Siemens AG (SIE:ETR) – market cap as of 29/09/2017: €101.32bn

Alstom SA (ALO:EPA) – market cap as of 29/09/2017: €7.92bn

Introduction

The French rail transport company Alstom SA and the German industrial conglomerate Siemens AG announced on Tuesday 24 September 2017 that they agreed to merge their rail operations. The deal will create a European entity strong enough to compete with “a dominant player in Asia”, namely China’s state-backed CRRC. The transaction, which has probably been favored by the French President Emmanuel Macron’s pro-business approach, has been billed as a “merger of equals”, with Siemens taking a c. 50% stake in Alstom. After months of negotiations between Bombardier and Siemens regarding a similar transaction, Tuesday’s announcement sent the Canadian group’s share price down by c. 10%.

About Siemens AG

Siemens AG is a Germany-based conglomerate and, with FY2016 revenues of €79.6bn, it is the largest industrial manufacturing company in Europe. Siemens is active in the fields of electrification, automation and digitalization and is a supplier of systems for power generation and transmission, as well as medical diagnosis. Siemens shares are listed on the Frankfurt stock exchange and German electronic trading platform Xetra. In the US, the company is traded OTC only. Over the past two years Siemens’ shares have risen nearly 50%.

Siemens 2Q17 profit margin for its industrials business climbed to 12.1% from 10.9% of the previous year. Operating profits for FY2017 are expected to rise to €8.3bn, from €5.8bn in 2016. These figures demonstrate the success of the “Vision 2020” strategic plan that CEO Joe Kaeser launched in 2014. Kaeser highlighted the need to streamline the expansive conglomerate in order to prepare it for what experts call “Industry 4.0” – the age of automation, AI and IoT.

Over the past four years Siemens has strengthened its focus on its core industrial businesses by restructuring non-core units to give them operational autonomy while, at the same time, allowing Siemens to retain control. For instance, in April 2017 Siemens merged its renewable energies unit with Gamesa, a Spanish wind producer. The combined entity was then publicly listed in Madrid with Siemens holding 60% of the shares. In 2018, Siemens plans to list its healthcare business.

About Alstom SA

Alstom SA is a French multinational company that operates in the rail transport market. While the high-speed train TGV is arguably its best-known product, the company also produces the Eurostar and Pendolino high-speed trains, in addition to suburban, regional and metro trains.

In FY2016 Alstom had revenues of €7.3bn and recorded a net profit of €303m. Alstom is listed on the Paris Stock Exchange only, having delisted from the LSE and the NYSE in 2003 and 2004 respectively. Overall, Alstom’s share price has performed weakly over the past five years. Fluctuations of the share price between €18.80 and €35.90 are mostly explained by takeover and merger announcements.

One of Alstom’s highest profile transactions was the $17bn sale of its power generation and electricity transmission business to General Electric (GE), which was announced in 2014 and completed the following year. Like Siemens, Alstom too has been sustaining a strategy of focus on its core business (i.e. rail transport products). Post-merger, Alstom’s CEO Henri Poupart-Lafarge will maintain leadership in the new combined entity.

Industry Overview

The train and locomotives manufacturing industry has been shaken in the past decade, as the rise of Chinese companies disrupted the traditional order of business. As of FY2016, CRRC Corp. reported train-manufacturing revenues (c. ¥136.2tn, or €17.4bn) larger than the sum of the revenues of Siemens Mobility and Alstom put together. In addition to these players, Canada-based Bombardier is also one of the main incumbents in the industry, and its merger with Siemens has been speculated for a long time.

The European market is marked by overcapacity, which has prompted a reduction in margins, especially after the entry of Hitachi, the Japanese company who acquired Finmeccanica in 2015. Thus, in Europe the industry is highly competitive and displays a high level of fragmentation, where the big players hold a c. 20% market share. Chinese giant CRRC has yet to make a serious effort to entry the European market, but it is already present in cost-sensitive economies, like LatAm, Africa, and Southeast Asia, boasting €630m contracts in Argentina, €560m in Iran, and €450m in Malaysia.

Due to the saturation of the Chinese market, CRRC (with its R&D budget of over 2x that of Bombardier) represents a likely entrant into the European market, which is difficult to operate in because of costly regulations, transportation costs, and complexity in achieving economies of scale due to small lots of orders. In this context, the merger of Alstom and Siemens’ rail transport business will create a European champion which will be better positioned for the competition coming from East Asia.

Deal Structure

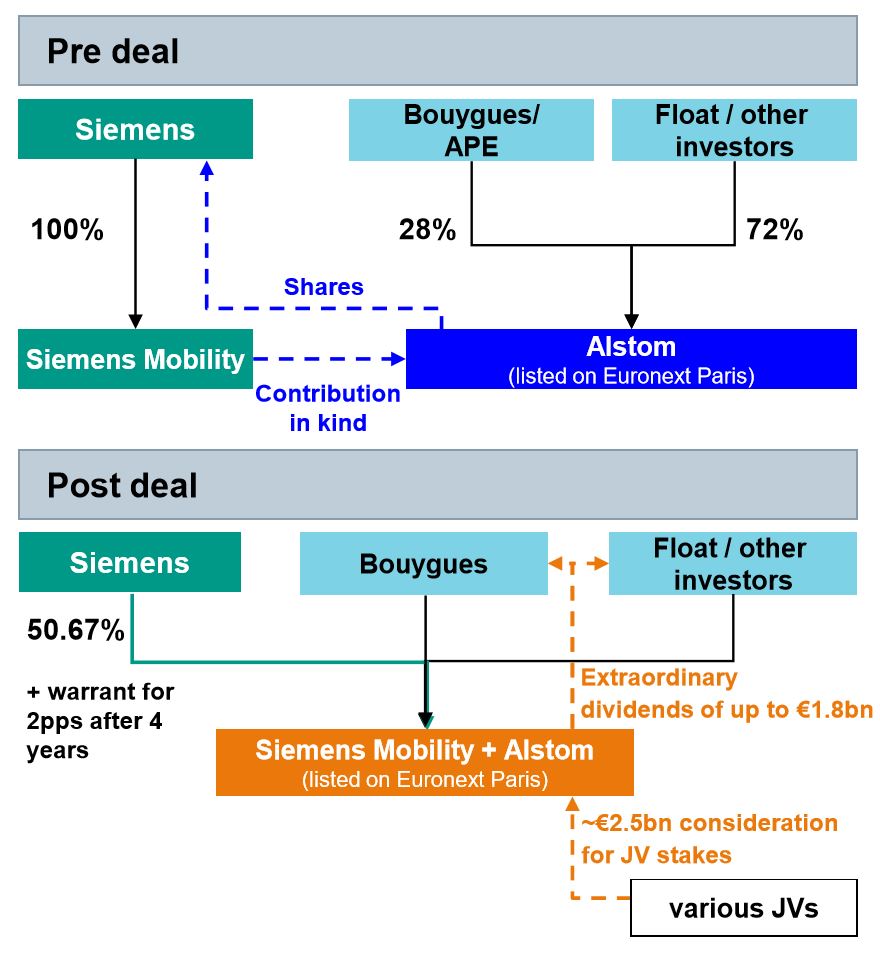

The combined entity, to be named Siemens Alstom, will contain Siemens’ rail transport business (Siemens Mobility) and Alstom. The deal will give Siemens 50.67% of the equity in the new company, which will be listed on Euronext Paris and will have Alstom’s current CEO, Henri Poupart-Lafarge, taking the lead, and the chairman nominated by Siemens. The transaction is cash neutral to Siemens, which will contribute the Siemens Mobility division and the Rail Traction Drives business in exchange for shares in Alstom.

Alstom shareholders will receive two special dividends: one of €4 per share for compensation of the loss of control (€0.9bn in total), and another one of up to €4 per share deriving from Alstom’s put options for various joint ventures it has with GE (up to a total of €0.9bn).

Alstom shareholders will receive two special dividends: one of €4 per share for compensation of the loss of control (€0.9bn in total), and another one of up to €4 per share deriving from Alstom’s put options for various joint ventures it has with GE (up to a total of €0.9bn).

Further, Siemens is to receive, after four years, a warrant for 2pps with strike price to be determined. There is a €140m break-fee for Alstom if it decides not to go through with the deal, and the transaction is subject to regulatory clearance from French authorities, as well as German and EU ones. The deal is expected to close by the end of 2018.

Deal Rationale

The transaction creates a European champion in the rail industry that can resist competitive threats arising from state-backed Chinese rivals and from changes in the global sector that will shape the future of mobility.

This merger brings together two innovative players with largely complementary businesses in terms of activities and geographies. In a combined setup, they can offer an increased range of diversified products to meet customer specific needs, from cost-efficient mass-market platforms to high-end technologies. Additionally, they can broaden their global footprint by accessing emerging growth markets and consolidating their European footprint.

Given the technological know-how, scale, global reach and innovation power that both Siemens Mobility and Alstom have, the merged company would have a full potential to tackle future challenges and create value for customers and shareholders. In particular, through the consolidation of the supplier base and procurement activities, the refocusing on sales efforts, and the harmonization and alignment of operational activities by exploiting scale benefits, the companies expect to unlock substantial synergy potential: €470m run-rate, equally split between supply chain, SG&A and other scale benefits, for total NPV of €4.7bn.

The combined digitalization capabilities along the entire value chain are expected also to enhance margins. FY2016 pro-forma revenues of €15.3, with 8% profit margin, are expected to climb to more than €20bn by 2023, with a profit margin of 11-14%. Finally, the deal is expected to be EPS accretive after two years post-closing.

Market Reaction

On September 27, 2017, Alstom shares rose 5% to €35.9, while Siemens shares rose 1% to €117.7.

Despite some initial fears of job losses and criticism from political opponents in France, this cross-border German-French deal now gets political backing from both France and Germany.

Advisors

Siemens was advised by BNP Paribas and Goldman Sachs, while JPMorgan and Rothschild acted as advisors for Alstom.

0 Comments