposed name for the direct lending focused fund that aims to gain market share in the private debt market. This idea on behalf of Oaktree comes at a time when new issuance on the leveraged loan market in the United States has steadily decreased over the past year. The distribution of new leveraged loans dropped drastically by 88% when compared to the beginning of 2022 and the overall value of leveraged loans in the United States is only $9bn. Oaktree’s ambitious fund, if it manages to raise the $10bn, would mark a large step forward for the company in the private credit market and would allow it to cement itself as one of the largest direct lending funds in history.

Recently, leading private equity firms have increasingly resorted to private lenders, rather than investment banks, to finance their acquisitions. For instance, Ares Management [ARES: NYSE] provided close to $2bn to finance the acquisition of Nielsen Holdings [NLSN: NYSE] by Brookfield [BN: NYSE] and Elliot Investment Management. We have also seen listed financial institutions like Goldman Sachs utilize their private credit branches to finance acquisitions such as Brookfield’s $8bn buyout of CDK Global [CDK: NASDAQ]. Through times of economic uncertainty private credit funds are able to gain market share from investment banks by providing investors with secure financing at higher rates. The reliability of private credit and their speed of execution have also served them well. This is evidenced by the increase in fundraising for private debt funds which almost doubled from 2021 to 2022.

In the European sphere, Blackstone raised its first dedicated European private credit fund in 2022. Following in the footsteps of Blackstone’s Luxembourg based private debt fund, rivals Apollo and Goldman Sachs Asset Management have announced their intention to launch their own private credit fund and sell it to high-net-worth individuals across the continent. The delayed arrival of private credit to Europe can be attributed to the high level of bureaucracy which closed off the private space as an option to investors. Complex jurisprudence halted the private credit market from taking off which led investors to skirt these regulations by engaging in the US private credit market through business development companies (BDCs). These companies provide direct loans to small firms that are unable to secure financing from the public market.

Another advantage of the deal structure offered by private debt providers is the duration they plan on holding the loan for. While traditional banks offering acquisition financing only plan on holding the loan for months, private credit firms commonly hold the debt to maturity. The Carlyle Group’s [CG: NASDAQ] planned acquisition of a 50% stake in the healthcare analytics company Cotiviti [COTV: NYSE] is contingent on a $5.5bn direct loan that is planned to be sourced from private credit groups. The proposed deal would be the largest private loan ever.

The large amount of competition between underwriters for the deal has enabled Carlyle to decrease the yield on the loan to circa 6.25% percentage points above the Secured Overnight Financing Rate (SOFR) benchmark, instead of the proposed of 6.5% points. In this situation the private credit groups offer the advantage of allowing Cotiviti to pay the interest through a Payment In Kind (PIK). A PIK loan allows debtors to pay interest on a loan by raising additional debt rather than utilizing cash. If the lenders do indeed offer PIK to Carlyle, the firm would prefer the private credit financing over the J.P. Morgan [JPM: NYSE] and Goldman Sachs offer for a loan as it allows Cotiviti to conserve cash in lieu of a possible recession.

This possible transaction clearly shows the increased influence of private debt providers in an evolving macroeconomic climate, as banks are subject to stricter capital requirements which inherently prevent them from aggressively financing the private equity industry. More and more private equity firms have shifted towards private credit for funding as volatile bond markets forced banks to syndicate loans at steep discounts, entailing large losses and forcing the banks to reduce their financing activity. Emerging private credit firms have been lured by the extremely high returns that levered loans can offer at this point in time. Several loans offered by private debt institutions yield between 6-7% more than the SOFR, they also benefit from having floating rates meaning that they are protected from inflation to a certain extent. In March, the average rate for the SOFR was at 4.6% enabling private credit firms to generate returns in excess of 10%. Furthermore, we can expect this percentage figure to rise as Jerome Powell, the Federal Reserve chairman, has been adamant regarding the Fed’s intention to continue hiking rates, possibly even at an accelerated pace.

Although we have seen high-yield bonds and the leveraged loan market start to slowly recover, private debt is still one of the only sources of reliable funding available in this macroeconomic climate. In the future, due to the reduction in leverage, the compression of multiples at sale and the increase in the cost of financing leveraged buyouts, private equity firms’ returns may decrease. Through several advantages including proposed PIK financing and more secure funding we can expect large buyout funds to continue shifting towards receiving their funding from private lenders in contrast to banks regardless of the diminished returns.

Value in the UK

Public to private (P2P) transactions occur when a private investor acquires a public company and its shares are taken off the stock market. The rationale behind such deals includes avoiding costly and time-consuming regulatory requirements related to being a public company and running the firm with a long-term plan, without being disturbed by the pressures of public markets. In recent years, a surge of P2P deals has been observed in the UK. This strong momentum is partially a result of Brexit and the UK’s exposure to currently out-of-favor industries such as industrials and banks. Such factors imply lower valuations on UK indexes and create lucrative opportunities for P2P deals. Thus, the volume multi-billion-pound P2P deals in the UK increased considerably, which led to a 200% growth in transaction value between 2018 and 2019, from £8.4bn to £25.7bn. Deal count also significantly rose: in 2021, UK P2P deals nearly quadrupled from 5 in 2020 to 19. Although the market contracted abruptly, there were still 15 of such deals in 2022, triple 2020’s figure. The fact that 2022 and 2020 had similar global M&A deal volumes with $3.6tn and $3.4tn respectively, proves that the steep increase in P2P deals isn’t strictly due to a higher deal flow, but an upward trend in this specific type of transaction.

A recent example is Apollo Global Management’s multiple offers for Wood Group [WG: FTSE]. The Scotland-based business provides consultation, management of assets and engineering services for the energy and materials sector. In 2022, its revenue rose by 8% to $5.4bn, strongly benefiting from Oil & Gas companies trying to extend the lifetime of their projects amid concerns of potential energy shortages caused by Russia’s invasion of Ukraine. The group’s future prospects have become increasingly positive since its recent expansion into clean energy projects such as wind farms. However, the announcement of a $100mn charge on a US anti-missile defense project in Poland and the delayed publication of its annual report pushed its stock into a negative spiral with a 57% fall in its share price between June 2022 and February 2023. In addition, the global uncertainty and macroeconomic environment hurting markets further contributed to Wood Group’s lower valuation. As a result, the US based private equity fund Apollo saw a lucrative opportunity to acquire Wood Group and build on its growth potential through clean energy and new multi-year contracts with BP and Shell. The company was also particularly attractive due to its significantly lower than foreign markets’ PE ratio. Indeed, before Apollo’s first bid in January, Wood Group traded at a PE ratio of 10.1 while the oil & gas consulting and engineering sector averaged a 15.6 PE ratio on the S&P 500. It formulated four all-cash bids: the third one at 230p a share consisting in a 55% premium on the last closing share price before the bid was announced on February 22nd , and the fourth at 237p a share. All attempts have been rejected as they “significantly undervalued the repositioned group’s prospects”. However, the growing pressure on Wood Group and Providence Equity’s recent opportunistic takeover approach of exhibition company Hyve [HYVE: FTSE] effectively highlight UK-listed companies’ increasing vulnerability to foreign takeovers.

In order to understand if this trend will prevail, it is necessary to look at its underlying drivers. In May 2018, the FTSE 100 hit its all-time high at 7877.45. For the past 5 years, however, it struggled to reach the same levels. The index fluctuated until 2020 where massive monetary and fiscal stimulus helped it recover and soar upwards after the pandemic’s crash. Eventually, in February 2023, it reached 8000 points for the first time after going sideways for 5 years. This symbolic landmark is significant as round numbers are appealing to human psychology and can positively influence investors’ behavior. Still, the FTSE 100 remains rather inexpensive as it currently trades at a PE ratio of 14.4 and earnings yield of 8.3%. In contrast, across the same period, the S&P 500 appreciated by 63.20% and currently trades at a 20.9 PE ratio. This underlines the undervaluation of UK-listed companies and their attractiveness for foreign investors. Therefore, as long as this disparity between markets, such as the US and the UK, exists, foreign PE funds will look at lucrative P2P deals in the UK.

Furthermore, recent fears for the London stock market arose as companies are seeking to list on foreign exchanges. Soft Bank rejected a London listing for Arm, a Cambridge based chip designer, despite the extensive efforts of three successive UK prime ministers. The Japanese group instead opted for a single primary listing in New York, due to the greater valuations US investors apply to tech stocks. Even more alarming for the London Stock Exchange Group, certain companies already listed in the UK are wishing to delist in the UK, and instead list in the US. CRH [CRH: NYSE], a building materials giant, announced its plant to move its listing to the US, as most of its business is in North America, but most importantly because this shift could lead to a PE ratio re-rating to approximately 25x against a current 13x. Shell [SHEL: FTSE] also considered moving its shares to the US to gain a greater valuation, forcing an urgent discussion on how London listings can be made more attractive to companies, in addition to the governmental incentives for companies to list in the UK that already exist. Among the reasons for this collective movement, a fundamental issue is the lack of a vibrant domestic investor pool with a strong home bias ready to invest in newly London listed companies. In addition, Brexit leads many to have a pessimistic view on UK growth, inflation, and lack of loyal shareholder base which further reduces the luster of listing in the UK. The accelerating trend to search for higher valuations and better recognition abroad confirms the FSTE 100’s struggles, exposing vulnerable UK-listed companies to attractive P2P deals.

In conclusion, the outlined factors are significantly harming UK valuations. We expect this trend to continue, as the FTSE 100’s valuation gap to the S&P 500 is not closing. Indeed, higher growth, valuations and greater exposure overseas will continue to attract new listings away from the London Stock Exchange. As a result, UK-listed companies will likely remain considerably undervalued and PE funds will continue to shop for vulnerable targets with a strong growth potential.

0 Comments