Introduction

In 2022, the number of IPOs has plummeted to lows comparable to post-financial crisis levels after the highs of 2021 with individual deal values falling due to lower valuations. In September, the number of US IPOs was a mere 20% of the ones in the same period in 2021 while the amount of raised capital decreased by 94% on a year-on-year basis. The number European IPOs halved, and the proceeds declined by 76%. This trend is expected to continue in the last quarter of 2022 and early 2023, with companies planning to go public having to do so at far lower valuations than during the IPO boom of the last two years.

SPAC IPO volumes and sizes have experienced an even steeper drop. After an increase from a mere two issues in 2020 for European markets to 32 in 2021, the number of issues until 30 June stood at eight. The three European issuer nations with a total of 56% of the market share of SPACs were Luxembourg, the Netherlands, and France.

The sole exception to this general trend seems to be the Porsche IPO [P911] in September this year. However, the company itself seems to be sheltered from the general global macro trends as the buyers of its vehicles can handle the costs of rising interest rates and inflation in contrast to high-growth companies. The proceeds raised by this IPO allow VW and Porsche to expand more into the electric vehicle space as discussed in our article here.

Anecdotal Evidence of IPO Performance

The post-issuance weakness can be illustrated by the performance of the three largest European IPOs in 2021: Wise [WISE], Oatly [OTLY], and Deliveroo [ROO]. Wise is a UK-based fintech company that allows customers to transfer money internationally at lower rates than by using banks and credit cards. It was the largest technology listing on the London Stock Exchange with a market capitalization of £8.75bn and an initial share price of £8.8. By 26 October 2022, the market capitalization has dropped to £7.1bn. Oatly, a Swedish oat-milk company, that initially priced its shares at $17 summing to a market capitalization of $10bn, has its shares currently trading at $2.1 for a market capitalization of $1.3bn. Deliveroo initially priced its IPO at the low end of the range at £3.9 per share for a valuation of £7.6bn and experienced a drop of 26% on its first trading day. Its market cap is now around £1.7bn with shares trading at around 94 pence, constituting a drop of 77% from its initial valuation.

In contrast, Porsche’s offering valued the company at more than €75bn. The IPO was priced at the top end of the range at €82.5 on 25 September. On Friday, the stock was trading at €99. In comparison, the year-to-date return of the Euro Stoxx 50 Index is around -28%, while its return since the Porsche IPO is +13%. These cases seem to indicate that the underperformance of some of the largest IPOs in Europe in the last years might be related to a rotation from high growth to more mature companies. In the following, we review the literature on post-issuance performance and analyze empirical evidence for the European market.

Literature Review on IPO Performance

The literature mainly identifies two main aspects that determine an IPOs success, the first one being the involvement of private equity companies land the second being IPO underpricing. Median private equity listings have been shown to outperform compared to median non-private equity backed ones both in terms of stock performance as well as capital raised. On aggregate, the size of issuances not backed by private equity are larger as they more commonly refer to established companies that did not require funding until the IPO or used the IPO to create more liquid wealth for existing shareholders. The finding of stock outperformance of private equity IPOs is both significant during the stabilizing period as well as in the medium and long term. The early aftermarket one could be attributed to institutional investors being reluctant to sell private equity-backed IPOs to avoid being denied allocation in subsequent listings of the same private equity firms. Underwriters may be more inclined to ensure an effective stock price stabilization with the expectation of more business in the future. Another reason for this outperformance may be that a higher percentage of non-private equity backed IPOs tends to go public during periods with a high volume of IPOs and increased valuations, which contributes to their long-term relative underperformance. However, this relative performance pattern becomes less significant after the first months of trading.

Both longer floating periods and offer price revisions after the publication of the IPO prospectus lead to significantly lower underpricing. Through pre-selling activities, the underwriter reduces information asymmetries. The underpricing in fixed price listings is mainly affected by the systemic IPO risk, maturity of the firm, as well as offer sizes since the shares must be priced according to uncertainties faced by investors. Thereby, older firms carry less risks, leading to a smaller underpricing. In open-price IPOs, information can be signaled through revisions of the prospectus price range to uninformed investors, allowing less volatile trading. Higher volatility before the IPO correlates with lower underpricing as it is caused by diverging opinions on valuations from investors making firms reduce the initial underpricing bringing the offer price closer to the most optimistic investors. This is due to higher expected participation with more optimistic investors and euphoria.

A Brief Look at the US Market

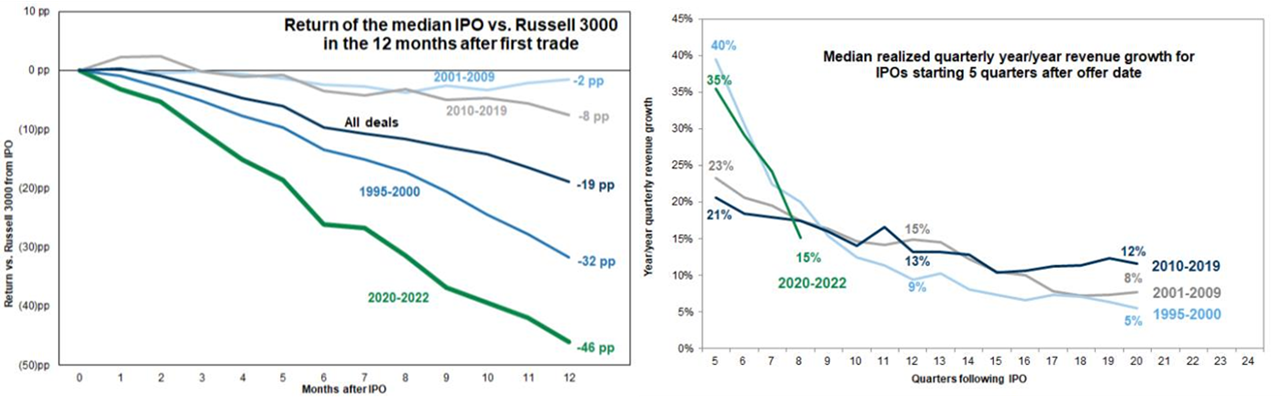

Before analyzing the European market, we look at the performance of US companies after their initial public offering. In a research note, Goldman Sachs equity strategists compared the return of companies that went public in different subperiods with the broad Russell 3000 Index. The report highlights some interesting facts on recent trends in capital markets. First, in every considered sub-period since 1995, the median IPO underperformed the stock index during the first year after issuance. Thereby, the latest period from 2020-2022 still stands out with a median underperformance of 46 percentage points compared to the index. As a matter of fact, only around ten percent of all companies that had an IPO during 2021 are trading above the initial offer price as an analysis by Bloomberg suggests. SPACs were excluded in both these reports. Second, the shift in investor preferences from growth to value stocks can partially be considered as driver of this underperformance. The companies that went public during the last two years had above average revenue growth rates and are therefore more susceptible to a worsening macroeconomic outlook and rising interest rates.

Source: Financial Times, Goldman Sachs

Before considering similar results for the European market, a few differences to the US market should be pointed out. First, the industry composition differs between the two markets. The US has established itself as global leader in the tech industry while Europe has its strengths rather in the industrial sector. These differences are also reflected in capital markets with a higher concentration of growth stocks in the US market. Second, there still exist a substantial gap in the development of capital markets between the two regions [1]. In Europe, total companies’ market capitalization as share of GDP is much lower than in all other developed regions, while corporates rely much more on bank loans than capital markets. Further, venture capital investments as a share of GDP are more than ten times higher in the US than Europe with institutional investors also allocating less capital in shares than elsewhere.

European IPO Performance

Building upon this analysis, we look at the recent performance of IPOs in Europe. For this, we employ a dataset of 41 IPOs in Europe between 2017-2022 that raised more than €500m. To obtain a similar measure of relative performance, we assess the returns of these companies against the Stoxx Europe 600 Index which comprises large-, mid-, and small-cap companies from Europe. Out of the sampled years, 2021 stands out with a number of 16 IPOs while the remaining transactions are rather equally distributed across the years.

Source: Bocconi Students Investment Club, Bloomberg

Considering the first year after the issuance, companies seemed to outperform the broader market in the period from 2017-2019 by 11.4% or 20.6%, when assessing the median and mean company, respectively. In recent years, this changed fundamentally with data for IPOs between 2020-2022 indicating an underperformance by 16% (median) or 23% (mean). In comparison to the results for the US market, the underperformance of the latter period seems to be consistent, although the decrease in value is much less pronounced in the European market. Additionally, contrary to the US results, the European IPOs outperform the market in the former period.

The recent underperformance of companies during the first year after their IPO can be explained by two main factors. First, the macroeconomic outlook led to a rotation of investor preferences from growth to value companies. By way of example, this is evident by the substantial outperformance of the Russell 3000 Value over the respective growth index. As companies that go public through an IPO are predominantly in the prior group, their underperformance with regards to a broad equity index is expected. Second, the strong supply of IPOs in 2021 paired with a higher presence of individual investors were key factors. This gave institutional and other professional players more leeway in selecting their investment, while also making them more wary of the increased volatility arising from a stronger presence of small investors.

The above-described differences between the European and US capital markets can further help to understand the arising differences in performance. First, the higher concentration of technology and, more broadly, growth stocks among US IPOs makes the market more vulnerable to the described rotation into value stocks. Further, with the Federal Reserve following a more aggressive path in raising interest rates than the ECB, stocks with a longer duration are more severely hit. Second, the weaker development of capital markets might play an important role. A less savvy and more risk-averse investor base increases the incentive for investment banks to initially set a more conservative pricing range to ensure the success of the offering. In turn, valuation ranges are less exhausted, offering ceteris paribus more room for positive returns in the first year after the offering.

Sources

[1] Demertzis, M., M. Domínguez-Jiménez and L. Guetta-Jeanrenaud. “Europe should not neglect its Capital Markets Union.” Bruegel Policy Contribution 13 (2021).

0 Comments