Introduction

In this article, we will present the pricing of Arithmetic Asian Options using Monte Carlo simulations. Additionally, we will introduce variance reduction techniques and the advantages of using Asian options in the oil market. We will show the functioning of the Monte Carlo models and analyze the option price evolution under various simulation methods.

There are three main types of options: European Options, American Options, and Asian Options. European Options give the holder the right, but not the obligation to buy or sell an underlying asset at a predetermined price at a given timeframe (exercise only at the date of expiration). On the other hand, an American Option allows holders to exercise the option rights at any time, before and including the last day. Finally, an Asian option is a derivative with a payoff at maturity that depends on the average of the underlying asset on a set of proposed observation dates.

Brokers and dealers usually sell Asian options as OTC instruments. They were first used in 1987 when Banker’s Trust Tokyo office introduced them for the average options pricing on crude oil contracts and thus the name of the “Asian” option.

Average types

The average method plays a central role in the calculation of the Asian Options payoff. We distinguish mainly four types of methods used to compute the average.

- Discrete arithmetic average:

![]()

- Discrete geometric average

![]()

- Continuous arithmetic average

![]()

- Continuous geometric average

![]()

For the simplification process, in most cases, discrete averages are used.

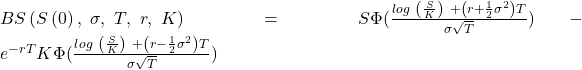

While for the arithmetic Asian options, there is no closed-form solution, for the geometric ones, there is. Specifically, the Black Scholes can be modified to obtain the call price for geometric Asian option with fixed strike and continuous geometric averaging:

![]()

where:

![]()

Asian-In and Asian-Out

As we have already seen, there are several types of Asian Options. Now we will show another means of differentiation, i.e., between Asian-In and Asian-Out options.

The Asian-out option is an average spot option characterized by the fixed strike and the variable spot price, calculated as an average of market prices at some specific date. Respectively, an Asian-In option refers to an average strike option: the strike price being calculated as an average that considers the market prices of each period, while the spot factors the value of the underlying asset at the expiration date.

It is interesting to note that, exceptionally, we may see a type of exotic Asian option that has both spot and strike prices calculated on an average basis. Nonetheless, it implies high complexity, as there is no implicit relationship between the variation of the strike and spot price, and the formulas used for the two calculations differ.

Asian-in options have the averaging observation dates spread uniformly during the entire option life. On the contrary, Asian-out options have their averaging dates split during the period close to the maturity date. Moreover, in most cases, the Asian-in option is less risky, as it implies lower volatility of the strike/spot price comparing with the Asian-out option. The latter has a risk profile closer to the European option, considering the observations being token at the end of the period.

Monte Carlo

Monte Carlo Option Pricing is a method often used in Mathematical finance to calculate the value of an option with multiple sources of uncertainties and random features, such as changing interest rates, stock prices or exchange rates, etc. This technique is generally used in variables estimations when the proprieties of the variables are not known or for the confirmation of asymptotic results. By using Monte Carlo, we are sampling randomly from a given distribution and generating the needed estimations.

Let us suppose we have a call option on a stock with the spot price ![]() , whose explicit form we do not know. Under the rationality assumption, a call option will be exercised when

, whose explicit form we do not know. Under the rationality assumption, a call option will be exercised when ![]() , as the payoff of a call option is

, as the payoff of a call option is ![]() . To estimate the option price, we need to get the present value of the future option payoff, so we will discount

. To estimate the option price, we need to get the present value of the future option payoff, so we will discount ![]() by a factor of

by a factor of ![]() where r is the risk-free rate, and T- the expiration period. The only unknown that we have is the stock price in the future. From the Black-Scholes, the evolution of the stock price is determined by the formula:

where r is the risk-free rate, and T- the expiration period. The only unknown that we have is the stock price in the future. From the Black-Scholes, the evolution of the stock price is determined by the formula:

![]()

Taking the definite integral for both parts, assuming that is the rate of return, which tend to be for a risk-neutral investor we obtain:

![]()

where ![]() represents the present stock price.

represents the present stock price.

Considering that ![]() is a distribution with the mean 0, and the standard deviation equal to

is a distribution with the mean 0, and the standard deviation equal to ![]() , applying a variable change formula:

, applying a variable change formula: ![]() we will express

we will express ![]() distribution using the standard normal distribution

distribution using the standard normal distribution ![]() with mean 0 and standard deviation 1, and

with mean 0 and standard deviation 1, and ![]() the previous formula for the stock price can be written as:

the previous formula for the stock price can be written as:

![]()

In the final step, if ![]() has a lognormal distribution, the present expected value of option payoff

has a lognormal distribution, the present expected value of option payoff ![]() can be seen as an integral with respect to a lognormal density function

can be seen as an integral with respect to a lognormal density function ![]() . So, the expected value can be determined using the function Φ based on the following arguments

. So, the expected value can be determined using the function Φ based on the following arguments ![]() :

:

Regarding the Monte Carlo simulation, the algorithm relies on several iterations (random draws) from the population. It will produce a sequence of independent standard normal variables, and with the aid of the previous formula, we will calculate the stock price and, respectively, the present value of the call option payoff for each value ![]() obtained. The generic procedure for pricing a European call has the following form:

obtained. The generic procedure for pricing a European call has the following form:

for i=1 to n (the number of replications):

generate ![]() (random standard normal variables)

(random standard normal variables)

define ![]()

calculate ![]()

calculate ![]()

whereas for pricing a path-dependent option such as Arithmetic Asian option, we will simulate n paths of m transitions each, and thus the algorithm transforms to:

for i=1 to n

for j=1 to m

generate ![]() (the th draw from the normal distribution along the th path)

(the th draw from the normal distribution along the th path)

define ![]()

calculate ![]()

calculate ![]()

calculate ![]()

After estimating the option price, the error will be estimated using the formula:

![]()

Variance Reduction Techniques

The variance reduction techniques aim to reduce the variance of the Monte Carlo estimates and narrow the confidence interval, thus making the model more efficient without the need to increase the number of simulations. Below, we will introduce two techniques that apply to our case.

Antithetic variates

Antithetic Variates aims to reduce the estimate variance by establishing an antithetic relationship between the replication pairs. One of the most popular ways of applying the method implies using the following fact: if ![]() is distributed uniformly over

is distributed uniformly over ![]() , then

, then ![]() follows the same distribution. Hence, given the path

follows the same distribution. Hence, given the path ![]() , we generate a second of

, we generate a second of ![]() that can be utilized to balance unusual high/low results of

that can be utilized to balance unusual high/low results of ![]() with exceptionally low/high results

with exceptionally low/high results ![]() . In this way, we achieve a variance reduction and a decrease in the number of necessary samples for

. In this way, we achieve a variance reduction and a decrease in the number of necessary samples for ![]() paths.

paths.

To exemplify how the method works, consider that our scope is to estimate ![]() and that using the antithetic method presented above, we construct the following pairs of observations

and that using the antithetic method presented above, we construct the following pairs of observations ![]() that represent independent and identically distributed random variables. Moreover, for every

that represent independent and identically distributed random variables. Moreover, for every ![]() and

and ![]() , have the same distribution, although they are not independent of one another.

, have the same distribution, although they are not independent of one another.

The antithetic variates estimator can be calculated using the average of the observations we have generated.

![]()

Applying the central limit theorem for the n independent variables ![]() , where

, where ![]() , we obtain the standard normal distribution:

, we obtain the standard normal distribution:

![]()

where:

![]()

Thus, we reduce the variance of the estimator if:

![]()

which is:

![]() , or

, or ![]()

However, we can rewrite ![]() as

as ![]() , considering that

, considering that ![]() and

and ![]() have the same distribution, and thus the same variance. Consequently, the requirement for reducing the variance is equivalent to:

have the same distribution, and thus the same variance. Consequently, the requirement for reducing the variance is equivalent to:

![]()

Control variates

Now we will proceed with showing another technique of variance reduction. To show how the control variates method works, let us assume that our goal is to estimate ![]() . We already know that

. We already know that ![]() is an unbiased estimator. We also suppose that for each of the n independent results of the simulation,

is an unbiased estimator. We also suppose that for each of the n independent results of the simulation, ![]() , we generate another output,

, we generate another output, ![]() , for which E[X] is already known and the pairs

, for which E[X] is already known and the pairs ![]() are i.i.d.

are i.i.d.

Going forward, for any fixed b, we can obtain the following unbiased control variate estimator:

![]()

Moreover, to find the optimal coefficient b for reducing the variance, the following relationship needs to hold:

![]()

So, the higher the correlation between the control variate and the Monte Carlo estimate, the higher the variance reduction. In our case, we will use the price of the geometric Asian options instead of the X variable, as it serves as the closest proxy for the value of an arithmetic Asian option.

Monte Carlo results

Finally, we will proceed towards the pricing of arithmetic Asian-out options (fixed strike). We will include geometric Asian options for utilizing it as a benchmark for the arithmetic ones, which we will price using Monte Carlo, with antithetic and control variates. In the table below, you can see the results of the simulations while changing the strike price. In parenthesis, you can view the standard errors of the estimates.

As we can see from the table, the gap between European and Asian options’ prices is significant. Thus, the European derivatives cannot serve as a proxy for getting the value of arithmetic or geometric Asian options. As emphasized in the theoretical part, a correction of the Black-Scholes model is needed for pricing geometric Asian options. Instead, for the arithmetic ones, there is the necessity to simulate their price given that a closed-form solution does not exist. Going further, we detect the lower standard error of the antithetic variates’ procedure, meaning that it succeeded in reducing the estimates’ variance. Besides, we can observe the excellent results in improving the model’s accuracy with the control variates technique, which achieves errors considerably lower than the previous two methods. In the end, we can also ascertain that the theoretical relationship between European, arithmetic, and geometric Asian option prices holds, as the European option is more expensive than any Asian option while the geometric one is cheaper than the arithmetic.

Standard and Antithetic Monte Carlo with ![]() , and

, and ![]() (discrete case, there are 10 fixing dates equally spread across the time period)

(discrete case, there are 10 fixing dates equally spread across the time period)

| K | |||||

| Model | 60 | 65 | 70 | 75 | 80 |

| European Options | 12.5433 | 9.0455 | 6.2412 | 4.1285 | 2.6264 |

| Geometric

Asian Options |

10.4904 | 6.3833 | 3.3202 | 1.4561 | 0.5391 |

| Arithmetic Asian Options | 10.6846

(0.0238) |

6.5285

(0.0210) |

3.4847

(0.0165) |

1.5561

(0.0114) |

0.6176

(0.0072) |

| Arithmetic Asian Options

(Antithetic variates) |

10.7066

(0.0045) |

6.5572

(0.0070) |

3.4675

(0.0087) |

1.5534

(0.0072) |

0.6078

(0.0048) |

| Arithmetic Asian Options

(Control variates) |

10.7071

(6.2916e-04) |

6.5640

(5.3759e-04) |

3.4638

(4.5270e-04) |

1.5649

(4.1611e-04) |

0.6099

(3.8839e-04) |

Oil market and Asian options

One of the initial problems traders had was the high cost of the American options. Giving the buyer a flexible timeframe implied an additional cost compared to exercising only on the last day, as for the European ones. On the other side, the issue with the European options was the reliance on the expected price of the final day. So, in case of the high volatility of the underlying asset, the risk exposure for the European Option was imminent, especially for the commodities. Despite the inelastic supply, the probability of having a price shock is still quite significant. So, in that case, considering the high standard deviation of the expected price of the commodity, the European Option is more expensive but also implies a higher degree of risk.

Furthermore, the price paid by the final consumer for the commodities is calculated on an average basis over a predetermined period. Having a spot price that is computed similarly allows companies to have a stable cash flow in the short run. So, the Asian options solve the problem of the different variation profiles of prices paid by the final consumers and by the distribution companies. Secondly, considering that crude oil’s price is constantly changing, Asian options allow firms to make consumer prices relatively stable compared to the price paid by the distribution companies and preserve a predictable spread. In addition, Asian options have an application in mitigating the calendar basis risk, which provides the option writer an efficient and easy way to manage continuous exposure price risk over a period by simplifying multiple hedge ratios. These two main features allow companies to plan their budget, matching the profile of revenues and expenses.

[1] Monte Carlo Methods in Financial Engineering, Paul Glasserman

0 Comments